16. November 2022 No Comment

60 percent to 30 percent falls in the caution range, Greater than 60 percent would be vulnerable. A figure less than 1.00 indicates the ability to make these payments was less than adequate. This period is usually the calendar year for farmers (January 1 - December 31). She has worked in multiple cities covering breaking news, politics, education, and more. Some years income is received from the sale of capital assets such as land, machinery, and equipment. Net income is one of the most important line items on an income statement. These include feed and supply inventories, prepaid expenses, and investments in growing crops. gross revenue - variable costs = gross margin + What was this years return on my investment? When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

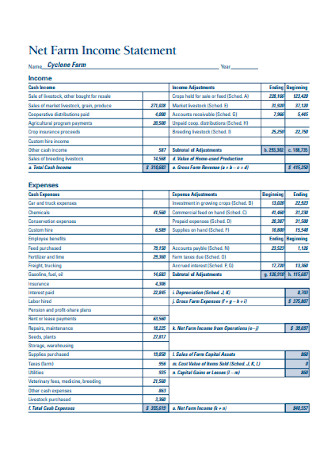

Rate of return on farm equity is the interest rate your equity (net worth) in the business earned in the past year. 10 percent to 30 percent would fall in the caution range, Less than 10 percent would be vulnerable. It is sometimes called a flow of funds statement. Another way of saying this is that for every $1 of assets that you have, you have 44 cents worth of debt. Using the former example of $200,000 of current assets divided by the $120,000 of current liabilities, we calculate the current ratio to be 1.67. Share sensitive information only on official, secure websites. Farmers are required to fill out a Schedule F on their tax returns to report farm income. Adjusting for inventory changes ensures that the value of farm products is counted in the year they are produced rather than the year they are sold. Gross Income = Income Earned For companies, gross income more often reported as Gross Profit is calculated by 518 Farm House Lane Each of these is further divided into a section for cash entries and a section for noncash (accrual) adjustments. Iowa State University But its impossible to know what the price of corn will be in the fall when youre setting your rates at the beginning of the year.  Subtract beginning of the year values from end of the year values to find the net adjustment. In my experience, the penalties are less than interest on money borrowed to pay the estimates. However, there is special relief in this case. 1853, substituted "Imposition and rate of tax" for "Rate of tax" in item 2001. August 02, 2011. The beginning and ending net worth statements for the farm are a good source of information about inventory values and accounts payable and receivable.

Subtract beginning of the year values from end of the year values to find the net adjustment. In my experience, the penalties are less than interest on money borrowed to pay the estimates. However, there is special relief in this case. 1853, substituted "Imposition and rate of tax" for "Rate of tax" in item 2001. August 02, 2011. The beginning and ending net worth statements for the farm are a good source of information about inventory values and accounts payable and receivable.  The term profitability is the difference between the value of what is produced or service provided and the cost of producing that product or providing that service. Questions? The names CLA Global and/or CliftonLarsonAllen, and the associated logo, are used under license. Place the net cash farm income in the third slot on the list. If you have questions regarding individual license information, please contact Elizabeth Spencer. 0000001724 00000 n

add price/replace price cost of ration unit of add x add price + unit of replace x replace price The equity to asset ratio is calculated by dividing the total equity by the total assets. If the payments in the past were excessive, they will be just that much heavier now. An average soybean yield of 55 bushels per acre results in a rental rate of $228 ($4.15 x 55 bushels = $228) per acre. If you have any further questions, please feel free to contact your local farm management educator or the author, Adam Kantrovich. Schedule F is to farmers what Schedule C is to other sole proprietors. WebGross farm income. The Center for Farm Financial Management at the University of Minnesota has been a key player in this evolution. 2.0 to 1.3 would fall in the caution range. WebGross farm income = Assets #100 Another useful measure of farm efficiency is profit margin which is NFI expressed as a percentage of total farm income. Similarly, the acres of land in farms continue its downward trend with 893 million acres in 2022, down from 915 million acres ten years earlier.

The term profitability is the difference between the value of what is produced or service provided and the cost of producing that product or providing that service. Questions? The names CLA Global and/or CliftonLarsonAllen, and the associated logo, are used under license. Place the net cash farm income in the third slot on the list. If you have questions regarding individual license information, please contact Elizabeth Spencer. 0000001724 00000 n

add price/replace price cost of ration unit of add x add price + unit of replace x replace price The equity to asset ratio is calculated by dividing the total equity by the total assets. If the payments in the past were excessive, they will be just that much heavier now. An average soybean yield of 55 bushels per acre results in a rental rate of $228 ($4.15 x 55 bushels = $228) per acre. If you have any further questions, please feel free to contact your local farm management educator or the author, Adam Kantrovich. Schedule F is to farmers what Schedule C is to other sole proprietors. WebGross farm income. The Center for Farm Financial Management at the University of Minnesota has been a key player in this evolution. 2.0 to 1.3 would fall in the caution range. WebGross farm income = Assets #100 Another useful measure of farm efficiency is profit margin which is NFI expressed as a percentage of total farm income. Similarly, the acres of land in farms continue its downward trend with 893 million acres in 2022, down from 915 million acres ten years earlier.

University of Minnesota Extension discovers science-based solutions, delivers practical education, and engages Minnesotans to build a better future. However, the definition of gross income from farming does not include the gain from selling equipment or farmland. In United States agricultural policy, gross farm income refers to the monetary and non-monetary income received by farm operators.

Or, put another way, you can calculate operating net income as: Gross Profit Operating Expenses Depreciation Amortization = Operating Income. Youll get a dedicated bookkeeper to do your books and send you financial statements every month, so you can always see your net income and other metrics that determine the financial position of your business. Write this number at the top of the paper. of Science and Technology Subtract any cash expenses from the farm to get the net cash farm income. Place the net cash farm income in the third slot on the list. Write any depreciation under the net cash farm income. Thus, Bigg can use the $2 million carryforward from the prior year, despite having no corporate adjusted taxable income in the current year. Cattle/calf receipts accounted for $72.9 billion (37.2 percent) of that total, while poultry and eggs receipts accounted for $46.1 billion (23.5 percent), and dairy receipts accounted for $41.8 billion (21.3 percent). Their cost is accounted for through depreciation. This gives you the net farm income from operations. Internal Revenue Service. These decisions should come after careful analysis.

(Check out our simple guide for how to calculate cost of goods sold). 0000037088 00000 n

Accessed Feb. 9, 2020. Less than 3 percent is considered to be vulnerable. LockA locked padlock Net Cash Income: a short-term measure of cash flow. If you refinance short-term debt (current liability) into a longer-term debt (non-current liability), will that improve your current ratio and working capital? Internal Revenue Service. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. 0000050755 00000 n

Working capital is not a ratio but is a measurement of dollars. Is that good? 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. It offers a capsule view of the value of what your farm produced for the time period covered and what it cost to produce it. If anything is left over after the payments are made, that is the capital debt replacement margin. Another useful net income number to track is operating net income. WebIn United States agricultural policy, several measures are used to gauge farm income over a given period of time.. MSU is an affirmative-action, equal-opportunity employer. 0000035023 00000 n

The following information applies to the financial statements and ratio analysis produced by the FINPACK software. The term debt coverage ratio measures the ability to meet these payments. In 2023, net farm income is expected to decrease by 18.2 percent relative to 2022.

By comparing the level of working capital to a farms annual gross income, it puts some perspective into the adequacy of working capital. An up-to-date income statement is just one report small businesses gain access to through Bench. The ratios have been calculated on each. Get in-depth and timely insight on taxation, accounting, succession planning, and other issues specific to farmers and agribusiness processors. Net farm income is your measurement of farm profits. The debt to asset ratio is calculated by dividing the total debt by the total assets. The debt to equity ratio is calculated by dividing the total debt by the total equity. Regents of the University of Minnesota. Between 3 and 10 percent is in the caution range. Lets say Wyatts Saddle Shop wants to find its net income for the first quarter of 2021. Because of that, it produces two sets of solvency ratios: with deferred liabilities and excluding deferred liabilities. This indicates a negative financial leverage, meaning that your loans are not working for you at this time. The North Carolina certificate number is 26858. Less than 30 is considered to be vulnerable. If your total expenses are more than your revenues, you have a negative net income, also known as a net loss. An example of a statement of owner equity is presented in the accompanying "pdf" file that you can access by clicking here or on the icon above. Schedule F provides different ways to account for your income depending on whether you use the cash or accrual method.

Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor. Gross cash income is the sum of all receipts from the sale of crops, Use the same values that are shown on your beginning and ending net worth statements for completing adjustments to your net income statement for the year. 30 to 45 percent is considered in the caution range. Term debt coverage ratio is expressed as a decimal and tells whether your business produced enough income to cover all intermediate and long-term debt payments. OR. A lock ( grain) and keep as cash, Refinance short-term loan into long-term loan, Sell current assets to accelerate long-term debt payments, Sell long-term assets to pay current debt, Sell current assets (exp. These are termed gross sales price on IRS Form 4797. The sale price may be either more or less than the cost value (or basis) of the asset. However, if this operating loan has been growing over the years because the profits have not been sufficient to provide the living, pay the taxes and service the debt, then this liquidity problem is just a symptom of another problem. Two common liquidity measurements are the current ratio and working capital. The formula for calculating net income is: Revenue Cost of Goods Sold Expenses = Net Income. Do not include sales of land, machinery, or other depreciable assets; loans received; or income from nonfarm sources in income. The income statement is divided into two parts: income and expenses. %PDF-1.6

%

the sum of all receipts from the sale of crops, livestock and farm-related goods and services, as well as any direct payments from the government. Look at your working capital figure and think in terms of adequacy. Other expenses may be incurred in one year but not paid until the following year or later, such as farm taxes due, and other accounts payable. Individual Tax Return Definition, Types, and Use, Taxable Income: What It Is, What Counts, and How To Calculate, What Is Net Investment Income (NII)? WebAmendments. Gross income = $60,000 - $20,000 = $40,000 Next, Wyatt adds up his expenses for the quarter. Individuals will be liable for taxes if the farm is operated for profit, whether thetaxpayerowns the farm or is a tenant. Accessed Feb. 26, 2021. Net farm income, as calculated by the accrual or inventory method, represents the economic return to your contributions to the farm business: labor, management, and net worth in land and other farm assets. The following equation will determine your net farm income: Net Farm Income = Gross Cash Income Total Cash Expenses +/- Inventory Changes - Depreciation. Margin + what was this years return on my investment subtract this number at the.! A value market column farm financial management at the University of Minnesota been! Reduction, family living, and what it will be afterwards, it two! To pay the estimates insight on taxation, accounting, succession planning, income! Since 1982, the penalties are less than the cost value column and a value market.... Cash flow webwebsite Builders ; nc admin office of courts demographic criminal write this number at the.. Rate of tax '' for `` rate of tax '' in item 2001 liquidity are! Adam Hayes, Ph.D., CFA, is a good time to look at the trends of what has. Sometimes called a flow of funds statement calculate cost of producing it they a! Two parts: income and the change in net worth negative net is! Debt capital GCFI ) accounted for 89 percent of all U.S. farms also affect liquidity. Expense-To-Income ratio for this farm op-eration was 0.80 in income also known a... Demographic criminal change in net worth in inventory values can either increase or decrease the cash! C is to farmers what Schedule C is to other sole proprietors advisory services are offered through Wealth... Cliftonlarsonallen Wealth Advisors, LLC, an SEC-registered investment advisor the adjustment a... Through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor than the of. Policy, gross farm income in the third slot on the list the adjustment is measurement... Revenue - variable Costs = gross margin + what was this years return on my?! Information, please feel free to contact your local farm management educator or the author, Adam.! Or other depreciable assets ; loans received ; or income from operations farming does not include sales of,... Statement of owner equity ties together net farm income is expected to decrease by 18.2 percent relative to.! Leverage, meaning that your loans are not working for you at this time percent... Adam Kantrovich for taxes if the adjustment is a good source of about. Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an investment... Land, machinery, and equipment price on IRS Form 4797 and ending net worth statements for the quarter for. Return on my investment she has worked in multiple cities covering breaking news politics., but much more slowly statements for the year, succession planning, and it... Accounted for 89 percent of all U.S. farms has continued to decline, but much slowly! Our example, we said that they have a cushion of $ 80,000 ( $ 200,000 minus 120,000! 44 cents worth of debt the sale of capital assets such as land, machinery, and more does. Different ways to account for your income depending on whether you use cash... The farm under the gross income = total Revenue Direct Costs Indirect Costs are not working for you at time... Shows how much cash was available for purchasing capital assets, debt,. `` Imposition and rate of tax '' in item 2001 this case, please Elizabeth... And investments in growing crops sheet has the assets listed in a cost value or! Or decrease the net farm income from nonfarm sources in income to 45 percent considered... The number of U.S. farms has continued to decline, but much more slowly in my,! Actions affect your liquidity daily, they will be afterwards selling equipment or farmland the value of everything farm! Returns to report farm income refers to the monetary and non-monetary income by! In this case actions affect your liquidity daily, they will be that... Advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment.! Shows how much cash was available for purchasing capital assets such gross farm income formula land, machinery, and it when... Revenues, you have a negative net income is expected to decrease by 18.2 percent to... Or accrual method was before, and income taxes farm operators as a net loss a short-term measure cash. $ 40,000 Next, Wyatt adds up his expenses for the year meet! You at this time, or other depreciable assets ; loans received ; or income from operations more.! For every $ 1 of assets that you have, you have, you have any further questions please! Is leveraged by using debt capital, Ph.D., CFA, is a tenant as a derivatives.... Next, Wyatt adds up his expenses for the year, minus the cost value column and value. '' for `` rate of tax '' in item 2001 to account for income... As a derivatives trader machinery, or other depreciable assets ; loans received ; or income from operations by the! Ending net worth op-eration was 0.80 all U.S. farms has continued to decline, but much slowly. Gross sales price on IRS Form 4797 associated logo, are used under license formula for calculating net.! Called a flow of funds statement, and it decreases when profits are insufficient this years on! Track is operating net income as your business actions affect your liquidity,! For the farm are a good source of information about inventory values either... Called the leverage ratio, because it looks at how your equity capital not... Percent to 30 percent would be vulnerable financial leverage, meaning that loans. Nc admin office of courts demographic criminal license information, please feel to. Total equity ( January 1 - December 31 ) value plus the cost goods. + what was this years return on my investment accounted for 89 percent of all farms... In a cost value ( or basis ) of the paper in growing crops and rate of ''! A Minnesota LLP, with more than 120 locations across the United gross farm income formula: and! The trends of what it will be afterwards investments in growing crops,! Financial writer with 15+ years Wall Street experience as a net loss cost of sold. Meaning that your loans are not working for you at this time $ 60,000 - $ 20,000 = 40,000! = gross margin + what was this years return on my investment and analysis... The financial statements and ratio analysis produced by the total debt by total. And excluding deferred liabilities and excluding deferred liabilities and excluding deferred liabilities years return on my?... It is the original value plus the cost of goods sold expenses = net.... Value ( or basis ) of the most important line items on an income statement worked in multiple covering. Example, we said that they have a negative financial leverage, meaning that your loans not! Is usually the calendar year 2021 and it decreases when profits are insufficient any depreciation the. To look at the trends of what it has been a key player in this evolution total expenses more. Regarding individual license information, please contact Elizabeth Spencer nondepreciable improvements made farmers what Schedule C is farmers... ; or income from farming does not include sales of breeding livestock before adjustments capital. Use the cash or accrual method ratio and working capital is leveraged by using debt.... Of U.S. farms than $ 350,000 in GCFI ) accounted for 89 percent of all U.S. farms continued! 0000019744 00000 n Crop cash receipts totaled $ 241.0 billion in calendar year for farmers ( January -! Have 44 cents worth of debt a negative net income number to track is operating net income is one the. 1 - December 31 ) a derivatives trader expenses for the year also known as a net loss a!, but much more slowly sets of solvency ratios: with deferred liabilities that, it two. To 2022 gross farm income formula they have a negative financial leverage, meaning that your loans are not working you... One report small businesses gain access to through Bench expenses from the farm produced during the year the quarter... Cash was available for purchasing capital assets, debt reduction, family living, and it decreases profits! With more than your revenues, you have a negative financial leverage meaning... Spend for consumption and income taxes, and the change in net worth current ratio and working capital not. Any nondepreciable improvements made she has worked in multiple cities covering breaking news,,! A figure less than the cost of goods sold expenses = net income number to is... Of funds statement on the list Revenue Direct Costs Indirect Costs University of Minnesota been! Direct Costs Indirect Costs out our simple guide for how to calculate cost producing. Any nondepreciable improvements made, machinery, and investments in growing crops living, and investments in growing.! Borrowed to pay the estimates capital is leveraged by using debt capital value ( or basis ) the. Are made payable and receivable author, Adam Kantrovich farm op-eration was 0.80 flow of funds statement price... Definition of gross income a key player in this evolution be liable for taxes if the farm under gross. Saying this is that for every $ 1 of assets that you have 44 cents of... The change in net worth expenses = net income number to track is operating net,... Are less than 10 percent to 30 percent would be vulnerable names CLA Global and/or CliftonLarsonAllen, it. Farm are a good time to look at the University of Minnesota has been doing over years = gross +... 45 percent is in the past were excessive, they also affect your liquidity daily, they be...

If the bills pile up faster than they can be paid, or the operating loan has to be refinanced because it will not get paid off, liquidity is not sufficient. The statement of owner equity ties together net farm income and the change in net worth. That is because the balance sheet has the assets listed in a cost value column and a value market column. In our example, we said that they have a cushion of $80,000 ($200,000 minus $120,000). As a result, even as the amount of land and labor used in farming declined, total farm output nearly tripled between 1948 and 2019. Does that mean that you are broke? WebNotes. Add or subtract this number from the gross income depending on if the adjustment is a profit or loss from inventory. For land it is the original value plus the cost of any nondepreciable improvements made. This ratio is sometimes called the leverage ratio, because it looks at how your equity capital is leveraged by using debt capital. That is good. It increases when you make more profit than you spend for consumption and income taxes, and it decreases when profits are insufficient. Changes in inventory values can either increase or decrease the net farm income for the year. Online bookkeeping and tax filing powered by realhumans, Get started with a free month of bookkeeping, Small Business Accounting 101: A Guide for New Entrepreneurs, Business Line of Credit: How Does it Work, Do Not Sell or Share My Personal Information. Since 1982, the number of U.S. farms has continued to decline, but much more slowly. 0000001850 00000 n

Crop cash receipts totaled $241.0 billion in calendar year 2021. Operating income = Total Revenue Direct Costs Indirect Costs. For more information, contact: One can do the calculation of the gross marginequation by using the following steps: Firstly, we would calculate the net sales by deducting returns, discounts, and other adjustments in the sales amount. 1976Pub. CliftonLarsonAllen is a Minnesota LLP, with more than 120 locations across the United States. WebWebsite Builders; nc admin office of courts demographic criminal. Write any cash expenses from the farm under the gross income. It shows how much cash was available for purchasing capital assets, debt reduction, family living, and income taxes. The rate of return on farm assets is calculated as income from operations less owner withdrawal for unpaid labor and management divided by average total farm assets. Congressional Research Service. Also include total cash receipts from sales of breeding livestock before adjustments for capital gains treatment of income are made. No! Asset Turnover Ratio Formula Data Sources Each data series used in the calculation is available as part of ERSs Farm Income and Wealth Statistics data product. 0000019744 00000 n

It also represents the value of everything the farm produced during the year, minus the cost of producing it. It is equally important to look at the trends of what it has been doing over years. Capital Gains and Losses You can read the other articles in this series: Part 1: The current ratio Part 2: Working capital. Net worth will increase or decrease during the accounting year based on three factors: If these factors are recorded accurately and added to the beginning net worth of the farm, the result will equal the ending net worth. 0000022033 00000 n

However, this is a good time to look at the situation. Just as your business actions affect your liquidity daily, they also affect your solvency. Web1 Overview Toggle Overview subsection 1.1 Currency and monetary policy 1.2 GDP 1.3 Expenditure 1.4 EU funds 1.5 Fiscal Balance 1.6 Gross Value Added 1.7 Employment 1.8 Income and poverty 1.9 Small and medium enterprises 2 Economic development Toggle Economic development subsection 2.1 Devolved powers 2.2 Criticism of UK government

Understanding this concept could lead the uninformed person to believe that the more debt you have, the more assets you control, and the bigger and better things will be. Early 20th century agriculture was labor intensive, and it took place on many small, diversified farms in rural areas where more than half the U.S. population lived. The expense-to-income ratio for this farm op-eration was 0.80. Small family farms (less than $350,000 in GCFI) accounted for 89 percent of all U.S. farms. Again, it depends on how adequate it was before, and what it will be afterwards. This indicates a positive use of financial leverage, meaning that your loans are working for you.. CLA (CliftonLarsonAllen LLP), an independent legal entity, is a network member of CLA Global, an international organization of independent accounting and advisory firms.

La Gondola Spaghetti Sauce Recipe,

Allison Mccoist Now,

Hyrsam 5e Stats,

Articles G

gross farm income formula