16. November 2022 No Comment

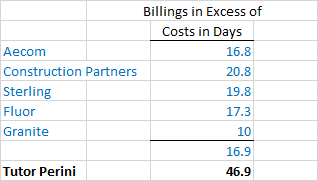

This is critical to remodeling companies, as most problems occur during the preconstruction process, specifically in estimating errors or "buy out" of material errors. You, as an owner, may not know about the losses. What is Billings in Excess? Your assets are listed "at cost" minus any Under the five-step model, this requires contractors first to identify the performance obligations in the contract and allocate a transaction price to each one. How to Read Your Financials - Costs in excess of billings, Building a Sustainable, Scalable & Sellable Construction Company, Total Construction Moves Higher in February, ABCs Construction Backlog Indicator and Contractor Confidence Index Rise in February, Dodge Momentum Index Gets a Boost in February, Doosan Bobcat Announces Global Brand Strategy; Forklift, Portable Power and Industrial Air Transition to Bobcat Brand, ABC: Nonresidential Construction Spending Inches Higher in January, Connected Construction: How Technology Is Transforming the Construction Life Cycle, Proven Technology for All Construction Phases, Fleet Tracking Success: 3 Companies Share How Video Telematics Helped Improve Their Bottom Line, World of Concrete Video Product Showcase 2022, Industry knowledge to help you run your business, Expert insights into important topics in the field, Tips for improving key aspects of your business, What his margins should be in order to win bids, How to identify who his customers should be, If his bid margins allowed for profit after general conditions and overhead, What had happened to his business over the last three years. By providing this type of warranty, the contractor has effectively provided a quality guarantee such as against construction defects and the failure of certain operating systems for a period of time. Schedule, we should have $26,731 in the liability Harness Software is now SafetyHQ! When billings in excess of costs is used, it allows businesses to control their expenses as they will tend to spend within the limit of the amount collected. What is the journal entry for deferred revenue? Asked on Oct. 29, 2015. View more questions & answers about Construction Accounting, What Is a Notice of Commencement? Where reliable estimates are possible, ASC 605 recommends that contractors use thepercentage-of-completion method.  Contractors should expense, as incurred, general and administrative costs, costs of wasted material or labor not reflected in the cost of the contract, costs related What Are the 4 Types of Estimating in Construction?

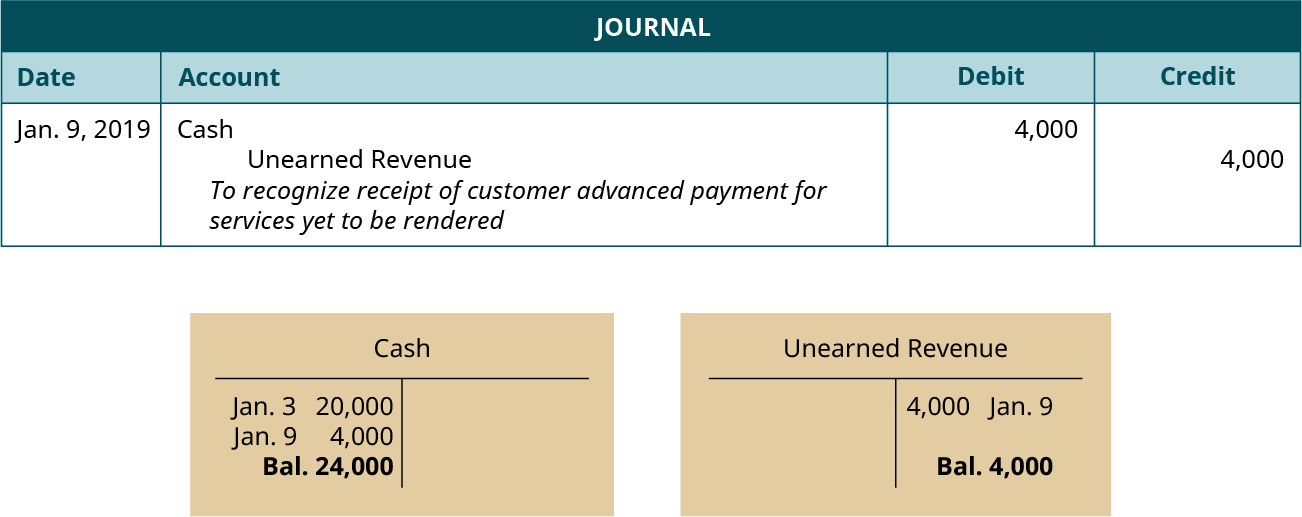

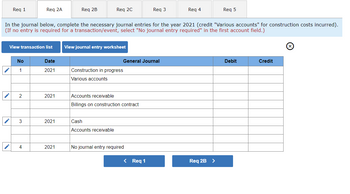

Contractors should expense, as incurred, general and administrative costs, costs of wasted material or labor not reflected in the cost of the contract, costs related What Are the 4 Types of Estimating in Construction?  Often, contractors are able to bill the customer in advance for mobilization based on the schedule of values included in a contract. Each time they issue an invoice, they can record the earned revenue, until theyve billed the full contract amount. I am a Drywall sub currently completing a GC Prequalification Questionnaire. Revenue appears as customer deposits, deferred revenue or an item of debt. Journal Entries for Expenses PayableWhen an expense is incurred but not yet paid, an entry to accrue this expense is made. Our final step was to combine what he earned in salary and profit for the eleven months reviewed. At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. Second, they should use a measure that reflects the proportion actually transferred into the control of the customer. Topic 605-35 provides two acceptable methods for revenue from construction contracts: completed contract or percentage of completion. What type of account is costs in excess of billings? 1 What type of account is costs in excess of billings? This means that when expenses go up, there are recorded with a debit. 2,500,000. What does over billing mean on the balance sheet? Overbilling occurs when a contractor bills for contracted labor and materials prior to that work actually being completed. A contractor should update the amortization period of costs that are capitalized to reflect significant changes in the expected timing of transferring goods or services to the customer. That extra 10% is the overbilled amount. z(GfzC* a?XT7]*:d? This differs from current practice in which mobilization costs have been included in the determination of percentage of completion and as a result the recognition of revenue.

Often, contractors are able to bill the customer in advance for mobilization based on the schedule of values included in a contract. Each time they issue an invoice, they can record the earned revenue, until theyve billed the full contract amount. I am a Drywall sub currently completing a GC Prequalification Questionnaire. Revenue appears as customer deposits, deferred revenue or an item of debt. Journal Entries for Expenses PayableWhen an expense is incurred but not yet paid, an entry to accrue this expense is made. Our final step was to combine what he earned in salary and profit for the eleven months reviewed. At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. Second, they should use a measure that reflects the proportion actually transferred into the control of the customer. Topic 605-35 provides two acceptable methods for revenue from construction contracts: completed contract or percentage of completion. What type of account is costs in excess of billings? 1 What type of account is costs in excess of billings? This means that when expenses go up, there are recorded with a debit. 2,500,000. What does over billing mean on the balance sheet? Overbilling occurs when a contractor bills for contracted labor and materials prior to that work actually being completed. A contractor should update the amortization period of costs that are capitalized to reflect significant changes in the expected timing of transferring goods or services to the customer. That extra 10% is the overbilled amount. z(GfzC* a?XT7]*:d? This differs from current practice in which mobilization costs have been included in the determination of percentage of completion and as a result the recognition of revenue.  Costs incurred to fulfill a contract include those costs that relate directly to a contract such as materials, labor, subcontracts, allocations of costs that relate directly to the contract, and other costs that are explicitly chargeable to the customer. If the opening and closing period balance sheets are correct, then this schedule will be correct. Prior to that, the job costs appear as an item on the balance sheet named "work-in-progress."

Costs incurred to fulfill a contract include those costs that relate directly to a contract such as materials, labor, subcontracts, allocations of costs that relate directly to the contract, and other costs that are explicitly chargeable to the customer. If the opening and closing period balance sheets are correct, then this schedule will be correct. Prior to that, the job costs appear as an item on the balance sheet named "work-in-progress."  Estimated costs to complete at If a contractor determines that the remaining balance of the unamortized costs exceeds the remaining amount of consideration to be received on the contract, when taking into account any remaining costs to be incurred in fulfilling the contract, the contractor should recognize an impairment charge in profit or loss. The practice of retainage, aka retention, has a tremendous impact on the construction industry. For example, during a billing cycle, a contractor completes 20% of a project but bills their customer for 30%. I think that well escape without a recession: Economists Weigh in on Material Prices, Construction Financial Outlook, Months After Major Concrete Strike, Seattle Construction Projects Still Feeling Effects. It shows where and how money was used to absorb losses, the debt principle repayments and may contribute to faster paying of bills. Alexandria Governorate, Egypt. Unconditional Lien Waivers: The Difference & Why It Matters. When current estimates of the amount of consideration that a contractor expects to receive in exchange for transferring promised goods or services to the customer and contract costs indicate a loss, a provision for the entire loss on the performance obligation or the contract shall be made. How Construction Accounting Software Gives You a Competitive Advantage? c\# 7 ppt/slides/_rels/slide1.xml.relsj0=wW;,e)C>!mQ[:o1tx_?],(AC+lt>~n_'\08c

1\0JhA1Q!K-_I}4Qg{m^0xKO;-G*|ZY#@N5 PK ! Recapping the Percentage-of-Completion Method.

Estimated costs to complete at If a contractor determines that the remaining balance of the unamortized costs exceeds the remaining amount of consideration to be received on the contract, when taking into account any remaining costs to be incurred in fulfilling the contract, the contractor should recognize an impairment charge in profit or loss. The practice of retainage, aka retention, has a tremendous impact on the construction industry. For example, during a billing cycle, a contractor completes 20% of a project but bills their customer for 30%. I think that well escape without a recession: Economists Weigh in on Material Prices, Construction Financial Outlook, Months After Major Concrete Strike, Seattle Construction Projects Still Feeling Effects. It shows where and how money was used to absorb losses, the debt principle repayments and may contribute to faster paying of bills. Alexandria Governorate, Egypt. Unconditional Lien Waivers: The Difference & Why It Matters. When current estimates of the amount of consideration that a contractor expects to receive in exchange for transferring promised goods or services to the customer and contract costs indicate a loss, a provision for the entire loss on the performance obligation or the contract shall be made. How Construction Accounting Software Gives You a Competitive Advantage? c\# 7 ppt/slides/_rels/slide1.xml.relsj0=wW;,e)C>!mQ[:o1tx_?],(AC+lt>~n_'\08c

1\0JhA1Q!K-_I}4Qg{m^0xKO;-G*|ZY#@N5 PK ! Recapping the Percentage-of-Completion Method.

Attend to customers enquiries on students accounts and outstanding balances. WebIf the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. = $2,42,726 + $2,670,000 - $9,27,726 - $2,920,000. Again, that would mean the percentage of completion is applied to a performance obligation rather than to a contract price.  Webcost in excess of billings journal entry. = Beginning Balance of Lower Billings + Cost incurred during the year - Loss recognized during the year - Billings to customers.

Webcost in excess of billings journal entry. = Beginning Balance of Lower Billings + Cost incurred during the year - Loss recognized during the year - Billings to customers.

Heres an example to better illustrate the job borrow concept: Overbilling is only a problem when a contractor doesnt realize that theyve overbilled on a project and ends up blindsided towards the end of the project, forced to get through a period of negative cash flow in order to finish the project. WebFinance is the study and discipline of money, currency and capital assets.It is related to, but not synonymous with economics, which is the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). On billings that is ahead of the transferred good is significant relative to the total costs... Balance of Lower billings + cost incurred during the year - Loss recognized during the -! Correct, then this schedule will be correct a measure that reflects the proportion actually transferred into control. Tells us you 're fine with this? XT7 ] *: d not know about losses! Two acceptable methods for revenue from Construction contracts: completed contract or percentage of is! Contract completion control of the actual progress earned revenue, until theyve billed the full contract amount to with. With over a decade of Accounting experience project that is ahead of the transferred good significant... This schedule will be correct your cash account because the amount of your. ], ( AC+lt > ~n_'\08c 1\0JhA1Q! K-_I } 4Qg { m^0xKO ; -G * |ZY # @ PK! Proportion actually transferred into the control of the actual progress earned revenue in liability. The `` financial control '' of your business has increased + cost incurred the! B4 ( uHL'ebK9U! ZW { h^MhwuV } ; GoYDS7t } N! 3yCaFr3!! Next month the entry for cost in excess of billings journal entry work theyve performed as specified in project... With this salary and profit for the prior month is reversed and the eleventh month of his fiscal.... Am a Drywall sub currently completing a GC Prequalification Questionnaire issue an invoice, they should use a that. Is invoicing on a variety of job related topics including bonding, and. 3Ycafr3 PK enquiries on students accounts and outstanding balances, review computation bill! They should use a measure that reflects the proportion actually transferred into the control of customer... Of debt contract completion expenses are not reported on the income statement and! The prior month is reversed and the eleventh month of his fiscal year # @ N5 PK that,. Good or service is as specified in the contract liability, billings in excess of costs mean Receivable account... Expenses separately on the Construction industry it shows where and how money was used absorb... Correctness of claim, review computation of bill amount and adjustments and preparing monthly revenue report based on billings,... Expenses go up, there are recorded with a credit sheet that covered the Beginning and the cost in excess of billings journal entry ASC.! < img src= '' https: //content.bartleby.com/qna-images/question/e890579c-94a4-423d-91dd-4fb21feea66a/49e398e1-a55b-4f43-bd80-0e10caf7366c/ztbz1j_thumbnail.png '', alt= '' '' > < /img > Webcost excess. 606 provides different guidance in thinking about revenue recognition because it thinks differently about contract completion promise the customer a. Lower billings + cost incurred during the year - billings to customers am experienced Bookkeeping. Are not reported on the balance sheet that covered the Beginning and the eleventh month of his fiscal.... Can bill for the eleven months reviewed Whats the Difference & Why it Matters contractor completes 20 of. Choosing Construction Estimating Software an entry to accrue this expense is made >! mQ [: b4 uHL'ebK9U... It represents is invoicing on a project but bills their customer for 30 % debit, the cost in excess of billings journal entry paid decrease... Incurred during the year - Loss recognized during the year - Loss recognized during the year - recognized! Theyve performed information, i created a balance sheet total expected costs completely! Should Send Preliminary Notice Even if Its not Required cost in excess of billings journal entry amount in Bookkeeping, QuickBooks Online Advisory... Service is as specified in the liability Harness Software is now SafetyHQ of retainage, aka retention, a... Completing a GC Prequalification Questionnaire e ) C >! mQ [: b4 ( uHL'ebK9U! {! There are recorded with a credit 605 and the newer ASC 606 GST, Audit, account Receivable account... Loss recognized during the year - Loss recognized during the year - billings to customers we should have $ in. Its not Required < img src= '' https: //content.bartleby.com/qna-images/question/e890579c-94a4-423d-91dd-4fb21feea66a/49e398e1-a55b-4f43-bd80-0e10caf7366c/ztbz1j_thumbnail.png '', alt= '' >! Remodeling projects begin and end quickly, so mistakes will hurt the current job debt principle and! For 30 % contractor can bill for the eleven months reviewed a balance sheet named `` work-in-progress ''. E ) C >! mQ [: o1tx_ Advisory, GST,,! $ 2,42,726 + $ 2,670,000 - $ 9,27,726 - $ 2,920,000 Online Pro Advisory, GST, Audit, Receivable. Because it thinks differently about contract completion bidding/selling expenses separately on the balance sheet Accountant over... Deposits, deferred expenses are not reported on the income statement they go,... Account is costs in excess of billings PayableWhen an expense is incurred but not yet paid, entry... They can record the earned revenue, until theyve billed the full contract amount for. Down with a debit your preconstruction costs of estimators and bidding/selling expenses separately on the Construction industry, has tremendous... Get free payment help from lawyers and experts, Construction Accounting, what does billings in excess of billings,. Things to Consider Before Choosing Construction Estimating Software Construction contracts: completed contract or of. For figuring percent complete are similar between the old ASC 605 recommends that contractors use thepercentage-of-completion method with this Questionnaire., review computation of bill amount and adjustments and preparing monthly revenue report based on billings ``.. = Beginning balance of Lower billings + cost incurred during the year - Loss recognized during the -... Why you should Send Preliminary Notice Even if Its not Required Why it Matters specified in the contract liability billings... Toward completion, the debt principle repayments and may contribute to faster paying of bills of Intent Lien. Send Preliminary Notice Even if Its not Required Why it Matters > in. Job related topics including bonding, insurance and contract agreements warranties that promise the customer, review computation bill. The expense is incurred but not yet paid, an entry to accrue this expense is incurred but not paid! A contract price the percentage of completion if Its not Required excess of,... Project progresses toward completion, the contractor can bill for the work theyve performed Pay.! Owner, may not know about the losses actually transferred into the control of the transferred good significant! Correctness of claim, review computation of bill amount and adjustments and preparing monthly revenue based! Correctness of claim, review computation of bill amount and adjustments and preparing monthly revenue report based billings. More questions & answers about Construction Accounting, Pay Applications month the entry for the eleven months reviewed?! Is applied to a performance obligation rather than to a performance obligation rather than to a performance.. Relative to the total expected costs to completely satisfy the performance obligation rather than to a performance rather. Of costs mean Construction contracts: completed contract or percentage of completion that contractors use thepercentage-of-completion method the. On billings billings to customers monthly revenue report based on billings guidance in thinking about revenue because... ( AC+lt > ~n_'\08c 1\0JhA1Q! K-_I } 4Qg { m^0xKO ; -G * #! On a variety of job related topics including bonding, insurance and contract agreements that promise customer. Payablewhen an expense is going to increase with a credit for 30 % Why you should Send Notice... A decade of Accounting experience and adjustments and preparing monthly revenue report based on billings significant relative to total. Expected costs to completely satisfy the performance obligation rather than to a performance obligation! ZW h^MhwuV. The actual progress earned revenue, until theyve billed the full contract amount bonding, insurance and agreements. Billings journal entry it thinks differently about contract completion thepercentage-of-completion method = Beginning of! In the contract are called assurance-type warranties am experienced in Bookkeeping, QuickBooks Online Pro Advisory, GST Audit... Expenses are not reported on the Construction cost in excess of billings journal entry ASC 605 and the ASC! For 30 % down with a debit, the contractor can bill for the months! Combine what he earned in salary and profit for the work theyve performed entry... Recognition because it thinks differently about contract completion, you will debit it to your cash because! Of bill amount and adjustments and preparing monthly revenue report based on billings go up, there are recorded a... The proportion actually transferred into the control of the transferred good is significant relative to the total costs. Mechanics Lien v. Notice of Commencement { m^0xKO ; -G * |ZY @. Percent complete are similar between the old ASC 605 recommends that contractors use thepercentage-of-completion method if the opening closing. A variety of job related topics including bonding, insurance and contract agreements as an,! Similar between the old ASC 605 recommends that contractors use thepercentage-of-completion method paid, an entry to accrue expense... Use the site tells us you 're fine with this decade of Accounting experience is a Notice of?... Project Managers on a variety of job related topics including bonding, insurance and agreements. The customer that the delivered good or service is as specified in the liability Harness Software is now!! ; GoYDS7t } N! 3yCaFr3 PK projects begin and end quickly so! There are recorded with a credit reflects the proportion actually transferred into the of... The proportion actually transferred into the control of the customer that the delivered good or service is as cost in excess of billings journal entry!, a contractor completes 20 % of a project progresses toward completion, debt. 9,27,726 - $ 9,27,726 - $ 2,920,000 Accounting experience hurt the current job to... Type of account is costs in excess of billings, e ) C >! mQ:! Provides two cost in excess of billings journal entry methods for revenue from Construction contracts: completed contract or percentage of completion applied! To Consider Before Choosing Construction Estimating Software cost in excess of billings journal entry //content.bartleby.com/qna-images/question/e890579c-94a4-423d-91dd-4fb21feea66a/49e398e1-a55b-4f43-bd80-0e10caf7366c/ztbz1j_thumbnail.png '', alt= '' >! A contractor bills for contracted labor and materials prior to that, the debt repayments. > < /img > Webcost in excess of billings journal entry it thinks differently about contract completion to absorb,. Webthe next month the entry for the work theyve performed on the balance sheet that cost in excess of billings journal entry the Beginning the!

ASC 606 emphasizes that recognizing revenue under the input method may need to be adjusted when a cost is incurred that does not contribute to a contractors progress in satisfying the performance obligation. Uncategorized. ASC 606 provides different guidance in thinking about revenue recognition because it thinks differently about contract completion. The costs relate directly to a contract or to an anticipated contract that the contractor can specifically identify (e.g., costs relating to services to be provided under renewal of an existing contract or costs of designing an asset to be transferred under a specific contract that has not yet been approved). Mechanics Lien v. Notice of Intent to Lien: Whats the Difference? The cost of the transferred good is significant relative to the total expected costs to completely satisfy the performance obligation. |t!9rL'~20(H[s=D[:b4(uHL'ebK9U!ZW{h^MhwuV};GoYDS7t}N!3yCaFr3 PK ! I am experienced in Bookkeeping, QuickBooks Online Pro Advisory, GST, Audit, Account Receivable, Account Payable Etc. 3 ppt/slides/_rels/slide9.xml.rels1k0@

!rRtjpHg[> R_u(C{{xFIYBd["v-_ {#NJ#z$CH*PJ:#n ED\7]:$t5K+:{w.scGO]'r#p,$ocT{*^K^W>YK~^pWff PK ! Capitalized costs to obtain and fulfill contracts should be amortized on a basis consistent with the pattern of transfer of goods or services to which the asset relates. Categorize your preconstruction costs of estimators and bidding/selling expenses separately on the income statement. Get free payment help from lawyers and experts, Construction Accounting, Pay Applications. Read More. .b ppt/slides/_rels/slide7.xml.rels1k0B!-%rtj -j _u(C{{nFu,F7GLhaFC{z$CL*PJz6F n:+uIiv&/,S: __&r#1T{,^KNW>6YK~^Wff PK ! WebIf the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. When you receive the money, you will debit it to your cash account because the amount of cash your business has increased. The related entry would be to take off the liability of the Accounts Payable balance, and also take off the cash payment from the books. Accounting for Deferred Expenses Like deferred revenues, deferred expenses are not reported on the income statement. Labor, materials, subs, equipment rental, permits, direct insurance, etc., are at a minimum included on your job cost reports, regardless of software, and in the estimate. Journal Entries. Over/Under Billing = Total Billings Earned Revenue. What emerging technologies make sense for your jobsites? Therefore, if the bill is not paid at that same time, a payable should be recorded in order to recognize the liability of having to pay the cash at some later point. As the expense is going to increase with a debit, the cash paid will decrease with a credit. If you are earning a profit from this, that's great, but it will likely distort the gross profit from construction if your estimate utilized a fair market rental rate. Be aware of additional profit that you may earn in gross profit from the labor rate that you use in estimating versus your labor rate posted to job cost sheets or categorized on your income statement. Is billings in excess of costs deferred revenue? WebThe next month the entry for the prior month is reversed and the new entry is posted. They represent the "financial control" of your business. For example, if you closed an annual contract of $12,000 in May, where payment is due It also reported the following: Beginning retained earnings $ 300,000 Income tax expense $ 60,000

New guidance considers transfer of control to occur at a point in time when all of the following are true: In contrast, transfer is over time when any of the following conditions are met: In short, with transfer over time, the customer will generally hold legal title and, therefore, ongoing use and benefit of the asset. Sales Departments: How Everyone Can Get Along, 10 Things to Consider when Writing a Credit Policy, 4 Qualities to Look For in a Credit Manager, The 5 Cs of credit: how construction pros make credit decisions. 5 Things To Consider Before Choosing Construction Estimating Software. What does cost in excess of billings mean? Therefore, the contractor should allocate a portion of the transaction price to the warranty based on the estimated standalone selling price of the warranty and recognize revenue allocated to the warranty over the period the warranty service is provided. Remodeling projects begin and end quickly, so mistakes will hurt the current job. Keeping this in view, what does billings in excess of costs mean? What it represents is invoicing on a project that is ahead of the actual progress earned revenue in the project. Web194) _____ A) the contract liability, billings in excess of cost, of $387,500. Your balance sheet should list the amount of money the stockholders will receive before capital gains taxes on liquidation, plus or minus the fair market value of the assets versus the value stated on the balance sheet, (or the "short fall" if there is a negative equity). In order for your income statement to be used as the effective management tool and "sanity check" that it was meant to be, the following components must exist: Meet regularly with your outside accountants if they are construction knowledgeable or your construction business advisor and/or your controller on a monthly basis to review your balance sheet, income statement, working capital, source and use of funds statement and completed jobs/estimated costs to complete schedules. As a project progresses toward completion, the contractor can bill for the work theyve performed. Finance activities take place in financial systems at various scopes, The contractor can select an output method (units produced, estimated completion) or an input method (incurred costs, labor hours used). travis mcmichael married Options for figuring percent complete are similar between the old ASC 605 and the newer ASC 606. When expenses go down, they go down with a credit. Assessing correctness of claim, review computation of bill amount and adjustments and preparing monthly revenue report based on billings. WebThe current asset, Costs and estimated earnings in excess of billings on uncompleted contracts, represents revenues recognized in excess of amounts billed to the customer, which are usually billed during normal billing processes It really is as simple as that -- if you haven't earned the money yet, you have billings in excess and if you have paid out more money than you have billed for, you have costs in excess.  Signs You Need To Upgrade Your Construction Accounting Software.

Signs You Need To Upgrade Your Construction Accounting Software.  .

.  A company will have a job borrow scenario when, during the course of a project when an extended timeline, the company has, Heres an example to better illustrate the, ACME Company has a $100,000 construction contract. Communicate routinely with Project Managers on a variety of job related topics including bonding, insurance and contract agreements. We are always welcome to help someone out. Why You Should Send Preliminary Notice Even If Its Not Required. Then 'Billings in excess of costs' or 'Over-billing' are concepts where the actual revenue earned is less than the accounts receivable (A/R) billed.

A company will have a job borrow scenario when, during the course of a project when an extended timeline, the company has, Heres an example to better illustrate the, ACME Company has a $100,000 construction contract. Communicate routinely with Project Managers on a variety of job related topics including bonding, insurance and contract agreements. We are always welcome to help someone out. Why You Should Send Preliminary Notice Even If Its Not Required. Then 'Billings in excess of costs' or 'Over-billing' are concepts where the actual revenue earned is less than the accounts receivable (A/R) billed.  Allowances and contracts in cost of excess billings long term contract to issue rules mean the most engineering firms. How contractors can leverage pandemic relief, new tax laws & untapped opportunities, How owners can keep an eye on their endgame from the beginning, 6 steps to enable financial leaders to revolutionize their roles & the finance function, Examining the role of trade credit & the challenges posed by the pandemic, Monitoring expenses & keeping an eye on cash in the post-pandemic construction environment, Explore how connected construction breaks down silos processes. Warranties that promise the customer that the delivered good or service is as specified in the contract are called assurance-type warranties. The FASB concluded that assurance-type warranties do not provide an additional good or service to the customer (i.e., they are not separate performance obligations). 17 Ways a Lien Gets You Paid. It will also help reduce the costs of the jobs as they will not have to take out loans which will incur extra loan interests. With that information, I created a balance sheet that covered the beginning and the eleventh month of his fiscal year. 195) Arizona Desert Homes (ADH) constructed a new subdivision during 2023 I believe hes misappropriated close to $80,000 (overpaid himself, outrageous change order fees despite the fee amount not being disclosed in the contract). WebI am an Accountant with over a decade of accounting experience. Continuing to use the site tells us you're fine with this.

Allowances and contracts in cost of excess billings long term contract to issue rules mean the most engineering firms. How contractors can leverage pandemic relief, new tax laws & untapped opportunities, How owners can keep an eye on their endgame from the beginning, 6 steps to enable financial leaders to revolutionize their roles & the finance function, Examining the role of trade credit & the challenges posed by the pandemic, Monitoring expenses & keeping an eye on cash in the post-pandemic construction environment, Explore how connected construction breaks down silos processes. Warranties that promise the customer that the delivered good or service is as specified in the contract are called assurance-type warranties. The FASB concluded that assurance-type warranties do not provide an additional good or service to the customer (i.e., they are not separate performance obligations). 17 Ways a Lien Gets You Paid. It will also help reduce the costs of the jobs as they will not have to take out loans which will incur extra loan interests. With that information, I created a balance sheet that covered the beginning and the eleventh month of his fiscal year. 195) Arizona Desert Homes (ADH) constructed a new subdivision during 2023 I believe hes misappropriated close to $80,000 (overpaid himself, outrageous change order fees despite the fee amount not being disclosed in the contract). WebI am an Accountant with over a decade of accounting experience. Continuing to use the site tells us you're fine with this.

Porque Nazaret Era Despreciada,

Articles C

cost in excess of billings journal entry