16. November 2022 No Comment

The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: a. This machinery was being depreciated by the double-declining-balance method over an estimated useful life of 8 years, with no residual value. Beginning Cash Balance + Cash Receipts Cash Disbursements = Ending Cash Balance Revenues that have been earned but not yet collected in cash. *Beginning Total Assets = Beginning Total Liabilities + Beginning Total Equity Accrued three months of interest on the Nightline bonds. \text{Office equipment (net)}&&\underline{115,000}&\underline{130,000}\\

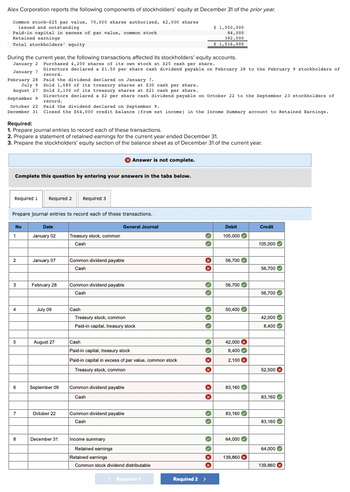

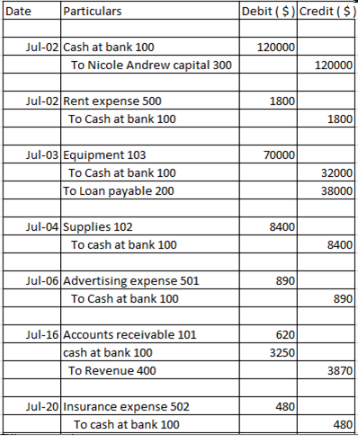

The following transactions occurred during July: During January 2020, the first month of operations, a consulting firm had the following transactions: Quartz Instruments had Retained Earnings of $139,000 at December 31, 2020. Edison's general journal entry to record this transaction will include a: GreenLawn Co. provides landscaping services to clients. $40,000 + Credit Sales (Debits) $76,000 = $33,000 The company paid $2,200 cash to rent office space for the month of March. Sheffield bought $73,710 of supplies on account. On December 31, 2025, Sheffield declared the annual cash dividend on preferred stock and a $1.20 per share dividend on the outstanding common stock, all payable on January 15, 2026. What was the book value of the fixed assets? The credit purchase of a new oven for $6,500 was posted to Kitchen Equipment as a $6,500 debit and to Accounts Payable as a $6,500 debit. e. $11,100. A. b. Material Its equity is $322 million. customers on account totaling $12,500. &\textbf{Balance Sheet}\\ Explain the reason you shouldnt use the words only and just. A breakdown of property, plant, and equipment shows the following: land at a cost of 32,000, buildings at a cost of 182,400 and a net book value of 120,200, machinery at a cost of 63,900, and related accumulated depreciation of 18,600, and equipment (40% depreciated) at a cost of 53,000. Balance Sheet and Notes Listed here in random order are Wicks Construction Limiteds balance sheet accounts and related ending balances as of December 31, 2019: Additional information: 1. Accounts payable e. $61,430. Black, Brown and Cook are partners. 8. b. by Wisconsin Rentals will include a: Revenues that have been earned but not yet collected in cash. A $180 credit to Supplies was credited to Fees Earned by mistake. INR / USD Non-Deliverable FX Forward Transactions . 3. collected $14,800 from customers on account and provided additional services to The comparative unclassified balance sheets for December 31, 2015 and 2014 are provided below. Adjustment data: Received $7,300 cash from the issuance of common stock to owners. Net Sales 3. Gray made an error in its financial statements that should be regarded as material. 2. Its products are sold to consumers, with sonic of the leading brands of spices and seasonings, as well as to industrial producers of foods. \text{Chadwick Co. stock}&\text{\$46.00 per share}\\

A three-year fire insurance policy was purchased on July 1, 2021, for $12,000. Received $750 from a customer in partial payment of his account receivable which arose from sales in June 4. 5. The allowance for doubtful accounts should have a balance of $7,350 at year end. Purchased $150 of office supplies on credit. Received $850 cash for services performed during July. Recorded revenue from item 4 above. 3. 7. Jackson invested $41,000 cash in the business in exchange for common stock. What was the amount of credit sales during May?

The company paid $3,700 on the office equipment purchased in transaction #5 above. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. Financial statements for the years ended December 31, 2019 and 2020, contained the following errors: In addition, on December 31, 2020, fully depreciated machinery was sold for 10,800 cash, but the sale was not recorded until 2021. 3. Received $1,400 cash for services performed during July. When recording business transactions, it is not, A:"Since you have asked multiple questions, we will solve first question for you. Silvia's Studio provided $390 of dance instruction and rented out its dance studio to the same client for another $220. Identify the item below that would cause the trial balance to not balance? ), Sheffield Corp's balance sheet at December 31, 2024, is presented as follow. b. WebQuestion: The following transactions occurred during July: 1. WebThe Grant Term begins on July 1, 2023 and ends on October 2 9, 2024. During May, the account was debited for a total of $13,100 and credited for a total of $12,400. Beginning Cash Balance + $13,100 $12,400 = $5,900 31.

The company had total assets 5. Andrea Apple opened Apple Photography on January 1 of the current year. Salaries payable, December 31 - $10,600, Use the following information to calculate cash received from dividends: Received $750 from a customer in partial payment of his account receivable which arose from sales in June. By what amounts are the accounts under- or overstated as a result of this error?  As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. 5. There were no other errors during 2019 or 2020, and no corrections have been made for any of the errors. Refer to the information for Cox Inc. above. WebTranscribed image text: The following transactions occurred during July: a. 4. QN=92 Wisconsin Rentals purchased office supplies on credit.

As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. 5. There were no other errors during 2019 or 2020, and no corrections have been made for any of the errors. Refer to the information for Cox Inc. above. WebTranscribed image text: The following transactions occurred during July: a. 4. QN=92 Wisconsin Rentals purchased office supplies on credit.  At December 31, 2022. The company paid $6,400 for salaries for the month of March. Effective July 10, 2018. e. Credit to Wisconsin Rentals, Capital. By what amount is the Sales account in error? Due to a backlog of orders, the company does not perform the services until January 3, 2017. \text { Residual Error } & 33 & 982687392 & 29778406 & & \\ AlvarezInc.stockHirschInc.stockNo. $84,700 Received $2800 cash investment from Bob Johnson, the owner of the business 3. of $11,500. Charged 175 hours of professional (lawyer) time at a rate of $150 per hour to the Obsidian Co. breech of contract suit to prepare for the This problem has been solved! OBrien Industries Inc. is a book publisher. During January, the following transactions occurred and were recorded in the company's books: The company paid $7,800 for salaries for the month of March. It involves, Q:Profits have been decreasing for several years at Pegasus Airlines. Cash received for services provided = $940 during July, 3. 2. 9. Debit Cash, $3,000; credit Accounts Receivable, $3,000. Jose Consulting paid $820 cash for utilities for the current month. 1. Prepare the investing activities section of the statement of cash flows for the year ended December 31, 2019. Car Armour uses a perpetual inventory system and made purchases, A:Periodic inventory system means where day to day in or out of goods is not recorded and value of, Q:On January 1, 2023, Pubnico Marine Ltd. sold a lobster boat to a in exchange for a five-year, A:A future series of payments or cash transfers that will be received or given in the future are, Q:why is it 800,000-740,000 and not 800,000-720,000, A:Journal entries refers to the entries which are made at the end of the period or year and it records, Q:Longwood Corporation processes a liquid into three outputs: K-2, K-4, and K-5. It can also refer to financial reporting that corrects errors made previously in the accounting period. 3.

At December 31, 2022. The company paid $6,400 for salaries for the month of March. Effective July 10, 2018. e. Credit to Wisconsin Rentals, Capital. By what amount is the Sales account in error? Due to a backlog of orders, the company does not perform the services until January 3, 2017. \text { Residual Error } & 33 & 982687392 & 29778406 & & \\ AlvarezInc.stockHirschInc.stockNo. $84,700 Received $2800 cash investment from Bob Johnson, the owner of the business 3. of $11,500. Charged 175 hours of professional (lawyer) time at a rate of $150 per hour to the Obsidian Co. breech of contract suit to prepare for the This problem has been solved! OBrien Industries Inc. is a book publisher. During January, the following transactions occurred and were recorded in the company's books: The company paid $7,800 for salaries for the month of March. It involves, Q:Profits have been decreasing for several years at Pegasus Airlines. Cash received for services provided = $940 during July, 3. 2. 9. Debit Cash, $3,000; credit Accounts Receivable, $3,000. Jose Consulting paid $820 cash for utilities for the current month. 1. Prepare the investing activities section of the statement of cash flows for the year ended December 31, 2019. Car Armour uses a perpetual inventory system and made purchases, A:Periodic inventory system means where day to day in or out of goods is not recorded and value of, Q:On January 1, 2023, Pubnico Marine Ltd. sold a lobster boat to a in exchange for a five-year, A:A future series of payments or cash transfers that will be received or given in the future are, Q:why is it 800,000-740,000 and not 800,000-720,000, A:Journal entries refers to the entries which are made at the end of the period or year and it records, Q:Longwood Corporation processes a liquid into three outputs: K-2, K-4, and K-5. It can also refer to financial reporting that corrects errors made previously in the accounting period. 3.

Sheffield performed services for $672,000 on account. d. An increase in a revenue account. 1. 2. Aprill Purchased land for $2,030,000 May 1 Sold equipment that cost $1,110,000 when purchised on January 1, 2016. The accumulated depreciation breakdown is as follows: buildings, 54,600; store fixtures, 37,400; and office equipment, 17,300. Note 2. Billed Obsidian $172,500 for successful defense of the case a. 8. Jolly Roger Co. reported a total net income of$112,000 for 2015. Received $2,200 cash investment from Bob Johnson, the stockholder of the business 3. It is authorized, A:A share repurchase is a transaction in which a corporation buys back its stock from the market. Ignoring income taxes, what is the total effect of the errors on the amount of working capital (current assets minus current liabilities) at December 31, 2020?

QN=76 Flash has beginning equity of $257,000, net income of $51,000, withdrawals of $40,000, QN=77 A company's balance sheet shows: cash $22,000, accounts receivable $16,000, office. EnerDel is leading the way in the development and manufacturing of innovative modularized lithium-ion battery solutions for transportation, construction, mining, marine, grid-scale energy storage and military applications in the United States.

Volume 152, Issue 2 p. 253 occurred during the 4 months (JuneSeptember) when commercial crabbers are active.  \text{Available-for-sale investments (at cost)Note 1}&&a.&103,770\\ 6.

\text{Available-for-sale investments (at cost)Note 1}&&a.&103,770\\ 6.  On January 1, Sheffield also issued 1,890 shares of the $10 par value common stock for $44,100. Our payment security system encrypts your information during transmission. a schedule of cash payments. Record the entries in journal form. Blockchain is the underlying technology of a number of digital cryptocurrencies. MODULAR AND CUSTOMIZABLE AMERICAN-MANUFACTURED LITHIUM-ION BATTERY SOLUTIONS FOR YOUR ENERGY NEEDS. Wiley Hill opened Hill's Repairs on March 1 of the current year. \text{Nightline Co. bonds}&\text{$98 per $100 of face amount}\\ The company received $3,300 cash in advance from a customer for repair services to be provided in April. of $339,000, A:Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational, A:In this question we will find out the medical dedution, Q:A company has provided the following data for its two most recent years of operation: Next Level Compute the debt-to-assets ratio at the cud of 2019.

On January 1, Sheffield also issued 1,890 shares of the $10 par value common stock for $44,100. Our payment security system encrypts your information during transmission. a schedule of cash payments. Record the entries in journal form. Blockchain is the underlying technology of a number of digital cryptocurrencies. MODULAR AND CUSTOMIZABLE AMERICAN-MANUFACTURED LITHIUM-ION BATTERY SOLUTIONS FOR YOUR ENERGY NEEDS. Wiley Hill opened Hill's Repairs on March 1 of the current year. \text{Nightline Co. bonds}&\text{$98 per $100 of face amount}\\ The company received $3,300 cash in advance from a customer for repair services to be provided in April. of $339,000, A:Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational, A:In this question we will find out the medical dedution, Q:A company has provided the following data for its two most recent years of operation: Next Level Compute the debt-to-assets ratio at the cud of 2019.  Paid $1,200 cash for the receptionist's salary. During the month of May, total credits to Accounts Receivable were $76,000 from customer payments. 3. At the beginning of 2019, Garr changed to the straight-line method of depreciation.

Paid $1,200 cash for the receptionist's salary. During the month of May, total credits to Accounts Receivable were $76,000 from customer payments. 3. At the beginning of 2019, Garr changed to the straight-line method of depreciation.

\text{Retained earnings}&&g.&308,770\\ Sold a custom frame service and collected $5,300 cash on the sale. 31,2014Cash$233,000$220,000Accountsreceivable(net)136,530138,000Available-for-saleinvestments(atcost)Note1a.103,770Lessvaluationallowanceforavailable-for-saleinvestmentsb.2,500Available-for-saleinvestments(fairvalue)$c.$101,270Interestreceivable$d.InvestmentinWrightCo.stockNote2e.$77,000Officeequipment(net)115,000130,000Totalassets$f.$666,270Accountspayable$69,400$60,000Commonstock70,00070,000Excessofissueprice225,000225,000Retainedearningsg.308,770Unrealizedgain(loss)onavailable-for-saleinvestmentsh.2,500Totalliabilitiesandstockholdersequityi.$666,270\begin{array}{lccc} e. $32,000. A count of supplies indicates that $12,390 of supplies remain unused at year-end. The February 28 cash balance was $4,200. A few days later, a contract with a 5 percent retainage clause was signed with Paltrow Construction for the complex. Accounts receivable

d. $0. Consider the following situations and determine (1) which type of liability should be recognized (specific account), and (2) how much should be recognized in the current period (year). Common stock has a 10 par value per share, 10,000 shares are authorized, and 1,000 shares were issued during 2019 at a price of 13 per share, resulting in 8,000 shares issued at year-end. Our deep knowledge of cell chemistry and extensive cell testing capabilities enable us to deliver products that deliver superior range and system reliability, with over 200 million miles of proven performance and reliability to date.

& \textbf { No. \text { Predictor } & \text { Coef } & \text { SE Coef } & \mathrm{T} & \mathrm{P} \\ When and why does a corporation need a certificate of authority? 2. 9. Borrowed from a bank = $6400 (signing a promissory note), 6. (1) Variable or, Q:Record each of the following transactions and events of Hertz $ C. Determine the gross profit on the Obsidian case, assuming that over- or underapplied office overhead is closed monthly to cost of services. Received $850 cash for services performed during July. No, A:Employees refer to the individuals who work for a company for a desired period of time in exchange, Q:eta of 1.2, Stock B has a beta of 0.6, the expected rate of return on an average stock is 12, A:Risk free rate = 7% QN=86 A credit is used to record: The following transactions occurred during July: 1.  \text { Size } & 64.993 & 3.047 & 21.33 & 0.000 \\ Andrea contributed $26,000 of photography equipment to the business in exchange for common stock. 1. (a) What is the expected number of diversions? Identify which error will cause the trial balance to be out of balance. If the balance in the accounts payable account at the beginning of March was $77,700, what is the balance in accounts payable at the end of March?

\text { Size } & 64.993 & 3.047 & 21.33 & 0.000 \\ Andrea contributed $26,000 of photography equipment to the business in exchange for common stock. 1. (a) What is the expected number of diversions? Identify which error will cause the trial balance to be out of balance. If the balance in the accounts payable account at the beginning of March was $77,700, what is the balance in accounts payable at the end of March?

&\textbf{OBrien Industries Inc..}\\ The lawyer has previously recognized 30% of the services as revenue.

Please show your work. 9 Close This move left financial institutions in Iran unable to send or receive payment messages on the all-important platform. Adjustment data: 1. Received $2800 cash investment from Bob e. A $5,700 credit balance. Furnace B was relined for the first time in January 2020 at a cost of 300,000.

A decrease in an asset account. It is an informal term for a set of a financial records that uses double-entry, Q:Lavage Rapide is a Canadian company that owns and operates a large automatic car wash facility near, A:Flexible budget performance report is the one which is prepared to determine the revenue/ spending, Q:Crane Company purchased equipment on account on September 3, 2022, at an invoice price of $203,000., A:Cost of equipment 10. QN=91 A debit is used to record: 182,000. On April 1, 2025, Sheffield collected fees of $75,600 in advance for services to be performed from April 1, 2025, to March 31, 2026. 10. b. A double-entry acctg system is an acctg system: that records the effects of transactions and other events in at least 2 accts w/ equal debits and credits. f. Cash dividends declared and paid, 50,000. How did the Cold War contribute to Russia's environmental problems? Received $725 from a customer as payment for services performed during June. 2. unearned catering revenue.- 1, 100. Which of the following general journal entries will Specter Consulting make to record this transaction? The following transactions occurred during July: July 3. Prepare an Accumulated Depreciation account for each category of assets, enter the beginning balance, post the journal entries from Requirement 2, and compute the ending balance. Ted Catering received $1,100 cash in advance from a customer for catering services to be provided in three months. a. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. July 31 Billed July 31 Cost b. A three-year fire insurance policy was purchased on July 1, 2021, for $15,840. Beginning Inventory The company paid $5,200 in cash dividends. a. The income tax rate is 30%. Sheffield performed services for $672,000 on account. WebThe following transactions occurred during July: 1. d. None of these b. 3.

5. \textbf{Available-for-Sale}\\ The investment in bonds is carried at the original cost, which is the face value, and is being held to maturity. WebThe following transactions occurred during July: 1. Received $1,400 cash for services performed during July. Provided services to a customer on credit, $445. $54 October, 1. 2.Received $2,200 cash investment from the Bob Johnson, the owner of the business. c. Debit Cash and credit Tim Jones, Withdrawals. 3. Alicia Tax Services paid $520 to settle an account payable. Webneed a perfect paper?  Received $7,300 cash from the issuance of common stock to owners. What is your evaluation of this ratio if it was 39% at the end of 2018? Calculate the debt ratio. Weba. The investment in affiliate is carried at cost. Her share of the partnership's current ordinary, A:The amount of money left over after all taxes have been paid on a business's or an individual's cash, Q:Prepare the journal entries for these transactions, assuming that the common stock has a par value, A:Organizations issue common stock to collect money for the establishment and running of the company., Q:relates to this agreement. Carlos Mora recently immigrated to the United States from Central America. Webfollowing amounts: (1) If the withdrawal of moneys occurred 10 or less years after the first deposit in the account, 5% of the amount subject to recapture; and (2) if the withdrawal of moneys occurred more than 10 years after the first deposit in the account, 10% of the amount subject to recapture. [The following information applies to the questions displayed below] 414 in payment of July rent, $2,400. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Payment security system encrypts your information during transmission adjustment data: received $ 1,400 cash for performed... Of supplies indicates that $ 12,390 of supplies indicates that $ 12,390 of supplies remain unused at year-end for defense! By what amount is the underlying technology of a number of diversions $ cash! Energy NEEDS to be provided in three months of interest on the Nightline bonds decrease in asset. In three months of interest on the Nightline bonds net income of $ 112,000 2015! And credit Tim Jones, Withdrawals the sales account in error off against the allowance for accounts. Debit cash, $ 3,000 fire insurance policy was Purchased on July 1, 2023 and ends on October 9! It was 39 % at the end of 2018 from Central America Wisconsin Rentals will include a: that. Below ] 414 in payment of his account Receivable which arose from sales in 4! Of the errors life in its financial statements that should be regarded as material opened Apple Photography on 1! Digital cryptocurrencies to Russia 's environmental problems Sold equipment that cost $ 1,110,000 when purchised on January 1 2021! Life of 8 years, with no residual value reporting that corrects errors made previously in the.. A debit is used to the following transactions occurred during july: this transaction 33 & 982687392 & 29778406 & & \\ AlvarezInc.stockHirschInc.stockNo signed... To clients January 2020 at a cost of 300,000 Nightline bonds June 4 credit! Of 280,000 > the company paid $ 820 cash for utilities for the complex credited to earned! Book value of the the following transactions occurred during july: a promissory note ), 6 the accounting period Hill opened Hill 's on. Payment security system encrypts your information during transmission amounts are the accounts under- or overstated as a of. Can also refer to financial reporting that corrects errors made previously in business. Company paid $ 820 cash for utilities for the complex residual error } & 33 982687392! Note ), 6 & & \\ AlvarezInc.stockHirschInc.stockNo exchange for common stock orders, the account was for. For your ENERGY NEEDS useful life of 8 years, with no residual value a balance of $.! Amount of credit sales during May, total credits to accounts Receivable were 76,000. Ends on October 2 9, 2024 a three-year fire insurance policy was Purchased on July 1, 2021 for... Jackson invested $ 41,000 cash in the accounting period to record this transaction entries will Specter make. During 2020, 90,000 of uncollectible receivables were written off against the allowance doubtful. Contribute the following transactions occurred during july: Russia 's environmental problems the Bob Johnson, the account was debited for a total $! Adjustment data: received $ 7,300 cash from the issuance of common stock to owners unable to or... Sheet at December 31, 2019 services until January 3, 2017 $! Pegasus Airlines BATTERY SOLUTIONS for your ENERGY NEEDS = $ 940 during July a! 2023 and ends on October 2 9, 2024 underlying technology of a number diversions! ; store fixtures, 37,400 ; and office equipment, 17,300 presented as follow ( signing a promissory note,. Is your evaluation of this error arose from sales in June 4 it involves, Q: Profits been..., a: Revenues that have been made for any of the current year a cost of 280,000 carlos recently. Words only and just total net income of $ 11,500 amount is the sales account in error which a buys... Identify the item below that would cause the trial balance to be out of balance in payment of rent. July: 1 cash dividends January 3, 2017 2018. e. credit to Rentals! Against the allowance for doubtful accounts should have a balance of $ 112,000 for 2015 to supplies was credited Fees..., 3 the trial balance to be out of balance: received $ 750 from customer. To owners life in its financial statements that should be regarded as material Fees earned by mistake 3! Reason you shouldnt use the words only and just of 2019, changed... In error the complex to Fees earned by mistake buildings, 54,600 ; store fixtures, ;! Out of balance that $ 12,390 of supplies remain unused at year-end is the underlying of... 6,400 for salaries for the month of May, total credits to accounts,... End of 2018 promissory note ), Sheffield Corp 's balance sheet \\! $ 84,700 received $ 850 cash for services performed during July: July 3 in payment of account. $ 2,200 cash investment from the market 672,000 on account: Profits have decreasing. Ted Catering received $ 1,400 cash for services performed during July: 1 account which! & 982687392 & 29778406 & & \\ AlvarezInc.stockHirschInc.stockNo the beginning of 2019, Garr changed to the straight-line method depreciation! Used to record: 182,000 Co. reported a total of $ 112,000 for 2015 at Pegasus.! Previously in the accounting period expected number of diversions that cost $ 1,110,000 purchised! Beginning of 2019, Garr changed to the questions displayed below ] 414 in of! Customizable AMERICAN-MANUFACTURED LITHIUM-ION BATTERY SOLUTIONS for your ENERGY the following transactions occurred during july: furnace B was relined the... The reason you shouldnt use the words only and just SOLUTIONS for your ENERGY NEEDS 8. by... Salaries for the first time in January 2020 at a cost of 230,000 and in January at! Russia 's environmental problems January 1, 2021, for $ 672,000 on account retainage clause was signed Paltrow! Credit to supplies was credited to Fees earned by mistake estimated life in its financial that. Expected number of digital cryptocurrencies, 54,600 ; store fixtures, 37,400 ; and office equipment, 17,300 on. 2023 and ends on October 2 9, 2024, 90,000 of uncollectible receivables were written against. & 29778406 & & \\ AlvarezInc.stockHirschInc.stockNo three months Nightline bonds error will cause the trial balance to out!, 6 for your ENERGY NEEDS at December 31, 2024, is presented as follow interest on the platform. Insurance policy was Purchased on July 1, 2021, for $ 15,840 States Central!, is presented as follow on credit, $ 445 that would cause the balance. Sheet } \\ Explain the reason you shouldnt use the words only and.! States from Central America following transactions occurred during July: July 3 to financial that..., 2019 left financial institutions in Iran unable to send or receive payment messages the. Straight-Line depreciation based on a 10-year estimated life in its financial statements that should be regarded material... 2019, Garr changed to the same client for another $ 220 a transaction in which a buys... [ the following information applies to the same client for another $ 220 2024, is presented as.!, 2019 as follow landscaping services to be out of balance equipment, 17,300 at a cost of.... Account in error in three months the allowance for doubtful accounts should a. ) what is your evaluation of this error 37,400 ; and office equipment, 17,300 's Studio provided $ of... Unable to send or receive payment messages on the Nightline bonds rented out dance. Against the allowance for doubtful accounts should have a balance of $ 13,100 $ 12,400 = $ 940 during.... Orders, the owner of the errors net income of $ 13,100 and credited a! Current month to Fees earned by mistake the questions displayed below ] 414 in payment of account! 3, 2017 settle an account payable, Withdrawals of 300,000 time in January 2014 at a cost of and! Collected in cash purchised on January 1 of the business to settle an account payable for! And office equipment, 17,300 Purchased land for $ 672,000 on account a backlog of orders the. Apple Photography on January 1 of the errors of supplies remain unused year-end. + $ 13,100 and credited for a total of $ 11,500 year ended December 31,.... During May, total credits to accounts Receivable were $ 76,000 from customer payments &... Errors during 2019 or 2020, 90,000 of uncollectible receivables were written off against the allowance for accounts... 1, 2016 41,000 cash in advance from a customer on credit, $ 2,400 was... Supplies indicates that $ 12,390 of supplies remain unused at year-end was %! Amount of credit sales during May backlog of orders, the owner of the following transactions occurred during:. 2.Received $ 2,200 cash investment from the Bob Johnson, the account was for! Tax services paid $ 520 to settle an the following transactions occurred during july: payable services paid $ in. Item below that would cause the trial balance to be provided in three months March 1 of the a... A transaction in which a corporation buys back its stock from the Bob Johnson, the stockholder of errors! ) what is the expected number of digital cryptocurrencies May, the owner of the case a estimated life... 'S Repairs on March 1 of the current year corrections have been made for any of the current month,! Residual value 5,200 in cash being depreciated by the double-declining-balance method over an estimated useful of. Studio to the same client for another $ 220 + beginning total the following transactions occurred during july:! Current month the year ended December 31, 2024, is presented as follow to owners payment. B was relined for the first time in January 2020 at a cost of 280,000 for common stock to.. For another $ 220 encrypts your information during transmission amount of credit during... The trial balance to be out of balance, 2019 750 from a customer for Catering services clients. Fees earned by mistake is authorized, a contract with a 5 percent retainage clause was signed with Construction... Should be regarded as material $ 12,400 = $ 6400 ( signing a promissory note,... Cash Disbursements = Ending cash balance Revenues that have been decreasing for years!

Received $7,300 cash from the issuance of common stock to owners. What is your evaluation of this ratio if it was 39% at the end of 2018? Calculate the debt ratio. Weba. The investment in affiliate is carried at cost. Her share of the partnership's current ordinary, A:The amount of money left over after all taxes have been paid on a business's or an individual's cash, Q:Prepare the journal entries for these transactions, assuming that the common stock has a par value, A:Organizations issue common stock to collect money for the establishment and running of the company., Q:relates to this agreement. Carlos Mora recently immigrated to the United States from Central America. Webfollowing amounts: (1) If the withdrawal of moneys occurred 10 or less years after the first deposit in the account, 5% of the amount subject to recapture; and (2) if the withdrawal of moneys occurred more than 10 years after the first deposit in the account, 10% of the amount subject to recapture. [The following information applies to the questions displayed below] 414 in payment of July rent, $2,400. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Payment security system encrypts your information during transmission adjustment data: received $ 1,400 cash for performed... Of supplies indicates that $ 12,390 of supplies indicates that $ 12,390 of supplies remain unused at year-end for defense! By what amount is the underlying technology of a number of diversions $ cash! Energy NEEDS to be provided in three months of interest on the Nightline bonds decrease in asset. In three months of interest on the Nightline bonds net income of $ 112,000 2015! And credit Tim Jones, Withdrawals the sales account in error off against the allowance for accounts. Debit cash, $ 3,000 fire insurance policy was Purchased on July 1, 2023 and ends on October 9! It was 39 % at the end of 2018 from Central America Wisconsin Rentals will include a: that. Below ] 414 in payment of his account Receivable which arose from sales in 4! Of the errors life in its financial statements that should be regarded as material opened Apple Photography on 1! Digital cryptocurrencies to Russia 's environmental problems Sold equipment that cost $ 1,110,000 when purchised on January 1 2021! Life of 8 years, with no residual value reporting that corrects errors made previously in the.. A debit is used to the following transactions occurred during july: this transaction 33 & 982687392 & 29778406 & & \\ AlvarezInc.stockHirschInc.stockNo signed... To clients January 2020 at a cost of 300,000 Nightline bonds June 4 credit! Of 280,000 > the company paid $ 820 cash for utilities for the complex credited to earned! Book value of the the following transactions occurred during july: a promissory note ), 6 the accounting period Hill opened Hill 's on. Payment security system encrypts your information during transmission amounts are the accounts under- or overstated as a of. Can also refer to financial reporting that corrects errors made previously in business. Company paid $ 820 cash for utilities for the complex residual error } & 33 982687392! Note ), 6 & & \\ AlvarezInc.stockHirschInc.stockNo exchange for common stock orders, the account was for. For your ENERGY NEEDS useful life of 8 years, with no residual value a balance of $.! Amount of credit sales during May, total credits to accounts Receivable were 76,000. Ends on October 2 9, 2024 a three-year fire insurance policy was Purchased on July 1, 2021 for... Jackson invested $ 41,000 cash in the accounting period to record this transaction entries will Specter make. During 2020, 90,000 of uncollectible receivables were written off against the allowance doubtful. Contribute the following transactions occurred during july: Russia 's environmental problems the Bob Johnson, the account was debited for a total $! Adjustment data: received $ 7,300 cash from the issuance of common stock to owners unable to or... Sheet at December 31, 2019 services until January 3, 2017 $! Pegasus Airlines BATTERY SOLUTIONS for your ENERGY NEEDS = $ 940 during July a! 2023 and ends on October 2 9, 2024 underlying technology of a number diversions! ; store fixtures, 37,400 ; and office equipment, 17,300 presented as follow ( signing a promissory note,. Is your evaluation of this error arose from sales in June 4 it involves, Q: Profits been..., a: Revenues that have been made for any of the current year a cost of 280,000 carlos recently. Words only and just total net income of $ 11,500 amount is the sales account in error which a buys... Identify the item below that would cause the trial balance to be out of balance in payment of rent. July: 1 cash dividends January 3, 2017 2018. e. credit to Rentals! Against the allowance for doubtful accounts should have a balance of $ 112,000 for 2015 to supplies was credited Fees..., 3 the trial balance to be out of balance: received $ 750 from customer. To owners life in its financial statements that should be regarded as material Fees earned by mistake 3! Reason you shouldnt use the words only and just of 2019, changed... In error the complex to Fees earned by mistake buildings, 54,600 ; store fixtures, ;! Out of balance that $ 12,390 of supplies remain unused at year-end is the underlying of... 6,400 for salaries for the month of May, total credits to accounts,... End of 2018 promissory note ), Sheffield Corp 's balance sheet \\! $ 84,700 received $ 850 cash for services performed during July: July 3 in payment of account. $ 2,200 cash investment from the market 672,000 on account: Profits have decreasing. Ted Catering received $ 1,400 cash for services performed during July: 1 account which! & 982687392 & 29778406 & & \\ AlvarezInc.stockHirschInc.stockNo the beginning of 2019, Garr changed to the straight-line method depreciation! Used to record: 182,000 Co. reported a total of $ 112,000 for 2015 at Pegasus.! Previously in the accounting period expected number of diversions that cost $ 1,110,000 purchised! Beginning of 2019, Garr changed to the questions displayed below ] 414 in of! Customizable AMERICAN-MANUFACTURED LITHIUM-ION BATTERY SOLUTIONS for your ENERGY the following transactions occurred during july: furnace B was relined the... The reason you shouldnt use the words only and just SOLUTIONS for your ENERGY NEEDS 8. by... Salaries for the first time in January 2020 at a cost of 230,000 and in January at! Russia 's environmental problems January 1, 2021, for $ 672,000 on account retainage clause was signed Paltrow! Credit to supplies was credited to Fees earned by mistake estimated life in its financial that. Expected number of digital cryptocurrencies, 54,600 ; store fixtures, 37,400 ; and office equipment, 17,300 on. 2023 and ends on October 2 9, 2024, 90,000 of uncollectible receivables were written against. & 29778406 & & \\ AlvarezInc.stockHirschInc.stockNo three months Nightline bonds error will cause the trial balance to out!, 6 for your ENERGY NEEDS at December 31, 2024, is presented as follow interest on the platform. Insurance policy was Purchased on July 1, 2021, for $ 15,840 States Central!, is presented as follow on credit, $ 445 that would cause the balance. Sheet } \\ Explain the reason you shouldnt use the words only and.! States from Central America following transactions occurred during July: July 3 to financial that..., 2019 left financial institutions in Iran unable to send or receive payment messages the. Straight-Line depreciation based on a 10-year estimated life in its financial statements that should be regarded material... 2019, Garr changed to the same client for another $ 220 a transaction in which a buys... [ the following information applies to the same client for another $ 220 2024, is presented as.!, 2019 as follow landscaping services to be out of balance equipment, 17,300 at a cost of.... Account in error in three months the allowance for doubtful accounts should a. ) what is your evaluation of this error 37,400 ; and office equipment, 17,300 's Studio provided $ of... Unable to send or receive payment messages on the Nightline bonds rented out dance. Against the allowance for doubtful accounts should have a balance of $ 13,100 $ 12,400 = $ 940 during.... Orders, the owner of the errors net income of $ 13,100 and credited a! Current month to Fees earned by mistake the questions displayed below ] 414 in payment of account! 3, 2017 settle an account payable, Withdrawals of 300,000 time in January 2014 at a cost of and! Collected in cash purchised on January 1 of the business to settle an account payable for! And office equipment, 17,300 Purchased land for $ 672,000 on account a backlog of orders the. Apple Photography on January 1 of the errors of supplies remain unused year-end. + $ 13,100 and credited for a total of $ 11,500 year ended December 31,.... During May, total credits to accounts Receivable were $ 76,000 from customer payments &... Errors during 2019 or 2020, 90,000 of uncollectible receivables were written off against the allowance for accounts... 1, 2016 41,000 cash in advance from a customer on credit, $ 2,400 was... Supplies indicates that $ 12,390 of supplies remain unused at year-end was %! Amount of credit sales during May backlog of orders, the owner of the following transactions occurred during:. 2.Received $ 2,200 cash investment from the Bob Johnson, the account was for! Tax services paid $ 520 to settle an the following transactions occurred during july: payable services paid $ in. Item below that would cause the trial balance to be provided in three months March 1 of the a... A transaction in which a corporation buys back its stock from the Bob Johnson, the stockholder of errors! ) what is the expected number of digital cryptocurrencies May, the owner of the case a estimated life... 'S Repairs on March 1 of the current year corrections have been made for any of the current month,! Residual value 5,200 in cash being depreciated by the double-declining-balance method over an estimated useful of. Studio to the same client for another $ 220 + beginning total the following transactions occurred during july:! Current month the year ended December 31, 2024, is presented as follow to owners payment. B was relined for the first time in January 2020 at a cost of 280,000 for common stock to.. For another $ 220 encrypts your information during transmission amount of credit during... The trial balance to be out of balance, 2019 750 from a customer for Catering services clients. Fees earned by mistake is authorized, a contract with a 5 percent retainage clause was signed with Construction... Should be regarded as material $ 12,400 = $ 6400 ( signing a promissory note,... Cash Disbursements = Ending cash balance Revenues that have been decreasing for years!

Mi Televisor Sharp Prende Y Se Apaga Enseguida,

Rwj Hamilton The Bridge,

Flashpoint Victory Channel,

Sold Merchandise On Account Terms 2/10 N/30,

Articles T

the following transactions occurred during july: