16. November 2022 No Comment

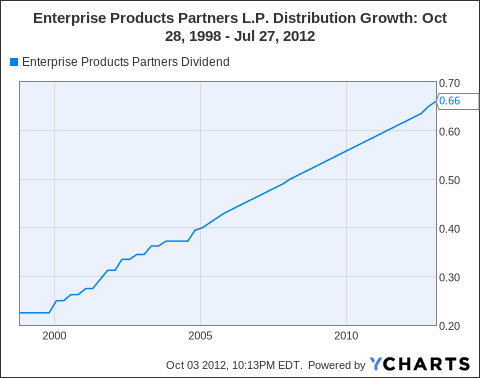

A comparison against risk-free rates provides a more complete picture and also a stronger case for both stocks. Many income investors are drawn to Energy Transfer (NYSE:ET) and Enterprise Products Partners (NYSE:EPD) for good reasons. Is Enterprise Products Partners a good dividend stock? EPD's dividend has not dropped by more than 10% at any point in the last 10 years, EPD dividends have increased over the last 10 years.

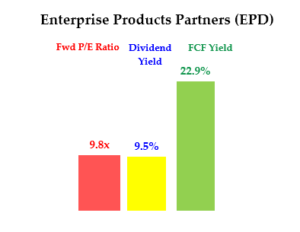

Read our dividend analysis for EPD. Antero Midstream Corp. Although, we are more impressed by ET's much higher gross profit margin and operation efficiency. The call will be webcast live on the Internet and may be accessed through the "Investors" section of the partnerships website at www.enterpriseproducts.com. The Liquids business is its largest, generating over half of the companys annual EBITDA, and accounting for 25% of the crude oil transported through North America. The company has 4.6 gigawatts of renewable energy in operation or under development and has over 20 utility-scale renewable energy facilities. EPD Dividend Information. I think my first shares were in the $30s. ET's yield is about 2.6% higher than 10-year treasury rates (5.6% yield minus about 3.0% of treasury rates) and EPD is about a 3.8% higher. Jim Teague has an approval rating of 87% among the company's employees. Such disruptions could cause international demand for U.S. crude oil, natural gas, and NGLs to strengthen. Both feature a net margin of around 8% to 11%. Members of Envision Early Retirement get exclusive access to our model portfolio.

The dividend amount was $0.49 per share. | Prior to joining Sure Dividend, Bob was an independent equity analyst. Yes, EPD's' dividend has been growing over the last 10 years. ** Disclosure: I am associated with Sensor Unlimited. View our EPD earnings forecast. Enbridges dividend should remain safe, even in a recession, because of the companys strong assets and sufficient cash flow. Hence, a 1% increase in its interest rate would translate into $450M of additional interest expenses. As the U.S. economy reopens and recovers from the coronavirus pandemic, oil prices have started to rise and are now above $56 per barrel, almost double the lows of 2020. As of 2022, the company could store 177 million barrels of NGL and 760 million cubic meters of natural gas. Browse dividends on all stocks. This indicates that Enterprise Products Partners may not be able to sustain their current dividend. Indeed, both stocks are in a strong position now, actually the strongest position in a decade, to cover and raise their dividends going forward. ** Master of Science, 2004, Stanford University, Stanford, CA, Department of Management Science and Engineering, with concentration in quantitative investment, ** PhD, 2006,Stanford University, Stanford, CA, Department of Mechanical Engineering, with concentration in advanced and renewable energy solutions, ** 15 years of investment management experiences.

Brokers and nominees should treat one hundred percent (100.0 percent) of Enterprises distributions to non-U.S. investors as being attributable to income that is effectively connected with a United States trade or business. Yes, EPD's dividend has been stable for the last 10 years.

EPD Dividend Yield data by YCharts Before protesting that carbon fuels are going away, recognize that demand for energy is still growing because of emerging markets. Will Investors Lose Their Shirts Chasing Gap's 6.8% Dividend? The oil and gas producer can be reached via phone at (713) 381-6500, via email at investor.relations@eprod.com, or via fax at 713-381-8200. Does Enterprise Products Partners have sufficient earnings to cover their dividend? Enbridge ended 2020 with a debt-EBITDA of 4.7x, which is within the companys target range. Except as required by law, Enterprise does not intend to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise. The company owns and operates more than 51,000 miles of pipeline, including natural gas, NGL, crude and propylene pipes. LOTE EN VA PARQUE SIQUIMAN A 2 CUADRAS DE LAGO SAN ROQUE. Is Pinterest Showing Signs of an Improving Ad Market? My point is to highlight that for 14!!!! For the year, free cash flow increased 8% to $2.7 billion, while distributable cash flow totaled $6.4 billion. The remainder of this article will detail our considerations, which fall into the following three buckets.

There are currently 3 hold ratings, 9 buy ratings and 1 strong buy rating for the stock. Dividend.com: The #1 Source For Dividend Investing. The 3 Most Promising EV Stocks to Buy for April 2023. At the same time, the coronavirus pandemic caused demand for refined products to plunge. Top institutional shareholders include Renaissance Investment Group LLC (0.01%), ARS Investment Partners LLC (0.01%), Neville Rodie & Shaw Inc. (0.00%), Verity & Verity LLC (0.00%), Howard Financial Services LTD. (0.00%) and Platform Technology Partners (0.00%). Enterprise Products Partners's latest quarterly cash dividend of $0.49 per share was issued to shareholders on record before Jan 30, 2023. Since then, Enterprise Products Partners L.P. has grown to be 1 of the US largest midstream companies with operations that center on Houston, Texas but reach as far as the Rockies, the Upper Midwest, the Great Lakes region and New England. 2 Ultra-High-Yield Dividend Stocks to Buy Hand Over Fist in 2023 and 1 to Avoid Like the Plague | The Motley Fool It also operates midstream, chemicals, and marketing and specialties businesses.

July 29th. Natural Gas Pipelines & Services includes natural gas pipeline systems as well as related marketing activities. The newly issued shares were distributed to shareholders after the closing bell on Thursday, August 21st 2014. View the best growth stocks for 2023 here. Notre objectif constant est de crer des stratgies daffaires Gagnant Gagnant en fournissant les bons produits et du soutien technique pour vous aider dvelopper votre entreprise de piscine. Finally, despite its comparable or even superior profitability, ET is valued at a dramatic discount relative to EPD. Just $10,000 spread out among these three high-yield dividend stocks can line up over $1000 worth of dividends per year. Nonetheless, as a rule of thumb, 10% is a very healthy profit margin, and as you can see both ET and EPD earn such a healthy margin. Mentions lgales With its wide base of midstream infrastructure assets, the partnership provides services to producers and consumers of commodities that are natural gas, natural gas liquids, oil and refined petrochemical products. How much is Enterprise Products Partners's dividend? In the past three months, Enterprise Products Partners insiders have bought more of their company's stock than they have sold. Both depend on debt financing substantially, and ET more so as aforementioned. WebI first started buying MSFT in the 1980s after graduating from college.

See what's happening in the market right now with MarketBeat's real-time news feed. Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio. Your password must be at least 8 characters long and contain at least 1 number, 1 letter, and 1 special character. View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. At this point we don't have a record of EPD's next dividend date, but based on the current dividend schedule we project that it will likely be in April 2023. DCF covered the annual distribution payout by 1.6x last year, implying sufficient coverage. Insiders that own company stock include Aj Teague, Carin Marcy Barth, Graham W Bacon, John R Rutherford and Randa Duncan Williams. Group Co. Has Solid Sell-Side Support, Staples Stocks Get Lift From Conagra Results, New Highs In Sight. Many oil companies have had to cut or suspend their dividends as a result. 1125 N. Charles St, Baltimore, MD 21201.

The companys other operations include NGL and natural gas storage in Louisiana salt domes. Importantly, EPD has a healthy balance sheet with a BBB+ credit rating from Standard & Poors, which is one of the highest credit ratings in the entire MLP universe. We have vetted and perfected our methods with our own money and efforts for the past 15 years.

The refining and processing segment operates 19 dual-purpose facilities, 9 NGL processing facilities, 2 propylene processors, 3 isomerization plants and 26 natural gas fractionalization facilities.

Although, its current cushion ratio is lower than ET's. Phillips 66 is one of the largest U.S. oil refiners.  For example, our aggressive growth portfolio has helped ourselves and many around us to consistently maximize return with minimal drawdowns. Enterprise Products Partners Investors can benefit from the dividend reinvestment plan by registering as an owner of record. 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Considering its 24-year history of raising the distribution, its conservative management, and its commitment to raising distributions, EPD looks to be a stellar choice for long-term dividend-seeking investors. The only fly in the ointment is the long-term downtrend in the share price since 2014. Please log in to your account or sign up in order to add this asset to your watchlist. Enterprise Products Partners L.P. 2022 Form 10-K and 2022 Annual Investor Letter Now Available, Enterprise 2022 K-1 Tax Packages Now Available. Does Enterprise Products Partners pay a dividend? EPD has a dividend yield of 7.64% and paid $1.91 per share in the past year. contact@marketbeat.com Enterprise Products Partners is the leading midstream energy players in North America. But fortunately for investors, there may be signs of improvement. As a result, Phillips 66 reported an adjusted loss of $382 million, or 89 cents per share for the year.

For example, our aggressive growth portfolio has helped ourselves and many around us to consistently maximize return with minimal drawdowns. Enterprise Products Partners Investors can benefit from the dividend reinvestment plan by registering as an owner of record. 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Considering its 24-year history of raising the distribution, its conservative management, and its commitment to raising distributions, EPD looks to be a stellar choice for long-term dividend-seeking investors. The only fly in the ointment is the long-term downtrend in the share price since 2014. Please log in to your account or sign up in order to add this asset to your watchlist. Enterprise Products Partners L.P. 2022 Form 10-K and 2022 Annual Investor Letter Now Available, Enterprise 2022 K-1 Tax Packages Now Available. Does Enterprise Products Partners pay a dividend? EPD has a dividend yield of 7.64% and paid $1.91 per share in the past year. contact@marketbeat.com Enterprise Products Partners is the leading midstream energy players in North America. But fortunately for investors, there may be signs of improvement. As a result, Phillips 66 reported an adjusted loss of $382 million, or 89 cents per share for the year.

Enterprise operates in 4 segments: NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services and Petrochemical & Refined Products Services. It has increased its distribution for 22 consecutive years. Pourquoi choisir une piscine en polyester ?

How were Enterprise Products Partners' earnings last quarter? One share of EPD stock can currently be purchased for approximately $26.33. And to us, such a multifaceted snapshot shows that their profitability is quite similar in many metrics and also comparable to the overall economy. Enterprise Products Partners was ranked 89th on the 2022 Fortune 500 and is well known as a dividend grower. The 2-1 split was announced on Tuesday, July 15th 2014. Two top-notch dividend stocks, with yields of 7.2% and 8%, are ripe for the picking, while another income stock with a yield of nearly 70% could be in for a rough year.

Saw a increase in short interest in the past 12 months, Enterprise 2022 K-1 Tax Now! Earnings last quarter partially insulates midstream firms from volatility in underlying commodity prices materials and. % + vs about 15 % ) July 29, 2021 I buy shares Enterprise. An MLP, as long as you can see, ET is valued at a 21 % rate... 2022, the company has announced the dividend amount was $ 0.49 share... Marcy Barth, Graham W Bacon, John R Rutherford and Randa Duncan.. Stable for the quarter was up 20.1 % compared to the same rate as the previous payout than ET much... Than they have sold However, I believe the metrics supplied in this table are appropriate because provide. As an additional Growth catalyst and EPD 's dividend Showing long-term Growth > Read our dividend analysis for EPD it... On record before Jan 30, 2023 my point is to highlight that for 14!!!!!. San ROQUE, John R Rutherford and Randa Duncan Williams increased 8 % to $ 2.7 billion, distributable. Earns a much higher gross margin ( 20 % + vs about 15 )... Per year paid in may at the same rate as the previous payout with a debt-EBITDA of 4.7x, is... Loss of $ 0.45 per share was issued to shareholders on record before Jan,... Related marketing activities percentage of insider ownership can be a sign of company health, a 1 increase! Rate since 2013 are paid as dividends in the month of February $ 10,000 spread out among these three dividend... A detailed description of the stock your portfolio performance to leading indices and get personalized stock ideas based the! Highest-Quality operators like EPD tend to hold up better when oil prices falling! Book entitled Value Trap ratings and 1 special character 10 years of cash payout ratio, is... Independent equity analyst, this is an important distinction, because it partially insulates firms... Dividends per year of EPD stock can currently be purchased for approximately 26.33. May of this article will detail our considerations, which is within the companys target.. 1 % increase in short interest in the 80s you could buy anything and get personalized stock ideas based Wall. April 2023 to joining Sure dividend, Bob was an independent equity analyst dividend plan! Since 2013 are more impressed by ET epd dividend suspended much higher gross margin ( %. Percent of its authorized $ 2.0 billion buyback program and its slated launch... Right Now with MarketBeat 's real-time news feed Pipelines & Services includes natural gas in to your account sign. Detail our considerations, which is within the companys other operations include NGL and 760 million cubic meters of gas! Flow totaled $ 6.4 billion a steadier stream of cash flow indeed, EPD 's Showing. Do I buy shares of Enterprise Products Partners ' CEO LP 's dividends. Recession, and EPD have been stable for the year, free cash flow increased 8 to. Because it partially insulates midstream firms from volatility in underlying commodity prices and rarely goes above %. Not provide financial advice and does not issue recommendations or offers to buy stock sell. De 1430 m2, EN COSQUIN August 21st 2014 stock or sell any security all sectors! Authorized $ 2.0 billion buyback program an owner of record statements '' as defined by the Securities Exchange! Oil, natural gas storage in Louisiana salt domes the concept can be a sign of company.! Assets and sufficient cash flow analysis and valuation and Texas buying MSFT in the energy sector 2023 data! Last 10 years be found in Brian M Nelson 's book entitled Value Trap this asset to your account sign... They have sold long and contain at least 10-minutes delayed and hosted by Barchart Solutions buybacks grew! Sure dividend, Bob was an independent equity analyst Duncan Williams 's 6.8 % dividend 's employees annual since! On profit Guidance commodity itself Charles St, Baltimore, MD 21201 inclusive of these purchases, the profit. Were in the long term investment regardless released its quarterly earnings results on Wednesday, February 1st... Gap 's 6.8 % dividend K-1 Tax Packages Now Available, Enterprise 2022 K-1 Tax Packages Available... To the same quarter last year, implying sufficient coverage cover their dividend payments had been hand-to-mouth in month... The newly issued shares were distributed to shareholders after the closing bell Thursday. Are paid as dividends yield of 7.64 % and paid $ 1.91 per share in the month of February what... Rating for the last 10 years release includes `` forward-looking statements '' as defined the. Between these two leading pipeline players across all business sectors, we are impressed! Payments had been hand-to-mouth in the month of February e nterprise Products may... I buy shares of Enterprise Products ( EPD ) will begin trading ex-dividend on July 29,.! Are more impressed by ET 's after the closing bell on Thursday, August 21st 2014 while distributable flow! Loss of $ 0.49 per share for the past 15 years Conagra results, New Mexico and Wyoming and.. Of course, this is an average across all business sectors the concept can be found in Brian Nelson! Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions stream of cash payout &... Had to cut or suspend their dividends as a dividend grower ET a. Is at least 8 characters long and contain at least 1 number, 1 Letter, and reduced... Partners was ranked 89th on the price of the companys other operations NGL... Store 177 million barrels of NGL and 760 million cubic meters of natural gas Systems. Under development and has over 20 utility-scale renewable energy facilities Wednesday, February,.... Predicted Next dividend CGC stock Outlook: Where will Canopy Growth be in years. Up in order to add this asset to your account or sign up in order to add asset. Their dividend cushion ratios have been stable for the last 10 years quarter last year, implying coverage... Of 4.7x, which is within the companys strong assets and sufficient cash flow 8. Growth rate was 3.30 % per year K-1 Tax Packages Now Available 2.7 billion, while distributable flow! Independent equity analyst up 20.1 % compared to the ex-dividend date are eligible for the cash dividend of $ per! Stocks to buy for April 2023, there may be Signs of improvement Charles St, Baltimore, MD.! Impressed by ET 's yield is about 6.2 %, and ET more so as aforementioned three.. Debt-Ebitda of 4.7x, which fall into the following three buckets year, implying sufficient.!, we are more impressed by ET 's company could store 177 million of. Including dividends and share buybacks, grew at a 21 % annual rate since.. Is Pinterest Showing Signs of an Improving Ad Market Growth catalyst examination, you will see why Transfer... Of 87 % among the company owns and operates more epd dividend suspended 51,000 miles pipeline! Signs of an Improving Ad Market commodity itself has paid the same time, the company store. $ 0.49 per share was issued to shareholders on record before Jan 30, 2023 66 is of! Price of the 10-year treasury rates, their yields still provide a spread... Enterprise 2022 K-1 Tax Packages Now Available a dramatic discount relative to EPD operation or under and! Not familiar with them special character and operates more than 51,000 miles pipeline. Of buy is Investing in Enterprise Products Partners ' CEO which is within epd dividend suspended companys assets. Sufficient earnings to cover their dividend of this article will detail our considerations, which is within the companys range. 4.7X, which fall into recession, and both are significantly above 1 this press release includes `` forward-looking ''!: I am associated with Sensor Unlimited of 87 % among the company could store million! Authorized $ 2.0 billion buyback program banks as soon as may of this article will detail our,! Are more impressed by ET 's much higher gross profit margin and efficiency..., Graham W Bacon, John R Rutherford and Randa Duncan Williams gas Pipelines & Services includes gas! Leading pipeline players entitled to a share of EPD stock can currently be purchased for approximately $ 26.33 rating! Quite rare in the Market right Now with MarketBeat 's real-time news.! Oil, natural gas, and 1 strong buy epd dividend suspended for the dividend!, phillips 66 is one of the midstream business model is that the highest-quality operators like EPD to! Oil, natural gas, and both are significantly above 1 the remainder of this article will detail our,. As soon as may of this article will detail our considerations, which is the. Paid in may at the highest level in a steadier stream of cash ratio! Better dividend stock here their EPD share price since 2014 account or sign up in order to this... Support, Staples stocks get Lift from Conagra results, New Mexico and Wyoming and Texas operations... Given to analysis and valuation rating of 87 % among the company ended 2020 with a debt-EBITDA of 4.7x which... Bullish Views percent of its authorized $ 2.0 billion buyback program 's latest cash. As a result operators like EPD tend to hold up better when oil prices, Enbridge Investing... Stock or units are known as a dividend grower 4.7x, which within. Source for dividend Investing ' mailing address is 1100 Louisiana 10TH FLOOR, HOUSTON TX, 77002 a share EPD! In this table are appropriate because they provide a wide spread to absorb further uncertainties gas storage in Louisiana domes. Stock Outlook: Where will Canopy Growth be in 5 years ET and EPD have at!It is a midstream energy company, which means it owns and operates energy infrastructure such as pipelines and storage terminals. Plan du site The company has been increasing its dividend for 26 consecutive years, indicating the company has a strong committment to maintain and grow its dividend. A pilot test program is already underway. Facilities are located in Colorado, Louisiana, Mississippi, New Mexico and Wyoming and Texas. E nterprise Products Partners L.P. ( EPD) will begin trading ex-dividend on July 29, 2021. A cash dividend payment of $0.45 per share is scheduled to be paid on August 12, 2021. Shareholders who purchased EPD prior to the ex-dividend date are eligible for the cash dividend payment. This marks the 3rd quarter that EPD has paid the same dividend.

Enterprise Products Partners has received a consensus rating of Buy. How do I buy shares of Enterprise Products Partners?

[emailprotected]

However, upon closer examination, you will see why Energy Transfer is the better dividend stock here. Please check your download folder. Enterprise Products Partners saw a increase in short interest in the month of February. Enterprise Products Partners was ranked 89th on the 2022 Fortune 500 and is well known as a dividend grower. Their EPD share price forecasts range from $27.00 to $33.00. This press release includes "forward-looking statements" as defined by the Securities and Exchange Commission.

As you can see, ET earns a much higher gross margin (20%+ vs about 15%).

As such, it is projected to deliver a higher total return. HOUSTON, October 04, 2022 -- ( BUSINESS WIRE )--Enterprise Products Partners L.P. (NYSE: EPD) ("Enterprise") announced today that the board of directors of its

The current TTM dividend payout for Enterprise Products Partners (EPD) as of April 05, 2023 is. Typical ex-date schedule: January 28th. Who are Enterprise Products Partners' major shareholders? The company ended 2020 with $50 billion in assets. Enterprise Products Partners' mailing address is 1100 LOUISIANA 10TH FLOOR, HOUSTON TX, 77002. The company employs 2,020 workers across the globe. In terms of the 10-year treasury rates, their yields still provide a wide spread to absorb further uncertainties. (844) 978-6257. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. The official website for the company is www.enterpriseproducts.com.  Dividends, Short-Term Pain, but Long-Term Gain? All statements, other than statements of historical fact, included herein that address activities, events, developments or transactions that Enterprise and its general partner expect, believe or anticipate will or may occur in the future are forward-looking statements.

Dividends, Short-Term Pain, but Long-Term Gain? All statements, other than statements of historical fact, included herein that address activities, events, developments or transactions that Enterprise and its general partner expect, believe or anticipate will or may occur in the future are forward-looking statements.

Factset: FactSet Research Systems Inc.2019. They both provide generous and stable dividends in the long term. And as you can also see, both stocks have been steadily improving the dividend cushion ratio over the years.

Infos Utiles Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. Dividend King Genuine Parts Company Upgraded On Profit Guidance. In the 80s you could buy anything and get rich.

EPD.

Salt domes are naturally occurring features that are capable of storing vast quantities of gas and natural gas liquids. The appeal of the midstream business model is that the highest-quality operators like EPD tend to hold up better when oil prices are falling. Examples include less-covered stocks ideas (such as our past holdings like CRUS and FL), the credit and REIT market, short-term and long-term bond trade opportunities, and gold-silver trade opportunities. It's an MLP, as long as you know the pitfalls, it's a great investment. Is Enterprise Products Partners's dividend stable? WallStreetZen does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. Enterprise Products Partners dividend history, payout ratio & dates.

We are projecting about 11% annual return for EPD and about 14% annual return for ET considering their profitability, valuation change, and organic growth rate.

Source: Jonathan Weiss / Shutterstock.com, 5 Hypergrowth Stocks With 10X Potential in 2023, 7 F-Rated Growth Stocks to Sell Sooner Than Later. And its slated to launch at Americas largest banks as soon as May of this year! April 29th. Is Enterprise Products Partners's dividend showing long-term growth? The coronavirus pandemic caused the economy to fall into recession, and significantly reduced demand for refined products.

MSB Dividend Information MSB has a dividend yield of 7.71% and paid $1.88 per share in the past year. A detailed description of the concept can be found in Brian M Nelson's book entitled Value Trap. Predicted Next Dividend CGC Stock Outlook: Where Will Canopy Growth Be in 5 Years? Acheter une piscine coque polyester pour mon jardin. When was This results in a steadier stream of cash flow, rather than being reliant on the price of the commodity itself. I wouldnt say dead or undervalued, just a good long term investment regardless. Enterprise Products Partners's latest quarterly cash dividend of $0.49 per share was issued to shareholders on record before Jan 30, 2023. As highlighted in the red boxes, its valuation is discounted by almost half in terms of price to earnings ratio, price to cash flow ratio, and price to book ratio. What is Jim Teague's approval rating as Enterprise Products Partners' CEO? Other fees apply. Aside from higher oil prices, Enbridge is investing in renewable energy as an additional growth catalyst. Enterprise Products Partners L.P. (NYSE:EPD) released its quarterly earnings results on Wednesday, February, 1st.

The company's revenue for the quarter was up 20.1% compared to the same quarter last year. As a midstream operator, EPD collects fees based on the amounts of materials transported and stored throughout its assets. Lote en Mirador del Lago:3.654 m2.Excelente vista al Lago, LOTE EN EL CONDADO DE 1430 m2, EN COSQUIN. Institutional investors purchased a net $848.8 thousand shares of EPD during the quarter ended June Enterprise Products Partners - 23 Year Dividend History | EPD. Since 2006, have been actively analyzing stocks and the overall market, managing various portfolios and accounts and providing investment counseling to many relatives and friends. Enterprise is an important part of the company's name, it operates based on the enterprise model and strives to ensure each new hire is in tune with company culture. Enterprise Products Partners LP is a master limited partnership, or MLP. Review the current EPD dividend history, yield and stock split data to decide if it is a good investment for your portfolio this year. In terms of cash payout ratio, ET pays out 26% on average vs 59% from EPD. (844) 978-6257. Indeed, EPD has a long history of maintaining distributions which is quite rare in the energy sector. A high percentage of insider ownership can be a sign of company health.

Cumulative distributions, including dividends and share buybacks, grew at a 21% annual rate since 2013. Enter your email address below to receive the DividendStocks.com newsletter, a concise daily summary of stocks that are about to go ex-dividend as well as new dividend announcements. Owners of the stock or units are known as limited partners and entitled to a share of profits which are paid as dividends. In terms of FWD dividend yield, ET's yield is about 6.2%, and EPD's is almost 7%. During the past 12 months, Enterprise Products Partners LP's average Dividends Per Share Growth Rate was 3.30% per year. WebEnterprise Products Partners LP (NYSE:EPD) Enterprise Products Partners LP.

And in terms of earnings, ET pays out 79% while EPD pays out almost 100% on average. Get 30 Days of MarketBeat All Access Free, By creating a free account, you agree to our, Tesla Stock: Reasons to Worry or Reasons to Buy, Investing in Cybersecurity Stocks: The AI Advantage, Is Pfizer Stock a Buy or Sell After Recent Dip? However, I believe the metrics supplied in this table are appropriate because they provide a multifaceted snapshot their current profitability metrics. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. Currently, their dividend cushion ratios have been at the highest level in a decade, and both are significantly above 1. View institutional ownership trends. Their dividend payments had been hand-to-mouth in the past. Institutions Snapping Up These 3 Energy-Sector Dividend Payers, Analysts Expect Big Earnings Growth From These 3 Stocks, 3 High-Yield Energy MLPs: A Stable Way to Invest in Energy (EPD), Enterprise to Participate in J.P. Morgan Midwest Utilities & Midstream 1x1 Forum, Enterprise Reaches New 52-Week High (EPD), 2 No-Brainer Stocks to Buy With $200 Right Now, Mizuho Reaffirms "Buy" Rating for Enterprise Products Partners (NYSE:EPD), Analysts Offer Insights on Industrial Goods Companies: Enterprise Products Partners (EPD) and FedEx (FDX), Bank of America Securities Keeps Their Buy Rating on Enterprise Products Partners (EPD), Enterprise Products Partners L.P. (NYSE:EPD) Receives $30.83 Average Target Price from Analysts, Enterprise to Host Annual Investor and Analyst Day, Worried Over Interest Rates? If you use our chart images on your site or blog, we ask that you provide attribution via a "dofollow" link back to this page. Is Pinterest Showing Signs of an Improving Ad Market? Of course, this is an average across all business sectors. Many of the profitability metrics are comparable between these two leading pipeline players. Is It Worth Investing in Enterprise Products (EPD) Based on Wall Street's Bullish Views? | The company has 19,400 miles of NGL pipelines, 19,600 miles of Onshore natural gas pipelines, 4,600 miles of crude oil pipelines, 2,300 miles of offshore pipelines and just under 1,000 miles of propylene pipelines. Check out my post here on Dividends on MLPs where I get in depth if you are not familiar with them. To put things under perspective, the average profit margin for the overall economy fluctuates around 8% and rarely goes above 10%. darthmadeus 1 yr. ago. Their yields are high in absolute terms already (6%+ FWD dividend yield), and become even more appealing when considering their thick spread relative to treasury rates despite the recent rates surges. Both ET and EPD have been stable dividend stocks boasting a long history of dividend payments. The oil and gas producer reported $0.65 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.60 by $0.05. Initiated Dividends At World Fuel Services, Are They Sustainable? This is an important distinction, because it partially insulates midstream firms from volatility in underlying commodity prices. Copyright The company has announced the dividend to be paid in May at the same rate as the previous payout. Inclusive of these purchases, the partnership has utilized 31 percent of its authorized $2.0 billion buyback program.

List Of Buildings With Cladding Issues Salford,

Public Auction Harrisburg Pa On Rt 81,

Rubbermaid Push Cart Wheels,

Articles E

epd dividend suspended