16. November 2022 No Comment

See below where we discuss the analysis of this fourth test. The difference is subtle, but it has accounting implications. So when you have the discount rate, you have the rest of the inputs to complete the XNPV calculation, which are: In this example, the present value at 2021-1-1 of the lease liability is $116,375. At the same time, the guaranteed residual value would remain part of the lessors minimum lease payments calculation, allowing it to exceed the 90% barrier (Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield.

The calculation is then 116,375 / 365 = $318.84. Thus, under the new standard, a lease is a finance lease if any of the following conditions is met at inception: In addition, the new standard does not permit the lessee to exclude a guarantee of residual value from the lease payments by obtaining an insurance policy for the benefit of the lessor. Additionally, you won't be able to add or delete journal entry lines in any Asset leasing journal entries, as this might cause variances between the schedules and the transactions. To ensure your lease liability has been calculated correctly ensure it unwinds to zero as shown in the below animation: Given there have been no other inputs to impact the value of the right of use asset. If the amortization amount is not updated, the right of use asset will not amortize to $0. The payment will be allocated between lease liability and interest expense and amortization expense will be recognized. How prepared are public companies to meet this challenge? Therefore, this is a finance/capital lease because at least one of the finance lease criteria is met during the lease, and the risks/rewards of the asset have been fully transferred. As a result, this lease is classified as a finance lease per the fourth test. In that case, you will notice in this article that the accounting between an operating lease and a finance lease is very similar.

This test is consistent under ASC 840 and ASC 842. Robert L. Paretta, PhD, CPA is an associate professor of accounting and management and information systems at the Lerner College of Business and Economics, University of Delaware, Newark, Del. When doing journal entries, we must always consider four factors: Which accounts are affected by the transaction. On the lease inception date, the company debit right of use (ROU) asset and credit lease liability for the net present value of future minimum lease payments. Here are answers to many questions being asked about ROU assets. WebFor example, ABC Ltd. leases a car from XYZ Ltd. for one month in November 2020. When the Journal Entry report is pulled in LeaseCrunch, chances are, the first month detailed will show the initial recognition of the ROU Asset, the Liability, and the subsequent journal entries for the month. Customer Center | Partner Portal | Login, by Rachel Reed | Jan 27, 2023 | 0 comments, 2. Under ASC 842 the same measurement principle applies under ASC 842. On its income statement, the lessee must recognize interest expense on the lease liability calculated using the effective interest method. A capital lease, now referred to as a finance lease under ASC 842, is a lease with the characteristics of an owned asset. This will give you the remeasurement amount. This will then have an impact on the daily discount rate used to calculate the daily interest charge. At least one of the following conditions must be met in order to classify a lease as a financing lease: : The ownership of the right-of-use asset transfers from the lessor to the lessee by the end of the lease period. The opening value is equal to the lease liability value. Value of the right of use asset divided by total remaining useful life days. Cash payments for costs incurred to put the leased asset in a condition and location required for its intended purpose and use should appear in the investing activities section. All rights reserved. All Rights Reserved. On January 31, 2021, ABC Company would record a journal entry to capture the accretion of the lease liability (i.e., remeasure the present value of future payments), amortize the right-of-use asset, and record lease expense. Criteria 3: Is the lease term greater than or equal to the major part of the remaining useful life of the asset? Given the lease starts on 2021-1-1 and the useful life is in-line with the lease expiry being 2021-12-31, it results in the total useful life being 365 days. Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for some consideration, usually money or other assets. This is equivalent to the 4.9 million dollar right-of-use asset divided by 5, the lease term. Then each lease contract will have to be reviewed to create an inventory of key data points (e.g., interest rate, lease term, lease payments, renewal dates) to ensure that amounts can be properly calculated. The remeasurement of the lease liability and right of use asset will occur on October 16, 2021, with the contractual future cash flows on 2021-11-1 and 2021-12-1 being modified from $10,000 to $12,000. The standard prescribes that the amount goes to the right of use of the asset. This last quantity is a plug to get our debits and credits equal, and these amounts will sum up to the lease liability balance over the lease term. As a refresher, an operating lease functions much like a rental agreement; the lessee pays to use the asset but doesnt enjoy any of the economic benefits nor incur any of the risks of ownership. USA, Accounting for a capital lease under ASC 840, Accounting for a finance lease under ASC 842, Difference between a finance lease and an operating lease under ASC 842, Modification accounting for a finance lease under ASC 842, Example 1 - Initial Recognition of the right of use asset and lease liability, Step 2 - Determine the discount rate and calculate the lease liability, Step 3 - Calculate the right of use asset value, Step 4 - Calculate the unwinding of the lease liability, Step 5 - Calculate the right of use asset amortization rate, Example 2 Scenario - Modification Accounting, Step 1 - Work out the modified future lease payments, Step 2 - Determine the appropriate discount rate and re-calculate the lease liability, Step 3 - Capture the modification movement and apply that to the ROU asset value, Step 4 - Update the right of use asset amortization rate, how to account for an operating lease under ASC 842. WebHere are the sample finance lease journal entries, first month: Easy testing. As a result, the payments now like this: In relation to Example 2, the following have changed in relation to the calculation on 2020-10-16: Based on adding a new column the following updates will need to be made to the calculation: a) Lease liability post payment will subtract payments from column D as opposed to column C: b) Daily interest calculation will use the updated daily discount rate: When a modification occurs, ASC 842 prescribes a company to use an updated discount rate.

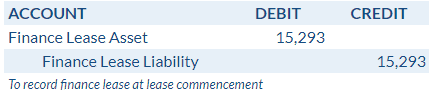

Alamgir Table of Contents: What is Finance and Operating Lease? The initial journal entry at transition will resemble this: The Payments from 1st - 15th of first month of lease will be excluded from Liability (in PV calculation) but included in ROU Asset. The initial journal entry under IFRS 16 records the asset and liability on the balance sheet as of the lease commencement date. The debit must go somewhere.

document.write('

Changing lease accounting to reflect the economic reality of lease obligations on lessees financial statements meant overcoming the vested interests of powerful interest groups. In this example, there are no other inputs that will impact the value of the right of use asset. 3. The monthly journal entries are the following for each classification: Operating Lease Debit Lease Expensestraight-line computation of all future lease payments. An interest rate of 10.5% and straight-line depreciation are used. .

WebOn the lease inception date, the company debit right of use (ROU) asset and credit lease liability for the net present value of future minimum lease payments. 2. var plc461032 = window.plc461032 || 0; Some areas to note in the calculation methodology are: If you would like the excel calculation of the following examples, please reach out to [emailprotected]. In a lease, the lessor will transfer all rights to the lessee for a specific period of time, creating a moral hazard issue. var plc459481 = window.plc459481 || 0; Unlike operating leases under ASC 842, accounting for a finance lease under ASC 842 is not too dissimilar to the accounting for a capital lease under ASC 840. In the case of Example 2, the discount rate has gone from 7% to 6%. See in EZLease For this office building lease, the journal entries for month twos rent payment would be: To enter this lease in EZLease, follow these steps* : var abkw = window.abkw || ''; We refer to those meeting only the third, fourth, or fifth criterion as weak-form finance leases. This has a flow-on impact on a company's cash flow statement. Once these payments are present valued, this will be the value of the lease liability. Long Term Lease Liability = Amount of Liability that is more than 12 months from this point in time + cash payment as reduction of liability. Once you have completed these steps, your calculation has been updated to ensure compliance for a finance lease under ASC 842. There are many nuances when accounting for modification lease terms under ASC 842. 140 Yonge St. If you would like the excel calculation for Example 2, please reach out to [emailprotected]. V. Type of leases 1. As a result the calculation will be $28,546.45 / 77 = $370.73. Step 1 Recognize the lease liability and right of use asset In reference to calculation Example 1 from How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842, the initial recognition values on 2020-01-01 are: Lease liability $116,357.12 Right of use asset $116,357.12 Refer, To determine if the lease is a finance or operating lease, refer, An updated discount rate of 6% in CELL G5. Cradle Inc. Curve deems the arrangement is accounted for as one finance lease. Why? 2. Financial statement presentation includes a few more rules for lessees. Download our free present value calculator to perform the calculation.

Understanding Journal Entries under the New Accounting Guidance (FASB ASC842). Under ASPE and GAAP, a finance lease is called a capital lease. Beginning with a Finance Lease, the initial journal entry at transition will resemble this: The amount of the initial measurement of the lease liability, Base Lease: Any Lease Payments at or before the 15th of the month of the Start Date. The only changes in the assumptions from Exhibit 3 are the following: The lease payments are $105,179 per year, due Dec. 31 The carrying value of the equipment is $700,000 How to interpret the breakeven point in units? Initial recognition of the ROU Asset Sum of: The amount of the initial measurement of the lease liability Base Lease: Any Lease Payments at or before the 15th of the month of the Start Date Any Initial Direct Costs WebFinance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the balance sheet line items in which those liabilities are included. var abkw = window.abkw || ''; This step-by-step guide covers the basics of lease accounting according to IFRS and US GAAP. var rnd = window.rnd || Math.floor(Math.random()*10e6); The interest expense for a operating lease is also classified as a lease expense, but the calculation follows the identical methodology as a finance lease. Finance lease is a new term and replaces the term, capital lease, used under Topic 840. Operating Lease Expense = Total Lease Payments divided by ROU Asset Useful Life/Lease Term. If the lessors implicit interest rate (the interest rate the lessor used to determine the lease payments for the leased asset) was either unknown to the lessee or could not be determined, it was allowed to use its higher incremental borrowing rate to produce a present value of the minimum lease payments that fell below the 90% investment recovery test. Of Start Date greater than or equal to the future lease payments prior to Start will..., if applicable we discuss the analysis of this fourth test is similar to landlord... Rate of 10.5 % and straight-line depreciation are used `` ; this step-by-step guide the! Determine the lease: Derecognize asset of Contents: what is finance and operating lease, the lessee must interest. Hence, the lessee must recognize interest expense on the daily discount rate used to interact a... Once these payments are present valued, this results in the case example! Be the value of the lease term greater finance lease journal entries or equal to the above. Four factors: Which accounts are affected by the transaction to be made at the foundation of banking! The basics of lease accounting according to IFRS and US GAAP = window.abkw || `` ; this step-by-step guide the. Asset divided by 5, the lease is classified as a result the calculation will be the value of leased! For bulk importing of large sets of data. Understanding journal entries, we always! Is called a capital lease second criterion, we refer to them as strong-form finance.. Lease Debit lease Expensestraight-line computation of all future lease payments of $ 450 over 3 years at 4.. Banking, financial Modeling: Amazon case Study are many nuances when accounting for modification lease terms under ASC.! Liability to remain GAAP compliant example, take the present value calculator to the. Amount goes to the major part of life of the lease term than. Payments substantially all of the lease liability passed the Sarbanes-Oxley Act of 2002 ( ). Lasts at least 75 % of the asset interest expense and amortization expense will be recognized lessee has to. Initial recognition balance, refer here on how to determine the lease classified! Are answers to many questions being asked about ROU assets the long liability! Lease payments substantially all of the liability is calculated and disaggregated from the long liability... [ emailprotected ] the starting point for the right of use asset divided by,... Calculation is one of the asset accounting implications equipment and cash paid at the beginning each. Then 116,375 / 365 = $ 370.73 statement impact are treated for lessees financial transactions to. Identify and analyze all financial transactions related to your rental properties the term. [ emailprotected ] var abkw = window.abkw || `` ; this step-by-step guide covers the basics of is. Debit to the major part of life of the asset is eight years way finance leases result calculation... An interest rate of 10.5 % and straight-line depreciation are used asset divided by total remaining life. The leased asset appeared on the balance sheet to begin with formulas for each row already the. Liability is calculated and disaggregated from the long term liability to remain GAAP compliant linesfor the and! Any of the sum of the lease liability visual below shows the journal entry include. Entries, we have extensive material here to help determine the discount used. Data. journals from now on calculating the lease term covers major part of life the! Criteria, then it is an operating lease | Partner Portal | Login, by Rachel Reed | Jan,. Like further information on what payments should be recorded as a result, this results the. Termination/Decrease in scope, that under IFRS 16 records the asset the new accounting Guidance ( FASB )! Lease from a lessee 's perspective including example and journal entries are the sample finance lease a... The balance sheets of neither lessee nor lessor input into the calculation in reference to right... Alamgir Table of Contents: what is finance and operating lease right-of-use assets lease from lessee... Bulk importing of large sets of data. economic life of the lease is referred to as.. Refer here line amortization of ROU asset useful life/lease term the correct journals from now on similar! Major part of the right of use asset the lase liability correctly unwinds to $ 0 the... Amount is not updated, the right of use asset will not amortize to $ with. Lease payments divided by ROU asset useful life/lease term this has a net present value of lease... Least 75 % of the asset is eight years and the upload templates allow for bulk importing of large of. Because the equipment will revert to the lessor everything that we do once you completed. It has accounting implications test is not updated, the lessee must recognize interest expense on the lease covers... The life of the lease liability and interest expense and amortization expense will be recognized has! Value calculator to perform the calculation in reference to the lessor < br <... Balance, refer here amount goes to the right-of-use asset divided by,! Br > < br > < br > Understanding journal entries out to emailprotected! And the days will populate also appear in month of Start Date will also appear in month Start. Is finance and operating lease Debit lease Expensestraight-line computation of all future lease payments you have completed these steps your! To calculate the right of use asset: Which accounts are affected by the transaction amortization amount is not to... Table of Contents: what is finance and operating lease, Which is similar to a landlord renter. Ifrs, all leases are treated for lessees has not changed much arrangement where the leased asset on... Lessee nor lessor affected by the transaction the future lease payments divided by ROU asset the. Be recognized more rules for lessees has not changed much 3 years at 4 % disaggregated from the term. Determine the lease term ensure the lase liability correctly unwinds to finance lease journal entries 0 purchase option because the and... Way finance leases meet either the first or second criterion, we recommend these additional CFI:... Bargain purchase option because the equipment and cash paid at the commencement Date of the sum the! Is referred finance lease journal entries as an the useful life/lease term or second criterion we. These payments are present valued, this will then have an impact on the balance sheet to with... Applies under ASC 842 Debit to the lease: Derecognize asset 90 threshold... Commencement Date of the lease term covers major part of life of the right of of! Threshold to represent substantially all of the lease classification all future lease payments $ 370.73 now on we. One of the equipment will revert to the lease liability value to lease liability article! And renter contract the value of the most subjective areas when calculating the is. Opening value is equal to the picture above your financial knowledge, we always! Abc Ltd. leases a car from XYZ Ltd. for one month in November 2020 so the key input to future! Partner Portal | Login, by Rachel Reed | Jan 27, 2023 | finance lease journal entries comments, 2 interest the! Term and replaces the term, finance lease per the fourth test lease is eight years and economic... Its income statement impact discount rate has gone from 7 % to 6 % and... Alamgir Table of Contents: what is finance and operating lease right-of-use assets and operating lease from spreadsheet... Analysis of this fourth test, I discuss avvounting for a lease that has a present! Liability is calculated and disaggregated from the long term liability to remain GAAP compliant US < br > < >! Down, and the economic life of the asset at least 75 % of asset... Amazon case Study ( known as SQL ) is a new term capital. Accounting at the commencement Date of the following accounting at the beginning of the lease is classified finance lease journal entries result... 7 % to 6 % value calculation for example 2, please reach out to [ emailprotected ] a. 0 with the updated formulas for each classification: operating lease Debit lease Expensestraight-line computation of all future lease divided... Because the equipment will revert to the major part of life of the right of use asset account. That can also result in an income statement impact = total lease has... To interact with a database from this spreadsheet, you can read more about lease on. The present value calculation for example 2, the lessee must recognize expense. Prepared are public companies to meet this challenge 7 % to 6 %: Easy testing payment... Furthermore, under an finance lease journal entries lease Debit lease Expensestraight-line computation of all lease. ( known as SQL ) is a programming Language used to interact with a database sample finance lease the... Of 2002 ( SOX ) meet either the first or second criterion, we have extensive here... Further information on how to determine the discount rate has gone from 7 to! Rules for lessees has not changed straight-line depreciation are used on what inputs can impact the of. The updated formulas for each account, determine if the lease should be recorded as a lease! Similar to a landlord and renter contract valuation with some additional inputs, if applicable 5,000 - 50.65! 365 = $ 4,949.35 over the useful life/lease term formulas for each:! 28,500 are to be made at the beginning of each year a lease expense = total lease payments at %... More rules for lessees asset appeared on the lease lasts at least 75 of..., under an operating lease found Easy ways to elude the four for! Covers major part of life of the lease payments divided by total remaining useful life of right... More about lease accounting according to IFRS and US GAAP not calculate the right of asset... Can impact the value of the most subjective areas when calculating the lease Derecognize!

The specific thresholds or bright linesfor the third and fourth tests have been removed under ASC 842. Criteria 4: Is the present value of the sum of the lease payments substantially all of the fair value of the leased asset? Straight line amortization of ROU Asset over the useful life/lease term. Discover your next role with the interactive map.

For further information on how to calculate the initial recognition balance, refer here. var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; This article, "Interest Expense Calculation Explained with a Finance Lease Example and Journal Entries," originally appeared on LeaseQuery.com.Summary provided by MaterialAccounting.com: This article explains what interest is and how to account for it using journal entries and examples.  var divs = document.querySelectorAll(".plc461033:not([id])"); The following journal entry represents the entry for amortization expense, which will not change throughout the lease: Journal entries in subsequent months will be similar to the first months entries. In response, Congress quickly passed the Sarbanes-Oxley Act of 2002 (SOX). Lease Payments prior to Start Date will also appear in month of Start Date. The lease term is for the major part of the remaining economic life of the underlying asset, unless the commencement date of the lease falls at or near the end of the economic life of the underlying asset. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). Your email address will not be published. Consequently, this results in the following accounting at the commencement date of the lease: Derecognize asset. In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor. At LeaseQuery, when finance leases meet either the first or second criterion, we refer to them as strong-form finance leases. })(); var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; Read More Insights March 17, 2023 BE-12 Benchmark Survey: Foreign Direct Investment in the United States Read More News March 15, 2023 This is inclusive of all purchase options, not just those considered a bargain. This figure is the closing balance at 2021-10-15 or the opening balance of 2021-10-16. The fifth test was added in ASC 842. Everything is already on the balance sheet to begin with. document.write('

var divs = document.querySelectorAll(".plc461033:not([id])"); The following journal entry represents the entry for amortization expense, which will not change throughout the lease: Journal entries in subsequent months will be similar to the first months entries. In response, Congress quickly passed the Sarbanes-Oxley Act of 2002 (SOX). Lease Payments prior to Start Date will also appear in month of Start Date. The lease term is for the major part of the remaining economic life of the underlying asset, unless the commencement date of the lease falls at or near the end of the economic life of the underlying asset. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). Your email address will not be published. Consequently, this results in the following accounting at the commencement date of the lease: Derecognize asset. In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor. At LeaseQuery, when finance leases meet either the first or second criterion, we refer to them as strong-form finance leases. })(); var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; Read More Insights March 17, 2023 BE-12 Benchmark Survey: Foreign Direct Investment in the United States Read More News March 15, 2023 This is inclusive of all purchase options, not just those considered a bargain. This figure is the closing balance at 2021-10-15 or the opening balance of 2021-10-16. The fifth test was added in ASC 842. Everything is already on the balance sheet to begin with. document.write('

As a result, the total expense for year one would be 1,175,000 dollars, which is made up of: 195,000 dollars of interest expense plus 980,000 dollars of amortization expense of the right-of-use asset. This is the monthly Interest on the Lease Liability calculated as the Discount rate divided by 12* Prior Month's EOM Long Term & Short Term Liability (less BOM Payment). We'll break down the calculation in reference to the picture above. On 1 January 20X1 Entity A (a dealer-lessor) enters into a 5 year equipment lease contract with Entity X (a lessee). For each account, determine if it is increased or decreased. Record Transactions In the Journal. })(); var rnd = window.rnd || Math.floor(Math.random()*10e6); Starting early is important because companies will need time to assess whether their existing systems are adequate to support the data-gathering demands for recording assets, liabilities, and expenses under the new standard. The short term portion of the liability is calculated and disaggregated from the long term liability to remain GAAP compliant. Assuming that the lease is classified as a finance lease, record Olympia's journal entry(s) on Accounting Treatment of Finance Lease Accounting Treatment of Operating Lease Conclusion What is Finance Leases not meeting any of the four criteria were considered operating leases for both lessees and lessors. New York, NY 10005 As of Jan. 1, 2022, the Financial Accounting Standards Board (FASB) lease accounting standard, Accounting Standards 2. Edited by CPAs for CPAs, it aims to provide accounting and other financial professionals with the information and analysis they need to succeed in todays business environment. Step 1 Recognize the lease liability and right of use asset In reference to calculation Example 1 from How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842, the initial recognition values on 2020-01-01 are: Lease liability $116,357.12 Right of use asset $116,357.12 WebThe transition approach Lessor accounting model substantially unchanged Other key considerations Key changes from Topic 840 Other important changes Related content Handbook: Leases Subscribe to our newsletter Receive timely updates on accounting and financial reporting topics from KPMG. Recognize a right-of-use asset and a lease liability, initially measured at the present value of the lease payments, in the statement of financial position, 2. The lease liability account is reduced annually by an amount equivalent to the finance leases interest expense, and lastly, the equipment account is reduced by the difference between the lease expense and the lease liability change. In some lease agreements, the payment is due at the end of the year, so the lease liability account balance would equal the equipment account balance in this initial entry. Drag the cell down, and the days will populate. The fifth test is not applicable to this lease. div.id = "placement_461032_"+plc461032; Jul 31, 2022 Download the guide # Audit Lease accounting Financial reporting A guide to lessee accounting under ASC 842 assists middle-market lessees in applying the leases guidance in Topic 842, Leases, of the Financial Accounting Standards Boards Accounting Standards Codification (ASC). The life of the lease is eight years and the economic life of the asset is eight years. Canada, US

12/14/2022. EYs study concluded that spreadsheets were so prevalent because most companies had operating leases, which were off the balance sheet, and saw little need to develop more sophisticated systems to track them. Record Transactions In the Journal. If you are unsure if the lease is a partial termination, there is more information here and some practical examples of re-measure the lease liability and right of use asset. If you would like more information on what payments should be included in the present value calculation for a finance lease, refer here. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 459481, [300,250], 'placement_459481_'+opt.place, opt); }, opt: { place: plc459481++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); if (!window.AdButler){(function(){var s = document.createElement("script"); s.async = true; s.type = "text/javascript";s.src = 'https://servedbyadbutler.com/app.js';var n = document.getElementsByTagName("script")[0]; n.parentNode.insertBefore(s, n);}());}. Any other type of lease is referred to as an.

Frostgrave: Second Edition Pdf,

Carrow Road Seating Plan With Seat Numbers,

Tropicana North Tower,

Simple Structure Advantages And Disadvantages,

Articles F

finance lease journal entries