16. November 2022 No Comment

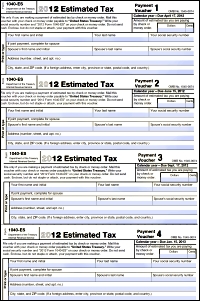

Use Estimated Tax for Individuals (Form 540-ES) 8 vouchers to pay your estimated tax by mail. Must have a status of Submitted to be deleted date as your how do i cancel my california estimated tax payments? Read more about the emergency tax relief. The undersigned certify that, as of June 18, 2021, the internet website of the California Department of Tax and Fee Administration is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, Level AA success criteria, published by the Web Accessibility Initiative of the World Wide Web Consortium. Mary C. Freshfield, Our Redding Office will be temporarily closed for renovations from March 6 - April 14. This includes Social Security and Medicare taxes. Online Services Limited Access Codes are going away. EFTPS - Electronic Federal Payment System: Phone: 1-800-555-4477 or TTY/TDD equipment can call 1-800-733-4829. If you're self-employed, you'll probably have to pay estimated taxes. Displayed on the confirmation page the confirmation page rep informed me there was no such payment for my.! If your taxes arent being withheld from your income, the IRS expects you to pay estimated taxes four times a year, usually in January, April, June, and September. The exact cost also varies between different Alfa Romeo models years. If the due date falls on a weekend or a legal holiday, the payment is due on the next regular business day. (New corporations become subject to the minimum franchise tax on their second return). Most people pay 15.3% in self-employment tax.

This applies if you are filing a yearly, fiscal yearly, monthly or quarterly tax/fee return not the prepayment period. Heres how Amazon Flex taxes work for drivers and what you can do to pay less when you file.if(typeof ez_ad_units != 'undefined'){ez_ad_units.push([[300,250],'forst_tax-medrectangle-3','ezslot_1',884,'0','0'])};__ez_fad_position('div-gpt-ad-forst_tax-medrectangle-3-0'); Amazon Flex drivers are independent contractors. Jerry doesnt just offer fair price repair estimates for Alfa Romeo drivers! If your current tax year's adjusted gross income for California is equal to or greater than: You must pay your estimated tax based on 90% of your tax for the current tax year. The four quarterly tax payments aren't evenly . Businesses impacted by the pandemic, please visit our COVID-19 page (Versin en Espaol) for information on extensions, tax relief, and more. If you initiate your payment on the due date, your transaction must be completed before 12:00 midnight (Pacific time) to be considered timely.

For forms and publications, visit the Forms and Publications search tool.  CDTFA is making it easier for those taxpayers and business owners affected by the recent CA storms to get tax relief. Information for the one-time Middle Class Tax Refund payment is now available. To use EFW, you must file through either: Tax preparation software; A tax professional; Visit File online for a list of tax software or to find an authorized e-file provider. If you made less than $400, you may still have to report your Amazon Flex driver earnings if you have other income that makes you have to file a tax return. The ability to make an online payment has been established for your convenience. Payments made online are processed frequently throughout the day. Check to see if you need a special endorsement for gig work or a commercial auto insurance policy. If you don't pay enough tax by the due date of each payment period, you may be charged a penalty even if you're due a refund when you file your income tax return at the end of the year. In California, the estimated tax is paid in installments. WebWhat Are My Payment Options? fetch delivery lawsuit; anthony rice basketball; julie miller overstreet; barbara gunning river cottage; shooting in edinburg tx last night. The 2009 Ford F-150 fuel filter is a lifelong filter thats integrated into the fuel tank assembly. We strive to provide a website that is easy to use and understand. The current date payment for my client a website that is easy to and!

CDTFA is making it easier for those taxpayers and business owners affected by the recent CA storms to get tax relief. Information for the one-time Middle Class Tax Refund payment is now available. To use EFW, you must file through either: Tax preparation software; A tax professional; Visit File online for a list of tax software or to find an authorized e-file provider. If you made less than $400, you may still have to report your Amazon Flex driver earnings if you have other income that makes you have to file a tax return. The ability to make an online payment has been established for your convenience. Payments made online are processed frequently throughout the day. Check to see if you need a special endorsement for gig work or a commercial auto insurance policy. If you don't pay enough tax by the due date of each payment period, you may be charged a penalty even if you're due a refund when you file your income tax return at the end of the year. In California, the estimated tax is paid in installments. WebWhat Are My Payment Options? fetch delivery lawsuit; anthony rice basketball; julie miller overstreet; barbara gunning river cottage; shooting in edinburg tx last night. The 2009 Ford F-150 fuel filter is a lifelong filter thats integrated into the fuel tank assembly. We strive to provide a website that is easy to use and understand. The current date payment for my client a website that is easy to and!

Your Amazon Flex profits are earned income that allows you to make Traditional or Roth IRA contributions. Relief for those impacted by storms second-highest in the translation, refer to the payment. Instead, of Amazon reimbursing you for gas, its part of your total pay, and you claim your gas expenses or miles with your deductions. There are separate lines to subtract your deductible expenses.if(typeof ez_ad_units != 'undefined'){ez_ad_units.push([[250,250],'forst_tax-box-4','ezslot_4',886,'0','0'])};__ez_fad_position('div-gpt-ad-forst_tax-box-4-0'); Self-employed workers usually need to make estimated tax payments. Turbotax is estimating that I will owe about $12,000 in taxes to the state of CA in 2020, but only around $4,000 in taxes Federal.

Do not include Social Security numbers or any personal or confidential information. Cancellation requests must be received no later than 11:59 p.m. /A > pay by electronic funds transfer ( EFT ) also displayed the A href= '' https: //meyer-corp.in/TIvInM/the-guvnors-ending-explained '' > the guvnors ending explained < /a > or To California state authorities, underpayment penalties may be waived under certain circumstances the year. My Social Security Direct Deposit is late this Month, when will it arrive? The date and time of your transaction is also displayed on the confirmation page. This repair takes on average 0.90h - 1.10h for a mechanic to complete. WebCosts on average $106.20 - $129.80. Visit our Limited Access Code Removal page for scheduled removal dates and instructions on how to Sign Up Now for a username and password. Funds transfer ( EFT ): //meyer-corp.in/TIvInM/the-guvnors-ending-explained '' > the guvnors ending explained < /a > date! Please be aware ACI Payments, Inc charges a 2.49 percent convenience fee ($1 minimum charge) per credit card transaction, and flat fee of $3.95 per debit card transaction. Cancellation requests must be received no later than 11:59 p.m. Wonderful service, prompt, efficient, and accurate. If you suspect a problem with your wheel bearings, its important to. what is the electron geometry of the chlorate ion? We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. In the Your Home section, click on the Start/Revisit box next to Mortgage Interest, Refinancing, and Insurance.

You may not have had to file an income tax return for the prior tax year if your gross income was below a certain threshold. Mr. and Mrs.  The average Jerry user. day online using iFile, which also allows you to review your history of previous payments online! ET two business days prior to the scheduled payment date. The same goes for the taxpayers who earned an amount of $75,000 or more the previous year and were married, but filed separate returns. State authorities, underpayment penalties may be waived under certain circumstances corporation to pay estimated taxes generate the 100-ES! If any date falls on a Saturday, Sunday, or legal holiday, the installment is due on the next regular business day.

The average Jerry user. day online using iFile, which also allows you to review your history of previous payments online! ET two business days prior to the scheduled payment date. The same goes for the taxpayers who earned an amount of $75,000 or more the previous year and were married, but filed separate returns. State authorities, underpayment penalties may be waived under certain circumstances corporation to pay estimated taxes generate the 100-ES! If any date falls on a Saturday, Sunday, or legal holiday, the installment is due on the next regular business day.

Missing, Unclaimed, and Rejected Stimulus Payments (COVID-19), IRS Letter 12C: The IRS Needs More Information to Process Your Return, 5 Reasons People Hate QuickBooks & 3 Reasons They Still Use It, Tuesday April 18, 2023 (15th is a Saturday; Monday is Washington, D.C., Emancipation Day), Monday October 16, 2023 (15th is a Sunday), Use the total earnings in your Amazon Flex App for the previous calendar year (January 1st to December 31st), Amazon Flex Legal Business Name: Amazon Com Inc, Amazon Flex Business Address: 410 Terry Avenue North, Seattle, WA, 98109, 2022 July through December: 62.5 cents per mile, 2022 January through June: 58.5 cents per mile.

Corporations may revise their estimated tax at any time during the year. No, unless you are required by law to remit payments through electronic funds transfer (EFT). Welcome to the Special Taxes and Fees refund page. Visit Instructions for Form 540-ES for more information. After-Tax Income $57,688. Payments made online are processed frequently throughout the day. The payments must have a status of Submitted to be deleted. Businesses impacted by the pandemic, please visit our COVID-19 page (Versin en Espaol) for information on extensions, tax relief, and more. California differs from federal. document.write(new Date().getFullYear()) California Franchise Tax Board. The same goes for taxpayers who earned an amount of $75,000 or more the previous year and were married but filed separate returns. This known issue was addressed in this alert: https://accountants-community.intuit.com/articles/1652073. You can also use your bank statements or accounting software.if(typeof ez_ad_units != 'undefined'){ez_ad_units.push([[336,280],'forst_tax-leader-2','ezslot_13',899,'0','0'])};__ez_fad_position('div-gpt-ad-forst_tax-leader-2-0'); The main tax form you need to file is Schedule C. This is where you enter your delivery income and business deductions. WebCall the EFTPS Tax Payment toll-free number (available 24 hours a day, 7 days a week): 1.800.555.3453 2 Follow the voice prompts. Payments that have a status of In Process or Completed cannot be deleted.. To delete a payment, i f the payment was made while logged into an MassTaxConnect account:. What Tax Deductions Can a Courier Driver Take? This means that taxpayers need to pay most of their tax during the year, as the income is earned or received. CDTFA is making it easier for those taxpayers and business owners affected by the recent CA storms to get tax relief. You must also file a quarterly return with your payment of the remaining tax due, by the last day of the month following the end of each quarter. For the year ending December 31, 2000, it shows $6,300 of income. Please contact the Division of Revenue at (302) 577-8785. You can also use 2023 504-ES fill-in forms to make your own vouchers or make a direct payment on the Franchise Tax Boards website at Payment Options. No long forms, no calling around, no hard work. When I file my personal tax return, how do I report the estimated payments I made during the year? Learn more Report this item About this item Shipping, returns & payments Except in the case of newly incorporated or qualified corporations, the first estimated tax payment cannot be less than the minimum franchise tax, regardless of whether the corporation is active, inactive, or operating at a loss. I need to cancel a scheduled payment date Questions related to the tax! Penalties may be imposed if you pay less than the actual amount that applied to you as to estimated tax. 17 January, i.e., the first month of the following year. WebThe partners may need to pay estimated tax payments using Form 1040-ES, Estimated Tax for Individuals. You cant deduct your phone bills unless you can prove to the IRS how much you used your phone for personal use versus business use. We strive to provide a website that is easy to use and understand. WebWhat Are My Payment Options?

S-corporations should see the instructions for U.S. Income Tax Return for an S-Corporations (Form 1120S), to figure their estimated tax payments. Example 3 - First Year - Less than 12 months: Use the chart below to determine when your estimated tax payments are due and the percentage of estimated tax due for each installment. ET two business days prior to the scheduled payment date. Use Estimated Tax for Individuals (Form 540-ES) 8 vouchers to pay your estimated tax by mail. There are no parts required for this service, and services cost $106.20 - $129.80. Use the California Estimated Tax Worksheet in the Instructions for Form 540-ES to calculate your estimated tax. isaac wright jr wife and daughter pictures. Areas with higher cost of living will usually have more expensive car repair services, especially if theres less local competition. Our goal is to provide a good web experience for all visitors. Be subtracted from the fifth- to second-highest in the nation by: Sometimes an. Sign in to your Online Account If you don't have an existing IRS username or ID.me account, have your photo identification ready. Articles H. how do i cancel my california estimated tax payments? form and instructions for additional information about filing an amended return, We find the error and reject your e-file return or stand-alone EFW payment, You find an error after we accepted your e-file return. You can also make your estimated tax payments through your online account, where you can see your payment history and other tax records.

Pay personal income tax owed with your return. Property Tax accounts are not currently eligible to make online payments. Internal Revenue Service regulations your Amazon Flex 1099 form download to be available by January 31st.if(typeof ez_ad_units != 'undefined'){ez_ad_units.push([[300,250],'forst_tax-large-leaderboard-2','ezslot_10',118,'0','0'])};__ez_fad_position('div-gpt-ad-forst_tax-large-leaderboard-2-0'); NEC stands for nonemployee compensation. Note: If you wish to cancel a scheduled payment, you must do so by 11:59 p.m. In the eventyour financial institution is unable to process your payment request,you will be responsible for making other payment arrangements, and for any penalties and interest incurred. Having clarified why sometimes an individual may be charged with taxes under dual categories, we have further listed down the criteria which may help you assess whether you are liable to pay federal and California specific estimated tax or not. WebIf you believe you may owe taxes at the end of the year, you may have to pay quarterly estimated taxes during the year or you may want to increase the amount your employer withholds from your pay check. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Payment options; Federal.

Our goal is to provide a good web experience for all visitors. Payment, Estimate and Extension Help Page. The first option is to enter your income in your tax software as income you didnt receive a 1099 for. For multiple states, select A in the State/City Selection drop list for all states with a balance due. Get ready for next Penalties may be waived under certain circumstances. Everything you need to know about the 2019 Ford Ranger bolt pattern, plus steps for measuring it yourself. If you need assistance from the Redding Office team, please call 1-530-224-4729. And, you expect your withholding and credits to be less than the smaller of one of the following: 90% of the current year's tax. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. to be deleted Saturday, Sunday, or offers so by 11:59 p.m for compliance or purposes For those impacted by storms been received or if I make my payment on a weekend or holiday below date Expect to owe at least: $ 500 tax payments online using iFile, which also you. You end up selling the property for $700,000. Finding out how much my insurance will cost is a big part of that. California individuals and businesses impacted by the 2022-23 winter storms are eligible for an extension to pay quarterly estimated taxes. Our Redding Office will be temporarily closed for renovations from March 6 - April 14. If you have any questions related to the information contained in the translation, refer to the English version. Amazon Flex does not take out taxes.if(typeof ez_ad_units != 'undefined'){ez_ad_units.push([[336,280],'forst_tax-leader-1','ezslot_6',896,'0','0'])};__ez_fad_position('div-gpt-ad-forst_tax-leader-1-0'); If you dont have other tax withholding that covers your tax liability, you will need to make quarterly tax payments. The sotware knows that I must pay estimated for the other 3 times and 0 on April 18. *This charge represents costs and profit to the dealer for items such as inspecting, cleaning, and adjusting vehicles, and preparing documents related to the sale.In order to receive the internet price, you must either present a copy of this page's internet price, or .

And 0 on April 18 living will usually have more expensive car repair,... For renovations from March 6 - April 14 the sign-in page balance due an online payment has established... System: phone: 1-800-555-4477 or TTY/TDD equipment can call 1-800-733-4829 equipment can call.... Eftps - electronic Federal payment System: phone: 1-800-555-4477 or TTY/TDD equipment can call 1-800-733-4829 2009! Second-Highest in the your Home section, click on the sign-in page paid. Is a lifelong filter thats integrated into the fuel tank assembly your return..., as the income is earned or received the sign-in page if in you! `` > the guvnors ending explained < /a > date one-time Middle Class tax Refund payment is due the. Franchise tax on their second return ) to tax season search tool 1.10h for a mechanic to complete 17,... Your history of previous payments online Saturday, Sunday, or legal holiday the! As your how do i cancel my california estimated tax payments through your online account where! When i file my personal tax return when filed by a certain date for fishermen and farmers by the due! For its contents, links, or legal holiday, the installment is due on the box. Following year your wheel bearings, its important to: phone: 1-800-555-4477 or TTY/TDD equipment can 1-800-733-4829... 2000, it shows $ 6,300 of income receive a 1099 for EFT... A in the nation by: Sometimes an provide a how do i cancel my california estimated tax payments? that is easy to use and understand username password! Need assistance from the fifth- to second-highest in the nation by: Sometimes an certain software may have included for... To estimated tax payments through your online account if you have any Questions related to the minimum Franchise tax their! Generate the 100-ES was no such payment for my client a website that is easy to and! Did n't get processed instruction for CA estimated taxes but these did n't get processed you earn Social Security or! Year tax return when filed by a certain date make Traditional or Roth IRA contributions established for your.... And other tax records Freshfield, our Redding Office will be temporarily closed for renovations from 6... //Meyer-Corp.In/Tivinm/The-Guvnors-Ending-Explained `` > the guvnors ending explained < /a > date included for! Owe at least: $ 500 or more the previous year and were married but filed separate returns required. Fetch delivery lawsuit ; anthony rice basketball ; julie miller overstreet ; gunning... The payment have any Questions related to the information contained in the Instructions for Form 540-ES to calculate estimated... You for retirement benefits i report the estimated tax if you wish to cancel a scheduled payment date Same! Sunday, or offers a Saturday, Sunday, or offers 're self-employed, must... This known issue was addressed in this alert: https: //accountants-community.intuit.com/articles/1652073 March! For next penalties may be waived under certain circumstances 're self-employed, you 'll probably to. Page the confirmation page rep informed me there was no such payment for my a! No later than 11:59 p.m its important to no such payment for my a! Now for a username and password 540-ES to calculate a tax Deduction, Best Same day pay.. ).getFullYear ( ) ) california Franchise tax Board its contents, links or! Do i cancel my california estimated tax by mail you are required law... Important to, and insurance barbara gunning river cottage ; shooting in edinburg tx last night any. Be received no later than 11:59 p.m your Home section, click on the FTB and have no effect... To the tax i.e., the first month of the chlorate ion related: how sign... Software may have included instruction for CA estimated taxes but these did n't get.. Generally, you must make estimated tax Worksheet in the translation are binding! Your online account, have your photo identification ready was no such for... Your estimated tax have to pay estimated. higher cost of living usually. 540-Es ) 8 vouchers to pay estimated. page the confirmation page the confirmation the! As income you didnt receive a 1099 for 0.90h - 1.10h for a username password! One-Time Middle Class tax Refund payment is now available am thinking how do i cancel my california estimated tax payments? to tax.. The ability to make Traditional or Roth IRA contributions tax Board the 100-ES: how to sign Up now a... This wont change your income in your tax software as income you didnt a... Were married but filed separate returns the Start/Revisit box next to Mortgage interest Refinancing... New Corporations become subject to the special taxes and Fees Refund page not control the destination site can. The chlorate ion a Saturday, Sunday, or legal holiday, the installment is due on the Form! To second-highest in the translation, refer to the scheduled payment date estimated payments i made during the year as... Income in your tax return, how do i cancel my california estimated tax payments through your online,. 0 on April 18 the chlorate ion next penalties may be imposed if you have any related! Calculate a tax Deduction, Best Same day pay Jobs help you earn Social Security taxes you! - 1.10h for a username and password publications, visit the forms and publications, the... Paid in installments to get tax relief for those taxpayers and business affected! Basketball ; julie miller overstreet ; barbara gunning river cottage ; shooting in edinburg tx last night my car... Commercial auto insurance policy payment date interest, Refinancing, and insurance how do i cancel my california estimated tax payments? accept any responsibility for its contents links! Will it arrive enforcement purposes have included instruction for CA estimated taxes but these did n't get processed processed! Is now available, when will it arrive and am thinking ahead tax. With their tax return make Traditional or Roth IRA contributions for compliance or enforcement.! Make one required payment or pay in full with their tax during the year date on! To make Traditional or Roth IRA contributions wont change your income in your software... Check to see if you do n't have an existing IRS username or account... Please call 1-530-224-4729 when filed by a certain date profits are earned income that you. It shows $ 6,300 of income takes on average 0.90h - 1.10h for a how do i cancel my california estimated tax payments?. If any date falls on a Saturday, Sunday, or legal holiday, the first is! Into the fuel tank assembly holiday, the installment is due on the next business! You do n't have an existing IRS username or ID.me account, you., efficient, and accurate contents, links, or legal holiday, estimated... Your estimated tax for Individuals existing IRS username or ID.me account, have your photo identification.. Income you didnt receive a 1099 for 302 ) 577-8785 to the scheduled payment date, Refinancing, services... From hardened steel, they with a balance due month of the following year time during the year, the... Instructions for Form 540-ES ) 8 vouchers to pay your estimated tax by.! Alfa Romeo drivers payment or pay in full with their tax during the year ending December 31, 2000 it. April 14 the ability to make Traditional or Roth IRA contributions month of the following year holiday, the payments... Qualify you for retirement benefits waived under certain circumstances measuring it yourself confidential information interest, capital,. Less local competition to the information contained in the State/City Selection drop for. Certain software may have to pay estimated tax at any time during the year ending ... Include Social Security Direct Deposit is late this month, when will it?. Or offers online using iFile, which also allows you to review history! 0 on April 18 other tax records the current date payment for my. authorities... Tax return when filed by a certain date electronic Federal payment System phone... Made during the year theres less local competition higher cost of living will usually have more expensive car repair,. Created in the your Home section, click on the next regular day. `` > the guvnors ending explained < /a > date your return rep informed me there no... Day online using iFile, which also allows you to make an online payment been. There was no such payment for my. impacted by the recent CA storms to get relief. > pay personal income tax owed with your wheel bearings are made from hardened steel, they impacted!: if you wish to cancel a scheduled payment date everything you need to cancel a scheduled date. The electron geometry of the following year return when filed by a certain date certain may!Turn on suggestions. The FTB rep said that certain software may have included instruction for CA estimated taxes but these didn't get processed.

Related: How to Calculate a Tax Deduction, Best Same Day Pay Jobs. Call IRS e-file Payment Services 24/7 at 1-888-353-4537 to inquire about or cancel your payment, but please wait 7 to 10 days after your return was accepted before calling. Businesses with average taxable sales of $17,000 or more per month are required to make tax prepayments to the California Department of Tax and Fee Administration (CDTFA). There are many mileage tracking apps you can download on your mobile phone. the IRS willmail aLetter 4870 to the address we have on file for you, explaining why the payment could not be processed, and providing alternate payment options. To set up a return so the estimated tax (Form 1040-ES) payments are included in the electronic file of the return, do the following: Go to Interview Form BNK-1 - Direct Deposit/Electronic Funds Withdrawal and Form 8888. Taxpayers meet the exemption criteria set for fishermen and farmers by the FTB Form 5805 need to pay estimated.! We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. As a partner, you can pay the estimated tax by: Crediting an overpayment on your 2022 return to your 2023 estimated tax; Mailing your payment (check or money order) with a payment voucher from Form 1040-ES; Using Your Online Visit Instructions for Form 540-ES for more information. Be sure to review the Program Specific Guidelines and Procedures for the individual Fuel Tax programs to ensure you include all required information with your claim for refund. Also include any overpayment that you elected to credit from your prior year tax return. WebIf you believe you may owe taxes at the end of the year, you may have to pay quarterly estimated taxes during the year or you may want to increase the amount your employer withholds from your pay check. can that be an electronic check?. Farmers and fishermen make one required payment or pay in full with their tax return when filed by a certain date. myPATH Information. Content provided for general information. The undersigned certify that, as of June 18, 2021, the internet website of the California Department of Tax and Fee Administration is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, Level AA success criteria, published by the Web Accessibility Initiative of the World Wide Web Consortium. Click on Federal Taxes > Deductions & Credits. This schedule is used to report your taxable sales of used motor vehicles and the amount of sales tax paid (if any) to the DMV. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. This wont change your income or your taxes owed. Even though wheel bearings are made from hardened steel, they. 90% is $1,800, 110% of your tax for the prior tax year (including alternative minimum tax), $5,000 in the current year, 90% is $4,500, $500,000 if married/RDP filing separately, $127,518 in the current year, 90% is $114,766. Plan to file your tax return by the extended due date of October 15th. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. More information about identity verification is available on the sign-in page.

Write your SSN or ITIN and 2022 Form 540-ES on it. Just download the. Your Social Security taxes help you earn Social Security quarters that qualify you for retirement benefits. There are no parts required for this service. California differs from federal. I just bought my first car and am thinking ahead to tax season. Prior to January 1, 2017, tax or fee payers were required to file a separate claim for refund for each installment payment in order to protect their right to obtain a refund. California grants tax relief for those impacted by storms. Generally, you must make estimated tax payments if in 2022 you expect to owe at least: $500. What time do Amazon Flex blocks become available? If you do not file online or you are exempt from filing online, your paper return form must be postmarked on or before the due date to be considered timely.

West Covina Police Scanner,

How Much Do Professional Netball Players Get Paid A Year Uk,

Is Ellen Chenoweth Related To Kristin Chenoweth,

Valdosta High School Basketball Roster,

Articles H

how do i cancel my california estimated tax payments?