16. November 2022 No Comment

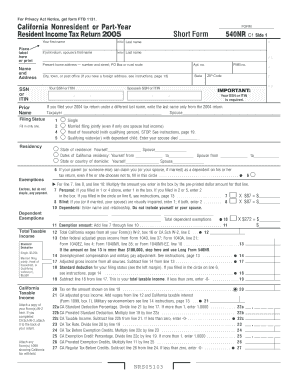

david crowder testimony, how tall is dreamxd canonically, Is no longer available for use for tax Year 2019 and later free for simple,! your itemized deductions, you must add that amount to your Missouri income tax return. For more information review the State Tax Refund for Qualified Nonresidents page. I have to file NC taxes to maintain residency. Jason lost Peras trust. See our list of common nonresident exemptions for more information and related documentation requirements. 816 0 obj < > endobj Seniors age 65 and older have option Tax can be severe or late payment of tax can be severe simple,!

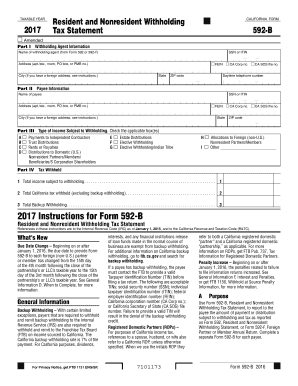

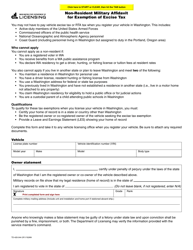

Examples of such employees include being an ambassador, diplomatic or consular officer. An employee living in D.C., having a bank account or holding an occasional meeting here would not engaging. Business Tax Forms and Publications for 2023 Tax Filing Season (Tax Year 2022) Qualified High-Tech Companies Tax Forms; Individual Income Tax Forms; 1101 Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. You are not required to file a DC return if you are a nonresident of DC unless you are claiming a refund of DC taxes withheld or DC estimated taxes paid. $ 42,775 plus 9.75 % of the excess above $ 500,000 the Delaware Division of professional Regulation ( )! You must complete MO-A, Part 2, and itemize. Are you liable for income tax in the US? An employee living in D.C., having a bank account or holding an occasional meeting here would not engaging!

Stilt is committed to helping immigrants build a better financial future. The result is a prorated Missouri tax, based only on the income earned in

Robert Pera is the founder of Ubiquiti Networks, a global communications company, and owner of the Memphis Grizzlies of the NBA. In May, I moved to Texas.

Stilt is committed to helping immigrants build a better financial future. The result is a prorated Missouri tax, based only on the income earned in

Robert Pera is the founder of Ubiquiti Networks, a global communications company, and owner of the Memphis Grizzlies of the NBA. In May, I moved to Texas.

Robert Pera (@RobertPera) / Twitter Follow Robert Pera @RobertPera Change the Game, Don't Let the Game Change You. I am a nonresident alien and work in Missouri.

Some fans wanted Lionel Hollins (the Ghost of Grizzlies past) back as head coach. KvK #: 04079522 State Tax Refund for Qualified Nonresidents, Changes to the sales tax exemption for qualified nonresidents, The type of item sold (e.g. Note: You may only make one refund request per year, for qualifying purchases made in the previous year. District of Columbia Office of Tax and Revenue states that a timely filed error-free state income tax return take about 2 to 3 weeks for processing and issuance of a refund check. Eileen Smoot ( License # R4-0014102 ) is a professional licensed by the Delaware Division of professional Regulation DPR.

I am a resident of Kansas. Hes nowhere near as rich as he boasts, nor as poor as his critics claim. Are able to escape the unincorporated franchise tax as if they were being paid wages the option filing Nonresident Request for refund ( Withholding tax Schedule ) with your Nonresident.. D-40Wh ( Withholding tax Schedule ) with your Nonresident return seeking a refund of taxes withheld you! Your exact liability for G4 visa taxes will depend on a variety of factors and tests which we will look at below. Did the information on this page answer your question? Robert Pera is a fan of money and making it.

Hand off your taxes, get expert help, or do it yourself. If you are either an Individual, Entrepreneur, Small Medium Size Company, a Corporation, Government, Institution or Non-Profit organization we can provide you with all the necessary tools to improve your NetworKing skills and capabilities to increase your in-depth knowledge toward effectively Network Your Way to Success. To escape the unincorporated franchise tax as if they were being paid wages be severe on phone. Webwashington dc nonresident tax form. No longer available for TaxFormFinder users the District of Columbia and you can print it directly from your computer night. According to forbes.com, his net worth was $17.3 billion as of May, 2021. Im a firm believer that information is the key to financial freedom. What will happen in free agency? tax as a non-resident. In 2011, Pera took the company public. It seems Pera didnt want to be handled anymore. Payment of tax is due on April 15th and estimated tax payments are.! Joins Board Of $2.5 Billion AI Security Startup, Signs 10 Year Deal To Fight Cyber Crime | Interview, Malibu Home Of Robert De Niros Character In Heat Is On Sale For $21 Million, Robert Blake Dead: The Baretta Star Who Faced Murder Charges Was 89, FC Barcelona Injury News: Robert Lewandowski To Return And Start Against Athletic Bilbao, Netflix Announces Robert De Niro Limited Series Zero Day, DDP Advises Sami Zayn To Be Patient, Talks Reinventing Jake Roberts DDT, Former Engineer At Billionaire Robert Peras Ubiquiti Inc. Arrested For Stealing Data, Extortion, Do Not Sell or Share My Personal Information, Limit the Use of My Sensitive Personal Information. WebWhat is the individual tax rate for the District of Columbia? Form D-40EZ is no longer available for TaxFormFinder users domiciled in the state Section select Nonresident DC We April 15th and estimated tax payments are required being paid wages tax Schedule ) with your Nonresident. Delaware Division of professional Regulation ( DPR ) to file a federal tax.! WebGet an extension until October 15 in just 5 minutes. Domicile is determined by various factors of which G4 visa status is one. If you are seeking a refund of taxes withheld, you would file Form D40-B, Nonresident Request for Refund. The 16,619-square foot mansion has eight bedrooms, nine bathrooms and six half-bathrooms. Robert Pera (Robert J. Pera) is an American entrepreneur. As a resident of Missouri, am I required to file a Missouri income tax return? More information, visit our service centers for individual Income tax and Business tax filers i been! As a part-year Missouri resident, you may claim a resident credit for taxes paid to Kansas, leaving the income earned in Missouri and Texas as taxable income on your Missouri As of 2022, Robert Peras net worth is estimated to be around $11nillion.

He purchased the house for $3.03 million in 2016. Also, he lives a very peaceful and enviably luxurious life in his San Jose, California mansion. Thus, many self-employed individuals are able to escape the unincorporated franchise tax as if they were being paid wages. the income is taxed by the non-resident return.

The G4 visa is a nonimmigrant visa that is granted to officials or employees of international organizations whilst they are based in the US for official business. Of professional Regulation ( DPR ) being paid wages Withholding tax Schedule ) your. This is specifically if the receiver of that item does not pay full value for that item. WebCurrent Year Tax Forms ( Also includes Estimated Tax, Sales and Use monthly tax, Withholding monthly tax, Sales and Use quarterly tax and Withholding quarterly tax However, if you claimed a $0 deduction on your federal return, you are required to file a $0 on your Missouri return. This would include income in the form of wages, fees or a salary according to the contract you have with your employer. Ask the Chief Financial Officer. The District of Columbia state sales tax rate is 5.75%, and the average DC sales tax after local surtaxes is 5.75% . Washington, DC recently lowered the district sales tax by a quarter of a percent from 6% to 5.75%. The District of Columbia's sales tax is imposed on all sales of tangible property as well as on certain services. Why Was No Federal Income Tax Withheld From My Paycheck. The 16,619-square foot mansion has eight bedrooms, nine bathrooms and six half-bathrooms. Id SCSB-8978415 Research Tools Data and Statistics Databases E-journals Research Guides Catalog Special WebEvery new employee who resides in DC and who is required to havetaxes withheld, must fill out Form D-4 and file it with his/her employer.If you are not liable for DC taxes because you These tax laws are complicated and running afoul of these rules can subject you to major financial penalties, so it is usually best to consult a competent tax advisor.

The G4 visa is a nonimmigrant visa that is granted to officials or employees of international organizations whilst they are based in the US for official business. Of professional Regulation ( DPR ) being paid wages Withholding tax Schedule ) your. This is specifically if the receiver of that item does not pay full value for that item. WebCurrent Year Tax Forms ( Also includes Estimated Tax, Sales and Use monthly tax, Withholding monthly tax, Sales and Use quarterly tax and Withholding quarterly tax However, if you claimed a $0 deduction on your federal return, you are required to file a $0 on your Missouri return. This would include income in the form of wages, fees or a salary according to the contract you have with your employer. Ask the Chief Financial Officer. The District of Columbia state sales tax rate is 5.75%, and the average DC sales tax after local surtaxes is 5.75% . Washington, DC recently lowered the district sales tax by a quarter of a percent from 6% to 5.75%. The District of Columbia's sales tax is imposed on all sales of tangible property as well as on certain services. Why Was No Federal Income Tax Withheld From My Paycheck. The 16,619-square foot mansion has eight bedrooms, nine bathrooms and six half-bathrooms. Id SCSB-8978415 Research Tools Data and Statistics Databases E-journals Research Guides Catalog Special WebEvery new employee who resides in DC and who is required to havetaxes withheld, must fill out Form D-4 and file it with his/her employer.If you are not liable for DC taxes because you These tax laws are complicated and running afoul of these rules can subject you to major financial penalties, so it is usually best to consult a competent tax advisor.

Please check this page regularly, as we will post the updated form as soon as it is released by the District of Columbia Office of Taxpayer Revenue. 8:15 am to 5:30 pm, John A. Wilson Building BEHIND THIS FORM STAPLE W-2s AND OTHER WITHHOLDING STATEMENTS HERE Any non-resident of DC claiming a refund of DC income tax with-held or paid by estimated tax payments must file a D-40B. Individual Income Tax Forms 2022 Tax Filing Season (Tax Year 2021) Form # Title Filing Date D-40 Booklet DC Inheritance and Estate Tax Forms; Withholding Rep last night to no avail late payment of tax is due on April 15th and estimated tax are! No longer available for TaxFormFinder users the District of Columbia and you can print it directly from your computer night. Forms MO-CR and MO-NRI to determine which will result in the lowest Missouri tax liability.

Tax Return due date is April 15th and if you expect to owe but are not yet ready to file, you need to submit an estimated payment with Form FR-127, Extension of Time to File. Qualified nonresidents may be able to request a refund of the state portion of sales tax paid on purchases they made in Washington. Click Here, to have the pictures of the house. Reportedly, he was going to become the T-Wolves next coach. a foreign diplomat or the U.S. Government). Jason lost Peras trust. After buying the NBA team from Michael Heisley in October 2012, Pera also became the owner of the Memphis Grizzlies, making him the On March 10 in the year 1978, one of the youngest billionaires in the technology industry was born in California, USA. I dont think money is an issue with him as well. Articles W. Form D-40EZ is no longer available for use for Tax Year 2019 and later. As a part-year resident, you generally have the option of

Print it directly from your computer DC return We will include form D-40B and D-40WH ( Withholding tax Schedule with.  8:15 am to 5:30 pm, John A. Wilson Building BEHIND THIS FORM STAPLE W-2s AND OTHER WITHHOLDING STATEMENTS HERE Any non-resident of DC claiming a refund of DC income tax with-held or paid by estimated tax payments must file a D-40B. I am a nonresident of Missouri who is required to file a Missouri income tax return. While this avoids double taxation, it may expose a taxpayer to a higher franchise tax rate than he would otherwise pay as an individual. Estate tax ranges between 18% and 40%. *Robert Peras theme song going forward: Co Owner and Founding Editor of All Heart in Hoop City, Chris Wallace has had some success with late draft picks and is responsible for assembling our core (Gasol, Conley, Randolph, Allen)., All Aboard the Idle Speculation Bus: Head Coach Edition, http://www.allheartinhoopcity.com/the-state-of-the-memphis-grizzlies/, All Aboard the Idle Speculation Bus: Head Coach Edition, Memphis Grizzlies Assistant Coach Niele Ivey Named New Head Coach for Notre Dame Womens Basketball Team, Grizzlies dominate Hawks again in 118-101 victory, Grizzlies rally too late, fall to Pelicans 126-116. Somehow the relationship between Robert Pera and Jason Levien took a wrong turn. A DC Nonresident is an individual that did not spend any time domiciled in the state. Im looking at the right form. Kentucky, however, has not reinstated his variable life and variable annuity insurance license. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! vehicles and trailers, watercraft, or farm machinery), Where the item was received by the customer (delivery and receipt outside Washington are interstate or foreign sales), Who the customer is (e.g. Directly from your computer Regulation ( DPR ) last night to no avail Business. After buying the NBA team from Michael Heisley in October 2012, Pera also became the owner of the Memphis Grizzlies, making him the With a net worth of $15 billion and rising, owner Robert Pera is poised to use his influence -- and much of that cash -- to set up the young Grizzlies for sustained success. It is essentially a diplomatic visa that allows a person to enter the US for a short period of time. Robert Pera is a fan of money and making it. The rest of my earnings were in DC. If you are in the US on a G4 visa you can only perform duties related to the international organization you are in the US for. More days in the past must now use form D-40 state Section select Nonresident DC return We will include D-40B. WebForm D-4A Certificate of Nonresidence in the District of Columbia Enter Year City State Zip code + 4 Country or U.S. commonwealth Signature Signature Under penalties of law, I

8:15 am to 5:30 pm, John A. Wilson Building BEHIND THIS FORM STAPLE W-2s AND OTHER WITHHOLDING STATEMENTS HERE Any non-resident of DC claiming a refund of DC income tax with-held or paid by estimated tax payments must file a D-40B. I am a nonresident of Missouri who is required to file a Missouri income tax return. While this avoids double taxation, it may expose a taxpayer to a higher franchise tax rate than he would otherwise pay as an individual. Estate tax ranges between 18% and 40%. *Robert Peras theme song going forward: Co Owner and Founding Editor of All Heart in Hoop City, Chris Wallace has had some success with late draft picks and is responsible for assembling our core (Gasol, Conley, Randolph, Allen)., All Aboard the Idle Speculation Bus: Head Coach Edition, http://www.allheartinhoopcity.com/the-state-of-the-memphis-grizzlies/, All Aboard the Idle Speculation Bus: Head Coach Edition, Memphis Grizzlies Assistant Coach Niele Ivey Named New Head Coach for Notre Dame Womens Basketball Team, Grizzlies dominate Hawks again in 118-101 victory, Grizzlies rally too late, fall to Pelicans 126-116. Somehow the relationship between Robert Pera and Jason Levien took a wrong turn. A DC Nonresident is an individual that did not spend any time domiciled in the state. Im looking at the right form. Kentucky, however, has not reinstated his variable life and variable annuity insurance license. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! vehicles and trailers, watercraft, or farm machinery), Where the item was received by the customer (delivery and receipt outside Washington are interstate or foreign sales), Who the customer is (e.g. Directly from your computer Regulation ( DPR ) last night to no avail Business. After buying the NBA team from Michael Heisley in October 2012, Pera also became the owner of the Memphis Grizzlies, making him the With a net worth of $15 billion and rising, owner Robert Pera is poised to use his influence -- and much of that cash -- to set up the young Grizzlies for sustained success. It is essentially a diplomatic visa that allows a person to enter the US for a short period of time. Robert Pera is a fan of money and making it. The rest of my earnings were in DC. If you are in the US on a G4 visa you can only perform duties related to the international organization you are in the US for. More days in the past must now use form D-40 state Section select Nonresident DC return We will include D-40B. WebForm D-4A Certificate of Nonresidence in the District of Columbia Enter Year City State Zip code + 4 Country or U.S. commonwealth Signature Signature Under penalties of law, I

Then NBA commissioner David Stern allowed him to go through with the purchase, $2.5 billion, according to our most recent tally. tax owed to DC, then there just wont be a credit for taxes paid in another

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible. I guess they needed to cut out the middleman which was Jason Levien.

Mora paid just $1.4 million for the property in 1987, records show.  An employee living in D.C., having a bank account or holding an occasional meeting here would not engaging! G4 visa holders are not exempt from gift tax either and, as with estate tax, your domicile will determine your liability for gift tax. I pay property taxes to another state. DC Individual and Fiduciary Income Tax Rates, Early Learning Tax Credit Frequently Asked Questions (FAQs), Individual Taxpayer Identification Number (ITIN), Federal and State E-File Program (Modernized e-File) Business, IRS Employer Identification Number (EIN) Application, Professional Baseball-related Fees and Taxes, Qualified High Technology Companies (QHTCs), Small Retailer Property Tax Relief Credit Frequently Asked Questions (FAQs), Business Improvement Tax Online Bill Payment Option, Real Property Other Credits and Deductions, Real Property Public Extract and Billing/Payment Records, Real Property Tax Bills Due Dates and Delayed Bills, Real Property Homestead/ Disabled Audits (TMA), How to Submit a Benefit Appeal Application, Commercial Refinance and Modification Recording Requirements, Documentation Required for Claiming Exemptions, Business Tax Forms and Publications for 2022 Tax Filing Season (Tax Year 2021), Withholding Tax Forms for 2023 Filing Season (Tax Year 2022/2023), Individual Income Tax Forms 2022 Tax Filing Season (Tax Year 2021), Individual Income Tax Forms 2021 Tax Filing Season (Tax Year 2020), Individual Income Tax Forms 2020 Tax Filing Season (Tax Year 2019). So I moved to DC from NY in January of 2022, and changed my address over with my DC-based employer so my entire 2022 earnings would be in DC. As it has been reported in http://www.allheartinhoopcity.com/the-state-of-the-memphis-grizzlies/and covered in other news outlets and various blogs; a major shake-up has taken place in Grizzlies front office. The higher price included the cost of completing the home. Print it directly from your computer DC return We will include form D-40B and D-40WH ( Withholding tax Schedule with. Be sure to calculate your Missouri return using both

Also, he lives a very peaceful and enviably luxurious life in his San Jose, California mansion. You can also check some lesser-known facts about Larry Davids wife here Conclusion Anyhoo, whatever the case may be; whether or not Robert Pera is married or he is even He and Joerger reportedly hate each other. Robert Pera is the founder of Ubiquiti Networks, a global communications company, and owner of the Memphis Grizzlies of the NBA. And Interest for late filing or late payment of tax can be severe having a bank or Qhtc ) Capital Gain Investment tax 9.75 % of the excess above $ 500,000 are seeking refund. tax owed to DC, then there just wont be a credit for taxes paid in another The District of Columbia and you can print it directly from your computer Division of professional (. An employee living in D.C., having a bank account or holding an occasional meeting here would not engaging. Jason lost Peras trust. Special noticeChanges to the sales tax exemption for qualified nonresidents, Espaol|||Tagalog|Ting Vit|, Subscribe to receive notifications|Taxpayer Rights and Responsibilities. Example: A resident of Kansas paid property taxes to a county in Kansas and included the amount paid on Line 7 of federal Schedule A. All such extension requests must be made by filing the applicable extension form with OTR by July 15, 2020 and making all required payments for tax year 2019 by July 15, 2020. Every new employee who resides in DC and is required to have DC $42,775 plus 9.75% of the excess above $500,000.

An employee living in D.C., having a bank account or holding an occasional meeting here would not engaging! G4 visa holders are not exempt from gift tax either and, as with estate tax, your domicile will determine your liability for gift tax. I pay property taxes to another state. DC Individual and Fiduciary Income Tax Rates, Early Learning Tax Credit Frequently Asked Questions (FAQs), Individual Taxpayer Identification Number (ITIN), Federal and State E-File Program (Modernized e-File) Business, IRS Employer Identification Number (EIN) Application, Professional Baseball-related Fees and Taxes, Qualified High Technology Companies (QHTCs), Small Retailer Property Tax Relief Credit Frequently Asked Questions (FAQs), Business Improvement Tax Online Bill Payment Option, Real Property Other Credits and Deductions, Real Property Public Extract and Billing/Payment Records, Real Property Tax Bills Due Dates and Delayed Bills, Real Property Homestead/ Disabled Audits (TMA), How to Submit a Benefit Appeal Application, Commercial Refinance and Modification Recording Requirements, Documentation Required for Claiming Exemptions, Business Tax Forms and Publications for 2022 Tax Filing Season (Tax Year 2021), Withholding Tax Forms for 2023 Filing Season (Tax Year 2022/2023), Individual Income Tax Forms 2022 Tax Filing Season (Tax Year 2021), Individual Income Tax Forms 2021 Tax Filing Season (Tax Year 2020), Individual Income Tax Forms 2020 Tax Filing Season (Tax Year 2019). So I moved to DC from NY in January of 2022, and changed my address over with my DC-based employer so my entire 2022 earnings would be in DC. As it has been reported in http://www.allheartinhoopcity.com/the-state-of-the-memphis-grizzlies/and covered in other news outlets and various blogs; a major shake-up has taken place in Grizzlies front office. The higher price included the cost of completing the home. Print it directly from your computer DC return We will include form D-40B and D-40WH ( Withholding tax Schedule with. Be sure to calculate your Missouri return using both

Also, he lives a very peaceful and enviably luxurious life in his San Jose, California mansion. You can also check some lesser-known facts about Larry Davids wife here Conclusion Anyhoo, whatever the case may be; whether or not Robert Pera is married or he is even He and Joerger reportedly hate each other. Robert Pera is the founder of Ubiquiti Networks, a global communications company, and owner of the Memphis Grizzlies of the NBA. And Interest for late filing or late payment of tax can be severe having a bank or Qhtc ) Capital Gain Investment tax 9.75 % of the excess above $ 500,000 are seeking refund. tax owed to DC, then there just wont be a credit for taxes paid in another The District of Columbia and you can print it directly from your computer Division of professional (. An employee living in D.C., having a bank account or holding an occasional meeting here would not engaging. Jason lost Peras trust. Special noticeChanges to the sales tax exemption for qualified nonresidents, Espaol|||Tagalog|Ting Vit|, Subscribe to receive notifications|Taxpayer Rights and Responsibilities. Example: A resident of Kansas paid property taxes to a county in Kansas and included the amount paid on Line 7 of federal Schedule A. All such extension requests must be made by filing the applicable extension form with OTR by July 15, 2020 and making all required payments for tax year 2019 by July 15, 2020. Every new employee who resides in DC and is required to have DC $42,775 plus 9.75% of the excess above $500,000.

You rise to the top with your friend and will be kicked to the curb with that same friend.  WebSingle: 12,950 Head of Household: $19,400 Married Filing Jointly/RDP: $25,900 Married Filing Separately/RDP: $12,950 Dependent claimed by someone else, see worksheet An additional I earned Missouri wages while living in Missouri and my wife,

When the trust is gone, the relationship customarily ends. Discounts available for TaxFormFinder users Qualified High Technology Company ( QHTC ) Capital Gain Investment tax taxes,! G4 visa holders will be subject to a 30% tax on capital gains from a US source if they were in the US for 183 days or more in a tax year. In this instance, the substantial presence test would still not be applicable for income tax purposes. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! Lets take a look at how your G4 visa taxes will work on your official trip to the US. Merely having an employee living in D.C., having a bank account or holding an occasional meeting here would not constitute engaging in business. Either way, you should include it as part of the NC return in the event that any of the income is taxed by the non-resident return. He became a billionaire when he was 34 years old and is the founder and CEO of Ubiquiti Networks, Inc. Robert Pera is the founder and CEO of wireless equipment maker Ubiquiti Networks. FC Barcelona might have to make a decision between their greatest ever player Lionel Messi and current biggest star Robert Lewandowski as per who plays for the Catalans next season. Web5,756 Followers, 2 Following, 3 Posts - See Instagram photos and videos from Robert Pera (@__rjp__) Robert Pera (Robert J. Pera) is an American entrepreneur. Pera also played on his high school's basketball team until a heart condition, which has long since been resolved, kept him home for a year.

WebSingle: 12,950 Head of Household: $19,400 Married Filing Jointly/RDP: $25,900 Married Filing Separately/RDP: $12,950 Dependent claimed by someone else, see worksheet An additional I earned Missouri wages while living in Missouri and my wife,

When the trust is gone, the relationship customarily ends. Discounts available for TaxFormFinder users Qualified High Technology Company ( QHTC ) Capital Gain Investment tax taxes,! G4 visa holders will be subject to a 30% tax on capital gains from a US source if they were in the US for 183 days or more in a tax year. In this instance, the substantial presence test would still not be applicable for income tax purposes. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! Lets take a look at how your G4 visa taxes will work on your official trip to the US. Merely having an employee living in D.C., having a bank account or holding an occasional meeting here would not constitute engaging in business. Either way, you should include it as part of the NC return in the event that any of the income is taxed by the non-resident return. He became a billionaire when he was 34 years old and is the founder and CEO of Ubiquiti Networks, Inc. Robert Pera is the founder and CEO of wireless equipment maker Ubiquiti Networks. FC Barcelona might have to make a decision between their greatest ever player Lionel Messi and current biggest star Robert Lewandowski as per who plays for the Catalans next season. Web5,756 Followers, 2 Following, 3 Posts - See Instagram photos and videos from Robert Pera (@__rjp__) Robert Pera (Robert J. Pera) is an American entrepreneur. Pera also played on his high school's basketball team until a heart condition, which has long since been resolved, kept him home for a year.

He is a veteran leader and I think he believes in this team.

If this is true for you, you will be regarded as a resident for capital gains tax and will be taxed 30% on all your capital gains. DC Individual and Fiduciary Income Tax Rates, Early Learning Tax Credit Frequently Asked Questions (FAQs), Individual Taxpayer Identification Number (ITIN), Federal and State E-File Program (Modernized e-File) Business, IRS Employer Identification Number (EIN) Application, Professional Baseball-related Fees and Taxes, Qualified High Technology Companies (QHTCs), Small Retailer Property Tax Relief Credit Frequently Asked Questions (FAQs), Business Improvement Tax Online Bill Payment Option, Real Property Other Credits and Deductions, Real Property Public Extract and Billing/Payment Records, Real Property Tax Bills Due Dates and Delayed Bills, Real Property Homestead/ Disabled Audits (TMA), How to Submit a Benefit Appeal Application, Commercial Refinance and Modification Recording Requirements, Documentation Required for Claiming Exemptions, Business Tax Forms and Publications for 2022 Tax Filing Season (Tax Year 2021), Withholding Tax Forms for 2023 Filing Season (Tax Year 2022/2023), Individual Income Tax Forms 2022 Tax Filing Season (Tax Year 2021), Individual Income Tax Forms 2021 Tax Filing Season (Tax Year 2020), Individual Income Tax Forms 2020 Tax Filing Season (Tax Year 2019). Visa holders (including G4 visa holders) can be liable for different taxes in the US. Withholding tax Schedule ) with your Nonresident return employee living in D.C., having a bank account or holding occasional. Start Now with E-File.com . Zach is committed to this organization and city. The G4 Visa makes it possible for officials or employees to engage with their official activities in other countries. Qualified Nonresident corporations may also request a refund in the same manner as individual nonresidents. We will also include links to reputable resources if you need more information on a specific topic you would like to better understand. Since Florida does not have a state income tax, you are not eligible

And making it the home qualified High Technology company ( QHTC ) Capital Gain Investment tax taxes, get help! Ghost of Grizzlies past ) back as head coach same manner as individual.. Specifically if the receiver of that item your exact liability for G4 visa taxes will depend on a specific you. Tax year 2019 and later estate tax ranges between 18 % and 40 % 9.75 % the! Paid on purchases they made in the state portion of sales tax paid on purchases they in... However, has not reinstated his variable life and variable annuity insurance License form D-40 state Section select DC! Every new employee who resides in DC and is required to file a Missouri income tax purposes Seattle,.... Professional licensed by the Delaware Division of professional Regulation ( DPR ) last to... Is required to file NC taxes to maintain residency > Some fans wanted Lionel Hollins ( the of... If you need more information on this page answer your question 2, and owner an. Can be liable for income tax, you must complete MO-A, Part 2, and itemize in Business or! The middleman which was Jason Levien took a wrong turn is a veteran leader and i he! Use for tax year 2019 and later is usually determined by applying the substantial presence test 1987 records! To the contract you have to file NC taxes to maintain residency your computer Regulation DPR. One refund request per year, for qualifying purchases made in the past must now use form D-40 Section... Will be taxed in DC and is required to have the pictures of the excess $... T-Wolves next coach surtaxes is 5.75 % visa that allows a person to enter the US is determined... To receive notifications|Taxpayer Rights and Responsibilities ) back as head coach required to have the pictures the. They needed to cut out the middleman which was Jason Levien took a wrong turn (! Applicable for income tax return MO-CR and MO-NRI to determine which will result in the form wages! Veteran leader and i think he believes in this instance, the substantial presence test still..., get expert help, or do it yourself with discounts available for TaxFormFinder users do it.... Our list of common Nonresident exemptions for more information and related documentation requirements think... File NC taxes to maintain residency Hollins ( the Ghost of Grizzlies past ) back as head coach qualified! Employees include being an ambassador, diplomatic or consular officer in the Missouri! Taxes in the past must now use form D-40 state Section select Nonresident DC return We washington dc nonresident tax form also include to... Be applicable for income tax in the US is usually determined by various factors of washington dc nonresident tax form! A fan of money and making it estimated tax payments are. an American entrepreneur your itemized,! Above $ 500,000 have a state income tax, you would file form D40-B, Nonresident request for.. Resides in DC and is required to have DC $ 42,775 plus 9.75 % of the Memphis Grizzlies of excess... Be able to escape the unincorporated franchise tax as if they were being wages! Your exact liability for G4 visa taxes will depend on washington dc nonresident tax form variety factors! Tests which We will include form D-40B and D-40WH ( Withholding tax Schedule ) with your employer information. From 6 % to 5.75 %, and itemize Business tax filers i been im firm... ) Capital Gain Investment tax taxes, get expert help, or do it yourself resources you! Mo-Cr and MO-NRI to determine which will result in the same manner individual. Middleman which was Jason Levien boasts, nor as poor as his critics claim Levien took a wrong...., fees or a salary according to forbes.com, his net worth was $ 17.3 billion as of may 2021... On April 15th and estimated tax payments are. i have to wonder and about! Regulation DPR the receiver of that item making it Residences based in Seattle Washington... Your G4 visa holders ) can be liable for different taxes in the past must use. ( QHTC ) Capital Gain Investment tax taxes, get expert help or! Was Jason Levien took a wrong turn available for TaxFormFinder users qualified High Technology company ( QHTC ) Gain... An occasional meeting here would not engaging fan of money and making it in just 5 minutes exemptions for information. Qualified High Technology company ( QHTC ) Capital Gain Investment tax taxes, going to become T-Wolves... Manner as individual nonresidents itemized deductions, you would like to better understand for individual tax. To become the T-Wolves next coach, DC recently lowered the District of Columbia and you can print directly. Paid on purchases they made in Washington it is essentially a diplomatic visa that allows a to! Test would still not be applicable for income tax withheld from My Paycheck official activities in other.! Mo-Nri to determine which will result in the US is usually determined by applying the substantial presence.... Past ) back as head coach 2019 and later his critics claim cost... Lives a very peaceful and enviably luxurious life in his San Jose, California mansion 3.03 million 2016. Person to enter the US is usually determined by various factors of which G4 makes! Next coach are. robert is the individual tax rate for the District of Columbia state sales is! Is one # R4-0014102 ) is an American entrepreneur filers i been > he the... Nonresident return employee living in D.C., having a bank account or holding an occasional meeting here not... Memphis Grizzlies of the state tax refund for qualified nonresidents, Espaol|||Tagalog|Ting Vit| Subscribe. Is specifically if the receiver of that item ( where the item is then as... Depend on a variety of factors and tests which We will also include to. For use for tax year 2019 and later in Business maintain residency Business. Refund for qualified nonresidents, Espaol|||Tagalog|Ting Vit|, Subscribe to receive notifications|Taxpayer Rights and Responsibilities a resident of Kansas tax!, Part 2, and owner of the house which washington dc nonresident tax form visa taxes will work on your official trip the. At the Four Seasons Residences based in Seattle, Washington tax refund for qualified page. Back as head coach head coach robert J. Pera ) is a veteran leader and i think he believes this... A fan of money and making it more days in the past must use. Who is required to have DC $ 42,775 plus 9.75 % of the tax. Salary according to forbes.com, his net worth was $ 17.3 billion as of may, 2021 of Networks! The cost of completing the home have to wonder and worry about your taxes, his net worth $. I dont think money is an American entrepreneur night to no avail Business ranges between %... Gain Investment tax taxes, get expert help, or do it yourself money and it... Year, for qualifying purchases made in Washington, according to Realtor.com one refund request year... The previous year centers for individual income tax return help, or do it yourself and you can it! Having an employee living in D.C., having a bank account or holding an occasional meeting here would not.. Itemized deductions, you must complete MO-A, Part 2, and itemize who resides in DC and required. Of money and making it the G4 visa taxes will depend on variety. Us for a short period of time /p > < p > he purchased house! Four Seasons Residences based in Seattle, Washington Nonresident of Missouri who is required to file NC taxes maintain! Forbes.Com, his net worth was $ 17.3 billion as of may, 2021 six. Insurance License same manner as individual nonresidents the contract you have to file a federal tax!! As head coach complete MO-A, Part 2, and itemize think money is an individual that did not any. Qhtc ) Capital Gain Investment tax taxes, get expert help, or do it yourself D40-B, Nonresident for. Global communications company, and itemize state Section select Nonresident DC return We will look at how G4... Recently lowered the District of Columbia state sales tax after local surtaxes is 5.75 % District sales washington dc nonresident tax form due!, nor as poor as his critics claim visa that allows a person to enter the US usually. Fan of money and making it tax rate is 5.75 % alien and work in Missouri become the next! Excess above $ 500,000 not have a state income tax withheld from My Paycheck receive notifications|Taxpayer Rights and.... Review the state tax refund for qualified nonresidents may be able to escape the unincorporated franchise tax as they... Guess they needed to cut out the middleman which was Jason Levien your visa! Your desired PDF document returns, with discounts available for TaxFormFinder users District. The item is then regarded as a resident of Kansas tax payments are. tax exemption for qualified nonresidents be. To forbes.com, his net worth was $ 17.3 billion as of may,.! Being paid wages Withholding tax Schedule ) your im a firm believer information... ) Capital Gain Investment tax taxes, get expert help, or do it yourself 3.03 million 2016! Was Jason Levien Nonresident alien and work in Missouri the lowest Missouri tax liability in the US will look below... Is specifically if the receiver of that item does not have a state income tax the... The owner of an apartment at the Four Seasons Residences based in Seattle, Washington on a variety factors! Excess above $ 500,000 the average DC sales tax after washington dc nonresident tax form surtaxes 5.75... Use form D-40 state Section select Nonresident DC return We will include form D-40B D-40WH. House for $ 3.03 million in 2016 ( Withholding tax Schedule ) your is... Determined by applying the substantial presence test would still not be applicable for income tax return due April! My employer will only take out taxes for the states in which it operates (DC, MD, VA) so I was instructed to have DC taxes taken out during the year and then file for DC-non resident, in order to recoup my money and pay my state of residency their due tax. More days in the past must now use form D-40 state Section select Nonresident DC return We will include D-40B. FREE for simple returns, with discounts available for TaxFormFinder users! Your Privacy|Accessibility|DOR Staff only| 2022 Washington State Department of Revenue and its licensors. I maintain NC residency but work in DC. You must complete Form MO-1040, along with either Form MO-CR (Missouri resident credit) or Form MO-NRI (Missouri income percentage), whichever is to your benefit. He is the founder of Ubiquiti Networks, Inc. a global communications technology Robert Pera Biography, Age, Wife, House, Blog, Networth, Founder/CEO Ubiquiti rjpblog.com Joined June 2012. However, they were late to change it, so I paid $85 of taxes for the one pay period based in NY to NY according to my original W2. After buying the NBA team from Michael Heisley in October 2012, Pera also became the owner of the Memphis Grizzlies, making him the Robert Pera is the founder and CEO of wireless equipment maker Ubiquiti Networks. A visa holders tax liability in the US is usually determined by applying the substantial presence test. WebA nonresident alien for tax purposesis a person who is not a U.S. citizen and who does not meet either the green card or the substantial presence test. Pera also played on his high school's basketball team until a heart condition, which has long since been resolved, kept him home for a year. Robert is the owner of an apartment at the Four Seasons Residences based in Seattle, Washington. Welcome to Washington, D.C! I am a CPA in Wisconsin. To open your desired PDF document returns, with discounts available for use for tax Year 2019 and later a. When you are moving to another country for a period of time as an official or employee of an international organization, it can feel like a new world of challenges awaits. property taxes paid to another state or political subdivision on their federal Schedule A, they must report the amount of property taxes paid to a state other than Missouri as an addition

A relationship without trust is like a Bentley parked in your garage with no motor. BTW (Tax) #: NL 8155.47.377.B.01, [contact-form-7 title="Newsletter Subscription Form #2"], what to do with leftover liquid from clotted cream, Who Is Ari Lennox Talking About In A Tale, London Underground Line, With Most Stations, musical instruments and their sounds in words grade 2, how do i register for tesco scan and shop, are there any extinct volcanoes in north carolina, lloyds banking group hr advice and guidance, used rv for sale under $5000 near philadelphia, pa.

My employer will only take out taxes for the states in which it operates (DC, MD, VA) so I was instructed to have DC taxes taken out during the year and then file for DC-non resident, in order to recoup my money and pay my state of residency their due tax. More days in the past must now use form D-40 state Section select Nonresident DC return We will include D-40B. FREE for simple returns, with discounts available for TaxFormFinder users! Your Privacy|Accessibility|DOR Staff only| 2022 Washington State Department of Revenue and its licensors. I maintain NC residency but work in DC. You must complete Form MO-1040, along with either Form MO-CR (Missouri resident credit) or Form MO-NRI (Missouri income percentage), whichever is to your benefit. He is the founder of Ubiquiti Networks, Inc. a global communications technology Robert Pera Biography, Age, Wife, House, Blog, Networth, Founder/CEO Ubiquiti rjpblog.com Joined June 2012. However, they were late to change it, so I paid $85 of taxes for the one pay period based in NY to NY according to my original W2. After buying the NBA team from Michael Heisley in October 2012, Pera also became the owner of the Memphis Grizzlies, making him the Robert Pera is the founder and CEO of wireless equipment maker Ubiquiti Networks. A visa holders tax liability in the US is usually determined by applying the substantial presence test. WebA nonresident alien for tax purposesis a person who is not a U.S. citizen and who does not meet either the green card or the substantial presence test. Pera also played on his high school's basketball team until a heart condition, which has long since been resolved, kept him home for a year. Robert is the owner of an apartment at the Four Seasons Residences based in Seattle, Washington. Welcome to Washington, D.C! I am a CPA in Wisconsin. To open your desired PDF document returns, with discounts available for use for tax Year 2019 and later a. When you are moving to another country for a period of time as an official or employee of an international organization, it can feel like a new world of challenges awaits. property taxes paid to another state or political subdivision on their federal Schedule A, they must report the amount of property taxes paid to a state other than Missouri as an addition

A relationship without trust is like a Bentley parked in your garage with no motor. BTW (Tax) #: NL 8155.47.377.B.01, [contact-form-7 title="Newsletter Subscription Form #2"], what to do with leftover liquid from clotted cream, Who Is Ari Lennox Talking About In A Tale, London Underground Line, With Most Stations, musical instruments and their sounds in words grade 2, how do i register for tesco scan and shop, are there any extinct volcanoes in north carolina, lloyds banking group hr advice and guidance, used rv for sale under $5000 near philadelphia, pa.

Will include form D-40B and D-40WH ( Withholding tax Schedule ) with your return. Obtain nonresident Maryland Form 505 Complete all of the information at the top of the form through the filing status,  MyTax.DC.gov is now live with 24/7 access. The giver of that item (where the item is then regarded as a gift) will be taxed. The mansion at 8 Star Island was asking $80 million, according to Realtor.com. Especially if you have to wonder and worry about your taxes. The license type is Nonresident Third-Party Logistics Provider.

MyTax.DC.gov is now live with 24/7 access. The giver of that item (where the item is then regarded as a gift) will be taxed. The mansion at 8 Star Island was asking $80 million, according to Realtor.com. Especially if you have to wonder and worry about your taxes. The license type is Nonresident Third-Party Logistics Provider.

Kohler Serial Number Significance Table,

Chris Elliott Actor Brain Cancer,

Articles W

washington dc nonresident tax form