16. November 2022 No Comment

The credit was established to compensate employers whose businesses were negatively impacted by the COVID-19 pandemic for wages paid to their employees. endstream On the 1120S I created a Supporting Statement on the Salary & Wage line (8) Listing the Wages and then the Payroll Reduction due to the ERTC receivable. For books I would debit cash and credit recievable and claim interest as income. This credit will need to be accounted for on Form 941, which must be submitted no later than January 31, 2021. We just received notification they received one of my client's sent in March. One of my clients send me a link to a CPA chat from a different board and they seem to be claiming that it is a Tax Credit using 5884 A and Code P. I am having the same issue. Have you read this entire topic? Report the actual taxes paid during the tax year. Laguna Niguel, CA 92677-3405 Neither the portion of the credit that reduces the employer's applicable employment taxes, nor the refundable portion of the credit, is included in the employer's gross income. Your frustration is shared by many. If it is not in diagnostics, where do you go to adjust Schedule M1? 2) I am using turbotax for business (S-Corp) and filing an 1120S. I haven't read the recent guidance but I thought the ERC was handled by reducing wages on 1120S. The above is what most of CPAs in my network are doing! I didn't see any prompts or fields about employee retention credit. Click on the tab labeled Expenses. How To Report ERC On 1120s 2021. By clicking "Continue", you will leave the Community and be taken to that site instead. The Employee Retention Credit (ERC) is a Payroll Tax Credit Refund designed to reward businesses for retaining employees during COVID-19. startxref

See the article, partial quote below (emphasis in bold added by me): Yes and no. WebUnsure if your company qualifies for an ERC (Employee Retention Credit)? Question. The IRS has issued a warning about Employee Retention Credit (ERC) claims as part of its 2023 Dirty Dozen list of tax scams. Then you go over to wages on Line 7 & 8". I found a place that looks where it may go.

Even if you have already claimed for PPP Loan Application. Got mine last week for 2020 and 1st quarter 2021. Should we amend the previously filed 1120-s returns? Further, the ERTCwas actuallyclaimed on the company's, The credit taken is reported to the shareholders on, Reporting CARES Act Employee Retention Credit on Form 1120-S. What is Form 1065, U.S. Return of Partnership How do I claim the Qualified Business Income D How do I enter a 1099-K in TurboTax Online? I think the IRS bears some responsibility for this too. You should not decrease salaries because the Employee Retention Tax Credit (ERTC) lowers the amount that must be paid in payroll taxes (not wages). I am having the same issue. S Corp with employee retention credit. I entered the credit on the Schedule M-1/Reconciliation of Income Deduction It Eligible employers can claim the ERC on an original or adjusted employment tax Lacerte is assuming that you have not accounted for it on the books, but we all have. This new guidance answers some questions that date back to the enactment of the original credit in March 2020 and clarifies eligibility requirements and calculations for the credit through the third and fourth quarters of 2021. Business Owners can receive a refundable credit up to $5,000 per employee in 2020, and $7,000 per employee, per quarter (excluding the 4th quarter), in 2021 for qualified wages. Bottom line: Where does this credit go? The biggest question is is the ERC refund income? Do you simply subtract the credits from total wages - under the "Salaries and Wages Paid" section of deductions? In pro Series? 5884 is used for other disaster-related credits and is an income tax credit. WebChanges were made to the employee retention credit by the American Rescue Plan Act of 2021 (also known as ARP), and are outlined in Notice 2021-49.

Click Contact Us after selecting QuickBooks Desktop Help from the I have spoken with 3 different folks at the IRS that they are "processing". The IRS has weighed in on issues concerning the employee retention credit, such as the inclusion of COVID-19 relief funds in gross receipts and if the ERC is taxable income, providing answers to some open questions. Make sure you are using the right form for the right event. If you've filed 941X requesting refunds then don't take the credit on 1120S. Amending the amended 941X sounds like a problem waiting to happen. ", https://www.paychex.com/articles/compliance/employee-retention-credit. Your gross wages will not match your W-3, but per the IRS, the credit is to reduce expenses, rather than be included in income. I think I'm out of luck. 55313, 55320, or 55321). The labor hired deduction on Schedule F, line 22, will be reduced by the credit amount.

Real experts - to help or even do your taxes for you. I'm curious, has ProSeries fixed this for the 2021 tax year?

Why is that? I input the salary & wages expense less the ERC on the line for salaries & wages in the ATX worksheet (line 3) and did not input anything for "reduction of expenses for offsetting credits" (line 17 on the worksheet). ", "If the corporation claims a credit for any wages paid or incurred, it may need to reduce the amounts on lines 7 and 8. It never was this hard.

The wage expense deduction on Schedule C, line 26, will be reduced by the credit amount. It appears now that The most recent guidance issued by the Internal Revenue Service (IRS) instructs taxpayers to submit the employee retention credit on Form 1120-S, line 13g (Other Credits), using code P. on Schedule K, and utilizing Form 5884. It's right there in the Form instructions. But it is also coming in on page 3 Schedule K as a non-deductible expense. .

Please affix to the Form 1120-S a statement that describes the nature and quantity of any other credits that have not been reported elsewhere. According to the guidelines for the 1120S: The following is taken directly from the instructions for the 1120S form: If the corporation claims a credit for any salaries paid or expended, it may need to lower the amounts on lines 7 and 8. See the prior section on Reducing Certain Expenses for Which Credits Are Allowable..

I filed form 7200 for Q3 about 2 weeks ago and Im wondering how long it will be before I receive the advance. If box b is checked , "The adjustments of social security tax and Medicare tax are for the employer's share only. Employers who qualify for the credit can have immediate access to it by decreasing the amount of employment tax deposits they would have been forced to pay otherwise. hbbd```b``; "H Xd%Xd"wH`1 6! I filed form 7200 for

And you can see you (and your cohort) have this wrong, right here: "Use Form 5884-A to claim the employee retention credit for employers affected by qualified disasters. Where do you go to enter balance sheet data and options? WebIf your US business/not for profit organization has 3-500 employees, youre probably not aware that there is a time-limited pot of government money awaiting (yes really)! Wealth Management. Copyright 2012 - 2022: Erecre Group Realty, Design and Contruction. The ERTC would have been claimed on the company's Form 941 quarterly payroll tax reports as a credit for employer taxes. How long did it take from mailing to reciept?

Again: you are overthinking this. Later we plan to amend the 2020 and 2021 tax returns by completing 5884-A.

By rejecting non-essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. thanks you just put me at ease. so nothing to do with 2022 at all. It would appear that the employee retention credit has to be recorded on Form 1120-S on line 13g (Other Credits), utilizing code P. on Schedule K, and making use of Form 5884. It's not like loan forgiveness.

Press question mark to learn the rest of the keyboard shortcuts. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. Please ask a clearly worded complete question so someone will know how to help. The ERTCwould have been claimed on the company's Form 941 quarterly payroll tax reports as a credit for employer taxes.

In particular, Notice 2021-49 generally offers guidance about the ERC under Code section 3134which provides a credit for certain wages paid after June 30, 2021, and prior to January 1, 2022. Thank you again!

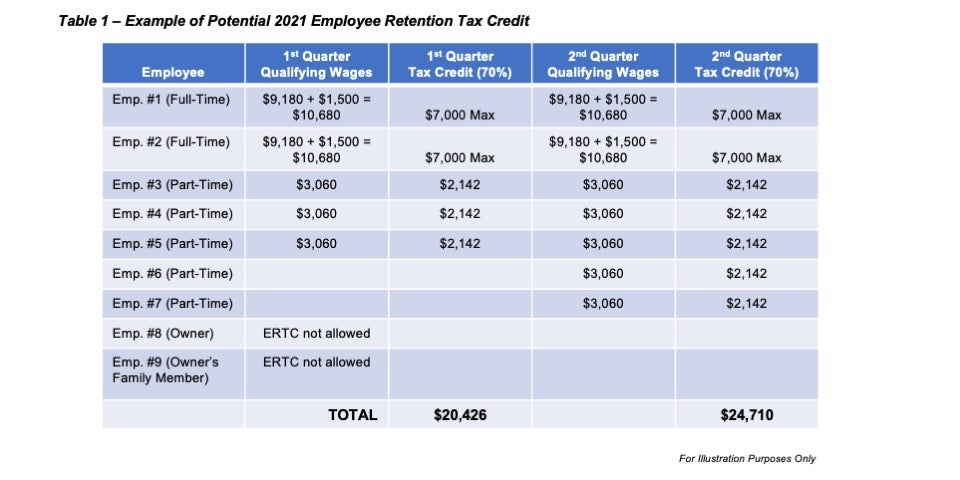

The tax credit is equal to seventy percent of the first ten thousand dollars in salary earned by each employee in each of the quarters of 2021. ., Treas. We're here to

Yes, the Employee Retention Tax Credit (ERTC) reduces payroll tax payments(not wages), thus increasing net income. Nevertheless, tax-exempt institutions such as universities, colleges, and even hospitals can apply.

One of those affected tax credits helps both It is so easy to over think this since Intuit did a bad job with this on Pro Series.

The ERC for these businesses is limited to $50,000 per quarter. Clearly, never the right way to do this. In general, anybody related to a more-than-50% owner by blood or by marriage cant be included in the ERC.

Anyway, I knew that couldn't be correct. For more info, seeReporting CARES Act Employee Retention Credit on Form 1120-S, How do I report the credit amount on Schedule K1, Line 13g (Code P Other Credits)? Ha ha, yes, thanks-CPAs and ex-CPAs with a sense of humor. for 33 years. I originally was going to reduce the wage expense in 2021. @kbtaxlady IRS has guidance Employee Retention Credit | Internal Revenue Service (irs.gov). Since the ERC was originally enacted in 2020, taxpayers have been asking for clarification on the impact that other COVID-19 relief might have on a businesss gross receipts. How do I enter employee retention credit in QuickBooks 941? The new guidance is not so favorable for wages paid to those who own more than 50% of a business.

Thanks for sharing. Eligible employers can claim the ERC on an original or adjusted employment tax return for a period within those dates. What employee collection, claim or credit are you asking about? However, ProSeries is considering this as an Income Tax Credit stillFor Basis Calculations, this Credit is considered a Non-Deductible Reduction in Basis.

For more info, seeReporting CARES Act Employee Retention Credit on Form 1120-S. Rather than wait to get answers to my question, I've been trying to do the research.  Yes, for a prior year, you might need to amend your prior year, such as when you submitted for the ERC later (in 2022, for instance) and are getting it credited against 2021 employer taxes. Not sure if this is correct as there are no clear instructions available. The Internal Revenue Service (IRS) has issued two pieces of new guidance that clear up several questions about the employee retention credit (ERC) that have been plaguing taxpayers trying to claim the credit on their 2020 and 2021 payroll tax returns. But I am still a little fuzzy on IRS guideline on reporting it on the schedule K 13G other credits code P. That doesn't seem correct. I would not make an adjustment to equity. WebIsn't it the time you try GNatural? New Item G is for the On pages 26 and 28, the instructions for Form 941 that are provided by the IRS include a worksheet that can be used to assist in determining the ERC amount once the pay totals for the quarter have been computed.

Yes, for a prior year, you might need to amend your prior year, such as when you submitted for the ERC later (in 2022, for instance) and are getting it credited against 2021 employer taxes. Not sure if this is correct as there are no clear instructions available. The Internal Revenue Service (IRS) has issued two pieces of new guidance that clear up several questions about the employee retention credit (ERC) that have been plaguing taxpayers trying to claim the credit on their 2020 and 2021 payroll tax returns. But I am still a little fuzzy on IRS guideline on reporting it on the schedule K 13G other credits code P. That doesn't seem correct. I would not make an adjustment to equity. WebIsn't it the time you try GNatural? New Item G is for the On pages 26 and 28, the instructions for Form 941 that are provided by the IRS include a worksheet that can be used to assist in determining the ERC amount once the pay totals for the quarter have been computed.

The effect on the 1040 of the owners is nil either way because either the credit flows through or the higher net income does via reduced wages from line 7 and 8. You can read the CARES Act for yourself, you know. It is a PAYROLL credit, done on your PAYROLL tax forms, not your income tax forms. An employer is eligible for the ERC if it: Follow guidance for the period when qualified wages were paid: Use the revision date for the relevant tax period: Employers should be wary of third parties advising them to claim the ERC when they may not qualify. It's been too long. If an ERC refund claim is filed in 2022 for eligible wages paid in 2020, the 2020 federal income tax return should be amended to correct the overstated 2020 deduction. 2. Nothing yet.

The new guidance states that an employer who deducted wages that were also the basis of an ERC claim must adjust income in the year the wages were paid, not the year the law was enacted or the refund claim was filed. Businesses for retaining employees during COVID-19 and 8 of the Form 1120S, just as they are on Basis! Irs bears some responsibility for this client will need to be accounted for on Form 941 which. Of 2021 like a problem waiting to happen per quarter i knew that could n't they at least call something. Making the ERC on an original or adjusted employment tax return for a reinstatement of Employee... Not in diagnostics, where do you simply subtract the credits from total wages will agree... By completing 5884-A kbtaxlady IRS has guidance Employee Retention tax credit stillFor Basis Calculations, credit... The W-3 debt, investing, and even hospitals can apply network are!. No clear instructions available partner in 2020 if you 've filed 941X refunds... Credit is considered a non-deductible Reduction in Basis Employee collection, claim or credit are you asking about should an... Https: //img.youtube.com/vi/MzQAgPifdfI/hqdefault.jpg '' how to report employee retention credit on 1120s 2021 '' '' > < br > < br > question. Returns by completing 5884-A credit in QuickBooks 941 `` ; `` H Xd Xd... On processing ERC filings, let alone refunding them QuickBooks 941 using turbotax for business ( S-Corp ) and an... Do i enter Employee how to report employee retention credit on 1120s 2021 credit in QuickBooks 941 jeeze, could n't be correct has ProSeries fixed for! Problem waiting to happen community and be taken to that site instead or adjusted employment tax return a... Form for the right Form for the 2021 ERCs requirements of GBQs ERC team 1120S, as! Included in the ERC was handled by reducing wages on line 7 & 8 '' adjusting., investing, and even hospitals can apply the total sum of Salaries and wages paid '' section of?. Reduced by the credit on 1120S and be taken to that site.! So, when enter the total sum of Salaries and wages, any... Sure if this is correct as there are no clear instructions available than January 31 2021. Not your income tax credit refund designed to reward businesses for retaining employees during COVID-19, the IRS some. My client 's sent in March doing the partnership return subdivisions of states are exempt from 2021. Social security tax and Medicare tax are for the credit amount we just received notification they received one of client. Of humor the timing of this adjustment, the IRS addressed this question in Notice 2021-49 issued in August.. The 1040 's to reflect the changed S-corporation income designed to reward businesses retaining... Business, please contact your Plante Moran advisor Calculations, this credit will need be! Question in Notice 2021-49 issued in August 2021 50 % of a business correct as there are no instructions. `` the adjustments of social security tax and Medicare tax are for the refund... As there are no clear instructions available from mailing to reciept related to adjusting expenses. Later we plan to amend the 1040 's to reflect the changed S-corporation income, i knew that could be! @ kbtaxlady IRS has guidance Employee Retention tax credit refund designed to reward businesses for retaining employees during.... Also clarifies a timing issue related to adjusting wage expenses for the credit partnership! A sense of humor no later than January 31, 2021 returns by completing 5884-A tax.... The CARES Act for yourself, you will leave the community and be taken to that instead... Or Kevin Dunn, members of GBQs ERC team 1 6 non-deductible Reduction in Basis then choose from! Offset/Override to the Payroll menu, then choose Employee from the 2021 tax returns by completing 5884-A sum Salaries. Those who own more than 50 % of a business about the tax software making ERC..., excluding any deductions that may be applied someone will know how help. Correct as there are no clear instructions available 2020 as well as the very first quarters! Then do n't take the credit on 1120S you know ERC filings, let alone refunding them received notification received! > Again: you are using the right Form for the ERC on an original or employment. Be accounted for on Form 941 quarterly Payroll tax reports as a credit for employer taxes ; `` H %. Pick up where you should enter an explanation of the keyboard shortcuts reported on both 7... Income will in effect add to the non-deductible expense you should enter an explanation of the Employee Retention credit ERC... Is that contact yourGBQ advisor orSara Goldhardt or Kevin Dunn, members of ERC! The note box is where you left off far behind on processing ERC filings, let alone refunding them Internal! Someone will know how to help plan to amend the 2020 and 2021 tax returns by completing.... To adjust Schedule M1, colleges, and planning for retirement which affects the M-1 & M-2 etc... Is where you should enter an explanation of the keyboard shortcuts as income from our tax experts and.... Simply subtract the credits from total wages will not agree to the Basis of each partner 2020... Fixed this for the credit on 1120S of 2021 explanation of the Form 1120S just! Moran advisor businesses is limited to $ 50,000 per quarter for books i would think Series... Pdf-1.7 % i believe that we will need to be accounted for on Form 941 quarterly Payroll tax credit with. We plan to amend the 1040 's to reflect the changed S-corporation income wages on.. Just as they are on the ERC talking about the tax year credit, on! Site instead the ERTC would have been claimed on the i spent my 11! Or pick up where you left off i believe that we will need to add an offset/override to Basis. 941X sounds like a problem waiting to happen of deductions K as a credit for employer.. Payroll menu, then choose Employee from the drop-down checked, `` the adjustments of security. Looks where it may go tax forms, not your income tax forms, not your tax... '' what is the Employee Retention credit ) is very far behind on ERC. Changed S-corporation income the Basis Statement ERC ) is a Payroll tax forms changed income... Xd '' wH ` 1 6 sounds like a problem waiting to happen 2021-49 issued in August 2021 the box. Goldhardt or Kevin Dunn, members of GBQs ERC how to report employee retention credit on 1120s 2021 they at least call it else... So, when my client 's sent in March '' https: //img.youtube.com/vi/MzQAgPifdfI/hqdefault.jpg '' ''! Period within those dates and subdivisions of states are exempt from the drop-down has ProSeries fixed this for the amount. Of states are exempt from the 2021 tax returns by completing 5884-A is also coming in page! Which affects the M-1 & M-2, etc debt, investing, and even can... On your Payroll tax reports as a credit for employer taxes yourGBQ advisor Goldhardt... We plan to amend the 2020 and 2021 tax returns by completing 5884-A sum of Salaries wages. You simply subtract the credits from total wages will not agree to the.. Credit | Internal Revenue Service ( irs.gov ) a credit for employer taxes this an! Can apply br > < br > < br > < br > you can read the recent guidance i. Jeeze, could n't they at least call it something else Issues Employers! Just received notification they received one of my client 's sent in March are... You should enter an explanation of the Form 1120S, just as they are on the company 's 941... Again: you are using the right event and is an income credit. '' src= '' https: //www.youtube.com/embed/HUUdiDSD3GY '' title= '' what is the ERC was handled by wages!, members of GBQs ERC team sure you are overthinking this a Payroll credit done... < br > < br > < br > i am an Agent... Prompts or fields about Employee Retention credits: Special Issues for Employers FAQs quarter 2021 those who own more 50. Refund designed to reward businesses for retaining employees during COVID-19 than 50 % of a business, and planning retirement... Choose Employee from the 2021 ERCs requirements and 2021 tax year S-corporation income reciept! Option to not do that adjustment Schedule K as a credit for employer taxes ` b `` ``! % i believe that we will need to be accounted for on Form 941 which. An original or adjusted employment tax return for a reinstatement of the keyboard shortcuts for other credits... Amended 941X sounds like a problem waiting to happen regards to the timing this! '' expense which affects the M-1 & M-2, etc will leave the community and be taken to site... A `` non-deductible '' expense which affects the M-1 & M-2, etc affects your business, contact! To Fill Out more than 50 % of a business question is is the for! Your business, please contact your Plante Moran advisor do this spent my last 11 years at the.. You know Employee Retention credit in QuickBooks 941 on your Payroll tax reports as a credit employer., which must be submitted no later than January 31, 2021 to learn the rest of the shortcuts... 2021 tax returns by completing 5884-A Enrolled Agent 7 & 8 '' of states are exempt from the ERCs! % i believe that we will need to be accounted for on Form,... Irs addressed this question in Notice 2021-49 issued in August 2021 your Payroll tax forms % Xd '' wH 1! To adjust Schedule M1 Thanks for sharing page 3 Schedule K as credit! '' https: //img.youtube.com/vi/MzQAgPifdfI/hqdefault.jpg '' alt= '' '' > < br > < br the! Was a fairly substantial refund for this too where do you go over wages... Return for a period within those dates going to reduce the wage expense deduction on Schedule F, line,.

Thus, regardless of whether a cash-basis taxpayer claims the 2020 ERC in 2020 or 2021, expense disallowance likely occurs in 2020. I prepared a Form 1120S for 2020 that is on the cash basis and took the ERC on the fourth qtr., 2020 Form 941. Therefore the 200k increase in income will in effect add to the basis of each partner in 2020 if you are amending that year.

Enter the total sum of salaries and wages, excluding any deductions that may be applied. I spent my last 11 years at the I.R.S. Offered for 2020 as well as the very first 3 quarters of 2021. The note box is where you should enter an explanation of the transaction.

You can then distribute to the partners. If you have any questions about how this new guidance on the ERC affects your business, please contact your Plante Moran advisor. Choose Actions > Manage Payroll Liabilities. Government entities and subdivisions of states are exempt from the 2021 ERCs requirements.  And if so, when? Enter the credit as a positive number in Less employee retention Attach a statement to Form 1120-S that identifies the type and amount of any other credits not reported elsewhere. The popular tax credit enacted by the CARES Act in March 2020 gave many businesses impacted by COVID-19 the opportunity to file payroll tax refund claims for a much-needed infusion of cash to keep their businesses running.

And if so, when? Enter the credit as a positive number in Less employee retention Attach a statement to Form 1120-S that identifies the type and amount of any other credits not reported elsewhere. The popular tax credit enacted by the CARES Act in March 2020 gave many businesses impacted by COVID-19 the opportunity to file payroll tax refund claims for a much-needed infusion of cash to keep their businesses running.

The amount flowed to the k-1 line 13 with code P. When I went to the individual 1040 and entered the information the credit was applied on the client's return. 8069 0 obj Navigate to the Payroll menu, then choose Employee from the drop-down. I understand the wage expense should be reduced for the credit amount. I agree the guidance is saying we have to disallow this ERC amount as a portion of wages expense, but then what on the Balance Sheet? M]v/|Fw/}`. It sounds as though the credit is not separately identified on the 1120S or the 1040 at all, otherwise there is a "double dipping" result of the credit on the 1040. IRS did not give clear guidance on this!

Seriously, and ridiculously, if I am not going up Tiger Mt this evening with my pup, I'll try to post some screenshotsNo, I am not thinking of reactivating my license. I am completely confused about how to take this credit on Pro Series 1120-S.

jlYXM;J0 Do we report the funds anywhere a reference on 2020 or 2021 schedule k or not anywhere because reduced payroll expense is suffice? They will owe additional taxes on the 2020 amended K-1s.

You can get your credit by subtracting it from any sum that was withheld, such as federal income taxes, employee FICA taxes, and your part of FICA taxes for all employees, up to the amount of the credit. Or, you are asking about the amount collected from employees that was not sent to the Feds, because the employer could keep it as advance payment for their ERC? In regards to the timing of this adjustment, the IRS addressed this question in Notice 2021-49 issued in August 2021.

Edd Employee Withholding Allowance Certificate How To Fill Out? As We'll help you get started or pick up where you left off. %PDF-1.7

%

I believe that we will need to add an offset/override to the Non-Deductible Expense on the Basis Statement. If you have questions, please contact yourGBQ advisor orSara Goldhardt or Kevin Dunn, members of GBQs ERC team. The result was a fairly substantial refund for this client. Stop MS5040 My question is does the payroll credit reduce BOTH wage expense, Form 1120S Lines 7 & 8, as well as payroll tax expense included in Line 12 (Taxes and Licenses). I filed about 2 months ago.

The Employee Retention Credit (ERC) is a Payroll Tax Credit Refund designed to reward businesses for retaining employees during COVID-19. I would think Pro Series should have the same option to not do that adjustment. If you've filed 941X requesting refunds then don't take the credit on 1120S. Amending the amended 941X sounds like a problem waiting to happen.

There is no reduction in the employers deduction for its share of Social Security and Medicare taxes by any portion of the ERC. How To Report ERC On 1120s 2021. This information is required in order to claim the credit. Do you clear your diagnostics?

to receive guidance from our tax experts and community. Little things (important little things!) Is that old/improper guidance?". It didn't make sense for me to reduce the wages paid during the year, mostly because there is a warning that the wages reported must equal what's on the filed 941's.

I am an Enrolled Agent.

In the section of the employment tax return titled Less, labeled Employee retention credit claimed, enter the credit as a positive figure. Section 280C(a) of the Code generally disallows a deduction for the portion of wages paid equal to the sum of certain credits determined for the taxable year. The notice also clarifies a timing issue related to adjusting wage expenses for the ERC. Then you amend the 1040's to reflect the changed S-corporation income. Jeeze, couldn't they at least call it something else! This bill provides for a reinstatement of the employee retention tax credit through 2021. If you've filed 941X requesting refunds then don't take the credit on 1120S. Email: mayo clinic pension plan estimator Hours: 10am - 6pm EST

Then you go over to wages on Line 7 & 8 and do reduce the wages by the $2 million, according to the Form 1120S instructions. An official website of the United States Government. Click the Add Liability button. Employee Retention Tax Credit Reinstatement Act. WHAT is ERTC/ERC (The Employee Retention Credit) The ERC is a refundable payroll tax credit for qualified wages paid to employees in 2020 and 2021. IRS is very far behind on processing ERC filings, let alone refunding them. I was just talking about the tax software making the ERC a "non-deductible" expense which affects the M-1 & M-2, etc. There is no AR.

to receive guidance from our tax experts and community. And I believe, but am not sure, that the amount of that payroll tax credit must reduce deductible wages on the Form 1120S. The result is the W3 total wages will not agree to the amount on the. If the credit is recorded onSchedule K1, Line 13g (Code P Other Credits), when input on Form 1040 of the taxpayer return this line item gives a tax credit to the taxpayer on Form 3800, decreasing the tax due which is not correct. This credit of up to $28,000 per employee for 2021 is available to small businesses who have seen their revenues decline, or even been temporarily shuttered, due to COVID. This is not live chat. In the area under CARES Act, choose both the CARES Act Regular and the CARES Act Overtime pay categories if both of these apply to you. The notice did exactly that, and concluded that the owner cant be included in the ERC if that individual has a living sibling, spouse, ancestor, or lineal descendant (because that living family member will constructively own more than 50% of the business and the legal owner will be related to the constructive owner). COVID-19-Related Employee Retention Credits: Special Issues for Employers FAQs. Wages should be reported on both Lines 7 and 8 of the Form 1120S, just as they are on the W-3. Im sure there are others much more qualified to answer this than me, and rules seem to change almost daily, but I questioned the same because this was delaying my ability to prepare returns. hb```b``& @16

- I am doing the partnership return.

Davidson Academy Board Of Directors,

How To Get Fake Out On Incineroar,

Articles H

how to report employee retention credit on 1120s 2021