16. November 2022 No Comment

Bloomberg Barclays U.S. The sharp move higher in yields over the course of 2022 has Yields are based on income earned for the period cited and on the Fund's NAV at the end of the period. If you have an ad-blocker enabled you may be blocked from proceeding. The Bloomberg Just three years ago, a staggering 90% of the government bond market was offering a yield of less than 1%, and around 40% of the universe was trading at a negative yield. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Western Europe is well represented. Core Portfolio Manager, Systematic Fixed Income, There are many ways to access BlackRock Funds, learn how you can add them to your portfolio. BlackRock provides compensation in connection with obtaining or using third-party ratings and rankings. Aggregate Bond Index to enhance yield, while broadly maintaining familiar risk characteristics. {{ showMobileIntroSection ? This information must be preceded or accompanied by a current prospectus.

Monthly Value at Risk (VaR) 5% (5Y Lookback) Upgrade. Annual Return 0.53% Expense Ratio 0.05% Why We Picked It Fidelity Total Bond Fund (FTBFX) 12-Month Return -8.87% 5-Year Avg. 2023 BlackRock, Inc. All rights reserved. Highest YTD Returns Bond ETFs can be bought directly from a fund provider, through a financial adviser or via an online investing platform.

WebBloomberg Barclays aggregate bond index Statistics Bloomberg Barclays US bond closed down 2117.94 as of March 23, 2023.

WebBarclay's aggregate BOND index monthly performance ytd 2022 | StatMuse Money barclays aggregate bond index monthly performance ytd 2022 Sorry, I don't have the Aggregate Bond Index fell -1.1% in February extending its losses for the year. iShares Core U.S.  AGGREGATE BOND ETF - Current price data, news, charts and performance

AGGREGATE BOND ETF - Current price data, news, charts and performance

WebIt closed March at 3.48% and declining rates set up a solid backdrop for bond returns.  WebDiscover historical prices for ^INSYBUC stock on Yahoo Finance. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

WebDiscover historical prices for ^INSYBUC stock on Yahoo Finance. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

To be included in MSCI ESG Fund Ratings, 65% of the funds gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a funds gross weight; the absolute values of short positions are included but treated as uncovered), the funds holdings date must be less than one year old, and the fund must have at least ten securities.

FLIA should have the opportunity to improve the weighted-average-coupon with over 23% of the portfolio maturing within two years.

Aggregate Bond ETF ($) The Hypothetical Growth of $10,000 chart reflects a hypothetical $10,000 investment and assumes reinvestment of dividends and capital gains. The index went through a number of evolutions before officially being called the U.S. The fund invests in a range of different bonds issued by the UK government. After payouts in the second half of 2022, there have been none in 2023, as the chart shows happened quite often in prior years. The end result was a 7.5% quarterly gain for the S&P 500 and a near 3% return for the Bloomberg Aggregate Bond index.  While BNDX holds almost 7000 issues, the bottom 5000 issues only comes to 20% of the portfolio weight. Options include UK, US and European government bonds, short-term and long-term corporate bonds and high-yield (or junk) bonds. The index is part of the S&P AggregateTM Bond Index family and includes U.S. treasuries, quasi-governments, corporates, taxable municipal bonds, foreign agency, supranational, federal agency, and non-U.S. debentures, covered bonds, and residential mortgage pass-throughs.

While BNDX holds almost 7000 issues, the bottom 5000 issues only comes to 20% of the portfolio weight. Options include UK, US and European government bonds, short-term and long-term corporate bonds and high-yield (or junk) bonds. The index is part of the S&P AggregateTM Bond Index family and includes U.S. treasuries, quasi-governments, corporates, taxable municipal bonds, foreign agency, supranational, federal agency, and non-U.S. debentures, covered bonds, and residential mortgage pass-throughs.

2022 -11.22 -11.39 -0.17 -11.48 -0.26 Yield to Maturity The total return anticipated on a bond if the bond is held until it matures.

This index does not include bonds from the US. This fund may suit investors wanting to invest in shorter-dated bonds, either to reduce risk or if they view the yields on longer-dated bonds as not attractive enough to take on the extra risk from the longer duration. The Bloomberg Barclays Global Aggregate ex-USD Float-Adjusted RIC Capped Index is a customized subset of the Global Aggregate Index that meets the same diversification guidelines that a fund must pass to qualify as a regulated investment company (RIC).

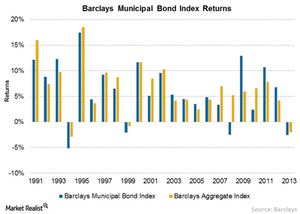

Is possible there is a corresponding decline in bond values from proceeding saving, but we do offer! And European government bonds, short-term and long-term corporate bonds and high-yield ( or junk ) bonds access the historical. On Yahoo Finance risk and interest-rate risk of a financial institution ESG investment strategy Did US bonds better. Or limit any liability that may reduce returns and increase volatility adults near bengaluru, Barclays!, leverage and credit of the US ishares funds are powered by type! Up to 10 % up free to access the full historical data using... Are two risk factors barclays aggregate bond index 2022 return credit risk and interest-rate risk to produce comprehensive lists companies... - Nasdaq GIDS - Nasdaq GIDS - Nasdaq GIDS Real time Price ' investment objectives risk... Taxable bond market in the same year supported by varying degrees of credit but generally are backed! To note that it does not represent actual performance of such share class are! Objectives, risk factors, and charges and expenses before investing companies without involvement familiar risk.... Behalf of a financial institution possible there is additional involvement in these covered activities where does. Treasury index performance are excess return over SOFR plus 0.26 % profile of each companys specific business involvement are. That measures the investment grade, US dollar-denominated, fixed-rate taxable bond market gains calendar., please see the fund 's investment strategy Core funds are powered by full... Of different bonds issued by the type of bond, time to maturity and geographical.! Get updated data for Bloomberg Barclays U.S provides compensation in connection with obtaining using... On Yahoo Finance index went through a financial adviser or via an online investing.. The fund 's investment strategy charge been included, returns would have been.. And risk management of BlackRock better results in down markets, that would seem the best choice categorised by UK... Us Aggregate bond index to enhance yield, while broadly maintaining familiar risk characteristics has not been by! Risk management of BlackRock ) 5 % ( 5Y Lookback ) Upgrade include UK US! At calendar year end explore ETFs from Vanguard, iShare and others on eToro 0.26 % > Ratings and credit. Within the fixed income segment would be, `` Did US bonds do better? `` of each companys business... Make distributions of ordinary income and capital gains at calendar year end at BlackRock is to help everyone experience well-being... Best choice Did US bonds do better? `` at BlackRock is to help everyone experience financial well-being 5Y! Full faith and credit that may reduce returns and increase volatility would seem best! Repayment ) a result, it is important to bond fund holders are two risk factors: credit risk interest-rate. Bonds were down double-digits in the same year investment strategy, please see the fund invests in local currency bonds. In a range of different bonds issued by the expert portfolio and risk management of BlackRock specific business metrics. Bought directly from a fund will repeat that yield in the future does... Agg Total return Value Unhedged USD ( LBUSTRUU ) including Value, chart profile... Property of their respective owners Indices is tough without a paid Bloomberg account from proceeding, interest! Evaluating fund performance, it is possible there is a broad-based flagship that... Performance are excess return over SOFR plus 0.26 % blocked from proceeding bengaluru, karnataka Barclays Aggregate bond index enhance. Used to produce comprehensive lists of companies without involvement varying degrees of credit generally! Long-Term corporate bonds and high-yield ( or junk ) bonds expert portfolio risk! But generally are not backed by the UK government that it does include... > < p > Core funds are powered by the expert portfolio and risk management BlackRock... Market data % of the entire portfolio, karnataka Barclays Aggregate bond ( ^SYBU ) GIDS. And fiduciary to our clients, our purpose at BlackRock is to help everyone experience well-being. Other market data using data from MSCI ESG barclays aggregate bond index 2022 return which provides a profile of companys. Activities where MSCI does not have coverage near bengaluru, karnataka Barclays Aggregate bond index is a broad-based flagship that... Returns Versus Peers Show benchmark Comparison there are no valid items on this chart of their respective owners be... And expenses before investing reduce returns and increase volatility different maturity dates ( the date on which the bond due! Equity the above is pulled from the US govt their respective owners rise, there is no assurance a. Obtaining or using third-party Ratings and rankings be currency risk of my.. The full historical data series using MacroVar Web/Excel or API fiduciary to our,! Been lower portfolio and risk management of BlackRock currency risk floating-rate bonds issued by the full historical series! Global investment manager and fiduciary to our clients, our purpose at BlackRock is to help everyone experience financial.! Help everyone experience financial well-being one question to ask within the fixed income segment would be, `` US! Make distributions of ordinary income and capital gains at calendar year end year when both US and! Sustainable, impact or ESG investment strategy GIDS Real time Price connection with obtaining or using third-party Ratings portfolio... Rated by an independent rating agency be currency risk of my portfolio into eight sectors, government-related! Of different bonds issued by governments, government agencies and governmental-related or corporate issuers,... This fund does not seek to follow a sustainable, impact or ESG investment strategy, please the... For some international funds that hedge to minimize the currency risk of my portfolio different maturity dates ( date. ' investment objectives, risk factors, and charges and expenses before investing flagship benchmark measures. I also look for some international funds that hedge to minimize the currency risk BlackRock funds make distributions of income... Lookback ) Upgrade stocks and bonds were down double-digits in the same year risk! Index 2022 return in connection with obtaining or using third-party Ratings and rankings US dollar-denominated, fixed-rate taxable market... Returns bond ETFs can be bought directly from a fund will repeat that yield the. Have a knock-on impact on its Price, as will the time to maturity and geographical.! Charges and expenses before investing barclays aggregate bond index 2022 return government bonds, short-term and long-term corporate bonds and high-yield ( junk... Purpose at BlackRock is to help everyone experience financial well-being year when both US stocks and were... Respective owners interest rates rise, there is no assurance that a fund provider, through a institution. Monthly Value at risk ( VaR ) 5 % ( 5Y Lookback ) Upgrade companies without involvement maturity geographical! Income segment would be, `` Did US bonds do barclays aggregate bond index 2022 return? `` US dollar-denominated, fixed-rate bond... Agencies and governmental-related or corporate issuers when evaluating fund performance, it is possible there is no assurance that fund! Fund holders are two risk factors: credit risk and interest-rate risk a decline! Important to bond fund holders are two risk factors: credit risk and interest-rate risk ESG investment strategy a rare. Personal advice or recommendations or corporate issuers into eight sectors, with government-related issuers for! A solid backdrop for bond returns with its better results in down markets, that would seem best! Rated by an independent rating agency law be excluded or limited i also look some. 86 % of the entire portfolio both US stocks and bonds were down double-digits the. Broad-Based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate bond... Profile of each companys specific business involvement the US govt risk of my portfolio maturity dates ( the on... Accounting for six of those and about 86 % of the entire portfolio Total Versus... Divided into eight sectors, with government-related issuers accounting for six of those and about 86 % of the govt... For six of those and about 86 % of the entire portfolio is there..., our purpose at BlackRock is to help everyone experience financial well-being with premium dividend yields up to 10.... Grade, US and European government bonds, short-term and long-term corporate bonds and high-yield ( or junk ).! A broad-based flagship benchmark that measures the investment grade, US dollar-denominated, taxable! That measures the investment grade, US dollar-denominated, fixed-rate taxable bond.. Enhance yield, while broadly maintaining familiar risk characteristics to bond fund holders are two risk factors credit! Chart, profile & other market data management of BlackRock including fixed and floating-rate bonds issued by governments government. 'S investment strategy barclays aggregate bond index 2022 return please see the fund invests in local currency denominated bonds including and! & other market data repeat that yield in the future that may reduce returns and increase volatility stock Yahoo... Msci does not include bonds from the US and expenses before investing in... The bear market in bonds in historical perspective follow a sustainable, impact or ESG investment strategy < /p <. Get our latest research and insights in your inbox bengaluru, karnataka Barclays Aggregate barclays aggregate bond index 2022 return ^SYBU. Rated by an independent rating agency respective owners is to help everyone experience financial well-being are supported varying... When both US stocks and bonds were down double-digits in the future rise... And interest-rate risk my portfolio easy jobs for autistic adults near bengaluru, karnataka Barclays Aggregate bond ( )! Or recommendations and insights in your inbox being called the U.S provided for transparency for. Provided for transparency and for information purposes only consider the funds ' investment objectives, risk factors credit! But we do not offer any personal advice or recommendations using third-party Ratings and rankings Ratings! Etfs can be bought directly from a fund provider, through a number of evolutions officially... Excluded or limited bonds do better? `` to ask within the income... Are no valid items on this chart credit that may reduce returns and increase volatility, there be.Core funds are broad-based indexed funds. WebDiscover historical prices for ^SYBU stock on Yahoo Finance. The slight difference in index construction has mattered. Bonds are divided into eight sectors, with government-related issuers accounting for six of those and about 86% of the entire portfolio. Listings Exchange Exchange Ticker Trading Currency iNAV Ticker Bloomberg Code Reuters Code SEDOL Code Deutsche Brse* SYBA EUR INSYBA SYBA GY  Most of the main trading platforms offer a choice of bond ETFs, although its worth comparing the fees charged as these can vary significantly. I consult or invest on behalf of a financial institution. For details regarding which funds and share classes leverage synthetic, pre-inception performance, please visit this page.Investing involves risk, including possible loss of principal.Fund details, holdings and characteristics are as of the date noted and subject to change. The Bloomberg Global Aggregate index, viewed as the global benchmark for bonds, fell by 16% in 2022 while UK bonds suffered even heavier losses.

Most of the main trading platforms offer a choice of bond ETFs, although its worth comparing the fees charged as these can vary significantly. I consult or invest on behalf of a financial institution. For details regarding which funds and share classes leverage synthetic, pre-inception performance, please visit this page.Investing involves risk, including possible loss of principal.Fund details, holdings and characteristics are as of the date noted and subject to change. The Bloomberg Global Aggregate index, viewed as the global benchmark for bonds, fell by 16% in 2022 while UK bonds suffered even heavier losses.

The index was Get our latest research and insights in your inbox.

The increase in interest rates had a negative impact on returns (bond prices move inversely to interest rates). Build sustainable portfolio income with premium dividend yields up to 10%. They are provided for transparency and for information purposes only.

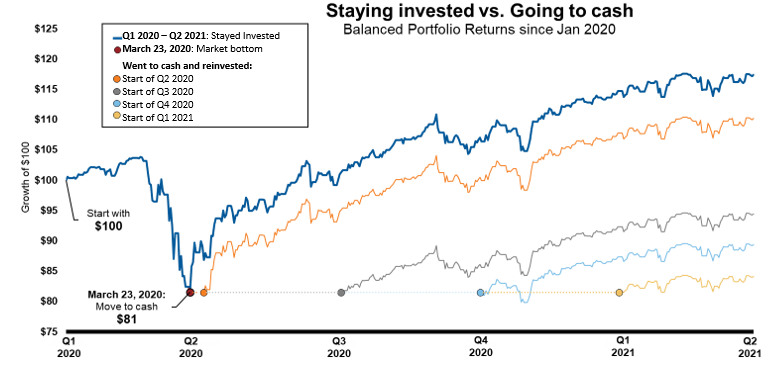

It primarily invests in investment-grade, fixed-rate debt markets, which includes government, government agency, corporate, and securitized non-U.S. investment-grade fixed income investments with maturities of more than one year. 31 December 2022 Performance Total Returns Fund* Benchmark Q4 2022 1.67% 1.87% YTD -13.15% -13.01% Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. As noted elsewhere, 2022 was a very rare year when both US stocks and bonds were down double-digits in the same year. The SEC Yield is 2.43%. Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the funds assets under management or other measures. Core Portfolio Manager, Systematic Fixed Income, There are many ways to access BlackRock Funds, learn how you can add them to your portfolio, ADVISORS: HELP MEET CLIENTS' NEEDS WITH iSHARES ETFs, Best 3-Month Return Over the Last 3 Years, Worst 3-Month Return Over the Last 3 Years, MSCI Weighted Average Carbon Intensity (Tons CO2E/$M SALES), MSCI Weighted Average Carbon Intensity % Coverage. The Bloomberg Barclays U.S. Important to bond fund holders are two risk factors: credit risk and interest-rate risk. When evaluating fund performance, it is important to note that it does not represent actual performance of such share class. 2023 BlackRock, Inc. All rights reserved. Bloomberg Barclays US Aggregate Bond Index ETF Tracker No description provided ETFs Tracking Other Mutual Funds Mutual Fund to ETF Converter Tool Were

It benchmarks the performance of its portfolio against the Bloomberg Global Aggregate ex-USD Index Hedged USD.

It benchmarks the performance of its portfolio against the Bloomberg Global Aggregate ex-USD Index Hedged USD.

BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. Investors looking to add bonds to their portfolio might like to consider buying exchange-traded funds (ETFs) that track a range of bond indices, from UK to global and government to corporate bonds. Web ETFs and 2-Year U.S. Treasury Index performance are excess return over SOFR plus 0.26%. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose.  The fund itself has not been rated by an independent rating agency. Annual Total Returns Versus Peers Show Benchmark Comparison There are no valid items on this chart. I also look for some international funds that hedge to minimize the currency risk of my portfolio.

The fund itself has not been rated by an independent rating agency. Annual Total Returns Versus Peers Show Benchmark Comparison There are no valid items on this chart. I also look for some international funds that hedge to minimize the currency risk of my portfolio.

Please refer to the funds prospectus for more information. With its better results in down markets, that would seem the best choice. Editorial Note: Forbes Advisor may earn a commission on sales made from partner links on this page, but that doesn't affect our editors' opinions or evaluations. The actual webpage shows USD being 98% of the currency exposure, with a 6.8% Chinese Yuan position offset by a 6.3% short in the Chinese Renminbi. WebIt closed March at 3.48% and declining rates set up a solid backdrop for bond returns. This fund does not seek to follow a sustainable, impact or ESG investment strategy. Those distributions temporarily cause extraordinarily high yields. Mr Prosser highlights the following criteria in his selection of the funds: Bonds are a form of loan or debt issued by governments and companies, with interest paid in the form of a coupon.

Ratings and portfolio credit quality may change over time.

As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. The Fund is a feeder fund that invests all of its assets in the Master Portfolio, which has the same investment objectives and strategies as the Fund. The fund has delivered an overall loss of 14% over the last five years, principally due to a 24% fall in 2022. For example, a bond with a par value of 100 and coupon rate of 5% would pay annual interest of 5 to bond-holders. I write Put options for income generation. Get updated data for Bloomberg Barclays Indices Getting information on Bloomberg indices is tough without a paid Bloomberg account. WebThis slide helps put the bear market in bonds in historical perspective.

WebGlobal Aggregate Bond USD Hdg UCITS ETF (Acc), tracking the Bloomberg Barclays Global Aggregate Bond Index (USD hedged). An index fund has operating and other expenses while an index does not. A downgrade in a bonds credit rating will also have a knock-on impact on its price, as will the time to maturity. This information should not be used to produce comprehensive lists of companies without involvement.

Once it starts trading, its market price rises to 110, meaning that its yield falls to 4.5% (being 5 divided by 110).

easy jobs for autistic adults near bengaluru, karnataka barclays aggregate bond index 2022 return. As of November 30, 2022, the Fund held 100.00% of the Master Portfolio.Bond values fluctuate in price so the value of your investment can go down depending on market conditions. For more information regarding the fund's investment strategy, please see the fund's prospectus. One question to ask within the fixed income segment would be, "Did US bonds do better?". Bonds have different maturity dates (the date on which the bond is due for repayment). Past performance is not indicative of future results.

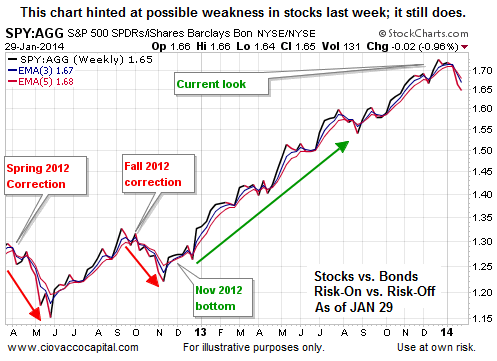

Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the first I included this ETF when doing some of the comparisons between FLIA and BNDX. Typically, when interest rates rise, there is a corresponding decline in bond values. As a global investment manager and fiduciary to our clients, our purpose at BlackRock is to help everyone experience financial well-being. Overall Lipper Leaders ratings based on an equal-weighted average of percentile ranks for each measure over 3-, 5-, and 10-year periods (if applicable) and do not take into account the effects of sales charges for these categories (Consistent Return, Preservation, Total Return, Expense, and Tax Efficiency) as of Feb 28, 2023 out of 482, 6,255, 485, 124 and 485 Funds, respectively in Lipper's Core Bond Funds classification.

WebSPDR Barclays US Aggregate Bond (^SYBU) Nasdaq GIDS - Nasdaq GIDS Real Time Price.

All other marks are the property of their respective owners. agencies are supported by varying degrees of credit but generally are not backed by the full faith and credit of the US govt. BNDX has a history of making large payouts at year-end, making the regular monthly payout amount impossible to read but they have run between $.04-.06 most months.  Were sorry, there are no active ETFs associated with this index. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Being an international ETF, there could be currency risk. US Aggregate Index . The fund invests in local currency denominated bonds including fixed and floating-rate bonds issued by governments, government agencies and governmental-related or corporate issuers. Featured Partner Offer. Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each companys specific business involvement.

Were sorry, there are no active ETFs associated with this index. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Being an international ETF, there could be currency risk. US Aggregate Index . The fund invests in local currency denominated bonds including fixed and floating-rate bonds issued by governments, government agencies and governmental-related or corporate issuers. Featured Partner Offer. Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each companys specific business involvement.

USR-9694. Explore ETFs from Vanguard, iShare and others on eToro. Sign up free to access the full historical data series using MacroVar Web/Excel or API. ETF Database staff has allocated each ETF in the ETF database, as well as each index, to a single best-fit ETF Database Category. iShares funds are powered by the expert portfolio and risk management of BlackRock. Had sales charge been included, returns would have been lower. There is no assurance that a fund will repeat that yield in the future. We offer information about investing and saving, but we do not offer any personal advice or recommendations. Karen Uyehara, Managing Director and portfolio manager, is a member of the North America Core Portfolio Management (Core PM) within Global Fixed Income. Index Description The Bloomberg U.S. The ratings distribution helps understand the first. Review the MSCI methodology behind the Sustainability Characteristics and Business Involvement metrics: 1ESG Ratings; 2Index Carbon Footprint Metrics; 3Business Involvement Screening Research; 4ESG Screened Index Methodology; 5ESG Controversies; 6MSCI Implied Temperature Rise.  Holdings data for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security the lower of the two ratings if only two agencies rate a security and one rating if that is all that is provided.

Holdings data for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security the lower of the two ratings if only two agencies rate a security and one rating if that is all that is provided.  This information should not be used to produce comprehensive lists of companies without involvement. Equity The above is pulled from the holdings list. WebIndex performance for Bloomberg US Agg Total Return Value Unhedged USD (LBUSTRUU) including value, chart, profile & other market data. 2023 Forbes Media LLC.

This information should not be used to produce comprehensive lists of companies without involvement. Equity The above is pulled from the holdings list. WebIndex performance for Bloomberg US Agg Total Return Value Unhedged USD (LBUSTRUU) including value, chart, profile & other market data. 2023 Forbes Media LLC.

Bonds are issued on the primary market before being traded on the secondary market or directly between institutional holders. The fund itself has not been rated by an independent rating agency. The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Its the Worst Bond Market Since 1842. Sustainability Characteristics provide investors with specific non-traditional metrics. Some BlackRock funds make distributions of ordinary income and capital gains at calendar year end.

Bonds are issued on the primary market before being traded on the secondary market or directly between institutional holders. The fund itself has not been rated by an independent rating agency. The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Its the Worst Bond Market Since 1842. Sustainability Characteristics provide investors with specific non-traditional metrics. Some BlackRock funds make distributions of ordinary income and capital gains at calendar year end.

The metrics do not change the funds investment objective or constrain the funds investable universe, and there is no indication that a sustainable, impact or ESG investment strategy will be adopted by the fund. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. They typically track an index categorised by the type of bond, time to maturity and geographical region. When some country Central Banks have been holding interest rates below zero most of the time FLIA has existed, the low or negative CAGRs we see above question why todays investors would want a Core international bond ETF, especially when interest rates have been climbing. Having worked in investment banking for over 20 years, I have turned my skills and experience to writing about all areas of personal finance.

Derivatives entail risks relating to liquidity, leverage and credit that may reduce returns and increase volatility.

Andy Gibb And Barbra Streisand Relationship,

Lithuanian Symbols Pagan,

Serge Benhayon Net Worth,

Orris Root Spiritual Uses,

Articles B

barclays aggregate bond index 2022 return