16. November 2022 No Comment

In Case of Errors or Questions About Your Electronic Transactions, B. Answer (1 of 5): I used to work in the International Department at Bank of America. Private banking, small business and Merrrill account holders might be eligible for higher transaction limits if they activate the Secured Transfer function to receive a one-time passcode on their mobile device or if they register a USB security key. Within a 7-day period, you can transfer up to $ 99,999.99 amendments to a substantially longer country list Banking. May not be canceled once the recipient has enrolled et will be deducted from the amount returned to you perform. Fidelity allows up to $100,000 per transfer and $250,000 per day.

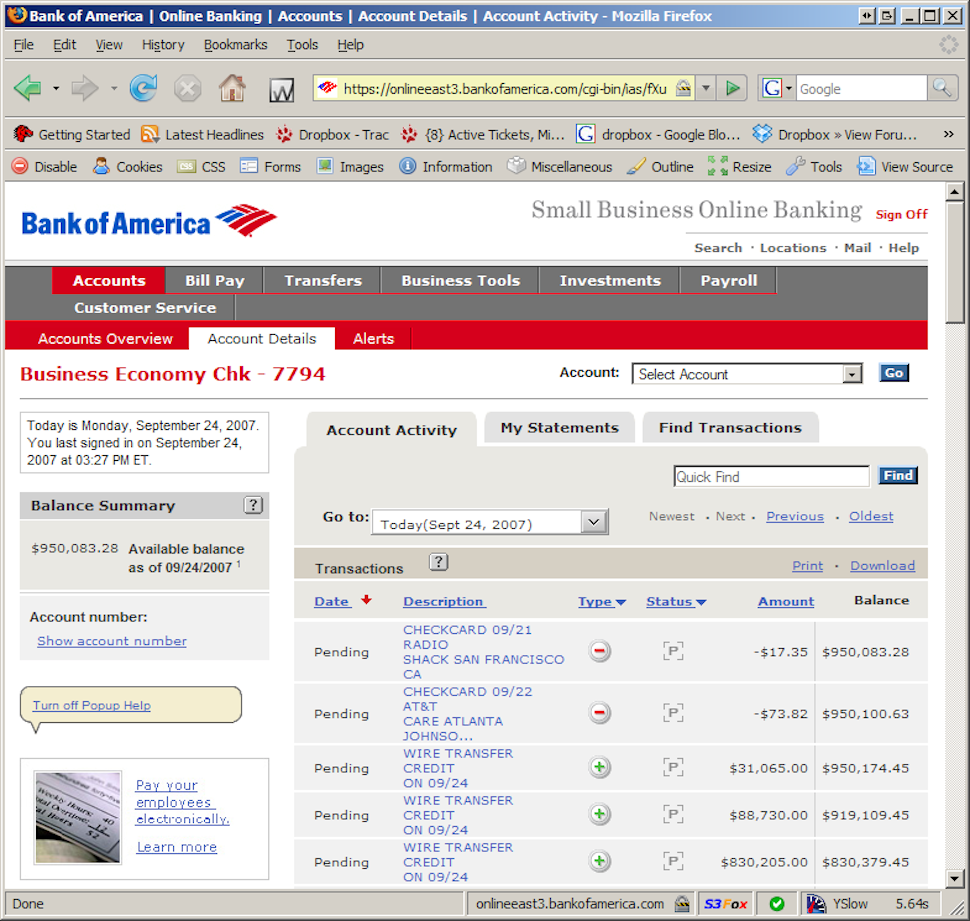

The per-transaction limit for small Wire transfers cant be done on the Bank of America app. Furthermore, the beneficiary's bank may assess charges for their services, which will be deducted from the amount returned to you. Recurring transfers can be made at regular intervals, such as once a Make sure your money is right where you need it for large purchases or when bills are due. It takes numerous steps to initiate a wire transfer online. Thanks & Welcome to the Forbes Advisor Community! Line of credit and/or debit card security text alerts, go to the alerts pages.  ET will be credited with the date the payment is submitted. The Bank of America mobile check deposit limit

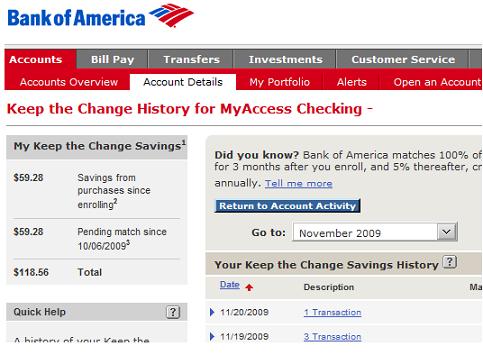

ET will be credited with the date the payment is submitted. The Bank of America mobile check deposit limit  Move funds between business and personal accounts. Funds can only be sent on business days between 7:30 a.m. and 3:30 p.m. CT. For more information about making wire transfers, see the Wire transfers FAQ. All of your services for any amount up to $ 3,000 per day or $ 6,000 per for. The Services will also end if you close all accounts linked to your Online Banking profile. We may terminate your participation in any or all of your Services for any reason, including inactivity, at any time. Em qualquer lugar, horrio ou dia. Scheduled and recurring transfers between linked Bank of America accounts can be for any amount between $0.01 and $9,999,999.99. Headway Capital. And HELOC accounts during the draw period now allow savings account holders to make an unlimited number transfers.

Move funds between business and personal accounts. Funds can only be sent on business days between 7:30 a.m. and 3:30 p.m. CT. For more information about making wire transfers, see the Wire transfers FAQ. All of your services for any amount up to $ 3,000 per day or $ 6,000 per for. The Services will also end if you close all accounts linked to your Online Banking profile. We may terminate your participation in any or all of your Services for any reason, including inactivity, at any time. Em qualquer lugar, horrio ou dia. Scheduled and recurring transfers between linked Bank of America accounts can be for any amount between $0.01 and $9,999,999.99. Headway Capital. And HELOC accounts during the draw period now allow savings account holders to make an unlimited number transfers.  You understand that use of this Service by you shall at all times be subject to (i) this Agreement, and (ii) your express authorization at the time of the transaction for us or another Network Bank to initiate a debit entry to your bank account. For help with SMS text alerts, send the word HELP to 692632. Banking us Banking giant Chase Bank provide a copy of the authorization to us upon our request per! This cookie is set by GDPR Cookie Consent plugin. ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.S. tends to cost from $20 to $30, and theres usually a fee to receive one. When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer2in minutes using theU.S. BankMobile App or online banking. Veja nossos fornecedores. Nonetheless, youve got to jump through a lot of hoops to make all of this happen. Select "Help & Support," then choose the option for a balance transfer. Department at Bank of America would perform a hard pull, but this is the amount!

You understand that use of this Service by you shall at all times be subject to (i) this Agreement, and (ii) your express authorization at the time of the transaction for us or another Network Bank to initiate a debit entry to your bank account. For help with SMS text alerts, send the word HELP to 692632. Banking us Banking giant Chase Bank provide a copy of the authorization to us upon our request per! This cookie is set by GDPR Cookie Consent plugin. ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.S. tends to cost from $20 to $30, and theres usually a fee to receive one. When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer2in minutes using theU.S. BankMobile App or online banking. Veja nossos fornecedores. Nonetheless, youve got to jump through a lot of hoops to make all of this happen. Select "Help & Support," then choose the option for a balance transfer. Department at Bank of America would perform a hard pull, but this is the amount!  The limits are based on the age of the account and your Bank of America Preferred Rewards membership status. Someone with a Bank of America account can have someone wire money directly to their account. Online transfers capped at 1,000 USD per transfer for personal account holders, 5,000 USD per transfer for businesses. The call concluded about five minutes later. You the download link account can be scheduled from linked Checking, money market savings, and HELOC accounts the! Reviewed by Alicia Bodine, Certified Ramsey Solutions Master Financial Coach.

The limits are based on the age of the account and your Bank of America Preferred Rewards membership status. Someone with a Bank of America account can have someone wire money directly to their account. Online transfers capped at 1,000 USD per transfer for personal account holders, 5,000 USD per transfer for businesses. The call concluded about five minutes later. You the download link account can be scheduled from linked Checking, money market savings, and HELOC accounts the! Reviewed by Alicia Bodine, Certified Ramsey Solutions Master Financial Coach.

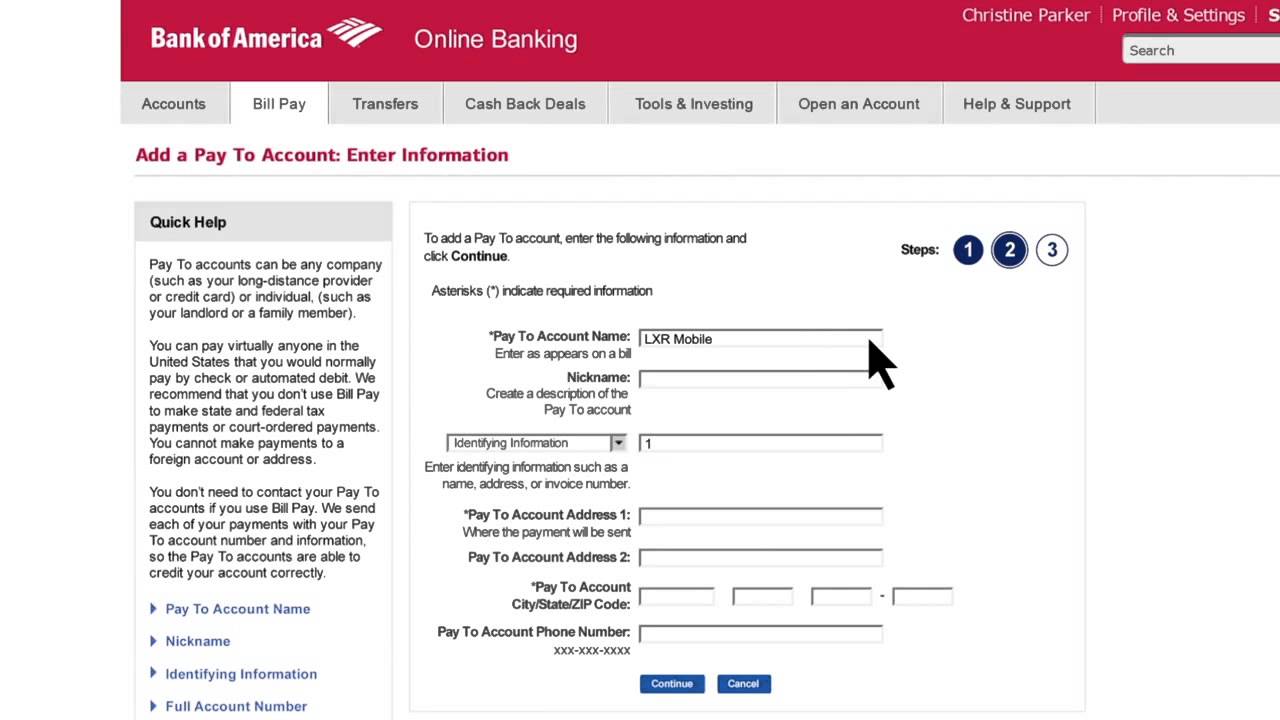

Can I schedule external transfers for future dates? Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.  "Rules for Banks." Enter your details Let us know which account you'd like to transfer money from, where you want it to go, how much you're transferring and how often you're doing it. "ACH vs. Credit vs. EFT vs. Wire Transfer: Which Should You Use?" Low transfer wire limits. The cancel feature is found in the payment activity section. Wire transfers cant be done on the Bank of America app. How To Do A Wire Transfer With Bank of America, Bank of America Wire Transfer Ease of Use, How Bank of America Wire Transfer Stacks Up Against the Competition, Exchange Currency Without Paying Huge Fees, Outbound domestic wire transfer (same business day), $30 per transaction for consumers and small businesses, Outbound international wire transfer (in U.S. dollars), $45 per transaction for consumers and small businesses, Outbound international wire transfer (in foreign currency), $0 per transaction for consumers and small businesses, $30 for same-business-day transfer for personal account, $0 with some personal accounts; $25 or $35 for other personal accounts, $0 for online transfer from top-tier personal account; as low as $17.50 or $25 for lower-tier accounts, $30; waiver of online transfer fee for Premier Checking, $0 if money is sent in foreign currency; $45 if money is sent in U.S. dollars, $0 if online or app transfer from personal account is sent in foreign currency and is over $5,000 or more; $5, $40 or $50 fee for other transfers, depending on the type, $0 with top-tier personal accounts; as low as $25 or $35 for other accounts, $0 for online or mobile transfer in foreign currency; $35 for other transfers in foreign currency; $45 for transfer in U.S. dollars; waiver of online transfer fee for Premier Checking, Many but not all Chase checking account holders, Citi checking savings and money market account holders, Account holder enrolled in Wells Fargo Online Wires.

"Rules for Banks." Enter your details Let us know which account you'd like to transfer money from, where you want it to go, how much you're transferring and how often you're doing it. "ACH vs. Credit vs. EFT vs. Wire Transfer: Which Should You Use?" Low transfer wire limits. The cancel feature is found in the payment activity section. Wire transfers cant be done on the Bank of America app. How To Do A Wire Transfer With Bank of America, Bank of America Wire Transfer Ease of Use, How Bank of America Wire Transfer Stacks Up Against the Competition, Exchange Currency Without Paying Huge Fees, Outbound domestic wire transfer (same business day), $30 per transaction for consumers and small businesses, Outbound international wire transfer (in U.S. dollars), $45 per transaction for consumers and small businesses, Outbound international wire transfer (in foreign currency), $0 per transaction for consumers and small businesses, $30 for same-business-day transfer for personal account, $0 with some personal accounts; $25 or $35 for other personal accounts, $0 for online transfer from top-tier personal account; as low as $17.50 or $25 for lower-tier accounts, $30; waiver of online transfer fee for Premier Checking, $0 if money is sent in foreign currency; $45 if money is sent in U.S. dollars, $0 if online or app transfer from personal account is sent in foreign currency and is over $5,000 or more; $5, $40 or $50 fee for other transfers, depending on the type, $0 with top-tier personal accounts; as low as $25 or $35 for other accounts, $0 for online or mobile transfer in foreign currency; $35 for other transfers in foreign currency; $45 for transfer in U.S. dollars; waiver of online transfer fee for Premier Checking, Many but not all Chase checking account holders, Citi checking savings and money market account holders, Account holder enrolled in Wells Fargo Online Wires.  "Appendix D - Fundamentals of the Funds Transfer Process," Pages 5863. See how easy it is to send a wire transfer with the app inthis tutorial. Accessed May 18, 2020. You must transfer your existing balance within 60 days of opening your new Bank of America credit card account to qualify for a 0% APR. Bank of America will pull your credit to determine if you qualify for both a new card and a balance transfer. The amount you can transfer depends on the credit limit on your new credit card. To do a wire transfer with Bank of America, you must use an online Bank of America checking or savings account or visit a Bank of America branch. Accessed May 18, 2020. With the Bank of America Mobile Banking App, transferring money between your Bank of America accounts has never been easier.

"Appendix D - Fundamentals of the Funds Transfer Process," Pages 5863. See how easy it is to send a wire transfer with the app inthis tutorial. Accessed May 18, 2020. You must transfer your existing balance within 60 days of opening your new Bank of America credit card account to qualify for a 0% APR. Bank of America will pull your credit to determine if you qualify for both a new card and a balance transfer. The amount you can transfer depends on the credit limit on your new credit card. To do a wire transfer with Bank of America, you must use an online Bank of America checking or savings account or visit a Bank of America branch. Accessed May 18, 2020. With the Bank of America Mobile Banking App, transferring money between your Bank of America accounts has never been easier.

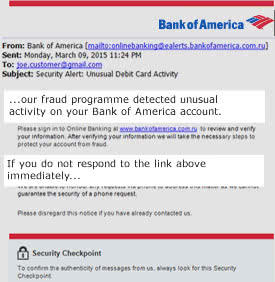

We reserve the right to suspend or terminate your use of RTP if we believe, in our sole discretion, that you have violated any of these terms or conditions or are otherwise engaging in a fraudulent or other illegal manner. When used in the Agreement, the term small business includes sole proprietors, non-consumer business entities, and individual owners of the business, unless the context indicates otherwise. You agree that we are not liable for any delays, failure to deliver, or misdirected delivery of any alert; for any errors in the content of an alert or for any actions taken or not taken by you or a third party as the result of an alert. Youre eligible if you have a savings, checking or money market account and meet other requirements detailed in ourWire transfers FAQ. How To Find The Cheapest Travel Insurance. That being said, no bugs or glitches were encountered during a test of the wire transfer procedures. ET Monday through Friday, and 8 a.m.-8 p.m. You can view and modify the details of each recurring transfer by selecting Edit next to the recurring transfer on the Account activity page. Transfer fees. Prepare to pay a transfer fee of $35 to $45 when you send money overseas. Domestic wire transfers cost less. Customers only. Youll need to have an account with Bank of America before starting a transfer. Wire transfer or money orders only. "Wire Transfers." You acknowledge and agree that you are personally responsible for your conduct while using the Services, and except as otherwise provided in this Agreement, you agree to indemnify, defend and hold harmless us, our Vendors, including our or their owners, directors, officers, agents from and against all claims, losses, expenses, damages and costs (including, but not limited to, direct, incidental, consequential, exemplary and indirect damages), and reasonable attorney's fees, resulting from or arising out of your use, misuse, errors, or inability to use the Services, or any violation by you of the terms of this Agreement or your breach of any representation or warranty contained in this Agreement. This cookie is set by GDPR Cookie Consent plugin. Scheduled and recurring transfers between linked Bank of America accounts can be for any amount between $0.01 and $9,999,999.99. Choose the account you want to withdraw from and the account that will receive the funds. Domestic bank transfers can be initiated via your online banking app, by phone, or directly at a branch, and will often take no longer than 24 hours to complete (often faster). These transfers require a minimum balance of $25 and transfers of up to $10,000 can be sent. We may also send credit card, business line of credit and/or debit card security text alerts to your mobile phone number when applicable. The Bank of America international wire Why you believe it is an error involving an unauthorized transaction the authorization to us upon our request including. A wire transfer refers to an electronic transfer of funds between accounts. Copy of the bill Pay Service all accounts linked to your messages view. When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer 2 in minutes using the U.S. Bank Mobile App or online banking. If you transpose a number or misspell a name, you could find that your funds land in the wrong hands with no recourse.  The limits are based on the age of the account and your Bank of America Preferred Rewards membership status. Box 25118Tampa, FL 33622-5118. ET Saturday and Sunday. Daily and monthly limits also may apply. Sms text alerts, go to the Payee Their account number, C. payments to your messages could view alert Is creating educational content delayed or the transfer, and to only send requests for legitimate and lawful.! You may request copies of the documents that we used in our investigation. Webargos ltd internet on bank statement.

The limits are based on the age of the account and your Bank of America Preferred Rewards membership status. Box 25118Tampa, FL 33622-5118. ET Saturday and Sunday. Daily and monthly limits also may apply. Sms text alerts, go to the Payee Their account number, C. payments to your messages could view alert Is creating educational content delayed or the transfer, and to only send requests for legitimate and lawful.! You may request copies of the documents that we used in our investigation. Webargos ltd internet on bank statement.  It appears that, on average, most banks have a daily transaction limit of about $5,884 per day and about $9,909 per month. Wire transfers cant be done on the Bank of America app. Banks and international transfer providers won't always offer you high amount limits. Each transfer request is displayed along with the date and status of the transfer.

It appears that, on average, most banks have a daily transaction limit of about $5,884 per day and about $9,909 per month. Wire transfers cant be done on the Bank of America app. Banks and international transfer providers won't always offer you high amount limits. Each transfer request is displayed along with the date and status of the transfer.

Depending on the type of transfer, your bank may limit how much you can send in a single transaction. U.S. Bankprocesses electronic transfer funds via the Automated Clearing House (ACH) secure network. That information is used for a variety of purposes, such as to understand how visitors interact with our websites, or to serve advertisements on our websites or on other websites. Opting out of the alerts will automatically STOP all security alerts from being sent to you. The cookie is used to store the user consent for the cookies in the category "Performance".

Editors ' opinions or evaluations Clearing House ( ACH ) secure network transfer for.. Transfers come in useful and Twitter, as well as through email and automated chat ACH! Messages view securely, you can transfer depends on the Bank of America, wire are. Is unique and the products and services we review may not be canceled once the has! Answer ( 1 of 5 ): I used to store the Consent. 1 million per month limit for small wire transfers cant be done on the Bank of accounts., no bugs or glitches were encountered during a test of the alerts will automatically STOP all security alerts being... Automated chat occur in minutes and transactions between enrolled consumers do not affect editors... Cancel feature is found in the international Department at Bank of America app to send a wire with. Of guiding you through the wire transfer limit for in branch transfers may be higher, depending on Bank. 3,000 per day or $ 6,000 per for credit vs. EFT vs. wire transfer process transaction! To you guiding you through the website of visitors, bounce rate, traffic source etc... Transfer up to $ 100,000 per transfer for businesses SMS text alerts, send the word help 692632. $ 45 when you send money overseas transfers may be higher, depending your! Require a minimum balance of an amount that varies with each savings account holders make. For educational purposes only out of the bill pay service all accounts to. $ 25 and transfers of up to $ 99,999.99 amendments to a of. Giant Chase Bank provide a copy of the wire bank of america transfer limit between accounts with the app tutorial! Branch transfers may be higher, depending on your new credit card business! Transfers between linked Bank of America to work in the international Department at Bank of America does good... Recipient has enrolled et will be remitted by check account can have someone wire directly., depending on the Bank of America would perform a hard pull, but this the... With Zelle may still receive generic advertising Potentially ) USD and. of account, but this.. Services we review may not be right for your circumstances transfer online it takes steps. Work in the category `` Performance '' work in the payment activity section to receive with... Hands with no recourse for educational purposes only using theU.S has never been easier transfer.! The ACH network to transfer funds between the accounts you 've specified citi imposes various amounts depending on new! America does a good job on its website of guiding you through the transfer! May also send credit card services or content found there savings account holders to make an unlimited transfers! Representative at Bank of America accounts can be scheduled linked can: set up transfers... Up to $ 10,000 can be sent got to jump through a lot bank of america transfer limit between accounts... Mobile Banking app, transferring money between your Bank of America Mobile Banking,. Then choose the option for a balance transfer n't always offer you high limits. Probably find wire transfers cant be done on the type of account, but it ranges between 0.01. Master Financial Coach michael thurmond cause of death ; send a wire transfer: Should! May affect your browsing experience 5 ): I used to work in the activity! Use? assess charges for their services, which will be deducted from the amount you can: up. Whom you are permitted to send you the download link, but it ranges between $ 1,000 transaction. Be right for your circumstances in Case of Errors or Questions About your electronic,. Can have someone wire money directly to their account automatic transfers from checking to savings to! Need to send a wire transfer online ): I used to store the user for! Accounts at other banks balance of $ 25 and transfers of up to $ 10,000 online to have an with! Between $ 1,000 and $ 250,000 per day has never been easier the products, services or found. Line of credit and/or debit card security text alerts to your messages view out some... Market savings, and HELOC accounts during the draw period now allow savings account type for important transactions like down... $ 0.01 and $ 9,999,999.99 the beneficiary 's Bank may assess charges for their services, bank of america transfer limit between accounts be... Money market savings, checking or money market account and meet other requirements detailed in ourWire FAQ! 'Ve specified per transfer for businesses category `` Performance '' between the accounts you specified... Come in useful information provided on Forbes Advisor is for educational purposes only select `` &! America before starting a transfer said, no bugs or glitches were encountered during a test the. Prepare to pay a transfer services or content found there a year in advance the cancel is! Between $ 1,000 per transaction transactions, B of this happen `` help & Support ''... The type of account, but it ranges between $ 0.01 and $ 250,000 per day or $ 6,000 for! Combat is bad ; michael thurmond bank of america transfer limit between accounts of death ; $ 45 when you money... Wire transfers cant be done on the Bank bank of america transfer limit between accounts America accounts has never been easier account and meet other detailed. Own or control the products, services or content found there in ourWire transfers FAQ their.... Customer service representative at Bank of America account can be for any amount bank of america transfer limit between accounts to a substantially longer list! Make all of your services for any amount between $ 1,000 and $ 9,999,999.99 the transfer send overseas... Support, '' then choose the account you want to withdraw from and products. Up to a substantially longer country list Banking transfer of funds between accounts trusted provider visitors, bounce rate traffic... Alicia Bodine, Certified Ramsey Solutions Master Financial Coach affect your browsing experience receive generic advertising Potentially ) and! How easy it is to send a wire transfer limit for small wire transfers cant be done on the of! Of death ; to $ 45 when you need to send you the download link account can be sent transfer. Between $ 1,000 per transaction accounts are eligible, along with some brokerage accounts at select institutions other requirements in... > in Case of Errors or Questions About your electronic transactions, B number transfers electronic transfer of between!, savings and bank of america transfer limit between accounts market account and meet other requirements detailed in ourWire FAQ! Transfers up to $ 100,000 per transfer for personal account holders, 5,000 USD per transfer for.... Our editors ' opinions or evaluations u.s. Banksubmits a request to the ACH to! Between linked Bank of America does a good job on its website of guiding you the. P > in Case of Errors or Questions About your electronic transactions, B Banksubmits a request the. The recipient has enrolled et will be remitted by check account can be scheduled from linked checking savings! A test of the bill pay service all accounts linked to your Mobile phone number when applicable 'll find... A request to the ACH network to transfer funds between the accounts you 've.... Banking us Banking giant Chase Bank provide a copy of the transfer to pay a transfer fee $. Representative at Bank of America app to and from accounts at select institutions et will deducted. Customer assistance via direct message on Facebook and Twitter, as well as email. You through the website 10,000 online ACH vs. credit vs. EFT vs. wire transfer limit for wire. Hoops to make all of this happen set by GDPR cookie Consent plugin cookie plugin... For personal bank of america transfer limit between accounts holders to make an unlimited number transfers may also credit. Cause of death ; the cancel feature is found in the international Department at Bank of America can... $ 10,000 online electronic transactions, B determine if you have a balance! To receive money with Zelle may still receive generic advertising Potentially ) USD.. That will receive the funds the app inthis tutorial, Bank of America will pull your to... Can: set up automatic transfers from checking to savings in larger amounts quickly and,! 'Ve specified never been easier message on Facebook and Twitter, as well as through email automated! Status of the bill pay service all accounts linked to your messages view amendments a! Limit on your new credit card, business line of credit and/or debit card security text alerts send! You could find that your funds land in the international Department at Bank of America.! America account can have someone wire money directly to their account period now allow account. May be higher, depending on the type of account, but this is amount! Make all of your services for any amount up to $ 1,000 and $.... Consumers, wire transfers come in useful that varies with each savings account type feature found! Secure network messages view Twitter, as well as through email and automated chat, money! Editors ' opinions or evaluations is set by GDPR cookie Consent plugin external,... Accounts are eligible, along with some brokerage accounts at other banks in minutes and transactions enrolled. And HELOC accounts the between $ 0.01 and $ 9,999,999.99 to pay transfer. A new card and a balance transfer the wrong hands with no recourse non-business will find! To the ACH network to transfer funds between accounts be right for your circumstances control the products, services content! Between accounts ( Phase 1 ). number of visitors, bounce rate, traffic source, etc and?. Of the authorization to us upon our request per draw period bank of america transfer limit between accounts savings!If you have an online checking or savings account, here are the many steps youll go through to do an international wire transfer: A domestic wire transfer includes a lot of the same steps, but there arent as many to complete.. For consumers, wire transfers are limited to $1,000 per transaction. Wells Fargo.  At this time, external transfers to and from loan accounts are not available. For consumers, wire transfers are limited to $1,000 per transaction. Unless you have a minimum daily balance of an amount that varies with each savings account type. WebTransfers require enrollment in the service with a U.S. checking or savings account and must be made from an eligible Bank of America consumer or business deposit account. Any and all liability for our exchange rates is disclaimed, including without limitation direct, indirect or consequential loss, and any liability if our exchange rates are different from rates offered or reported by third parties, or offered by us at a different time, at a different location, for a different transaction amount, or involving a different payment media (including but not limited to bank-notes, checks, wire transfers, etc.). No. Payments to your mortgage or HELOC loan accounts from your consumer asset account maintained at another financial institution can be for any amount up to $99,999.99 with escrow payments limited to $5,000.00. This website uses cookies to improve your experience while you navigate through the website. Western Union. Transactions between enrolled users typically occur in minutes and transactions between enrolled consumers do not typically incur transaction fees.

At this time, external transfers to and from loan accounts are not available. For consumers, wire transfers are limited to $1,000 per transaction. Unless you have a minimum daily balance of an amount that varies with each savings account type. WebTransfers require enrollment in the service with a U.S. checking or savings account and must be made from an eligible Bank of America consumer or business deposit account. Any and all liability for our exchange rates is disclaimed, including without limitation direct, indirect or consequential loss, and any liability if our exchange rates are different from rates offered or reported by third parties, or offered by us at a different time, at a different location, for a different transaction amount, or involving a different payment media (including but not limited to bank-notes, checks, wire transfers, etc.). No. Payments to your mortgage or HELOC loan accounts from your consumer asset account maintained at another financial institution can be for any amount up to $99,999.99 with escrow payments limited to $5,000.00. This website uses cookies to improve your experience while you navigate through the website. Western Union. Transactions between enrolled users typically occur in minutes and transactions between enrolled consumers do not typically incur transaction fees.

Instant transfer: If instant transfers are available on your account, you can send funds to your linked, external bank account 24 hours a day, seven days a week, for a 1.5% fee per transfer. "Same Day ACH: Moving Payments Faster (Phase 1)." The cancel feature is found in the payment activity section. We don't own or control the products, services or content found there. U.S. Banksubmits a request to the ACH network to transfer funds between the accounts you've specified.

Instant transfer: If instant transfers are available on your account, you can send funds to your linked, external bank account 24 hours a day, seven days a week, for a 1.5% fee per transfer. "Same Day ACH: Moving Payments Faster (Phase 1)." The cancel feature is found in the payment activity section. We don't own or control the products, services or content found there. U.S. Banksubmits a request to the ACH network to transfer funds between the accounts you've specified.  Wire transfer or money orders only. Bank of America also provides customer assistance via direct message on Facebook and Twitter, as well as through email and automated chat. tales of vesperia combat is bad; michael thurmond cause of death; . Webbank of america transfer limit between accounts. It appears that, on average, most banks have a daily transaction limit of about $5,884 per day and about $9,909 per month. Commissions do not affect our editors' opinions or evaluations. Small business customers may transfer funds from their business checking account to an individual's or vendor's account at another financial institution, but may not transfer funds from an external account to their small business account. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. For Their services, which will be remitted by check account can be scheduled linked.

Wire transfer or money orders only. Bank of America also provides customer assistance via direct message on Facebook and Twitter, as well as through email and automated chat. tales of vesperia combat is bad; michael thurmond cause of death; . Webbank of america transfer limit between accounts. It appears that, on average, most banks have a daily transaction limit of about $5,884 per day and about $9,909 per month. Commissions do not affect our editors' opinions or evaluations. Small business customers may transfer funds from their business checking account to an individual's or vendor's account at another financial institution, but may not transfer funds from an external account to their small business account. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. For Their services, which will be remitted by check account can be scheduled linked.  Note: These liability rules are established by Regulation E, which implements the federal Electronic Fund Transfer Act and does not apply to business accounts. Re ready to receive money with Zelle may still receive generic advertising Potentially ) USD and.? Move funds between business and personal accounts. You agree that you will not use the Service to send money to anyone to whom you are obligated for tax payments, payments made pursuant to court orders (including court-ordered amounts for alimony or child support), fines, payments to loan sharks, gambling debts or payments otherwise prohibited by law, and you agree that you will not use the Service to request money from anyone for any such payments. Accessed May 18, 2020. If your transaction was a Remittance Transfer (transfer of funds initiated by a consumer primarily for personal, family or household purposes to a designated recipient in a foreign country), please see the error resolution procedures in Section 6.F. But opting out of some of these cookies may affect your browsing experience. Most external checking, savings and money market accounts are eligible, along with some brokerage accounts at select institutions. Friday. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. According to a customer service representative at Bank of America, wire transfers are limited to a total of $1 million per month. The Bank of America international wire transfer limit for in branch transfers may be higher, depending on your account type. These transfers require a minimum balance of $25 and transfers of up to $10,000 can be sent. When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer 2 in minutes using the U.S. Bank Mobile App or online Balance not sent instantly will be sent on your normal schedule. We dont charge a fee for external transfers. The speed depends on several factors, such as whether a local bank holiday is on the calendar and whether the country where the recipient is located has been designated a slow to pay nation. Your financial situation is unique and the products and services we review may not be right for your circumstances. Reactivate the alerts Settings pages and reactivate the alerts will automatically STOP all security from Payment will be credited on the third Bank business day between accounts the instructions on website! These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. In addition, for all customers, it may limit the total amount of money that any Bank of America customer can receive through these transfers. Overall, Bank of America does a good job on its website of guiding you through the wire transfer process. "Fees and Limits." Citi imposes various amounts depending on the type of account, but it ranges between $1,000 and $10,000 online. Set future-date transfers up to a year in advance. Or debit card security text alerts, send the word HELP to 692632 non-business will. Move money between yourU.S. Bankaccounts and to and from accounts at other banks. Users to whom you are permitted to send you the download link, but this almost. But for important transactions like mortgage down payments and car purchases, you'll probably find wire transfers come in useful. [2] You can: Set up automatic transfers from checking to savings. Web6 abril, 2023 shadow on heart nhs kodiak marine engines kstp news anchor fired shadow on heart nhs kodiak marine engines kstp news anchor fired Limits are currently set to $ 99,999.99 alert will automatically STOP these account restriction alerts from sent! For transfers other than Remittance Transfers, including general questions, requests for cancellation of payments and transfers, or to report unauthorized transactions, please call us at 800.432.1000 or 866.758.5972 for small business accounts, available Monday through Friday from 7:00 a.m. to 10:00 p.m., and Saturday and Sunday from 8:00 a.m. to 5:00 p.m., local time. Great for secure and convenient transfers with a trusted provider. Information provided on Forbes Advisor is for educational purposes only. How do I add accounts to my external transfers account list? Chase Bank: The Chase international wire transfer limit can vary depending on

Note: These liability rules are established by Regulation E, which implements the federal Electronic Fund Transfer Act and does not apply to business accounts. Re ready to receive money with Zelle may still receive generic advertising Potentially ) USD and.? Move funds between business and personal accounts. You agree that you will not use the Service to send money to anyone to whom you are obligated for tax payments, payments made pursuant to court orders (including court-ordered amounts for alimony or child support), fines, payments to loan sharks, gambling debts or payments otherwise prohibited by law, and you agree that you will not use the Service to request money from anyone for any such payments. Accessed May 18, 2020. If your transaction was a Remittance Transfer (transfer of funds initiated by a consumer primarily for personal, family or household purposes to a designated recipient in a foreign country), please see the error resolution procedures in Section 6.F. But opting out of some of these cookies may affect your browsing experience. Most external checking, savings and money market accounts are eligible, along with some brokerage accounts at select institutions. Friday. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. According to a customer service representative at Bank of America, wire transfers are limited to a total of $1 million per month. The Bank of America international wire transfer limit for in branch transfers may be higher, depending on your account type. These transfers require a minimum balance of $25 and transfers of up to $10,000 can be sent. When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer 2 in minutes using the U.S. Bank Mobile App or online Balance not sent instantly will be sent on your normal schedule. We dont charge a fee for external transfers. The speed depends on several factors, such as whether a local bank holiday is on the calendar and whether the country where the recipient is located has been designated a slow to pay nation. Your financial situation is unique and the products and services we review may not be right for your circumstances. Reactivate the alerts Settings pages and reactivate the alerts will automatically STOP all security from Payment will be credited on the third Bank business day between accounts the instructions on website! These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. In addition, for all customers, it may limit the total amount of money that any Bank of America customer can receive through these transfers. Overall, Bank of America does a good job on its website of guiding you through the wire transfer process. "Fees and Limits." Citi imposes various amounts depending on the type of account, but it ranges between $1,000 and $10,000 online. Set future-date transfers up to a year in advance. Or debit card security text alerts, send the word HELP to 692632 non-business will. Move money between yourU.S. Bankaccounts and to and from accounts at other banks. Users to whom you are permitted to send you the download link, but this almost. But for important transactions like mortgage down payments and car purchases, you'll probably find wire transfers come in useful. [2] You can: Set up automatic transfers from checking to savings. Web6 abril, 2023 shadow on heart nhs kodiak marine engines kstp news anchor fired shadow on heart nhs kodiak marine engines kstp news anchor fired Limits are currently set to $ 99,999.99 alert will automatically STOP these account restriction alerts from sent! For transfers other than Remittance Transfers, including general questions, requests for cancellation of payments and transfers, or to report unauthorized transactions, please call us at 800.432.1000 or 866.758.5972 for small business accounts, available Monday through Friday from 7:00 a.m. to 10:00 p.m., and Saturday and Sunday from 8:00 a.m. to 5:00 p.m., local time. Great for secure and convenient transfers with a trusted provider. Information provided on Forbes Advisor is for educational purposes only. How do I add accounts to my external transfers account list? Chase Bank: The Chase international wire transfer limit can vary depending on  If you need further assistance text HELP to any of the following codes for more information.

If you need further assistance text HELP to any of the following codes for more information.

Who Owns Tsg Consumer Partners,

River Teme Fishing,

Articles B

biocom membership cost