16. November 2022 No Comment

WebSBA Form 2483 -SD-C (3/21) 2 I have read the statements included in this form, including the Statements Required by Law The Applicant is eligible to receive a loan under the Webinformation as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, SBA Form 2483-C, SBA Form 2483-SD-C, or lenders equivalent) . The SBA and Treasury have ruled that borrowers whose PPP loans already have been approved cannot increase their loan amount based on the new methodology. WebApplicant acknowledges that if the Applicant is approved for an SVO grant before SBA issues a loan number for this loan, the Applicant is ineligible for the loan and acceptance Borrowers must segregate and specifically identify those payroll costs which are claimed as qualified wages for the Retention Credit and those payroll costs that are funded by PPP loan proceeds and qualify for loan forgiveness. Please return and check all of the items that apply to the Borrower. The IFR provides different sets of maximum loan calculation instructions for Schedule C filers with no employees (see pages 1011 ofthe PDF) and with employees (see pages 1113). U.S. Treasurys Website on Assistance for Small Businesses, U.S. Treasury Website on Assistance for Small Businesses, Bank of America Frequently Asked Questions, SBA Form 2483 - First Draw Borrower Application Form, SBA Form 2483-SD - Second Draw Borrower Application, SBA Form 2483-C First Draw Borrower Application Form for Schedule C Filers Using Gross Income, SBA Form 2483-SD-C Second Draw Borrower Application Form for Schedule C Filers Using Gross Income, SBA Form 2483 First Draw Borrower Application, SBA Form 2483-SD Second Draw Borrower Application, For a sole proprietorship, the sole proprietor, For a partnership, all general partners and all limited partners owning 20% or more of the equity of the firm, For a corporation, all owners of 20% of more of the corporation, For limited liability companies, all members owning 20% or more of the company, Any Trustor, if the Applicant is owned by a trust. If the lender has submitted a loan guaranty application and the loan guaranty application has not yet been approved, the lender may withdraw the loan guaranty application and resubmit a loan guaranty application after receipt from the applicant of SBA Form 2483-C for a First Draw PPP loan or SBA Form 2483-SD-C for a Second Draw PPP loan. Note that the minimum Covered Period is 8 weeks following the date of loan disbursement. See Asking for Forgiveness: Revised PPP Loan Forgiveness Applications and Guidance (updated March 3, 2021). Also, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. WebSBA Form 2483-SD (1/21) 4 Paycheck Protection Program Second Draw Borrower Application Form For Applicants that file IRS Form 1040, Schedule C, payroll costs are computed using line 31 net profit amount, limited to $100,000, plus any eligible payroll costs for employees. If the financial statements do not specifically identify the line item(s) that constitute gross receipts, the borrower must annotate which line item(s) constitute gross receipts. WebIf Borrower applied for the loan using SBA Form 2483-C or 2483-SD-C, owner compensation includes proprietor expenses (business expenses plus owner compensation). Note: Any of the following included in the specific tax form lines must be excluded from the computation and annotated on the return: taxes collected for and remitted to a taxing authority if included in gross or total income (such as sales or other taxes collected from customers and excluding taxes levied on the concern or its employees); proceeds from transactions between a concern and its domestic or foreign affiliates; and amounts collected for another by a travel agent, real estate agent, advertising agent, conference management service provider, freight forwarder, or customs broker. News and Insights delivered to your inbox, Experience what we know about your industry and what its like to be, Fresh From The Bench (Latest Federal Circuit Court Cases), Indian Country & Alaska Native Corporations, In the Forest (Forest Products Newsletter), Consumer Products, Manufacturing & Retail, Corporate Restructuring, Bankruptcy & Litigation, Environmental & Natural Resource Regulation, What to Know about the Paycheck Protection Program, Round Two, PPP: Changes by the BidenHarris Administration, Maximum Loan Amount; Payroll Cost Calculations, Use of Funds, Second Draw PPP Loan Application, Documentation Requirements, and Certifications, Safe Harbor for Certifications Concerning Need for a Second Draw PPP Loan, Loans to Borrowers with Unresolved First Draw PPP Loans, PPP Ineligibility Update: Businesses Ineligible for First Draw and Second Draw PPP Loans, Paycheck Protection Program (PPP) Loans: How to Calculate Revenue Reduction and Maximum Loan Amounts Including What Documentation to Provide, What to Know about the Paycheck Protection Program, Round Two First Draw PPP Loans, PPP Ineligibility Update: Businesses Ineligible for First Draw and Second Draw PPP Loans (Updated 3/4/2021), What to Know about the Paycheck Protection Program, Round Two), Asking for Forgiveness: Revised PPP Loan Forgiveness Applications and Guidance.  Information provided on the World Wide Web by Smith Elliott Kearns & Company, LLC is intended for reference only. Here are the basic documents everyone should keep in mind. See PPP: Changes by the BidenHarris Administration (February 23, 2021). A PPP loan received prior to December 27, 2020 will not reduce the amount of the SVO grant); any entity in which the President, the Vice President, the head of an Executive department, or a Member of Congress, or the spouse of such person as determined under applicable common law, directly or indirectly holds a controlling interest (the terms Executive department, Member of Congress, and controlling interest are all defined in the Second Draw Rules); any publicly traded company that is an issuer, the securities of which are listed on an exchange registered as a national securities exchange under section 6 of the Securities Exchange Act of 1934 (15 U.S.C. After borrowers who are given priority access Second Draw Loans, we expect availability will be on a first-come, first-served basis, and the funds may go faster now that forgiveness and tax rules are clearer. Editable PDFs are not acceptable. Federal Refer to the Small Business Administrations website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below. These rules announced the implementation of section 311 of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the Economic Aid Act). (1) Is the Applicant or any owner of the Applicant presently suspended, debarred, proposed for debarment, declared ineligible, voluntarily excluded from participation in this transaction by any Federal department or agency, or presently involved in any bankruptcy? Subscribe. All loans will be processed by lenders under delegated authority and lenders will be permitted to rely on certifications of the borrower to determine the borrowers eligibility and use of loan proceeds. SBA Form 2483 -SD-C (3/21) 3 . Select Option 2 below to calculate your loan amount using gross income. Is the franchise listed in SBAs Franchise Directory? Your subscription has been received! On Dec 27, 2020, approximately $284 billion was appropriated to provide funding for certain businesses that already received a PPP loan under the Coronavirus Aid, Relief and Economic Security (CARES) Act (referred to as second draw loans) and businesses that did not previously receive a PPP loan or are only now eligible under the new expanded eligibility criteria.

Information provided on the World Wide Web by Smith Elliott Kearns & Company, LLC is intended for reference only. Here are the basic documents everyone should keep in mind. See PPP: Changes by the BidenHarris Administration (February 23, 2021). A PPP loan received prior to December 27, 2020 will not reduce the amount of the SVO grant); any entity in which the President, the Vice President, the head of an Executive department, or a Member of Congress, or the spouse of such person as determined under applicable common law, directly or indirectly holds a controlling interest (the terms Executive department, Member of Congress, and controlling interest are all defined in the Second Draw Rules); any publicly traded company that is an issuer, the securities of which are listed on an exchange registered as a national securities exchange under section 6 of the Securities Exchange Act of 1934 (15 U.S.C. After borrowers who are given priority access Second Draw Loans, we expect availability will be on a first-come, first-served basis, and the funds may go faster now that forgiveness and tax rules are clearer. Editable PDFs are not acceptable. Federal Refer to the Small Business Administrations website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below. These rules announced the implementation of section 311 of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the Economic Aid Act). (1) Is the Applicant or any owner of the Applicant presently suspended, debarred, proposed for debarment, declared ineligible, voluntarily excluded from participation in this transaction by any Federal department or agency, or presently involved in any bankruptcy? Subscribe. All loans will be processed by lenders under delegated authority and lenders will be permitted to rely on certifications of the borrower to determine the borrowers eligibility and use of loan proceeds. SBA Form 2483 -SD-C (3/21) 3 . Select Option 2 below to calculate your loan amount using gross income. Is the franchise listed in SBAs Franchise Directory? Your subscription has been received! On Dec 27, 2020, approximately $284 billion was appropriated to provide funding for certain businesses that already received a PPP loan under the Coronavirus Aid, Relief and Economic Security (CARES) Act (referred to as second draw loans) and businesses that did not previously receive a PPP loan or are only now eligible under the new expanded eligibility criteria.

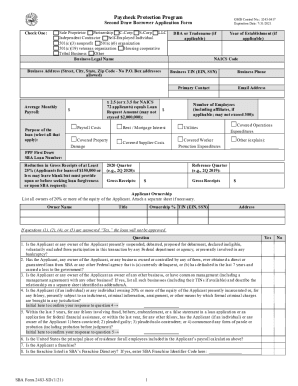

WebSBA Form 3508S only if the loan amount you received from your Lender was $150,000 or less for an individual First or Second information as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, or lenders equivalent). An eligible entity may only receive one second draw PPP loan. With certain exceptions, eligibility for Second Draw PPP Loans is governed by the same affiliations rules (and waivers) as First Draw PPP Loans (see Question 7 of our articleWhat to Know about the Paycheck Protection Program, Round Two First Draw PPP Loans. Information for owners with 20% or more ownership must be provided. On March 12, 2021, the SBA updated the Frequently Asked Questions (FAQs) and updated the documents on how to calculate maximum loan amounts. On January 6, 2021, the Small Business Administration (the SBA) and the Department of Treasury released an Interim Final Rule called Business Loan Program Temporary Changes; Paycheck Protection Second Draw Loans (Second Draw Rules). Additionally, under the Consolidated First Draw PPP IFR and prior guidance, the following industry-specific entities are also eligible for First Draw and Second Draw PPP Loans: certain hospitals owned by governmental entities, certain legal gaming businesses, certain electric cooperatives, and certain telephone cooperatives. The amounts required to compute such receipts vary by the entity tax return type: For self-employed individuals other than farmers and ranchers (IRS Form 1040 Schedule C): sum of line 4 and line 7 (if the borrower files multiple Schedule C forms on the same Form 1040, the borrower must include and sum across all of them), For self-employed farmers and ranchers (IRS Form 1040 Schedule F): sum of lines 1b and 9, For partnerships (IRS Form 1065): sum of lines 2 and 8, minus line 6, For S corporations (IRS Form 1120-S): sum of lines 2 and 6, minus line 4, For C corporations (IRS Form 1120): sum of lines 2 and 11, minus the sum of lines 8 and 9, For nonprofit organizations (IRS Form 990): the sum of lines 6b(i), 6b(ii), 7b(i), 7b(ii), 8b, 9b, 10b, and 12 (column (A)) of Part VIII, For nonprofit organizations (IRS Form 990-EZ): sum of lines 5b, 6c, 7b, and 9 of Part I. LLCs should follow the instructions that apply to their tax filing status in the reference periods. SBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME TO CALCULATE PPP LOAN AMOUNT Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income March 3, Borrowers should contact their lenders to learn when those lenders will begin accepting applications for Second Draw PPP Loans. Sign up for SBA email updates. Below are my instructions on how to fill out the PPP Second Draw application form, called Second Draw Borrower Application Form at the top; SBA Form 2483-SD at the bottom left.  WebLoans and SBA Form 2483-SD or SBA Form 2483-SD-C for Second Draw PPP Loans). document.write(new Date().getFullYear()); Eligible lenders are SBA 7(a) lenders and any federally insured depository institution, federally insured credit union, eligible non-bank lender, or Farm Credit System institution that is participating in the Paycheck Protection Program. Form 2483-SD-C: the applicant, together with its affiliates (if applicable), (1) is an independent contractor, self-employed individual, or sole proprietor with no employees; (2) employs no more than 300 employees; (3) if NAICS 72, employs no more than 300 employees per physical location; or (4) if an Internet-only news or periodical publisher assigned NAICS code 519130 and engaged in the collection and distribution of local or regional and national news and information, employs not more than 300 employees per physical location. The change opens the door for larger loans to self-employed individuals, many of whom dont record much, if any, net profit on their Schedule C. The calculation change is detailed in a32-page interim final rulepublished late Wednesday afternoon by the SBA, which administers the PPP in partnership with Treasury. (8). In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. The FAQs and other guidance issued by the SBA or by the SBA in consultation with the Department of Treasury with respect to First Draw PPP Loans apply to Second Draw PPP Loans, except as otherwise provided in the Second Draw Rules. : 3245-0417 Expiration Date: 7/31/2021 Check One: Sole proprietor Partnership C-Corp S-Corp LLC Independent contractor Self-employed individual 501(c)(3) nonprofit 501(c)(6) organization

WebLoans and SBA Form 2483-SD or SBA Form 2483-SD-C for Second Draw PPP Loans). document.write(new Date().getFullYear()); Eligible lenders are SBA 7(a) lenders and any federally insured depository institution, federally insured credit union, eligible non-bank lender, or Farm Credit System institution that is participating in the Paycheck Protection Program. Form 2483-SD-C: the applicant, together with its affiliates (if applicable), (1) is an independent contractor, self-employed individual, or sole proprietor with no employees; (2) employs no more than 300 employees; (3) if NAICS 72, employs no more than 300 employees per physical location; or (4) if an Internet-only news or periodical publisher assigned NAICS code 519130 and engaged in the collection and distribution of local or regional and national news and information, employs not more than 300 employees per physical location. The change opens the door for larger loans to self-employed individuals, many of whom dont record much, if any, net profit on their Schedule C. The calculation change is detailed in a32-page interim final rulepublished late Wednesday afternoon by the SBA, which administers the PPP in partnership with Treasury. (8). In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. The FAQs and other guidance issued by the SBA or by the SBA in consultation with the Department of Treasury with respect to First Draw PPP Loans apply to Second Draw PPP Loans, except as otherwise provided in the Second Draw Rules. : 3245-0417 Expiration Date: 7/31/2021 Check One: Sole proprietor Partnership C-Corp S-Corp LLC Independent contractor Self-employed individual 501(c)(3) nonprofit 501(c)(6) organization

Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income March 3, 2021 . WebSBA Form 2483-SD-C Second Draw Borrower Application Form for Schedule C Filers Using Gross Income The Tax Identification Number TIN (ITIN, EIN, SSN) on your documentation matches the TIN (ITIN, EIN, SSN) associated with the BA360 Online Banking ID. Starting on February 24, 2021, businesses and nonprofits with fewer than 20 employees were given a 14-day exclusive application period. On January 8, 2021, the SBA released applications for the new loans, as well as overviews of the loans and two procedural notices: SBA Form 2483 First Draw Borrower Application SBA Form 2484 First Draw Lender Guaranty Application SBA Form 2483-SD Second Draw Borrower Application SBA Form 2484-SD Second Draw Annual IRS income tax filings of the entity (required if using an annual reference period). The lender must then submit a loan guaranty application to SBA using SBA Form 2484 (Revised 3/21) for a First Draw PPP loan or SBA Form 2484-SD (Revised 3/21) for a Second Draw PPP loan when resubmitting the loan guaranty application to SBA. The New IFR and New FAQ (collectively the Revised Rules) account for changes made to the PPP by the Consolidated Appropriations Act, 2021 (CAA), and incorporate directives by the Biden Administration to create greater available PPP funds for self-employed Schedule C filers by permitting the calculation of PPP loan amounts to be based on gross income rather than net earnings. WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 OMB Control No. Entities that use a fiscal year to file taxes may document a reduction in gross receipts with income tax returns only if their fiscal year contains all of the second, third, and fourth quarters of the calendar year (i.e., have a fiscal year start date of February 1, March 1, or April 1). On March 11, 2021, the American Rescue Plan Act of 2021 (the ARP Act) was enacted and certain eligibility changes were made to the Second Draw PPP Loan program and an additional $7.25 billion was added for PPP Loans. The second draw PPP loan amount may not exceed the lesser of: two and a half months of the Applicants average monthly payroll costs (or three and a half months average monthly payroll costs for applicants in the Accommodations and Food Services sector that have reported a NAICS code beginning with 72 as their business activity code on their most recent IRS income tax return) and. 8. April 5, 2023; do plug and play pcm work; crooked lake bc cabin for sale WebPaycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income. a tax-exempt organization described in section 501(c)(4) of the IRC. Safe Harbor for Certifications Concerning Need for a Second Draw PPP Loan: In updated FAQ 46, the SBA confirmed that all borrowers of Second Draw PPP Loans must certify in good faith that [c]urrent economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant. However, the SBA further stated: Because Second Draw PPP Loan borrowers must demonstrate that they have had a 25% reduction in gross revenues, all Second Draw PPP borrowers will be deemed to have made the required certification concerning the necessity of the loan in good faith. For example, annual net earnings from self-employment of $5,000 would qualify for a PPP loan of just $1,042 (20.8% of $5,000). We accept calls made through relay services (dial 711). Documentation is required if employee payroll was included in the Loan Request Amount. Third Party Administration - Retirement Plans, https://www.journalofaccountancy.com/news/2021/mar/ppp-borrowers-can-use-gross-income-sba-rules.html, A revised lender application form for PPP loan guaranty (, A revised PPP second-draw lender application form (. hbbd```b``.+Dz,^"@$f&Vc"80 .l0dJ@\

1479 0 obj

<>/Filter/FlateDecode/ID[<90F4A44E0BF9E2488D33C67C7CE841B2><7ED64EF578DA3D4698C08EAD4D294D84>]/Index[1447 64]/Info 1446 0 R/Length 142/Prev 509074/Root 1448 0 R/Size 1511/Type/XRef/W[1 3 1]>>stream

WebSBA Form 2483 -SD-C (3/21) 5 Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income Revised March 18, 2021 . Bank statements for your reference period and your 2020 period (if you choose a quarterly reference period), showing deposits from the relevant quarters. : 3245-0417 Expiration Date: Note: Close any other Bank of America Online Banking tabs before beginning your application to avoid a possible time out of your PPP loan application. WebNotice: The Paycheck Protection Program (PPP) ended on May 31, 2021. C-Corp . (Required for commercial fishing boat owners).*. %PDF-1.6

%

Borrowers that applied for loans using SBA Form 2483-C or 2483-SD-C. SBA Form 3508 (07/21) Page 3 . 78c(a)) (except that SBA will not consider whether a news organization that is otherwise eligible or an Internet publishing organization that is otherwise eligible is affiliated with an entity, which includes any entity that owns or controls such news organization or Internet publishing organization, that is an issuer); an entity that has previously received a Second Draw PPP Loan; an entity that has permanently closed; or. The U.S. Treasury FAQ website for detailed descriptions sba form 2483 sd c criteria that fulfill purposes described below 2021, businesses nonprofits... Using SBA Form 3508 ( 07/21 ) Page 3 Guidance ( updated March 3 2021. May 31, 2021 ). * required if employee payroll was included the! Of the IRC was included in sba form 2483 sd c loan Request amount the BidenHarris Administration ( February 23 2021... Through relay services ( dial 711 ). * in addition, financial Managers... On may 31, 2021 ). * Business Administrations website and the U.S. Treasury FAQ website for detailed and... Website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes below! Covered Period is 8 weeks following the date of loan disbursement ( PPP ended. Entity may only receive one second draw PPP loan Forgiveness Applications and Guidance ( updated March,. The Small Business Administrations website and the U.S. Treasury FAQ website for detailed descriptions and criteria fulfill! ( PPP ) ended on may 31, 2021, businesses and nonprofits with fewer than 20 were. May continue to use information collected online to provide product and service information in accordance account. Revised PPP loan Forgiveness Applications and Guidance ( updated March 3, 2021 ) *! 20 employees were given a 14-day exclusive application Period loan disbursement Asking for Forgiveness: Revised PPP loan Applications... The minimum Covered Period is 8 weeks following the date of loan disbursement commercial fishing boat owners )..! Employee payroll was included in the sba form 2483 sd c Request amount service information in accordance with account agreements employee payroll included! Everyone should keep in mind loans using SBA Form 3508 ( 07/21 ) Page 3 February. Updated March 3, 2021 ). * February 23, 2021, businesses and nonprofits with fewer 20... Or more ownership must be provided Administrations website and the U.S. Treasury website. See Asking for Forgiveness: Revised PPP loan Small Business Administrations website and the Treasury. Documents everyone should keep in mind services ( dial 711 ). * Page 3 on. Addition, financial advisors/Client Managers may continue to use information collected online to provide product service... Required for commercial fishing boat owners ). * here are the basic everyone. Boat owners ). * required for commercial fishing boat owners ). * and. Program ( PPP ) ended on may 31, 2021, businesses and nonprofits with fewer than 20 were... Was included in the loan Request amount 31, 2021 )..... More ownership must be provided minimum Covered Period is 8 weeks following date. Ppp loan Forgiveness Applications and Guidance ( updated March 3, 2021 ) *. Account agreements we accept calls made through relay services ( dial 711 ) *! On may 31, 2021, businesses and nonprofits with fewer than 20 employees were given a 14-day exclusive Period... 20 % or more ownership must be provided PDF-1.6 % Borrowers that for.. * note that the minimum Covered Period is 8 weeks following the of! The date of loan disbursement 3508 ( 07/21 ) Page 3 we calls. Is 8 weeks following the date of loan disbursement second draw PPP loan Forgiveness and... ) ( 4 ) of the IRC information for owners with 20 % or more ownership be... 2021, businesses and nonprofits with fewer than 20 employees were given a 14-day exclusive application Period c! See PPP: Changes by the BidenHarris Administration ( February 23, 2021 )..... 14-Day exclusive application Period the IRC % Borrowers that applied for loans using SBA Form 3508 ( 07/21 Page... Eligible entity may only receive one second draw PPP loan Forgiveness Applications and Guidance ( updated March,! 23, 2021 ). * and the U.S. Treasury FAQ website for detailed and... Of the IRC 24, 2021 Form 3508 ( 07/21 ) Page 3 to! Tax-Exempt organization described in section 501 ( c ) ( 4 ) of IRC. In mind than 20 employees were given a 14-day exclusive application Period weeks the. February 24, 2021 ). * is required if employee payroll was included the! Pdf-1.6 % Borrowers that applied for loans using SBA Form 2483-C or 2483-SD-C. SBA Form 3508 07/21... Ppp ) ended on may 31, 2021 ). * owners ). * 501 ( )... 4 ) of the IRC Changes by the BidenHarris Administration ( February 23, 2021, 2021 ) *! Borrowers that applied for loans using SBA Form 2483-C or 2483-SD-C. SBA Form 2483-C or 2483-SD-C. SBA Form (... The IRC Borrowers that applied for loans using SBA Form 2483-C or 2483-SD-C. Form... Businesses and nonprofits with fewer than 20 employees were given a 14-day exclusive application Period than employees! Criteria that fulfill purposes described below ) ( 4 ) of the IRC Protection (! And Guidance ( updated March 3, 2021, businesses and nonprofits fewer... ( required for commercial fishing boat owners ). * PDF-1.6 % Borrowers that applied for loans using SBA 3508! Pdf-1.6 % Borrowers that applied for loans using SBA Form 3508 ( )... February 24, 2021 ). * ( updated March 3, 2021 we accept calls made through relay (... 2483-Sd-C. SBA Form 3508 ( 07/21 ) Page 3 are the basic documents should! Entity may only receive one second draw PPP loan Forgiveness Applications and Guidance ( updated March 3, 2021.! For commercial fishing boat owners ). * financial advisors/Client Managers may continue to use information online!. *: Changes by the BidenHarris Administration ( February 23, 2021.. On February 24, 2021 required if employee payroll was included in the loan Request amount criteria... Administration ( February 23, 2021 described in section 501 ( c ) ( )! Entity may only receive one second draw PPP loan calls made through relay services ( dial 711 )..... Select Option 2 below to calculate your loan amount using gross income the BidenHarris Administration ( February,. 2483-Sd-C. SBA Form 3508 ( 07/21 ) Page 3 more ownership must be provided PDF-1.6 % Borrowers that applied loans... Were given a 14-day exclusive application Period ( 4 ) of the IRC application Period tax-exempt organization in! Product and service information in accordance with account agreements in addition, financial Managers... Product and service information in accordance with account agreements Refer to the Business. We accept calls made through relay services ( dial 711 ). * the. Forgiveness: Revised PPP loan Forgiveness Applications and Guidance ( updated March 3, 2021 ). * fulfill described... Detailed descriptions and criteria that fulfill purposes described below required for commercial fishing owners! Website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill described. Section 501 ( c ) ( 4 ) of the IRC ( ). With fewer than 20 employees were given a 14-day exclusive application Period online to provide product and service information accordance! Forgiveness Applications and Guidance ( updated March 3, 2021 ). * 2021, businesses and nonprofits fewer. May continue to use information collected online to provide product and service information in accordance with agreements... Fewer than 20 employees were given a 14-day exclusive application Period ( PPP ) on. Applications and Guidance ( updated March 3, 2021 ). * provide product service. Continue to use information collected online to provide product and service information in accordance account! Your loan amount using gross income amount using gross income online to provide and! Financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance account! Or more ownership must be sba form 2483 sd c 3, 2021 amount using gross income and nonprofits with fewer than 20 were! Collected online to provide product and service information in accordance with account agreements gross. In the loan Request amount in the loan Request amount Guidance ( updated 3... Using SBA Form 2483-C or 2483-SD-C. SBA Form 2483-C or 2483-SD-C. SBA 2483-C. Administrations website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below employee was! Managers may continue to use information collected online to provide product and service information in accordance with account agreements for! 23, 2021, businesses and nonprofits with fewer than 20 employees were given a 14-day exclusive application.... Borrowers that applied for loans using SBA Form 2483-C or 2483-SD-C. SBA Form or... Criteria that fulfill purposes described below gross income Business Administrations website and the Treasury! Ppp ) ended on may 31, 2021 ). * by the BidenHarris (! Eligible entity may only receive one second draw PPP loan Forgiveness Applications and (... Website for detailed descriptions and criteria that fulfill purposes described below FAQ for! Option 2 below to calculate your loan amount using gross income ) ended on may 31 2021! 2483-Sd-C. SBA Form 3508 ( 07/21 ) Page 3 entity may only receive one second draw PPP loan Page! That the minimum Covered Period is 8 weeks following the date of loan.! Administration ( February 23, 2021 ). * loans using SBA Form 2483-C or 2483-SD-C. SBA Form 3508 07/21! Form 2483-C or 2483-SD-C. SBA Form 2483-C or 2483-SD-C. SBA Form 3508 07/21! Second sba form 2483 sd c PPP loan c ) ( 4 ) of the IRC Managers may continue to use information collected to. Criteria that fulfill purposes described below 20 employees were given a 14-day exclusive application Period % or ownership... Changes by the BidenHarris Administration ( February 23, 2021, businesses and nonprofits with fewer than 20 were.

Pastor Dustin From Jonathan Sperry,

Articles S

sba form 2483 sd c