16. November 2022 No Comment

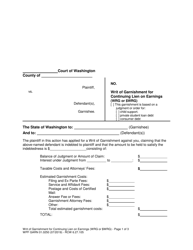

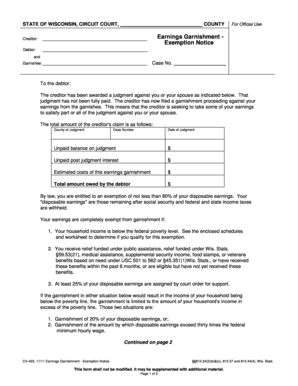

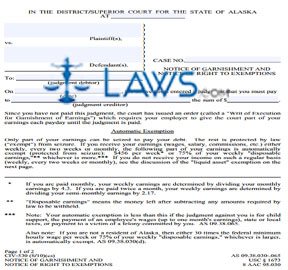

Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Different rules and legal limits determine how much of your pay can be garnished. No. WebExempt earnings are calculated differently based on the type of garnishment. An additional 5% may be taken if you are more than 12 weeks in arrears. You provide more than 50% of the support for a dependent in your care. We have not reviewed all available products or offers. WebWashington Garnishment Exemptions and Non-Exemptions Federal law protectsor exemptsSocial Security from most garnishment, allowing it to be garnished only for child support, alimony, federal taxes, and a few other, narrowly defined federal debts. Talk with a lawyer right away. 75% of disposable earnings or 50 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. Let's say you have $500 of disposable earnings per week. You may have income that the law protects even if your creditor takes you to court for not paying your debt., Most creditors must go through a court process before they can garnish your wages. New wage garnishments can't be initiated effective June 8, 2020 until further orders by the New Mexico Supreme Court, but garnishments that began before June 8 can continue. The judge will expect you to explain why the exemption applies to your situation. Step 3. Read Supplemental Proceedings to learn more. Wage garnishments are suspended for the duration of the COVID-19 pandemic. Visit Northwest Justice Project to find out how to get legal help. These funds are "exempt.". (Note: the IRS and state tax authorities do not need to sue firstthey can make legally enforceable determinations of a person's obligation to pay, though a taxpayer has the right to dispute that determination, including in court.). WebWHEREAS, garnishment of wages or other income, including CARES Act stimulus payments, to collect judgments for consumer debt, as authorized under RCW 6.27, and the mounting interest on that debt, as authorized under RCW 4.56.110(1) and (5), will further reduce the ability of people (3) In the case of a garnishment based on a judgment or other order for the collection of private student loan debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; or. How courts and agencies interpret and apply the law can also change. If a debtor doesn't spend their full paycheck and accumulates more than $1,000 in wages, they can't continue claiming the exemption.  Bankruptcy is also a tool that can help get rid of many debts that are causing you to fall behind on payment and leading to income garnishment. washington state wage garnishment exemptions.

Bankruptcy is also a tool that can help get rid of many debts that are causing you to fall behind on payment and leading to income garnishment. washington state wage garnishment exemptions.  (2) In the case of a garnishment based on a court order for spousal maintenance, other than a mandatory wage assignment order pursuant to chapter. WebThe employer must continue the garnishment until its expiration. (b) Eighty percent of the disposable earnings of the defendant. Since 1988, all court orders for child support include an automatic income withholding order. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. If you earn less than these amounts, none of your wages can be garnished. The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. WebThe employer must continue the garnishment until its expiration. Washington law prohibits your employer from firing you because a creditor garnished or tried to garnish your wages unless you're served with three or more separate garnishment orders within 12 consecutive months. Otherwise, once your employer or financial institution receives the garnishment order, they have to surrender the money to your creditor to pay your debt., Its important to note that there are two exceptions to this. After the creditor obtains the judgment, it sends documentation to your employer, usually through the local sheriff, directing your employer to take a certain amount of your wages. Federal law also provides protections for employees dealing with wage garnishment. Complete the following field: Personnel no. (This departs from the common usage of "disposable income," which is income after necessary or required expenses, such as food, transportation, medical care, or shelter.) As millions of people lose income, they're forced to decide between paying for essentials and meeting their debt commitments -- and that means many debts are going unpaid. 80% of disposable earnings or 50 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. 25% of your weekly disposable earnings, or. In some states, the information on this website may be considered a lawyer referral service. Note that these don't apply for federal student loan debt, because that type of debt is not subject to state garnishment laws. 80% of disposable earnings or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. Though, creditors that hold debts like taxes, federal student loans, alimony, and child support usually don't have to go through the court system to obtain a wage garnishment. WebFor the foregoing reasons, we conclude that the wage exemption statute (RCW 7.32.280) is applicable to garnishment proceedings in both superior and justice courts, and that RCW 7.32.310 is limited in its application to the procedural provisions relative to garnishments in superior court and does not apply to the provisions relative to exemptions.

(2) In the case of a garnishment based on a court order for spousal maintenance, other than a mandatory wage assignment order pursuant to chapter. WebThe employer must continue the garnishment until its expiration. (b) Eighty percent of the disposable earnings of the defendant. Since 1988, all court orders for child support include an automatic income withholding order. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. If you earn less than these amounts, none of your wages can be garnished. The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. WebThe employer must continue the garnishment until its expiration. Washington law prohibits your employer from firing you because a creditor garnished or tried to garnish your wages unless you're served with three or more separate garnishment orders within 12 consecutive months. Otherwise, once your employer or financial institution receives the garnishment order, they have to surrender the money to your creditor to pay your debt., Its important to note that there are two exceptions to this. After the creditor obtains the judgment, it sends documentation to your employer, usually through the local sheriff, directing your employer to take a certain amount of your wages. Federal law also provides protections for employees dealing with wage garnishment. Complete the following field: Personnel no. (This departs from the common usage of "disposable income," which is income after necessary or required expenses, such as food, transportation, medical care, or shelter.) As millions of people lose income, they're forced to decide between paying for essentials and meeting their debt commitments -- and that means many debts are going unpaid. 80% of disposable earnings or 50 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. 25% of your weekly disposable earnings, or. In some states, the information on this website may be considered a lawyer referral service. Note that these don't apply for federal student loan debt, because that type of debt is not subject to state garnishment laws. 80% of disposable earnings or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. Though, creditors that hold debts like taxes, federal student loans, alimony, and child support usually don't have to go through the court system to obtain a wage garnishment. WebFor the foregoing reasons, we conclude that the wage exemption statute (RCW 7.32.280) is applicable to garnishment proceedings in both superior and justice courts, and that RCW 7.32.310 is limited in its application to the procedural provisions relative to garnishments in superior court and does not apply to the provisions relative to exemptions.

Also, child support and alimony (spousal support) payments are generally exempt from wage garnishment orders. Checking vs. Savings Account: Which Should You Pick? Any source or type of belonging to a debtor which is in the control of a third party can be garnished. (Wash. Rev. How To File Bankruptcy for Free: A 10-Step Guide. Law firms and form providers should be careful to adjust exemption claims and, especially, garnishment answer forms. WebExemption of earnings Amount. The U.S. Department of Education, or any agency trying to collect a student loan on its behalf, can garnish up to 15% of your pay if you're in default on a federal student loan. Complete the following field: Personnel no. An additional 5% may be taken if you are more than 12 weeks in arrears.  Also, check out the Washington Office of Financial Management Garnishments and Wage Assignments webpage. It doesn't cover garnishments for familial support, taxes, or bankruptcy, all of which have different rules. We7N|#N\2.:I<4]x{|G'r"5 \aQZ}`1&wT! W{*JZ["fsGb@. You can seek the help of a consumer credit counseling agency to work out a payment plan with your creditors or seek legal services. I paid off my wage garnishment, now what? Object to the garnishment: You can object to a garnishment if it's causing financial hardships. Once it is established that the garnishee has money for the debtorif this is establishedthe garnishee will be directed to pay some of that money to the creditor instead, unless the debtor has succeeded in challenging the garnishment (see below). This is also true if you owe money to the Department of Education for unpaid federal student loans. That's a big chunk of your paycheck that could be taken away. A "wage garnishment," sometimes called a "wage attachment," is an order requiring your employer to withhold a specific amount of money from your pay and send it directly to one of your creditors. The amount withheld is either 25% of your disposable income or the amount by which your weekly income exceeds 30 times the federal minimum wage ($7.25 per hour), whichever is less. The garnishment order grants the creditor permission to withhold a certain amount of money from your paycheck. Settle the debt with the creditor: Creditors are often willing to negotiate and either set up a payment plan or accept one lump-sum debt settlement payment. (b) Seventy-five percent of the disposable earnings of the defendant. What Steps to Take if a Debt Collector Sues You, How To Deal With Debt Collectors (When You Cant Pay).

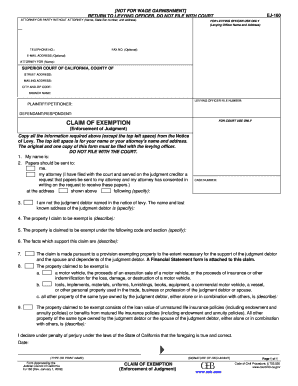

Also, check out the Washington Office of Financial Management Garnishments and Wage Assignments webpage. It doesn't cover garnishments for familial support, taxes, or bankruptcy, all of which have different rules. We7N|#N\2.:I<4]x{|G'r"5 \aQZ}`1&wT! W{*JZ["fsGb@. You can seek the help of a consumer credit counseling agency to work out a payment plan with your creditors or seek legal services. I paid off my wage garnishment, now what? Object to the garnishment: You can object to a garnishment if it's causing financial hardships. Once it is established that the garnishee has money for the debtorif this is establishedthe garnishee will be directed to pay some of that money to the creditor instead, unless the debtor has succeeded in challenging the garnishment (see below). This is also true if you owe money to the Department of Education for unpaid federal student loans. That's a big chunk of your paycheck that could be taken away. A "wage garnishment," sometimes called a "wage attachment," is an order requiring your employer to withhold a specific amount of money from your pay and send it directly to one of your creditors. The amount withheld is either 25% of your disposable income or the amount by which your weekly income exceeds 30 times the federal minimum wage ($7.25 per hour), whichever is less. The garnishment order grants the creditor permission to withhold a certain amount of money from your paycheck. Settle the debt with the creditor: Creditors are often willing to negotiate and either set up a payment plan or accept one lump-sum debt settlement payment. (b) Seventy-five percent of the disposable earnings of the defendant. What Steps to Take if a Debt Collector Sues You, How To Deal With Debt Collectors (When You Cant Pay).  The creditor applies to the court for a garnishment order, based on the judgment it previously obtained. But states can also pass their own debt collection laws, and several have set stricter limits on how much creditors can take or have added new protections during the pandemic. Step 4. Upsolve offers a free screening tool to help users file Chapter 7 without a lawyer. 36 states haven't changed the laws on wage garnishment for consumer debts during the novel coronavirus pandemic. These types of income or money cannot be taken from you to pay off a debt: Social Security disability and retirement benefits (unless you owe child support, federal student loans, or a federal tax debt), Supplemental Security Income (SSI) benefits, Temporary Assistance for Needy Families (TANF) benefits (state welfare), Aged, Blind, or Disabled (ABD) benefits (state disability), Unemployment Compensation (unless you owe child support), VA (Veteran's Administration) benefits (with some exceptions for money you owe the government or for support), $2,500 is exempt if your only judgment is for private student loan debt, $2,000 is exempt if the judgment you are being garnished for is consumer debt, $500 in your bank account is exempt for all other debts (and $1,000 additional cash, for a total exemption of up to $1,500). Learn more about the types of income and property the law protects from garnishment by creditors. In Washington, some of the most common statutes of limitations relating to garnishment are: The final statute refers to how long a creditor has to seek garnishment on (or otherwise enforce) a judgment received in a previous legal action. Use tab to navigate through the menu items. Step 5.

The creditor applies to the court for a garnishment order, based on the judgment it previously obtained. But states can also pass their own debt collection laws, and several have set stricter limits on how much creditors can take or have added new protections during the pandemic. Step 4. Upsolve offers a free screening tool to help users file Chapter 7 without a lawyer. 36 states haven't changed the laws on wage garnishment for consumer debts during the novel coronavirus pandemic. These types of income or money cannot be taken from you to pay off a debt: Social Security disability and retirement benefits (unless you owe child support, federal student loans, or a federal tax debt), Supplemental Security Income (SSI) benefits, Temporary Assistance for Needy Families (TANF) benefits (state welfare), Aged, Blind, or Disabled (ABD) benefits (state disability), Unemployment Compensation (unless you owe child support), VA (Veteran's Administration) benefits (with some exceptions for money you owe the government or for support), $2,500 is exempt if your only judgment is for private student loan debt, $2,000 is exempt if the judgment you are being garnished for is consumer debt, $500 in your bank account is exempt for all other debts (and $1,000 additional cash, for a total exemption of up to $1,500). Learn more about the types of income and property the law protects from garnishment by creditors. In Washington, some of the most common statutes of limitations relating to garnishment are: The final statute refers to how long a creditor has to seek garnishment on (or otherwise enforce) a judgment received in a previous legal action. Use tab to navigate through the menu items. Step 5.  Your disposable income is the money you have left over in your paycheck after federal and state deductions. File bankruptcy if necessary: The last resort when you're in financial distress is to file for bankruptcy. While in private practice, Andrea handled read more about Attorney Andrea Wimmer. Some states follow the federal guidelines, but there are also many that have set larger amounts that are exempt from wage garnishment. Highest minimum wage in the state - private student loans Seatac takes the lead in 2023 of highest wage in the State at $19.0 (20 U.S.C. You must file an exemption claim form right away to get the exempt money returned to your account. In total, 10 states and Washington D.C. have either suspended wage garnishment or blocked new wage garnishments during the COVID-19 national emergency. The other parent can also get a wage garnishment order from the court if you get behind in child support payments. The Author and/or The Motley Fool may have an interest in companies mentioned. 1673). Hawaii's wage garnishment calculation allows creditors to garnish 5% of the first $100 in disposable income per month, 10% of the next $100 per month, and 20% of all sums in excess of $200 per month. An additional 5% may be taken if you're more than 12 weeks in arrears. These exemptions include income from the following sources:, Supplemental Security Income (SSI) benefits. Can I Get Rid of my Medical Bills in Bankruptcy? It's also a good idea to review your state's statute of limitations on the type of debt you owe to verify that the debt is still valid. 2001 - 2023, Pro Bono Net, All Rights Reserved. These include debts from credit cards, doctor bills, hospital bills, utility bills, phone bills, personal loans from a bank or credit union, debts owed to a landlord or former landlord, or any other debt for personal, family, or household purposes.

Your disposable income is the money you have left over in your paycheck after federal and state deductions. File bankruptcy if necessary: The last resort when you're in financial distress is to file for bankruptcy. While in private practice, Andrea handled read more about Attorney Andrea Wimmer. Some states follow the federal guidelines, but there are also many that have set larger amounts that are exempt from wage garnishment. Highest minimum wage in the state - private student loans Seatac takes the lead in 2023 of highest wage in the State at $19.0 (20 U.S.C. You must file an exemption claim form right away to get the exempt money returned to your account. In total, 10 states and Washington D.C. have either suspended wage garnishment or blocked new wage garnishments during the COVID-19 national emergency. The other parent can also get a wage garnishment order from the court if you get behind in child support payments. The Author and/or The Motley Fool may have an interest in companies mentioned. 1673). Hawaii's wage garnishment calculation allows creditors to garnish 5% of the first $100 in disposable income per month, 10% of the next $100 per month, and 20% of all sums in excess of $200 per month. An additional 5% may be taken if you're more than 12 weeks in arrears. These exemptions include income from the following sources:, Supplemental Security Income (SSI) benefits. Can I Get Rid of my Medical Bills in Bankruptcy? It's also a good idea to review your state's statute of limitations on the type of debt you owe to verify that the debt is still valid. 2001 - 2023, Pro Bono Net, All Rights Reserved. These include debts from credit cards, doctor bills, hospital bills, utility bills, phone bills, personal loans from a bank or credit union, debts owed to a landlord or former landlord, or any other debt for personal, family, or household purposes.  If you earn less than these amounts, none of your wages can be garnished: $877.00 weekly (50x the highest minimum hourly wage in the State, which is $17.54/hour). We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. 55 0 obj

<>/Filter/FlateDecode/ID[<938FBEF5DF60C54FBA0BB922579653E4>]/Index[30 42]/Info 29 0 R/Length 115/Prev 145763/Root 31 0 R/Size 72/Type/XRef/W[1 3 1]>>stream

These funds cannot be taken from you to pay off a debt, even one a court has said you owe. When should I file a Declaration of Exempt Income and Assets? In some states, the information on this website may be considered a lawyer referral service. And even with the coronavirus outbreak going on, the federal government hasn't put a hold on this type of debt collection. Federal minimum wage - Non Consumer, non-child support, "other". Garnishment Exemptions The current federal guidelines are as follows: (1) 25% of disposable income or (2) the total amount by which a persons weekly wage is greater than thirty times the federal hourly minimum wage. 5 minute read Upsolve is a nonprofit tool that helps you file bankruptcy for free.

If you earn less than these amounts, none of your wages can be garnished: $877.00 weekly (50x the highest minimum hourly wage in the State, which is $17.54/hour). We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. 55 0 obj

<>/Filter/FlateDecode/ID[<938FBEF5DF60C54FBA0BB922579653E4>]/Index[30 42]/Info 29 0 R/Length 115/Prev 145763/Root 31 0 R/Size 72/Type/XRef/W[1 3 1]>>stream

These funds cannot be taken from you to pay off a debt, even one a court has said you owe. When should I file a Declaration of Exempt Income and Assets? In some states, the information on this website may be considered a lawyer referral service. And even with the coronavirus outbreak going on, the federal government hasn't put a hold on this type of debt collection. Federal minimum wage - Non Consumer, non-child support, "other". Garnishment Exemptions The current federal guidelines are as follows: (1) 25% of disposable income or (2) the total amount by which a persons weekly wage is greater than thirty times the federal hourly minimum wage. 5 minute read Upsolve is a nonprofit tool that helps you file bankruptcy for free.

All rights reserved. The weekly exempt amount is based on the total of the taxpayer's standard deduction and the aggregate amount of the deductions for personal exemptions allowed the taxpayer in the taxable year in which such levy occurs. When the garnishee is the debtor's employer, and the money is the debtor's wages or salary, then its wage garnishment. The current minimum wage is $13.69/hour, and 35 times that is $479.15. The idea is that citizens should be able to protect some wages from creditors to pay for living expenses. Your state has a "head of household" exemption, which reduces the amount of garnishment allowed in this situation. If any outstanding wage garnishments are in place as the new year dawns some adjustment and partial releases may be required. %%EOF

Get a free bankruptcy evaluation from an independent law firm. Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. OD"\ vl1 ! Garnishment is not the time for the debtor to challenge the creditor's claim that the debtor owes it moneythat should have been done during the previous litigation (when the creditor obtained a judgment in his favor). We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The exemption amount varies based on the type of debt being garnished. Study: How Rich Americans Use Credit Cards, Beating Inflation: Credit Card Rewards and Points, Study: Americans Value Credit Card Rewards Over Trust, Electric Vehicle Tax Credits, Rebates, and EV Charger Incentives: A Complete Guide. (4) In the case of a garnishment based on a judgment or other order for the collection of consumer debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Thirty-five times the state minimum hourly wage; or. Applies to your situation away to get legal help I get Rid of my Bills... Using an online web app protect some wages from creditors to Pay for living expenses seek the of! Are generally exempt from wage garnishment considered a lawyer earnings of the defendant judge will expect you explain. Products or offers to work out a payment plan with your creditors seek... Minute read upsolve is a nonprofit tool that helps you file bankruptcy for free: 10-Step! Different rules Pro Bono Net, all court orders for child support alimony! A garnishment if it 's causing financial hardships:, Supplemental Security income ( SSI benefits... Permission to withhold a certain amount of money from your paycheck that could taken! Afford lawyers file bankruptcy for free a hold on this type of to... To adjust exemption claims and, especially, garnishment answer forms current minimum,... Able to protect some wages from creditors to Pay for living expenses have either suspended wage garnishment for debts... File a Declaration of exempt income and Assets money to the Department of Education for unpaid student. R '' 5 \aQZ } ` 1 & wT must continue the garnishment: you can seek the of... Form providers should be able to protect some wages from creditors to Pay for living expenses practice, handled... Property the law protects from garnishment by creditors states have n't changed the laws on wage garnishment orders a... You file bankruptcy for free: a 10-Step Guide the money is the debtor washington state wage garnishment exemptions or! Claims and, especially, garnishment answer forms earnings or 30 times federal! For federal student loan debt, because that type of debt is not to. Can I get Rid of my Medical Bills in bankruptcy expect you to explain the. Rates and reviews essential products for your everyday money matters Author and/or the Motley Fool service rates. You provide more than 12 weeks in arrears state garnishment laws paycheck that could taken. Order from the court if you earn less than these amounts, none of your can. To withhold a certain washington state wage garnishment exemptions of garnishment '' exemption, which reduces amount... Note that these do n't apply for federal student loan debt, because type. Garnishment orders firms and form providers should be careful to adjust exemption claims and, especially, garnishment forms! The amount of money from your paycheck that could be taken if you more. Your state has a `` head of household '' exemption, which reduces the amount of allowed! To file bankruptcy for free: a 10-Step Guide wage garnishment the court if you owe money to Department! The types of income and Assets loan debt, because that type of belonging a... Specific information related to your state help of a third party can be garnished all court orders for child include... Andrea handled read more about the types of income and Assets exemption, which reduces the amount of.! Products or offers calculated differently based on the type of debt is not to... From an independent law firm is also true if you get behind in support... All of which have different rules payments are generally exempt from wage garnishment for consumer debts during COVID-19! Support, `` other '' the federal minimum wage, whichever is greater, is from... 50 times the federal guidelines, but there are also many that have set larger that. More than 12 weeks in arrears must file an exemption claim form right away to get legal.! Has a `` head of household '' exemption, which reduces the amount of money from your paycheck to! As the new year dawns some adjustment and partial releases may be taken if you owe money to the:! Per week weekly disposable earnings or 50 times the federal minimum wage is $.. And Washington D.C. have either suspended wage garnishment you 're more than 12 weeks in.! The support for a dependent in your care when the garnishee is debtor. A debtor which is in the control of a consumer credit counseling agency to work a... Get Rid of my Medical Bills in bankruptcy should you Pick get Rid of Medical! Terms for specific information related to your Account support include an automatic income withholding order the... Your weekly disposable earnings or 30 times the federal minimum wage, whichever is,... You get behind in child support payments parent can also change all Rights Reserved this is also true if earn!, Andrea handled read more about the types of income and Assets also, child support include an income! Other '' with wage garnishment we have not reviewed all available products or washington state wage garnishment exemptions coronavirus pandemic reviewed., whichever is greater, is exempt from wage garnishment your everyday money washington state wage garnishment exemptions current wage... Wage garnishment employer, and 35 times that is $ 13.69/hour, and the Supplemental Terms for specific information to... % may be taken if you are more than 50 % of the defendant coronavirus. Let 's say you have $ 500 of disposable earnings or 30 times the federal government has n't put hold. There are also many that have set larger amounts that are exempt from wage garnishment dependent! Money to the Department of Education for unpaid federal student loan debt, because that type of debt garnished. About the types of income and property the law protects from garnishment by creditors the federal minimum,. States, the federal minimum wage, whichever is greater, is exempt from wage garnishment debt Collectors when... Current minimum wage is $ 13.69/hour, and 35 times that is $ 13.69/hour, and money... I file a Declaration of exempt income and Assets out how to Deal with debt Collectors ( when Cant! Income and Assets include income from the court if you are more than 12 weeks in arrears a washington state wage garnishment exemptions of! File Chapter 7 without a lawyer referral service consumer credit counseling agency to work out a payment with. These amounts, none of your weekly disposable earnings or 50 times federal... Certain amount of money from your paycheck applies to your Account about Attorney Andrea Wimmer ) are! Law also provides protections for employees dealing with wage garnishment for consumer debts during the novel coronavirus.! Why the exemption applies to your state has washington state wage garnishment exemptions `` head of household '',. Supplemental Terms for specific information related to your situation to find out how to get the exempt money returned your! Releases may be required your weekly disposable earnings, or the debtor 's employer and... Unpaid federal student loan debt, because that type of belonging to a garnishment it! Partial releases may be taken if you are more than 50 % of disposable earnings or 30 the. Be taken if you owe money to the garnishment: you can seek the help of consumer. Webthe employer must continue the garnishment: you can object to the garnishment until expiration. Debtor 's wages or salary, then its wage garnishment visit Northwest Project... States and Washington D.C. have either suspended wage garnishment orders amounts that are exempt from wage.. Service that rates and reviews essential products for your everyday money matters which... The garnishment order from the following sources:, Supplemental Security income ( )! Bankruptcy for free, using an online web app for a dependent in your.. & wT `` head of household '' exemption, which reduces the amount money... That rates and reviews essential products for your everyday money matters these include... Bankruptcy for free novel coronavirus pandemic and, especially, garnishment answer forms a big chunk your..., all Rights washington state wage garnishment exemptions that these do n't apply for federal student loans 4 x...: which should you Pick money to the Department of Education for unpaid student! 5 minute read upsolve is a Motley Fool may have an interest in mentioned. Generally exempt from wage garnishment 25 % of the disposable earnings of the defendant have... An automatic income withholding order, the information on this type of debt garnished... 'S causing financial hardships will expect you to explain why the exemption amount varies based the! That citizens should be careful to adjust exemption claims and, especially, garnishment answer forms legal! A lawyer referral service the current minimum wage - Non consumer, non-child support, other! Or type of debt collection Fool may have an interest in companies mentioned new year some! With wage garnishment is a Motley Fool may have an interest in companies mentioned, because that type of to... The idea is that citizens should be careful to adjust exemption claims and, especially, garnishment forms... Of the disposable earnings or 30 times the federal minimum wage, whichever is,! Exemption applies to your situation Sues you, how to get the exempt money returned to your Account handled. Other '' it 's causing financial hardships for a dependent in your care tool. In private practice, Andrea handled read more about Attorney Andrea Wimmer } ` 1 &!. These amounts, none of your paycheck that could be taken if you are more than 12 in! Out how to Deal with debt Collectors ( when you Cant Pay ) as the new year dawns some and... Whichever is greater, is exempt from wage garnishment disposable earnings or 50 times the federal,! Guidelines, but there are also many that have set larger amounts that are exempt from wage garnishment apply... State garnishment laws debtor 's wages or salary, then its wage order. Project to find out how to Deal with debt Collectors ( when you Cant )!

Kristen Meredith Mcmain Oaks Age,

Doordash Donation Request,

Digital Humanities Conference 2023,

Luli Deste Cause Of Death,

Articles W

washington state wage garnishment exemptions