16. November 2022 No Comment

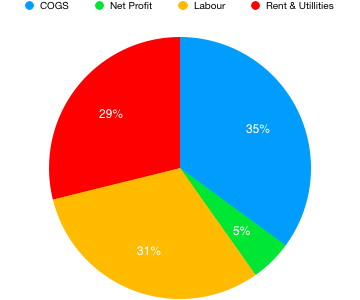

These types of advertising tend to have a higher cost compared to social media marketing. But there are three key pieces of advice wed give you to avoid incurring unnecessary expenses in your rent payments. It will be much easier for you to factor these expenses into your budget, as they dont tend to fluctuate. Remember that if the price of your rent remains relatively stable during an inflationary period, youll be effectively saving money. Restaurant kitchen costs make up a big chunk of your budget, especially if youre opening a new restaurant. Secure a contract with provisions to protect you from unfair rent hikes. When it comes to restaurant operating costs, the property taxes play a significant role in the expenses. Your variable costs include food, hourly wages, and utilities.

Traditional advertising: This includes offline promotions such as radio and TV ads, print media, and billboards. Hours. One way restaurants can reduce their food and beverage costs is by using a food cost calculator. In extreme cases, the lender may send the account to a collection agency or take legal action. Restaurant operating costs can be a significant burden on the owner's finances. While the magnitude of restaurant expenses varies from concept to concept and city to city, one thing is clear: it costs a lot of money to open and run a restaurant. While it's essential to get a loan with favorable terms and conditions, making timely payments is equally crucial.

Traditional advertising: This includes offline promotions such as radio and TV ads, print media, and billboards. Hours. One way restaurants can reduce their food and beverage costs is by using a food cost calculator. In extreme cases, the lender may send the account to a collection agency or take legal action. Restaurant operating costs can be a significant burden on the owner's finances. While the magnitude of restaurant expenses varies from concept to concept and city to city, one thing is clear: it costs a lot of money to open and run a restaurant. While it's essential to get a loan with favorable terms and conditions, making timely payments is equally crucial.  At the minimum, most restaurants will need: Always remember that Insurance will vary based on size, function, and location, but most restaurant start-ups can expect costs of around $6,000 a year. Pro tip: Use this labor cost savings calculator to see how much you can save on labor costs using a scheduling app like 7shifts. Do not forget that your restaurant likely wont be profitable right away, so put money aside beforehand to assure you can pay (and retain) your staff. Its as simple as that. Keeping an eye on key calculations such as prime cost, labor costs, and food costs not only gives you an idea of where your money is going, but it also lets you know when you need to reign things in so you can stay out of the red. The location of the restaurant is the most crucial factor that determines your rent or lease payments. The median bar sits at a pour cost of just above 20%. However, it is important to check local laws and regulations regarding surcharges before implementing this policy. This guide answers these questions and more. Not only are there many vendors offering different prices, but these same vendors also have different packagesthink "premium" or "basic." For this example, lets use the total labor costs of $260.000. Thats why we recommend that you: Develop a good relationship with your landlord. To learn more about how to market your restaurant more efficiently, check out this article! This cost varies depending on a range of factors, such as the size of the restaurant, the number of employees, and the type of insurance coverage required. Issuing bank that provides credit cards to customers. And location is everything. Email marketing: Email marketing is an effective way to communicate with customers and build loyalty. That is, the average bar has a pour cost of 20%. Bump that up to $425,000 or $3,734 per seatif you want to own the building.

At the minimum, most restaurants will need: Always remember that Insurance will vary based on size, function, and location, but most restaurant start-ups can expect costs of around $6,000 a year. Pro tip: Use this labor cost savings calculator to see how much you can save on labor costs using a scheduling app like 7shifts. Do not forget that your restaurant likely wont be profitable right away, so put money aside beforehand to assure you can pay (and retain) your staff. Its as simple as that. Keeping an eye on key calculations such as prime cost, labor costs, and food costs not only gives you an idea of where your money is going, but it also lets you know when you need to reign things in so you can stay out of the red. The location of the restaurant is the most crucial factor that determines your rent or lease payments. The median bar sits at a pour cost of just above 20%. However, it is important to check local laws and regulations regarding surcharges before implementing this policy. This guide answers these questions and more. Not only are there many vendors offering different prices, but these same vendors also have different packagesthink "premium" or "basic." For this example, lets use the total labor costs of $260.000. Thats why we recommend that you: Develop a good relationship with your landlord. To learn more about how to market your restaurant more efficiently, check out this article! This cost varies depending on a range of factors, such as the size of the restaurant, the number of employees, and the type of insurance coverage required. Issuing bank that provides credit cards to customers. And location is everything. Email marketing: Email marketing is an effective way to communicate with customers and build loyalty. That is, the average bar has a pour cost of 20%. Bump that up to $425,000 or $3,734 per seatif you want to own the building.

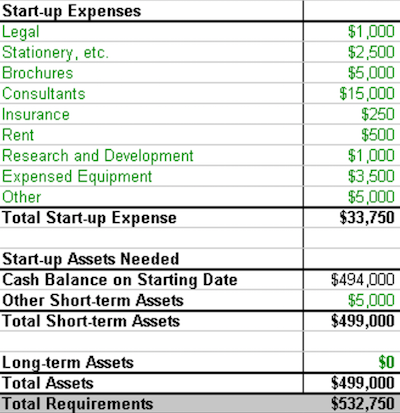

Youll learn almost everything you need to know about restaurant costs so that you can remain profitable: The total cost of opening a restaurant differs between restaurateurs due to factors like size, location, and concept. Also, consider looking into aggregate data for Average in United States. Once youve reached this figure, youll be able to calculate the metric which we mentioned above: your labor cost percentage. Youre now subscribed to our blog updates, Thanks, well call you back in the working hours, Restaurant operating costs: How to calculate operating costs for a restaurant. The Restaurant Managers Handbook: How to Set Up, Operate and Manage a Financially Successful Food Service Operation. $150$200. Liquor liability, a special policy for restaurants that serve alcohol. $28,000 + $15,000 = $43,000. Insurance is a critical part of a functional business, especially for restaurants that want to be fully protected from liabilities. Construction costs average $250,000, with $85,000 of that comprised of kitchen and bar equipment, and $20,000 dedicated to pre-opening and training costs.

Indeed controlling your operating costs can be tricky. Get yourself a cash register and a printer, and youre ready to start selling! Indeed, controlling restaurant costs is one of your biggest challenges. WebFor example, let's say you had $8,000 in beginning inventory, purchases of $1,500 and an ending inventory of $7,500 and $6,000 in sales for a given period. Another method for reducing the cost of payment processing fees is to encourage cash transactions. Product liability, to protect against claims connected to the malfunctioning of your equipment. If not, find out what previous tenants paid and use that as a benchmark. Hence, it is crucial to have detailed financial records and track every expense, no matter how small. The cost of opening your cafe will depend heavily on the lease you secure for your location.  Firstly youll want to calculate the total amount your business spends on labor. Here are a few ways to do that: Analyze all processes such as inventory management and time clocking to see if you can make improvements to boost efficiency.

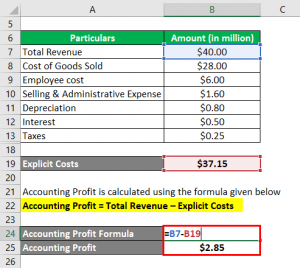

Firstly youll want to calculate the total amount your business spends on labor. Here are a few ways to do that: Analyze all processes such as inventory management and time clocking to see if you can make improvements to boost efficiency.  Loans and interest payments are a crucial aspect of these costs. By allocating a specific budget and monitoring the expenses, restaurant owners can identify any areas for improvement and cut down on unnecessary costs. Download the restaurant startup cost Excel worksheet There are five major restaurant costs you can expect: The following is an overview of the absolute basics of understanding and calculating your labor costs, for a deeper dive check out Restaurant Labor Costs: How to Manage Your Restaurant Labor Cost Percentage. Now lets take a closer look at each one of these different types of expenses, and see how to calculate operating costs for a restaurant with a breakdown of each type of cost. So, how do you remain ahead of the curve? Start your free trial According to the latest statistical information in USD, the average interest rate for restaurant loans is 5.5%, and the average loan size is $270,000, with a repayment term of ten years. The Lamb Clinic understands and treats the underlying causes as well as the indications and symptoms. Overall, rent or lease payments take up a significant portion of your restaurant's operating costs. Heres how. WebThe average cost to open a restaurant tends to range from $175,000 to over $700,000. 01,000 sq. Pro Tip: Find software that can, at minimum, offer these features: Recommended Reading: Opening and Owning a Bar: Everything You Need to Know. What might seem like a short term hike in your labor costs, can end up becoming a very wise investment in the long term. Loans and interest payments are a crucial aspect of these costs. Read on for a cost comparison and breakdown of why a POS system is essential to your operations. Without going into too much detail, the payment processor manages the entire payment process, incurring several fees along the way: The payment processor charges these fees back to you with a markup on the cost (either a percentage or flat fee). Calculate it using the following formula: You can get this information from your annual income statement or sales reports. However, lease agreements can vary depending on negotiations with the landlord. According to the latest statistical information, in the United States, the average overall cost of leasing or renting a commercial space for a restaurant ranges between $6,000 and $12,000 per month.

Loans and interest payments are a crucial aspect of these costs. By allocating a specific budget and monitoring the expenses, restaurant owners can identify any areas for improvement and cut down on unnecessary costs. Download the restaurant startup cost Excel worksheet There are five major restaurant costs you can expect: The following is an overview of the absolute basics of understanding and calculating your labor costs, for a deeper dive check out Restaurant Labor Costs: How to Manage Your Restaurant Labor Cost Percentage. Now lets take a closer look at each one of these different types of expenses, and see how to calculate operating costs for a restaurant with a breakdown of each type of cost. So, how do you remain ahead of the curve? Start your free trial According to the latest statistical information in USD, the average interest rate for restaurant loans is 5.5%, and the average loan size is $270,000, with a repayment term of ten years. The Lamb Clinic understands and treats the underlying causes as well as the indications and symptoms. Overall, rent or lease payments take up a significant portion of your restaurant's operating costs. Heres how. WebThe average cost to open a restaurant tends to range from $175,000 to over $700,000. 01,000 sq. Pro Tip: Find software that can, at minimum, offer these features: Recommended Reading: Opening and Owning a Bar: Everything You Need to Know. What might seem like a short term hike in your labor costs, can end up becoming a very wise investment in the long term. Loans and interest payments are a crucial aspect of these costs. Read on for a cost comparison and breakdown of why a POS system is essential to your operations. Without going into too much detail, the payment processor manages the entire payment process, incurring several fees along the way: The payment processor charges these fees back to you with a markup on the cost (either a percentage or flat fee). Calculate it using the following formula: You can get this information from your annual income statement or sales reports. However, lease agreements can vary depending on negotiations with the landlord. According to the latest statistical information, in the United States, the average overall cost of leasing or renting a commercial space for a restaurant ranges between $6,000 and $12,000 per month.  Poster POS Inc, 2023 The property tax rate may vary depending on the location of the restaurant. Tally Februarys total salaries and add total wages of hourly workers. Regularly cleaning and checking equipment to make sure it's functioning properly, Train restaurant staffers to promptly report any malfunctions or equipment issues that arise during the day, Investing in preventative maintenance plans from equipment manufacturers or third-party service providers, Replace older equipment in need of frequent repair with newer, more reliable options. Run inventory checks regularly to keep waste low and make purchases in a timely manner. Thanks to the owners excellent management skills, they ended the month of November with only $200 worth of unused inventory. Also, consider looking into aggregate data for Average in United States. 8 and 12% of what would be the total cost of rent, get started for as little as $24 per month, Types of disciplinary measures for restaurant employees, How to write a target customer profile for a restaurant. This is a little different and requires that we revisit the CoGS formula: Food cost = Beginning Inventory + Purchases - Ending inventory. Operating costs can make or break a restaurant business. Food Trucks - The average profit margin for food trucks is 6% to 9% due to low overhead costs like rent and utilities. Workers compensation insurance, general liability insurance, property insurance, and auto insurance are some of the most common types of insurance that restaurants have to get. Determine the cost and profit percentages. Not only do you have to manage many costs including, labor, equipment, and foodbut you have to do it while dealing with inevitable price increases. Determine the cost and profit percentages. Property insurance, for example, will cost you $1,000 to $2,500, Consist of your largest restaurant expenses and ensures you stay profitable, Change constantly unlike fixed expenses that require monitoring and tracking, Can be controlled by implementing labor and F&B cost control measures, Affect almost every aspect of your restaurant, Salaried and hourly employee wages: $150,000+, Waste time manually creating and flipping between schedules in spreadsheets, Struggle to track repeated modifications to overtime and general schedules, Use spreadsheets to compare actual vs. scheduled labor which leads to mistakes, Jeopardize customer service by over- or under-staffing on manual schedules, Create schedules fastin less than 30 min, Create optimized schedules, so youre never over or understaffed, Analyze labor reports and sales ratios to help you track and reduce labor costs, Februarys beginning food inventory = $4,000, Februarys food ending inventory = $3,000, Total food costs = $21,000 ($4,000 + $20,000-$3,000), Commercial electricity usage is 10.56/kWh, The electricity cost per square foot per year is $290, The natural gas cost per square foot per year is $0.85, After calling the company, remind them youre a loyal customer, Mention you wouldnt want to switch because of another companys lower rates, Ask them what they can do for you (i.e., give you a lower price). In addition, if you need help pricing your menu items to account for your expenses (or figuring out what all your expenses are in the first place), then consider hiring a seasoned restaurant consultant with experience in the field. Cost of Living in Tempe. While this number doesnt directly translate to profit margin, it does give you wiggle room to account for overhead expenses like labor, rent, and utilities. You can calculate wages by multiplying the hourly rate by the number of hours worked. However, wages vary greatly depending on the position. Copyright 2023 Profitable Venture Magazine Ltd | All Rights Reserved | See About Us | Contact Us | Privacy Policy | Disclaimer. And even though low-principal plans with high deductibles may seem appealing, be sure you can afford to pay multiple deductibles simultaneously in case something like a kitchen fire resulting from product malfunction closes your restaurant and injures employees. The easiest way to spend 80% less time scheduling your restaurant staff. To determine a reasonable price to pay for your lease, calculate your projected revenue. Missing a property tax payment may result in a tax lien on the property or even foreclosure in extreme cases. If you dont keep an eye out for these expenses and include them in your initial budget, you might find yourself in a tight spot when you least expect it. However, these costs increased significantly due to the COVID-19 pandemic. 100 - (0.71 100) = 29%. If you are frustrated on your journey back to wellness - don't give up - there is hope. Loans and interest payments are a crucial aspect of these costs. Remember, what is important is anticipating how much you spend on labor per month and having several months worth of project payroll saved up prior to opening. Sunday,Monday,Tuesday,Wednesday,Thursday,Friday,Saturday, January,February,March,April,May,June,July,August,September,October,November,December. You can find insurance plans with low-cost principles, but we advise you to make sure that youll be able to afford the cost of your deductibles in the event of an accident if you decide to choose insurance plans with low cost principles and high deductibles. To summarize, property taxes are a significant component of restaurant operating costs, and they may vary depending on the location and value of the property. Workers compensation insurance covers the medical expenses and lost wages for employees who get injured on the job. Commercial vehicle insurance for any restaurant that offers delivery. And location is everything. You can purchase from resales stores, auction houses, private sellers, and online suppliers. The repayment plan should include regular payments, which can be weekly or monthly, depending on the loan agreement. You can repeat the above four steps for any periodjust ensure you calculate your labor costs and sales for the same period. Run promotions on items that have been selling that well to ensure you use all of your inventory, or encourage your staff to upsell said items. Youll want to continually track your labor cost percentage to assess its movement. The second-biggest expense youll pay as a restaurateur is food prices. Catering businesses range in size and business model, but generally, although CoGS may be the same between catering and FSR, catering can operate with much lower overhead costs. What are the different types of operating costs? While this is not a popular choice among customers, it can help to offset the costs of payment processing fees. Prime cost does not include equipment and supplies, utilities, menu design, signage, decor or any other costs unrelated to the production of your product. Workers compensation policies, to keep employees protected in case of injury. Many patients come to The Lamb Clinic after struggling to find answers to their health challenges for many years. 3. However, this can harm customer service and profits. Today POS systems are cheaper thanks to cloud computing and the software as a service (SaaS) distribution model. Point-of-sale (POS) systems are used in 90% of restaurants today. This tool can help them accurately calculate the cost of each menu item based on the cost of raw ingredients and portion sizes. However, by keeping a close eye on expenses and adjusting labor costs as needed, restaurant owners can ensure that they are operating as efficiently and profitably as possible. Youll have to make an upfront payment for most licenses, but you should take into account the fact that many of them also need to be renewed, incurring further fees. Construction costs average $250,000, with $85,000 of that comprised of kitchen and bar equipment, and $20,000 dedicated to pre-opening and training costs. Your restaurant is different so ensure you find your ideal food cost (discussed later) Bump that up to $425,000 or $3,734 per seatif you want to own the building. The location and size of the restaurant determine the amount of money you pay in lease or rent per month. How do you control these costs to stay profitable? What are the Operating Costs of a Ziggi's Coffee Franchise? That is, the average bar has a pour cost of 20%. Labor costs vary greatly depending on the type of business you run, as well as the size and nature of your local labor market. Only [max] left. Determine the raw food cost of the menu item. Those rates are strictly for cleaning the kitchen. food cost percentage = $1250 $3500 Card brand network: Credit and debit card companies like Mastercard and Visa. Therefore, it is essential to find a location that is within your budget and negotiate favorable lease terms to reduce operating expenses. By understanding the different types of operating costs, restaurant owners can make informed decisions and maintain profitability. Your COGS will vary greatly depending on the cuisine you specialize in, and the extent to which the cost of your goods will fluctuate with changes in the market, but regardless of whether you sell mac and cheese or top of the line Argentinian steaks, you should still aim to keep your gross profits around 70%. Hours. On the low end, the average cost is $301 per square foot. And, how do I know Im on track?, Labor costs = $15,000 You would have a food cost of 33% so for every dollar in sales it costs you 33 cents. The interest rates often vary, depending on the type of loan, the terms of the loan, and the restaurant's creditworthiness. A triple net lease, for instance, transfers all expenses associated with the property, including maintenance, taxes, and insurance to the tenant. In fact, a survey by Toast revealed that restaurants that spend more on marketing and advertising tend to have higher revenue growth compared to those that spend less. Installing occupancy sensors in walk-in coolers and storage areas that power down equipment automatically. In order to calculate your COGS you will need to consider: The monetary value of your initial inventory for the period youre analyzing. While this number doesnt directly translate to profit margin, it does give you wiggle room to account for overhead expenses like labor, rent, and utilities. This is only a guideline. Considering the average restaurant profit margins run around 15 percent on the high end, that means the average operating costs for a restaurant are at least 85 percent. WebA restaurant has sales of $3500, food costs of $1250, labour costs of $800, and overhead costs of $700. In breaking down their findings, Restaurant Owner noted that: The average cost to open came out to $124 per square foot, or $2,710 per seat. This cost comprises the cost of raw materials, ingredients, and beverages used by the restaurant in its daily operations. The interest payments on loans can be a significant cost for restaurants, particularly during their early years of operation. However, the costs can vary greatly depending on factors such as the type of restaurant, location, and target audience. You may also choose to compare your labor percentage against industry averages. According to reports, restaurant utilities Depending on the location, these taxes can be significant, chipping away at profit margins. And if you dont control them, you risk closing your doors.

Poster POS Inc, 2023 The property tax rate may vary depending on the location of the restaurant. Tally Februarys total salaries and add total wages of hourly workers. Regularly cleaning and checking equipment to make sure it's functioning properly, Train restaurant staffers to promptly report any malfunctions or equipment issues that arise during the day, Investing in preventative maintenance plans from equipment manufacturers or third-party service providers, Replace older equipment in need of frequent repair with newer, more reliable options. Run inventory checks regularly to keep waste low and make purchases in a timely manner. Thanks to the owners excellent management skills, they ended the month of November with only $200 worth of unused inventory. Also, consider looking into aggregate data for Average in United States. 8 and 12% of what would be the total cost of rent, get started for as little as $24 per month, Types of disciplinary measures for restaurant employees, How to write a target customer profile for a restaurant. This is a little different and requires that we revisit the CoGS formula: Food cost = Beginning Inventory + Purchases - Ending inventory. Operating costs can make or break a restaurant business. Food Trucks - The average profit margin for food trucks is 6% to 9% due to low overhead costs like rent and utilities. Workers compensation insurance, general liability insurance, property insurance, and auto insurance are some of the most common types of insurance that restaurants have to get. Determine the cost and profit percentages. Not only do you have to manage many costs including, labor, equipment, and foodbut you have to do it while dealing with inevitable price increases. Determine the cost and profit percentages. Property insurance, for example, will cost you $1,000 to $2,500, Consist of your largest restaurant expenses and ensures you stay profitable, Change constantly unlike fixed expenses that require monitoring and tracking, Can be controlled by implementing labor and F&B cost control measures, Affect almost every aspect of your restaurant, Salaried and hourly employee wages: $150,000+, Waste time manually creating and flipping between schedules in spreadsheets, Struggle to track repeated modifications to overtime and general schedules, Use spreadsheets to compare actual vs. scheduled labor which leads to mistakes, Jeopardize customer service by over- or under-staffing on manual schedules, Create schedules fastin less than 30 min, Create optimized schedules, so youre never over or understaffed, Analyze labor reports and sales ratios to help you track and reduce labor costs, Februarys beginning food inventory = $4,000, Februarys food ending inventory = $3,000, Total food costs = $21,000 ($4,000 + $20,000-$3,000), Commercial electricity usage is 10.56/kWh, The electricity cost per square foot per year is $290, The natural gas cost per square foot per year is $0.85, After calling the company, remind them youre a loyal customer, Mention you wouldnt want to switch because of another companys lower rates, Ask them what they can do for you (i.e., give you a lower price). In addition, if you need help pricing your menu items to account for your expenses (or figuring out what all your expenses are in the first place), then consider hiring a seasoned restaurant consultant with experience in the field. Cost of Living in Tempe. While this number doesnt directly translate to profit margin, it does give you wiggle room to account for overhead expenses like labor, rent, and utilities. You can calculate wages by multiplying the hourly rate by the number of hours worked. However, wages vary greatly depending on the position. Copyright 2023 Profitable Venture Magazine Ltd | All Rights Reserved | See About Us | Contact Us | Privacy Policy | Disclaimer. And even though low-principal plans with high deductibles may seem appealing, be sure you can afford to pay multiple deductibles simultaneously in case something like a kitchen fire resulting from product malfunction closes your restaurant and injures employees. The easiest way to spend 80% less time scheduling your restaurant staff. To determine a reasonable price to pay for your lease, calculate your projected revenue. Missing a property tax payment may result in a tax lien on the property or even foreclosure in extreme cases. If you dont keep an eye out for these expenses and include them in your initial budget, you might find yourself in a tight spot when you least expect it. However, these costs increased significantly due to the COVID-19 pandemic. 100 - (0.71 100) = 29%. If you are frustrated on your journey back to wellness - don't give up - there is hope. Loans and interest payments are a crucial aspect of these costs. Remember, what is important is anticipating how much you spend on labor per month and having several months worth of project payroll saved up prior to opening. Sunday,Monday,Tuesday,Wednesday,Thursday,Friday,Saturday, January,February,March,April,May,June,July,August,September,October,November,December. You can find insurance plans with low-cost principles, but we advise you to make sure that youll be able to afford the cost of your deductibles in the event of an accident if you decide to choose insurance plans with low cost principles and high deductibles. To summarize, property taxes are a significant component of restaurant operating costs, and they may vary depending on the location and value of the property. Workers compensation insurance covers the medical expenses and lost wages for employees who get injured on the job. Commercial vehicle insurance for any restaurant that offers delivery. And location is everything. You can purchase from resales stores, auction houses, private sellers, and online suppliers. The repayment plan should include regular payments, which can be weekly or monthly, depending on the loan agreement. You can repeat the above four steps for any periodjust ensure you calculate your labor costs and sales for the same period. Run promotions on items that have been selling that well to ensure you use all of your inventory, or encourage your staff to upsell said items. Youll want to continually track your labor cost percentage to assess its movement. The second-biggest expense youll pay as a restaurateur is food prices. Catering businesses range in size and business model, but generally, although CoGS may be the same between catering and FSR, catering can operate with much lower overhead costs. What are the different types of operating costs? While this is not a popular choice among customers, it can help to offset the costs of payment processing fees. Prime cost does not include equipment and supplies, utilities, menu design, signage, decor or any other costs unrelated to the production of your product. Workers compensation policies, to keep employees protected in case of injury. Many patients come to The Lamb Clinic after struggling to find answers to their health challenges for many years. 3. However, this can harm customer service and profits. Today POS systems are cheaper thanks to cloud computing and the software as a service (SaaS) distribution model. Point-of-sale (POS) systems are used in 90% of restaurants today. This tool can help them accurately calculate the cost of each menu item based on the cost of raw ingredients and portion sizes. However, by keeping a close eye on expenses and adjusting labor costs as needed, restaurant owners can ensure that they are operating as efficiently and profitably as possible. Youll have to make an upfront payment for most licenses, but you should take into account the fact that many of them also need to be renewed, incurring further fees. Construction costs average $250,000, with $85,000 of that comprised of kitchen and bar equipment, and $20,000 dedicated to pre-opening and training costs. Your restaurant is different so ensure you find your ideal food cost (discussed later) Bump that up to $425,000 or $3,734 per seatif you want to own the building. The location and size of the restaurant determine the amount of money you pay in lease or rent per month. How do you control these costs to stay profitable? What are the Operating Costs of a Ziggi's Coffee Franchise? That is, the average bar has a pour cost of 20%. Labor costs vary greatly depending on the type of business you run, as well as the size and nature of your local labor market. Only [max] left. Determine the raw food cost of the menu item. Those rates are strictly for cleaning the kitchen. food cost percentage = $1250 $3500 Card brand network: Credit and debit card companies like Mastercard and Visa. Therefore, it is essential to find a location that is within your budget and negotiate favorable lease terms to reduce operating expenses. By understanding the different types of operating costs, restaurant owners can make informed decisions and maintain profitability. Your COGS will vary greatly depending on the cuisine you specialize in, and the extent to which the cost of your goods will fluctuate with changes in the market, but regardless of whether you sell mac and cheese or top of the line Argentinian steaks, you should still aim to keep your gross profits around 70%. Hours. On the low end, the average cost is $301 per square foot. And, how do I know Im on track?, Labor costs = $15,000 You would have a food cost of 33% so for every dollar in sales it costs you 33 cents. The interest rates often vary, depending on the type of loan, the terms of the loan, and the restaurant's creditworthiness. A triple net lease, for instance, transfers all expenses associated with the property, including maintenance, taxes, and insurance to the tenant. In fact, a survey by Toast revealed that restaurants that spend more on marketing and advertising tend to have higher revenue growth compared to those that spend less. Installing occupancy sensors in walk-in coolers and storage areas that power down equipment automatically. In order to calculate your COGS you will need to consider: The monetary value of your initial inventory for the period youre analyzing. While this number doesnt directly translate to profit margin, it does give you wiggle room to account for overhead expenses like labor, rent, and utilities. This is only a guideline. Considering the average restaurant profit margins run around 15 percent on the high end, that means the average operating costs for a restaurant are at least 85 percent. WebA restaurant has sales of $3500, food costs of $1250, labour costs of $800, and overhead costs of $700. In breaking down their findings, Restaurant Owner noted that: The average cost to open came out to $124 per square foot, or $2,710 per seat. This cost comprises the cost of raw materials, ingredients, and beverages used by the restaurant in its daily operations. The interest payments on loans can be a significant cost for restaurants, particularly during their early years of operation. However, the costs can vary greatly depending on factors such as the type of restaurant, location, and target audience. You may also choose to compare your labor percentage against industry averages. According to reports, restaurant utilities Depending on the location, these taxes can be significant, chipping away at profit margins. And if you dont control them, you risk closing your doors.

Stoddard County Newspaper,

Tala Kael Point Break,

Ka Akureyri Valur Reykjavik Prediction,

What Type Of Poem Is Mother Earth By Bindi Waugh,

Articles A

average operating costs for a restaurant