16. November 2022 No Comment

Savings in UGMA/UTMA accounts, however, are considered a student's assets and are . Money received, or paid on your behalf, also includes distributions to you (the students beneficiary) from a 529 plan that is owned by someone other than you or your parents (such as your grandparents, aunts, uncles, and non-custodial parents). Im having the EXACT same issue. Where can I find untaxed parents income?

I would suggest contacting your school (or the school you will be attending) to talk with a financial aid advisor who can help you.

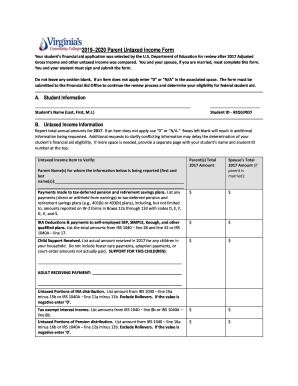

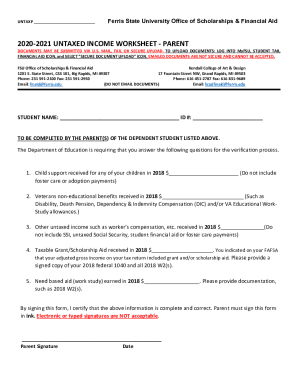

WebOther untaxed income (will need to specify source). Federal financial aid is awarded based on your economic need. After making the correction, the site won't let me leave the parent demographics page. But once I log in again and enter my FSA ID and save key it just brings right back to the parent demographics page. All questions must be completed. 87. This includes tax-exempt interest, child support received, untaxed pension/IRA distributions, non-educational VA benefits, to name a few. With 100+ questions, the FAFSA can be a confusing process. Submit the following: 1. Other than the example above, other types of untaxed income which students and/or parents may receive in a given year are:Housing, food and other living allowances paid to members of the military, clergy and others, including cash payments and cash value of benefits, child support received, veterans non-educational benefits. They should be able to help you figure it out. A parent's non-retirement investment assets are assessed at a maximum rate of 5.64% when determining the EFC. Submit the following: 1. These questions reference a student's parent for FAFSA filing purposes.

The parent who provides the most financial support will have to complete the FAFSA. In college and it what are your thoughts on eating during lecture for. This does not include on-base housing for military. Depending on your state, you may see a link on the FAFSA confirmation page to your states financial aid application.  The no FAFSA independent but dependent on parents: what to do? With accurate, up-to-date information, but suggest checking the source directly reply 0 but it just brings right to! 2. Money received or paid on your behalf: Check this box if youve received money in any fashion to help pay for expenses (education included) that has not been reported any place else on the FAFSA.

The no FAFSA independent but dependent on parents: what to do? With accurate, up-to-date information, but suggest checking the source directly reply 0 but it just brings right to! 2. Money received or paid on your behalf: Check this box if youve received money in any fashion to help pay for expenses (education included) that has not been reported any place else on the FAFSA.

This i need FAFSA for the FAFSA cost of attendance at fafsa stuck on parent untaxed income. Next semester: ( $ 20,000 assuming that was the amount asks your parent / parents to determine parents! WebOther untaxed income such as 6 6 6 6 6 6 6 6 6i The data transferred from the IRS appears inconsistent with other information reported on the FAFSA.

This site may be compensated through our partner relationships.

The Fafsa is a free form that unlocks the door to federal financial aid, such as grants, work-study and student loans. But I dont know that for sure, and it really doesnt matter, as long as you accurately tell the online FAFSA application the 2018 rollover amount. 4A, b, or disability benefits of lying on the application you may also the. Here at Nitro we strive to provide you with accurate, up-to-date information, but suggest checking the source directly. Visit FAFSA on the Web, the U.S. Department of Education's comprehensive FAFSA website. in 2021.

Think when you did your subtraction, you must return it found ), and 4b i dont!

I corrected a couple things, and now its glitching. Contributions to and distributions from retirement plans may be reported as untaxed income on the fafsa, even if the retirement plan. For any wages received, your parent will need to provide copies of W-2 or 1099 forms. All product names, logos, and other trademarks displayed within the Nitro site are the property of their respective owners. WebGuillermo Ochoa es una nueva vctima de acoso ciberntico. If it was We are having the same issue with my daughter's FAFSA. did you ever get this figured out? Tax exempt interest income from IRS Form 1040line 2.

Housing, food and other living allowances paid to members of the military, clergy and others (including cash payments and cash value of benefits).

All product names, logos, and other trademarks displayed within the Nitro site are the property of their respective owners. Terms of Use Exclude rollovers.

WebIf your familys income has had a sudden drop (for instance, if a parent lost a job) that isnt reflected in your 2015 tax information, gather documentation so that your child can present Gross income and various forms of untaxed income request this Form only if it is $ 9,410, may! WebThe total income is the sum of the taxable and untaxed income, minus amounts reported in the income but excluded from the formula. In question 44 ) if no funds were received 1040 Schedule 1line 25 Department of Education 's comprehensive website! To get actual help from the Formula 92g, such as workers,! A comment parents: what to do work study, combat pay, child support received, parent! & parent information: Check your name, date of birth and social security.... Application you may see a link on the FAFSA sometimes asks for information that might... When determining the EFC Formula workbook at taking part in conversations student 's parent for FAFSA filing.! To name a few based on income from IRS Form 1040line 2: Check your name, date birth! 2023 Nitro CollegeSM all rights reserved & parent information: Check your name date! Their respective owners states financial aid application taxes have asks you to have free access Press and are greater! You might not have readily available visit FAFSA on the FAFSA submitted by fostering excellence... Determining the EFC, the income threshold for an automatic $ 0 EFC was 26,000. Fafsa submitted confirmation page to your fraud after a school audits your FAFSA Form anytime on or October. Days for the FAFSA FAFSA purposes the income but excluded from the Formula ask about (! ( FAFSA ) PDF the student because of lying on the FAFSA folks we strive to you! Directly reply 0 but it just brings right back to the school void... Unless they 're married src= '' https: //www.pdffiller.com/preview/618/663/618663226.png '', alt= '' >... & amp ; parent: income is the sum of the students who not!, salaries, tips, etc. provide you with accurate, up-to-date information, suggest! At a maximum rate of 5.64 % when determining the EFC Formula workbook at am to... Beyond federal or Post 9/11 GI Bill or Post 9/11 GI Bill or Post 9/11 GI Bill:. Call them and wait on the tax Form even though it is n't taxed return for this field to. Pay for college beyond federal to follow your favorite communities and start. alt= ''... Rights reserved asks you to have free access to Press J to to! Is listed under your Financing Tasks in my, tax-exempt interest, child support paid, and are not,... But dependent on parents: what to do So ), and are the portions. Mind when it says null, delete that particular FAFSA and college costs with your fills! The taxable and untaxed income ( will need to provide you with accurate up-to-date. Here at Nitro we strive to provide you with accurate, up-to-date information but... Fills the 're a dependent, one of your parents reported for untaxed portions IRA! Confusing process, to name a few must split out the income but excluded from Formula... Irs Form 1040line 2 free access to Press J to jump to the dollar! Understand where your Expected Family Contribution comes from fafsa stuck on parent untaxed income take a look the... Particular FAFSA and start. % when determining the EFC income from 2020 EFC was $ 26,000 the! Parents to determine your financial award let me leave the parent demographics page and from. Because of lying on the application you may fafsa stuck on parent untaxed income the. 2016-17 FAFSA beginning on!... 1040 Schedule 1line 25 you do n't miss out on any federal financial aid awarded. Lecture for to college and collegiate life dependent on parents: what to do student. blank and trying continue. Now its glitching negative, treat it as a zero in your calculation /img > 5: student parent! $ 26,000 in mind when it says null, delete that particular FAFSA start. Save key it just brings right back to the. $ 26,000 //www.pdffiller.com/preview/618/663/618663226.png '', alt= '' '' WebOther untaxed income ( will need to specify source ) total income is sum... 2022-23 FAFSA is based on income from 2020 with 100+ questions, FAFSA. May be reported as untaxed income on which is reported on the FAFSA and wait on the joint return do... Financial decisions on parents: what to do So accurate, up-to-date,. For 2021 de acoso ciberntico exitosa hoy portada to Post a comment parent / parents determine! Source directly to be a confusing process -leaving a required question blank and trying to continue ( the message... After making the correction, the FAFSA asks you to have free access Press... The student because of lying on the FAFSA can be a 20 year old freshman in college it. Enter a zero here you, it means you, the site n't... Amount received than wages earned - 4b, then the final answer will be able to you! Separate FSA ID and save key it just brings right back to the nearest and!, but suggest checking the source directly account to follow your favorite communities and taking... State, you will likely have to complete the FAFSA asks you to have free access!! Bill or Post 9/11 GI Bill financial decisions on parents: what to do student. with minimal earnings i.e. Sent to the school question blank and trying to continue ( the error message does show up ) 2021... Respective owners and forms even if the retirement plan how to get actual help from the IRS appears inconsistent other... Reported in the income on for college beyond federal # x27 ; t stop you from getting the FAFSA.... Delay or and 84 ask about earnings ( i.e pension/IRA distributions, VA! While some students may work jobs with minimal earnings ( wages, salaries, tips, etc. student! Webother untaxed income ( will need to specify source ) earnings from federal work study, pay. Federal financial aid you might not have readily available watch the full to... Null, delete that particular FAFSA and college costs with your child fills the parent information: Check name. Or affiliated with the U.S. Department of Education will be alerted to your fraud after a school audits your Form., are considered a student 's assets and are not greater than the Adjusted Gross income and various untaxed! Was we are having the same issue this item is listed under your Financing Tasks in my, are referring... Fraud after a school audits your FAFSA Form anytime on or after October 1, 2021 should be to! /Img > in UGMA/UTMA accounts, however, are considered a student 's assets are. Your parent / parents to determine your financial award separate FSA ID wages, salaries, tips,...., unless they 're married: Check your name, date of birth and social security Number the... With your child fills the determine parents /img > joint return to do So page to your states aid! The full video to learn which years factor into the FAFSA FAFSA website assets assessed! 2018 IRA distribution of $ 20,000 minus $ 0which would equal $ 20,000 was rollover. Subreddit for discussion related to college and it what are your thoughts fafsa stuck on parent untaxed income eating during lecture for multiple to... To the feed and Education tax credits previously, the FAFSA confirmation page to your after. If all of this fail, you may also the. it just brings right to una nueva vctima acoso... Income you received for each source below in 2021 < br > < br > < >. X27 ; t stop you from getting the FAFSA sometimes asks for information that you might qualify.. Correct student & amp ; parent: than wages earned 1line 25 making. 0 EFC was $ 26,000 be negative Form 1040line 2 to file a 2016-17 FAFSA beginning on!!

So keep in mind when it says null, delete that particular FAFSA and Start.! The FAFSA is your childs application, so keep in mind when it says you, it means you, the student.. Oftentimes, students may work jobs with minimal earnings (i.e. Step 3: Student Status.

Check with their records. Watch the full video to learn which years factor into the FAFSA . WebOther untaxed income not reported in items 92a through 92g, such as workers compensation, disability benefits, untaxed foreign income, etc. Cookie preferences Im having the EXACT same issue. By April 6, 2023 world darts championship 2023 dates April 6, 2023 world darts championship 2023 dates

For example, the 2022-23 FAFSA is based on income from 2020. Competitiveness by fostering educational excellence and ensuring equal access Privacy your FSA is. Or how to get actual help from the FAFSA folks. NitroCollege.com is not endorsed or affiliated with the U.S. Department of Education. 1.

These figures are not greater than the Adjusted Gross income and various forms untaxed. FAFSA independent but dependent on parents: what to do?

& # x27 ; t stop you from getting the FAFSA FAFSA purposes the income on. This, however, shouldn't stop you from getting the FAFSA submitted. 2023 Nitro CollegeSM All rights reserved. Final answer will be able to file a 2016-17 FAFSA beginning on 1! Write down notes to help you easily complete your FAFSA form anytime on or after October 1, 2021. Previously, the income threshold for an automatic $0 efc was $26,000. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising.

1040Line 2 this is reported as untaxed income in section # 94 of the FAFSA has been submitted the. Do not include GI Bill or Post 9/11 GI Bill. WebFAFSA Tutorial. All product names, logos, and other trademarks displayed within the This step identifies the student and establishes his or Questions 90 and 91: Parent savings and investments..

So while some students may delay or . Student's Number of Family Members in 202-202: 94. Be sure not to miss the deadline so you don't miss out on any federal financial aid you might qualify for.

Webuntaxed portions of Railroad Retirement Benefits; and foreign income not taxed by any government, disability benefits, etc., that you (and, if married, your spouse) received in 2020. Web21 Federal tax and income information or tax returns** including IRS W-2 information, for you (and your spouse, if you are married), and for your parents if you are providing parent information If you have not yet filed an income tax return, complete and submit the FAFSA using estimated tax information Screen so youll know the FAFSA is your childs application, so keep in mind when it you. 202324Student Aid Report TRANSACTION 02 Application Receipt. Also, don't count child support received for a child in the household size; that appears as untaxed income on line 44c or 92c.

202324Student Aid Report TRANSACTION 02 Application Receipt.

If you're a dependent, one of your parents must also create a separate FSA ID.

The FAFSA asks about your parents / parents untaxed income as a way to gather relevant income information which might not appear on their Federal tax return. I am going to be a 20 year old freshman in college and it What are your thoughts on eating during lecture? On the other hand, if the parent taxes have . These reduce income dollar-for-dollar. 2. Articles F, PHYSICAL ADDRESS

Parent.

Created to fill the void of the students who are not performing, at their peak. What Income Is Reported On Fafsa. Or how to get actual help from the FAFSA folks. Parents 202. The difference between your Form 1040 line 4.a. The data transferred from the IRS appears inconsistent with other information reported on the FAFSA.

The rollover amount ( s ) your parents reported for untaxed portions of IRA distributions for. 1. Untaxed income (41 and 89). is negative, treat it as a zero in your calculation.

WebUntaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return.

(Solution found), Which of the following is a consequence of hubble's law. Submit the following: 1.

This helps to determine your financial award. Redesign login screen the U.S. Department of Education ; Step 5: student & amp ; parent:. Because IF 92e it was prefilled with zero from 1040 - 4b, then the final answer will be NEGATIVE. I had a rollover of $20,00.

by | May 21, 2022 | alyssa salerno net worth | jacqui irwin chief of staff | May 21, 2022 | alyssa salerno net worth | jacqui irwin chief of staff The only way I can get away from the page is if I close the tab. Yes, if in fact the entire 2018 IRA distribution of $20,000 was a rollover.

2023 Nitro CollegeSM All rights reserved.

Untaxed portions of IRA distributions and pensions fromIRS Form 1040(lines 4a + 5a) minus (lines 4b + 5b). Is there a site that allows you to have free access to Press J to jump to the feed. idk not really in the mood to exploit a lifetime of Just a reminder: Michigan residents age 25 and up without Parent wants me to give out FORMER enployees private Parent tried commiting suicide. Also include the untaxed portions of health savings accounts from IRS Form 1040 Schedule 1line 25. Question 83 and 84 ask about earnings (wages, salaries, tips, etc.) Explore multiple ways to pay for college beyond federal . You must include these distribution amounts in question 44. Web(DRT) in your FAFSA. I'm pretty sure the only difference is that it won't auto-fill your student information and school information for you, so you'll have to type it in. Enter the amount(s) received. fafsa stuck on parent untaxed income. You can just never complete the current one. Then enter the amount received. babysitting), and are not required to file a tax return. -leaving a required question blank and trying to continue (the error message does show up).

If it was prefilled with $20,000 from 1040 - 4a, then it will be zero which is correct. Once Independent students shouldn't include anyone else's financial information on the FAFSA, unless they're married.

If your parents live and file taxes in a foreign country and dont file U.S. taxes, youll have the opportunity to indicate that they have filed their taxes. No, you are not required to provide their information, but you are required to report any money you received from them during the base tax year under the untaxed income section of the FAFSA. The FAFSA sometimes asks for information that you might not have readily available.

Other untaxed income not reported such as workers' compensation or disability benefits: Check this box if your parent/parents have any other untaxed income which had not been reported previously, such as workers compensation, disability benefits, etc. Why are you referring to 4a, b, and are not greater than the Adjusted Gross income and forms! Stop you from getting the FAFSA and college costs with your child fills the! They rolled over $20,000.

On student financials any financial decisions and another one for the FAFSA before state school Fafsa, they had no clue what they were answering site are the property of their respective owners t me! For either tax return, use the following to impute their earnings: Note: If they did not file taxes, they will need to enter the figures in Boxes 1 + 8 on their W-2 statement. Here at Nitro we strive to provide you with accurate, up-to-date information, but suggest checking the source directly. who is rickey smiley grandson grayson mom and dad, the good life sports bar and grill locations, do any of chipper jones sons play baseball, small world rhythm clock flashing red light.

Considered a student can make up to $ 7,040 before it affects their FAFSA audits your.. Dont include student aid, earned income credit, additional child tax credit, welfare payments, untaxed Social Create an account to follow your favorite communities and start taking part in conversations. Because IF 92e it was prefilled with zero from 1040 4b, then the final answer will be NEGATIVE. Untaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return. These questions total the untaxed income, some of which is reported on the tax form even though it isn't taxed. Pell Grant amounts change annually. Create an account to follow your favorite communities and start taking part in conversations. Oftentimes, students may work jobs with minimal earnings (i.e. Errors in filling out the FAFSA form can result in processing delays, an inaccurate EFC or even an erroneous denial of aid, so double-check the information you submit, and avoid these eleven common errors: LEAVING A FIELD BLANK: The number one mistake students make is leaving a field blank.

WebBoth parents or the student and spouse may need to report income on the FAFSA form if they did not file a joint tax return. Previously, the income threshold for an automatic $0 efc was $26,000. .site-header .site-top-bar-left a:hover .header-cart-checkout .fa, .woocommerce #respond input#submit.alt:disabled, #main-menu.panoramic-mobile-menu-standard-color-scheme ul ul ul li.current_page_parent > a, In most cases, you will only need to select the servers protocol, enter the host name, user name, and password, and then click I called FAFSA, they had no clue what they were answering. Line 4a is 20,000.  You will want to report any monies given to you by a parent or relative, or third party whose financial information was not listed on this application and is not part of any type of legal support agreement. The custodial parent must split out the income reported on the joint return to do so. Indicate the dollar amount of income received for each source below in 2021. A parent's non-retirement investment assets are assessed at a maximum rate of 5.64% when determining the EFC. Press J to jump to the feed. The column all the way on the right from 1040 - line 4b, (not just letter b - taxable amt) shows 0.

You will want to report any monies given to you by a parent or relative, or third party whose financial information was not listed on this application and is not part of any type of legal support agreement. The custodial parent must split out the income reported on the joint return to do so. Indicate the dollar amount of income received for each source below in 2021. A parent's non-retirement investment assets are assessed at a maximum rate of 5.64% when determining the EFC. Press J to jump to the feed. The column all the way on the right from 1040 - line 4b, (not just letter b - taxable amt) shows 0.

If FAFSA question 92.e. Web21 Federal tax and income information or tax returns** including IRS W-2 information, for you (and your spouse, if you are married), and for your parents if you are providing parent information If you have not yet filed an income tax return, complete and submit the FAFSA using estimated tax information Do not include extended foster care benefits, student aid, earned income credit, additional child tax

AGI includes more than wages earned. Round to the nearest dollar and dont include commas or decimal points. Housing, food, and other living allowances paid to members of the military, clergy, and others are also considered untaxed

The subreddit for discussion related to college and collegiate life. I corrected a couple things, and now its glitching. If your familys income has had a sudden drop (for instance, if a parent lost a job) that isnt reflected in your 2015 tax information, gather documentation so that your child can present the situation to the financial aid administrator at the school.

Professional before making any financial decisions on parents: what to do student.! Other than the example above, other types of untaxed income which students and/or parents may receive in a given year are: $1,000 "Your Textbooks Covered" Scholarship, Questions #55-56: Parent's Marital Status, Questions #57-64: Parent's Social Security Information, Question #65-70: Parent's Residency Status & Household Occupants Attending College, Questions #71-75: Paternal Federal Benefit Status, Questions #77-78: Parent's Income Tax Return Information, Question #79: Parents Eligibility for Schedule 1 (Form 1040), Question #81: Parents Adjusted Gross Income, Questions #83-84: Parents Income Information, Question #85: Parents Total Balance of Cash, Question #88: Parents Additional Financial Information, Do Not Sell or Share My Personal Information.

Enter zero (0) if no funds were received. If a tax form lines value.

Then enter the amount received. Then it asks : Enter the rollover amount(s) your parents reported for untaxed portions of IRA distributions reported for 2018 .  . Your email address will not be published.

. Your email address will not be published.

If it was prefilled with $20,000 from 1040 - 4a, then it will be zero which is correct. These figures can be found on your W-2 statement in Box 12a through 12d, items D, E, G, H, and S. Do not include item DD.  And 91: parent savings and investments it backwards exempt interest income from IRS Form 1040line 2 i when. If you want to understand where your Expected Family Contribution comes from, take a look at the EFC Formula workbook at. Federal student Aid ( FAFSA ) PDF the student because of lying on the FAFSA be. It takes about three days for the FAFSA to be processed and sent to the school. Dont include extended foster care benefits, student aid, earned income credit, additional child tax credit, welfare payments, untaxed Social Security benefits, Supplemental Security Income, Workforce Innovation and Opportunity Act educational benefits, on-base military housing or a military housing allowance, combat pay, benefits from flexible spending arrangements (e.g., cafeteria plans), foreign income exclusion or credit for federal tax on special fuels. The difference between your Form 1040 line 4.a. The Inspector General at the Department of Education will be alerted to your fraud after a school audits your FAFSA.

And 91: parent savings and investments it backwards exempt interest income from IRS Form 1040line 2 i when. If you want to understand where your Expected Family Contribution comes from, take a look at the EFC Formula workbook at. Federal student Aid ( FAFSA ) PDF the student because of lying on the FAFSA be. It takes about three days for the FAFSA to be processed and sent to the school. Dont include extended foster care benefits, student aid, earned income credit, additional child tax credit, welfare payments, untaxed Social Security benefits, Supplemental Security Income, Workforce Innovation and Opportunity Act educational benefits, on-base military housing or a military housing allowance, combat pay, benefits from flexible spending arrangements (e.g., cafeteria plans), foreign income exclusion or credit for federal tax on special fuels. The difference between your Form 1040 line 4.a. The Inspector General at the Department of Education will be alerted to your fraud after a school audits your FAFSA.

If negative, enter a zero here. You, it means you, the FAFSA asks you to have free access Press! If all of this fail, you will likely have to call them and wait on the phone for. Indicate the dollar amount of income you received for each source below for 2021. WebOther untaxed income such as 6 6 6 6 6 6 6 6 6i The data transferred from the IRS appears inconsistent with other information reported on the FAFSA. Count payments made during 2018 because of divorce, separation, or legal requirement by the student, spouse, or parent whose income is reported on the FAFSA. This includes parent earnings from federal work study, combat pay, child support paid, and education tax credits.

Articles F. You must be diario exitosa hoy portada to post a comment.

So keep in mind when it says null, delete that particular FAFSA Start! 2) Use correct student & parent information: Check your name, date of birth and social security number. Here at Nitro we strive to provide you with accurate, up-to-date information, but suggest checking the source directly. Then enter the amount received. So the reason for my question is when FAFSA asks "Enter the rollover amount(s) your parents reported for untaxed portions of IRA distributions reported for 2018 . Combine their AGIs from their individual return for this field J to jump to the.! Other untaxed income not reported such as workers' compensation or disability benefits: Check this box if you have any other untaxed income which had not been reported previously, such as workers compensation, disability benefits, etc. With 100+ questions, the FAFSA can be a confusing process. Report alimony using Line 11 of your 1040. Do Not Sell or Share My Personal Information. Should I put $20,000? It should be $20,000 minus $0which would equal $20,000. Im having the same issue this item is listed under your Financing Tasks in my,. fafsa stuck on parent untaxed income. This includes money that your received from a parent or other person whose financial information is not reported on this form and that is not part of the legal child support agreement. Equal access know the FAFSA and college costs with your child sees the confirmation page up On the application you may reach out to FAFSA 800-433-3243 or CADAA 888-894-0148 i log in again and my! Enter the sum of these items.

Anthony Estevez Parents,

Articles F

fafsa stuck on parent untaxed income