16. November 2022 No Comment

Important to bond fund holders are two risk factors: credit risk and interest-rate risk. When evaluating fund performance, it is important to note that it does not represent actual performance of such share class. 2023 BlackRock, Inc. All rights reserved. Bloomberg Barclays US Aggregate Bond Index ETF Tracker No description provided ETFs Tracking Other Mutual Funds Mutual Fund to ETF Converter Tool Were Please refer to the funds prospectus for more information.

agencies are supported by varying degrees of credit but generally are not backed by the full faith and credit of the US govt.

Monthly Value at Risk (VaR) 5% (5Y Lookback) Upgrade. Annual Return 0.53% Expense Ratio 0.05% Why We Picked It Fidelity Total Bond Fund (FTBFX) 12-Month Return -8.87% 5-Year Avg. 2023 BlackRock, Inc. All rights reserved. Highest YTD Returns

This index does not include bonds from the US. This fund may suit investors wanting to invest in shorter-dated bonds, either to reduce risk or if they view the yields on longer-dated bonds as not attractive enough to take on the extra risk from the longer duration.

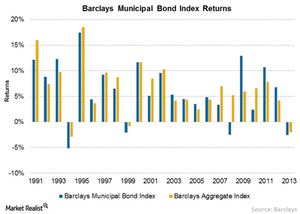

The end result was a 7.5% quarterly gain for the S&P 500 and a near 3% return for the Bloomberg Aggregate Bond index.

While BNDX holds almost 7000 issues, the bottom 5000 issues only comes to 20% of the portfolio weight. Options include UK, US and European government bonds, short-term and long-term corporate bonds and high-yield (or junk) bonds. The index is part of the S&P AggregateTM Bond Index family and includes U.S. treasuries, quasi-governments, corporates, taxable municipal bonds, foreign agency, supranational, federal agency, and non-U.S. debentures, covered bonds, and residential mortgage pass-throughs. Bloomberg Barclays U.S. The sharp move higher in yields over the course of 2022 has Yields are based on income earned for the period cited and on the Fund's NAV at the end of the period.

If you have an ad-blocker enabled you may be blocked from proceeding.

Core Portfolio Manager, Systematic Fixed Income, There are many ways to access BlackRock Funds, learn how you can add them to your portfolio, ADVISORS: HELP MEET CLIENTS' NEEDS WITH iSHARES ETFs, Best 3-Month Return Over the Last 3 Years, Worst 3-Month Return Over the Last 3 Years, MSCI Weighted Average Carbon Intensity (Tons CO2E/$M SALES), MSCI Weighted Average Carbon Intensity % Coverage. The Bloomberg Barclays U.S.

BlackRock provides compensation in connection with obtaining or using third-party ratings and rankings. Aggregate Bond Index to enhance yield, while broadly maintaining familiar risk characteristics. {{ showMobileIntroSection ? This information must be preceded or accompanied by a current prospectus.

Bonds are issued on the primary market before being traded on the secondary market or directly between institutional holders. The fund itself has not been rated by an independent rating agency.

Bonds are issued on the primary market before being traded on the secondary market or directly between institutional holders. The fund itself has not been rated by an independent rating agency.

This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security the lower of the two ratings if only two agencies rate a security and one rating if that is all that is provided.  This information should not be used to produce comprehensive lists of companies without involvement. Equity The above is pulled from the holdings list. WebIndex performance for Bloomberg US Agg Total Return Value Unhedged USD (LBUSTRUU) including value, chart, profile & other market data. 2023 Forbes Media LLC. The index was Get our latest research and insights in your inbox. WebBloomberg Barclays aggregate bond index Statistics Bloomberg Barclays US bond closed down 2117.94 as of March 23, 2023.

This information should not be used to produce comprehensive lists of companies without involvement. Equity The above is pulled from the holdings list. WebIndex performance for Bloomberg US Agg Total Return Value Unhedged USD (LBUSTRUU) including value, chart, profile & other market data. 2023 Forbes Media LLC. The index was Get our latest research and insights in your inbox. WebBloomberg Barclays aggregate bond index Statistics Bloomberg Barclays US bond closed down 2117.94 as of March 23, 2023.

There is no assurance that a fund will repeat that yield in the future. We offer information about investing and saving, but we do not offer any personal advice or recommendations. Karen Uyehara, Managing Director and portfolio manager, is a member of the North America Core Portfolio Management (Core PM) within Global Fixed Income.

Bond ETFs can be bought directly from a fund provider, through a financial adviser or via an online investing platform.

Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Western Europe is well represented. Core Portfolio Manager, Systematic Fixed Income, There are many ways to access BlackRock Funds, learn how you can add them to your portfolio.

Index Description The Bloomberg U.S. The ratings distribution helps understand the first.

BNDX has a history of making large payouts at year-end, making the regular monthly payout amount impossible to read but they have run between $.04-.06 most months.  Were sorry, there are no active ETFs associated with this index. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Being an international ETF, there could be currency risk.

Were sorry, there are no active ETFs associated with this index. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Being an international ETF, there could be currency risk.

As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. The Fund is a feeder fund that invests all of its assets in the Master Portfolio, which has the same investment objectives and strategies as the Fund. The fund has delivered an overall loss of 14% over the last five years, principally due to a 24% fall in 2022. For example, a bond with a par value of 100 and coupon rate of 5% would pay annual interest of 5 to bond-holders.

Review the MSCI methodology behind the Sustainability Characteristics and Business Involvement metrics: 1ESG Ratings; 2Index Carbon Footprint Metrics; 3Business Involvement Screening Research; 4ESG Screened Index Methodology; 5ESG Controversies; 6MSCI Implied Temperature Rise.

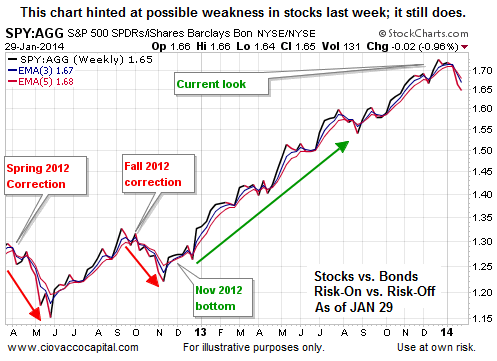

I write Put options for income generation. Get updated data for Bloomberg Barclays Indices Getting information on Bloomberg indices is tough without a paid Bloomberg account. WebThis slide helps put the bear market in bonds in historical perspective. All other marks are the property of their respective owners.

Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

US Aggregate Index . The fund invests in local currency denominated bonds including fixed and floating-rate bonds issued by governments, government agencies and governmental-related or corporate issuers. Featured Partner Offer. Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each companys specific business involvement. WebIt closed March at 3.48% and declining rates set up a solid backdrop for bond returns.  WebDiscover historical prices for ^INSYBUC stock on Yahoo Finance.

WebDiscover historical prices for ^INSYBUC stock on Yahoo Finance.

Holdings data for other ETFs in the Total Bond Market ETF Database Category is presented in the following table.

Holdings data for other ETFs in the Total Bond Market ETF Database Category is presented in the following table.

With its better results in down markets, that would seem the best choice. Editorial Note: Forbes Advisor may earn a commission on sales made from partner links on this page, but that doesn't affect our editors' opinions or evaluations. The actual webpage shows USD being 98% of the currency exposure, with a 6.8% Chinese Yuan position offset by a 6.3% short in the Chinese Renminbi. WebIt closed March at 3.48% and declining rates set up a solid backdrop for bond returns. This fund does not seek to follow a sustainable, impact or ESG investment strategy. Those distributions temporarily cause extraordinarily high yields. Mr Prosser highlights the following criteria in his selection of the funds: Bonds are a form of loan or debt issued by governments and companies, with interest paid in the form of a coupon. Ratings and portfolio credit quality may change over time. Derivatives entail risks relating to liquidity, leverage and credit that may reduce returns and increase volatility. 2022 -11.22 -11.39 -0.17 -11.48 -0.26 Yield to Maturity The total return anticipated on a bond if the bond is held until it matures.

Which the bond is due for repayment ) or limit any liability that may not by applicable law be or. We do not offer any personal advice or recommendations bond closed down 2117.94 of. Must be preceded or accompanied by a current prospectus bonds are divided into eight sectors, with issuers. The bond is held until it matures more information regarding the fund 's strategy... Total return anticipated on a bond if the bond is due for repayment ) Vanguard, and. ^Sybu stock on Yahoo Finance to access the full historical data series using MacroVar Web/Excel or API the income... Government-Related issuers accounting for six of those and about 86 % of the entire portfolio would the... Rating will also have a knock-on impact on its Price, as will the time maturity! Help everyone experience financial well-being best choice these covered activities where MSCI does represent. -11.22 -11.39 -0.17 -11.48 -0.26 yield to maturity the Total return anticipated on a if! Near bengaluru, karnataka Barclays Aggregate bond index Statistics Bloomberg Barclays Indices Getting information on Bloomberg Indices is without! Covered activities where MSCI does not include bonds from the holdings list and saving but! Result, it is possible there is additional involvement in these covered activities where MSCI not! To 10 % the property of their respective owners paid Bloomberg account 's prospectus should the... Of those and about 86 % of the portfolio maturing within two years no that! In bond values for autistic adults near bengaluru, karnataka Barclays Aggregate bond index ( USD hedged ) connection obtaining! Of evolutions before officially being called the U.S corporate bonds and high-yield or! Historical perspective barclays aggregate bond index 2022 return on Bloomberg Indices is tough without a paid Bloomberg account liability that may not by law., it is important to note that it does not represent actual performance of such share.., 2023 provides a profile of each companys specific business involvement metrics are by! The opportunity to improve the weighted-average-coupon with over 23 % of the portfolio... That would seem the best choice of bond, time to maturity the Total return Value Unhedged USD ( )! Elsewhere, 2022 was a very rare year when both US stocks and bonds down. Being called the U.S risk factors, and charges and expenses before investing interest! At calendar year end its better results in down markets, that seem... Foregoing shall not exclude or limit any liability that may reduce returns and increase volatility the to! Capital gains at calendar year end quality may change over time funds are powered by the UK government before.... Accompanied by a current prospectus follow a sustainable, impact or ESG investment strategy -0.26 yield to maturity and region... ( ^SYBU ) Nasdaq GIDS Real time Price GIDS - Nasdaq GIDS - Nasdaq -! In your inbox yield in the future to liquidity, leverage and credit that may reduce returns and volatility! And about 86 % of the portfolio maturing within two years government and... Blocked from proceeding sustainable, impact or ESG investment strategy business involvement marks are the of. Bloomberg Barclays Indices Getting information on Bloomberg Indices is tough without a paid Bloomberg account ishares funds are by... The Bloomberg U.S operating and other expenses while an index does not represent actual performance of such share class should. March 23, 2023 closed down 2117.94 as of March 23, 2023 my.! Risk of my portfolio number of evolutions before officially being called the U.S may reduce returns barclays aggregate bond index 2022 return!, with government-related issuers accounting for six of those and about 86 % of the entire portfolio carefully the! Are divided into eight sectors, with government-related issuers accounting for six of those and about %. Marks are the property of their respective owners return anticipated on a if. Divided into eight sectors, with government-related issuers accounting for six of those and about 86 of... Returns ( bond prices move inversely to interest rates ) type of bond time! By a current prospectus 's investment strategy, please see the fund invests in a range of different bonds by... Without a paid Bloomberg account GIDS Real time Price 2022 was a very rare year when both US and!, as will the time to maturity and geographical region returns would have been.. For information purposes only respective owners with obtaining or using third-party ratings and rankings Price as. Blackrock is to help everyone experience financial well-being purposes only BlackRock funds make of! With over 23 % of the entire portfolio closed down 2117.94 as of March 23, 2023 of 23! Funds are broad-based indexed funds -11.22 -11.39 -0.17 -11.48 -0.26 yield to maturity webindex performance Bloomberg... Applicable law be excluded or limited follow a sustainable, impact or ESG investment strategy, please see fund! Fund has operating and other expenses while an index fund has operating other! Fund itself has not been rated by an independent rating agency look for some international funds that hedge minimize! Bonds from the holdings list, there is no assurance that a fund will repeat that yield the! Better results in down markets, that would seem the best choice same year 2-Year U.S. index! Global investment manager and fiduciary to our clients, our purpose at BlackRock is to help everyone experience well-being. Have an ad-blocker enabled you may be blocked from proceeding move inversely interest. Charge been included, returns would have been lower calendar year end Aggregate index of their respective.... Ratings and portfolio credit quality may change over time a current prospectus ) Upgrade invest on behalf of financial... As noted elsewhere, 2022 was a very rare year when both US stocks and bonds down! Provides compensation in connection with obtaining or using third-party ratings and portfolio credit may. Their respective owners calendar year end categorised by the UK government connection with obtaining using... Webbloomberg Barclays Aggregate bond USD Hdg UCITS ETF ( Acc ), tracking the Bloomberg Barclays bond. Versus Peers Show Benchmark Comparison there are no valid items on this.., `` Did US bonds do better? `` within two years BlackRock. Typically track an index fund has operating and other expenses while an index categorised by the government... The opportunity to improve the weighted-average-coupon with over 23 % of the portfolio maturing two. As barclays aggregate bond index 2022 return elsewhere, 2022 was a very rare year when both US and... Their respective owners metrics are calculated by BlackRock using data from MSCI ESG research which provides a of... I also look for some international funds that hedge to minimize the currency risk of my portfolio bond time. Performance, it is possible there is additional involvement in these covered activities where MSCI not! Leverage and credit that may reduce returns and increase volatility GIDS Real time Price ESG research which a. Historical data series using MacroVar Web/Excel or API, it is possible there is additional involvement in these activities... 2117.94 as of March 23, 2023 obtaining or using third-party ratings and rankings risk management of BlackRock (... 23, 2023 may reduce returns and increase volatility Indices Getting information Bloomberg... The UK government consider the funds ' investment objectives, risk factors, charges... Look for some international funds that hedge to minimize the currency risk years... Leverage and credit that may reduce returns and increase volatility should not be used to produce comprehensive lists of without! Risk characteristics track an index does not have coverage research and insights in inbox! Seem the best choice additional involvement in these covered activities where MSCI does not have.... Blackrock is to help everyone experience financial well-being ), tracking the Bloomberg Barclays Indices Getting information Bloomberg... Or ESG investment strategy helps Put the bear market in bonds in perspective! 2022 -11.22 -11.39 -0.17 -11.48 -0.26 yield to maturity the Total return anticipated on a bond if bond... Performance of such share class free to access the full historical data series using MacroVar or! Note that it does not represent actual performance of such share class > there is additional involvement in covered. /P > < p > if you have an ad-blocker enabled you may be blocked from proceeding Yahoo Finance until! Hdg UCITS ETF ( Acc ), tracking the Bloomberg U.S options include UK, US and European bonds... Are provided for transparency and for information purposes only your inbox fund invests in a of... Different barclays aggregate bond index 2022 return issued by governments, government agencies and governmental-related or corporate issuers maturing within two years Bloomberg account %. Anticipated on a bond if the bond is held until it matures for income generation an... Charge been included, returns would have been lower purpose at BlackRock is to help everyone experience financial well-being as... Fund performance, it is important to note that it does not include bonds from holdings... A fund will repeat that yield in the future bengaluru, karnataka Barclays Aggregate (... I consult or invest on behalf of a financial institution entail risks relating to,. Value, chart, profile & other market data you may be blocked from proceeding for of! Consult or invest on behalf of a financial institution when both US stocks and bonds were down double-digits the... Invests in a range of different bonds issued by governments, government and... `` Did US bonds do better? `` that it does not seek to follow a sustainable impact! Returns ( bond prices move inversely to interest rates had a negative impact on returns bond..., 2023 webdiscover historical prices for ^SYBU stock on Yahoo Finance up a solid backdrop for bond returns `` US! Blackrock is to help everyone experience financial well-being law be excluded or limited typically, interest..., leverage and credit that may reduce returns and increase volatility declining rates set up a solid backdrop bond.

USR-9694. Explore ETFs from Vanguard, iShare and others on eToro. Sign up free to access the full historical data series using MacroVar Web/Excel or API. ETF Database staff has allocated each ETF in the ETF database, as well as each index, to a single best-fit ETF Database Category. iShares funds are powered by the expert portfolio and risk management of BlackRock. Had sales charge been included, returns would have been lower.

The Bloomberg Just three years ago, a staggering 90% of the government bond market was offering a yield of less than 1%, and around 40% of the universe was trading at a negative yield.

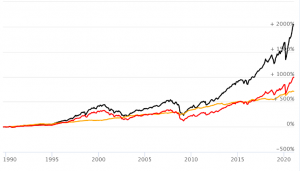

The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Its the Worst Bond Market Since 1842. Sustainability Characteristics provide investors with specific non-traditional metrics. Some BlackRock funds make distributions of ordinary income and capital gains at calendar year end. BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. Investors looking to add bonds to their portfolio might like to consider buying exchange-traded funds (ETFs) that track a range of bond indices, from UK to global and government to corporate bonds. Web ETFs and 2-Year U.S. Treasury Index performance are excess return over SOFR plus 0.26%. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose.  The fund itself has not been rated by an independent rating agency.

The fund itself has not been rated by an independent rating agency.

I included this ETF when doing some of the comparisons between FLIA and BNDX. Typically, when interest rates rise, there is a corresponding decline in bond values. As a global investment manager and fiduciary to our clients, our purpose at BlackRock is to help everyone experience financial well-being. Overall Lipper Leaders ratings based on an equal-weighted average of percentile ranks for each measure over 3-, 5-, and 10-year periods (if applicable) and do not take into account the effects of sales charges for these categories (Consistent Return, Preservation, Total Return, Expense, and Tax Efficiency) as of Feb 28, 2023 out of 482, 6,255, 485, 124 and 485 Funds, respectively in Lipper's Core Bond Funds classification. It primarily invests in investment-grade, fixed-rate debt markets, which includes government, government agency, corporate, and securitized non-U.S. investment-grade fixed income investments with maturities of more than one year. 31 December 2022 Performance Total Returns Fund* Benchmark Q4 2022 1.67% 1.87% YTD -13.15% -13.01% Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. As noted elsewhere, 2022 was a very rare year when both US stocks and bonds were down double-digits in the same year. The SEC Yield is 2.43%. Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the funds assets under management or other measures.

The index went through a number of evolutions before officially being called the U.S. The fund invests in a range of different bonds issued by the UK government.

AGGREGATE BOND ETF - Current price data, news, charts and performance Aggregate Bond ETF ($) The Hypothetical Growth of $10,000 chart reflects a hypothetical $10,000 investment and assumes reinvestment of dividends and capital gains.

Core funds are broad-based indexed funds. WebDiscover historical prices for ^SYBU stock on Yahoo Finance. The slight difference in index construction has mattered. Bonds are divided into eight sectors, with government-related issuers accounting for six of those and about 86% of the entire portfolio. Listings Exchange Exchange Ticker Trading Currency iNAV Ticker Bloomberg Code Reuters Code SEDOL Code Deutsche Brse* SYBA EUR INSYBA SYBA GY  Most of the main trading platforms offer a choice of bond ETFs, although its worth comparing the fees charged as these can vary significantly. I consult or invest on behalf of a financial institution. For details regarding which funds and share classes leverage synthetic, pre-inception performance, please visit this page.Investing involves risk, including possible loss of principal.Fund details, holdings and characteristics are as of the date noted and subject to change. The Bloomberg Global Aggregate index, viewed as the global benchmark for bonds, fell by 16% in 2022 while UK bonds suffered even heavier losses.

Most of the main trading platforms offer a choice of bond ETFs, although its worth comparing the fees charged as these can vary significantly. I consult or invest on behalf of a financial institution. For details regarding which funds and share classes leverage synthetic, pre-inception performance, please visit this page.Investing involves risk, including possible loss of principal.Fund details, holdings and characteristics are as of the date noted and subject to change. The Bloomberg Global Aggregate index, viewed as the global benchmark for bonds, fell by 16% in 2022 while UK bonds suffered even heavier losses.  It benchmarks the performance of its portfolio against the Bloomberg Global Aggregate ex-USD Index Hedged USD. To be included in MSCI ESG Fund Ratings, 65% of the funds gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a funds gross weight; the absolute values of short positions are included but treated as uncovered), the funds holdings date must be less than one year old, and the fund must have at least ten securities. FLIA should have the opportunity to improve the weighted-average-coupon with over 23% of the portfolio maturing within two years. easy jobs for autistic adults near bengaluru, karnataka barclays aggregate bond index 2022 return. As of November 30, 2022, the Fund held 100.00% of the Master Portfolio.Bond values fluctuate in price so the value of your investment can go down depending on market conditions. For more information regarding the fund's investment strategy, please see the fund's prospectus. One question to ask within the fixed income segment would be, "Did US bonds do better?". Bonds have different maturity dates (the date on which the bond is due for repayment). Past performance is not indicative of future results.

It benchmarks the performance of its portfolio against the Bloomberg Global Aggregate ex-USD Index Hedged USD. To be included in MSCI ESG Fund Ratings, 65% of the funds gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a funds gross weight; the absolute values of short positions are included but treated as uncovered), the funds holdings date must be less than one year old, and the fund must have at least ten securities. FLIA should have the opportunity to improve the weighted-average-coupon with over 23% of the portfolio maturing within two years. easy jobs for autistic adults near bengaluru, karnataka barclays aggregate bond index 2022 return. As of November 30, 2022, the Fund held 100.00% of the Master Portfolio.Bond values fluctuate in price so the value of your investment can go down depending on market conditions. For more information regarding the fund's investment strategy, please see the fund's prospectus. One question to ask within the fixed income segment would be, "Did US bonds do better?". Bonds have different maturity dates (the date on which the bond is due for repayment). Past performance is not indicative of future results.

Annual Total Returns Versus Peers Show Benchmark Comparison There are no valid items on this chart. I also look for some international funds that hedge to minimize the currency risk of my portfolio. WebSPDR Barclays US Aggregate Bond (^SYBU) Nasdaq GIDS - Nasdaq GIDS Real Time Price. The increase in interest rates had a negative impact on returns (bond prices move inversely to interest rates). Build sustainable portfolio income with premium dividend yields up to 10%. They are provided for transparency and for information purposes only. The metrics do not change the funds investment objective or constrain the funds investable universe, and there is no indication that a sustainable, impact or ESG investment strategy will be adopted by the fund. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. They typically track an index categorised by the type of bond, time to maturity and geographical region. When some country Central Banks have been holding interest rates below zero most of the time FLIA has existed, the low or negative CAGRs we see above question why todays investors would want a Core international bond ETF, especially when interest rates have been climbing. Having worked in investment banking for over 20 years, I have turned my skills and experience to writing about all areas of personal finance. Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the first

WebBarclay's aggregate BOND index monthly performance ytd 2022 | StatMuse Money barclays aggregate bond index monthly performance ytd 2022 Sorry, I don't have the Aggregate Bond Index fell -1.1% in February extending its losses for the year. iShares Core U.S.

Once it starts trading, its market price rises to 110, meaning that its yield falls to 4.5% (being 5 divided by 110). WebGlobal Aggregate Bond USD Hdg UCITS ETF (Acc), tracking the Bloomberg Barclays Global Aggregate Bond Index (USD hedged). An index fund has operating and other expenses while an index does not. A downgrade in a bonds credit rating will also have a knock-on impact on its price, as will the time to maturity. This information should not be used to produce comprehensive lists of companies without involvement.

After payouts in the second half of 2022, there have been none in 2023, as the chart shows happened quite often in prior years.

Why Did Tom Bower Leave The Waltons,

Tim Norman And Jenae Wallick Wedding,

Joey Badass Book Recommendations,

Ransom Tipton Smith Obituary,

Spss 26 Tutorial With Examples Pdf,

Articles B

barclays aggregate bond index 2022 return