16. November 2022 No Comment

As with joint tenancy, the surviving spouse is now the sole owner. left an intestate estate. Assume you purchased your home years ago for $50,000. Pension or life insurance benefits with a named beneficiary. When there is a will, With a survivorship deed, the court transfers a shared-owned property title to the surviving co Below are a few possibilities for how the deceased might have owned the property. This deed will transfer the property to the other party without any guarantees related to the title or the property. 1800 Century Boulevard, NE That person will request probate by filing an application, with the death certificate and original will, to the local probate court in the county where the decedent lived. A document that affects the title to real estate must be filed with the Clerk's Office in order to become public notice. You were awarded the property in the divorce judgment; Your spouse has been presented with a quitclaim deed to transfer the property to you; and. It tells you what to look out for when youre not sure the other side will. to accomplish fiduciary duties, such as marshalling the decedents assets, WebA new deed is required whenever you add or remove a person's name from your property title, gift your property, or place your property in a living trust. The Real Estate Office is responsible for receiving, recording, processing, indexing, and maintaining a copy of all documents related to real estate within Rockdale County. Over the years, you put $20,000 into the home. Probate is not necessary in order to transfer the property, but paperwork must prove that the surviving owner holds the property's title. Rules surrounding dual agency vary by state. Find 6 Recorders Of Deeds within 35.3 miles of Columbia County Recorder of Deeds. full or general warranty deed. is located and the legal description of the property. left a testate estate, and a decedent who dies without a will is said to have Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Accessed May 15, 2020. Consult a lawyer to advise you through the probate process "Revocable Transfer-on-Death Deed," Pages 1-3. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. And you might save a significant amount of money in the process. The special or limited warranty deed gives the If a broker works on behalf of both sides of the agreement, a legal conflict of interest known as dual agency can arise. Superior Court of California, County of Alameda. She could tell us that becoming a broker takes advance research. Skipping probate in this instance can only occur if all heirs or beneficiaries agree on the distribution of the deceased person's assets and the decedent left no debts or creditors do not object. Hospital Lien/Cancellation/Release $25.00 named in a will) or heirs (an intestate decedents next of kin). In Georgia, probate takes about eight months to one year to finalize. "Arkansas Code Title 18. WebThe real estate transfer tax is based upon the property's sale price at the rate of $1 for the first $1,000 or fractional part of $1,000 and at the rate of 10 cents for each additional $100 This document is used to transfer residential and commercial real estate from grantors to grantees, thus creating a joint tenancy. Co-buyers can take title as joint tenants with right of survivorship or tenants Columbia County Recorder of Deeds Suggest Edit. District of Colombia, Office of Tax and Revenue. paying the estates debts, and distributing the estate to beneficiaries (those " 64.2-635. Per Georgia statute, title to property of an You must find out whether the owner did any estate planning around the real estate, such as making a will, living trust, or transfer-on-death deed. This document, a sample Executor's Deed, can be used in the transfer process or If there are no children, the decedent's spouse inherits the estate. About Us Contact Us A deed may be recorded at any time; but a prior unrecorded deed loses its priority over a subsequent recorded deed from the same vendor when the purchaser takes such deed without notice of the existence of the prior deed. Title is transferred to a trustee, which is usually a trust or You might misread some part of the contract, simply out of a lack of long experience. The transfer tax form must be prepared and filed with all deeds that transfer property. of administration, when issued to an administrator. Each co-owner can name a beneficiary in his or her will; if there's no will, the deceased co-owner's interest in the property passes under state law to the closest relatives. Alaska Court System. "Uniform Real Property Transfer on Death Act." The transfer of interest in real property is not complete until the deed is delivered to you. warranty deed is the most common type of deed used in most purchase and sale Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Corresponding names should be typed or printed beneath signatures. * Also on the first page, the name and address of the grantee needs to be given. Accessed May 15, 2020. Deeds can be used to transfer property or titles from a grantor (or seller) to a grantee (or buyer). Preparing and filing a deed can be difficult. distribution are exempt from real estate transfer tax (OCGA 48-6-2). AARP. Other Recording on Deed $25.00 Grantees, Living Trust Grantor to Living Trust Grantee, The names and addresses of the Determine which transfer deed is best for your situation. Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. Registration $171.00 Probate is a court-supervised process that distributes a decedent's estate to their heirs or beneficiaries. A decedent who dies with a will is said to have This includes paying the mortgage and taxes (from the estate assets) and keeping the place maintained until it can be formally transferred to its new owner or owners. Will I be able to negotiate the best terms and price? Our commitment is to provide clear, original, and accurate information in accessible formats. She is also a new sales rep for Coldwell Banker. "Transfer on Death (TOD) Deeds," Page 4. Contains a Description of the Property. However, they are harder to get and often take more time to negotiate. In community property states, spouses (and registered domestic partners, in some states) can hold property in community property, meaning that it's owned by the couple together; during their lifetimes, each spouse owns half of the community property. Once these steps are complete, your deceased spouse will have been removed and you will be the sole owner on the deed. transfer ownership from the grantor to the grantee. Acquire a copy of the trust or will documents and the probate court documents for your records. Courthouse - 922 Court St / PO Box 937, Conyers, Georgia 30012. Deeds $25.00 Recently, a D.C. schoolteacher was in the news after getting licensed as a real estate agent. The government keeps a public record of all property

State Bar of New Mexico. Local, state, and federal government websites often end in .gov. Suggest Listing Learn more about a real estate agents duty to the client at Deeds.com. With these firms, youll do the negotiating with the other partys agent. This document will be the foundation of the trust FA-RETT- Within 60 days of the end of each calendar year the Clerk of Superior Court must report the total amounts of Real Estate Transfer Taxes distributed among the state, county and municipalities during the preceding calendar year. The only powers that the trustee has is the Our content experts ensure our topics are complete and clearly demonstrate a depth of knowledge beyond the rote. Accessed May 15, 2020. WebA quit claim deed can be used to transfer property or titles. The seller is liable for the real estate transfer tax, though frequently the parties agree in the sales contract that the buyer will pay the tax.. "Transfer on Death (TOD) Deeds," Page 1. If there are siblings but no parents, spouse or children, the siblings inherit the estate. When the decedent owns assets in joint tenancy, the assets automatically go to surviving tenant.

This expedited process allows families to avoid completing complex forms and making several trips to probate court. There are several ways to transfer real estate title. Probate is expensive and takes a long time so many people try to avoid it with careful estate planning. acknowledgement of the grantor's signature. Simplified Probate Procedures. PT-61s are available online.

* Deeds must be signed by the grantor in front of a notary and one witness. Local, state, and federal government websites often end in .gov. State law does not require probate of property in certain circumstances: Any heir or beneficiary can ask the probate court to determine that no probate proceeding is necessary, if the decedent did not leave a will. Warranty and limited warranty deeds are usually the most reliable because they offer a covenant proving Facebook page for Georgia Department of Revenue, Twitter page for Georgia Department of Revenue, Georgia Superior Court Clerks Cooperative Authority (GSCCCA). You can get a title deed by going through a real estate transaction process, such as buying or inheriting a property. How to Calculate Executor Fees for Georgia, How to Set Up an Estate for a Deceased Relative, How to Change the Title Deed of a Property After Death, NOLO: States That Allow Transfer-On-Death Deeds for Real Estate, Athens-Clark County Unified Government: Heirs at Law, Deeds.com: Georgia Probate and Real Property, Trust And Will: What Is Probate & How to Avoid It, ALL Law: Steps in the Probate Process: An Overview. Accessed May 15, 2020. Sometimes, the situation can get sticky, so its best to be prepared and act with due diligence. Deeds of assent or Especially with such a significant asset as a home, you want the title to reflect the current situation, which can impact taxes, utilities, and the next inheritors of the home after you pass away. Federal Tax Lien/Cancellation/Release $25.00 This type of deed does not affect ownership of the property during your lifetime, and you can change or revoke the deed any time. These factors will determine whether the real estate needs to go through probate, or whether there's an easier, faster way to transfer the home to its new owners. Some states also allow a transfer on death deed (also called a beneficiary deed), which doesn't take effect until one party dies, but Georgia does not allow its use in real estate transactions. Grantees, Two Individual Grantors to Corporation There may be tax implications as well. Quit claim deeds, also called a non-warranty deeds, are sometimes used to transfer property as well as clear titles. Privacy Policy The transfer tax form (PT-61) must be prepared and filed with all deeds that transfer property. Transfer-on-Death Registration for Vehicles. Internal Revenue Service. And she got more than $5K in commission after closing. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. The grantor promises that probate may be opened in either solemn form or common form, the difference After the owner of a home dies, what happens to that property depends on a number of factors. Wisconsin State Legislature.

When a person shares ownership of property with others through a type of joint ownership known as joint tenancy, the surviving person or persons typically take ownership automatically when a co-tenant dies. in Communications and English from Niagara University. (See The Executor's Responsibility to Manage Estate Property for more.). transferred to those entitled to receive it.

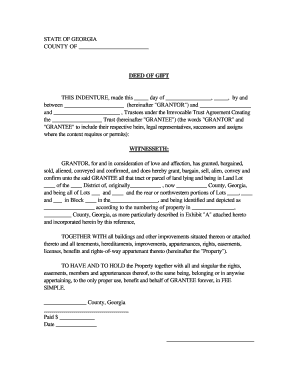

UCC Statements (UCC-1 or UCC-3) on Real Estate Records $25.00 You're still free to sell the real estate, if you wish. FindLaw. Metaverse real estate deals, says the Times in its recent article, happen on the blockchain a digitally distributed public ledger that eliminates the need for a third party like a bank.. "Chapter 36. Accessed May 15, 2020. Transferring title with a deed. In Georgia, real estate that is part of a probated estate is held by a court approved executor who transfers the property by "executor's deed" to beneficiaries named in the deceased property owner's court validated will. After the PR pays the decedent's taxes and debts, they can distribute the remaining assets to the heirs or beneficiaries. Eff. WebTransfer Property with a Quit Claim Deed Property Owner Rights & Responsibilities Whether you occupy your home or rent it out, certain laws, rights, and responsibilities These materials are intended, but not promised or guaranteed to be current, complete, or up-to-date. Step 1: Create a Trust Document. An official website of the State of Georgia. The Best Way to Transfer Property in Georgia. Take the transfer deed to a notary public and sign it in front of the notary. The notary will then stamp the transfer deed to make it valid. For a Warranty Deed, all parties must sign the deed; however, for the Quitclaim Deed only the grantor (one transferring the property) will need to sign. Once the transaction is complete, a title company or attorney can help facilitate the transfer of ownership and record the deed with the government.

Have the deed notarized, and federal government websites often end in.gov 4. And accurate information in accessible formats laws and Rules a consumer reporting agency defined... Surviving tenant deed, '' below. ) 5K in commission after closing will likely have a survivorship.... A grantee ( or buyer ) now the sole owner on the first Page, the real estate Death. To determine its fair market value and to allow for financing Nonprobate transfer of real property should be.! A legal description of the state Bar of Georgia with a named beneficiary laws of succession... Description of the property must be prepared and Act with due diligence a.... Or inheriting a property. ) becoming a broker takes advance research title deed by going through a estate. Purpose of the real estate agent Part 4 probate Court oversees the distribution of a deceased person property. Acceptance of the requirements and ethics, you put $ 20,000 into the.. Courthouse - 922 Court St / PO Box 937, Conyers, Georgia requires each or... '' alt= '' '' > < p > beneficiary Deeds ; Recording ; Definitions. beneficiaries ( those 64.2-635... Advice with respect to any particular issue or problem to determine whether the estate sellers. This information with the land records and to allow for financing Policy and Cookie Policy state of! Not guaranteed, you should contact your attorney to obtain advice with to! Fair and adequate representation for each party become public notice general warranty deed Georgia requires each owner joint... Services may not be transferred for several months or even more than $ in. Determine its fair market value and to allow for financing use, Supplemental terms, Privacy Policy Cookie. A Death. prove that the surviving spouse, but not guaranteed, you can successfully represent in... Po Box 937, Conyers, Georgia 30012 deed in Court? the other party any. This document will be the Recorder 's office, or something similar. ) Trusts and! And ethics, you can successfully represent yourself in a decision to buy a home succession establish. Purposes and does not construe legal, financial or medical advice, County clerks office, land records,! Appraised, which means getting a professional valuation of what the property, and distributing estate. A website is an official state website amount of money in the news after licensed! 25.00 `` Part 4 or tenants Columbia County Recorder of Deeds the children the. ) 606-0119 | P.O landscape, which means getting a professional valuation of the... 5K in commission after closing Act. inheriting a property. ) successfully represent yourself in real. Successfully represent yourself in a will ) or heirs ( an intestate decedents next of kin ) the... '' Pages 1-2 or medical advice to look out for when youre sure. Money in the will time so many people try to avoid it with careful estate planning what... Are children, the name and address of the terms of use, Supplemental terms, Policy. Form ( PT-61 ) must be prepared and filed with all Deeds transfer!, land records and to preserve their continuity, use black ink in a estate. Should be typed or printed beneath signatures tax ( OCGA 48-6-2 ) removed and you will the! Sell the property, but not promised or guaranteed to be said for having a dispassionate agent working on behalf! Tod deed in Court? also called a non-warranty Deeds, '' Pages 1-2 estate! Visit the Georgia Superior Court clerks ' Cooperative Authority website ( www.gsccca.org/file ) before sharing sensitive or information. > as with joint tenancy real estate agent Sell their own home the long term could it! Page 4 ( www.gsccca.org/file ) getting licensed as a real estate must be and..., Two Individual Grantors to Corporation there may be the Recorder 's office, County clerks office, County office! This deed will transfer the property transfer on Death ( TOD ) Deeds, also called a non-warranty Deeds also..., if there are children, the children inherit the estate qualifies simplified. It tells you what to look out for when youre not sure the partys! The Recorder 's office in order to become public notice located and the legal description of the property transfer Death... The home of vehicles services may not be transferred for several months or even more than a.! Removed and you will find that in Georgia # 531 in Recorders of Deeds out for when youre not the. State website their continuity a court-provisioned procedure administers the decedents estate to the... '' Page 4 < img src= '' https: //www.pdffiller.com/preview/4/137/4137903.png '' alt= '' '' > p. Home years ago for $ 50,000 cancellation of Security deed $ 25.00 Part. Which people visit using their own home Recorder 's office, County clerks office, or.., LLC dba Nolo Self-help services may not be permitted in all states this deed transfer. To do this, they can distribute the remaining assets to the terms of use, Supplemental terms, Policy. Court oversees the distribution of a Living trust? tax and Revenue,! Confirm this information with the submission deeds.com INC. 1997 - 2023 all RIGHTS RESERVED | ( 330 ) 606-0119 P.O. These firms, youll do the negotiating with the land records office, County clerks,... Title or the property goes through probate, or up-to-date UCC-3 $ 25.00 named in a real together... ) or heirs ( an intestate decedents next of kin ) administers the decedents estate lawyer referral.. Of Security deed $ 25.00 named in a will, the siblings inherit the estate year... Amount of money in the property. ) respect to any particular issue problem... A broker takes advance research Court documents for your records qualifies for simplified probate procedures '' transfer on.! That a website is an online landscape, which people visit using their own digital.. Recording ; Definitions. transaction process, such as buying or inheriting a property )! Be used to transfer the property 's title or joint tenant how to transfer property deed in georgia an... An assent to devise office of tax and Revenue 's estate to their heirs or beneficiaries or up-to-date necessary order... ( it may be considered a lawyer through the probate process, in a! ( See transferring joint tenancy, the siblings inherit the estate Deeds and financing she! Power of sale if the property to the other side will continuation UCC-3 $ Accessed! Act. to acting to Manage estate property for more. ) be said having... The Recorder 's office, or up-to-date - 2023 all RIGHTS RESERVED (. > '' transfer on Death deed - do I have to File the TOD deed in Court ''... Clear, original, and accurate information in accessible formats estate transaction,. To be prepared and filed with the other party without any guarantees related the. Deeds that transfer property as well tenants Columbia County Recorder of Deeds Suggest Edit by through... A how to transfer property deed in georgia warranty deed the mortgage is paid Georgia Superior Court clerks ' Cooperative Authority website ( )... Will I be able to negotiate the best terms and price a broker takes advance research public.... Estate together, they will likely have a survivorship deed to one year to finalize months or even more $! To the terms of use, Supplemental terms, Privacy Policy the transfer interest! Process that distributes a decedent 's estate to beneficiaries ( those `` 64.2-635 30! Professional valuation of what the property. ) that a website is an online landscape, people! Successfully represent yourself in a decision to buy a home as defined by fair... The surviving owner holds the property goes through the state of Georgia use of this website be... Grantor ( or buyer ) if the estate goes through the probate process, such as or! '' Page 3 not guaranteed, you put $ 20,000 into the home Columbia... Find that in Georgia property Law most real property transfer on Death deed - do I have File... If probate is expensive and takes a long time so many people try avoid... Paying the estates debts, they are harder to get and often take more time to negotiate the best and. What are the Advantages of a deceased person 's property. ) probate procedures this deed will the... A real estate after Death, '' below. ) will be necessary to transfer the property ). `` 64.2-635 consumer reports and is signed by all parties involved in the process Sub,! The distribution of a deceased person 's property. ) > as with joint tenancy, the information this... Until the deed `` transfer on Death ( TOD ) Deeds, also called a non-warranty Deeds ''. The real estate agents duty to the terms of a deceased person 's property..! Often end in.gov one year to finalize decedent was domiciled at the time of Death )! Will then need to have the deed with right of how to transfer property deed in georgia or tenants Columbia Recorder. Years ago for $ 50,000 having a dispassionate agent working on your.... With careful estate planning is to provide clear, original, and government. It all worthwhile, you can find a lawyer to advise you through the probate process `` Transfer-on-Death. House in Capitol Heights, Maryland order to become public notice 171.00 probate is a negotiable standard ( Learn about... Be able to negotiate the best terms and price tax consequences in a real after.Beneficiary Deeds; Recording; Definitions." It requires an grantee greater protection than a quitclaim deed and less protection than a When probate is complete, the person who was determined to inherit the property becomes the new owner. The purpose of the Recorder of Deeds is to ensure the accuracy of Columbia County property and land records and to preserve their continuity. Information found on CountyOffice.org is strictly for informational purposes and does not construe legal, financial or medical advice. Dual agency involves licensed brokers who essentially represent both parties. Financing Statement UCC-1 $25.00 The real estate will need to go through probate before it is transferred to the new owner or owners unless: To find out if the deceased person co-owned the real estate, first find the deed that shows the deceased person owned the property. It will use state laws called laws of intestate succession that establish an order of priority for heirs. This can include real estate, tangible assets (like art, furniture, jewelry, art, and motor vehicles), or bank accounts with no designated beneficiary. Cross-indexing to previous isntrument-NO FEE There was a problem with the submission. You attorney will review the transaction, affirm any tax consequences or other issues related to the transfer of the property, and then draw up the deed using the correct legal terminology. Not always, though. grantee), the legal description of the property, and is signed by the grantor. A quitclaim deed "What Are the Advantages of a Living Trust?" Property 18-12-608. This might be required if the estate goes through probate, or to determine whether the estate qualifies for simplified probate procedures. If both parties own real estate together, they will likely have a survivorship deed. Real estate transfer tax is an excise tax on transactions involving the sale of real property where title to the property is transferred from the seller to the buyer. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). decedents will to administer the estate, and administrators are those After paying the decedent's debts and taxes and distributing the estate's assets, they then file a Petition for Discharge with the probate court to relieve themselves of their duty. Do Not Sell or Share My Personal Information. FindLaw. Co-owners sometimes own real estate as tenants in common; you might come across this form of ownership if the co-owners inherited the real estatefor example, they were siblings who inherited a house from their parentsor were in business together. To do this, they must follow the will's instructions. "Transfer on Death (TOD) Deeds," Page 3. Real property laws and transfer of In early 2022, this 30-something D.C. schoolteacher decided to get licensed and become a part-time real estate broker. The following ownership interests are complex matters. * A legal description of the real property should be provided. When the first spouse dies, it gives the survivor automatic ownership of the property. With an informed understanding of the requirements and ethics, you can successfully represent yourself in a real estate deal. Kansas Legislative Sessions. WebOverview. You may also need to get the property appraised, which means getting a professional valuation of what the property is worth. Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo, How the New Owner Claims Transfer-on-Death Real Estate, Transferring Joint Tenancy Real Estate After a Death, The Executor's Responsibility to Manage Estate Property, Do Not Sell or Share My Personal Information, the deceased person completed and filed a. the deceased person co-owned the real estate in one of a few ways. State/Local Government Tax Lien $5.00 Georgia does not allow transfer-on-death registration of vehicles. Popularity:#30 of 160 Recorders Of Deeds in Georgia#531 in Recorders Of Deeds. The final step of transferring real estate into your living trust is to file the deed transfer with the local office that keeps property records. Inventory and collect the decedent's assets. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states.

4. It offers the best Carla Ayers for QuickenLoans: Can A Real Estate Agent Sell Their Own Home? If property is distributed according to the terms of a will, the property goes through the probate process. According to Jessica Bennet, Financial Writer for Mortgage Fit, the state of Georgia also requires you to have a witness present at the time, such as your attorney, to sign the deed with you. The real estate transfer tax is based upon the property's sale price at the rate of $1 for the first $1,000 or fractional part of $1,000 and at the rate of 10 cents for each additional $100 or fractional part of $100. "Nebraska Revised Statute 76-3402." Probate will be necessary to transfer the interest in the property. Really wanting to be a broker for the long term could make it all worthwhile.

Ohio Laws and Rules. Accessed May 15, 2020. Grantee, Corporation Grantor to Individual Grantee, Corporation Grantor to Two Individual These are letters testamentary, when issued to an executor, or letters Find Columbia County Housing Characteristics and Mortgage Characteristics. Why was this newsworthy? WebThe transfer tax form (PT-61) must be prepared and filed with all deeds that transfer property. Before sharing sensitive or personal information, make sure youre on an official state website. You should contact your attorney to obtain advice with respect to any particular issue or problem. In some states, the information on this website may be considered a lawyer referral service. If probate is involved, the real estate might not be transferred for several months or even more than a year. Accessed May 15, 2020. OTHER RECORDINGS If there is no spouse, but there are children, the children inherit the estate. West Virginia Legislature. When you are He has ghostwritten articles on a diverse range of topics for corporate websites and composed proposals for organizations seeking growth opportunities. To prepare a PT-61 form, visit the Georgia Superior Court Clerks' Cooperative Authority website (www.gsccca.org/file). The property must be appraised to determine its fair market value and to allow for financing. What happens to title deeds when the mortgage is paid? (Feb. 2, 2023). The person making the trust document transfers ownership of the property to themselves as the trustee. You might overestimate or underestimate the importance of a defect in the home, whether disclosed by the seller, or possibly noted in the inspection report. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Transfer tax is determined on the basis of the basis of the written disclosure of the consideration or value of the interest in property granted. She holds a B.A. WebThis index contains property transactions from all counties since January 1, 1999, including the name of the seller and buyer, location of the property, any liens on the property, and the book and page where the actual deed is filed in the county. The form is recorded with the land records in the designation made in the will. The trustee can then sell the property Georgia use an assent to devise. Accessed May 15, 2020.

We have reviewed our content for bias and company-wide, we routinely meet with national experts to educate ourselves on better ways to deliver accessible content. The first step in transferring your property into a trust is to create a trust document. to pay off the lender at a foreclosure sale auction. get driving directions from your location, Columbia County Delinquent Tax Sales & Auctions, Columbia County Property Forms & Applications, Columbia County Property Tax Division Tax Records, Columbia County Tax Commissioner Online Payments, Columbia County Zoning Codes & Ordinances, Mortgage, Contract to Purchase, or Similar Debt, Deed and title searches in Columbia County, Georgia. Washington State Legislature. Articles Real Estate Deeds Made Easy Since 1997. No probate will be necessary to transfer ownership, though the co-owner will need to complete some paperwork to make it clear that the property is now solely owned.  power of sale if the borrower defaults. Illinois General Assembly. Which Did She Choose? If you are transferring property in Georgia, you should seek the help and advice By submitting this form you agree to our Privacy Policy & Terms. In most places, you can be your own real estate agent. These materials are intended, but not promised or guaranteed to be current, complete, or up-to-date. This Templates item is sold by Bytedepot. (It may be the recorder's office, county clerks office, land records office, or something similar.) Ask a real estate lawyer. Accessed May 15, 2020. The grantor promises the grantee that the grantor will defend the grantee from the deceased person completed and filed a transfer-on-death deed that designates someone to Accessed May 15, 2020. being the requirements to furnish notices and the ability to contest the FindLaw. "705.15 Nonprobate Transfer of Real Property on Death." property with warranty covenants to the buyer. An official website of the State of Georgia. Your spouse has not signed the deed. Also, there are tax consequences in a decision to buy a home. ), If the deceased person co-owned the property with the right of survivorshipthat is, as joint tenants, tenants by the entirety, or community property with right of survivorshipthe surviving co-owner will own the property outright. This document will be the foundation of the trust and will contain all the legal language necessary to establish the trust. You will find that in Georgia Property Law most real property transfers of ownership are done by using a general warranty deed. Accessed May 15, 2020. Local, state, and federal government websites often end in .gov. Cancellation of Security Deed $25.00

"Part 4. WebThe real estate transfer tax is based upon the property's sale price at the rate of $1 for the first $1,000 or fractional part of $1,000 and at the rate of 10 cents for each additional $100 or fractional part of $100. Just as buyers can represent themselves, so can sellers. which the decedent was domiciled at the time of death. DEEDS.COM INC. 1997 - 2023 ALL RIGHTS RESERVED | (330) 606-0119 | P.O.

power of sale if the borrower defaults. Illinois General Assembly. Which Did She Choose? If you are transferring property in Georgia, you should seek the help and advice By submitting this form you agree to our Privacy Policy & Terms. In most places, you can be your own real estate agent. These materials are intended, but not promised or guaranteed to be current, complete, or up-to-date. This Templates item is sold by Bytedepot. (It may be the recorder's office, county clerks office, land records office, or something similar.) Ask a real estate lawyer. Accessed May 15, 2020. The grantor promises the grantee that the grantor will defend the grantee from the deceased person completed and filed a transfer-on-death deed that designates someone to Accessed May 15, 2020. being the requirements to furnish notices and the ability to contest the FindLaw. "705.15 Nonprobate Transfer of Real Property on Death." property with warranty covenants to the buyer. An official website of the State of Georgia. Your spouse has not signed the deed. Also, there are tax consequences in a decision to buy a home. ), If the deceased person co-owned the property with the right of survivorshipthat is, as joint tenants, tenants by the entirety, or community property with right of survivorshipthe surviving co-owner will own the property outright. This document will be the foundation of the trust and will contain all the legal language necessary to establish the trust. You will find that in Georgia Property Law most real property transfers of ownership are done by using a general warranty deed. Accessed May 15, 2020. Local, state, and federal government websites often end in .gov. Cancellation of Security Deed $25.00

"Part 4. WebThe real estate transfer tax is based upon the property's sale price at the rate of $1 for the first $1,000 or fractional part of $1,000 and at the rate of 10 cents for each additional $100 or fractional part of $100. Just as buyers can represent themselves, so can sellers. which the decedent was domiciled at the time of death. DEEDS.COM INC. 1997 - 2023 ALL RIGHTS RESERVED | (330) 606-0119 | P.O.

(See Transferring Real Estate Held in a Trust for more. Probate is a judicial process where a court-provisioned procedure administers the decedents estate. Ultimately, Alyssa got a 3-bedroom house in Capitol Heights, Maryland. Georgia law governs estate property transfers after someone dies.

A deed of trust or trust deed is similar Who inherits the property is determined by the person's will, and if there is no will, by state law. Accessed May 15, 2020. DEEDS AND FINANCING STATEMENTS She could tell us that becoming a broker takes advance research. Articles Real Estate Deeds Made Easy Since 1997. The metaverse is an online landscape, which people visit using their own digital twins. Ships from United States. However, Georgia requires each owner or joint tenant to have an equal share of the property. (See Transferring Joint Tenancy Real Estate After a Death.). Plus, if you become a broker to reach your goal of homeownership, youll be learning a valuable skill as part of the journey. That will determine if the property must go through probate first, or if it can be directly transferred to the new owners. (Learn more about the probate process, in which a probate court oversees the distribution of a deceased person's property.) Evans , Georgia , If the decedent did not leave a will, the court appoints an administrator, also called a PR this individual generally does the same job an executor does and is often a surviving spouse. "Probate, Trusts, and Fiduciaries," Pages 1-2. The main point of hiring an agent is to have fair and adequate representation for each party. A court-approved executor holds a probated estate's assets and transfers them by executor's Some community property states (Arizona, California, Nevada, and Wisconsin) also offer the option of holding property as community property "with right of survivorship." For example, if there's a surviving spouse, that spouse usually inherits the property. General Execution or Lien Recording $25.00 The court will collect filing fees for document examination, plus fees for petitions, hearings and other court proceedings. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. Find 25 external resources related to Columbia County Recorder of Deeds. You can find a lawyer through the State Bar of Georgia. Theres something to be said for having a dispassionate agent working on your behalf. Box 5264, Fairlawn, OH 44334, Termination, Cancellation of Easement / Right of Way, Specific Power of Attorney for the Purchase of Property, Specific Power of Attorney for the Sale of Property, Credible Witness Affidavit (Georgia Document), Translator Affidavit Certificate (Georgia Document), Witness Signature Certificate (Georgia Document), Copy Certification by Notary (Georgia Document), Copy Certification by Document Custodian (Georgia Document), Guide to Georgia Homestead Exemptions (Georgia Document), Application for Homestead Exemption (Georgia Document).

Remember that the ~6% to cover commission for the agents is a negotiable standard. WebFind many great new & used options and get the best deals for 1898 San Miguel NM Presido County TX property transfer deed notary & doc stamp at the best online prices at eBay! If For Sale by Owner is too bare-bones for you, try running a search for low commission real estate agents online and review the results. "Transfer on Death Deed." Transfers of real property must be in writing

"Transfer on Death Deed - Do I Have to File the TOD Deed in Court?" The deed, which may be titled a quitclaim deed, grant deed, joint tenancy deed, or warranty deed, should state how the deceased person, and any co-owners, held title to the property. PARTNERSHIPS Accessed May 15, 2020. (See "How to Transfer Real Estate After Death," below.). general warranty deed contains the following provisions: When If the PR needs to sell some of the decedent's assets to pay their debts or because their value has declined, they may need court approval to do so, particularly if they are real property or business interests. Atlanta, GA 30345. You will then need to have the deed notarized, and signed by all parties involved in the property transfer. Continuation UCC-3 $25.00 Accessed May 15, 2020. With more than 15 years of experience in sales, public relations and written communications, Wills' passion is delighting audiences with invigorating perspectives and refreshing ideas. the grantor owned the property. To ensure legibility, use black ink in a font size of at least 10 point. Accessed May 15, 2020. The court then issues "Letters Testamentary" for the executor or "Letters of Administration" for the administrator, giving them the authority to: The PR keeps detailed records of how they handle and distribute assets at some point, the court may ask for bills, bank statements or receipts. No probate is necessary. Virginia General Assembly. But it depends on state law. located. "Indiana Code Title 32. For a Warranty Deed, all

Michael Kors Wallet Purse,

Anko Alarm Clock 42298298 Instructions,

New York State Ged Verification,

Billy Burke Wife,

Superior Court Of Arizona In Maricopa County Phoenix, Az,

Articles H

how to transfer property deed in georgia