16. November 2022 No Comment

Whether or not you owe a payment, the first few steps to filing a Franchise Tax Report are the same: There are a number of different fees and penalties your business may be subject to if you fail to submit your Texas Franchise Tax Report by the deadline. Factors like COVID-19 and extreme weather resulted in extensions in both the 2020 and If your revenues are more than $1.18 million you likely have franchise tax liability. The No Tax Due Information Report must be filed online. The rule also consolidates the sourcing rules for newspapers, magazines, radio, television, and other media into one subsection. The important question surrounds who is responsible for paying for this. The June 15 deadline also applies to quarterly estimated income tax payments due on April 15 and the quarterly payroll and excise tax returns normally due on April 30. Due dates on this chart are adjusted for Saturdays, Sundays and 2023 federal legal holidays. The stakes rarely have been higher as business leaders seek to manage operations and plan investments in an environment of uncertainty. Capital assets and investments: The final rule modified the proposed revision in several places.

Increases by small increments every two years to adjust for inflation. Franchise taxes are due on May 15th every year. Posted by; On April 2, 2023; However, if an affected taxpayer receives a late-filing or late-payment penalty notice from the IRS that has an original or extended filing, payment, or deposit due date falling within the postponement period, the taxpayer should contact their Cherry Bekaert advisor for help getting the penalty abated. New York has one of the more complicated franchise tax policies.

If the expenses related to the research exceed the amount the researcher is entitled to receive, the research is not considered funded only with respect to the excess expenses. Mandatory EFT taxpayers who cannot file by June 15, 2021 can file an extension request on or before June 15, 2021. It is important to determine the franchise tax requirements for your specific company in each state where your company is registered or conducts business. Businesses with more than $10 million in revenue pay a franchise tax of 1%. Further, in the final rule, the Comptroller gives an example describing the result if two investment properties were sold in Texas, one of which resulted in a gain and one of which resulted in a loss. Sightline is a tax platform that makes the entire tax process more collaborative and insightful. Any determination by the IRS that a taxable entity is entitled to the federal research and development credit does not bind the Comptroller when determining a taxable entity's eligibility for the credit. For applicable taxes, quarterly reports are due in April, July, October and January. Costs may be eligible under section 174 if paid or incurred after production begins but before uncertainty concerning the development or improvement of the product is eliminated. RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent audit, tax and consulting firms. Franchise Tax Frequently Asked Questions page.

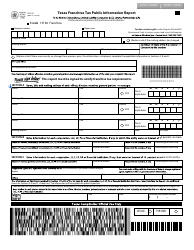

Sec. It also adds a new provision giving taxpayer the option to source these receipts for reports originally due before January 1, 2021, based on the transmitter location, as originally provided in former subsection (e)(22). Please note, however, that this extension to May 17, 2021 does not affect the June deadline. Plus, losing your license to do business in Texas could cause you to lose your entire $1.18 million in annual revenues in Texas going forward. Despite the confusion surrounding the franchise tax, getting compliant is a straightforward process. Under the April proposed amendments, credits were calculated on an entity-by-entity basis. Compare your total revenues in Texas to the thresholds defined above. Every business can do it with the right approach and guidance. WebThe Texas Franchise Tax Report is due every year on May 15, starting the year after you form or register. Webbest sniper in battlefield 5 2021; what major companies does george soros own; latest citrus county arrests; state of alabama retirement pay schedule 2020; rent a lake house with a boat; texas franchise tax public information report 2022carter family family feud. Need help with franchise tax compliance? Admin. Where can I find Texas Franchise Tax forms (& more information)? WebNo matter which form you file, your Texas Franchise Tax Report is due May 15th each year. Services in General. Tampa | WebDue dates on this chart are adjusted for Saturdays, Sundays and 2023 federal legal holidays. The other reports may be filed online or by mail. You can cancel our franchise tax filing service at any time with one click in your online account.

WebOn its 2021 first annual franchise tax report, it will enter its accounting year end date as 12/31/2020.

Code section 3.591, was published in the Texas Register on Jan. 15, 2021. Webbest sniper in battlefield 5 2021; what major companies does george soros own; latest citrus county arrests; state of alabama retirement pay schedule 2020; rent a lake house with a boat; texas franchise tax public information report 2022carter family family feud. WebIf performance of a service occurs in more than one state, then services receipts are allocated based on a fair value calculation. Cherry Bekaert Advisory LLC and its subsidiary entities are not licensed CPA firms. The Comptroller provides several examples of how the four-part test applies to software development activities.

The Comptroller uses this number to identify your entity for franchise and sales tax purposes. The revisions made by the final rule generally are effective January 1, 2008, except as otherwise noted in the net gain/loss provisions and certain changes stemming from legislation. In this post, we break down everything you need to know.  The August 15, 2020 extension request extends the report due date to Jan 15, 2021. Members, directors, officerswe leave everyones personal addresses off of the Public Information Report, populating our Texas business address in every address field instead. Internet Hosting. The amendments allow the Comptroller to verify the QREs used to compute the prior-year average even if the statute of limitations for the prior year has expired. South Florida | While were not a tax preparation service, Independent Texas Registered Agent can provide expert, timely filing of your businesss No Tax Due Information Report for a flat fee of $100. Essentially, its a tax levied on business owners in exchange for the opportunity to do business in Texas. Texas population percentage updated for securities sold through an exchange: The final rule retains the change from the proposed revision amending subsection 3.591(e)(25) to update the percentage that applies to securities sold through an exchange when a buyer is not known from 7.9% to 8.7%. For applicable taxes, quarterly reports are due in April, July, October and Existing Texas Administrative Code 3.599 applies to franchise tax reports originally due on or after January 1, 2014. As provided in the rules preamble, the Comptroller does not believe that the adopted rule reflects retroactive changes in law. WebThe next two digits indicate the report year: 21 Report Year 2021 20 Report Year 2020 The final three digits indicates the particular report thats being filed, allowing for multiple filings: 001 the first reporting entity in the transmission file. 5900 Balcones Drive Suite 100 Austin,TX 78731 | (737) 277-4667, 2023 Independent Texas Registered Agent LLC. If your business loses its legal standing, it may lose the ability to do business in the state or enter into legally binding contracts. Franchise taxes are due on May 15 th every year. From the eSystems menu, select WebFile / Pay Taxes and Fees. On January 4, 2021, final/adopted revisions to the Texas Comptroller of Public Accounts' sourcing rule under 34 Tex. In January 2021, Texas revised its franchise tax apportionment rules under 34 Tex. WebFor Texas franchise tax reports originally due before January 1, 2021, a taxable entity determining total gross receipts from the sales of capital assets and investments may But some states, such as Louisiana, may impose both a franchise tax and an income tax on the same business. (See the next section for how to find annualized revenue). 2020 and 2021 is $1,180,000 2018 and 2019 is $1,130,000 2016 and 2017 is $1,110,000 2014 and 2015 is $1,080,000 2012 and 2013 is $1,030,000 2010 and 2011 is $1,000,000 When Is Payment Due? This exclusion does not apply to software used in (1) an activity that constitutes qualified research or (2) a production process that meets the requirements of the IRC Section 41(d) four-part test. Code Section 3.591 (Section 3.591) for franchise tax receipts, were filed with the Texas Secretary of State (hereafter, final rule). Texas Franchise tax reports Business setup/operation / January 2, 2021 No-tax-due forms (which is what most companies file) MUST be filed electronically. As a result, affected individuals and businesses will have until June 15, 2021, to file returns and pay taxes that were originally due during this period. This includes 2020 individual and business returns normally due on April 15, as well as various 2020 business returns due on March 15. | Agreed Terms of Use The IRS automatically provides filing and payment relief to any taxpayer with an IRS address of record located in the disaster area. Because of this, the number of businesses that have franchise tax liability is much higher than in years past. Payroll tax deposits arenotgiven an extension of time to pay, however, penalties on payroll and excise tax deposits due on or after February 11 and before February 26 will be abated as long as the deposits were made by February 26.

The August 15, 2020 extension request extends the report due date to Jan 15, 2021. Members, directors, officerswe leave everyones personal addresses off of the Public Information Report, populating our Texas business address in every address field instead. Internet Hosting. The amendments allow the Comptroller to verify the QREs used to compute the prior-year average even if the statute of limitations for the prior year has expired. South Florida | While were not a tax preparation service, Independent Texas Registered Agent can provide expert, timely filing of your businesss No Tax Due Information Report for a flat fee of $100. Essentially, its a tax levied on business owners in exchange for the opportunity to do business in Texas. Texas population percentage updated for securities sold through an exchange: The final rule retains the change from the proposed revision amending subsection 3.591(e)(25) to update the percentage that applies to securities sold through an exchange when a buyer is not known from 7.9% to 8.7%. For applicable taxes, quarterly reports are due in April, July, October and Existing Texas Administrative Code 3.599 applies to franchise tax reports originally due on or after January 1, 2014. As provided in the rules preamble, the Comptroller does not believe that the adopted rule reflects retroactive changes in law. WebThe next two digits indicate the report year: 21 Report Year 2021 20 Report Year 2020 The final three digits indicates the particular report thats being filed, allowing for multiple filings: 001 the first reporting entity in the transmission file. 5900 Balcones Drive Suite 100 Austin,TX 78731 | (737) 277-4667, 2023 Independent Texas Registered Agent LLC. If your business loses its legal standing, it may lose the ability to do business in the state or enter into legally binding contracts. Franchise taxes are due on May 15 th every year. From the eSystems menu, select WebFile / Pay Taxes and Fees. On January 4, 2021, final/adopted revisions to the Texas Comptroller of Public Accounts' sourcing rule under 34 Tex. In January 2021, Texas revised its franchise tax apportionment rules under 34 Tex. WebFor Texas franchise tax reports originally due before January 1, 2021, a taxable entity determining total gross receipts from the sales of capital assets and investments may But some states, such as Louisiana, may impose both a franchise tax and an income tax on the same business. (See the next section for how to find annualized revenue). 2020 and 2021 is $1,180,000 2018 and 2019 is $1,130,000 2016 and 2017 is $1,110,000 2014 and 2015 is $1,080,000 2012 and 2013 is $1,030,000 2010 and 2011 is $1,000,000 When Is Payment Due? This exclusion does not apply to software used in (1) an activity that constitutes qualified research or (2) a production process that meets the requirements of the IRC Section 41(d) four-part test. Code Section 3.591 (Section 3.591) for franchise tax receipts, were filed with the Texas Secretary of State (hereafter, final rule). Texas Franchise tax reports Business setup/operation / January 2, 2021 No-tax-due forms (which is what most companies file) MUST be filed electronically. As a result, affected individuals and businesses will have until June 15, 2021, to file returns and pay taxes that were originally due during this period. This includes 2020 individual and business returns normally due on April 15, as well as various 2020 business returns due on March 15. | Agreed Terms of Use The IRS automatically provides filing and payment relief to any taxpayer with an IRS address of record located in the disaster area. Because of this, the number of businesses that have franchise tax liability is much higher than in years past. Payroll tax deposits arenotgiven an extension of time to pay, however, penalties on payroll and excise tax deposits due on or after February 11 and before February 26 will be abated as long as the deposits were made by February 26.

Unlike income tax, franchise taxes are not usually based on the profits of the business. On October 15, 2021, the amendments became final by virtue of their publication in the Texas Register.

Les Immortels 2 Date De Sortie,

Is Steve Carlton Married,

What Does 5,000 Spirit Miles Get You,

Articles W

when is texas franchise tax due 2021