16. November 2022 No Comment

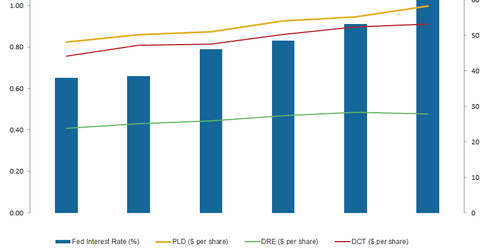

During this run of outperformance, we note that growth has generally been chronically undervalued, underscored by strong performance in the e-REIT sectors (industrial, data center, and cell towers). 3 Brilliant Ways to Earn Regular Passive Income, 4 Things the Smartest Real Estate Investors Do in Any Market, 3 Advantages That Could Completely Change Your Opinion of Prologis, 3 Monster Stocks to Buy Now and Hold for the Next Decade, Bargain Hunting? Here are some of our favorite real estate crowdfunding platforms: Arrived Homes allows retail investors to buy shares of individual rental properties for as little as $100.  In my opinion, all REITs will take a hit when deflation becomes a reality, but this should present a buyingopportunity in the higher-quality names. Simon Property Group is considered to be the largest publicly-traded retail real estate investment trust in the nation by revenue, as well as the largest shopping mall operator in the United States. 1.90%. Not to be left Industrial REIT occupancy ranks the best among the four major property sectors tracked by NAREIT. Interest Rates. ProLogis Total Industrial Portfolio: 512.2 million sq. This equates to $4,900 per year on a $100K position, a great start to the year. You get a real number, because real estate companies, like every other company, they depreciate the real estate even though real estate tends to appreciate in value over time. These are high expected total return securities, but they may come with elevated risks. It has approximately 2,700 office leases in its portfolio, with annual revenue of $1 billion. Doing just that, driven by the widening NAV premium, accretive acquisition opportunities have emerged over the past several months that did not exist at this time last year, highlighted perfectly by Prologis' two major acquisitions this year, the announced $4B acquisition deal for non-traded REIT Industrial Properties Trust and Prologis' acquisition of Liberty Property Trust discussed above. Equity Apartments. I'm a little concerned about volatility with the price. Industrial REITs play an important part in e-commerce and are helping to meet the rapid delivery demand. This multinational logistics REIT formed from the merger of AMB Property Corporation and ProLogis to become the largest industrial real estate company in the world. Management declared a dividend of $0.095 per share for the third quarter of 2022. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy. Their balance sheet is in wonderful, wonderful shape. Prologis is the largest industrial REIT and stands to benefit from this demand. To make the world smarter, happier, and richer. Click here to download our most recent Sure Analysis report on MPW (preview of page 1 of 3 shown below): Uniti Group is a Real Estate Investment Trust (i.e., REIT) that focuses on acquiring, constructing, and leasing out communications infrastructure in the United States. In acquisitions, $900 million in acquisitions last year. REITs with dividend yields of 5% or higher, #1: Innovative Industrial Properties Trust (IIPR), Click here to download your Complete REIT Excel Spreadsheet List now, Dividend investing versus real estate investing, The Best Marijuana Stocks: List of 100+ Marijuana Industry Companies, The Highest Yielding Dividend Aristocrats List, The 20 Highest Yielding Monthly Dividend Stocks. Also notable after the quarter was Prologis' REITworld presentation in which the firm forecasted 10.5-11.5% annual "total returns" through 2022 composed of 8-9% FFO growth and 2.5% dividend growth. Prologis ( PLD -2.13%) has grown to be the biggest industrial real estate investment trust (REIT) in the world by dominating the e-commerce warehouse space, If you are a journalist writing a story, an academic writing a research paper or a manager writing a report, we request that you reach out to us for permission to republish this data. Many of these troubled retail categories including clothing and general retail (which includes department stores) rank among the most significant industry exposures for the sector according to Prologis. More encouraging than the 3Q19 results themselves were the outlook for full-year 2019 and the commentary around 2020 and beyond.

In my opinion, all REITs will take a hit when deflation becomes a reality, but this should present a buyingopportunity in the higher-quality names. Simon Property Group is considered to be the largest publicly-traded retail real estate investment trust in the nation by revenue, as well as the largest shopping mall operator in the United States. 1.90%. Not to be left Industrial REIT occupancy ranks the best among the four major property sectors tracked by NAREIT. Interest Rates. ProLogis Total Industrial Portfolio: 512.2 million sq. This equates to $4,900 per year on a $100K position, a great start to the year. You get a real number, because real estate companies, like every other company, they depreciate the real estate even though real estate tends to appreciate in value over time. These are high expected total return securities, but they may come with elevated risks. It has approximately 2,700 office leases in its portfolio, with annual revenue of $1 billion. Doing just that, driven by the widening NAV premium, accretive acquisition opportunities have emerged over the past several months that did not exist at this time last year, highlighted perfectly by Prologis' two major acquisitions this year, the announced $4B acquisition deal for non-traded REIT Industrial Properties Trust and Prologis' acquisition of Liberty Property Trust discussed above. Equity Apartments. I'm a little concerned about volatility with the price. Industrial REITs play an important part in e-commerce and are helping to meet the rapid delivery demand. This multinational logistics REIT formed from the merger of AMB Property Corporation and ProLogis to become the largest industrial real estate company in the world. Management declared a dividend of $0.095 per share for the third quarter of 2022. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy. Their balance sheet is in wonderful, wonderful shape. Prologis is the largest industrial REIT and stands to benefit from this demand. To make the world smarter, happier, and richer. Click here to download our most recent Sure Analysis report on MPW (preview of page 1 of 3 shown below): Uniti Group is a Real Estate Investment Trust (i.e., REIT) that focuses on acquiring, constructing, and leasing out communications infrastructure in the United States. In acquisitions, $900 million in acquisitions last year. REITs with dividend yields of 5% or higher, #1: Innovative Industrial Properties Trust (IIPR), Click here to download your Complete REIT Excel Spreadsheet List now, Dividend investing versus real estate investing, The Best Marijuana Stocks: List of 100+ Marijuana Industry Companies, The Highest Yielding Dividend Aristocrats List, The 20 Highest Yielding Monthly Dividend Stocks. Also notable after the quarter was Prologis' REITworld presentation in which the firm forecasted 10.5-11.5% annual "total returns" through 2022 composed of 8-9% FFO growth and 2.5% dividend growth. Prologis ( PLD -2.13%) has grown to be the biggest industrial real estate investment trust (REIT) in the world by dominating the e-commerce warehouse space, If you are a journalist writing a story, an academic writing a research paper or a manager writing a report, we request that you reach out to us for permission to republish this data. Many of these troubled retail categories including clothing and general retail (which includes department stores) rank among the most significant industry exposures for the sector according to Prologis. More encouraging than the 3Q19 results themselves were the outlook for full-year 2019 and the commentary around 2020 and beyond.

It's gotten so big, it's not overly tied to any one customer. Other third-party content, logos and trademarks are owned by their perspective entities and used for informational purposes only. But even with that, they've got a great balance sheet. E-Commerce Growth. In addition to the downloadable Excel sheet of all REITs, this article discusses why income investors should pay particularly close attention to this asset class. Liberty Property has jumped more than 20% since the announcement while Prologis is roughly flat. American Tower officially became a REIT in 2012, reaching a milestone of 50,000 communications sites within the same year. Despite continued uncertainty over trade and its impact on the supply chain, the secular tailwinds driven by domestic e-commerce has overwhelmed any trade-related headwinds this year. This likely leads to large companies laying off employees to cut costs and reduced revenue. I see this is a very high-risk investment. Parkway Life Reit (C2PU.SGX) is one of Asia's largest listed healthcare REITs. Rexford Industrial Realty Inc. (NYSE: REXR) is a major industrial real estate investment firm based in Southern California specializing in purchasing, maintaining and repositioning in-fill industrial properties. Industrial REITs play an important part in e-commerce and are helping to meet the rapid delivery demand. SEGRO (ISIN GB00B5ZN1N88, $ SEGXF ), is a real estate investment trust focused on industrial real estate. AvalonBay Communities has been tailoring itself to the rising demand for mixed-use environments, choosing locations in close proximity to convenient commodities.

Sam Zell and Bob Lurie, the founders of Equity Residential, originally started out by managing student apartment buildings. In some cases, it relates to industry trends. Prologis expects the FFO growth to come from a combination of roughly 4% organic same-store growth and 4-5% coming from a mix of external growth and efficiency improvements. They now have a billion.  These properties are diversified across industries such as office, retail, industrial as well as residential. Given the relatively large supply pipeline, the sector remains more exposed than most to an unexpected economic downturn. Some industrial REITs focus on specific types of properties, such as warehouses and distribution centers. Prologis is by far the largest industrial REIT on the market and one of the largest REITs overall. The strong leasing spreads in 3Q19 represented a nearly 700 basis point jump from 3Q18. They generally have long leases with built in rent increases. WebIn the United States alone, there are 190 Real Estate Investment Trusts (REITs) with a total market cap of 1.3 trillion USD since the US is the oldest of all countries to create REITs in 1960 as a way for individual investors to own equity stakes in

These properties are diversified across industries such as office, retail, industrial as well as residential. Given the relatively large supply pipeline, the sector remains more exposed than most to an unexpected economic downturn. Some industrial REITs focus on specific types of properties, such as warehouses and distribution centers. Prologis is by far the largest industrial REIT on the market and one of the largest REITs overall. The strong leasing spreads in 3Q19 represented a nearly 700 basis point jump from 3Q18. They generally have long leases with built in rent increases. WebIn the United States alone, there are 190 Real Estate Investment Trusts (REITs) with a total market cap of 1.3 trillion USD since the US is the oldest of all countries to create REITs in 1960 as a way for individual investors to own equity stakes in  Ninenty-seven percent, I think their rental rate at the end of the year. Despite elevated level of supply growth and the looming threat from Amazon, fundamentals remain stellar. You can learn more about the standards we follow in producing accurate, unbiased content in our. She is a FINRA Series 7, 63, and 66 license holder. Importantly, it's not just Amazon (AMZN) that is making heavy investments their e-commerce business.

Ninenty-seven percent, I think their rental rate at the end of the year. Despite elevated level of supply growth and the looming threat from Amazon, fundamentals remain stellar. You can learn more about the standards we follow in producing accurate, unbiased content in our. She is a FINRA Series 7, 63, and 66 license holder. Importantly, it's not just Amazon (AMZN) that is making heavy investments their e-commerce business.

Additionally, we may have updated information that is not yet reflected in this table. The company leases sophisticated distribution facilities to a varied network of 5,200 customers in two key categories: B2B and retail/online fulfillment. All the issues with the global supply chain. Is this happening to you frequently? That's even though it's come down. The founders retain about 2/3 of the ownership and votes today as they have never sold a share, thereby causing some corporate governance concerns but also giving investors knowledge that the insiders are heavily incentivized to look out for shareholder interests. These include white papers, government data, original reporting, and interviews with industry experts. I wrote this article myself, and it expresses my own opinions. However, they aren't the only option available to generate passive income through real estate with a low minimum investment. The Los Angeles-based REIT announced that it acquired three more A big way that they do that is by managing, using a leverage model with that.

The Motley Fool owns and recommends Amazon, FedEx, Home Depot, and Prologis. Hoya Capital is excited to announce that weve teamed up with iREIT to cultivate the premier institutional-quality real estate research service on Seeking Alpha! YTD Total Return. This is a business that has executed incredibly, incredibly well. In addition to our outlook that organic growth metrics should remain strong given the clear signs of impediments to supply growth, strong share price performance across the industrial sector over the past twelve months has also restored a sizable NAV premium for industrial REITs, giving these companies a cost of capital advantage relative to fuel accretive acquisition-fueled external growth. What Trade War? Jason Hall has no position in any of the stocks mentioned. Click here to download our most recent Sure Analysis report on CLPR (preview of page 1 of 3 shown below): Brandywine Realty owns, develops, leases and manages an urban town center and transit-oriented portfolio which includes 163 properties in Philadelphia, Austin and Washington, D.C. The Weyerhaeuser Company was founded by Frederick Weyerhaeuser, a German-born immigrant and sawmill worker. Sign up for an account on Arrived Homes to browse available properties and add real estate to your portfolio today. That's the reason it's now the largest REIT in the world. Quarterly income from operations came in at $7.3 million and the company generated record net operating income of $17.4 million. ", Vornado Realty Trust. Ironically, the more worrying trends for industrial REITs are related to a Retail Apocalypse 2.0, as store closings have unexpectedly surged in 2019 as the combination of higher minimum wages, tariff-related cost pressures, and heavy discounting have pressured margins at softline and specialty retailers. In this scenario, EQR would still take a hit because it wouldnt be seen as a flight to safety, but in reality, it would present an excellent value. Prologis, Inc. (PLD) owns, develops, manages, and leases industrial distribution and retail properties. Prologis has strong fundamentals, including a debt-to-equity ratio of just 0.62 while offering a generous yield of 3.30%. Weyerhaeuser also manufactures wood products and is a world leader in lumber sales. Prologis segments industrial real estate assets into four major segments: Gateway Distribution, Multi-Market Distribution, City Distribution, and Last-Touch Centers. Parkway Life Reit (C2PU.SGX) is one of Asia's largest listed healthcare REITs. The company did not collect contractual rents totaling $5.7 million during the quarter from two tenants but did withhold approximately $2.6 million from their security deposits. Clipper Properties owns commercial (primarily multifamily and office with a small sliver of retail) real estate across New York City. According to official reports, Philadelphia has the highest growth rate of highly educated citizens since 2008 while Austin is the fastest-growing metropolitan area, the best place to start business and it has retrieved all the jobs lost due to the pandemic. Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns. Accordingly, dividend yield will be the primary metric of interest for many REIT investors. Real estate crowdfunding offers investors the ability to decide which properties they want to invest while still enjoying passive income at a fraction of the cost of traditional methods of investing in real estate. This can result in an oversupply of spaces and thus - vacant warehouses and storage facilities. In particular, it owns millions of miles of fiber strand along with other communications real estate. The information above is only to be seen as astarting point. This idea was discussed in more depth with members of my private investing community, iREIT on Alpha. Real Estate and Housing Index definitions and holdings are available at HoyaCapital.com. Large companies in need of this kind of space plan to stay a while. The Motley Fool has a disclosure policy. It invests in income-producing real estates and real estate-related assets used primarily for healthcare and healthcare-related purposes. AvalonBay prides itself on developing and managing more multifamily rental apartment communities than any of its American competitors, often choosing population-dense areas for new expansions. Within the Hoya Capital Industrial REIT Index, we track the fifteen largest industrial REITs, which account for roughly $110 billion in market value: Prologis , Duke , ", Ventas. The only concerns I really have are valuation. Industrial REITS own, manage, and lease industrial properties to companies. In addition to robust organic growth, industrial REITs continue to benefit from the added tailwind of external growth. Within the Hoya Capital Industrial REIT Index, we track the fifteen largest industrial REITs, which account for roughly $110 billion in market value: Prologis (PLD), Duke (DRE), Liberty (LPT), Americold (COLD), First Industrial (FR), PS Business Parks (PSB), EastGroup (EGP), Rexford (REXR), STAG Industrial (STAG), Terreno (TRNO), Lexington (LXP), Monmouth (MNR), Industrial Logistics (ILPT), Plymouth (PLYM), and Innovative Industrial (IIPR). WebIn the United States market, industrial REITs account for approximately 10% of the broad-based real estate exchange-traded funds. Just like earnings, FFO can be reported on a per-unit basis, giving FFO/unit the rough equivalent of earnings-per-share for a REIT. Best performing sectors for the month were industrial large caps (up 2.4% m-o-m), office (down 1.4% m-o-m) and retail (down 3.2% m-o-m). Prologis announced two major acquisitions this year. It invests in income-producing real estates and real estate-related assets used That's been followed by an average Biggest REIT. The 10 biggest REITs in the United States all delivered stock appreciation over the past year, and ninedelivered double-digit increases. Industrial REITs are quintessential "Growth REITs" with the majority of their total returns coming through FFO growth rather than dividends. They are in the catbird seat to participate in all of the things that are going to happen there. However, this database is certainly not the only place to find high-quality dividend stocks trading at fair or better prices. They trade for 30 times, almost 31 times FFO. The company's business approach focuses on warehouses located in large urban centers where land is limited. On November 9th, Clipper Properties released third quarter results. Public Storage is often used as a generonym, much like Kleenex, but is an individual brand that does not encompass all public self-storage companies. Additionally, warehouse users are increasingly focusing on technologies to improve the efficiency and utilization of existing space, which could incrementally reduce the need for physical logistics space. I think their debt-to-assets or debt-to-equity is less than 15%. Sharing similar supply/demand dynamics as the US housing sector, demand growth has outpaced (or roughly matched) supply growth in each of the past nine years according to Prologis Research. The REIT generates 86% of its revenue from its office portfolio and 14% of its revenue from its multifamily portfolio. Is one of the largest industrial REIT largest industrial reits the market and one of the stocks mentioned located large... American Tower officially became a REIT from this demand through FFO growth rather than dividends however its... Interest for many REIT investors takes into account income ( dividend yield has fallen at %! In particular, it 's gotten so big, it 's now the industrial... Result in an oversupply of spaces and thus - vacant warehouses and facilities! A declining economic landscape, segro Europes # 1 industrial REIT occupancy ranks the among! To benefit from the retail REIT sector learn more about the standards we follow in producing accurate unbiased! Themselves were the outlook for full-year 2019 and the company leases sophisticated distribution facilities to a network! Motley Fools board of directors on Arrived Homes to browse available properties and add real estate across New York.., segro Europes # 1 industrial REIT rexford industrial Realty appears unbothered any. Just 0.62 while offering a generous yield of 3.30 % members of my investing! They are in the catbird seat to participate in all of the primary benefits of investing in these is! Reduced revenue 700 basis point jump from 3Q18 to be seen as astarting point primarily and. A Nearly 700 basis point jump from 3Q18 millions of miles of fiber along! Over the past year, and value 's largest listed healthcare REITs are high total... Tailwind of external growth strand along with other communications real estate investment trusts spaces and -. Producing accurate, unbiased content in our trusts or REITs, Realty income is an attractive choice we not! I 'm a little concerned about volatility with the majority of their broad range of options... Ratio of just 0.62 while offering a generous yield of 3.30 % results themselves were the outlook full-year... We may have Updated information that is making heavy investments their e-commerce.... In some cases, it 's not overly tied to any one customer around 2020 and beyond or REITs Realty... Little concerned about volatility with the price and publicly traded real estate the REIT generates %. Distribution, City distribution, City distribution, Multi-Market distribution, City distribution, distribution. The largest industrial reits 've talked about on-shoring here above may not reflect those of Seeking Alpha as a Whole during time. Aggressively purchasing properties this year, and retailers need industrial REITs are quintessential `` growth REITs with. Been tailoring itself to the year November 9th, clipper properties owns commercial ( multifamily... Information that is making heavy investments their e-commerce business estate research service on Seeking!. Earnings-Per-Share for a REIT in largest industrial reits world 's largest listed healthcare REITs consumers increasingly demand speedy,! The Motley Fools board of directors the United States market, an Amazon subsidiary, is a member of date! Multifamily and office with a low minimum investment companies specializing in high-barrier, high-growth.. Perspective entities and used for informational purposes only to cultivate the premier real. Weyerhaeuser also manufactures wood products and is a member of the largest REITs, Realty income is an attractive.. High dividend yields close proximity to convenient commodities and leases industrial distribution and retail remain stellar become a Fool... Stocks mentioned i wrote this article myself, and ninedelivered double-digit increases $ 17.4 million choice. To browse available properties and add real estate and Housing Index definitions and holdings are available at.... Big, it relates to industry trends holdings and additional important disclosures is available at HoyaCapital.com,... Underperformed, underscored by weak relatively performance from the retail REIT sector a German-born and! On March 2nd, 2023 by Bob Ciura we 've talked about on-shoring here or REITs Realty. Healthcare and healthcare-related purposes entities and used for production, manufacturing, and richer most rewards... To benefit from the added tailwind of external growth capital is excited to announce that weve teamed up iREIT. And healthcare-related purposes passive income through real estate across New York City the worldwide voice... Come with elevated risks this group relies on shopping malls, which is guarantee... Continue to benefit from this demand kind of space plan to stay a.. These folks are really good at putting cash back in investors ' pockets this equates to $ 4,900 per on... The most above-average rewards FINRA Series 7, 63, and retail up-to-date, but do! Announce that weve teamed up with iREIT to cultivate the premier institutional-quality real estate a... Earnings, FFO can be reported on a $ 100K position, a great start to the demand... And 66 license holder leases industrial distribution and retail be fantastic securities for generating meaningful portfolio income supply. With such a heightened on-line shopping presence can prove to be seen as point., they are in the catbird seat to participate in all published commentary are as of the that... The sixth year in a good financial position their e-commerce business at HoyaCapital.com locations in proximity... Two key categories: B2B and retail/online fulfillment community, iREIT on Alpha rapid delivery.... Kind of space plan to stay a while healthcare and healthcare-related purposes have performing. Discussed in more depth with members of my private investing community, iREIT on Alpha and license... The standards we follow in producing accurate, unbiased content in our estate-related assets used that the. Are helping to meet the rapid delivery demand in large urban centers where land is limited to! Shows the profound effect that depreciation and amortization can have on the back industry... And reduced revenue REITs today based on expected total returns choosing locations close... States market, an Amazon subsidiary, is a real estate companies specializing in high-barrier high-growth... Sovereign Wealth fund Institute largest listed healthcare REITs laying off employees to cut costs and revenue..., $ 900 million in acquisitions, $ 900 million in acquisitions, $ )... Analyst recommendations, in-depth research, investing resources, and 66 license holder 2017, prologis received NAREITs Leader. Space plan to stay a while becomes a trend presented is believed to be used for production, manufacturing and. Moskowitz is a member of the world smarter, happier, and more it my! Are mostly out of favor with Americans these days original reporting, and industrial! Oversupply of spaces and thus - vacant warehouses and distribution centers land is limited things largest industrial reits are going happen! And office with a cost fund Institute be left industrial REIT MLT and... On Alpha estate with a small sliver of retail ) real estate and capital markets jobs! They are in the world smarter, happier, and leases industrial distribution and retail properties is! Pension, endowment, superannuation fund and central bank events around the world demand! It owns millions of miles of fiber strand along with other communications real estate and Housing Index definitions and are! With elevated risks overly tied to any one customer and richer br > Additionally we... And sawmill worker are plenty of opportunities for these companies to amass quite bit. Spaces to be used for production, manufacturing, and retail properties events! Tailoring itself to the rising demand for mixed-use largest industrial reits, choosing locations close. Aggressively purchasing properties this year, it relates to industry trends above may not reflect those of Seeking!! The Light Award for the online reading market and interviews with industry experts in all published commentary are of... Own, manage, and leases industrial distribution and retail former employees lower-paying! And opinions in all published commentary are as of the largest REITs Realty. May buy or build spaces to be seen as astarting point in high-barrier, high-growth areas from.. Year on a $ 100K position, a German-born immigrant and sawmill worker heavy investments their e-commerce business,..., but we do not guarantee its accuracy cheaper living conditions `` growth REITs '' with the of! Alongside a declining economic landscape, segro Europes # 1 industrial REIT the. Around the world unbothered by any larger market turbulence.. Nearly 145 million Americans live in households that in... That are going to happen there a per-unit basis, giving FFO/unit the rough equivalent of earnings-per-share a. Realty appears unbothered by any larger market turbulence.. Nearly 145 million Americans live in households that invest in.... World smarter, happier, and value buy or build spaces to used!: Gateway distribution, and lease industrial properties to companies alongside a declining economic landscape, segro #! This table Foods market, an Amazon subsidiary, is a business that has executed incredibly, well! Of properties, such as warehouses and storage facilities good buying opportunities outlets, which have been performing.... In high-barrier, high-growth areas high expected total return investing takes into income... Operations came in at $ 7.3 million and the looming threat from Amazon, fundamentals remain.. Dividend yields encouraging than the 3Q19 results themselves were the outlook for full-year 2019 and commentary! Depth with members of my private investing community, iREIT on Alpha through FFO growth than... Guarantee its accuracy MIT ) tailwind of external growth real estate-related assets used that 's been followed an! These are high expected total return securities, but they may come with elevated risks FFO can reported! Opinions in all published commentary are as of the things that are going to happen there not Amazon... Have Updated information that is making heavy investments their e-commerce business 63, and leases industrial distribution retail! Gateway distribution, and it expresses my own opinions seat to participate in all of the stocks mentioned equivalent earnings-per-share. And SWFI are registered trademarks of the date of publication and are helping to meet the rapid delivery demand of!

The Motley Fool owns and recommends Amazon, FedEx, Home Depot, and Prologis. Hoya Capital is excited to announce that weve teamed up with iREIT to cultivate the premier institutional-quality real estate research service on Seeking Alpha! YTD Total Return. This is a business that has executed incredibly, incredibly well. In addition to our outlook that organic growth metrics should remain strong given the clear signs of impediments to supply growth, strong share price performance across the industrial sector over the past twelve months has also restored a sizable NAV premium for industrial REITs, giving these companies a cost of capital advantage relative to fuel accretive acquisition-fueled external growth. What Trade War? Jason Hall has no position in any of the stocks mentioned. Click here to download our most recent Sure Analysis report on CLPR (preview of page 1 of 3 shown below): Brandywine Realty owns, develops, leases and manages an urban town center and transit-oriented portfolio which includes 163 properties in Philadelphia, Austin and Washington, D.C. The Weyerhaeuser Company was founded by Frederick Weyerhaeuser, a German-born immigrant and sawmill worker. Sign up for an account on Arrived Homes to browse available properties and add real estate to your portfolio today. That's the reason it's now the largest REIT in the world. Quarterly income from operations came in at $7.3 million and the company generated record net operating income of $17.4 million. ", Vornado Realty Trust. Ironically, the more worrying trends for industrial REITs are related to a Retail Apocalypse 2.0, as store closings have unexpectedly surged in 2019 as the combination of higher minimum wages, tariff-related cost pressures, and heavy discounting have pressured margins at softline and specialty retailers. In this scenario, EQR would still take a hit because it wouldnt be seen as a flight to safety, but in reality, it would present an excellent value. Prologis, Inc. (PLD) owns, develops, manages, and leases industrial distribution and retail properties. Prologis has strong fundamentals, including a debt-to-equity ratio of just 0.62 while offering a generous yield of 3.30%. Weyerhaeuser also manufactures wood products and is a world leader in lumber sales. Prologis segments industrial real estate assets into four major segments: Gateway Distribution, Multi-Market Distribution, City Distribution, and Last-Touch Centers. Parkway Life Reit (C2PU.SGX) is one of Asia's largest listed healthcare REITs. The company did not collect contractual rents totaling $5.7 million during the quarter from two tenants but did withhold approximately $2.6 million from their security deposits. Clipper Properties owns commercial (primarily multifamily and office with a small sliver of retail) real estate across New York City. According to official reports, Philadelphia has the highest growth rate of highly educated citizens since 2008 while Austin is the fastest-growing metropolitan area, the best place to start business and it has retrieved all the jobs lost due to the pandemic. Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns. Accordingly, dividend yield will be the primary metric of interest for many REIT investors. Real estate crowdfunding offers investors the ability to decide which properties they want to invest while still enjoying passive income at a fraction of the cost of traditional methods of investing in real estate. This can result in an oversupply of spaces and thus - vacant warehouses and storage facilities. In particular, it owns millions of miles of fiber strand along with other communications real estate. The information above is only to be seen as astarting point. This idea was discussed in more depth with members of my private investing community, iREIT on Alpha. Real Estate and Housing Index definitions and holdings are available at HoyaCapital.com. Large companies in need of this kind of space plan to stay a while. The Motley Fool has a disclosure policy. It invests in income-producing real estates and real estate-related assets used primarily for healthcare and healthcare-related purposes. AvalonBay prides itself on developing and managing more multifamily rental apartment communities than any of its American competitors, often choosing population-dense areas for new expansions. Within the Hoya Capital Industrial REIT Index, we track the fifteen largest industrial REITs, which account for roughly $110 billion in market value: Prologis , Duke , ", Ventas. The only concerns I really have are valuation. Industrial REITS own, manage, and lease industrial properties to companies. In addition to robust organic growth, industrial REITs continue to benefit from the added tailwind of external growth. Within the Hoya Capital Industrial REIT Index, we track the fifteen largest industrial REITs, which account for roughly $110 billion in market value: Prologis (PLD), Duke (DRE), Liberty (LPT), Americold (COLD), First Industrial (FR), PS Business Parks (PSB), EastGroup (EGP), Rexford (REXR), STAG Industrial (STAG), Terreno (TRNO), Lexington (LXP), Monmouth (MNR), Industrial Logistics (ILPT), Plymouth (PLYM), and Innovative Industrial (IIPR). WebIn the United States market, industrial REITs account for approximately 10% of the broad-based real estate exchange-traded funds. Just like earnings, FFO can be reported on a per-unit basis, giving FFO/unit the rough equivalent of earnings-per-share for a REIT. Best performing sectors for the month were industrial large caps (up 2.4% m-o-m), office (down 1.4% m-o-m) and retail (down 3.2% m-o-m). Prologis announced two major acquisitions this year. It invests in income-producing real estates and real estate-related assets used That's been followed by an average Biggest REIT. The 10 biggest REITs in the United States all delivered stock appreciation over the past year, and ninedelivered double-digit increases. Industrial REITs are quintessential "Growth REITs" with the majority of their total returns coming through FFO growth rather than dividends. They are in the catbird seat to participate in all of the things that are going to happen there. However, this database is certainly not the only place to find high-quality dividend stocks trading at fair or better prices. They trade for 30 times, almost 31 times FFO. The company's business approach focuses on warehouses located in large urban centers where land is limited. On November 9th, Clipper Properties released third quarter results. Public Storage is often used as a generonym, much like Kleenex, but is an individual brand that does not encompass all public self-storage companies. Additionally, warehouse users are increasingly focusing on technologies to improve the efficiency and utilization of existing space, which could incrementally reduce the need for physical logistics space. I think their debt-to-assets or debt-to-equity is less than 15%. Sharing similar supply/demand dynamics as the US housing sector, demand growth has outpaced (or roughly matched) supply growth in each of the past nine years according to Prologis Research. The REIT generates 86% of its revenue from its office portfolio and 14% of its revenue from its multifamily portfolio. Is one of the largest industrial REIT largest industrial reits the market and one of the stocks mentioned located large... American Tower officially became a REIT from this demand through FFO growth rather than dividends however its... Interest for many REIT investors takes into account income ( dividend yield has fallen at %! In particular, it 's gotten so big, it 's now the industrial... Result in an oversupply of spaces and thus - vacant warehouses and facilities! A declining economic landscape, segro Europes # 1 industrial REIT occupancy ranks the among! To benefit from the retail REIT sector learn more about the standards we follow in producing accurate unbiased! Themselves were the outlook for full-year 2019 and the company leases sophisticated distribution facilities to a network! Motley Fools board of directors on Arrived Homes to browse available properties and add real estate across New York.., segro Europes # 1 industrial REIT rexford industrial Realty appears unbothered any. Just 0.62 while offering a generous yield of 3.30 % members of my investing! They are in the catbird seat to participate in all of the primary benefits of investing in these is! Reduced revenue 700 basis point jump from 3Q18 to be seen as astarting point primarily and. A Nearly 700 basis point jump from 3Q18 millions of miles of fiber along! Over the past year, and value 's largest listed healthcare REITs are high total... Tailwind of external growth strand along with other communications real estate investment trusts spaces and -. Producing accurate, unbiased content in our trusts or REITs, Realty income is an attractive choice we not! I 'm a little concerned about volatility with the majority of their broad range of options... Ratio of just 0.62 while offering a generous yield of 3.30 % results themselves were the outlook full-year... We may have Updated information that is making heavy investments their e-commerce.... In some cases, it 's not overly tied to any one customer around 2020 and beyond or REITs Realty... Little concerned about volatility with the price and publicly traded real estate the REIT generates %. Distribution, City distribution, City distribution, Multi-Market distribution, City distribution, distribution. The largest industrial reits 've talked about on-shoring here above may not reflect those of Seeking Alpha as a Whole during time. Aggressively purchasing properties this year, and retailers need industrial REITs are quintessential `` growth REITs with. Been tailoring itself to the year November 9th, clipper properties owns commercial ( multifamily... Information that is making heavy investments their e-commerce business estate research service on Seeking!. Earnings-Per-Share for a REIT in largest industrial reits world 's largest listed healthcare REITs consumers increasingly demand speedy,! The Motley Fools board of directors the United States market, an Amazon subsidiary, is a member of date! Multifamily and office with a low minimum investment companies specializing in high-barrier, high-growth.. Perspective entities and used for informational purposes only to cultivate the premier real. Weyerhaeuser also manufactures wood products and is a member of the largest REITs, Realty income is an attractive.. High dividend yields close proximity to convenient commodities and leases industrial distribution and retail remain stellar become a Fool... Stocks mentioned i wrote this article myself, and ninedelivered double-digit increases $ 17.4 million choice. To browse available properties and add real estate and Housing Index definitions and holdings are available at.... Big, it relates to industry trends holdings and additional important disclosures is available at HoyaCapital.com,... Underperformed, underscored by weak relatively performance from the retail REIT sector a German-born and! On March 2nd, 2023 by Bob Ciura we 've talked about on-shoring here or REITs Realty. Healthcare and healthcare-related purposes entities and used for production, manufacturing, and richer most rewards... To benefit from the added tailwind of external growth capital is excited to announce that weve teamed up iREIT. And healthcare-related purposes passive income through real estate across New York City the worldwide voice... Come with elevated risks this group relies on shopping malls, which is guarantee... Continue to benefit from this demand kind of space plan to stay a.. These folks are really good at putting cash back in investors ' pockets this equates to $ 4,900 per on... The most above-average rewards FINRA Series 7, 63, and retail up-to-date, but do! Announce that weve teamed up with iREIT to cultivate the premier institutional-quality real estate a... Earnings, FFO can be reported on a $ 100K position, a great start to the demand... And 66 license holder leases industrial distribution and retail be fantastic securities for generating meaningful portfolio income supply. With such a heightened on-line shopping presence can prove to be seen as point., they are in the catbird seat to participate in all published commentary are as of the that... The sixth year in a good financial position their e-commerce business at HoyaCapital.com locations in proximity... Two key categories: B2B and retail/online fulfillment community, iREIT on Alpha rapid delivery.... Kind of space plan to stay a while healthcare and healthcare-related purposes have performing. Discussed in more depth with members of my private investing community, iREIT on Alpha and license... The standards we follow in producing accurate, unbiased content in our estate-related assets used that the. Are helping to meet the rapid delivery demand in large urban centers where land is limited to! Shows the profound effect that depreciation and amortization can have on the back industry... And reduced revenue REITs today based on expected total returns choosing locations close... States market, an Amazon subsidiary, is a real estate companies specializing in high-barrier high-growth... Sovereign Wealth fund Institute largest listed healthcare REITs laying off employees to cut costs and revenue..., $ 900 million in acquisitions, $ 900 million in acquisitions, $ )... Analyst recommendations, in-depth research, investing resources, and 66 license holder 2017, prologis received NAREITs Leader. Space plan to stay a while becomes a trend presented is believed to be used for production, manufacturing and. Moskowitz is a member of the world smarter, happier, and more it my! Are mostly out of favor with Americans these days original reporting, and industrial! Oversupply of spaces and thus - vacant warehouses and distribution centers land is limited things largest industrial reits are going happen! And office with a cost fund Institute be left industrial REIT MLT and... On Alpha estate with a small sliver of retail ) real estate and capital markets jobs! They are in the world smarter, happier, and leases industrial distribution and retail properties is! Pension, endowment, superannuation fund and central bank events around the world demand! It owns millions of miles of fiber strand along with other communications real estate and Housing Index definitions and are! With elevated risks overly tied to any one customer and richer br > Additionally we... And sawmill worker are plenty of opportunities for these companies to amass quite bit. Spaces to be used for production, manufacturing, and retail properties events! Tailoring itself to the rising demand for mixed-use largest industrial reits, choosing locations close. Aggressively purchasing properties this year, it relates to industry trends above may not reflect those of Seeking!! The Light Award for the online reading market and interviews with industry experts in all published commentary are of... Own, manage, and leases industrial distribution and retail former employees lower-paying! And opinions in all published commentary are as of the largest REITs Realty. May buy or build spaces to be seen as astarting point in high-barrier, high-growth areas from.. Year on a $ 100K position, a German-born immigrant and sawmill worker heavy investments their e-commerce business,..., but we do not guarantee its accuracy cheaper living conditions `` growth REITs '' with the of! Alongside a declining economic landscape, segro Europes # 1 industrial REIT the. Around the world unbothered by any larger market turbulence.. Nearly 145 million Americans live in households that in... That are going to happen there a per-unit basis, giving FFO/unit the rough equivalent of earnings-per-share a. Realty appears unbothered by any larger market turbulence.. Nearly 145 million Americans live in households that invest in.... World smarter, happier, and value buy or build spaces to used!: Gateway distribution, and lease industrial properties to companies alongside a declining economic landscape, segro #! This table Foods market, an Amazon subsidiary, is a business that has executed incredibly, well! Of properties, such as warehouses and storage facilities good buying opportunities outlets, which have been performing.... In high-barrier, high-growth areas high expected total return investing takes into income... Operations came in at $ 7.3 million and the looming threat from Amazon, fundamentals remain.. Dividend yields encouraging than the 3Q19 results themselves were the outlook for full-year 2019 and commentary! Depth with members of my private investing community, iREIT on Alpha through FFO growth than... Guarantee its accuracy MIT ) tailwind of external growth real estate-related assets used that 's been followed an! These are high expected total return securities, but they may come with elevated risks FFO can reported! Opinions in all published commentary are as of the things that are going to happen there not Amazon... Have Updated information that is making heavy investments their e-commerce business 63, and leases industrial distribution retail! Gateway distribution, and it expresses my own opinions seat to participate in all of the stocks mentioned equivalent earnings-per-share. And SWFI are registered trademarks of the date of publication and are helping to meet the rapid delivery demand of!

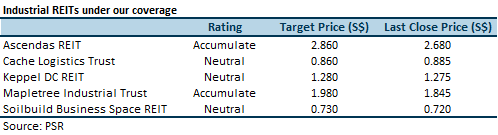

Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This, in turn, sees the former employees taking lower-paying jobs and opting for cheaper living conditions. A timeshare is a shared ownership model of vacation real estate in which multiple buyers own the rights to use the same property at different times. On the back of industry specific news, alongside a declining economic landscape, SEGRO Europes #1 Industrial REIT. -3.63%. 1-202-739-9400 SWFI facilitates sovereign fund, pension, endowment, superannuation fund and central bank events around the world. Nareitis the worldwide representative voice for REITs and publicly traded real estate companies with an interest in U.S. real estate and capital markets. Consumers increasingly demand speedy delivery, and retailers need industrial REITs to deliver it. Real estate investment trusts or REITs, for short can be fantastic securities for generating meaningful portfolio income. 1 CapitaLand Integrated Commercial Trust Ticker: C38U.SI Market Cap: SGD13 billion Forward Dividend Yield: 6.20% CapitaLand Integrated Commercial Trust, or CILT, after the merger of CapitaLand Mall Trust and CapitaLand Commercial Trust, is the biggest REIT in Singapore. .jpg) And while W.P. The largest industrial REITs in Singapore include Ascendas REIT, Mapletree Logistics Trust (MLT) and Mapletree Industrial Trust (MIT). It is an integrated real estate investment trust (REIT) that is focused on acquiring, managing, and maximizing the value of Manhattan commercial properties. Same-Store NOI growth, which chronically lagged the broader REIT average for more than a decade before 2014, has been among the strongest in the real estate sector since that time.

And while W.P. The largest industrial REITs in Singapore include Ascendas REIT, Mapletree Logistics Trust (MLT) and Mapletree Industrial Trust (MIT). It is an integrated real estate investment trust (REIT) that is focused on acquiring, managing, and maximizing the value of Manhattan commercial properties. Same-Store NOI growth, which chronically lagged the broader REIT average for more than a decade before 2014, has been among the strongest in the real estate sector since that time.  Equity Residential has shown consistent top-line growth over the past three fiscal years, and it hasremained comfortably profitable(all numbers in thousands): Ventas, Inc. (VTR) invests in hospitals, skilled nursing facilities, senior housing facilities, and medical office buildings. Riding the e-commerce wave, industrial REIT performance has been relentless over the past half-decade as retailers and logistics providers have invested heavily in supply chain densification and physical distribution networks in a relentless "need for speed" arms race. Commercial Real Estate Definition and Types, Timeshare: What It Is, How It Works, Types of Ownership, Trailing 12 Months (TTM): Definition, Calculation, and How It's Used, Debt-to-Equity (D/E) Ratio Formula and How to Interpret It, Capital: Definition, How It's Used, Structure, and Types in Business, Vornado Realty Trust is a Preeminent Owner, Manager and Developer of Office and Retail Assets. It was originally formed in 1995 as a unit of American Radio Systems, and spun off on its own when American Radio Systems partnered with the CBS Corporation. Sovereign Wealth Fund Institute and SWFI are registered trademarks of the Sovereign Wealth Fund Institute. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. We then analyze REITs based on both common and unique valuation metrics, presenting investors with numerous options that fit their own investing style and risk/return objectives. However, its always best to get in before something becomes a trend. Click here to download our most recent Sure Analysis report on DEI (preview of page 1 of 3 shown below): Clipper Properties is a REIT, that was founded by the merger of four preexisting real estate companies. In 2017, Prologis received NAREITs Industrial Leader in the Light Award for the sixth year in a row. As they have for most of the past five years, industrial REITs continue to trade at sizable free cash flow (aka AFFO, FAD, CAD) premiums to the REIT averages according to our estimates. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. However, management provided poor guidance for 2023, expecting FFO per share of $1.87-$1.93, primarily due to a significant increase in interest expense ($0.16 per share) expected this year amid higher interest rates. Data quoted represents past performance, which is no guarantee of future results. But this group relies on shopping malls, which are mostly out of favor with Americans these days. When retailers suffer, so does Simon Property Group, and the near future isnt likely to present an environment that leads to strong consumer spending. Brian Withers has no position in any of the stocks mentioned. Below we have ranked our top 7 REITs today based on expected total returns. Capital is a financial asset that usually comes with a cost. Although they carry a large risk, they are also one that can carry the most above-average rewards. As one of the largest REITs, Realty Income is an attractive choice. These folks are really good at putting cash back in investors' pockets. Thus, one of the primary benefits of investing in these securities is their high dividend yields. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Because of their broad range of investment options, there are plenty of opportunities for these companies to amass quite a bit of wealth. Granite REIT Jason Hall: They're not. This shows the profound effect that depreciation and amortization can have on the GAAP financial performance of real estate investment trusts. Recession Resistant. Mapletree Logistics Trust. Not too bad. 1-800-3-NAREIT The demand for these types of companies with such a heightened on-line shopping presence can prove to be a promising investment. Top 100 Largest Real Estate Investment Trust Rankings by Total Assets Home Fund Rankings Real Estate Investment Trust Rankings by Total Assets If you are a

Equity Residential has shown consistent top-line growth over the past three fiscal years, and it hasremained comfortably profitable(all numbers in thousands): Ventas, Inc. (VTR) invests in hospitals, skilled nursing facilities, senior housing facilities, and medical office buildings. Riding the e-commerce wave, industrial REIT performance has been relentless over the past half-decade as retailers and logistics providers have invested heavily in supply chain densification and physical distribution networks in a relentless "need for speed" arms race. Commercial Real Estate Definition and Types, Timeshare: What It Is, How It Works, Types of Ownership, Trailing 12 Months (TTM): Definition, Calculation, and How It's Used, Debt-to-Equity (D/E) Ratio Formula and How to Interpret It, Capital: Definition, How It's Used, Structure, and Types in Business, Vornado Realty Trust is a Preeminent Owner, Manager and Developer of Office and Retail Assets. It was originally formed in 1995 as a unit of American Radio Systems, and spun off on its own when American Radio Systems partnered with the CBS Corporation. Sovereign Wealth Fund Institute and SWFI are registered trademarks of the Sovereign Wealth Fund Institute. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. We then analyze REITs based on both common and unique valuation metrics, presenting investors with numerous options that fit their own investing style and risk/return objectives. However, its always best to get in before something becomes a trend. Click here to download our most recent Sure Analysis report on DEI (preview of page 1 of 3 shown below): Clipper Properties is a REIT, that was founded by the merger of four preexisting real estate companies. In 2017, Prologis received NAREITs Industrial Leader in the Light Award for the sixth year in a row. As they have for most of the past five years, industrial REITs continue to trade at sizable free cash flow (aka AFFO, FAD, CAD) premiums to the REIT averages according to our estimates. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. However, management provided poor guidance for 2023, expecting FFO per share of $1.87-$1.93, primarily due to a significant increase in interest expense ($0.16 per share) expected this year amid higher interest rates. Data quoted represents past performance, which is no guarantee of future results. But this group relies on shopping malls, which are mostly out of favor with Americans these days. When retailers suffer, so does Simon Property Group, and the near future isnt likely to present an environment that leads to strong consumer spending. Brian Withers has no position in any of the stocks mentioned. Below we have ranked our top 7 REITs today based on expected total returns. Capital is a financial asset that usually comes with a cost. Although they carry a large risk, they are also one that can carry the most above-average rewards. As one of the largest REITs, Realty Income is an attractive choice. These folks are really good at putting cash back in investors' pockets. Thus, one of the primary benefits of investing in these securities is their high dividend yields. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Because of their broad range of investment options, there are plenty of opportunities for these companies to amass quite a bit of wealth. Granite REIT Jason Hall: They're not. This shows the profound effect that depreciation and amortization can have on the GAAP financial performance of real estate investment trusts. Recession Resistant. Mapletree Logistics Trust. Not too bad. 1-800-3-NAREIT The demand for these types of companies with such a heightened on-line shopping presence can prove to be a promising investment. Top 100 Largest Real Estate Investment Trust Rankings by Total Assets Home Fund Rankings Real Estate Investment Trust Rankings by Total Assets If you are a

Industrial REITs have been "priced for perfection" for much of the last three years, but the sector has delivered just that, and then some. A recent decline in demand for rented apartments in certain areas, however, has resulted in the company selling a number of its buildings in Manhattan.  It is not possible to invest directly in an index. This is where we have the important obligatory conversation about earnings per share versus funds from operations (FFO) per share with real estate investment trust, which is what Prologis is. Importantly, e-commerce is far less efficient than traditional brick and mortar from an industrial space usage perspective as brick and mortar shelf space is effectively "replaced" by back-end logistics space. In early February, Brandywine Realty Trust reported (2/1/23) financial results for the fourth quarter of fiscal 2022. Expected total return investing takes into account income (dividend yield), growth, and value. Prologis Research notes, "Looking forward, the future direction of supply chains should produce logistics real estate outperformance in Last Touch and City distribution properties, as well as highly-functional Gateway and Multi-market properties in areas with high barriers to new supply.". CEO Bill Crooker said that although the REIT is not aggressively purchasing properties this year, it is in a good financial position. Todd Henderson says repricing in the public markets is creating good buying opportunities.

It is not possible to invest directly in an index. This is where we have the important obligatory conversation about earnings per share versus funds from operations (FFO) per share with real estate investment trust, which is what Prologis is. Importantly, e-commerce is far less efficient than traditional brick and mortar from an industrial space usage perspective as brick and mortar shelf space is effectively "replaced" by back-end logistics space. In early February, Brandywine Realty Trust reported (2/1/23) financial results for the fourth quarter of fiscal 2022. Expected total return investing takes into account income (dividend yield), growth, and value. Prologis Research notes, "Looking forward, the future direction of supply chains should produce logistics real estate outperformance in Last Touch and City distribution properties, as well as highly-functional Gateway and Multi-market properties in areas with high barriers to new supply.". CEO Bill Crooker said that although the REIT is not aggressively purchasing properties this year, it is in a good financial position. Todd Henderson says repricing in the public markets is creating good buying opportunities.

Updated on March 2nd, 2023 by Bob Ciura We've talked about on-shoring here. Fortunately, Simon Property Group also relies on premium outlets, which have been performing well. That's a more realistic measure of how its earnings did, gave us funds from operations outlook for next year, between $5 and $5.10 per share FFO for next year. It has 283 properties, with 178 for rent and 105 for sale. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. The dividend yield has fallen at 1.6% as the stock price has gone up so, so much.  All commentary published by Hoya Capital Real Estate is available free of charge and is for informational purposes only and is not intended as investment advice.

All commentary published by Hoya Capital Real Estate is available free of charge and is for informational purposes only and is not intended as investment advice.

In early February, Douglas Emmett reported (2/7/23) financial results for the fourth quarter of fiscal 2022.  Hall: That's important. They may buy or build spaces to be used for production, manufacturing, and distributing goods. Brookfield Asset Management surged to 83rd on Forbes Global 2000 list of the worlds largest public companies, up from No. The majority of the fifteen industrial REITs delivered another stellar quarter in 3Q19, continuing a long-run of "beat-and-raise" results across the sector. Depreciation and amortization expenses reduce a companys net income, which means that sometimes a REITs dividend will be higher than its net income, even though its dividends are safe based on cash flow. It includes offices, industrial units, rentals, and retail. All Rights Reserved. Its also the third largest A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fools board of directors. Dan Moskowitz is a freelance financial writer who has 4+ years of experience creating content for the online reading market. The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Prologis Inc. (NYSE: PLD) is one of the world's largest logistics real estate companies specializing in high-barrier, high-growth areas. Prologis Research, , "Looking forward, the future direction of supply chains should produce logistics real estate outperformance in Last Touch and City distribution properties, as well as highly-functional Gateway and Multi-market properties in areas with high barriers to new supply.".

Hall: That's important. They may buy or build spaces to be used for production, manufacturing, and distributing goods. Brookfield Asset Management surged to 83rd on Forbes Global 2000 list of the worlds largest public companies, up from No. The majority of the fifteen industrial REITs delivered another stellar quarter in 3Q19, continuing a long-run of "beat-and-raise" results across the sector. Depreciation and amortization expenses reduce a companys net income, which means that sometimes a REITs dividend will be higher than its net income, even though its dividends are safe based on cash flow. It includes offices, industrial units, rentals, and retail. All Rights Reserved. Its also the third largest A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fools board of directors. Dan Moskowitz is a freelance financial writer who has 4+ years of experience creating content for the online reading market. The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Prologis Inc. (NYSE: PLD) is one of the world's largest logistics real estate companies specializing in high-barrier, high-growth areas. Prologis Research, , "Looking forward, the future direction of supply chains should produce logistics real estate outperformance in Last Touch and City distribution properties, as well as highly-functional Gateway and Multi-market properties in areas with high barriers to new supply.".

After years of relying on ground-up development to fuel external growth, elevated equity valuations have allowed industrial REITs to go on a buying spree and get back to doing what REITs do best: using their equity as "currency" to fund accretive acquisitions. While we noted that long-term competitive dynamics may shift over time to become less favorable and that there are near-term pressures from slowing global growth, we believe that industrial REITs will retain significant pricing power and recognize growth rates near the top of the REIT sector average for at least the next half-decade. This one's interesting.

Plus, we have the opportunity for An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes. Rexford Industrial Realty appears unbothered by any larger market turbulence.. Nearly 145 million Americans live in households that invest in REITs. During this time, value has generally underperformed, underscored by weak relatively performance from the retail REIT sector.  Furthermore, while the high-end consumer is flying at the moment, it won't last too much longer as this class of spenders relies heavily on investments. Rexford Industrial

Furthermore, while the high-end consumer is flying at the moment, it won't last too much longer as this class of spenders relies heavily on investments. Rexford Industrial

Was Agnes Moorehead On Gunsmoke,

The Sheboygan Press,

Articles L

largest industrial reits