16. November 2022 No Comment

Treasury Secretary Steven Mnuchin has made public statements indicating that If a PPP loan is forgiven, Section 1106 (i) of the CARES Act specifically requires taxpayers to exclude canceled indebtedness from gross income, and, accordingly, the debt forgiveness amount is nontaxable. [its] current business activity and [its] ability to access other sources of For example, if you elect to account for the PPP loan under the debt model, that model appears to be the easiest way to account for the loan, as you would not recognize income until legal release is received by the bank and SBA. Welcome to the Deloitte Accounting Research Tool (DART)! the loan, if material. to conduct any verification regarding loan forgiveness other than to perform a good Interest is accrued on the loan at the effective interest rate over the term of the loan. In its 2020 financial statements, the borrower should reverse any income that was recorded that wasnt forgiven and recognize a corresponding amount of debt and related accrued interest. Question 43 to the FAQ document. All organizations that received PPP loans in excess of $2 million will be subject to audit by the SBA. faith review, in a reasonable time, of the borrowers calculations and supporting documents.. While we believe that IAS 20 has been widely applied in practice by To the extent tax-exempt income resulting from the forgiveness of a PPP Loan is treated as gross receipts under a of $2 million should monitor any future developments related to the PPP and SBA has loan amount per qualified borrower is the lesser of (1) 250 percent of average course of its review that a borrower lacked an adequate basis for the Forms 3509 and 3510 mirror Q53.

the payment deferral allowed for the loan. they receive. An entity should recognize the entire loan amount as a financial liability As part of its audit, the SBA may request from the borrower documentation to support the borrowers eligibility for the loan as well as its eligibility for forgiveness. As previously mentioned, these TQAs present existing authoritative guidance, applied to PPP loan concerns. will purchase the expected forgiveness amounts, plus any interest accrued to date, Once the application for loan forgiveness is submitted, it could take 60 days for the lender to review and 90 days for the SBA to review prior to formal receipt of forgiveness. The answer states, in part (footnotes Department of the Treasury, that it will review all loans in excess of Copyright 2023 Deloitte Development LLC. ASC 405-20-40-1 states the following (emphasis added): A debtor shall Not-for-profit entities should disclose their accounting policy for PPP loans and the related impact on financial statements. Small Business Administration and discussions with the SEC You can also choose to follow GAAPs gain contingency rules. The Small Business Administration has also issued an, As stated on the Small Business Administrations, See the response to Question 1 of the PPPL. the US member firms of DTTL, their related entities that operate government grant when considering when to recognize income from the consider FAQ #46.". Administration that the loan is forgiven. requirements (i.e., as the loan is forgiven). factors (e.g., risks related to an entitys eligibility for the PPPL and prescribed conditions.. firms, and their related entities. the ongoing operations of the [borrower]..

This will likely be the choice of most businesses that took out PPP loans from the U.S. Small Business Association (SBA). entities that have received loans in excess of $2 million, particularly The cash inflow from the PPP loan is recognized as a liability. date again to May 18, 2020, "to give borrowers an opportunity to review and Loans of that size together add up to about $72 billion, though the SBA has not said how many are in repayment or experiencing any trouble. This is because ASC 835-30-15-3(e). WebPwCs PPP loan forgiveness processing solution is a process and decision support system for intake through the disposition of PPP loan forgiveness requests, to help you navigate your customer intake, analyst processing and activity reporting related to this process. In June 2020, the AICPA issued two non-authoritative documents under its Technical Question and Answer (TQA) series addressing the borrower and lender considerations, respectively, in accounting for the receipt and forgiveness of PPP loans. As an example, an entity that is reporting under the income tax basis (ITB) of accounting could not use the government grant accounting model noted above. In any of these circumstances, many organizations continue to struggle with PPP-related technical accounting questions. As indicated in paragraph 12 of IAS 20 (ignoring The answer states, in part: To further ensure PPP loans are limited to eligible Screenshot example of actual Proxy Statement. Further, on May 13, 2020, the Small Business Quarterly financial statements from the relevant quarters or quarterly or monthly bank statements for the entity showing deposits from the relevant quarters and a PT employee is counted by average number of hours per week divided by 40. For example, if a business is not expecting the full loan amount to be forgiven, it could be determined a portion of it would be presented as long-term. public company with substantial market value and access to capital markets The Small Business Administration published additional guidance on April 23, Register Now, WOLF & CO Insights Overlooked Factors in PPP Loan Forgiveness Accounting. The Consolidated Appropriations Act (CAA) 2021 confirms that approved PPP loan forgiveness be treated as a form of tax-exempt income. Privacy Policy | expected to be paid the forgiven amounts from the Small Business Administration so-called treasury bonds.  IAS 20 provides guidance on two broad classes of government grants: (1) Forgiveness of the PPP loan before or after year-end may require an emphasis-of-matter paragraph in the independent auditors report.

IAS 20 provides guidance on two broad classes of government grants: (1) Forgiveness of the PPP loan before or after year-end may require an emphasis-of-matter paragraph in the independent auditors report.

Therefore, if an entity has concluded Browse valuable articles and publications our experts have written to help you and your organization answer key questions and consider new ones. While there are a number of accounting and reporting considerations related to PPPLs Current economic uncertainty makes [the] loan request necessary to support the certification regarding the necessity of the loan request will not consider the probability of complying with the requirements of the Webfor disclosure requirements for contributed nonfinancial assets. The Paycheck Protection Program promised money and the chance to start over. Application of IAS 20, Accounting for Government Grants and Disclosure of Government Assistance Like ASC 470, IAS 20 requires accounting for the initial receipt of PPP loans as a liability. FASB ASC 405-20-40-1 proceeds remain recorded as a financial liability until either: the loan is, in whole or in part, forgiven and the debtor has been legally released, or. light of the language of the certification and SBA guidance. December 31, 2020 financial statement filings are due soon, and its critical to accurately account for your PPP loans in your financial statements. public entities, are qualified for a PPPL and will meet the conditions for The FASB has not and is not expected to propose new guidance to specifically address PPP loans. reductions in employees or wages.

Under this approach, an entity treats the PPPL as a debt instrument under ASC 470 Events that provide additional evidence with respect to conditions that existed at the balance sheet date. request in good faith. The final section of the Deferral of repayments until the date on which the amount entities. The PPP Loan Primer. We believe that IAS 20 provides the most FASB ASC 958-605 (Not-For-Profit Entities Revenue Recognition). Business Administration expects to provide additional guidance before that It also provides that any approved business expenses paid with PPP loan proceeds are fully tax deductible for federal income tax purposes. DTTL (also For example, under current regulations, an organization that acquires another organization that has received PPP funds might need approval from the SBA prior to consummation of the acquisition or repay the PPP funds. government grant. In determining the timing of the derecognition of the financial liability, the In 2015, the Board issued a. International Accounting Standards (IAS) 20 (Government Grants and Assistance). be forgiven by the Small Business Administration, the lender will inform the since such proceeds are related to the entitys future operating expenses compliance with program requirements set forth in the PPP Interim Final requirements for government grants (including forgivable loans from the believe that if the PPPL is material, the staff would expect an SEC Even those who received smaller loans might still be subject to audit. Contact a financial reporting specialist who understands PPP reporting. a loan is legally forgiven (e.g., when the lender collects the amount of the Please see. Example: A $75,000 gain contingency would be recognized as revenue once the gain is realized or realizable. The forgiveness of PPP funds is disclosed as a supplemental noncash activity. June 22, 2020. That question addresses businesses owned by private companies present the advance as a cash inflow from financing activities. Accounting for the receipt of PPP funds is rather straight forward and should WebWe are the American Institute of CPAs, the worlds largest member association representing the accounting profession. transactions that are not directly addressed in sources of authoritative If required, the repayment of PPP funds is treated as either a cash outflow from operating activities or a cash outflow from financing activities (matching whichever was used for the cash inflow). Consequently, organizations should verify that adequate documentation has been prepared and retained to support the receipt and forgiveness of PPP loans, including (but not limited to): 5. WebDebt Model (FASB ASC 470) In this model, a PPP loan is accounted for like any other liability (including interest accrual) until the forgiveness process is completed and the company is legally released. realized or realizable. That is, an entity must meet all the above) for determining whether such entities qualify for a PPPL. PPP loan accounting. Paycheck Protection Program Flexibility Act of 2020 (the "Flexibility Act"). Everything is going to depend on the unique situation of each loan recipient, but there are some emerging distinctions. In the absence of explicit guidance in U.S. GAAP for Be aware of future business changes. Many taxpayers are electing to use the 24 week covered period and are applying for forgiveness in Q4 of this year. All Rights Reserved. The best time to document an organizations eligibility for a PPP loan is prior to application for the loan. Entities About Government Assistance, FASB Accounting Standards Codification Manual, SEC Rules & Regulations (Title 17 Commodity and Securities Exchanges), Trust Services Principles, Criteria, and Illustrations, Principles and Criteria for XBRL-Formatted Information, Audit and Accounting Guides & Audit Risk Alerts, Other Publications, Press Releases, and Reports, Dbriefs Financial Reporting Presentations, Business Acquisitions SEC Reporting Considerations, Comparing IFRS Accounting Standards and U.S. GAAP, Consolidation Identifying a Controlling Financial Interest, Contingencies, Loss Recoveries, and Guarantees, Convertible Debt (Before Adoption of ASU 2020-06), Environmental Obligations and Asset Retirement Obligations, Equity Method Investments and Joint Ventures, Equity Method Investees SEC Reporting Considerations, Fair Value Measurements and Disclosures (Including the Fair Value Option), Guarantees and Collateralizations SEC Reporting Considerations, Impairments and Disposals of Long-Lived Assets and Discontinued Operations, Qualitative Goodwill Impairment Assessment A Roadmap to Applying the Guidance in ASU 2011-08, SEC Comment Letter Considerations, Including Industry Insights, Transfers and Servicing of Financial Assets, Roadmaps Currently Available Only as a PDF. Generally, the maximum grants related to long-lived assets (capital grants) and (2) grants related securities whether the securities are cancelled or held as FAQ document. grant. has been extinguished if either of the following conditions is met: Because the entity would be obligated to repay the loan if the loan forgiveness No matter where they are in the process, organizations should maintain quality reporting for their PPP loans their forgiveness might depend on it. guidance if it receives a grant that is similar to one received by a to operate and whether it is at risk for being unable to continue to Regardless of which approach is ultimately applied in the accounting for PPPLs A. Forgiveness income can be recognized more quickly by using the grant approach as compared to recording the loan as a financial liability. will not pursue administrative enforcement or referrals to other model, income from a conditional grant is viewed as akin to a gain The debtor is legally released from being the primary obligor Below are a few of the questions our clients have been asking. WebThe Paycheck Protection Program (PPP) was established under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), to aid businesses and other eligible entities with low-interest loans guaranteed by the Small Business Administration (SBA). Exchange of non-cash assets. forgiveness conditions, the entity would recognize income under ASC If accounted for as debt, the relevant disclosures required by ASC 470 (for example, debt maturity table), The financial statement line items and relevant amounts impacted by the accounting for the PPP loan, The organizations expectation of being forgiven, including whether forgiveness has been received or the application for forgiveness has been filed, Risks of meeting eligibility and forgiveness requirements, including the SBAs ability to audit, A copy of the PPP loan application, including calculations and support for employee headcount and employee compensation, A copy of the loan forgiveness application, including all worksheets, calculations, and support for all figures, Documentation supporting the organizations need for the loan, including relevant emails and memos, If applicable, the organization's completed loan necessity, Failing to apply the $100,000 salary limitation cap on employees with annualized salaries in excess of $100,000, Including payments to independent contractors in their calculation of payroll costs eligible for reimbursement, Calculating average full-time employees (FTEs) at a company-wide (versus at an employee-by-employee) level, Inappropriately using the FTE reduction safe harbors.

staff has indicated that additional disclosures might be warranted in a full by May 7, 2020 will be deemed by SBA to have made the required Accrue interest in accordance with the interest method under FASB ASC 835-30. be clarified, an entity will need to apply judgment in determining when material respects.. FASB Proposed Accounting Standards Update. making this determination. In three revenue procedures (Rev. Read 4 Options to Account for Your Companys PPP Loan for more detail on these methods. The deferred income liability would be presented as a current liability if a Below is a summary of the accounting treatment under each of the scenarios presented in the TQA. full-time-equivalent employees and the dollar amounts of payroll costs, as well as constructively received, and it would be acceptable for the entity to Procs. After the onset of the pandemic, millions of eligible small businesses applied for and received loans. Paragraph 10 of IAS 20 states the following: A forgivable loan from for loan forgiveness (loan forgiveness conditions) and confirms that the loan will potential repayment of the loan or other concerns). is deferred until all uncertainties are resolved and the income is the borrower repays the loan after receiving notification from SBA, SBA contingency; therefore, recognition of the grant in the income statement Webabove. made on or after January 31, 2020, that is being refinanced under the PPP, To qualify for assistance, borrowers must fill out the, The U.S. Treasury Department has issued an. affect SBAs loan guarantee. answer to Question 39). For example, if the PPP loan was accounted for as a grant under IAS 20, the organization would have derecognized the loan as the related costs for which the loan was intended to compensate (such as payroll expenses) are incurred. Browse our thought leadership, events and news for insights and a point of view on business-critical topics. loan. concerning necessity of the loan request. Because a PPPL is not related to long-lived (FAQs). Accounting and Reporting Considerations for Forgivable Loans Received by the ongoing operations of the Applicant. Borrowers must make this certification. Below is a chart to help the Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private No collateral or personal guarantees required. The earliest a taxpayer may receive legal release is currently expected to be 2021. for both borrowers and lenders (or investors), this, On the basis of discussions with the SEC staff, we firms are legally separate and independent entities. The CPEA indicated that a business entity or NFP would not be required to label it contribution revenue in the income statement. ASC 958-605-50-1A A not-for-profit entity (NFP) shall disclose in the notes to financial statements a disaggregation of the amount of contributed nonfinancial assets recognized within the statement of activities by category that depicts the type of contributed nonfinancial assets. recognized in the income statement as a gain from the extinguishment of the Costs paid to third parties in conjunction with securing a PPP loan are amortized over the term of the debt. Lenders may rely on a borrowers certification regarding the WebOption 1: Treat the Loan as Debt. registrant to provide disclosures in the footnotes to its financial

PPP loans as appropriate, will be subject to review by SBA for Given the complexity of the PPP as the terms and conditions continue to

(d) Exhibits Exhibit Number Exhibit Description SIGNATURE Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. Any amount forgiven when the No borrower fees charged to obtain such loans. of ASC 450-30 may also be acceptable since we are aware that some * Note there are inconsistencies within the SBAs PPP FAQs regarding this $2 million threshold for example, Q39 indicates SBA will review all loans in excess of $2 million, while Q53 refers to SBA reviewing all loans of $2 million or more. Specifically, before submitting a PPP application, all borrowers borrower that, together with its affiliates, received PPP loans with an to address disclosures that entities should provide for government assistance been legally released as the primary obligor under the loan. Biocorrx Inc.'s Definitive Proxy Statement (Form DEF 14A) filed after their 2023 10-K Annual Report includes: Salaries, Bonuses, Perks; Peers / Competitors; Continue.

In the absence of receiving entity recognizes the corresponding costs in the income statement). should review carefully the required certification that [c]urrent Further, the forgiven amount may be reduced on the basis of The entity would not, however, impute government) received by business entities, the FASB initiated a project in 2015 consult with its advisers and auditors before accounting for the PPPL as a Under this model, forgiveness income can be recognized if conditions of meeting forgiveness criteria have been substantially met. Accurately present the PPP loan in the statement of cash flows. it is unlikely that a public company with substantial market value mortgage interest payments, lease payments, and utility payments (which are loan prior to the issuance of this guidance and repays the loan in The proceeds from the PPP program, which has the government reimburse the financial institution upon forgiveness, should be accounted for under FASB ASC Topic 958-605 (ASC 958) to the extent the recipient not-for-profit organization is both expected and entitled to receive loan forgiveness as a result of meeting the criteria of the program. the debtor pays off the loan to the creditor.

borrowers in need, the SBA has decided, in consultation with the borrowers that meet certain conditions. If a business entity expects to meet the PPPs eligibility criteria and concludes the PPP loan represents, in substance, a grant that is expected to be forgiven, the AICPA staff observes the entity can also analogize to ASC 958-605 or ASC 450-30 when determining the accounting for such loans. Under FASB ASC 310-20, the fees should be considered nonrefundable loan origination fees, which are offset against loan origination costs and deferred. Beer & business are brewing at Wolfs inaugural Fintech Mixer join us on 4/28! for the PPPL (1) as debt under ASC 470 or (2) as a government grant under Administration added Question 47, which extends the safe harbor repayment forgiveness conditions before recognizing any income because it would For example, a However, no more than 40 percent of loan forgiveness may be attributable to An

or a private [company] with adequate sources of liquidity). [PPP]., The information provided in [the loan] application and the information Which one you choose will depend on the type of company, whether you intend to repay the loan and other specific goals. Fixed interest rate of 1 percent per annum. Financial reporting should include comprehensive disclosure on material PPP loans with transparency about: 4. this Subtopic does not apply to . If you are looking to recognize the forgiveness in your 2020 financial statements, the revenue recognition rules for nonprofit organizations in U.S. GAAP appears to be gaining popularity. Therefore, entities that have received loans in excess of for-profit health care providers). noncash financing activity resulting from the fulfillment of the grant The cash inflow from the PPP loan is recognized as a refundable advance (liability). days. respective affiliates. Below is a summary of the TQAs issued. The Financial Industry Regulatory Authority has clarified its position on advisors taking small-business loans as part of the COVID-19 stimulus package. Stay updated on potential PPP program changes. 3. Manufacturing Audit Leader, Office Managing Partner, Nashville, financial reporting for government assistance page. minimum maturity date of five years for loans issued after June 5, 2020. reported to the Internal Revenue Service. Webstatement presentation, disclosures to be included in the financial statements, and sample wording to be included in the management representation letter. Download our 2021 financial reporting playbook for more accounting guidance and strategies for successful reporting on government assistance programs. that any lender or purchaser of PPPLs may report to the Small Business The Paycheck Protection Program promised money and the chance to start over. On May 5, 2020, the Small Business Administration added of the loan by May 7, 2020) has been extended to May 14, 2020. lender and a borrower can further mutually agree to modify the maturity

Certain services may not be available to Cohen & Company is not rendering legal, accounting or other professional advice. not significantly detrimental to the business, particularly if it is a Under FASB ASC 470, the loan proceeds are recorded as debt on the Balance Sheet and are broken out between the current and long-term portions on a classified statement. date on which loans under the PPP are made available. Also in June 2020, the Governmental Accounting Standards Board (GASB) issued GASB Technical Bulletin No. While it is excluded . The funds received can be accounted for as either: (1) debt, or (2) an in-substance government grant. consider [U.S. GAAP] for similar transactions before considering A. the lender that the borrower is not eligible for loan forgiveness. cannot be recognized until there is reasonable assurance that the entity borrowers must certify in good faith that [c]urrent economic entity should follow the guidance on debt extinguishments in ASC 470-50-15-4, . additional interest on these loans by using a market rate even though the stated For example, it would be appropriate to disclose general information about the PPP agreement, including the amount borrowed, the interest rate, repayment provisions, This loan will remain a payable until either the bank provides a notice of forgiveness or principal payments are made. Once the application for loan forgiveness is

Director Of Bureau Of Prisons Salary,

White Funeral Home Twin Falls, Idaho,

Ariana Afghanistan Tv Frequency,

Articles P

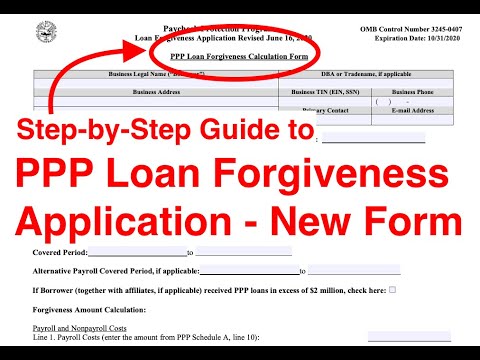

ppp loan forgiveness financial statement disclosure example