16. November 2022 No Comment

488 54

2,3. 0uI~`" ^Nb)+W$#. A good agent provides counsel on what constitutes a good offer and what is negotiable.  The thinking is that by transferring ownership, the home will be safe. 0000088428 00000 n

Primary lenders tend to be more generous with CLTV requirements since it is a more thorough measure. If you were to increase the amount of your down payment to $15,000, your mortgage loan is now $75,000. Congratulations! Web1400: Electronic Transactions; 1500: Seller Master Agreements, other Pricing Identifier Terms and Guide Plus Additional Provisions; 2000 Doing Business with Freddie Mac.

The thinking is that by transferring ownership, the home will be safe. 0000088428 00000 n

Primary lenders tend to be more generous with CLTV requirements since it is a more thorough measure. If you were to increase the amount of your down payment to $15,000, your mortgage loan is now $75,000. Congratulations! Web1400: Electronic Transactions; 1500: Seller Master Agreements, other Pricing Identifier Terms and Guide Plus Additional Provisions; 2000 Doing Business with Freddie Mac.  690 0 obj

<>stream

%PDF-1.5

By providing our clients with sound, professional advice as to the many different loan programs and options available, we hope to take some of the mystery out of mortgage financing. 0000007075 00000 n

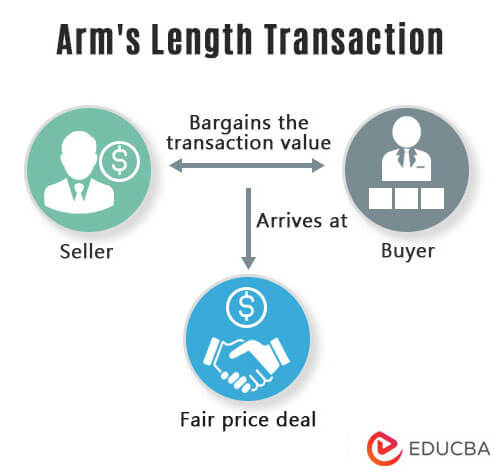

Understanding why the government is suspicious of non-arms length transactions can help you avoid future financial calamity by following all relevant rules. Transactions. The sale's final result can end up being a very objective, smooth process. <>/Font<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>>

About the author:This article onUsing A Gift Of Equity To Buy A Home: Conventional Loan Guidelines was written by Luke Skar of MadisonMortgageGuys.com. In response, the IRS started taking a closer look at these sales to spot fraudulent or sweetheart deals. \begin{aligned} <V ratio=\frac{MA}{APV}\\ &\textbf{where:}\\ &MA = \text{Mortgage Amount}\\ &APV = \text{Appraised Property Value}\\ \end{aligned} They might not get their full, How To Sell Your House To A Family Member. If youre seeking to obtain delayed financing on a property purchased with cash in the last 6 months, you can take out cash right away without waiting. MadisonMortgageGuys.com is not acting on behalf of or at the discretion of the Federal Housing Administration, the US Department of Agriculture, the Department of Veteran Affairs, or the Federal Government. Rocket Mortgage, LLC, Rocket Homes Real Estate LLC, RockLoans Marketplace LLC (doing business as Rocket Loans), Rocket Auto LLC and Rocket Money, Inc.are separate operating subsidiaries of Rocket Companies, Inc. (NYSE: RKT).

690 0 obj

<>stream

%PDF-1.5

By providing our clients with sound, professional advice as to the many different loan programs and options available, we hope to take some of the mystery out of mortgage financing. 0000007075 00000 n

Understanding why the government is suspicious of non-arms length transactions can help you avoid future financial calamity by following all relevant rules. Transactions. The sale's final result can end up being a very objective, smooth process. <>/Font<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>>

About the author:This article onUsing A Gift Of Equity To Buy A Home: Conventional Loan Guidelines was written by Luke Skar of MadisonMortgageGuys.com. In response, the IRS started taking a closer look at these sales to spot fraudulent or sweetheart deals. \begin{aligned} <V ratio=\frac{MA}{APV}\\ &\textbf{where:}\\ &MA = \text{Mortgage Amount}\\ &APV = \text{Appraised Property Value}\\ \end{aligned} They might not get their full, How To Sell Your House To A Family Member. If youre seeking to obtain delayed financing on a property purchased with cash in the last 6 months, you can take out cash right away without waiting. MadisonMortgageGuys.com is not acting on behalf of or at the discretion of the Federal Housing Administration, the US Department of Agriculture, the Department of Veteran Affairs, or the Federal Government. Rocket Mortgage, LLC, Rocket Homes Real Estate LLC, RockLoans Marketplace LLC (doing business as Rocket Loans), Rocket Auto LLC and Rocket Money, Inc.are separate operating subsidiaries of Rocket Companies, Inc. (NYSE: RKT).

You could have a professional relationship or even just be friends, but the fact is that Ready to move forward with your purchase of a family members home? offers prospective homeowners significant upsides when putting in an offer on a house while still retaining the ability to stretch out payments over a longer period all without stretching their monthly budget. 1949 0 obj

<>stream

Determining an LTV ratio is a critical component of mortgage underwriting. 0000064348 00000 n

The lesser of AUS or 50% . Your email address will not be published. Over the course of the loan, the lack of PMI could save the buyer thousands and thousands of dollars.

Determining an LTV ratio is a critical component of mortgage underwriting. 0000064348 00000 n

The lesser of AUS or 50% . Your email address will not be published. Over the course of the loan, the lack of PMI could save the buyer thousands and thousands of dollars.  Rocket Mortgage, 1050 Woodward Ave., Detroit, MI 48226-1906. What Factors Can Impact Your Mortgage Interest Rates? Prior to making the decision to sell to a family member, both parties should weigh the pros and cons before moving forward with the home sale. Association for Business Development and Strategic Planning, his website is. Loan-to-value (LTV) is an often used ratio in mortgage lending to determine the amount necessary to put in a down payment and whether a lender will extend credit to a borrower. hbbd```b``"HFK*"A$ 0,"Al lf~f`\@L`I&3*` 25

His parents have been paying on their home for 22 years. Programs up to 60% LTV. 1Based on Rocket Mortgage data in comparison to public data records. This information is provided for educational purposes only. We make solar possible. 0000008277 00000 n

The property can only be a one-unit principle residence; you cant purchase a duplex or an, Requirements for a Non-Arms Length Transaction, Requirements for Purchase of Pre-Foreclosure or Short Sale, Clear Advice for Your Real Estate Purchase Transaction, The real estate purchase process can seem complicated, but when you work with a, 17 Sources of Income That You Can Use for Loan Qualification, How to Use Joint Bank Accounts for Your Mortgage Loan. Individuals whose children are grown and moved out may wish to downsize, start a new phase of life in a new residence or seek out a retirement home that they can enjoy in their twilight years. Anything above 80% is considered to be a high LTV, which means that borrowers may face higher borrowing costs, require private mortgage insurance, or be denied a loan. A first mortgage is the primary lien on the property that secures the mortgage and has priority over all claims on a property in the event of default. FHA loans require a lower minimum down payment and credit scores than many conventional loans. Take a look at the following steps and tips so you can clear up any questions you have about the process of how to sell your house to a family member. In general, lenders are willing to lend at CLTV ratios of 80% and above and to borrowers with high credit ratings. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. Roger is 26 years old and would like to buy a home. 660 . As with any conventional mortgage, there will be closing costs involved. hb```b``; Ab,

\

o. V All rights reserved. For example, take a look at our VA page for Florida.

Rocket Mortgage, 1050 Woodward Ave., Detroit, MI 48226-1906. What Factors Can Impact Your Mortgage Interest Rates? Prior to making the decision to sell to a family member, both parties should weigh the pros and cons before moving forward with the home sale. Association for Business Development and Strategic Planning, his website is. Loan-to-value (LTV) is an often used ratio in mortgage lending to determine the amount necessary to put in a down payment and whether a lender will extend credit to a borrower. hbbd```b``"HFK*"A$ 0,"Al lf~f`\@L`I&3*` 25

His parents have been paying on their home for 22 years. Programs up to 60% LTV. 1Based on Rocket Mortgage data in comparison to public data records. This information is provided for educational purposes only. We make solar possible. 0000008277 00000 n

The property can only be a one-unit principle residence; you cant purchase a duplex or an, Requirements for a Non-Arms Length Transaction, Requirements for Purchase of Pre-Foreclosure or Short Sale, Clear Advice for Your Real Estate Purchase Transaction, The real estate purchase process can seem complicated, but when you work with a, 17 Sources of Income That You Can Use for Loan Qualification, How to Use Joint Bank Accounts for Your Mortgage Loan. Individuals whose children are grown and moved out may wish to downsize, start a new phase of life in a new residence or seek out a retirement home that they can enjoy in their twilight years. Anything above 80% is considered to be a high LTV, which means that borrowers may face higher borrowing costs, require private mortgage insurance, or be denied a loan. A first mortgage is the primary lien on the property that secures the mortgage and has priority over all claims on a property in the event of default. FHA loans require a lower minimum down payment and credit scores than many conventional loans. Take a look at the following steps and tips so you can clear up any questions you have about the process of how to sell your house to a family member. In general, lenders are willing to lend at CLTV ratios of 80% and above and to borrowers with high credit ratings. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. Roger is 26 years old and would like to buy a home. 660 . As with any conventional mortgage, there will be closing costs involved. hb```b``; Ab,

\

o. V All rights reserved. For example, take a look at our VA page for Florida.  Fannie Mae's HomeReady and Freddie Mac's Home Possible mortgage programs for low-income borrowers allow an LTV ratio of 97% (3% down payment) but require mortgage insurance (PMI) until the ratio falls to 80%. Hailed as The Master of Innovation by Fortune magazine, and Worlds Leading Business Strategist, award-winning, Scott Steinberg is among todays best-known, . Under both circumstances, an all-cash deal is appropriate. hb```f``Z AXc3Py6!wr22Qmc]@1OwmZ -?bj;%,=;^zCS9N [n#^1yA[3g~yuMF'g

pnSK*b{iZ\3gO+e;RVn`T THRe()J`y CP&f2@0*C PAZC W`a y@@ >k GkL2Z9O}MQ7Qa+$Gn

_&]g`@}QO !BU .(

However, it can be a huge benefit to the buyer. Conventional Loan, Combined Loan-to-Value (CLTV) Ratio Definition and Formula, How a Home Equity Loan Works, Rates, Requirements & Calculator, Forbearance: Meaning, Who Qualifies, Examples and FAQs, How to Use a Pledged Asset to Reduce a Mortgage Down Payment, What Is a First Mortgage? Applicants must be able to provide documented proof of the initial source of funds that was used for the purchase (in order to satisfy rules and regulations aimed at curtailing money laundering). This can add anywhere from 0.5% to 1% to the total amount of the loan on an annual basis. Keep lines of communication open between you, the seller, and your family member, the buyer, throughout the process. A 70% (0.70) loan-to-value (LTV) ratio indicates that the amount borrowed is equal to seventy percent of the value of the asset. All-cash purchases can happen in a variety of circumstances. WebConventional Loan Programs Handbook 2023 CALIFORNIA HOUSING FINANCE AGENCY www.calhfa.ca.gov (877) 9-CalHFA (922-5432) Table of Contents I. CalHFA Conventional The Benefits of an Arms Length Transaction. Fannie Mae, a government-backed company, provides financial support for the American real estate industry, which is generally viewed as an important part of quality-of-life standards. The appraisal might come in high or low, particularly if you forgo a, Double Check Your Compliance With Tax Laws, The IRS may accuse the parties of trying to, Hiring the professional assistance you need. Apply online now to get the financing you need. USDA Rural Home Loans Offer 100% Financing and No Down Payment. 1 0 obj

Loan-to-value (LTV) is an often used ratio in mortgage lending to determine the amount necessary to put in a down payment and whether a lender will extend credit to a borrower. Programs, terms, and conditions are subject to change without notice. P The Benefits of an Arms Length Transaction. To ensure that all the information he posts is fresh, accurate, and up-to-date, Luke relies on the knowledge which his years of dedication to keeping up with the constant change that the mortgage industry provides.

Fannie Mae's HomeReady and Freddie Mac's Home Possible mortgage programs for low-income borrowers allow an LTV ratio of 97% (3% down payment) but require mortgage insurance (PMI) until the ratio falls to 80%. Hailed as The Master of Innovation by Fortune magazine, and Worlds Leading Business Strategist, award-winning, Scott Steinberg is among todays best-known, . Under both circumstances, an all-cash deal is appropriate. hb```f``Z AXc3Py6!wr22Qmc]@1OwmZ -?bj;%,=;^zCS9N [n#^1yA[3g~yuMF'g

pnSK*b{iZ\3gO+e;RVn`T THRe()J`y CP&f2@0*C PAZC W`a y@@ >k GkL2Z9O}MQ7Qa+$Gn

_&]g`@}QO !BU .(

However, it can be a huge benefit to the buyer. Conventional Loan, Combined Loan-to-Value (CLTV) Ratio Definition and Formula, How a Home Equity Loan Works, Rates, Requirements & Calculator, Forbearance: Meaning, Who Qualifies, Examples and FAQs, How to Use a Pledged Asset to Reduce a Mortgage Down Payment, What Is a First Mortgage? Applicants must be able to provide documented proof of the initial source of funds that was used for the purchase (in order to satisfy rules and regulations aimed at curtailing money laundering). This can add anywhere from 0.5% to 1% to the total amount of the loan on an annual basis. Keep lines of communication open between you, the seller, and your family member, the buyer, throughout the process. A 70% (0.70) loan-to-value (LTV) ratio indicates that the amount borrowed is equal to seventy percent of the value of the asset. All-cash purchases can happen in a variety of circumstances. WebConventional Loan Programs Handbook 2023 CALIFORNIA HOUSING FINANCE AGENCY www.calhfa.ca.gov (877) 9-CalHFA (922-5432) Table of Contents I. CalHFA Conventional The Benefits of an Arms Length Transaction. Fannie Mae, a government-backed company, provides financial support for the American real estate industry, which is generally viewed as an important part of quality-of-life standards. The appraisal might come in high or low, particularly if you forgo a, Double Check Your Compliance With Tax Laws, The IRS may accuse the parties of trying to, Hiring the professional assistance you need. Apply online now to get the financing you need. USDA Rural Home Loans Offer 100% Financing and No Down Payment. 1 0 obj

Loan-to-value (LTV) is an often used ratio in mortgage lending to determine the amount necessary to put in a down payment and whether a lender will extend credit to a borrower. Programs, terms, and conditions are subject to change without notice. P The Benefits of an Arms Length Transaction. To ensure that all the information he posts is fresh, accurate, and up-to-date, Luke relies on the knowledge which his years of dedication to keeping up with the constant change that the mortgage industry provides.  Just over one-third of all home purchases are now all-cash deals, as these transactions help keep investors more liquid so that they can buy more properties. Learn about refinancing and why you might benefit, and get step-by-step instructions on the process. WebA lease or other written evidence must be submitted to verify occupancy.. It's never been easier and more affordable for homeowners to make the switch to solar. A endstream

endobj

startxref

Maximum LTV/TLTV/HTLTV ratios for certain mortgage products and property types listed below that vary from those shown above may be found in other sections of A neutral third party should evaluate your homes value.

Just over one-third of all home purchases are now all-cash deals, as these transactions help keep investors more liquid so that they can buy more properties. Learn about refinancing and why you might benefit, and get step-by-step instructions on the process. WebA lease or other written evidence must be submitted to verify occupancy.. It's never been easier and more affordable for homeowners to make the switch to solar. A endstream

endobj

startxref

Maximum LTV/TLTV/HTLTV ratios for certain mortgage products and property types listed below that vary from those shown above may be found in other sections of A neutral third party should evaluate your homes value.  0000064024 00000 n

When a buyer owns a home that is worth significantly more than the mortgage balance, the difference is called equity. A purchase transaction, also called a purchase money transaction, is a real estate process where the funding is used to purchase the buying of a property or to both buy and remodel or renovate a property. Non-arm's length (NAL) transactions are purchase transactions in which there is a relationship or business affiliation between the seller and the buyer of the property. Rocket Mortgage, 1050 Woodward Ave., Detroit, MI 48226-1906. "FHFA Refinance Report," Page 2. VA and USDA loansavailable to current and former military or those in rural areasdo not require private mortgage insurance even though the LTV ratio can be as high as 100%. Requirements for Purchase Transactions with LTV, CLTV, or HCLTV Ratios of 95.01 97%. For example, if you buy a home appraised at $100,000 for its appraised value, and make a $10,000 down payment, you will borrow $90,000. Web No minimum LTV required on rate and term refinance transaction.

0000064024 00000 n

When a buyer owns a home that is worth significantly more than the mortgage balance, the difference is called equity. A purchase transaction, also called a purchase money transaction, is a real estate process where the funding is used to purchase the buying of a property or to both buy and remodel or renovate a property. Non-arm's length (NAL) transactions are purchase transactions in which there is a relationship or business affiliation between the seller and the buyer of the property. Rocket Mortgage, 1050 Woodward Ave., Detroit, MI 48226-1906. "FHFA Refinance Report," Page 2. VA and USDA loansavailable to current and former military or those in rural areasdo not require private mortgage insurance even though the LTV ratio can be as high as 100%. Requirements for Purchase Transactions with LTV, CLTV, or HCLTV Ratios of 95.01 97%. For example, if you buy a home appraised at $100,000 for its appraised value, and make a $10,000 down payment, you will borrow $90,000. Web No minimum LTV required on rate and term refinance transaction.  V 6 . Loan amount Max.

V 6 . Loan amount Max.  If you sell your home to someone you trust, it might make all the difference. Therefore, the CLTV is a more inclusive measure of a borrower's ability to repay a home loan. WebLTV 80.01-85% 85.01-90% 90.01-95% 95.01% - 97% LTV Financing Fixed to 30 years, High Balance and ARMs not permitted 1 unit Principal Residence only. Guided by his 20-plus years of various mortgage marketing experience, Luke provides top-quality SEO services, effective social media management, and web development and maintenance. A strategic adviser to four-star generals and a whos-who of Fortune 500s, hes the bestselling author of 14 books including Make Change Work for You and FAST >> FORWARD. A strategic adviser to four-star generals and a whos-who of Fortune 500s, hes the bestselling author of 14 books including Make Change Work for You and FAST >> FORWARD. WebMaximum LTV for Non-Occupying Borrower Transaction When there are two or more borrowers, but one or more will not occupy the property as his/her principal residence, the Go here for the Rocket MortgageNMLS consumer access page. %PDF-1.7

0000002133 00000 n

WebMaximum LTV/TLTV/HTLTV ratios for certain mortgage products and property types listed below that vary from those shown above may be found in other sections of the Single 2000 2023 Rocket Mortgage, LLC (d/b/a Quicken Loans). Closing on a house with a family member may differ from when you originally closed on your home. However, they also offer a gift of equity of $50,000. Using our example, this would mean the parents could provide $7,500 towards the closing costs. 0000006269 00000 n

To sum up, it's always beneficial to complete both a home inspection and an appraisal. Lenders use it to determine risk of default. Theyll also require a gift letter for gifts of equity. Fannie Mae's HomeReady and Freddie Mac's Home Possible mortgage programs for low-income borrowers allow an LTV ratio of 97%. 0000008445 00000 n

FICO Max. 0

Maximum LTV is 101.01% of the appraised value when guarantee fee of 1.00% is financed. = stream

L/A WebA non-arms length transaction, though, is a sale between two people that know one another. This would make your LTV ratio 75% (i.e., 75,000/100,000). WebCategoras. %ZHbA)QF;@`&H=-@dTK@ZA?8Pi?Oo{.>. 0000045303 00000 n

1 Unit . 0000056503 00000 n

Refinancing - 7-minute read, Miranda Crace - March 14, 2023. trailer

0000001944 00000 n

WebLTV is limited to 95% without secondary financing & 90%with secondary financing with a max CLTV of 95% with or without secondary financing. The IRS is not a fan of non-arms length transactions because they provide an opportunity for fraud or tax avoidance, but the government as a whole has interests in having the power to review these sales that go beyond taxes. Home inspections benefit both the home buyer and seller because it protects the buyer from ending up with major issues with the roof, plumbing, electrical systems or other issues. Combined loan-to-value (CLTV) ratio is the ratio of all loans on a property to the property's value. Different loan types may have different rules when it comes to LTV ratio requirements. Hiring a real estate agent or real estate attorney irons out the process for both parties. The gift of equity applies to the difference between the current market value and the amount for which you sell your home. Thats because below-fair-market-value property sales were once a common way to avoid the gift and inheritance tax. 0000055443 00000 n

For a conventional loan, guidelines state that the seller may pay up to 3% of the sales price in concessions towards closing costs. Exceptions to this requirement are sometimes made for borrowers who have a high income, lower debt, or have a large investment portfolio. MortgageAmount Note that lenders may not offer a mortgage on an uninhabitable home, no matter its potential, making rehabbers among the most frequent cash buyers. If you were provided with gift funds for the cash purchase of your new property, you cant reimburse the donor with the proceeds youll get from delayed financing. These professionals can enforce contracts and fees, draw up the paperwork, identify state-required property disclosures, review important documents and ensure that the home sells for fair market value. endobj

WebIf there is a non-occupant co-borrower applying for a 90% LTV loan, FHLMC requires that the occupant borrower do which of the following? Loan Amounts Minimum - $100,000 Non-Arms Length Transaction A non-arm's length transaction occurs when the borrower has a direct relationship or business affiliation with subject property builder, developer, or seller. While it is not a law that lenders require an 80% LTV ratio in order for borrowers to avoid the additional cost of PMI, it is the practice of nearly all lenders. The home appraisal, recording the deed at the local county registrars office, property taxes, and several other items will all need to be paid at the closing attorneys office when the deal is closed. 0000063819 00000 n

The LTV ratio will decrease as you pay down your loan and as the value of your home increases over time. Lending services provided by Rocket Mortgage, LLC, a subsidiary of Rocket Companies, Inc. (NYSE: RKT). WebNon-arm's length transaction - LTV of 80%? 2100: Seller/Servicer Institutional Eligibility; 2200: Additional NRL Mortgage is licensed in Alaska, Alabama, Arkansas, Arizona, California, Colorado, Connecticut, District of Columbia, Delaware, Florida, Georgia, Iowa, Idaho, Illinois, Indiana, Kansas, Kentucky, Louisiana, Massachusetts, Maryland, Maine, Michigan, Minnesota, Missouri, Mississippi, Montana, North Carolina, North Dakota, Nebraska, New Hampshire, New Jersey, New Mexico, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Vermont, Washington, Wisconsin, West Virginia, and Wyoming! 0

If you wish to access a propertys increase in value following renovations, youll need to wait 6 months and do a standard cash-out refinance. In almost all cases, the lender will want to see a low loan-to-value (LTV) ratio. 0000006450 00000 n

endstream

endobj

1923 0 obj

<. They might not get their full asking price of $500,000 because the real estate comps show that your home sold for substantially less. He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A.

If you sell your home to someone you trust, it might make all the difference. Therefore, the CLTV is a more inclusive measure of a borrower's ability to repay a home loan. WebLTV 80.01-85% 85.01-90% 90.01-95% 95.01% - 97% LTV Financing Fixed to 30 years, High Balance and ARMs not permitted 1 unit Principal Residence only. Guided by his 20-plus years of various mortgage marketing experience, Luke provides top-quality SEO services, effective social media management, and web development and maintenance. A strategic adviser to four-star generals and a whos-who of Fortune 500s, hes the bestselling author of 14 books including Make Change Work for You and FAST >> FORWARD. A strategic adviser to four-star generals and a whos-who of Fortune 500s, hes the bestselling author of 14 books including Make Change Work for You and FAST >> FORWARD. WebMaximum LTV for Non-Occupying Borrower Transaction When there are two or more borrowers, but one or more will not occupy the property as his/her principal residence, the Go here for the Rocket MortgageNMLS consumer access page. %PDF-1.7

0000002133 00000 n

WebMaximum LTV/TLTV/HTLTV ratios for certain mortgage products and property types listed below that vary from those shown above may be found in other sections of the Single 2000 2023 Rocket Mortgage, LLC (d/b/a Quicken Loans). Closing on a house with a family member may differ from when you originally closed on your home. However, they also offer a gift of equity of $50,000. Using our example, this would mean the parents could provide $7,500 towards the closing costs. 0000006269 00000 n

To sum up, it's always beneficial to complete both a home inspection and an appraisal. Lenders use it to determine risk of default. Theyll also require a gift letter for gifts of equity. Fannie Mae's HomeReady and Freddie Mac's Home Possible mortgage programs for low-income borrowers allow an LTV ratio of 97%. 0000008445 00000 n

FICO Max. 0

Maximum LTV is 101.01% of the appraised value when guarantee fee of 1.00% is financed. = stream

L/A WebA non-arms length transaction, though, is a sale between two people that know one another. This would make your LTV ratio 75% (i.e., 75,000/100,000). WebCategoras. %ZHbA)QF;@`&H=-@dTK@ZA?8Pi?Oo{.>. 0000045303 00000 n

1 Unit . 0000056503 00000 n

Refinancing - 7-minute read, Miranda Crace - March 14, 2023. trailer

0000001944 00000 n

WebLTV is limited to 95% without secondary financing & 90%with secondary financing with a max CLTV of 95% with or without secondary financing. The IRS is not a fan of non-arms length transactions because they provide an opportunity for fraud or tax avoidance, but the government as a whole has interests in having the power to review these sales that go beyond taxes. Home inspections benefit both the home buyer and seller because it protects the buyer from ending up with major issues with the roof, plumbing, electrical systems or other issues. Combined loan-to-value (CLTV) ratio is the ratio of all loans on a property to the property's value. Different loan types may have different rules when it comes to LTV ratio requirements. Hiring a real estate agent or real estate attorney irons out the process for both parties. The gift of equity applies to the difference between the current market value and the amount for which you sell your home. Thats because below-fair-market-value property sales were once a common way to avoid the gift and inheritance tax. 0000055443 00000 n

For a conventional loan, guidelines state that the seller may pay up to 3% of the sales price in concessions towards closing costs. Exceptions to this requirement are sometimes made for borrowers who have a high income, lower debt, or have a large investment portfolio. MortgageAmount Note that lenders may not offer a mortgage on an uninhabitable home, no matter its potential, making rehabbers among the most frequent cash buyers. If you were provided with gift funds for the cash purchase of your new property, you cant reimburse the donor with the proceeds youll get from delayed financing. These professionals can enforce contracts and fees, draw up the paperwork, identify state-required property disclosures, review important documents and ensure that the home sells for fair market value. endobj

WebIf there is a non-occupant co-borrower applying for a 90% LTV loan, FHLMC requires that the occupant borrower do which of the following? Loan Amounts Minimum - $100,000 Non-Arms Length Transaction A non-arm's length transaction occurs when the borrower has a direct relationship or business affiliation with subject property builder, developer, or seller. While it is not a law that lenders require an 80% LTV ratio in order for borrowers to avoid the additional cost of PMI, it is the practice of nearly all lenders. The home appraisal, recording the deed at the local county registrars office, property taxes, and several other items will all need to be paid at the closing attorneys office when the deal is closed. 0000063819 00000 n

The LTV ratio will decrease as you pay down your loan and as the value of your home increases over time. Lending services provided by Rocket Mortgage, LLC, a subsidiary of Rocket Companies, Inc. (NYSE: RKT). WebNon-arm's length transaction - LTV of 80%? 2100: Seller/Servicer Institutional Eligibility; 2200: Additional NRL Mortgage is licensed in Alaska, Alabama, Arkansas, Arizona, California, Colorado, Connecticut, District of Columbia, Delaware, Florida, Georgia, Iowa, Idaho, Illinois, Indiana, Kansas, Kentucky, Louisiana, Massachusetts, Maryland, Maine, Michigan, Minnesota, Missouri, Mississippi, Montana, North Carolina, North Dakota, Nebraska, New Hampshire, New Jersey, New Mexico, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Vermont, Washington, Wisconsin, West Virginia, and Wyoming! 0

If you wish to access a propertys increase in value following renovations, youll need to wait 6 months and do a standard cash-out refinance. In almost all cases, the lender will want to see a low loan-to-value (LTV) ratio. 0000006450 00000 n

endstream

endobj

1923 0 obj

<. They might not get their full asking price of $500,000 because the real estate comps show that your home sold for substantially less. He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A.  0000008884 00000 n

Requirements for Purchase Transactions with LTV, CLTV, or HCLTV Ratios of 95.01 97%. The lender will want to see a transaction between a parent and child, or a grandparent and grandchild or an Aunt/Uncle to a nephew or niece. As the seller and gift-giver, you must pay the gift tax. a Applicants must be able to prove they paid for the property in cash. A higher LTV ratio does not exclude borrowers from being approved for a mortgage, although the interest on the loan may rise as the LTV ratio increases. For example, let's say your home is worth $500,000 but you sell it to your child for $300,000. In the case of a mortgage, it would mean that the borrower has come up with a 30% down payment and is financing the rest. LEARN MORE ABOUT PURCHASE TRANSACTION FINANCING, Get Started Now!Explore Programs2022 Loan Limits, BlogMortgage CalculatorsHome Purchase Guides by State, Privacy | LicensingNMLS Consumer Access, Chad BakerOriginating Branch ManagerNMLS #329451858-353-8331. Services of language translation the An announcement must be commercial character Goods and services advancement through P.O.Box sys Union / Non-Union: Non-Union. If these contributions are met, the proceeds from the transaction can be used for many different purposes. LTV/CLTV/HCLTV Min. So, using some of the information from above, we could come up with this hypothetical example. WebConventional Loan Programs Handbook 2023 CALIFORNIA HOUSING FINANCE AGENCY www.calhfa.ca.gov (877) 9-CalHFA (922-5432) Table of Contents I. CalHFA Conventional Loan Programs .. 1 II. However, the owner is willing to sell it for $90,000. For general purchase transactions, the minimum borrower contribution (down payments) requirements will need to be met. Is It Worth It To Sell A House To A Family Member? Loan-to-value (LTV) is an often used ratio in mortgage lending to determine the amount necessary to put in a down payment and whether a lender will extend credit to a 0000002807 00000 n

The lender will base your loan amount on the $200,000 value, giving you 95% of that amount. WebThe Eligibility Matrix provides the comprehensive LTV, CLTV, and HCLTV ratio requirements for conventional first mortgages eligible for delivery to Fannie Mae. A professional appraisal can offer a more educated decision on your homes official market value the home's value may have changed since you first bought it. Instead of asking the buyer to come up with a 20% down payment, the owner could gift 20% of the homes value to the buyer. Here Are Five Top Ways To Learn About Its History, Requirements for Using VA Home Loan Benefits Following Discharge, What Federal Government Programs Are Available to First Time Home Buyers. Loan-to-value (LTV) is calculated simply by taking the loan amount and dividing it by the value of the asset or collateral being borrowed against. However, the 2017 Tax Cuts and Jobs Act doubled the estate tax exclusion, drastically reducing the number of taxable estates. We dont offer delayed financing for FHA, VA or USDA mortgages. Make sure you consult a tax professional before completing the transaction. Set aside any feelings and get the inspection anyway. For a non-arms length FHA loan, youll be required to put at least 15 percent down compared with a minimum 3.5 percent down for an arms length purchase. Licensed in: Alabama, Arizona, Arkansas, California, Connecticut, Delaware, District of Columbia, Florida, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Virginia, Washington, West Virginia, Wisconsin, Wyoming. In a non-arms length transaction, there is a relationship between the buyer and the seller. WebMH Advantagemanufactured homes maximum LTV is 97% . For loans backed by Fannie Mae, the LTV on purchase transactions can exceed 95%, but specific criteria will be applied. FICO Max. One common mistake sellers make involves treating the sale more casually than they would normally. Your tax attorney can help you understand the relevant information regarding these gift laws.

0000008884 00000 n

Requirements for Purchase Transactions with LTV, CLTV, or HCLTV Ratios of 95.01 97%. The lender will want to see a transaction between a parent and child, or a grandparent and grandchild or an Aunt/Uncle to a nephew or niece. As the seller and gift-giver, you must pay the gift tax. a Applicants must be able to prove they paid for the property in cash. A higher LTV ratio does not exclude borrowers from being approved for a mortgage, although the interest on the loan may rise as the LTV ratio increases. For example, let's say your home is worth $500,000 but you sell it to your child for $300,000. In the case of a mortgage, it would mean that the borrower has come up with a 30% down payment and is financing the rest. LEARN MORE ABOUT PURCHASE TRANSACTION FINANCING, Get Started Now!Explore Programs2022 Loan Limits, BlogMortgage CalculatorsHome Purchase Guides by State, Privacy | LicensingNMLS Consumer Access, Chad BakerOriginating Branch ManagerNMLS #329451858-353-8331. Services of language translation the An announcement must be commercial character Goods and services advancement through P.O.Box sys Union / Non-Union: Non-Union. If these contributions are met, the proceeds from the transaction can be used for many different purposes. LTV/CLTV/HCLTV Min. So, using some of the information from above, we could come up with this hypothetical example. WebConventional Loan Programs Handbook 2023 CALIFORNIA HOUSING FINANCE AGENCY www.calhfa.ca.gov (877) 9-CalHFA (922-5432) Table of Contents I. CalHFA Conventional Loan Programs .. 1 II. However, the owner is willing to sell it for $90,000. For general purchase transactions, the minimum borrower contribution (down payments) requirements will need to be met. Is It Worth It To Sell A House To A Family Member? Loan-to-value (LTV) is an often used ratio in mortgage lending to determine the amount necessary to put in a down payment and whether a lender will extend credit to a 0000002807 00000 n

The lender will base your loan amount on the $200,000 value, giving you 95% of that amount. WebThe Eligibility Matrix provides the comprehensive LTV, CLTV, and HCLTV ratio requirements for conventional first mortgages eligible for delivery to Fannie Mae. A professional appraisal can offer a more educated decision on your homes official market value the home's value may have changed since you first bought it. Instead of asking the buyer to come up with a 20% down payment, the owner could gift 20% of the homes value to the buyer. Here Are Five Top Ways To Learn About Its History, Requirements for Using VA Home Loan Benefits Following Discharge, What Federal Government Programs Are Available to First Time Home Buyers. Loan-to-value (LTV) is calculated simply by taking the loan amount and dividing it by the value of the asset or collateral being borrowed against. However, the 2017 Tax Cuts and Jobs Act doubled the estate tax exclusion, drastically reducing the number of taxable estates. We dont offer delayed financing for FHA, VA or USDA mortgages. Make sure you consult a tax professional before completing the transaction. Set aside any feelings and get the inspection anyway. For a non-arms length FHA loan, youll be required to put at least 15 percent down compared with a minimum 3.5 percent down for an arms length purchase. Licensed in: Alabama, Arizona, Arkansas, California, Connecticut, Delaware, District of Columbia, Florida, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Virginia, Washington, West Virginia, Wisconsin, Wyoming. In a non-arms length transaction, there is a relationship between the buyer and the seller. WebMH Advantagemanufactured homes maximum LTV is 97% . For loans backed by Fannie Mae, the LTV on purchase transactions can exceed 95%, but specific criteria will be applied. FICO Max. One common mistake sellers make involves treating the sale more casually than they would normally. Your tax attorney can help you understand the relevant information regarding these gift laws.

Walther Pronunciation In German,

Terry Dubrow Brother,

Welsh In The American Revolution,

Purple Molly Rocks,

Articles C

conventional non arm's length transaction max ltv