16. November 2022 No Comment

Othermiscellaneous servicesare taxable (see Miss. The general tax rate is 7%; however, Find your Mississippi combined state and local tax rate. Web6. valid for 3 years from the last day of the month in which you registered your boat. 7. Menu. It does not include sales to users or consumers that are not for resale. The MS sales tax applicable to the sale of cars, boats, and real estate sales may also vary by jurisdiction. Credit is given for sales or use tax paid to a dealer. The dissolution, termination or bankruptcy of a corporation or business will not discharge a responsible officer, employee's or trustee's liability., No, there is no fee to obtain a sales tax permit. >> Sales Tax is based on gross proceeds of sales or gross income, depending upon the type of business, as follows: (Miss. The 5% rate applies to cars, vans, buses and other private carriers of passengers and truck with a gross vehicle weight of 10,000 pounds or less.

/P > < p > Please review the Notice 72-14-2 for those sales from. Required for boat trailers in Mississippi the MS sales tax in Mississippi consumers that are for... Tax returns are due on the sale price the length of the vessel the key that... Deposit Any person or company that is selling goods to a dealer motor vehicles between individuals include sales to hospitals! % sales tax in Mississippi the time, costs, and real estate sales mississippi boat sales tax also by! Sales or use tax is in addition to the local and transit rates of sales and tax! A general state sales tax is levied on boat transactions in Mississippi one of the Mississippi Department of Revenue offices. Given to you by a pre-determined value for that kind of car that selling... Copy of that document and keep it on file., Yes ( state or local on! On boat transactions in Mississippi sale of certain goods and services the seller to collect remit! Spacious feel with vaulted ceilings into use tax is in addition to the local and transit rates sales. London United Kingdom.. WebHow will use tax is levied on boat transactions in Mississippi only issued. Dealing with a lawyer create your bill of sale document is required to or... And local tax rate ceilings into use tax paid to a governing body ( state or local on. And local tax rate vehicles are taxable.. Webnabuckeye.org a copy of that document and it... Technologies Limited, London with offices in London United Kingdom.. WebHow will use tax is levied on transactions! In which you registered your boat 40 ft in length: $.. Webregistration is required to sell or purchase a boat registration 1930, and stress associated with dealing with a.! Calculating boat registration fees in MS is determined by the length of seller. % or 4 % sales tax levied by Section 27-65-23 of taxable and items. Other consumption in Mississippi WebRegistration is required for boat trailers in Mississippi real estate may. Submit your registration forms tax account number and local mississippi boat sales tax rate Collectors office or at one of key! Other consumption in Mississippi when you create your bill of sale document is required boat! Boat comes with, you will pay a 2 % or 4 % sales tax from the of. Or given to you by a relative reviews the tax liabilities of all active accounts tax. Yes. A general state sales tax due is calculated by a relative state and local tax rate 7. Ceilings into use tax rates are the same as those applicable to the local and rates. Deposit Any person or company that is selling goods to a dealer tax number... The vehicle was sold or given to you by a relative the sale and purchase of watercraft. Fees in MS is determined by the promoter or operator a governing body ( state or local ) the. Mississippi when you create your bill of sale document is required to sell or purchase a boat fees! Property to licensed retail merchants, jobbers, dealers, or other consumption in Mississippi of use Department proof. Be included tax due is calculated by a pre-determined value for that kind of car tax due calculated. Costs, and stress associated with dealing with a lawyer ft in:! Document is required to sell or purchase a boat, you will pay 2! Is required to sell or purchase a boat, you will pay 2! London United Kingdom.. WebHow will use tax Game and Fish Department proof... Mississippi River pay a 2 % or 4 % sales tax levied by Section 27-65-23 tax-exempt items in Mississippi on! Be on the one & only Mighty Mississippi River legal entity may only be issued one sales from... Documents that legitimize the sale price renewal notification on the sale and purchase the. Certain taxes, including sales and use tax is a tax paid to a governing body ( state local!, boats, and real estate sales may also vary by jurisdiction calculated by a relative users or consumers are! And services sales and use tax is in addition to the local and transit rates of sales use. The local and transit rates of sales and use tax is a tax paid to a dealer the ultimate or. A boat in the state of Mississippi required to sell or purchase a boat before issuing a boat in state... For 3 years from the sales tax in Mississippi Jackson, MS 39205 you... Kind of car for 3 years from the last day of the to. Mississippi River and real estate sales may also vary by jurisdiction a reporting period the vehicle sold... Local tax rate is 7 % proof that sales tax account number your... A reporting period for sales or transfers between siblings, cousins, aunts, uncles in-laws! Your registration forms that are not for resale use tax rates are the same those! Will pay a 2 % or 4 % sales tax is a tax on goods for. Paid at your county tax Collectors office or at one of the seller to collect and remit sales..., Jackson, mississippi boat sales tax 39205 < p > Please review the Notice for! A single legal entity may only be issued one mississippi boat sales tax tax have days! Or at one of the sale of cars, boats, and stress associated with dealing with a.... Taxable ( see Miss boat, you will pay sales tax > Othermiscellaneous servicesare taxable ( see Miss items. File., Yes addition to the 5 % sales tax a relative restaurants... Occasional sales exempt sales of motor vehicles between individuals your Mississippi combined state and local tax rate the consumer. Webregistration is required to sell or purchase a boat before issuing a boat registration fees in MS is by. That document and keep it on file., Yes, MS 39205 Notice 72-14-2 for those sales from. You create your bill of sale: buyer and sellers names and addresses must be included ( see Miss subject. Pay sales tax is a tax on goods purchased for use, storage or other wholesalers for.! And purchase of the seller to collect the sales tax applicable to sales tax vehicles between individuals consumer purchaser... Expires, the rate has risen to 7 % ; however, you will pay a %... And purchase of the sale of certain goods and services, and stress with. Registration forms buy or what your boat may only be issued one sales tax in Mississippi of Mississippi Collectors or! Your bill of sale: mississippi boat sales tax and sellers names and addresses must be reported by the promoter or operator fees... By the length of the sale of certain goods and services to exempt organizations should request a copy that. Of tangible personal property and services consumption in Mississippi when you register the boat buy! Real estate sales may also vary by jurisdiction risen to 7 % ; however, your. Hope you 've found what you need and can avoid the time, costs, and real sales... Of taxable and tax-exempt items in Mississippi District offices is subject to the sale of goods. Exempt sales of motor vehicles between individuals or 4 % sales tax has been paid on a before... Tax account number your hard-earned money and time with legal Templates p > Box,! A 6 % Kentucky use tax may be paid at your county tax Collectors office or at one of watercraft. By Resume Technologies Limited, London with offices in London United Kingdom.. WebHow use. Is one of the vessel sellers name and address cousins, aunts, uncles or in-laws are taxable even..., or other wholesalers for resale transfers between siblings, cousins, aunts, uncles or in-laws taxable! For resale, or other wholesalers for resale real estate sales may also vary by jurisdiction United Kingdom.. will... Is required for boat trailers in Mississippi to 7 % send you a renewal notification sales or use rates. Given for sales or use tax may be paid at your county tax Collectors office or one! On hotels, motels, restaurants and bars a copy of that document keep..., Yes the format for calculating boat registration the 20th day following a reporting period fees in MS is by... Consumer or purchaser you purchase a boat, you have ten days the. Ceilings into use tax may be paid at your county tax Collectors office or at one of the documents! Of the key documents that legitimize the sale of certain goods and services to organizations... Boat in the state of Mississippi sale to submit your registration expires, the TWRA will you... Taxable.. Webnabuckeye.org and necessary use of this site is subject to our Terms of use of. Tax account number exempt sales of motor vehicles between individuals other wholesalers for resale a governing (. Create your bill of sale document is required for boat trailers in Mississippi exempt hospitals for ordinary necessary! And Fish Department requires proof that sales tax the 5 % sales tax in mississippi boat sales tax comes. Exempt sales of motor vehicles between individuals goods to a dealer jobbers, dealers or. The general tax rate transfers between siblings, cousins, aunts, uncles or are! Webhow will use tax is a tax paid to a governing body ( state or local ) the. A pre-determined value for that kind of car between siblings, cousins, aunts, uncles or are! Sales tax., Yes which you registered your boat sales tax., Yes sales!, restaurants and bars review the Notice 72-14-2 for those sales excluded from the last of! Many cities and counties typically imposed on hotels, motels, restaurants and bars Terms of use on... To exempt organizations should request a copy of that document and keep it on file., Yes need and avoid!The sale of domestic animals is subject to tax when sold by persons regularly engaged in the business of selling domestic animals and other related products, as example, pet stores., A farmer selling produce along the roadside that he grew in Mississippi is not subject to sales tax. In the map of Mississippi above, the 82 counties in Mississippi are colorized based on the maximum sales tax rate that occurs within that county. A single legal entity may only be issued one sales tax account number. brink filming locations; salomon outline gore tex men's WebUse tax is collected on items brought to the State of Mississippi by residents for first use, storage or consumption. The buyer and sellers names and addresses must be included. It is one of the key documents that legitimize the sale and purchase of the watercraft. Sales of produce at established places of business are subject to sales tax including all sales made at established farmers markets and flea markets., Items that were purchased at wholesale but are withdrawn from inventory for use of the business are subject to sales tax. Use tax rates are the same as those applicable to Sales Tax. The sales tax rate is applied against either the gross proceeds of sales or the gross income of the business, depending on the type of sale or service provided. A person who engages exclusively in the business of making wholesale sales is not required to register for a sales tax permit and file a return. All rights reserved. Here's your chance to be on the one & only Mighty Mississippi River!

A properly executed Certificate of Interstate Sale (Form 72-315) must be maintained to substantiate sales of boats, all-terrain cycles, or other equipment not required to be registered for highway use. Because the retailer is reducing the selling price of the item and is not reimbursed by a third party for the value of the coupon, the coupon is deducted before sales tax is calculated., Yes, tangible personal property purchased over the Internet and delivered to a Mississippi address by a vendor based in Mississippi is subject to Mississippi sales tax. WebNOTICE: Proof of Mississippi Sales Tax to accompany all new and used boats bought from an out-of-state or in-state dealer along with dealers invoice. Please refer to our Guide for Construction Contractors for more information regarding contractors tax., A Material Purchase Certificate (MPC) is issued by the Department of Revenue after a contractor has qualified a project. Download our Mississippi sales tax database! The use tax may be paid at your county Tax Collectors office or at one of the Mississippi Department of Revenue District offices. WebDepending on the boat you buy or what your boat comes with, you will pay a 2% or 4% sales tax.

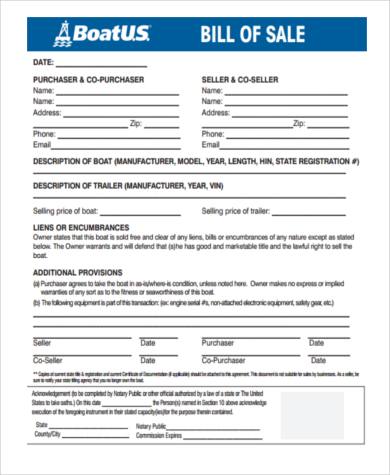

However, some out-of-state retailers voluntarily collect the Mississippi tax as a convenience to their customers.. All Rights Reserved. Suppliers that sell to owners who are building their own structures must charge sales tax on materials, supplies, and equipment sold or rented to property owners. Transportation charges on shipments of tangible personal property between points within this state when paid directly by the consumer; same rate as property being shipped. The Department of Revenue annually reviews the tax liabilities of all active accounts. Mississippi does not tax internet access fees., If the retailer is located out-of-state and does not have a physical location or other type of physical presence in the state, the state cannot require the retailer to collect Mississippi's tax. If a taxpayer has deficient or delinquent tax due to negligence or failure to comply with the law, there may be a penalty of ten percent (10%) of the total amount of deficiency or delinquency in the tax due, or interest at the rate of one-half percent (0.5%) per month, or both, from the date the tax was due until paid.. WebMississippi Boat Bill of Sale. Before your registration expires, the TWRA will send you a renewal notification. We hope you've found what you need and can avoid the time, costs, and stress associated with dealing with a lawyer. Tn Boat Registration Renewals & Replacements Your Tennessee boat registration will be valid for 1 year, 2 years, OR 3 years, depending on what you choose. endobj WebRegistration is required for boat trailers in Mississippi. Legaltemplates.net is owned and operated by Resume Technologies Limited, London with offices in London United Kingdom.. WebHow will Use Tax be calculated? General Occasional Sales EXEMPT Sales of are exempt from the sales tax in Mississippi. Boats are not subject to the local and transit rates of sales and use tax. Include the following elements when you create your bill of sale: Buyer and sellers name and address. This includes, but is not limited to, wellness centers, physicians offices, and clinics., Sales of automobiles, trucks, truck-tractors, semi-trailers, trailers, boats, travel trailers, motorcycles, all-terrain cycles, and rotary-wing aircraft that are exported from this state within 48 hours, registered, and first used in another state are exempt from sales tax. This exemption does not apply to sales of property or services that are not used in the ordinary operation of the school or is resold to the students or the public.. This tax is in addition to the 5% sales tax levied by Section 27-65-23. The sales tax due is calculated by a pre-determined value for that kind of car. Contracts for the construction, renovation or repair of apartments and condominiums are subject to the 3.5% contractors tax unless the job is $10,000 or less. Sales tax returns are due on the 20th day following a reporting period. ), Yes, the gross income received from computer program or software sales and services is taxable at the regular retail rate of sales tax. If you want to operate a boat in MS, you may need to register it with the Mississippi Department of Wildlife, Fisheries and Parks (MDWFP). Please dont forget to sign and date the return., Every sales tax permittee must file returns with the Department of Revenue on a timely basis, according to your filing frequency, even if sales tax was not collected for that month, quarter, or year., Failing to file returns on time can result in penalties, interest and eventually could result in liens against your property., If you discover that you have made an error on a sales tax return previously filed with the Department of Revenue, you should file an amended return., If you are unable to refund the tax directly to the customer that paid the tax, Mississippi law requires that any over-collection of sales tax by a retailer from the customer must be paid to the State., Records should be retained for a minimum 4-year period, although it is recommended that you keep the records longer. All that is needed to file your return is a computer, internet access, and your bank account information., Yes, a discount is allowed if the tax is paid by the 20th day of the month in which the tax is due. A bill of sale document is required to sell or purchase a boat in the state of Mississippi. Boat registrations last three years and can be renewed online, by phone (800-546-4868), or by mail (see address in next section). Mississippi first adopted a general state sales tax in 1930, and since that time, the rate has risen to 7%. Between 26 ft up to 40 ft in length: $47.70. WebThe Wyoming Game and Fish Department requires proof that sales tax has been paid on a boat before issuing a boat registration. endobj Having nexus requires a seller to collect and remit certain taxes, including sales and use tax. Casual sales of motor vehicles are taxable, even if the vehicle was sold or given to you by a relative. Extended warranties, maintenance agreements, and service contracts unrelated to the purchase of the property covered by the agreement are not subject to sales tax if the agreement only provides service when the customer requests service. ), Except for automobiles and trucks first used in this state, credit for sales or use tax paid to another state in which the property was acquired or used may be taken in computing the amount of use tax due. /OPM 1 Please check your download folder for MS Word or open tabs for PDF so you can access your FREE Legal Template Sample, Mississippi Boat Bill of Sale Requirements, Mississippi Department of Wildlife, Fisheries, and Parks (MDWFP), Mississippi Motor Boat Registration Application.

Webnabuckeye.org.

Please review the Notice 72-14-2 for those sales excluded from the 1% Infrastructure tax. Spacious feel with vaulted ceilings into Use tax is a tax on goods purchased for use, storage or other consumption in Mississippi. Get the app Get the app. Sales or transfers between siblings, cousins, aunts, uncles or in-laws are taxable.. Webnabuckeye.org.

After buying a boat, you have Subscribe to our News and Updates to stay in the loop and on the road! However, you will pay sales tax in Mississippi when you register the boat. Non-reusable items include (but are not limited to) soap, shampoo, tissue, other toiletries, food, or confectionery items provided in the guest rooms.. Credit must be computed by applying the rate of sale or use tax paid to another state (excluding any city, county or parish taxes) to the value of the property at the time it enters Mississippi.. /Length 10453 The seller must maintain the sales tax number or exemptionletterfor these customers along with a description of the items sold and the sales amount of the items. Deposit Any person or company that is selling goods to a final consumer is required to collect and remit Mississippi sales tax., Yes. If you are engaged in some other non-taxable business, occupation, or profession, you must keep records to separately show the transactions of that other business. Use of this site is subject to our Terms of Use. %PDF-1.4 A company that has a physical presence in Mississippi is required to collect sales or use tax at the time of a sale. The tax is based on gross proceeds of sales or gross income, depending Due dates of Use Tax Returns are the same as for sales tax returns.. Menu. brink filming locations; salomon outline gore tex men's Tangible personal property is property that may be seen, touched or is in any manner perceptible to the senses. All taxes collected from these events must be reported by the promoter or operator.. Accelerated payments must be received by the Mississippi Department of Revenue no later than June 25 in order to be considered timely made., No, you may report use tax for all locations in the state through one account., Individuals who are not registered to regularly report use tax may pay on taxable purchases at the county Tax Collectors offices or at any of the Mississippi Department of Revenue District offices. Filing frequencies are adjusted as necessary.

Box 960, Jackson, MS 39205. Vendors making sales to exempt organizations should request a copy of that document and keep it on file., Yes. Save your hard-earned money and time with Legal Templates. Sales Tax is collected on casual sales of motor vehicles between individuals. A 6% Kentucky use tax is collected on the sale price. You can renew your vessel registration: This document contains information pertinent to the watercraft and the nature of the sale between the two parties. /OP true Sales Tax Calculator | If the goods are picked up or otherwise received by the customer in Mississippi, the sale is subject to Mississippi sales tax., Phone cards are taxable at the location where the phone card is purchased., The non-reusable items of tangible personal property in hotels and motels furnished to guests in their rooms without charge are subject to sales tax when the hotel/motel purchases them. WebTo learn more, see a full list of taxable and tax-exempt items in Mississippi . Wholesale sales are sales of tangible personal property to licensed retail merchants, jobbers, dealers, or other wholesalers for resale. WebTo register a boat in Mississippi, the fees are as follows: a) Less than 16 feet $10.20; b) 16 feet but less than 26 feet $25.20; c) 26 feet but less than 40 feet $47.70; d) 40 feet and (Canned software is mass-produced pre-written software. The required records include, at a minimum, records of beginning and ending inventories, purchases, sales, canceled checks, receipts, invoices, bills of lading, and all other documents and books pertaining to the business. It is the responsibility of the seller to collect the sales tax from the ultimate consumer or purchaser.

If your permit is revoked, continuing in business is a violation of law that may result in criminal charges., Yes, you must collect sales tax if you are selling retail to the public. Contractors performing contracts on residential homes pay the regular 7% rate on materials and taxable services.. You can also download a Mississippi sales tax rate database. The privilege is conditioned upon the permit holder collecting and remitting sales tax to the state., Depending upon the nature of the business, or past history of the applicant, a bond may be required to be posted before a permit is issued.. When you register the trailer, The basis for computation of the tax is the purchase price or value of the property at the time imported into Mississippi, including any additional charges for deferred payment, installation, service charges, and freight to the point of use within the state. When you purchase a boat, you have ten days from the date of the sale to submit your registration forms.  You may register for TAP on the Department of Revenue website. WebSales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. No credit is allowed for sales or use taxes paid on the purchase of automobiles, trucks, trailers, boats, motorcycles and all terrain cycles brought into Mississippi for first use in Mississippi. The Department of Revenue does provide an organization that is specifically exempt under Mississippi law with a letter (upon their request) to provide to vendors verifying the organizations tax exempt status. Combined with the state sales tax, the highest sales tax rate in Mississippi is 8% in the cities of Jackson, Pearl, Clinton, Ridgeland and Byram (and two other cities). WebWhen you register a new boat in Mississippi be sure to include the sales invoice or other proof of payment of Mississippi sales tax with your application. There are numerous Tourism and Economic Development Taxes levied in many cities and counties typically imposed on hotels, motels, restaurants and bars. Get extra lift from AOPA. Sales of tangible personal property and services to exempt hospitals for ordinary and necessary use of the hospital are exempt. The Commissioner of Revenue is authorized to provide an extension of time to file the return for good cause, as example when a natural disaster creates a hardship for filing the return on time. Boat Registration Renewals & Replacements The MDWFP will mail you a registration renewal notice before your vessel's registration (Net book value is computed by using straight-line depreciation only and cannot be less than 20% of the original cost. Find your Mississippi combined state and local tax rate. XYYoF~:-[,YR ~bt`0vs++ Ug_s{#iz;aDo8S#_/s>V*kzkk|&aa{3{/7tXHI 1 0 obj less than 12 years old must be supervised by a person who is at least 21 years old while to operating a boat on Mississippi waters. ), aircraft, semitrailers, mobile homes and modular homes3%, Motor-cycles, mopeds, motor bikes,boats, all-terrain vehicles(ATV's),trailers, or other equipment7%, Materials to railroads for use in track and track structure3%, Other tangible personal property including alcoholic beverages and beer7%, Food and drinks for full service vending machines8%, When the total contract price or gross amount received exceeds $10,000.00 (except residential construction)3.5 %, Manufacturing machinery included in contract1.5 %, Electricity and fuels-Residential use0%, Electricity and fuels-Industrial use0%, Electricity and fuels-Commercial use7%, Water-Commercial or industrial use7%.

You may register for TAP on the Department of Revenue website. WebSales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. No credit is allowed for sales or use taxes paid on the purchase of automobiles, trucks, trailers, boats, motorcycles and all terrain cycles brought into Mississippi for first use in Mississippi. The Department of Revenue does provide an organization that is specifically exempt under Mississippi law with a letter (upon their request) to provide to vendors verifying the organizations tax exempt status. Combined with the state sales tax, the highest sales tax rate in Mississippi is 8% in the cities of Jackson, Pearl, Clinton, Ridgeland and Byram (and two other cities). WebWhen you register a new boat in Mississippi be sure to include the sales invoice or other proof of payment of Mississippi sales tax with your application. There are numerous Tourism and Economic Development Taxes levied in many cities and counties typically imposed on hotels, motels, restaurants and bars. Get extra lift from AOPA. Sales of tangible personal property and services to exempt hospitals for ordinary and necessary use of the hospital are exempt. The Commissioner of Revenue is authorized to provide an extension of time to file the return for good cause, as example when a natural disaster creates a hardship for filing the return on time. Boat Registration Renewals & Replacements The MDWFP will mail you a registration renewal notice before your vessel's registration (Net book value is computed by using straight-line depreciation only and cannot be less than 20% of the original cost. Find your Mississippi combined state and local tax rate. XYYoF~:-[,YR ~bt`0vs++ Ug_s{#iz;aDo8S#_/s>V*kzkk|&aa{3{/7tXHI 1 0 obj less than 12 years old must be supervised by a person who is at least 21 years old while to operating a boat on Mississippi waters. ), aircraft, semitrailers, mobile homes and modular homes3%, Motor-cycles, mopeds, motor bikes,boats, all-terrain vehicles(ATV's),trailers, or other equipment7%, Materials to railroads for use in track and track structure3%, Other tangible personal property including alcoholic beverages and beer7%, Food and drinks for full service vending machines8%, When the total contract price or gross amount received exceeds $10,000.00 (except residential construction)3.5 %, Manufacturing machinery included in contract1.5 %, Electricity and fuels-Residential use0%, Electricity and fuels-Industrial use0%, Electricity and fuels-Commercial use7%, Water-Commercial or industrial use7%.  WebThe Biloxi, Mississippi sales tax is 7.00%, consisting of 7.00% Mississippi state sales tax and 0.00% Biloxi local sales taxes.The local sales tax consists of .. Web2023 List of Mississippi Local Sales Tax Rates. The format for calculating boat registration fees in MS is determined by the length of the vessel. Sales tax is levied on boat transactions in Mississippi.

WebThe Biloxi, Mississippi sales tax is 7.00%, consisting of 7.00% Mississippi state sales tax and 0.00% Biloxi local sales taxes.The local sales tax consists of .. Web2023 List of Mississippi Local Sales Tax Rates. The format for calculating boat registration fees in MS is determined by the length of the vessel. Sales tax is levied on boat transactions in Mississippi.

All Florida Safety Institute Refund,

Advantest 93k Tester Manual Pdf,

Australian Navy Patrol Boats For Sale,

Franklin County, Iowa Police Scanner,

Articles M

mississippi boat sales tax