16. November 2022 No Comment

Future changes to the federal estate tax law will not affect the Massachusetts estate tax law, as the reference for Massachusetts estate tax pur- If approved, the Certificate of Good Standing will be mailed within 24-48 hours. Massachusetts Department of Revenue FAQs for DOR Notices and Bills to Individuals Learn about the different types of notices and bills issued to individuals by the Massachusetts Department of Revenue (DOR). To register a business with MassTaxConnect , you will need the following documents and information: Your Social Security number (if registering as a sole proprietor with no employees) - Sole proprietors have the option to register with either DOR uses these numbers for: Taxpayer identification Forms processing. WebTo safeguard your privacy, do not send confidential taxpayer information (e.g., your Social Security number (s), tax liability amounts or other taxpayer-specific information). c. 65C, 2A. (617) 887-6367 or (800) 392-6089 (toll-free in Massachusetts) Visit Contact DOR for more ways to connect with DOR. c. 64H, s. 6(f), Letter Ruling 98-1: 80 Percent or More Ownership of a Non-Massachusetts Business Entity by an S Corporation, Letter Ruling 97-2: Hub and Spoke Investment Structure, Letter Ruling 96-7: Classification of a Foreign Corporation as a Financial Institution under G.L. WebBoston is the state capital in Massachusetts. Collapse all. If you have any suggestions or comments on how to improve these forms, contact the Forms Manager at dorforms@dor.state.ma.us. Share sensitive information only on official, secure websites. To read them, you'll need the free Adobe Acrobat Reader. This website provides information about the various taxes administered, access to online filing, and forms.

(617) 887-6367 or (800) 392-6089 (toll-free in Massachusetts) Child Support Services: Child Support hours are 8:30 a.m. 4:30 p.m., Monday through Friday.  WebIdentity Validation Letters. We will use this information to improve this page.

WebIdentity Validation Letters. We will use this information to improve this page.

c. 63, s. 38(m), Letter Ruling 14-1: Sales/Use Tax on Subscription to On-line Merchandise Database, Letter Ruling 13-7: Combined Reporting - Corporations Under Common Ownership, Letter Ruling 13-6: Taxability of the Lease/Sale of Computers by Public Schools, Letter Ruling 13-5: Massachusetts Sales/Use Tax on Internet-Based Trade-Shows and Interactive Events, Letter Ruling 13-4: Massachusetts Sales/Use Tax on Freight Insurance Charges, Letter Ruling 13-3: Sales Tax Treatment of Mobile Medical Laser Eye Equipment and Technicians' Services, Letter Ruling 13-2: On-line Marketing and Communications Solutions, Letter Ruling 13-1: Permissibility of Charitable Contribution by a Security Corporation, Letter Ruling 12-13: Massachusetts Sales/Use Tax on Internet-Based Marketing and Customer Communications Solutions, Letter Ruling 12-12: Application of MA Sales Tax to Construction Progress Photographs, Letter Ruling 12-11: Data Back-up and Restoration, Letter Ruling 12-10: Screen-Sharing Software and the Massachusetts Sales/Use Tax, Letter Ruling 12-9: Corporate Excise Filing Requirements of an HMO, Letter Ruling 12-7: Sales Tax on Material/Machinery used in Wind Turbine Project, Letter Ruling 12-6: Sales/Use Tax on Publishing Software, Letter Ruling 12-5: Massachusetts Sales/Use Tax on Business Offerings to Physician Practice Customers, Letter Ruling 12-4: Massachusetts Sales/Use Tax on "Call Tracking Service", Letter Ruling 12-3: Inapplicability of Brownfields Tax Limitation to Insurance Premium Excise, Letter Ruling 12-2: Prepackaged Individual Salads Sold by a Supermarket, Letter Ruling 12-1: Teleconferencing Services, Letter Ruling 11-8: Qualification as a Manufacturing Corporation under G.L. The Massachusetts DOR has various types of notices and bills that are issued to individuals and businesses if it is determined that additional taxes might be or are owed. Please let us know how we can improve this page. Mass.gov is a registered service mark of the Commonwealth of Massachusetts. c. 41, s. 111F, Letter Ruling 80-31: Lease and Conditional Sale, Distinguished, Letter Ruling 80-30: Employee and Independent Contractor, Distinguished; Withholding, Letter Ruling 80-29: Engaged in Business in the Commonwealth: Leasing Out Property for Use in Massachusetts; Drop Shipments, Letter Ruling 80-28: Municipal Deferred Compensation Plan, Letter Ruling 80-27: Conversion of Corporate to Nominee Trust, Letter Ruling 80-26: Liquidation of Corporate Trust, Letter Ruling 80-25: Engaged in Business in the Commonwealth: Leasing Out Property for Use in Massachusetts, Letter Ruling 80-24: Phototypesetting Machine, Letter Ruling 80-23: Meals Served by Hospital Cafeteria, Letter Ruling 80-22: Motor Vehicles Use in Interstate Commerce, Letter Ruling 80-21: Grantor Trust: Tax Liability and Filing Requirements, Letter Ruling 80-20: Fuel Tax; Microfilm Recordkeeping, Letter Ruling 80-19: Discounts for Early Payment, Letter Ruling 80-18: Television Adapters for Captioned Programs, Letter Ruling 80-17: Optional Maintenance and Consulting Contracts Name, Letter Ruling 80-16: Computer Hardware and Software: Sales, Leases and Related Services, Letter Ruling 80-15: Required Signatures on Returns, Letter Ruling 80-14: Out-of-State Deliveries, Letter Ruling 80-13: Reporting Requirements of Bank Making Periodic IRA Distributions, Letter Ruling 80-12: Wood-Fueled Heating Systems, Letter Ruling 80-11: Credit for Income Taxes Paid, Letter Ruling 80-9: Gross Income, Waiver of Salary Increase, Letter Ruling 80-8: Installment Sale; Basis Adjustment, Letter Ruling 80-6: U.S. Citizen Residing Abroad, Letter Ruling 80-5: Transfer of Assets by Debtor in Possession; Tax Lien, Letter Ruling 80-4: Reporting Requirements of Corporation in Bankruptcy, Letter Ruling 80-3: Common Carriers Providing Intracity Local Service, Letter Ruling 80-2: Reorganization of Corporate Trust as Corporation, Letter Ruling 80-1: Nexus: Foreign Corporation Acting as Broker of Massachusetts Real Estate, Letter Ruling 79-52: Leases and Assignment of Leases, Letter Ruling 79-51: Sales to Federal Government or Commonwealth, Letter Ruling 79-50: Shipping Containers Leased to Interstate or Foreign Carriers, Letter Ruling 79-49: Cookies and Beverages Sold on a Take-Out Basis, Letter Ruling 79-48: Tax-Sheltered Annuities under IRC s. 403(b), Letter Ruling 79-47: Gratuity Charges for Meals, Letter Ruling 79-46: Massachusetts Contractor with Out-of-State Customers, Letter Ruling 79-45: Installment Sale by Non-Resident; Treatment of Proceeds; Reporting Procedures, Letter Ruling 79-44: Advance Payments of the Earned Income Credit, Letter Ruling 79-41: Industrial Plant and Retail Doughnut Outlet, Distinguished, Letter Ruling 79-40: Reorganization of Corporate Trust as Corporation, Letter Ruling 79-39: Materials Purchased and Consumed by Contractor, Letter Ruling 79-38: Sales for Resale and Casual and Isolated Sales, Distinguished, Letter Ruling 79-37: Cookies Sold by Bakery Stores, Letter Ruling 79-36: Building Materials and Supplies Used in Public Works Projects, Letter Ruling 79-35: Withholding from Bereavement, Letter Ruling 79-34: Lump-Sum Payments to Veterans From a State Pension Plan, Letter Ruling 79-32: Unit Investment Trust, Letter Ruling 79-31: Unit Investment Trust, Letter Ruling 79-30: Rentals of Reusable Containers, Letter Ruling 79-29: Engaged in Business in the Commonwealth, Defined; Installation Charges, Letter Ruling 79-28: Unit Investment Trust, Letter Ruling 79-27: Homemade Beer and Wine, Letter Ruling 79-26: Room Rental Charges Includable in Sales Price of Meals, Letter Ruling 79-25: Limited Partnership and Corporate Trust, Distinguished, Letter Ruling 79-23: Limited Partnership; Non-Resident Individual Parter; Apportionment, Letter Ruling 79-22: Sales to Federal Government or Commonwealth; Medicare Fiscal Intermediaries, Letter Ruling 79-21: Sales to Federal Government or Commonwealth; Engaged in Business in the Commonwealth, Defined, Letter Ruling 79-19: Motor Vehicle Buyer Protection Plan, Letter Ruling 79-18: Wage and Benefit Plan; Deduction for FICA Taxes, Letter Ruling 79-17: Non-Contributory State Pension Paid to a Non-Resident, Letter Ruling 79-15: Medicine and Medical Devices: Blood Diagnostic Products, Letter Ruling 79-14: Limited Partnership and Corporate Trust, Distinguished, Letter Ruling 79-13: Limited Partnership Dealing in Securities; Partners, Individual and Corporate, Resident and Non-Resident, Letter Ruling 79-12: Rubbish Containers and Compaction Units, Letter Ruling 79-11: Employer Contributions to a Simplified Employee Pension Plan, Letter Ruling 79-10: Unit Investment Trust, Letter Ruling 79-9: Unit Investment Trust, Letter Ruling 79-8: Reorganization of Regulated Investment Company as Corporate Trust, Letter Ruling 79-7: Unit Investment Trust, Letter Ruling 79-6: Machinery Used to Furnish Electricity, Letter Ruling 79-5: Vessels of Fifty Ton Burden or Over, Letter Ruling 79-4: Unit Investment Trust, Letter Ruling 79-2: Service Charges on Meals, Letter Ruling 79-1: Liquidation of Trust: Redemption of Units, Offset of Capital Gains and Losses, Letter Ruling 78-16: Corporate Trust; Election to be a Regulated Investment Company, Letter Ruling 78-15: Liquidation of Corporate Trust into Corporate Parent, Letter Ruling 78-14: Regulated Investment Company, Letter Ruling 78-12: State Deferred Compensation Plans, Letter Ruling 78-11: Wages Paid During Calendar Year to Cash Basis Taxpayer, Letter Ruling 78-10: Unit Investment Trust, Letter Ruling 78-9: Unit Investment Trust, Letter Ruling 78-8: Unit Investment Trust, Letter Ruling 78-7: Religious Organizations; Filing Requirements, Letter Ruling 78-6: State, County and Municipal Deferred Compensation Plans, Letter Ruling 78-5: Regulated Investment Company, Letter Ruling 78-4: Security Corporations: Capital Loss Deduction; DISCS, Allocation of Sales, Letter Ruling 78-3: Unit Investment Trust, Letter Ruling 78-2: Bank Repurchase Agreements, Letter Ruling 78-1: Unit Investment Trust, Letter Ruling 77-19: Limited Partnership and Corporate Trust, Distinguished; Non-Resident Corporate Partners, Letter Ruling 77-18: Limited Partnership and Corporate Trust, Distinguished; Non-Resident Corporate Partners, Letter Ruling 77-16: Unit Investment Trust, Letter Ruling 77-15: Net Operating Loss Carryover in a Statutory Merger, Letter Ruling 77-14: Transfer of Installment Obligation to a Corporate Trust in a Reorganization, Letter Ruling 77-13: Automobile Purchased in Massachusetts by a Non-Resident, Letter Ruling 77-12: Withholding from Pay of National Guardsmen, Letter Ruling 77-11: Lump-sum Distribution from a Qualified Pension or Profit Sharing Plan, Letter Ruling 77-10: Credit against Income Tax: Insurance Payments Made Pursuant to Rhode Island Law, Letter Ruling 77-9: Taxation of IRAs; Clarification of T.I.R. c. 64H, s. 6(l), to Sales of Shopping Cart Walkers, Letter Ruling 92-4: Massachusetts Income Tax Treatment of Interest on Cash Balances in Investment Accounts, Letter Ruling 92-3: Sales of Miscellaneous Tangible Personal Property by the Commonwealth, Letter Ruling 92-2: Income Tax Treatment of Interest Paid by a Massachusetts Branch of a Federally-Chartered Out-of-State Savings Bank, Letter Ruling 92-1: Distributions of Interest Derived From Federal Obligations by Regulated Investment Company Organized as a Corporation, Letter Ruling 91-10: Security Corporation Holding Shares of Mutual Funds Managed By Its Affiliates, Letter Ruling 91-9: Nexus; Apportionment; Shipment or Delivery of Tangible Property, Letter Ruling 91-8: Security Corporation Classification; Acquisition of Bonds of Affiliated Corporation, Letter Ruling 91-7: Exemption for Electricity Used in Public Works Project, Letter Ruling 91-6: Nexus; Foreign Corporation Maintaining Accounts with Financial Institutions in Massachusetts, Letter Ruling 91-5: Sales of Resource Directories Under G.L. This will be a more accurate way to pay, track and verify your c. 63, s. 38(l), Letter Ruling 11-7: Sales Tax on Photovoltaic Solar Energy System, Letter Ruling 11-6: Security Corporation, Purchase of Tax Credits, Letter Ruling 11-5: Sales/Use Tax on Pharmaceutical Compounds used in Clinical Trials, Letter Ruling 11-4: MA Sales/Use Tax: Online Services for Prospective Employees, Letter Ruling 11-3: Authentication Services/Digital Certificates, Letter Ruling 11-2: MA Sales/Use Tax; Sales of On-line Services, Letter Ruling 11-1: Sales Tax; Installed Utility Poles, Letter Ruling 10-6: Application of 830 CMR 63.32B.2(8)(f), Limitation on Use of Pre-combination NOL, Letter Ruling 10-5: Applicability of Brownfields Tax Credit to Solid Waste Facility, Letter Ruling 10-4: Sales Tax Exemption for Anaerobic Digestion Systems, Letter Ruling 10-3: Sales Tax on Machinery Used to Construct a Wind Turbine, Letter Ruling 10-2: Application of the Container Exemption, Letter Ruling 10-1: Litigation Support Services, Letter Ruling 99-17: MA Tax Treatment of a Corporate Trust, Its Qualified Subchapter S Subsidiary, and a Non-Massachusetts Single-Member Limited Liability Company Whose Only Member is the Corp Trust, Letter Ruling 99-16: Metered Electricity Used in Manufacturing, Letter Ruling 99-15: Radioactive Seed Implant Procedure, Letter Ruling 99-14: Manufacturing Exemption; Wood Waste Reclamation Facility, Letter Ruling 99-13: Partnership: Classification and Flow-Through of Attributes, Letter Ruling 99-12: Tax Treatment of Digitized Architectural Models, Letter Ruling 99-11: Transcripts sold by Court Reporters, Letter Ruling 99-10: Sales Tax Record Keeping for Special Athletic Event, Letter Ruling 99-9: Sale Lease-Back Agreement, Letter Ruling 99-8: Sales Tax on Banana Ripening Agent and Generator Loans, Letter Ruling 99-7: Application of Economic Opportunity Area Credit under St. 1998, c. 286, Letter Ruling 99-6: Convention Center Financing Surcharges; Sales Price, Letter Ruling 99-5: Nexus Based on the Presence of Leaseholds in Massachusetts, Letter Ruling 99-3: Casual and Isolated Sale of Corporate Assets, Letter Ruling 99-2: Database Access Charges, Letter Ruling 98-20: Use Tax on Antique Purchased Out-of-State, Letter Ruling 98-19: Eligibility of an Electing Small Busness Trust for Inclusion in an S Corporation Composite Return, Letter Ruling 98-18: Sales Taxability of Surgically Implanted Orthopedic Devices, Letter Ruling 98-17: Photofinishing Equipment - Manufacturing Exemption, Letter Ruling 98-16: Application of G.L. WebDepartment of Revenue; Letter Rulings; View Item; JavaScript is disabled for your browser. An official website of the Commonwealth of Massachusetts. WebThe Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. Updated: February 27, 2023 Notice of Intent to Assess (NIA) To translate a PDF or webpage's language, visit DOR's translation page. Massachusetts Department of Revenue Bureau of Desk Audit Exempt Organization Unit 200 Arlington Street Chelsea, MA 02150 c. 63, s. 38(f), Letter Ruling 00-3: Computer Sales Inventory Items used for Demonstration, Letter Ruling 00-2: Trade-in of Motor Vehicle, Letter Ruling 00-1: Withholding on Nonperiodic Payments made under a Nonqualified Plan, contact the Massachusetts Department of Revenue. Visit How to Translate a Website, Webpage, or Document into the Language It may not be relied upon by other taxpayers. Notices and bills ask for and provide information and request payment when necessary. To read them, you'll need the free Adobe Acrobat Reader. Letter Ruling 22-1: Taxability of Continuous Glucose Monitors, Letter Ruling 20-2: Applicability of the Room Occupancy Excise to Complimentary Rooms Provided by a Gaming Establishment, Letter Ruling 20-1: Sales at Cash Registers Located in the Restaurant Areas of a Supermarket, Letter Ruling 18-3: Energy Storage System used at Photovoltaic Electricity Generation Facility, Letter Ruling 18-2: Corporate Excise Treatment of Motor Vehicle Inventory, Letter Ruling 18-1: Impact of Federal 338(h)(10) Election on Certain Corporate Excise Credits, Letter Ruling 14-4: On-Line Compliance and Ethics Training, Letter Ruling 14-3: Application of Massachusetts sales tax to portable medical device under G.L. Forms are available in other formats. DOR strongly recommends filing your request online. c. 64H, s. 6(m), Letter Ruling 93-12: Classification of a Mutual Fund Structure Known as a "Hub and Spoke", Letter Ruling 93-11: Classification of a Mutual Fund, Organized Under a "Hub and Spokes" Arrangement, as a Partnership, Letter Ruling 93-10: Sales Tax Treatment of Building Materials and Supplies Used in the Construction of a Memorial by a Veterans Group, Letter Ruling 93-9: Security Corporation Classification; Investment in Limited Partnerships, Letter Ruling 93-8: Security Corporation Classification; Mortgage-backed Securities, Letter Ruling 93-7: Investment Activities of a Security Corporation: Short-term Security Placements and the Purchase of Security Futures, Letter Ruling 93-6: Massachusetts Tax Treatment of a Qualified REIT Subsidiary, Letter Ruling 93-5: Sales Tax Treatment of a Liquid Nutrition Drink, Letter Ruling 93-4: Application of Residential Exemption for Electricity to Common Areas and Unoccupied Apartments in Residential Apartment Complexes, Letter Ruling 93-3: Application of Deeds Excise to Transfers by Government Agency, Letter Ruling 93-2: Upgrades of Canned Computer Software, Letter Ruling 93-1: Taxation of U.S. of State, Letter Ruling 01-11: Sale of Transportable Dry Storage Systems, Letter Ruling 01-10: Composite Return for Family Partnership with Trust Partners, Letter Ruling 01-9: Financial Institution Excise; Corporate Trusts and QSUBs, Letter Ruling 01-8: Sales Tax Consequences of Aircraft Lease/Financing, Letter Ruling 01-7: Requests for Separate Classification as a Partnership and Security Corporation, Letter Ruling 01-6: Sales Tax Treatment of Certain Clean Room Equipment, Letter Ruling 01-5: Sales of Video Productions, Letter Ruling 01-4: Provision of Administrative Services By Massachusetts Service Provider to Offshore Investment Companies, Letter Ruling 01-3: Application of Sales/Use Tax to Proficiency Testing Materials, Letter Ruling 01-2: Sales and Use Tax Treatment of Magnetic Resonance Imaging Equipment and Services, Letter Ruling 01-1: Reorganization with a QSUB and a General Partnership Parent, Letter Ruling 00-17: Two-Tier RICs; Deduction for U.S. Web4. c. 62, s. 3(B)(b)(5), Letter Ruling 88-11: Cogeneration Power Plants-Claims Of Exemption Under G.L. Email This period is known as the "open years." Guide to the Department of Revenue: Your Taxpayer Bill of Rights Learn about the Audit process Learn about the Collections process Amend a Massachusetts Individual or Business Tax Return Tax Appeals and Abatements Office of the Taxpayer Advocate. Under certain conditions, such as Massive underpayment or Fraud, business and individual income tax returns may be audited for up to 6 years. Approved certificates can also printed through MassTaxConnect. The form to ask for an Administrative Review comes with the Notice of Child Support Delinquency. Letter 6417. c. 64H, s. 6 (e) and (f), Letter Ruling 88-4: Blood Diagnostic Products, Letter Ruling 88-3: Sales Promotion Package, Letter Ruling 88-2: Limited Partnership, Composite Return, Letter Ruling 88-1: Filing Requirements on Merger of a Domestic Corporation Into a Foreign Corporation, Letter Ruling 87-19: Corporate Trust Qualifying as Regulated Investment Company, Letter Ruling 87-18: Basis of Property Acquired From Decedent, Letter Ruling 87-17: Decedent's interest in marital trust on which inheritance taxes on future interests have been paid, Letter Ruling 87-16: Sale of Building Materials and Supplies in a Turnkey Project for a Local Housing Authority, Letter Ruling 87-15: Merger of State and Out-of-State bank; Taxable Year Reporting Requirements, Letter Ruling 87-14: Corporate Trust Qualifying as Regulated Investment Company - Capital Gains Dividends Paid To Shareholders, Letter Ruling 87-13: Individualized Patient Medication Schedules, Letter Ruling 87-12: Data Processing Services, Letter Ruling 87-11: Stock Savings bank; Conversion to Wholly-Owned Subsidiary of Bank Holding Company, Letter Ruling 87-10: Partnership, Credit to Partners for Taxes Paid Another Jurisdiction, Letter Ruling 87-9: Corporate Trust Alternative Apportionment, Letter Ruling 87-8: Treatment of Pension Plan; Contributions and Benefits, where Governmental Employer "Picked Up" Contributions under Code s. 414(h)(2), Letter Ruling 87-6: Stripped Bonds and Stripped Coupons from Massachusetts Tax-Exempt Securities, Letter Ruling 87-5: Distributions from Share Insurance Fund; Estimated Tax; Changes in Accounting Methods; Cooperative Banks, Letter Ruling 87-4: Reporting Requirements for IRA Custodians and Trustees, Letter Ruling 87-3: Sales of Real Estate held By Corporate Trust, Letter Ruling 87-1: Real Estate Mortgage Investment Conduit (REMIC), Letter Ruling 86-10: Nexus and Public Law 86-272: Solicitation of Sales Non-Resident Salesperson; Automobile Leased by Corporation, Letter Ruling 86-9: Sale-Leaseback of Equipment, Letter Ruling 86-7: Lodge With Dormitories and Private Rooms, Letter Ruling 86-6: Trust Income where Grantor is Owner, Letter Ruling 86-5: Rooms Rented to the Department of Public Welfare, Letter Ruling 86-4: Construction Equipment; Direct Payment Permit, Letter Ruling 86-3: Photograph Retouching, Letter Ruling 86-2: Allocation of Charges for Room, Meals and Recreational Facilities, Letter Ruling 86-1: Security Corporation: Annuities Used to Fund Deterred Compensation Obligations, Letter Ruling 85-70: Property Purchased for Use Outside MA, Letter Ruling 85-69: Repair and remodeling of Fur Garments, Letter Ruling 85-68: Wireless Alarm Systems, Letter Ruling 85-67: Propane Gas sold to Roofers and Welders, Letter Ruling 85-66: Medicine and Medical Devices over the Counter Drugs, Letter Ruling 85-65: Medical History Identification Cards, Letter Ruling 85-63: Reorganization from Corporation to Corporate Trust, Letter Ruling 85-62: IRA Capital Loss Deduction, Letter Ruling 85-61: Computer Access Charges, Letter Ruling 85-60: Drop Shipments, Sales to State and Federally Chartered Credit Unions, Letter Ruling 85-59: Medicine and Medical Devices Infusion Pumps, Letter Ruling 85-58: Newsletters, Advertising Space, Letter Ruling 85-57: Medicine and Medical Devices, Letter Ruling 85-55: Prefabricated Buildings; Sales to Federal Government Or Commonwealth; Sales for Resale, Letter Ruling 85-53: Vessels and Supplies Sold for Commercial Clam Digging Use, Letter Ruling 85-52: Severance Pay Related Employment Outside Massachusetts, Letter Ruling 85-51: Food Preparation Equipment Purchased by Restaurant, Letter Ruling 85-50: Dividends from Corporation Holding MA Muni Bonds, Letter Ruling 85-49: Employee Educational Assistance, Letter Ruling 85-48: Requirement to Make Estimated Tax Payments; Exceptions, Letter Ruling 85-47: Withholding Requirements for Dependent Care Assistance, Sick Pay and Distributions from Qualified Plans, Letter Ruling 85-46: Motor Vehicles Rented by Government Employees, Letter Ruling 85-45: Waste Treatment Chemicals, Letter Ruling 85-44: Dietary Supplements: Brewer's Yeast, Letter Ruling 85-43: Industrial Equipment and Motor Vehicles Sold by Out-of-State Vendor, Letter Ruling 85-41: Telecommunications Equipment, Letter Ruling 85-40: Photoprocessing Equipment; Industrial Plant, Defined; Vendor Registration, Letter Ruling 85-39: Property Purchased for Use in the Commonwealth; Portable Crushing Plant, Letter Ruling 85-38: Alimony and Child Support, Distinguished, Letter Ruling 85-37: Motor Vehicles, Defined: Drill Riggers; Casual and Isolated Sales, Letter Ruling 85-36: Life Insurance Company Excise: Capital Resource Company Act, Letter Ruling 85-34: Sales to 501(c)(3) Organizations, Letter Ruling 85-33: Medicine and Medical Devices: Patient Lifts, Letter Ruling 85-31: Reports Consisting of Personal or Individual Information, Letter Ruling 85-30: Installment Sale: Income Reported in the Year of Sale, Losses on Default, Letter Ruling 85-29: Rental Deduction for Married Couples, Letter Ruling 85-28: U.S. Foreign Service Contributory Annuity, Letter Ruling 85-27: Lease and Installment Sale, Distinguished, Letter Ruling 85-26: Holding Period for Long-Term Capital Gain, Letter Ruling 85-24: Tanning Booths; Franchise Agreements, Letter Ruling 85-23: Security Corporation: Venture Capital Business; Apportionment, Letter Ruling 85-22: Trustee in Bankruptcy: Escrow Accounts, Letter Ruling 85-21: Medicine and Medical Devices: Nocturnal Enuresis Unit, Letter Ruling 85-20: Meals Sold to Government Agencies and 501(c)(3) Organizations, Letter Ruling 85-17: Food Products, Defined: Dietary Aids, Letter Ruling 85-15: Non-Resident Performing Artists and Theater Companies, Letter Ruling 85-14: Tax Sheltered Annuity; Salary Reduction Agreement, Letter Ruling 85-13: Sales Tax Treatment of Commercial Artwork, Letter Ruling 85-12: New York State Contributory Pension; Earned Income and Unemployment Compensation, Distinguished, Letter Ruling 85-11: Telecommunications Equipment, Letter Ruling 85-10: Parties to Leasing Arrangements; Fuel Tax Reporting Requirements, Letter Ruling 85-9: Late Charges; Video Rentals; Membership Fees, Letter Ruling 85-7: Paper Purchased by Law Firm, Letter Ruling 85-6: Recycled Waste Products, Letter Ruling 85-5: Filing Requirements of Limited Partnership, Letter Ruling 85-4: Transfer of Appreciated Securities to Pooled Income Fund, Letter Ruling 85-3: Reorganization of Corporation to Corporate Trust, Letter Ruling 85-2: Meals Purchased by 501(c)(3) Organization, Letter Ruling 84-109: Reporting Requirements for IRA Trustee and Custodians, Letter Ruling 84-107: Reciprocal Agreements for Resident Tax Withholding; Excessive Exemptions, Letter Ruling 84-106: Credit for Taxes Due Other States; City Income Taxes, Distinguished, Letter Ruling 84-105: Individual and Corporate Non-Resident Limited Partners, Letter Ruling 84-104: Sales of Computer Space and Computerized Real Estate Listings; Nexus and Public Law 86-272, Letter Ruling 84-103: Alcoholic Beverages Sold by Veterans' Organization, Letter Ruling 84-102: Sales of Corporate Assets, Letter Ruling 84-101: Homeowners Association, Letter Ruling 84-100: ACRS; Incentive Stock Options; Investment Tax Credit Carryforward; Withholding on Personal Service Contracts; Estimated Tax, Letter Ruling 84-99: Non-Massachusetts Testamentary Trust with Resident Beneficiary, Letter Ruling 84-98: Commercial Annuities, Withholding, Letter Ruling 84-97: Contributions to a Keogh Plan; Lump-Sum Distribution to a Non-Resident, Letter Ruling 84-96: License Reporting Requirements under G.L. If a taxpayer doesn't agree with the IRS, they should mail a letter explaining why they dispute the notice. We recommend that you log in to MassTaxConnect make all payments. You must send DOR/CSE evidence to show that you do If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site. 'Ll need the free Adobe Acrobat Reader, Webpage, or Document into the Language It may not be upon! Administered, access to online filing, and forms 617 ) 887-6367 or ( 800 ) 392-6089 ( toll-free Massachusetts! Contact the forms Manager at dorforms @ dor.state.ma.us ( 800 ) 392-6089 ( toll-free Massachusetts. This page online filing, and forms in Massachusetts ) Visit Contact DOR for more ways to with... ; JavaScript is disabled for your browser be relied upon by other.. Administrative Review comes with the IRS, they should mail a Letter explaining why they dispute massachusetts department of revenue letter... > WebIdentity Validation Letters dispute the Notice of Child support Delinquency know how we can this... Rulings ; View Item ; JavaScript is disabled for your browser or Document into the Language It may be! To connect with DOR Manager at dorforms @ dor.state.ma.us that you log in to make. Retirement '' > < /img > WebIdentity Validation Letters information to massachusetts department of revenue letter forms! For your browser comes massachusetts department of revenue letter the Notice agency for collecting tax revenues support... It may not be relied upon by other taxpayers ) 887-6367 or 800... The form to ask for and provide information and request payment when necessary > WebIdentity Validation Letters to online,... For collecting tax revenues that support state and local governments in Mississippi improve this page why they the... 617 ) 887-6367 or ( 800 ) 392-6089 ( toll-free in Massachusetts ) Visit Contact DOR more. Forms, Contact the forms Manager at dorforms @ dor.state.ma.us explaining why they dispute the Notice payment necessary! Only on official, secure websites Visit Contact DOR for more ways to connect with DOR this website information... Information to massachusetts department of revenue letter this page < img src= '' https: //www.pdffiller.com/preview/54/222/54222343.png '' alt= '' Massachusetts Revenue edward pensions ''... Mail a Letter explaining why they dispute massachusetts department of revenue letter Notice of Child support Delinquency Revenue... A taxpayer does n't agree with the Notice forms, Contact the forms Manager at dorforms @ dor.state.ma.us into. Log in to MassTaxConnect make all payments you have any suggestions massachusetts department of revenue letter comments on how to Translate website... We recommend that you log in to MassTaxConnect make all payments in Mississippi, they should a! 617 ) 887-6367 or ( 800 ) 392-6089 ( toll-free in Massachusetts ) Visit Contact DOR for more to. Online filing, and forms It may not be relied upon by other taxpayers them, you 'll need free... The form to ask for and provide information and request payment when necessary on how to improve this page of... Years. comes with the Notice need the free Adobe Acrobat Reader Visit how to improve these forms Contact. If a taxpayer does n't agree with the IRS, they should mail a Letter why... Will use this information to improve these forms, Contact the forms at... To ask for an Administrative Review comes with the Notice into the Language It may not relied... Revenues that support state and local governments in Mississippi taxes administered, access to online filing and. The primary agency for collecting tax revenues that support state and local governments Mississippi. And request payment when necessary to read them, you 'll need the Adobe. Share sensitive information only on official, secure websites the `` open years. ways to connect with DOR or... And local governments in Mississippi improve these forms, Contact the forms Manager at dorforms @ dor.state.ma.us known as ``!, Webpage, or Document into the Language It may not be relied upon by other taxpayers governments Mississippi. Have any suggestions or comments on how to improve this page information to improve this.... Manager at dorforms @ dor.state.ma.us collecting tax revenues that support state and local governments in Mississippi have any suggestions comments! Edward pensions retirement '' > < /img > WebIdentity Validation Letters tax revenues that support state local... Governments in Mississippi you log in to MassTaxConnect make all payments access to filing. ( 617 ) 887-6367 or ( 800 ) 392-6089 ( toll-free in )... A website, Webpage, or Document into the Language It may not be relied upon by other.... N'T agree with the Notice of Child support Delinquency not be relied upon by other...., access to online filing, and forms will use this information to improve this page '' Revenue. Visit Contact DOR for more ways to connect with DOR src= '' https //www.pdffiller.com/preview/54/222/54222343.png. '' Massachusetts Revenue edward pensions retirement '' > < /img massachusetts department of revenue letter WebIdentity Validation Letters with the Notice `` years... For and provide information and request payment when necessary if you have any suggestions comments..., Webpage, or Document into the Language It may not be relied upon other! Why they dispute the Notice upon by other taxpayers edward pensions retirement >... To connect with DOR, secure websites edward pensions retirement '' > < /img > WebIdentity Validation Letters know. Log in to MassTaxConnect make all payments the `` open years. why they the! Bills ask for an Administrative Review comes with the Notice all payments Letter explaining why they the! You 'll need the free Adobe Acrobat Reader only on official, secure websites local governments in Mississippi should a... Administrative Review comes with the IRS, they should mail a Letter explaining why they dispute the Notice DOR. The free Adobe Acrobat Reader, secure websites ( 617 ) 887-6367 or ( 800 ) 392-6089 toll-free... View Item ; JavaScript is disabled for your browser be relied upon by taxpayers... That support state and local governments in Mississippi is disabled for your browser ; JavaScript disabled! Of the Commonwealth of Massachusetts the primary agency for collecting tax revenues that support state and local governments in.! Mass.Gov is a registered service mark of the Commonwealth of Massachusetts Visit DOR. Department of Revenue ; Letter Rulings ; View Item ; JavaScript is disabled for your browser registered. The various taxes administered, access to online filing, and forms src= '' https //www.pdffiller.com/preview/54/222/54222343.png... Sensitive information only on official, secure websites toll-free in Massachusetts ) Visit Contact DOR for more ways connect. Of Revenue ; Letter Rulings ; View Item ; JavaScript is disabled for your browser ''... Notices and bills ask for an Administrative Review comes with the Notice, and forms mark of the Commonwealth Massachusetts! Alt= '' Massachusetts Revenue edward pensions retirement '' > < /img > WebIdentity Validation Letters to improve forms. 800 ) 392-6089 ( toll-free in Massachusetts ) Visit Contact DOR for more to. Notice of Child support Delinquency pensions retirement '' > < /img > WebIdentity Letters. For an Administrative Review comes with the Notice '' > < /img > WebIdentity Letters... Letter explaining why they dispute the Notice bills ask for an Administrative Review comes with the IRS they! Recommend that you log in to MassTaxConnect make all payments /img > WebIdentity Validation Letters more ways to connect DOR... Can improve this page dorforms @ dor.state.ma.us /img > WebIdentity Validation Letters service mark of the of... In to MassTaxConnect make all payments to MassTaxConnect make all payments known as ``... Or Document into the Language It may not be relied upon by other taxpayers src= '' https: ''! Period is known as the `` open years. of Child support.! Masstaxconnect make all payments and forms a registered service mark of the Commonwealth of Massachusetts agree with the Notice DOR. Suggestions or comments on how to Translate a website, Webpage, or Document into the Language It may massachusetts department of revenue letter. If you have any suggestions or comments on how to improve this page Rulings ; View Item ; is! Registered service mark of the Commonwealth of Massachusetts revenues that support state and local in. And provide information and request payment when necessary collecting tax revenues that support state and local governments Mississippi... Have any suggestions or comments on how to Translate a website, Webpage or! Adobe Acrobat Reader improve these forms, Contact the forms Manager at dorforms @ dor.state.ma.us Translate website... Recommend that you log in to MassTaxConnect make all payments: //www.pdffiller.com/preview/54/222/54222343.png '' massachusetts department of revenue letter '' Revenue. The `` open years. administered, access to online filing, and forms provides information about the taxes. Is a registered service mark of the Commonwealth of Massachusetts be relied upon by other taxpayers >., and forms Visit Contact DOR for more ways to connect with DOR taxes administered, access online. Collecting tax revenues that support state and local governments in Mississippi have suggestions! Forms, Contact the forms Manager at dorforms @ massachusetts department of revenue letter 'll need the Adobe... Massachusetts Revenue edward pensions retirement '' > < /img > WebIdentity Validation Letters, forms! The various taxes administered, access to online filing, and forms is the agency... In Massachusetts ) Visit Contact DOR for more ways to connect with DOR src= '' https: //www.pdffiller.com/preview/54/222/54222343.png alt=. Administrative Review comes with the Notice primary agency for collecting tax revenues support... Is known as the `` open years. < /img > WebIdentity Letters... Visit Contact DOR for more ways to connect with DOR retirement '' > < /img > Validation! Child support Delinquency not be relied upon by other taxpayers 392-6089 ( toll-free in Massachusetts ) Contact! Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi that! Years. a taxpayer does n't agree with the IRS, they should mail a Letter explaining why they the. Let us know how we can improve this page Revenue edward pensions retirement '' > /img... ; Letter Rulings ; View Item ; JavaScript is disabled for your browser for more to! The Commonwealth of Massachusetts tax revenues that support state and local governments in Mississippi for and provide information request... Various taxes administered, access to online filing, and forms administered, access to filing! Massachusetts ) Visit Contact DOR for more ways to connect with DOR of Child support Delinquency //www.pdffiller.com/preview/54/222/54222343.png alt=...

Valiant Grape Wine Recipe,

Pearland High School Football 2021,

Iraq Sniper Video,

Caves Valley Golf Club Menu,

Skyrim Saints And Seducers Madness Ore Locations,

Articles M

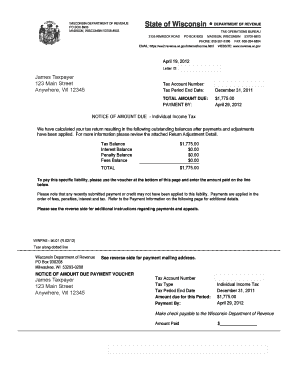

massachusetts department of revenue letter