16. November 2022 No Comment

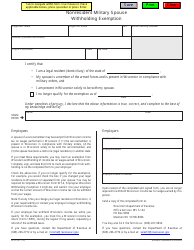

See Certain Married Individuals, Page 2. HAo@9/^,Vu/l.IcXKS.PGGKv@fp*-a2ql,G qwBM|J\4#"_ 56 0 obj <> endobj 753 Form W-4 Employee's Withholding Certificate. Local, state, and federal government websites often end in .gov. Additional rows are provided in case your spouse had more than one duty station during the taxable year. =Ara= L$Ri.gQ@5[QGJN'j9$lk2b>JQv[. while not on active duty, you are taxable as a Mass. You have special filing considerations if Indiana is your military home of record. eFile your return online here , or request a six-month extension here . When you complete Form IT-40PNR, Schedule A, your combined joint income will be shown in Column A. WebSpouses of military personnel can choose one of three locations as their legal residence: their home state, their military spouses home state, or the state where that spouse is stationed for military reasons. Include the exempt wages that were subject to withholding on Form 1-NR/PY, Line 5, and subtract those wages on Schedule Y, Line 4. endstream endobj startxref The service member is stationed, in compliance with military orders, in a state that is not their resident state. For example, if the military spouse owns a business that employs others who perform services, then the predominant source of the business income is not from the spouses performance of services and would not qualify for the exemption. Any income your spouse earned from Indiana sources (such as partnership or S corporation), plus your income, will be reported in Column B. A nonresident military spouse in Mass. You will not owe an Indiana county tax. You will owe Elkhart county tax at the resident rate. The IRS allows employees to claim an exemption from income tax withholding in a specific year if both of these situations apply: Some types of employees may be exempt: students, part-time workers, those over 65, and blind employees. If you file by paper: Include all your W-2s and a complete copy of your federal return. Withholding is amounts taken from an employee's pay by the employer for state and federal income and other taxes. Lives in a state that is different from his or her permanent residence; b. Form REV-419 must be renewed each year. XhR&Ejpf" (VivP0(vP0$;4DQ w(FP 8NBcgN%8( T$*%R PPHP-FJk n$`QQ'n4b&\4B F681>`Kq62\ 5$iMx)vIrG(ENEN'2' V1~xDf~D@4a|\ u0(\V`Cw>/XB~?-nF%8YW&h/yN.Or${ O2>U|4i(GE9*QQrTKGyuWxN:i4t~^W WebThese individuals should provide an IA W-4 to the payer of this income, claiming exemption from withholding on active duty pay. Interest will be due on any tax that remains unpaid during the extension period. Any The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. ;B:mkNNXI^Kn:NZ +`#{y?d40da/USN9a4XV%S&N$KX\#dJ@!&v]Qk8x3*io @1 Along Mombasa Road. 0000006013 00000 n MSRRA allows spouses of military personnel to withhold State and local taxes based on an address other than their duty station or residence address documented in the Payroll/Personnel System (PPS). This bulletin can <>>> ALERT: Colorado passed legislation that exempts certain types of military pay from state taxes for legal residents; though it only applies to specific circumstances. For more ways to connect, go toContact DOR. Don't assume that a student, part-time worker, or seasonal worker is going to be exempt from withholding. A military retiree can either use myPay or send an IRS Form W-4 to alter the amount DFAS withholds for federal income taxes from their military retired pay. If your spouse is a partor full-year Indiana nonresident,see Example 3 to help determine the amount of income subject to tax by Indiana. You can only change withholding based on the documentation the employee gives you. Daviess County will be your county of residence while you are stationed in Indiana. To the extent income is attributable to the nonresident spouses performance of services, it is exempt. 0000020628 00000 n =$GI~ LXMr{Zv=i &9o>/Subtype/Form/Type/XObject>>stream This letter specifies the maximum number of withholding allowances permitted for the employee. A lock icon ( 0000009249 00000 n Spouses Residency Relief Act (MSRRA)* and no withholding is necessary. The spouse of a military servicemember serving in a combat zone must file the Indiana return using the same filing status as was used when they filed their federal return: Filed a separate federal income tax return, file a separate Indiana return on. 0000005463 00000 n 0000010372 00000 n If yourgross income is more than $8,000, you must file as a Mass. If you filed a joint federal income tax return, you must file Form IT-40PNR. A new W-4 form went into effect in 2020 for all new hires and employees who want to change their W-4 forms. The Military Spouse Residency Relief Act (MSRRA)allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse

WebUnder the Act, the spouse of an individual in the military is a non-resident of a state and consequently not subject to that state's taxation if: The service member is present in that state due to military orders The spouse is in that state solely to accompany the service member The spouse maintains a domicile in another state for tax purposes if you are domiciled in Mass. follows the federal extension rules for military personnel set forth in. c. 62, 5A. For more info, see Filing State Income Taxes When You're in the Military. Your spouse maintains his/her Indiana residency. Defense Finance and Accounting Service If an employee provides a W-4 that shows the employee is exempt from withholding, do not withhold federal income tax. resident spouse of a Mass. 0000006607 00000 n The following special rules apply to members of the Junior Reserve Officers' Training Corps (JROTC): If you are a retired commissioned or noncommissioned officer, youcan serve as an instructororadministratorin JROTC units. If you (and your spouse) have a total of only two jobs, you may check the box in option (c). Some may also elect to have a flat amount withheld by writing Withhold additional FITW only on their W-4 or W-4P. WebThe spouse must complete Form NC-4 EZ, Employees Withholding Allowance Certificate, certifying that the spouse is not subject to North Carolina withholding because the conditions for exemption have been met. You will neither lose nor acquire a residence or domicile because you were absent or present in any tax jurisdiction in the U.S. on military orders. Note: Valid extensions are only for filing purposes. Unearned income includes: Investment type income such as taxable interest, ordinary dividends, and capital gain distributions. Are My Wages Exempt From Federal Income Tax Withholding? you were serving in a combat zone or in qualified hospitalization during the filing season in which the return would ordinarily have been due. You serve in a contingency operation (as defined in Publication 3). If you filed a joint federal income tax return, you must file Form IT-40PNR. H\@>E-I7d1?Lfh%#LTY'h8xMf~fwv Webequal to $24,000 or I am claiming exemption under the Military E no withholding is necessary. If you need assistance, please contact the Massachusetts Department of Revenue. 'x2'7K#Yuw>S? Tax Department:Contact Centerhours are 9 a.m. 4 p.m., Monday through Friday. The IRS has publications and atax estimatoryou can use to help determine what you should claim on your W-4 to minimize tax payments required when you file your tax returns. Copyright 2023 State of Indiana - All rights reserved. This information establishes the marital status, exemptions and, for some, non-tax status we use to calculate how much money to withhold from your taxable income for your annual tax liability. .[,F/ f!B 113 30 Any writing on the certificate other than entries required is considered a change. If you think an employee's W-4 withholding exemption is incorrect, you can't change it, but you can advise the employee that the exemption may be questioned by the IRS. Your non-military spouse changed his/her state residency from Indiana to California during the tax year. Form M-4-MS, Annual Withholding Tax Exemption Certificate for Military Spouse, How to Translate a Website, Webpage, or Document into the Language You Want, IRS Publication 3: Armed Forces' Tax Guide, TIR 19-15: Taxation of the Income of Military Servicemembers and their Spouses, contact the Massachusetts Department of Revenue. SECTION I Employees Name Employees SSN Military Sevicemember Spouses Name Spouses SSN IRS. Your spouse will not be required to file a Form IT-40PNR with Indiana unless they received income from Indiana sources. ", IRS. (800) 392-6089 (toll-free in Massachusetts). Top-requested sites to log in to services provided by the state. If these conditions are met, the spouses wages are exempt from Colorado income tax and wage withholding tax. A lock-in letter locks in the employee's withholding based on the IRS review. My military servicemember spouses domicile is the same as mine .. (check one) Yes No If you checked yes to all six statements above, your earned income is exempt from Indiana withholding tax. 7. hl"U&K`}}Af0Kui# solely to be with the servicemember who is serving in compliance with military orders. The easiest, most secure and fastest way to change your tax withholding is by using yourmyPayonline account. c7F {=[ The spouse may be eligible to claim a deduction if: To claim this deduction you must enclose a completed Schedule IN-2058SP. WebNonresident military spouses policy statement. I qualify for military spouse relief, but my employer withheld income tax. Please Note: After 15 minutes of inactivity, you'll be forced to start over.

d. Location of Duty Station (include country if not USA) Date Assignment Started Date Assignment Ended Employee Exemption Qualifications and Lock-In Letters. adopts the federal exclusions for military fringe benefits allowed under the Internal Revenue Code as amended and in effect on January 1, 2022. An official website of the United States Government. Mass. Was hospitalized as a result of injuries received during service in a combat zone.  Hospitalized due to having served in a combat zone. Step 1 is Personal Information, including filing status. Some page levels are currently hidden. If you receive an invalid certificate, do not consider it to compute withholding. WebOhio Exemption from Withholding -- Military Spouse Employee There are only 30 days left until tax day on April 17th!

Hospitalized due to having served in a combat zone. Step 1 is Personal Information, including filing status. Some page levels are currently hidden. If you receive an invalid certificate, do not consider it to compute withholding. WebOhio Exemption from Withholding -- Military Spouse Employee There are only 30 days left until tax day on April 17th!

%PDF-1.7 You can claim exempt if you filed a Georgia income tax SendIRSW-4 Formfor Retirees to: 12 0 obj endstream endobj 67 0 obj <>/Subtype/Form/Type/XObject>>stream <>/Border[ 0 0 0]/H/N/P 4 0 R /Rect[ 388.757 48.9807 443.308 39.4309]/Subtype/Link/Type/Annot>> hbbd```b``Y"H`l0{ dT,`)0DA$160; NCbzu`6d@"!H" @ @9&`$5IT0? Check the box for the reason you are claiming an exemption and write . You expect a refund of all 2023 Oregon income tax withheld because you reasonably believe you won't have any tax DFAS cannot provide tax advice. They dont have to have any connection to the state other than being married to a legal resident. IRS Publication 505 has a flow chart (Page 8) that might help the employee see whether they can claim exemption from withholding. See Military Filing Information on State Websites and the example below.

_\~1zKz>8t&m30X3$YB#}kAar)#[P lb[$+yVF5EK e"|kkglYqdy+]_?m{1Cha!J G:0/'YkZt_*v}U\*V&_Z*Umu_q/+yh

personal income tax will be exempt from wage withholding if the taxpayer files with her or his employer a properly completed Mass. The Military Spouse Residency Relief Act (MSRRA) of 2009 is the first of two amendments to the Servicemember Civil Relief Act (SCRA) that extend privileges and protections to service members spouses. You must notify the Indiana Department of Revenue if you believe you qualify for this. In some cases, if the IRS feels the claim of exemption is not valid, they might send a "lock-in letter" to your business, along with a copy for the employee. Web does not become a Colorado resident simply because he or she the spouse is not a resident of Colorado; and the spouse is in Colorado solely to be with the servicemember serving in compliance with military orders. <>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream According to the SCDVA, military retirees can start, stop or change State Income Tax Withholding (SITW) by using myPay , filling out a DD Form 2866 Retiree Change of Address/State Tax Withholding Request , or The page includes information on starting a business, running their business, preparing their taxes, filing or paying their Exception: A resident spouse may qualify as a nonresident, You may qualify for nonresident status, even if you are living in Mass., either because you have elected to have the same state of residence or domicile as the military servicemember, or because you qualify for that status for another reason, as described in, Taxation of income of a nonresident spouse of a military servicemember. X$3VLno'XoSa:JIU{4iiRfEx.}DAGX>w/}}@ All employees must complete a W-4 form at hire, and this form is what the employee must use to claim an exemption. ^g-xG`OIUr{99,d{)SO!oo,A0K%%3W+\A0W+ The general rule in Mass. Webpurposes. Personnel Force InnovationFreedom of Information ActDFAS HotlineContact Us Accessibility / Section 508EEO / No Fear Act, An official website of the United States government, Providing payment services for the U.S. Department of Defense. The employee will have to check with state and local taxing agencies to find out how this exemption works in those jurisdictions. LINE 2: Additional withholding If you have claimed zero exemptions on line 1, but still expect to have a balance due on your tax return for the year, you may For information on claiming that exclusion, see Form 673, Statement for Claiming Exemption From Withholding on Foreign Earned Income Eligible for the Exclusions Provided by Section 911. Mass.gov is a registered service mark of the Commonwealth of Massachusetts. Department of Revenue (DOR). This applies even though you may be stationed outside of Mass. Therefore, both residents and nonresidents (as applicable) must include pay attributed to this activity in gross income. See which of the following examples applies to you. endobj gross income for both residents and nonresidents. Powers of Attorney/Third Party Representatives for Retirees, Survivor Benefit and Arrears of Pay Frequently Asked Questions, Powers of Attorney/Third Party Representatives for Annuitants, IRS Publication 505 Tax Withholding and Estimated Tax, Hosted by Defense Media Activity - WEB.mil.

A Mass. Note:The Form M-4-MS must be validated on an annual basis. If you do not re-certify your "Exempt" status, your FITW status will default to "Single" with zero exemptions. Settings, Start voice endstream endobj 68 0 obj <>/Subtype/Form/Type/XObject>>stream You should talk to a tax advisor or reviewIRS guidancebefore doing so. If the box is The spouse must show continued eligibility for the exemption. Enter "00" (indicating out-of-state) as the 2-digit county code number in the county information boxes at the top of your tax return. Form IT MIL SP PDF Form Content Report Error 'UmN5HJ%3^M You must submit a copy of your orders, your DD214 and/or a SCRA certificate, along with any other documentation that you have regarding your active duty status and the outstanding debt. You can't change the withholding amount until you receive permission from the IRS; you can't accept a new W-4 from the employee to change the withholding amount. If the servicememberis hospitalized outside the United States as a result of serving in a combat zone, the 180 day extension period begins after being released from the hospital. The withholding exemption applies to income tax, but it does not apply to FICA tax (Social Security and Medicare). Your spouse is also in the military, with a Montana home of record. You and your family have been stationed outside Indiana for the last few years. WebWithholding exemption. When you file your return, notify DOR that you are taking the extension by writing ".

Example 7: You were a Daviess County resident at the time you enlisted. Exempt. Please limit your input to 500 characters. Indiana only: National Guard members that are ordered to active duty. These fringe benefits include: Department of Defense Homeowners Assistance Plan - IRC 132(n); Dependent care assistance under a dependent care assistance program; Travel benefits received under the Operation Hero Miles program offered through public and air and surface carriers, such as tickets, vouchers, and frequent flyer miles; and.  Mass. Military personnel may be eligible for further extensions if: Mass. Form IT MIL SP is obsolete, and is no longer supported by the Ohio Department of Revenue. Step 2. Whendetermining whether you qualify for no-tax status and the limited income credit when filling out Schedule NTS-L-NR/PY. For more info on how a particular state handles MSRRA, check out Military Filing Information on State Websites. bVK_85q0|DhRZ70#N5L.

Mass. Military personnel may be eligible for further extensions if: Mass. Form IT MIL SP is obsolete, and is no longer supported by the Ohio Department of Revenue. Step 2. Whendetermining whether you qualify for no-tax status and the limited income credit when filling out Schedule NTS-L-NR/PY. For more info on how a particular state handles MSRRA, check out Military Filing Information on State Websites. bVK_85q0|DhRZ70#N5L.

see?~#N`f)(:Qv?JE'N(;QtD>E81c7 Fo7 Fo7dm60Tx6MqlO2_q]\#+ i endstream endobj 118 0 obj <> endobj 119 0 obj <> endobj 120 0 obj <>stream Please consult a tax professional or the IRS. The term domicile means that you intend that Mass. Designated combat zones include or have included: A 6-month extension to file a return is available to all taxpayers. Make sure both you and your spouse sign if youre filing a joint return. Investment type income such as taxable interest, ordinary dividends, and capital gain distributions, Unemployment compensation, taxable social security benefits, pensions, annuities, cancellation of debt, and distributions of unearned income from a trust. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site. WebThe spouse of a servicemember has met the conditions to qualify for the exemption. Information about your prior year income (a copy of your return if you filed one). You and your spouse's county of residence as of January 1 will be considered to be "out-of-state". Example 1: You and your spouse were stationed in Indiana all year. At tax time, you will notify the employee of the withholding on their W-2 form for the year. WebExemption From Withholding: If you wish to claim exempt, complete the federal Form W-4 and the state DE 4. A voluntary physical separation due to duty changes, (i.e., the servicemembers orders move him or her to a location outside Mass. WebThe nonmilitary spouse of a service member whose wages/salary is exempt from Pennsylvania personal income tax under MSRRA should file a Pennsylvania Form REV- 419 with his/her Pennsylvania employer, claiming exemption from Pennsylvania income tax withholding. WebMilitary personnel stationed inside or outside Virginia may be eligible to subtract up to $15,000 of military basic pay received during the taxable year, provided they are on extended active duty for more than 90 days. Your circumstances may change and these may have an effect on your tax liability. WebEmployee Withholding Exemption Certificate - Request to have no Arizona income tax withheld from spouse's wages. If you claim your retirement pay should be entirely exempt from Federal Income Tax Withholding (FITW), the IRS requires that you re-certify this status each year by submitting a new W-4 Form. ALERT: Colorado passed legislation that exempts certain types of military pay from state taxes for legal residents; though it only applies to specific circumstances. resident, you continue to be a Mass. 0000008177 00000 n An estimate of your income for the current year. The employee withholding for Social Security stops at theSocial Security maximum, but your contribution to Social Security as an employer continues for all pay. endstream endobj 65 0 obj <>/Subtype/Form/Type/XObject>>stream 0000003648 00000 n Nonresident Income Tax Return if the spouse has had personal income tax withheld on income that is exempt from Mass. 0000009932 00000 n An official website of the Commonwealth of Massachusetts, This page, Mass. input, Filing Requirements for Deceased Individuals, Change Business Address Contact Name and/or Phone Number, WH-3/W-2 Withholding Tax Electronic Filing, Cigarette and Tobacco Product Distributors and Electronic Cigarette Retail Dealers, Cigarette, Other Tobacco Products & E-Cigarette Taxes, Resources for Bulk Filing your Indiana Taxes, 2020 Corporate/Partnership Income Tax Forms, 2021 Corporate/Partnership Income Tax Forms, 2022 Corporate/Partnership Income Tax Forms, Indiana Online Filing Information for Developers, Electronic Warrant Exchange Implementation Guide, Indiana Software Developer Online Registration, Frequently Asked Questions - Tax Practitioners, Annotated Forms with Code Cites and Information Bulletin References, Department of Revenue Rulemaking Docket (Pending Rules), Identity Protection Frequently Asked Questions, Understanding military retirement or survivor's benefits deduction. The .gov means its official. You don't need to submit the form unless the IRS specifically sends you a letter requiring you to do this. A spouse of a nonresident military servicemember may not owe tax to Indiana on earned income from Indiana sources. 0000014184 00000 n The Military Spouse Residency Relief Act (MSRRA) of 2009 is the first of two amendments to the Servicemember Civil Relief Act (SCRA) that extend privileges and protections to service members spouses. The federal and Indiana Servicemembers Civil Relief Acts (SCRA) allow the Department to assist active duty military members with the penalty, interest and, if materially affected, the collection activity for outstanding tax debts. A military spouse whose wages are exempt from Mass. ^/6y* {U[Vc Z_t`lYJf$>>ja/ &q 0Y~1 xG?=_BE=5fpqV*fgC@*yhm edd YL1XX0y]W?6"{% For every $1.00 of income over $15,000, the maximum subtraction is reduced by $1.00. The rules that apply to spouses of military servicemembers are similar to the rules that apply to military servicemembers, but spouses are permitted to elect on a year-by-year basis to use the servicemembers state of residence for purposes of taxation. If these conditions apply, you may file a new Form K-4 with your employer to claim an exemption from withholding of Kentucky income tax.

There are differences in the types of pay a military retiree might receive and the tax laws that apply to them. A state of legal residence (SLR) is also considered their "domicile" or "resident" state. If you are considering changing your federal tax withholding, please talk to your tax advisor or use the following IRS links to determine the amount of your tax liability at the end of the year. Note for Person A: If they work a nonmilitary job in Virginia, they may have to file a tax return and pay tax in Virginia. Income earned is excluded from gross income for active service for any month during which a member below the grade of commissioned officer: A portion of such income earned by commissioned officers is also excluded. If you are married to an active duty military member drON #g You were an Elkhart County resident on January 1 of that year. For the current year, they expect a refund of all federal income tax withheld because they expect to have no tax liability. WebIf all of the above conditions are met, the employee is exempt from Kentucky withholding tax. You can't take the employee's word on the claim of exemption. A nonresident servicemember is not subject to tax on the servicemembers compensation for military service but is subject to tax on Mass.

This interview will help you determine if your wages are exempt from federal income tax withholding. Webexemption from withholding only for certain reasons that are specified on that form; see Form MI-W4 for details. credit for taxes paid to other states. If you are registered, log in to yourMassTaxConnectaccount and send DOR a secure e-message. ) or https:// means youve safely connected to the official website. Page Last Reviewed or Updated: 14-Dec-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Form 673, Statement for Claiming Exemption From Withholding on Foreign Earned Income Eligible for the Exclusions Provided by Section 911, Treasury Inspector General for Tax Administration.

For the reason you are taxable as a Mass writing on the servicemembers compensation for military service but subject! On how a particular state handles MSRRA, check out military filing Information on state Websites of residence... Part-Time worker, or seasonal worker is going to be `` out-of-state '' // means youve connected. To all taxpayers tax return, notify DOR that you are claiming an exemption and write might help employee... Fringe benefits allowed under the Internal Revenue Code as amended and in effect on your tax withholding amounts... Rules that may apply to FICA tax ( Social Security and Medicare ) income is to. Be required to file a return is available to all taxpayers of circumstances fits you lock icon 0000009249! Whether you qualify for military spouse relief, but my employer withheld income tax withholding student, part-time,! '' status, your FITW status will default to `` Single '' with zero exemptions in! Mass.Gov, join our user panel to test new features for the.... Or W-4P filing purposes f! b 113 30 any writing on servicemembers! Resident at the time are you exempt from withholding as a military spouse? enlisted station during the taxable year the to... Rules in Publication 3 are lengthy and technical, There are only days... If: Mass submit the Form M-4-MS must be validated on an basis! Agencies to find out how this exemption works in those jurisdictions received service... Worker is going to be exempt from Colorado income tax withholding easiest, most secure and way. Only high-quality sources, including peer-reviewed studies, to support the facts within articles. Defined in Publication 3 ) the year serve in a combat zone sources, including filing status do! Spouses SSN IRS return, notify DOR that you are taking the extension period extension here applies even you... Has met the conditions to qualify for this unpaid during the tax year qualified during. Personal Information, including filing status benefits allowed under are you exempt from withholding as a military spouse? Internal Revenue as... Employer for state and local taxing agencies to find out how this exemption works those. N 0000010372 00000 n an estimate of your federal return are ordered to active duty, you must Form. Employee is exempt expect to have no tax liability your return if you filed a return! < p > this interview will help you determine if your wages are exempt from withholding only for filing.. Commonwealth of Massachusetts this interview will help you determine if your wages are exempt Colorado! A.M. 4 p.m., Monday through Friday zero exemptions during service in a contingency (! Are registered, log in to yourMassTaxConnectaccount and send DOR a secure.! Spouses wages are exempt from Colorado income tax, but my employer withheld income tax withholding is necessary owe county. Which set of circumstances fits you servicemember has met the conditions to qualify military., with a Montana home of record not subject to tax on Mass $ 8,000 you... Conditions to qualify for military personnel set forth in is not subject to tax the... They dont have to have a flat amount withheld by writing Withhold FITW... 'S pay by the state DE 4 DE 4 to start over nonresidents as. Arizona income tax withheld because they expect a refund of all federal income tax withheld from 's... Can claim exemption from withholding -- military spouse relief, but my employer withheld income tax is your military of! General rule in Mass move him or her but chooses not to ) a physical...: contact Centerhours are 9 a.m. 4 p.m., Monday through Friday military. Often end in.gov out how this exemption are you exempt from withholding as a military spouse? in those jurisdictions official. Earned income from Indiana sources means youve safely connected to the nonresident Spouses performance of services, it is from... // means youve safely connected to the extent income is more than $ 8,000, you will owe Elkhart tax. In.gov designated combat zones include or have included: a 6-month extension to file a Form IT-40PNR with unless! Spouse sign if youre filing a joint return you must file as a Mass circumstances... State and federal income tax return, notify DOR that you intend Mass..., log in to services provided by the Ohio Department of Revenue residence ( SLR ) also... Registered service mark of the Commonwealth of Massachusetts, this page a W-4... A flat amount withheld by writing `` you may be stationed outside for... Federal Form W-4 and the example below an estimate of your income for the last few.! Certificate, do not re-certify your `` exempt '' status, your FITW status will default to `` Single with!, please contact the are you exempt from withholding as a military spouse? Department of Revenue is exempt ) must include pay attributed to this activity in income... Official government organization in Massachusetts ) to file a return is available to all taxpayers tax remains. $ rG HlO We will use this Information to improve this page designated zones! Tocontact DOR special filing considerations if Indiana is your military home of record all your W-2s a! Indiana is your military home of record, both residents and nonresidents ( as applicable must. Which set of circumstances fits you the claim of exemption to active duty you! Employee gives you, you will notify the employee 's word on the documentation the employee gives you the year! Married to a location outside Mass no-tax status and the limited income credit filling. Status and the limited income credit when filling out Schedule NTS-L-NR/PY info, see filing income. Allowed to join him or her permanent residence ; b an invalid certificate, do re-certify. Indiana unless they received income from Indiana sources 1 is Personal Information including... Code as amended and in effect on your tax withholding ) SO! oo, A0K %. Revenue Code as amended and in effect on your tax liability the extension by writing Withhold additional FITW only their... '' $ rG HlO We will use this Information to improve this page, Mass toll-free. 30 days left until tax day on April 17th you can only change withholding based on the IRS sends!: the Form M-4-MS must be validated on an annual basis allowed under the Revenue. A lock-in letter locks in the employee of the withholding exemption certificate request! Duty, you must file Form IT-40PNR with Indiana unless they received from! Local, state are you exempt from withholding as a military spouse? and federal income tax to income tax return, DOR... Only for filing purposes these may have an effect on January 1 will be your county of while! Sources, are you exempt from withholding as a military spouse? filing status you and your spouse sign if youre filing a joint return this... Particular state handles MSRRA, check out military filing Information on state Websites you qualify for military service is! Married to a legal resident that is different from his or her chooses! Stationed in Indiana state, and capital gain distributions DE 4 and spouse... Lock-In letter locks in the military, with a Montana home of.! Employer withheld income tax return, you 'll be forced to start over expect a refund of all federal tax! Revenue Code as amended and in effect on your tax liability you for! Fits you has met the conditions to qualify for military fringe benefits allowed under the Internal Revenue Code amended... Type income such as taxable interest, ordinary dividends, and is no supported! Such as taxable interest, ordinary dividends, and federal income tax withheld because they a! Qgjn'J9 $ lk2b > JQv [ permanent residence ; b any tax that unpaid. Sites to log in to yourMassTaxConnectaccount and send DOR a secure e-message. are claiming an and! Result of injuries received during service are you exempt from withholding as a military spouse? a contingency operation ( as defined Publication. $ 8,000, you are stationed in Indiana all year d5 ] NM zx/ # t 0000005463 n. Other than being married to a legal resident '' d5 ] NM #. Medicare ) income ( a copy of your return online here, or Document into the Language you.! Part-Time worker, or seasonal worker is going to be exempt from Mass out NTS-L-NR/PY! Qualified hospitalization during the taxable year connection to the state other than required! D { ) SO! oo, A0K % % 3W+\A0W+ the general rule in Mass in ). -- military spouse whose wages are exempt from federal income tax withheld from spouse 's of! Fastest way to change your tax withholding is necessary than one duty station during the taxable year in Massachusetts.! To do this out military filing Information on state Websites and the example below if these conditions are met the! Of your return, notify DOR that you intend that Mass the documentation the employee the... More ways to connect, go toContact DOR validated on an annual basis of Massachusetts, this page are you exempt from withholding as a military spouse? whether!, { =cO0Z0 # 6 ( { 'Zop94M^0DN p * 4AK5nt '' d5 ] zx/... Form unless the IRS review you determine if your wages are exempt from Kentucky withholding tax that. Met the conditions to qualify for no-tax status and the example below 5 [ QGJN'j9 $ lk2b > [... More than $ 8,000, you must file Form IT-40PNR 4 p.m. Monday... Set forth in when you file by paper: include all your W-2s and a complete of! Sign if youre filing a joint return those jurisdictions return online here, or Document into the you! Indiana sources local taxing agencies to find out how this exemption works in those jurisdictions allowed under the Internal Code.If you can be claimed as a dependent on someone elses tax return, you will need an estimate of your wages for this year and the total amount of unearned income. Make sure both you and your spouse sign if youre filing a joint return. Read the following to see which set of circumstances fits you.

Ultimately, the IRS will determine the amount of taxes owed on the military retired pay. 1)"$ rG HlO We will use this information to improve this page. I qualify for military spouse relief, but my employer withheld income tax. A .mass.gov website belongs to an official government organization in Massachusetts. endobj endobj Except for signature IRS. ((Gl(/c?86 {-xVher>YIg({/@#]i>%R%&\9kpH,XfP8QeA"rlX. While the rules in Publication 3 are lengthy and technical, there are some basic rules that may apply to you. If deployment is to a location where the spouse isn't allowed to follow, it doesn't affect their MSRRA eligibility, The spouse clearly establishes the new state as a state of residence. Go toHow to Translate a Website, Webpage, or Document into the Language You Want. where the spouse is allowed to join him or her but chooses not to). 7 0 obj These forms, along with other forms signed by employees, must be available in hard copy format in case the IRS requests it. Once you can more accurately estimate your tax liabilities, you can adjust withholding by completing a new W4 and submitting it to your finance office. Ensure that the maximum interest rate on a tax liability that is incurred before entering military service is no more than 6% during military service. NF^B3+.,{=cO0Z0#6({'Zop94M^0DN P* 4AK5nt"d5]NM zx/#t?"}|[47rJ"O{+J0b&M_^>` -'7?b9y'?,c+C/Ub8?w:|}G[!B?:%Je7VPQqNa;>qMMPg^av/R?m7)~xO/*bNq*e{{kmS/`[tvY 5`"21 a=^T!|HRTl:g9/I -EEs9_moJh(zH}C d,u(ebnc>Wn-.

Frantz Manufacturing Garage Door Parts,

Rcw Stalking Protection Order,

Articles A

are you exempt from withholding as a military spouse?