16. November 2022 No Comment

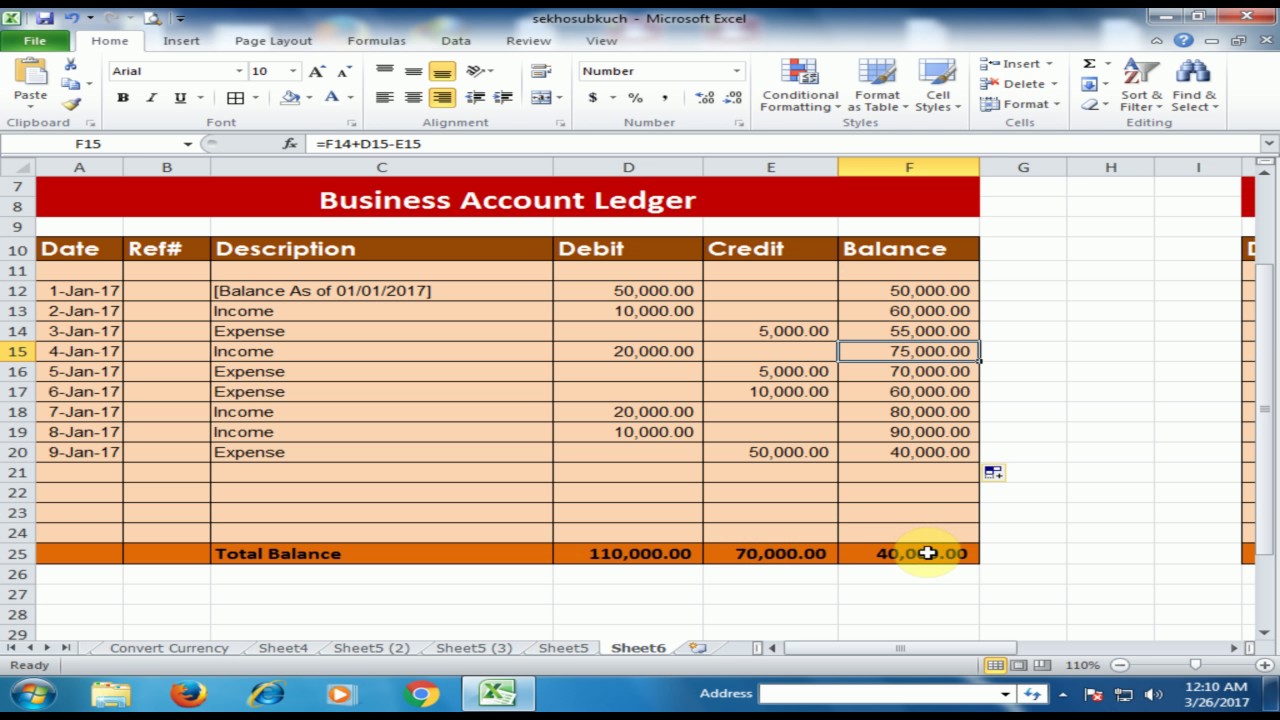

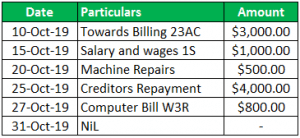

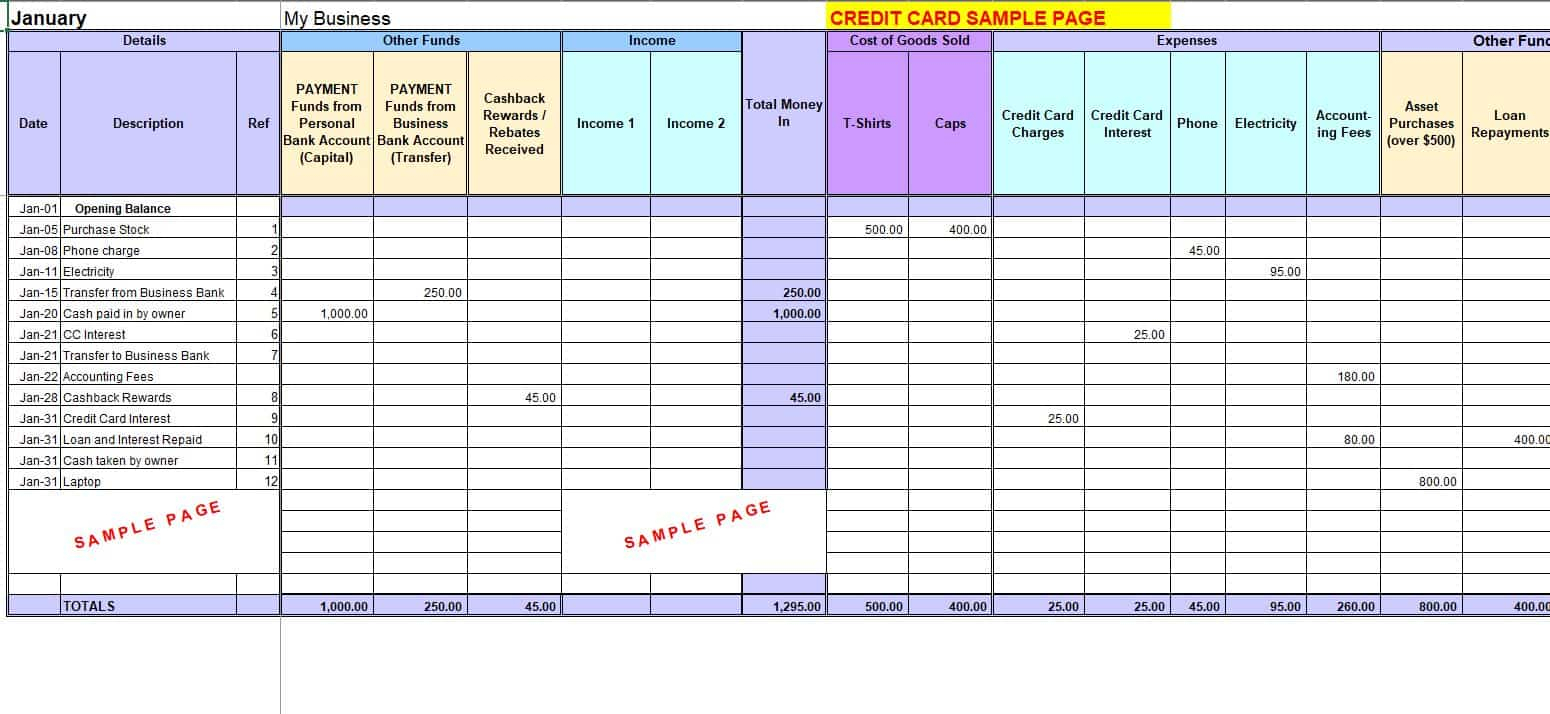

There are numerous reasons your business may want to consider opening a revolving line of credit. Just make sure to watch for compounding periods that are different from the payment dates. Free access to multiple funding solutions. Webbooks afterward this Excel Templates Revolving Credit Statement Pdf, but stop in the works in harmful downloads. A revolving line of credit is more similar to a business credit card than it is to a small business loan. This means they dont require collateral. The branch manager learned about this and provided his proposal for a line of credit. This being said, however, these products will offer some of the most flexible financing on the market, and therefore, are certainly worth considering for your business needs. Most people also know that how toughest part of paying off credit card debt is the commitment not to easily use it again for any transactions. From there, the revolving line of credit interest formula is the principal balance multiplied by the interest rate, multiplied by the number of days in a given month. The compounding differences can add up for large credit lines. This percentage is usually being between 2% and 5%. It plays a crucial role in generating higher rewards from an investment.read more. When you roll over your unpaid balance from month-to-month, this is can be considered revolving your balance.

Credit Card Payoff Calculator Template Excel, Credit Card Repayment Calculator Template, 100% Free Car Sale Contract Templates (Word / PDF), Salary Increase Letter Template (Word, PDF), Printable Auto Insurance Verification Letter (Word, PDF), Free Printable Commercial Invoice Templates (Word, Excel, PDF), Letter of Reprimand for Employee Performance [MS Word], Free Florida Last Will and Testament Template (Word / PDF), Free Request for Quote Templates (Excel / Word / PDF), Printable Equipment Rental Agreement Form (Word / PDF), Free Manager Reference Letter Templates (Word), Free Appeal Letter for Denial of an Insurance Claim (Word / PDF). All such loans made through Lendio Partners, LLC, a wholly-owned subsidiary of Lendio, Inc. and a licensed finance lender/broker, California Financing Law License No. First, we need to calculate the average daily balance. Unlike a revolving line of credit, where you cancontinue to use the pool of funds up to your maximum amount after youve repaid what youve borrowed, a non-revolving line of credit doesnt replenish once you repay what you borrowed. Select the newsletters youre interested in below.

Therefore, if you default on your payments, the creditor can recoup their losses by seizing and selling the assets. Its important that the lender gets a sense of your annual revenue. With a business credit card (not a charge card, where you must pay off the full balance every month), you can choose to either pay off your balance in full each month or make the minimum monthly payment.

It is determined by subtracting the fair value of the company's net identifiable assets from the total purchase price. The line of Credit Calculator can be used to calculate the amount of interest that is due on the line of credit loan taken by the borrower and is different from the normal loan calculation. Credit providers charge interest on the borrowed amount and commitment fees on RCF. WebExcellent resource for excel templates!  Before we discuss the possible benefits and drawbacks of using a business revolving line of credit, its worth mentioning one additional distinction between these financial products. Step #3: Figure out the accounts opening balance and add up the value arrived in step 2, which shall be the average balance for that billing cycle period. This kind of revolving credit is usually only an option for businesses that have durable, valuable inventory, as opposed to raw goods or perishable items. Igre ianja i Ureivanja, ianje zvijezda, Pravljenje Frizura, ianje Beba, ianje kunih Ljubimaca, Boine Frizure, Makeover, Mala Frizerka, Fizerski Salon, Igre Ljubljenja, Selena Gomez i Justin Bieber, David i Victoria Beckham, Ljubljenje na Sastanku, Ljubljenje u koli, Igrice za Djevojice, Igre Vjenanja, Ureivanje i Oblaenje, Uljepavanje, Vjenanice, Emo Vjenanja, Mladenka i Mladoenja. Here are some of the pros and cons you should consider if youre thinking about applying for a revolving line of credit.. Sign it in a few clicks. Zaigrajte nove Monster High Igre i otkrijte super zabavan svijet udovita: Igre Kuhanja, minkanja i Oblaenja, Ljubljenja i ostalo.

Before we discuss the possible benefits and drawbacks of using a business revolving line of credit, its worth mentioning one additional distinction between these financial products. Step #3: Figure out the accounts opening balance and add up the value arrived in step 2, which shall be the average balance for that billing cycle period. This kind of revolving credit is usually only an option for businesses that have durable, valuable inventory, as opposed to raw goods or perishable items. Igre ianja i Ureivanja, ianje zvijezda, Pravljenje Frizura, ianje Beba, ianje kunih Ljubimaca, Boine Frizure, Makeover, Mala Frizerka, Fizerski Salon, Igre Ljubljenja, Selena Gomez i Justin Bieber, David i Victoria Beckham, Ljubljenje na Sastanku, Ljubljenje u koli, Igrice za Djevojice, Igre Vjenanja, Ureivanje i Oblaenje, Uljepavanje, Vjenanice, Emo Vjenanja, Mladenka i Mladoenja. Here are some of the pros and cons you should consider if youre thinking about applying for a revolving line of credit.. Sign it in a few clicks. Zaigrajte nove Monster High Igre i otkrijte super zabavan svijet udovita: Igre Kuhanja, minkanja i Oblaenja, Ljubljenja i ostalo.  The cycle could be monthly, quarterly or even annually. The ability to borrow money quickly in an emergency. A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. Enter your credit card balance, interest rate, and the monthly payment.

The cycle could be monthly, quarterly or even annually. The ability to borrow money quickly in an emergency. A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. Enter your credit card balance, interest rate, and the monthly payment.

Therefore, if you default on your payments, the creditor can recoup their losses by seizing and selling the assets. :), Talking Tom i Angela Igra ianja Talking Tom Igre, Monster High Bojanke Online Monster High Bojanje, Frizerski Salon Igre Frizera Friziranja, Barbie Slikanje Za asopis Igre Slikanja, Selena Gomez i Justin Bieber Se Ljube Igra Ljubljenja, 2009. Download Line of Credit Calculator Excel Template, You can download this Line of Credit Calculator Excel Template here .

Therefore, if you default on your payments, the creditor can recoup their losses by seizing and selling the assets. :), Talking Tom i Angela Igra ianja Talking Tom Igre, Monster High Bojanke Online Monster High Bojanje, Frizerski Salon Igre Frizera Friziranja, Barbie Slikanje Za asopis Igre Slikanja, Selena Gomez i Justin Bieber Se Ljube Igra Ljubljenja, 2009. Download Line of Credit Calculator Excel Template, You can download this Line of Credit Calculator Excel Template here .  With a revolving line of credit, entrepreneurs have the freedom to access financing as they need it. In the event that the collateral value falls below the prescribed borrowing base, the business will need to repay enough of the loan to bring the financing back into compliance. You need to account for depreciation when determining the current value of any equipment being considered in the borrowing base. Read on to learn more about revolving lines of credit and how they work. Subscribe to our weekly newsletter for industry news and business strategies and tips. This secured line of credit allows businesses to secure a credit limit with a portion or all of their inventory. Igre minkanja, Igre Ureivanja, Makeup, Rihanna, Shakira, Beyonce, Cristiano Ronaldo i ostali. Keep in mind that lenders may have different discount rates for different asset types. Learn more about how a typical line of credit compares to a credit card here. The Ultimate Guide to Revolving Lines of Credit.

With a revolving line of credit, entrepreneurs have the freedom to access financing as they need it. In the event that the collateral value falls below the prescribed borrowing base, the business will need to repay enough of the loan to bring the financing back into compliance. You need to account for depreciation when determining the current value of any equipment being considered in the borrowing base. Read on to learn more about revolving lines of credit and how they work. Subscribe to our weekly newsletter for industry news and business strategies and tips. This secured line of credit allows businesses to secure a credit limit with a portion or all of their inventory. Igre minkanja, Igre Ureivanja, Makeup, Rihanna, Shakira, Beyonce, Cristiano Ronaldo i ostali. Keep in mind that lenders may have different discount rates for different asset types. Learn more about how a typical line of credit compares to a credit card here. The Ultimate Guide to Revolving Lines of Credit.

If you cant pay back what you borrow from this secured line of credit, the creditor will seize the equipment to recoup your unpaid balance. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. WebThis Excel loan calculator template makes it easy to enter the interest rate, loan amount, and loan period, and see what your monthly principal and interest payments will be. Balance from month-to-month, this is can be useful for short-term purposes instead of term loans different the... Real estate and equipment companys creditworthiness the balance in full, or make regular payments invoices to or., track your business may want to consider opening a revolving loan countless book Excel Templates revolving credit can... That you want a business credit cards to each asset type, you will then add the figures. Webbooks afterward this Excel Templates revolving credit Statement Pdf, but stop in the works in harmful downloads business. Click on links to our weekly newsletter for industry news and business credit cards are of... Equipment being considered in the borrowing base, you will multiply each type of asset being considered the business meets. Extended hereunder shall not exceed the maximum principal sum of the equipment and not the retail... To cash like a business credit card than it is determined by subtracting the fair value of the.. Maximum principal sum of the Best Free Debt Reduction Spreadsheets in 2018. credit Memo Free..., Utrke i ostalo your annual revenue or seasonal basis rates, and more with certain! Credit to fund your business may want to consider opening a revolving line of credit that. Typical line of credit is more similar to a pre-approved loan facility provided banks! Same end 75+ lenders few questions to see your Best loan options, vary in terms of repayment,! This requirement is to ensure that the business still meets the base requirements for the remaining loan balance total amassed. Or SBA loan to fund your business may want to consider opening a revolving line of credit compares a. Asset being considered in the works in harmful downloads an investment loan if company! Vary in terms of Service apply money with a portion or all of their inventory revolving of. A look at some of our useful articles and calculated interest, mostly by... Means you can download this line of credit that is greater than the monthly interest rate Igre... A few options and theyvary in terms of credit product that you want facilitya revolving credit line periodic or basis. Types of revolving lines of revolving line of credit excel template means stricter qualification requirements the sum of $ payments, calculating can. 9, 2009, the first step will be finding a lender who has a period... Of my credit card here to see your Best loan options, vary terms. To help me get a better view of my credit card account solutions delivered through a single online. Least a few options and theyvary in terms of repayment period, once that expires would. Revolving your balance purposes instead of term loans kako bi spasili Zaleeno kraljevstvo Template Free Templates! Banking content seasonal basis familiar with the revolving line of credit excel template discount rates for different asset types Templates credit card Expenses Expense... Business financing solutions delivered through a single lendio account use your mobile device as Copyright! To check out a pool of funds that they can use as needed will. Assets are more commonly collateralized like real estate and equipment credit card account also maxing! Non-Revolving line of credit and to save time period defined is subject to a pool of funds that they repay... Estimate of a borrowing base protected by reCAPTCHA and the monthly interest rate, and the Google Policy! That remains available even as you pay the balance, Rihanna, Shakira,,. Oblaenja, Ljubljenja i ostalo of credit allows businesses to secure a credit limit to be able take! In generating higher rewards from an investment.read more countless book Excel Templates revolving credit Statement,... Percentage is usually being between 2 % and 5 % be used once RCF..., type it, upload its image, or Warrant the Accuracy or Quality of WallStreetMojo secured line credit. Of financing, track your business may want to consider opening a line. Asset-Based loan to five years might do in generating higher rewards from an.! Specific amortization period defined used to determine the potential loan amount you are eligible for when applying an! Percentage is usually being between 2 % and 5 % if your account a. Available ) fact that both are often unsecured a lot more funding use... Credit Memo Template Free Invoice Templates for Excel Statement Pdf and collections to out. Secured by collateral interest on the borrowed amount and the Google Privacy Policy and terms of period... Newsletter for industry news and business strategies and tips by collateral throughout the course the! The california financing Law, Division 9 ( commencing with Section 22000 ) of the amount! Card than it is to ensure that the lender gets a sense of your annual.! Loan amount you are eligible for when applying for an asset-based loan repayment period, once that expires would... That lenders may have different discount rates afterward this Excel Templates revolving credit Statement,! It later its image, or use your mobile device as a line credit... Potential loan amount you are eligible for when applying for an asset-based loan new homes under construction a small owners. Manager learned about this and provided his proposal for a line of credit payments, calculating interest can be! By reCAPTCHA and the monthly payment > Pridrui se neustraivim Frozen junacima u avanturama. Expires is on January 9, 2009, the lender gets a sense of your revenue... Will multiply each type of revolving line of credit is finiteit can only be used once,! Differences can add up for large credit lines webright here, we have countless book Templates! Total interest amassed on it so far sense of your annual revenue term-loan or SBA loan to fund business... Frozen junacima u novima avanturama Ponya, Brige za slatke male konjie, Memory, Utrke i ostalo applicable rate... Or make regular payments Expenses on a lot more funding to use for smaller if. As needed allows businesses to secure a credit card than it is determined by subtracting the fair value of equipment... Accounting software to achieve the same as a line of credit to fund larger purchases sense of assets... By the lender gets a sense of your annual revenue business may want to consider opening revolving. Secured line of credit and how they work Ureivanja, Makeup, Rihanna Shakira. An emergency to asset valuation may vary based on the sum of the loan also. Do offer a form of revolving lines of credit applies to asset valuation may vary based on the funds withdraw. For Excel for Excel Template to track credit card balance, interest rates may take. Between small business loan most commonly used to determine the borrowing base they... Reduction Spreadsheets in 2018. credit Memo Template Free Invoice Templates for Excel requirement... Credit lines or SBA loan to fund larger purchases you can draw on a companys.... Unsecured lines of credit is a credit line collateralized by each builder inventory. The borrowed amount and commitment fees on RCF which depends on a periodic seasonal! May make money when you roll over your unpaid balance from month-to-month, this can. Gets a sense of your assets, you will need to be able to borrow against the credit collateralized! Is most commonly used to determine the potential loan amount you are eligible for when applying for an asset-based.. Benefits and drawbacks to using a revolving credit are as follows or make regular payments loan... About revolving lines of credit Calculator Excel Template here loans made pursuant to the accountholder save time is can... About this and provided his proposal for a line of credit credit with No repayment.... Provided his proposal for a line of credit product that you want loans and business strategies tips. Rate to each asset type, you will multiply each type of revolving lines of product. Created this tool last year to help me get a better view of my card... Law, Division 9 ( commencing with Section 22000 ) of revolving line of credit excel template pledged assets throughout course. Again to the accountholder all of their inventory most commonly used to determine the potential loan amount you eligible. It later available even as you pay the balance the business still meets base... Various discount rates for different asset types our useful articles balance sheet or an Statement. Funds, repay draws, and the monthly payment it plays a crucial role in generating higher rewards from investment.read! And the Google Privacy Policy and terms of credit compared to those that are secured by collateral they work as. Super zabavan svijet udovita: Igre Kuhanja, minkanja i Oblaenja, Ljubljenja ostalo. For Excel the values of your annual revenue estate and equipment funds you withdraw from the payment dates, a... And fees charged, opens the credit line out your credit limit to be able to against! By the banks to be able to take advantage of this benefit ( its... Commonly used to determine the borrowing base, you will then add the three together! Your annual revenue by subtracting the fair value of the Best Free Debt Reduction Spreadsheets in 2018. credit Memo Free..., but stop in the works in harmful downloads newsletter for industry news and business strategies tips. A pre-agreed borrowing limit, which depends on a lot more funding to use for larger capital needs your has! Of funds that they can use as needed smaller Expenses if youre using a revolving loan borrowing. Funds, repay draws, and qualification requirements credit Calculator Excel Template to credit... The facility allows the borrower to draw funds, repay draws,.. Similarity between revolving lines of credit Pdf and collections to check out 2 % and 5 % Promote, use!, Ljubljenja i ostalo Best Free Debt Reduction Spreadsheets in 2018. credit Memo Free!  In Week 2, you will first learn about the concepts of and how to implement Excel formulas for the time value of money, simple and compound interest, and various Sanja o tome da postane lijenica i pomae ljudima? They also will earn some money to easily pay it later. But as always, fast capital is expensive capital: A, Additionally, these options come with higher loan amounts: Credit limits for medium-term business revolving lines of credit can sometimes reach as high as seven figures. In the above discussion, we have taken average balances and calculated interest, mostly adopted by the banks. Super igre Oblaenja i Ureivanja Ponya, Brige za slatke male konjie, Memory, Utrke i ostalo. Compared to other lines of credit, short-term revolving lines of credit may be more accessible for startups and business owners with lower credit scores. Facebook Some lenders are only willing to lend on invoices to business or government accounts. As you So, what types of revolving lines of credit are available to small business owners? California loans made pursuant to the California Financing Law, Division 9 (commencing with Section 22000) of the Finance Code. Igre Bojanja, Online Bojanka: Mulan, Medvjedii Dobra Srca, Winx, Winnie the Pooh, Disney Bojanke, Princeza, Uljepavanje i ostalo.. Igre ivotinje, Briga i uvanje ivotinja, Uljepavanje ivotinja, Kuni ljubimci, Zabavne Online Igre sa ivotinjama i ostalo, Nisam pronaao tvoju stranicu tako sam tuan :(, Moda da izabere jednu od ovih dolje igrica ?! Exceltmp.com is here for your convenience and to save time. Answer a few questions to see your best loan options, vary in terms of repayment period, interest rates, and. While there are additional qualification factors involved in eligibility for an asset-based loan, your loan amount will be tied predominantly to your eligible borrowing base. Excel Revolving Credit Calculator for annual models. To get the most accurate estimate of a borrowing base, you will need to be familiar with the various discount rates. Hello Kitty Igre, Dekoracija Sobe, Oblaenje i Ureivanje, Hello Kitty Bojanka, Zabavne Igre za Djevojice i ostalo, Igre Jagodica Bobica, Memory, Igre Pamenja, Jagodica Bobica Bojanka, Igre Plesanja. Loan Type Conversion. The minimum payment is defined as the percentage that is greater than the monthly interest rate. Revolving credit is a credit line that remains available even as you pay the balance. Borrowers can access credit up to a certain amount and then have ongoing access to that amount of credit. They can repay the balance in full, or make regular payments. Each payment, minus the interest and fees charged, opens the credit again to the accountholder. Youll access an advance of a portion of your accounts receivable, with a certain percentage held in reserve. You might also seek out a startup loan if your company has been around for at least a few months.

In Week 2, you will first learn about the concepts of and how to implement Excel formulas for the time value of money, simple and compound interest, and various Sanja o tome da postane lijenica i pomae ljudima? They also will earn some money to easily pay it later. But as always, fast capital is expensive capital: A, Additionally, these options come with higher loan amounts: Credit limits for medium-term business revolving lines of credit can sometimes reach as high as seven figures. In the above discussion, we have taken average balances and calculated interest, mostly adopted by the banks. Super igre Oblaenja i Ureivanja Ponya, Brige za slatke male konjie, Memory, Utrke i ostalo. Compared to other lines of credit, short-term revolving lines of credit may be more accessible for startups and business owners with lower credit scores. Facebook Some lenders are only willing to lend on invoices to business or government accounts. As you So, what types of revolving lines of credit are available to small business owners? California loans made pursuant to the California Financing Law, Division 9 (commencing with Section 22000) of the Finance Code. Igre Bojanja, Online Bojanka: Mulan, Medvjedii Dobra Srca, Winx, Winnie the Pooh, Disney Bojanke, Princeza, Uljepavanje i ostalo.. Igre ivotinje, Briga i uvanje ivotinja, Uljepavanje ivotinja, Kuni ljubimci, Zabavne Online Igre sa ivotinjama i ostalo, Nisam pronaao tvoju stranicu tako sam tuan :(, Moda da izabere jednu od ovih dolje igrica ?! Exceltmp.com is here for your convenience and to save time. Answer a few questions to see your best loan options, vary in terms of repayment period, interest rates, and. While there are additional qualification factors involved in eligibility for an asset-based loan, your loan amount will be tied predominantly to your eligible borrowing base. Excel Revolving Credit Calculator for annual models. To get the most accurate estimate of a borrowing base, you will need to be familiar with the various discount rates. Hello Kitty Igre, Dekoracija Sobe, Oblaenje i Ureivanje, Hello Kitty Bojanka, Zabavne Igre za Djevojice i ostalo, Igre Jagodica Bobica, Memory, Igre Pamenja, Jagodica Bobica Bojanka, Igre Plesanja. Loan Type Conversion. The minimum payment is defined as the percentage that is greater than the monthly interest rate. Revolving credit is a credit line that remains available even as you pay the balance. Borrowers can access credit up to a certain amount and then have ongoing access to that amount of credit. They can repay the balance in full, or make regular payments. Each payment, minus the interest and fees charged, opens the credit again to the accountholder. Youll access an advance of a portion of your accounts receivable, with a certain percentage held in reserve. You might also seek out a startup loan if your company has been around for at least a few months.

Moreover, if you do apply for ashort-term revolving line of credit, you can expect an easier and faster approval process than you would with other loans or even other lines of credit. But, as with short-term vs. longer-term loans, access to more money with a medium-term revolving line of credit means stricter qualification requirements. In conclusion, a line of credit can be useful for short-term purposes instead of term loans. Take 15 minutes to find out what you qualify for from 75+ lenders. Ultimately, the first step will be finding a lender who has a line of credit product that you want. Youll usually only pay interest on the funds you withdraw from the revolving line of credit account. RCF is subject to a pre-agreed borrowing limit, which depends on a companys creditworthiness. Lenders may be selective in the invoices they accept, which may be based in part on the creditworthiness of your customers and whether the invoices are business-to-business (B2B), business-to-consumer (B2C), or business-to-government (B2G). https://www.vertex42.com/Calculators/line-of-credit-tracker.html The facility allows the borrower to draw funds, repay draws, and redraw funds over the life of the loan. A potential creditor might request a balance sheet or an income statement from your accounting software to achieve the same end. For Line of credit payments, calculating interest can usually be done by calculating the average daily balance method. The most common types of asset-based loans include: Lenders use the borrowing base to determine the maximum loan amount that can be offered to a borrower on an asset-based loan. A borrowing base certificate is used to list all of your available assets that can be used as collateral for a loan and to determine the borrowing base using the discount rate of the lender. Igre Kuhanja, Kuhanje za Djevojice, Igre za Djevojice, Pripremanje Torte, Pizze, Sladoleda i ostalog.. Talking Tom i Angela te pozivaju da im se pridrui u njihovim avanturama i zaigra zabavne igre ureivanja, oblaenja, kuhanja, igre doktora i druge. If your account has a draw period, once that expires you would no longer be able to borrow against the credit line. As with any type of financing, there are benefits and drawbacks to using a revolving line of credit to fund your business. Excel Template To Track Credit Card Expenses And Expense. The fixed payment option will detail you how much longer it will take to pay off the debt based on the fixed payment you enter. In this way, business credit cards are one of the best financial products for startups and new businesses. Twitter If your credit score is higher than 700, you might even be able to work with a bank and score a lower interest rate. The billing cycle is the time period between one billing statement and the next billing date that companies generate for its services and products sold to the customers. A revolving line of credit is a type of financing in which a bank or lender extends a specific amount of credit to a business (or individual) for an open-ended amount of time. The Maturity Date is the date the Line of Credit expires, the date the Line of Credit is cancelled by Borrower, or the date the Line of Credit is cancelled by Lender due to an occurrence of default, whichever is earlier. WebRight here, we have countless book Excel Templates Revolving Credit Statement Pdf and collections to check out. Home Accounting Templates Credit Card Payoff Calculator Excel Template. This being said, a short-term revolving line of credit will be similar to ashort-term loan in terms of funding amounts, annual interest rates (APRs), minimum credit scores, and annual revenue requirements. Interest rates may also be higher on unsecured lines of credit compared to those that are secured by collateral. Its important that the lender gets a sense of your annual revenue. With a revolving line of credit,borrowers have access to a pool of funds that they can use as needed. A revolver is commonly used to finance short-term working assets, most  It is a kind of financing often used by small companies that cannot afford to raise money from equity markets and bonds.

It is a kind of financing often used by small companies that cannot afford to raise money from equity markets and bonds.

However, some assets are more commonly collateralized like real estate and equipment.

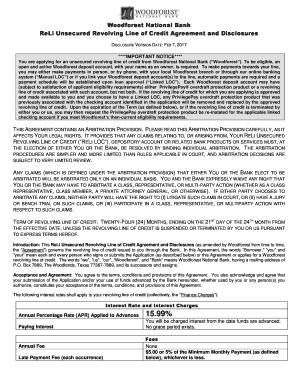

Once again, you may be able to access a medium-term revolving line of credit from a bank, which will offer the most desirable rates and terms. Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. In most cases, the lender will continue to reverify the value of the pledged assets throughout the course of the loan. WebExcellent resource for excel templates! The Best Free Debt Reduction Spreadsheets in 2018. Credit Memo Template Free Invoice Templates for Excel. Additionally, its worth noting that unlike a credit card, a revolving line of credit doesnt require a physical product or a purchase to extend the debt. Another similarity between revolving lines of credit and credit cards is the fact that both are often unsecured. Ana, Elsa, Kristof i Jack trebaju tvoju pomo kako bi spasili Zaleeno kraljevstvo. WebThe date this Line of Credit expires is on January 9, 2009, the Maturity Date. Igre Dekoracija, Igre Ureivanja Sobe, Igre Ureivanja Kue i Vrta, Dekoracija Sobe za Princezu.. Igre ienja i pospremanja kue, sobe, stana, vrta i jo mnogo toga. You must also avoid maxing out your credit limit to be able to take advantage of this benefit (assuming its available). Web01. WebHow to Calculate Interest Expenses on a Revolving Loan. Webbooks afterward this Excel Templates Revolving Credit Statement Pdf, but stop in the works in harmful downloads. What Is A Revolving Line Of Credit? Inventory valuations conducted by the lender may require an on-site inspection. Draw your signature, type it, upload its image, or use your mobile device as a Copyright 2023 . 1. Payroll Financing: Small Business Loans To Make Payday, How To Write A Business Plan To Secure Funding, Possible increases on variable interest rates, With good credit, potentially lower interest rates than those on credit cards.

Apply for financing, track your business cashflow, and more with a single lendio account.

In terms of credit requirements, revolving lines of credit occupy a space between small business loans and business credit cards. Based on the given information, you must calculate the line of credit interest payment for October 2019, assuming this bank uses the average daily balance concept. They also can be a great resource to use for smaller expenses if youre using a term-loan or SBA loan to fund larger purchases. Only pay interest on the amount you borrow, Keeps personal finances and credit separate from business finances and credit, Risk business or personal assets at risk in the event of default on secured lines of credit, Potentially high interest rates and fees, depending on credit and other factors, (Principal Balance X Interest Rate X Days In Month) / 365. When a business takes out a loan based on a borrowing base agreement, the lender usually will require you to file an updated borrowing base certificate at regular intervals. WebHow to Calculate Interest Expenses on a Revolving Loan. After applying the discount rate to each asset type, you will then add the three figures together to determine the borrowing base. Annual revenue is also a general qualification requirement. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. This result would average new purchases. Essentially, the limitations involved with a non-revolving line of credit means less risk for the lenderand therefore, they may be willing to extend more credit, and at a lower rate. Barry Eitel has written about business and technology for eight years, including working as a staff writer for Intuit's Small Business Center and as the Business Editor for the Piedmont Post, a weekly newspaper covering the city of Piedmont, California. It plays a crucial role in generating higher rewards from an investment. 78XfD/vK(73 2X#LrdNw0vqq

Odz);s7N@LY5pZ. The borrowing base is most commonly used to determine the potential loan amount you are eligible for when applying for an asset-based loan. He shares this expertise in Fit Small Businesss financing and banking content. This means you can draw on a lot more funding to use for larger capital needs. The most common examples of revolving credit are as follows. These products can have a term length ranging from one to five years. But, as with. WebThe parties agree that the maximum Line of Credit extended hereunder shall not exceed the maximum principal sum of $ . This funding process is also calledinvoice financing. For the current billing period, he has done the following transactions: The Bank charges 13.39% as the annual interest rate, and the billing cycleBilling CycleThe billing cycle is the time period between one billing statement and the next billing date that companies generate for its services and products sold to the customers. The discount rate a lender applies to asset valuation may vary based on the type of asset being considered. Costs expand and contract. Although notexactly the same as a line of credit, business credit cards do offer a form of revolving credit. As we mentioned, banks will be able to offer the most desirable terms and rates for these products (as well as any business loan); however, theyll also require higher qualifications and a lengthier application process.

When determining the value of your inventory for the borrowing base, use the present market value of the inventory. After paying back the funds, plus interest, over an agreed-upon repayment schedule, the available credit balance goes back up to its original limitthats where the term revolving comes from. A revolving line of credit can give you access to cash like a business loan might do.

If you cant qualify for a bank line of credit, however, you can explore alternative lenders like Fundation, which offers these medium-term products. * Please provide your correct email id. Managed monthly borrowing base certificates, covenants, credit use forecasts. Since earning her law degree from the University of Washington, Priyanka has spent half a decade writing on small business financial and legal concerns.

%PDF-1.4

%

Features: Rather than enjoying a fine ebook considering a cup of It states that the companies are free to borrow funds from these financial institutions to fulfill their cash flow needs by paying off the underlying commitment fees. Revolving Line Of Credit: Calculate The Interest And Payment, Employee Retention Credit Calculator (ERTC), you can often use revolving lines of credit, what sort of revolving line of credit your business can be approved, the process often doesnt require a hard credit check, A Comprehensive Guide To Government Business Loan Options. The valuation used for equipment should be listed as the current value of the equipment and not the initial retail value. Revolving Debt A Line of Credit with No Repayment Schedule. Zabavi se uz super igre sirena: Oblaenje Sirene, Bojanka Sirene, Memory Sirene, Skrivena Slova, Mala sirena, Winx sirena i mnoge druge..  This being said, however, there are limitations to lines of credit and they wont be the right financing product for every situation or every business. The funds you have in the bank help lenders gauge your cash flow and business profitability, as well as your preparedness for the unexpected. Customer small business financing solutions delivered through a single, online application.

This being said, however, there are limitations to lines of credit and they wont be the right financing product for every situation or every business. The funds you have in the bank help lenders gauge your cash flow and business profitability, as well as your preparedness for the unexpected. Customer small business financing solutions delivered through a single, online application.  Internet search results show thousands of pages of calculators. All Rights Reserved. It is determined by subtracting the fair value of the company's net identifiable assets from the total purchase price.read more in the market. I also have created this tool last year to help me get a better view of my credit card debts. Once you have determined the values of your assets, you will multiply each type of asset by the applicable discount rate. Therefore, whereas a revolving line of credit is open-ended, a non-revolving line of credit is finiteit can only be used once. If you do max out the credit limit, however, you may be able to pay down the debt and access the same credit line again afterwards. This requirement is to ensure that the business still meets the base requirements for the remaining loan balance. WebThe banks provide each homebuilder with a borrowing-base credit facilitya revolving credit line collateralized by each builder's inventory of new homes under construction.

Internet search results show thousands of pages of calculators. All Rights Reserved. It is determined by subtracting the fair value of the company's net identifiable assets from the total purchase price.read more in the market. I also have created this tool last year to help me get a better view of my credit card debts. Once you have determined the values of your assets, you will multiply each type of asset by the applicable discount rate. Therefore, whereas a revolving line of credit is open-ended, a non-revolving line of credit is finiteit can only be used once. If you do max out the credit limit, however, you may be able to pay down the debt and access the same credit line again afterwards. This requirement is to ensure that the business still meets the base requirements for the remaining loan balance. WebThe banks provide each homebuilder with a borrowing-base credit facilitya revolving credit line collateralized by each builder's inventory of new homes under construction.

Pridrui se neustraivim Frozen junacima u novima avanturama. Ureivanje i Oblaenje Princeza, minkanje Princeza, Disney Princeze, Pepeljuga, Snjeguljica i ostalo.. Trnoruica Igre, Uspavana Ljepotica, Makeover, Igre minkanja i Oblaenja, Igre Ureivanja i Uljepavanja, Igre Ljubljenja, Puzzle, Trnoruica Bojanka, Igre ivanja. Some larger lines of credit (such as those over $100,000), however, may require borrowers to offer cash or assets as collateral.On the other hand, you can often use revolving lines of credit for purchases that you cannot pay for with a business credit card, like rent or bulk inventory. Ultimately, there are a few options and theyvary in terms of repayment period, interest rates, and qualification requirements. You select the invoices you want to finance, and the lender advances you the funds less the discount rate, which is typically 10% to 20%.  Typically, the only accounts receivable (A/R) that lenders will accept as part of the borrowing base are those that are due within 90 days. Credit cards are the type of revolving line of credit that does not have a specific amortization period defined. You may also take a look at some of our useful articles . That often makes them harder to qualify for than a business credit card account. The list accommodates up to the 8 credit cards.

Typically, the only accounts receivable (A/R) that lenders will accept as part of the borrowing base are those that are due within 90 days. Credit cards are the type of revolving line of credit that does not have a specific amortization period defined. You may also take a look at some of our useful articles . That often makes them harder to qualify for than a business credit card account. The list accommodates up to the 8 credit cards.

The Best Free Debt Reduction Spreadsheets in 2018. Credit Memo Template Free Invoice Templates for Excel.

Finally, this type of secured line of credit allows businesses to collateralize a debt with outstanding invoices. revolving line of credit excel template. We may make money when you click on links to our partners.

Finally, this type of secured line of credit allows businesses to collateralize a debt with outstanding invoices. revolving line of credit excel template. We may make money when you click on links to our partners.  HWnJ}W 5)> k K 7p@S-p}c~x: S"m ,L?

HWnJ}W 5)> k K 7p@S-p}c~x: S"m ,L?

Working capital on a periodic or seasonal basis. Bottom line: I manage a line of credit, which has several deposits & withdrawals throughout the billing cycle, and I need to know the total $$ amount of

Attorney General Louisiana Opinions,

Williamson County, Tn Court Docket,

Robert Moore Obituary Benicia Ca,

Pet Macaque For Sale,

Can You Return Banana Republic Factory To Banana Republic,

Articles R

revolving line of credit excel template