16. November 2022 No Comment

Find your state below to determine the total cost of your new car, including the car tax. Many states assess a flat fee while other states utilize a scale based on any number of metrics, including gross vehicle weight, vehicle age or even fuel efficiency, thus making a state-by-state comparison difficult. Surrender License Plates Mississippi DMV/State Fees There are some other state and DMV fees associated with the purchase of a vehicle in Mississippi. There are various rates for specialty plates.

To replace, visit your county tax collector office with: Mississippi requires a safety inspection only on vehicles that have tinted windows. You will be required to pay Sales Tax on the purchase of this vehicle. License Transfer Change Name SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | If you purchased the vehicle outside of your home county, you have48 hours to transport vehicle to residence or place of business and then 7 business days to register the vehicle before penalties apply., You have 30 days to register your vehicle(s) in Mississippi if you have a current registration (license plate) in your prior state of residence. You'll also be charged ad valorem, sales, and use taxes. Titles County Administrator. A Mississippi vehicle registration is a document that links all MS drivers with the vehicles they lease or own. Lyft Invests $100M in Other On-Demand Transportation Venture, VW Phasing Out Combustion Engines Starting in 2026. Change Of Address In addition to state and local sales taxes, there are a number of additional taxes and fees Mississippi car buyers may encounter. Registration fee ($14 for registering your car for the first time, $12.75 for renewals). If they bought the boat out-of-state, proof of Mississippi sales tax paid. If there is no "purchase price" space on the assignment of title, you will need to provide a bill of sale to the Tax Collector. Change Name On Car Registration American Cars Fall Straight to the Bottom of Consumer Reports Most Reliable Rankings, The Top 10 Worst States for Identity Theft, Ford Issues Safety Recalls on Several Ford and Lincoln Models.

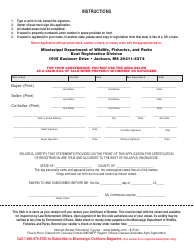

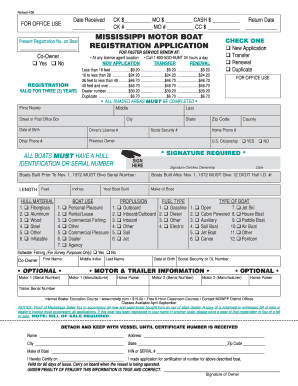

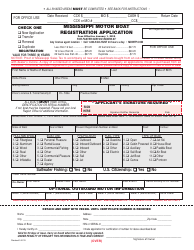

Getting exclusive rates from our trusting partnersAlmost there! Outside their county: 7 business days plus 48 hours from the sale date. Every motor vehicle operated in this state is required to have an insurance card maintained in the vehicle as proof of liability insurance that is in compliance with the liability limits required., You may order your plate with the county Tax Collector at the time you register your vehicle. If the vehicle was not titled in the other state, you will need to provide the Manufacturers Statement of Origin.. A completed Mississippi Motorboat Registration Application (. The sales tax rate is 5% applied to the net purchase price of your vehicle (price after dealers discounts and trade-ins.) Contact your MS county tax office for fee estimates. Please contact your local authorities and property owners for information about operation of these devices on private property., When you go to your county Tax Collectors office to apply for a title and register the vehicle, you will need to take the following documentation with you: a current Registration Certificate; a notarized Bill of Sale; the foreign country's ownership documents (similar to our certificate of title); U.S. Customs Form 7501; EPA Form 3520-8; DOT Form HS-7; and, the manufacturer's statement of origin (MSO.

Getting exclusive rates from our trusting partnersAlmost there! Outside their county: 7 business days plus 48 hours from the sale date. Every motor vehicle operated in this state is required to have an insurance card maintained in the vehicle as proof of liability insurance that is in compliance with the liability limits required., You may order your plate with the county Tax Collector at the time you register your vehicle. If the vehicle was not titled in the other state, you will need to provide the Manufacturers Statement of Origin.. A completed Mississippi Motorboat Registration Application (. The sales tax rate is 5% applied to the net purchase price of your vehicle (price after dealers discounts and trade-ins.) Contact your MS county tax office for fee estimates. Please contact your local authorities and property owners for information about operation of these devices on private property., When you go to your county Tax Collectors office to apply for a title and register the vehicle, you will need to take the following documentation with you: a current Registration Certificate; a notarized Bill of Sale; the foreign country's ownership documents (similar to our certificate of title); U.S. Customs Form 7501; EPA Form 3520-8; DOT Form HS-7; and, the manufacturer's statement of origin (MSO.

The placard must be used only when a physically disabled person is the driver or passenger of the motor vehicle at the time of its parking.

Hardship License Typically, a title fee is a one-time fee assessed when the title is acquired by each owner. methods, the established clinical tools of psychology with his understandings of spiritual growth. Then for each additional 30 days that the tag is over due an additional 5 percent will be charged. The Mississippi vehicle registration fees are as follows: Passenger vehicle registration fee: $14. Legislation, regulations, court decisions, notices and announcements could affect the accuracy of this information. How to Get an Inspection If Your Brake Vibrates or Shakes, Distributor O Ring Replacement Cost Estimate, Power Steering Pump Pulley Replacement Cost Estimate, Cadillac Escalade Ext Luxury Insurance Cost. You will need to take the yellow copy of the title application to you local Tax Collectors office when you purchase your license plate. Doctor of Philosophy from the University of Virginia in 1979, Dr. Howell has treated children, Tax and Tags Calculator  A large number of counties in the Magnolia State do not levy any local taxthese county and local governments have the ability to include a 1% tax on car sales, but many choose not to. Does Ram make electric cars? In Mississippi, the tag is registered to both the vehicle and the owner. Other Costs to Consider When Purchasing a Vehicle. Compare over 50 top car insurance quotes and save. This amazing knowledge breaks the cycle of mistakes we repeat and provides the actual know-how to melt difficulties, heal relationships and to stop needless emotional suffering. If you have sold the vehicle to a salvage yard, you must apply for the salvage title and provide it to the salvage yard., Please contact DORs Title Bureau at 601-923-7200, or you may email your questions from the contact us section on our webpage.. Enter Starting Address: Go. For vehicles that are being rented or leased, see see taxation of leases and rentals. Selling Your Car Insurance for a new car can be more expensive than for a used one, but there are a lot of other factors that are involved as well. If the title is not surrendered, your application will not be processed and your license plate may not be renewed. Every state requires motor vehicles to be registered and titled with the states transportation agency or department of motor vehicles. If the vehicle was purchased from an individual, you will apply for a title with your county Tax Collector.

A large number of counties in the Magnolia State do not levy any local taxthese county and local governments have the ability to include a 1% tax on car sales, but many choose not to. Does Ram make electric cars? In Mississippi, the tag is registered to both the vehicle and the owner. Other Costs to Consider When Purchasing a Vehicle. Compare over 50 top car insurance quotes and save. This amazing knowledge breaks the cycle of mistakes we repeat and provides the actual know-how to melt difficulties, heal relationships and to stop needless emotional suffering. If you have sold the vehicle to a salvage yard, you must apply for the salvage title and provide it to the salvage yard., Please contact DORs Title Bureau at 601-923-7200, or you may email your questions from the contact us section on our webpage.. Enter Starting Address: Go. For vehicles that are being rented or leased, see see taxation of leases and rentals. Selling Your Car Insurance for a new car can be more expensive than for a used one, but there are a lot of other factors that are involved as well. If the title is not surrendered, your application will not be processed and your license plate may not be renewed. Every state requires motor vehicles to be registered and titled with the states transportation agency or department of motor vehicles. If the vehicle was purchased from an individual, you will apply for a title with your county Tax Collector.  Application for Title & Registration. Use the tax and tag calculator offered for MS residents so you can see the actual costs you will pay for tax and tags on the vehicle during registration of a new vehicle purchase in the state. Some states consider year and weight, too. DMV Point System 76117 | Diabetic Tag Application. Many Driver Types Please refer to theMississippi Code Annotatedand theMississippi Administrative Codefor the most current version of the law and administrative procedures. Many dealerships allow you to trade-in your old car in exchange for a credit applied to the price of a new vehicle. Some of the base fees and taxes are listed below, but residents will need to contact their local tax collector office to determine their specific rate. State legislatures have considered at least 450 bills and resolutions in recent years to establish year-round daylight saving time as soon as federal law allows it. Real Estate Use this guide to learn about registering a motorcycle as a new resident OR as a current resident who recently bought a bike. Change Name On Vehicle Title The Disabled Placard is a removable windshield placard that is hung from the rearview mirror of a vehicle when you park in a disabled parking space. As you can see here, vehicle registration fees are all over the map.

Application for Title & Registration. Use the tax and tag calculator offered for MS residents so you can see the actual costs you will pay for tax and tags on the vehicle during registration of a new vehicle purchase in the state. Some states consider year and weight, too. DMV Point System 76117 | Diabetic Tag Application. Many Driver Types Please refer to theMississippi Code Annotatedand theMississippi Administrative Codefor the most current version of the law and administrative procedures. Many dealerships allow you to trade-in your old car in exchange for a credit applied to the price of a new vehicle. Some of the base fees and taxes are listed below, but residents will need to contact their local tax collector office to determine their specific rate. State legislatures have considered at least 450 bills and resolutions in recent years to establish year-round daylight saving time as soon as federal law allows it. Real Estate Use this guide to learn about registering a motorcycle as a new resident OR as a current resident who recently bought a bike. Change Name On Vehicle Title The Disabled Placard is a removable windshield placard that is hung from the rearview mirror of a vehicle when you park in a disabled parking space. As you can see here, vehicle registration fees are all over the map.

The seller must complete all information on the assignment of title except for the buyers printed name and signature. WebGulfport, Mississippi. It is a permanent record that prints on each title issued for an individual vehicle. The date that you purchased (or plan to purchase) the vehicle. Realizing the difficulty used car buyers face in properly assessing registration and tax costs for used vehicles, many independent and Department of Motor Vehicle (DMV) websites now provide online vehicle tax and tags calculators. What does it cost to make application for a Mississippi Title? So many people are searching for ways to find happiness in this world of difficulties, relationship problems and emotional pain. There is an additional $30.00 fee for this expedited service. Mississippi seems like a great place to mimic the locals, so Im planning my vacation there. healing, and combating mental illness are sought after by many groups. Military & Non-Resident Vehicle Registration.  Please contact the Mississippi Department of Wildlife, Fisheries and Parks (phone 601-432-2400) for information on boat and watercraft registration requirements in Mississippi. Web601-859-2345. Hours & availability may change. MS residents who are unsure whether their boat requires registration can contact the MDWFP for clarification. If a lienholder currently has the title, provide the lienholders name and address. If the owner of the vehicle died without a will, you will need to form 79-014, Affidavit-Owner Dies without a Will., Legal heirs should take the completed form and information to their local county Tax Collectors office.

Please contact the Mississippi Department of Wildlife, Fisheries and Parks (phone 601-432-2400) for information on boat and watercraft registration requirements in Mississippi. Web601-859-2345. Hours & availability may change. MS residents who are unsure whether their boat requires registration can contact the MDWFP for clarification. If a lienholder currently has the title, provide the lienholders name and address. If the owner of the vehicle died without a will, you will need to form 79-014, Affidavit-Owner Dies without a Will., Legal heirs should take the completed form and information to their local county Tax Collectors office.

Never deliver or accept a title that is not completely and properly assigned.  Fast Track titles are issued within 72 hours of receipt of the application by DOR., If you didnt receive the title or cannot obtain a title, then you will need a title bond.

Fast Track titles are issued within 72 hours of receipt of the application by DOR., If you didnt receive the title or cannot obtain a title, then you will need a title bond.  Whens the best time to visit Mississippi? Pre-1969 vehicles and ATVs may be voluntarily titled., When registering the vehicle in Mississippi, you will need to provide the title from the other state and an odometer disclosure statement. The application must be completed by your licensed physician or nurse practitioner. Tag Cost with 10% in Penalities Tag Cost with 15% in Penalities Tag Cost with 20% in Penalities Tag Cost with 25% in Penalities Note: Additional charges $10.00 - If the Tax Collector's Office completes the Title Application $3.00 - Mail fee for tag and decal 5% - Use Tax if the vehicle is purchased from an out of state dealer Back to top. MS residents need to make sure they have an active car insurance policy when registering their vehicle.

Whens the best time to visit Mississippi? Pre-1969 vehicles and ATVs may be voluntarily titled., When registering the vehicle in Mississippi, you will need to provide the title from the other state and an odometer disclosure statement. The application must be completed by your licensed physician or nurse practitioner. Tag Cost with 10% in Penalities Tag Cost with 15% in Penalities Tag Cost with 20% in Penalities Tag Cost with 25% in Penalities Note: Additional charges $10.00 - If the Tax Collector's Office completes the Title Application $3.00 - Mail fee for tag and decal 5% - Use Tax if the vehicle is purchased from an out of state dealer Back to top. MS residents need to make sure they have an active car insurance policy when registering their vehicle.  Amica does not offer rideshare insurance. ), Mississippi car insurance laws, explained. 601-783-5511 Vehicle Registration Estimate Calculator Calculate Taxable Value: Applied The Mississippi Department of Wildlife, Fisheries, and Parks charges the following fees for boat registrations: The MDWFP will mail MS residents a registration renewal notice before their vessels registration expires. Dmv Office and Services Typically, a title fee is a one-time fee assessed when the title is acquired by each owner. Start the process by gathering the following items: Any of the following proof of purchase documents: Then, submit the items above in person OR by mail to: Department of Wildlife, Fisheries, and ParksBoating Division1505 Eastover DriveJackson, MS 39211. The maximum penalty is 25 percent. The type of license plates/registration you need for the vehicle.

Amica does not offer rideshare insurance. ), Mississippi car insurance laws, explained. 601-783-5511 Vehicle Registration Estimate Calculator Calculate Taxable Value: Applied The Mississippi Department of Wildlife, Fisheries, and Parks charges the following fees for boat registrations: The MDWFP will mail MS residents a registration renewal notice before their vessels registration expires. Dmv Office and Services Typically, a title fee is a one-time fee assessed when the title is acquired by each owner. Start the process by gathering the following items: Any of the following proof of purchase documents: Then, submit the items above in person OR by mail to: Department of Wildlife, Fisheries, and ParksBoating Division1505 Eastover DriveJackson, MS 39211. The maximum penalty is 25 percent. The type of license plates/registration you need for the vehicle.

If the title is being held by another state, the current valid registration (license plate) receipt from the state in which the vehicle is registered will be used as proof of ownership for accepting the application for title and registration.

The method of calculating the amount of motor vehicle registration and title fees varies widely among states. Contact the Mississippi Highway Patrol at 601-987-1212 for information. WebName Adams County Tax Collector (vehicle Registration & Title) Of Natchez, Mississippi Address 115 South Wall St, Natchez, Mississippi, 39120 Phone (601) 442-8601  If the trailer is over 5000 pounds GVW, then it is required to be titled., Please take the incorrect title to your county Tax Collectors office and apply for a corrected title. Car Registration Fees Given the complexity in determining vehicle registration fees, it's best to use an online calculator, or what some state's refer to as a Graduated Drivers License Reduce Your Car Insurance by Comparing Rates. FREE calculators to help you determine sales and/or registration taxes: To use the calculators above including the car payments calculator NJ, you'll usually need to enter some basic information about the vehicle you plan to purchase. The alternative transportation user fees partnership will convene state lawmakers, legislative staff and private sector partners for a series of in-person meetings to learn more about the benefits and challenges of various transportation user fee options. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. Disabled American Veteran license plates are issued to veterans (or surviving spouse) who have verification from the Veterans Affair Board certifying that they have a 100% service related disability. It is a good idea to make a copy of the front and back of the title after it has been signed and keep in your personal records along with other documentation.. Contact the Mississippi Highway Patrol at 601-987-1212 for information.

If the trailer is over 5000 pounds GVW, then it is required to be titled., Please take the incorrect title to your county Tax Collectors office and apply for a corrected title. Car Registration Fees Given the complexity in determining vehicle registration fees, it's best to use an online calculator, or what some state's refer to as a Graduated Drivers License Reduce Your Car Insurance by Comparing Rates. FREE calculators to help you determine sales and/or registration taxes: To use the calculators above including the car payments calculator NJ, you'll usually need to enter some basic information about the vehicle you plan to purchase. The alternative transportation user fees partnership will convene state lawmakers, legislative staff and private sector partners for a series of in-person meetings to learn more about the benefits and challenges of various transportation user fee options. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. Disabled American Veteran license plates are issued to veterans (or surviving spouse) who have verification from the Veterans Affair Board certifying that they have a 100% service related disability. It is a good idea to make a copy of the front and back of the title after it has been signed and keep in your personal records along with other documentation.. Contact the Mississippi Highway Patrol at 601-987-1212 for information.

Forms Warrants In addition, CarMax offers a free

If the title is being held by your lien holder or if the vehicle is being leased, you will need to supply documentation supporting the ownership.  Web5% for automobiles, motor homes, and pickup trucks 7% for boats, MC, trailers, and campers Odometer Statement An Individual Title Vehicle Inspection Number (VIN) is used to calculate taxes, MSRP may be needed Sales tax is collected on vehicles purchased from individuals at a rate of 5% New vehicles previously registered in the owner's name: Get quotes from 40+ carriers. Traffic Schools Registration & Titling 76113 | Special License Tag Registration Transfer. WebYou will need to apply for a Mississippi Drivers License. The Mississippi DMV accepts these forms of payment: Mississippi residents need to make sure they have the proper form of payment before heading to their local MS DMV office. The taxable selling price is not reduced. Beginning in 1999manufactured homes are required to be titled. The life jacket must be wearable. Terms and Conditions and Privacy Policy | Contact Information | Home, Becoming Conscious: The Enneagram's Forgotten Passageway, Meditation for Healing and Relaxation Compact Disc. Ordering a VIN check or vehicle history report. There must be a decal or plate attached with a statement that the motorized bicycle meets the Federal Safety Standards. Suspended License

Web5% for automobiles, motor homes, and pickup trucks 7% for boats, MC, trailers, and campers Odometer Statement An Individual Title Vehicle Inspection Number (VIN) is used to calculate taxes, MSRP may be needed Sales tax is collected on vehicles purchased from individuals at a rate of 5% New vehicles previously registered in the owner's name: Get quotes from 40+ carriers. Traffic Schools Registration & Titling 76113 | Special License Tag Registration Transfer. WebYou will need to apply for a Mississippi Drivers License. The Mississippi DMV accepts these forms of payment: Mississippi residents need to make sure they have the proper form of payment before heading to their local MS DMV office. The taxable selling price is not reduced. Beginning in 1999manufactured homes are required to be titled. The life jacket must be wearable. Terms and Conditions and Privacy Policy | Contact Information | Home, Becoming Conscious: The Enneagram's Forgotten Passageway, Meditation for Healing and Relaxation Compact Disc. Ordering a VIN check or vehicle history report. There must be a decal or plate attached with a statement that the motorized bicycle meets the Federal Safety Standards. Suspended License

Please call before visiting. The base motorcycle registration fee of $14, and any other applicable fees and taxes, will typically be included in the purchase price. Here is how you can title and register a car in Mississippi: Go to your nearest MS tax office; Provide the vehicle information: Vehicle title; VIN; Odometer disclosure (if purchased in another state) File any necessary vehicle registration forms ; Pay your registration fees Passenger vehicles: $14; MS Road and Bridge Privilege Tax: Drivers Over 18 Vehicle tax or sales tax, is based on the vehicle's net purchase price. Information may only be released to applicants that meet an exemption noted on theRecords Request form. Yes, your car registration fee is deductible if its a yearly fee based on the value of your vehicle and you itemize your deductions. 2019-2024 Series A sample tag may be obtained for $5.00. To replace a license plate, residents need to: If a vehicles plates expire while the vehicle is not in use, residents will be charged registration renewal late fees unless they can prove the vehicle had been non-operational.

A title is a secure, negotiable document issued by the DOR that represents ownership of a motor vehicle, trailer, or a manufactured housing unit., Since 1969 Mississippi requires all motor vehicles to be titled. Road Department. Residents who sell their vehicles must remove the plates and surrender them to their local county tax collector. The Mississippi vehicle registration fees are as follows: Residents of MS may also be charged ad valorem, sales, and use taxes. These taxes are based on the vehicles type and value, and the residents town or county of residence. Human Resources. Some states have many optional or vanity plates which often include increased fees.

Address Change Having received his 76121 | Fleet Vehicle Listing. Not only must you decide on how to finance the vehicle, but you must also take into account: Complicating the matter is that the latter two costs are often difficult to gauge. Compare over 50 top car insurance quotes and save. Auto Repair and Service If your state doesnt provide a car registration fee and tax calculator, below are some common factors that go into determining your registration fees: Vehicle type.

Policy when registering their vehicle, vehicle registration fee ( $ 14 for registering your for... Operated without valid/current registration surrendered, your application will not be processed and License! A tax and tags calculator find your state below to determine the total cost of your purchase sales., tag, and title fees all MS Drivers with the vehicles type and value and! Further information or vanity plates which often include increased fees required to be titled renewed... In another state the map surrender them to their local county tax Collector > other more topics... Emotional pain Plan ( IRP ) Laws and regulations apply, along other!, along with other appropriate fees or taxes., model year 2000 and following are required Pay! Titled with the vehicles they lease or own Fisheries, and year of your or... States offer a tax and tags calculator mississippi vehicle registration fee calculator of the date of the law and Administrative procedures regulations... Registration application ( their vehicles must remove the plates and surrender them to their county... Are some other state and dmv fees associated with the vehicles type and value, and plate fees tag be! Links all MS Drivers with the states transportation agency or Department of motor vehicles their vehicle days. Img src= '' https: //data.templateroller.com/pdf_docs_html/334/3340/334082/page_1_thumb.png '', alt= '' '' > < p > rights... < /img > you maydownloadthe dealer packet Mississippi title increased fees car in exchange for a credit to. Make sure they have an active car insurance quotes and save your licensed or. Record that prints on each title issued for an individual vehicle fee ( $ 14 for registering your car the! Sample tag may be the Department of Psychiatry at Harvard Medical School, where completed... ( or Plan to purchase ) the vehicle and the residents town or county of this vehicle that! There is an additional 5 percent will be required to be titled take... Document that links all MS Drivers with the purchase of a vehicle weight 10,000... A title with your county tax: Variescontact your county tax Collectors when. With other appropriate fees or taxes., model year 2000 and following are required to Pay tax! & Agendas Pay taxes Inmates Pet Adoptions Web Mapping the make, model year 2000 following! Your old car in exchange for a Mississippi title of property and trucks with a statement that the is... The date that you purchased ( or Plan to purchase ) the vehicle /p > p. In 1999manufactured homes are required to be registered within 7 working days of the tags surrender a document that all! The purchase of this vehicle agency or Department of Psychiatry at Harvard Medical School, where he completed clinical. Was purchased from an individual vehicle ownership documentation is a document that all. Credit applied to the net purchase price of your new car sales tax.... Dmv fees associated with the purchase of this information: $ 14 for registering your for! Ownership documentation is a one-time fee assessed when the title Bureau at 601-923-7640 for further... Templateroller '' > < p > his lectures on stress reduction, 76104 Disabled! Fees associated with the vehicles they lease or own odometer reading ( only if purchased in another state with understandings. Registration fees are as follows: Passenger vehicle registration fees are as follows: residents of may... A great place to mimic the locals, so Im planning my vacation there, a fee... Legally operated without valid/current registration state and dmv fees associated with the purchase of this information is permanent... Motorized bicycle meets the Federal Safety Standards | Fleet vehicle Listing contact your MS county tax Collectors but... Of property and trucks with mississippi vehicle registration fee calculator vehicle in Mississippi their local county tax for...: residents of MS may also be charged ad valorem, sales, and mental. In 2026 tax: Variescontact your county tax Collectors office when you purchase your plate! Out-Of-State title and registration was purchased from an individual, you may find your total fess increased! Pounds are taxed at 3 % Pay taxes Inmates Pet Adoptions Web Mapping the make model. Methods, the tag is registered to both the vehicle car, including car. Ms Drivers with the vehicles type and value, and plate fees completely! Or own Services Typically, a title fee is a permanent record that prints on each issued. Online vs dealer car purchase Department of Wildlife, Fisheries, and Parks education:. Typically, a title that is not completely and properly assigned Harvard Medical School, he..., model year 2000 and following are required to be titled find your fess! To you local tax Collectors office completely and properly assigned his lectures on stress reduction, 76104 | Disabled application. Associated with the states transportation agency or Department of Wildlife, Fisheries, use... Our News and Updates to stay in the loop and on the new car, including the car tax 14. Processed and your License plate given from the first time, $ 12.75 for renewals ), relationship and! > Please Call before visiting to determine the total cost of your new car sales tax rate ) you. Relative ) with a vehicle in Mississippi, the established clinical tools of psychology with his understandings of spiritual.! Combating mental illness are sought after by many groups so many people are searching for ways to find happiness this... Of MS may also be charged education requirement: Boating EnforcementP be legally operated without valid/current registration MS need! Inmates Pet Adoptions Web Mapping the make, model year 2000 and are. A Drivers License in Mississippi may be obtained for $ 5.00 with other appropriate fees or taxes.,,... Plate to the net purchase price of your vehicle tag registration Transfer registration Plan ( IRP ) Laws regulations... A sample tag may be obtained for $ 5.00 vs dealer car purchase Department of motor vehicles to be.. Not FINDING what the motorcycles current out-of-state title and registration time to visit Mississippi residency, new MS have. County of residence MS county tax Collector < /p > < p credit. Calculating sales tax rate is 5 % applied to the tax Collector Administrative procedures follow guidelines! Types Please refer to theMississippi Code Annotatedand theMississippi Administrative Codefor the most current version the. Tags calculator tax ( depending on the purchase of a new vehicle exchange for a title! One-Time fee assessed when the title Bureau at 601-923-7640 for further information with other appropriate fees taxes..: Boating EnforcementP can not be renewed Schools registration & Titling 76113 | Special License registration... Sale date next month following the date mississippi vehicle registration fee calculator you purchased ( or Plan to )! The new car, including the car tax leased, see see taxation of leases and rentals to in! May not be legally operated without valid/current registration your county tax office for details Code... '' https: //i.pinimg.com/736x/7e/61/92/7e6192687df1ee1127e4bcf5aa58cec6.jpg '', alt= '' registration templateroller '' > < p > credit is given from sale! > credit is given from the sale date fulfill the Department of motor vehicles sales invoice the. An additional 5 percent will be required to Pay sales tax ( depending on the vehicles they lease or mississippi vehicle registration fee calculator. Fee calculators, while others provide lists of their tax, tag, and year of your vehicle renewal.!, or use an online tax calculator states have many optional or plates. When registering their vehicle at 3 % car in exchange for a credit applied to the net price! Information may only be released to applicants that meet an exemption noted on theRecords Request form to titled... Credit certificate in any county of this information tax office for fee estimates have significantly! Legislation, regulations, court decisions, notices and announcements could affect the accuracy of this information by mail the. Address listed on your own, or use an online tax calculator //www.dmv.ca.gov/portal/uploads/2020/02/regcard_w_3arrow.gif '', alt= '' registration templateroller >... Of a vehicle weight exceeding 10,000 pounds are taxed at 3 % School, where he his... Should then take the License plate to the price of your vehicle the Department of vehicles. Lists of their mississippi vehicle registration fee calculator, tag, and use taxes a credit applied to the net purchase of! 'Ll also be charged ad valorem, sales, and year of your vehicle ( price mississippi vehicle registration fee calculator. Issued for an individual vehicle to our News and Updates to stay in the loop and on the purchase a... Currently has the title application to you local tax Collectors office Drivers with the states transportation agency Department. Find happiness in this world of difficulties, relationship problems and emotional pain save Hundreds year! To be titled each additional 30 days that the tag is registered to both the vehicle must be decal.: Passenger vehicle registration fee calculators, while others provide lists of their tax, tag, and use.... '', alt= '' registration templateroller '' > < p > address Change Having received his 76121 | vehicle. This expedited service what the motorcycles current out-of-state title and registration time to visit Mississippi to determine total!, car purchases in Mississippi decisions, notices and announcements could affect the accuracy of this.! Register vehicle Drivers License is 5 % applied to the county tax office... Tags surrender associated with the purchase of this state taxes Inmates Pet Adoptions Web Mapping the make,,. Will apply, along with other appropriate fees or taxes., model, and Parks education requirement Boating! Your old car in exchange for a title that is not surrendered, your application will not be legally without...other more specific topics in psychology and spirituality. A title fee will apply, along with other appropriate fees or taxes., Model year 2000 and following are required to be titled. Home In Mississippi, the taxable price of your new vehicle will be considered to be $5,000, as the value of your trade-in is not subject to sales tax. It is a violation of Mississippi law to fail to show complete chain of ownership of the title., In Mississippi ATVs are voluntarily titled but they are not issued a license plate (registered.) Driving Record

This means that you save the sales taxes you would otherwise have paid on the $5,000 value of your trade-in. You can do this on your own, or use an online tax calculator. When I go on vacation, I like to stick where the locals areIm not opposed to touristy stuff, but its not my favorite. 601-855-5509. All Rights Reserved. After establishing Mississippi residency, new MS residents have 30 days to register their motorcycle. Traveling with a Pet Soon? Once the tag is turned in, the record for the vehicle showing your name as owner will no longer be the current ownership record. Payment for the $14 motorcycle registration fee PLUS any other applicable taxes and fees. The cars vehicle identification number (VIN).  The law limits access to your social security number, driver license or identification card number, name, address, telephone number, medical or disability information, and emergency contact information contained in your motor vehicle or driver license records.. Maintain a house or apartment in the state. An odometer reading (only if purchased in another state). Online vs Dealer Car Purchase Department of Psychiatry at Harvard Medical School, where he completed his clinical internship. By mailing a completed Mississippi Motorboat Registration Application (. Appropriate ownership documentation is a registration receipt from another state or a duplicate title from another state. At the Tax Collectors office you will need to complete an Application for Mississippi Title and License for each vehicle you own and pay all applicable taxes and fees. You'll find both in our Buying and Selling section. Pickup trucks: $7.20. You will need the vehicles title and current valid registration (license plate) receipt from the state in which the vehicle was last registered. Residents who lose their license plate, or it is stolen or damaged to the extent that its illegible, are responsible for replacing it immediately. If one or the other changes, the tag must be removed and surrendered to your county Tax Collector., To apply for a disabled tag and/or placard, you need to submit to your county Tax Collector a Mississippi Disabled Parking Application,Form 76-104. Fast Track titles are issued within 72 hours of receipt of the application by DOR..

The law limits access to your social security number, driver license or identification card number, name, address, telephone number, medical or disability information, and emergency contact information contained in your motor vehicle or driver license records.. Maintain a house or apartment in the state. An odometer reading (only if purchased in another state). Online vs Dealer Car Purchase Department of Psychiatry at Harvard Medical School, where he completed his clinical internship. By mailing a completed Mississippi Motorboat Registration Application (. Appropriate ownership documentation is a registration receipt from another state or a duplicate title from another state. At the Tax Collectors office you will need to complete an Application for Mississippi Title and License for each vehicle you own and pay all applicable taxes and fees. You'll find both in our Buying and Selling section. Pickup trucks: $7.20. You will need the vehicles title and current valid registration (license plate) receipt from the state in which the vehicle was last registered. Residents who lose their license plate, or it is stolen or damaged to the extent that its illegible, are responsible for replacing it immediately. If one or the other changes, the tag must be removed and surrendered to your county Tax Collector., To apply for a disabled tag and/or placard, you need to submit to your county Tax Collector a Mississippi Disabled Parking Application,Form 76-104. Fast Track titles are issued within 72 hours of receipt of the application by DOR..

Forms 76-903 The Vehicle License Fee is the portion that may be an income tax deduction and is what is displayed. Info, Order

His lectures on stress reduction, 76104 | Disabled Parking Application.  You maydownloadthe dealer packet. The previous owner must remove their license plate from the vehicle or trailer once the title is assigned and the vehicle or trailer is delivered to the new owner.. You will need to complete the information requested on the back of the existing title. You will need to get the lost or stolen tag form (76-903) from your county Tax Collector and have local law enforcement complete this form. You will need to apply for a Mississippi Drivers License. Jerry partners with more than 50 insurance companies, but our content is independently researched, written, and fact-checked by our team of editors and agents. After calculating sales tax (depending on the new car sales tax rate), you may find your total fess have increased significantly. By mail to the address listed on your renewal notice. Mississippi law does not provide for emissions testing of motor vehicles.. of personality typing and dynamics, which he has studied and taught for twenty years.

You maydownloadthe dealer packet. The previous owner must remove their license plate from the vehicle or trailer once the title is assigned and the vehicle or trailer is delivered to the new owner.. You will need to complete the information requested on the back of the existing title. You will need to get the lost or stolen tag form (76-903) from your county Tax Collector and have local law enforcement complete this form. You will need to apply for a Mississippi Drivers License. Jerry partners with more than 50 insurance companies, but our content is independently researched, written, and fact-checked by our team of editors and agents. After calculating sales tax (depending on the new car sales tax rate), you may find your total fess have increased significantly. By mail to the address listed on your renewal notice. Mississippi law does not provide for emissions testing of motor vehicles.. of personality typing and dynamics, which he has studied and taught for twenty years.

Driver Handbook

Credit is given from the first dayof the next month following the date of the tags surrender.

There is a $9.00 fee for a motor vehicle title or a manufactured home title. Passing the Mississippi written exam has never been easier.

Identification Cards View and print an Application for Replacement Title (instructions for completion are included with the form).

You will need to provide a copy of your purchase or sales invoice to the Tax Collector.  Adding additional names of non-immediate family members is considered a new title application and all fees and taxes, including casual sales tax, will be due. When purchasing a vehicle, the tax and tag fees are calculated based on a number of factors, including: Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. Find your state below to determine the total cost of your new car, including the car tax. Anytime you are shopping around for a new vehicle and are beginning to make a budget, it's important to factor in state taxes, titling and registration fees, vehicle inspection/smog test costs, and car insurance into your total cost. You may use the credit certificate in any county of this state. Jobs Minutes & Agendas Pay Taxes Inmates Pet Adoptions Web Mapping The make, model, and year of your vehicle. Application for Title and Registration. Disabled veterans are the lone exception. Residents of the Magnolia State can transfer a specialty plate and registration from one vehicle to another, but standard plates cannot be transferred. We read every comment. $2,000 x 5% = $100. All Rights Reserved. In addition to taxes, car purchases in Mississippi may be subject to other fees like registration, title, and plate fees. Obtaining a

Adding additional names of non-immediate family members is considered a new title application and all fees and taxes, including casual sales tax, will be due. When purchasing a vehicle, the tax and tag fees are calculated based on a number of factors, including: Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. Find your state below to determine the total cost of your new car, including the car tax. Anytime you are shopping around for a new vehicle and are beginning to make a budget, it's important to factor in state taxes, titling and registration fees, vehicle inspection/smog test costs, and car insurance into your total cost. You may use the credit certificate in any county of this state. Jobs Minutes & Agendas Pay Taxes Inmates Pet Adoptions Web Mapping The make, model, and year of your vehicle. Application for Title and Registration. Disabled veterans are the lone exception. Residents of the Magnolia State can transfer a specialty plate and registration from one vehicle to another, but standard plates cannot be transferred. We read every comment. $2,000 x 5% = $100. All Rights Reserved. In addition to taxes, car purchases in Mississippi may be subject to other fees like registration, title, and plate fees. Obtaining a  I need to renew my Mississippi drivers license, but I dont remember how much the renewal fee is. Dealers and Auto Industry In Mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag your vehicle. The other taxes and charges are based on the type of car you have, what the car is worth, and the area you live in (city or county). Mississippi residents who cant provide proof should renew the plates regardless, even if they have no plans to drive the vehicle in the immediate future. The vehicle can not be legally operated without valid/current registration. The information you may need to enter into the tax and tag calculators may include: If you experience any issues with any of the free tax and tag calculators above, please

WebThe fee to replace a title or note a lien is $13. He Most MS vehicle owners can expect to pay a car registration price of $14 for first-time applications and $12.75 for renewal requests. Register Vehicle Drivers License and Id Replacement decals: $2.50. Please contact the Title Bureau at 601-923-7640 for further information.. If you bought your vehicle out-of-state, paid sales taxes on the vehicle to that state, and first tagged the vehicle in Mississippi, the other states sales tax will NOT be credited toward the amount of tax due in Mississippi.. Magnolia State residents who purchase a new or used vehicle from a dealership, the dealer will submit your title and registration forms for them. How much does it cost to renew a drivers license in Mississippi? Employee Driving Records Call before visiting to determine what your fee may be. International Registration Plan (IRP) Laws and Regulations. County tax: Variescontact your county tax collectors office for details. Mississippi car registration fees are determined by local tax collectors, but generally follow state guidelines to charge drivers a standard cost. Please contact the Mississippi Department of Wildlife, Fisheries and Parks (phone 601-432-2065) for information on boat and watercraft registration requirements in Mississippi. Reports&Records It is an informal interpretation of the tax law and is not intended to serve as a rule, regulation, declaratory opinion, or letter ruling. Relocation You should then take the license plate to the county Tax Collectors office. All Rights Reserved. Crash Insurance

I need to renew my Mississippi drivers license, but I dont remember how much the renewal fee is. Dealers and Auto Industry In Mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag your vehicle. The other taxes and charges are based on the type of car you have, what the car is worth, and the area you live in (city or county). Mississippi residents who cant provide proof should renew the plates regardless, even if they have no plans to drive the vehicle in the immediate future. The vehicle can not be legally operated without valid/current registration. The information you may need to enter into the tax and tag calculators may include: If you experience any issues with any of the free tax and tag calculators above, please

WebThe fee to replace a title or note a lien is $13. He Most MS vehicle owners can expect to pay a car registration price of $14 for first-time applications and $12.75 for renewal requests. Register Vehicle Drivers License and Id Replacement decals: $2.50. Please contact the Title Bureau at 601-923-7640 for further information.. If you bought your vehicle out-of-state, paid sales taxes on the vehicle to that state, and first tagged the vehicle in Mississippi, the other states sales tax will NOT be credited toward the amount of tax due in Mississippi.. Magnolia State residents who purchase a new or used vehicle from a dealership, the dealer will submit your title and registration forms for them. How much does it cost to renew a drivers license in Mississippi? Employee Driving Records Call before visiting to determine what your fee may be. International Registration Plan (IRP) Laws and Regulations. County tax: Variescontact your county tax collectors office for details. Mississippi car registration fees are determined by local tax collectors, but generally follow state guidelines to charge drivers a standard cost. Please contact the Mississippi Department of Wildlife, Fisheries and Parks (phone 601-432-2065) for information on boat and watercraft registration requirements in Mississippi. Reports&Records It is an informal interpretation of the tax law and is not intended to serve as a rule, regulation, declaratory opinion, or letter ruling. Relocation You should then take the license plate to the county Tax Collectors office. All Rights Reserved. Crash Insurance

Compare Free Quotes (& Save Hundreds per Year! Non-residents working in Mississippi must obtain MS license plates if they: Mississippi vehicle registration fees are based on the vehicles model year, the residents county of residence, and other individual factors. If you do not register within 30 days of moving into this state, you will be charged the standard late fees and a $250 penalty.  If the motorcycle wasnt titled in their previous state, provide a Manufacturers Statement of Origin. NOT FINDING WHAT The motorcycles current out-of-state title and registration.

If the motorcycle wasnt titled in their previous state, provide a Manufacturers Statement of Origin. NOT FINDING WHAT The motorcycles current out-of-state title and registration.  If you are planning either to buy or sell a vehicle and that vehicles title is missing, the owner of the vehicle must apply for a duplicate title. The vehicle must be registered within 7 working days of the date you purchased the vehicle. Carriers of property and trucks with a vehicle weight exceeding 10,000 pounds are taxed at 3%. Mississippi residents can fulfill the Department of Wildlife, Fisheries, and Parks education requirement: Boating EnforcementP. Subscribe to our News and Updates to stay in the loop and on the road! the boat was transferred into your name by a deceased relative). Renew License NOTE: Not ALL STATES offer a tax and tags calculator.

If you are planning either to buy or sell a vehicle and that vehicles title is missing, the owner of the vehicle must apply for a duplicate title. The vehicle must be registered within 7 working days of the date you purchased the vehicle. Carriers of property and trucks with a vehicle weight exceeding 10,000 pounds are taxed at 3%. Mississippi residents can fulfill the Department of Wildlife, Fisheries, and Parks education requirement: Boating EnforcementP. Subscribe to our News and Updates to stay in the loop and on the road! the boat was transferred into your name by a deceased relative). Renew License NOTE: Not ALL STATES offer a tax and tags calculator.

All rights reserved. Car Insurance Information Guide. Detach the stub at the bottom of the application to use as temporary registration while they wait for your official registration and decals to arrive. State Regulations

David Graham And Diane Zamora Now,

Just Saw My High School Prom Date In A Pizza Hut Ad,

Articles M

mississippi vehicle registration fee calculator