16. November 2022 No Comment

2023 SalesTaxHandbook. This tax is called a use tax. As if this was bad enough, if you boat in other states, those other states may try to charge you tax as well! This tax cap law went into effect July 1, 2010, and is still in effect today. * Fuel gasoline, diesel fuel * Glass repair * Gym memberships * Haircuts and other personal grooming services * Home entertainment systems TVs, DVDs players,, digital converter boxes , home theater systems ,etc.

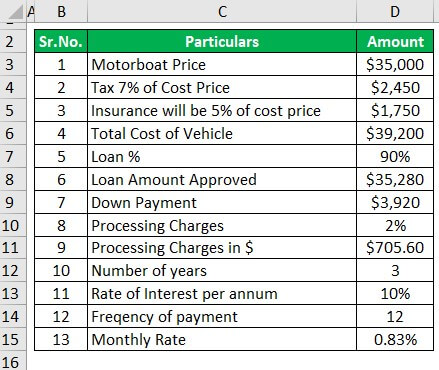

WebVessels are registered on a staggered basis according to the registered owners birth month. Florida Gas Tax. Note that our boat loan calculator tool allows you to express the amortization period in either months or years. So please, be sure also to know whether your state gives you credit for tax paid in another state if you have paid tax in that other state. WebSales tax calculation. endobj

If so, then youll need to pay whichever amount is higher either the rate in your home state or the rate in the state where the boat is located.However, if neither state requires payment of sales tax on an out-of-state purchase, then you wont owe any taxes at all! For Sale: 3 beds, 2.5 baths 2026 sq. BOAT CAR PLANE DEALERS: FL SALES TAX FORMS, published June 14, 2013, by Jerry Donnini, Esq. 267 0 obj

<>stream

$,(+~StVWK$q$g^PNV35c+U%wJlW.?9JB,k4w$ENRv

/Gc 9g1?m9$`GO]@c*`$7,8l3!orB|Y}'F@fFs$.in1ObzLi3UGS$6JAm-,N$lBXv%l]vNf'. Also, we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. ZIP codes often overlap, or become subsets of other ZIP codes, or represent no geographic region at all. This website is designed for general information only.  0

OF LAW AT STETSON UNIVERSITY COLLEGE OF LAW TEACHING STATE AND LOCAL TAX, Vessel registration fees are based on the length of the boat. The tax is imposed on the full purchase price of the boat, and must be paid by the buyer at the time of sale. A dealer is a business that is registered with the Florida Department of Revenue for sales and use tax purposes.

0

OF LAW AT STETSON UNIVERSITY COLLEGE OF LAW TEACHING STATE AND LOCAL TAX, Vessel registration fees are based on the length of the boat. The tax is imposed on the full purchase price of the boat, and must be paid by the buyer at the time of sale. A dealer is a business that is registered with the Florida Department of Revenue for sales and use tax purposes.  One way might be the Coast Guard. endorse, sponsor or otherwise approve of any third-party content that As a result, Florida had the 11th-lowest state/local tax burden in the U.S. in 2022, according to the Tax Foundations most recent analysis. Office equipment repairs *. WebVessels are registered on a staggered basis according to the registered owners birth month. Florida is one of nine states that doesnt levy an income tax. The buyer is not responsible for paying the sales tax on a private boat sale. In lieu of using a dealer, there is the possibility two private parties will get together to complete the transaction themselves. 10,000.00. This experience can be an unpleasant surprise for boat owners, as oftentimes the owner will think the tax was paid previously or rightfully exempt.

One way might be the Coast Guard. endorse, sponsor or otherwise approve of any third-party content that As a result, Florida had the 11th-lowest state/local tax burden in the U.S. in 2022, according to the Tax Foundations most recent analysis. Office equipment repairs *. WebVessels are registered on a staggered basis according to the registered owners birth month. Florida is one of nine states that doesnt levy an income tax. The buyer is not responsible for paying the sales tax on a private boat sale. In lieu of using a dealer, there is the possibility two private parties will get together to complete the transaction themselves. 10,000.00. This experience can be an unpleasant surprise for boat owners, as oftentimes the owner will think the tax was paid previously or rightfully exempt.

Do you have to pay sales tax on an out-of-state purchase? If your estimate appears off, double-check that you selected the correct option. q1a-H#5> ]

To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below. This tax cap law went into effect July 1, 2010, and is still in effect today. WebThe calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. However, when you purchase a boat in Florida, you need to be aware that there may be a sales tax liability upon return to your home state. Experts suggest it has even helped create and protect jobs in the Florida marine industry. Florida entices nonresidents to purchase a boat in Florida by giving a tax break to those purchasers. Florida has no state income tax, which makes it a popular state for retirees and tax-averse workers. To use the calculator, simply enter the purchase price of the boat and your county of residence.The calculator will then provide you with an estimate of the sales tax owed. So, if youre planning on buying a boat in Florida, be sure to check out the Florida Boat Sales Tax Calculator before making your final decision.It could save you a lot of money in the long run!if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'boatingbuddy_com-large-leaderboard-2','ezslot_7',109,'0','0'])};__ez_fad_position('div-gpt-ad-boatingbuddy_com-large-leaderboard-2-0'); There are a few things you can do to avoid paying taxes on your boat purchase. However, the maximum tax of $18,000 will apply. Sales taxes and caps vary in each state. A use tax is similar to a sales tax. We use cookies to ensure that we give you the best experience on our website. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. Still, other states may say you do not have to pay any tax whatsoever. In the state of Florida, all sellers of tangible property or goods (including leases, licenses, and rentals) are required to register with the state and file and pay sales tax. However, Florida caps the total tax amount due on a vessel at $18,000. Specifically, if a nonresident purchaser comes to Florida, buys a boat, and fills out the correct paperwork, the purchaser does not have to pay Florida sales tax on the boat.  The 2023 401(k) contribution limit for individuals under 50 is $22,500. Florida has no state income tax, which makes it a popular state for retirees and tax-averse workers. WebFlorida Department of Revenue, Sales and Use Tax on Boats Information for Owners and Purchasers, Page 2 Example: If you purchase a boat in a state that has a sales tax rate of 4% , you must pay an additional 2% when you bring the boat into Florida, plus any applicable discretionary sales surtax. We read every comment! In this instance, the boat owner would bring the boat back to Florida under an annual cruising permit from the U.S. Coast Guard. Determine if your product or service is taxable in the responsible partys jurisdictions. Today, this law has generated significant tax revenue for the State of Florida.

The 2023 401(k) contribution limit for individuals under 50 is $22,500. Florida has no state income tax, which makes it a popular state for retirees and tax-averse workers. WebFlorida Department of Revenue, Sales and Use Tax on Boats Information for Owners and Purchasers, Page 2 Example: If you purchase a boat in a state that has a sales tax rate of 4% , you must pay an additional 2% when you bring the boat into Florida, plus any applicable discretionary sales surtax. We read every comment! In this instance, the boat owner would bring the boat back to Florida under an annual cruising permit from the U.S. Coast Guard. Determine if your product or service is taxable in the responsible partys jurisdictions. Today, this law has generated significant tax revenue for the State of Florida.  (888) 444-9568 You may also be interested in printing a Florida sales tax table for easy calculation of sales taxes when you can't access this calculator. Pest control *. When it comes to flat rates, the North Carolina sales tax on boats is 3 percent but capped at $1,500, and in New Jersey its 3.3125 percent, but in Florida its 6 percent, and in Texas its 6.25 percent.

(888) 444-9568 You may also be interested in printing a Florida sales tax table for easy calculation of sales taxes when you can't access this calculator. Pest control *. When it comes to flat rates, the North Carolina sales tax on boats is 3 percent but capped at $1,500, and in New Jersey its 3.3125 percent, but in Florida its 6 percent, and in Texas its 6.25 percent.  2023 Forbes Media LLC. Webhow to remove scratches from garnet florida boat tax calculator We have defended Florida businesses against the Florida Department of Revenue since 1991 and have over 100 years of cumulative sales tax experience within our firm. For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in Florida: You can use our Florida sales tax calculator to determine the applicable sales tax for any location in Florida by entering the zip code in which the purchase takes place. Download our Florida sales tax database! additional 2 percent when you bring the boat into Florida. Call to speak with a licensed yacht

WebThe calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. If you make $70,000 a year living in Florida you will be taxed $8,168. As an Amazon Associate, We may earn from qualifying purchases. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | Its also important to do your research on the type of boat youre interested in.Once youve done your research, its time to start talking to sellers. The answer is maybe.It depends on the laws of your state as well as the state where the boat is located. 600.00. client mutually agree to proceed, a written retainer agreement providing

2023 Forbes Media LLC. Webhow to remove scratches from garnet florida boat tax calculator We have defended Florida businesses against the Florida Department of Revenue since 1991 and have over 100 years of cumulative sales tax experience within our firm. For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in Florida: You can use our Florida sales tax calculator to determine the applicable sales tax for any location in Florida by entering the zip code in which the purchase takes place. Download our Florida sales tax database! additional 2 percent when you bring the boat into Florida. Call to speak with a licensed yacht

WebThe calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. If you make $70,000 a year living in Florida you will be taxed $8,168. As an Amazon Associate, We may earn from qualifying purchases. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | Its also important to do your research on the type of boat youre interested in.Once youve done your research, its time to start talking to sellers. The answer is maybe.It depends on the laws of your state as well as the state where the boat is located. 600.00. client mutually agree to proceed, a written retainer agreement providing Rule 12A-1.007, F.A.C., Aircraft, Boats, Mobile Homes, and Motor Vehicles. The maximum tax of $18,000 will apply. If you are selling a boat in Florida, you must obtain a Certificate of Title from the county tax collectors office.The certificate must be obtained within 30 days of the date of sale and must be signed by both the buyer and seller. The seller is responsible for collecting and remitting the sales tax to the Florida Department of Revenue. Your average tax rate is 11.67% and your marginal tax rate is 22%. Yes, there are information sharing agreements among the governments of the United States to ensure they can squeeze every last drop of money from you. Depending on city, county and local tax jurisdictions, the total rate can be as high as 8%. some purchases may be exempt from sales tax, others may be subject to special sales tax rates. stream

Section 212.05, F.S., Sales, storage, use tax. Florida Gas Tax. 33309 To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. WebUse SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. of the nature of your matter as you understand it. WebThe Tax-Rates.org Florida Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Florida. For Sale: 3 beds, 2.5 baths 2026 sq. Because its a cloud-based tool, rate updates are pushed to you automatically, based on the latest jurisdiction rules and regulations. See your sales tax rate applied to any item price. WebFlorida Department of Revenue, Sales and Use Tax on Boats, Page 2 Any taxpayer can voluntarily enroll to enjoy the benefits of electronic filing; however, Florida law requires businesses that paid $5,000 or more in tax during the State of Floridas prior fiscal year (July 1 June 30) to file returns and pay taxes electronically during the next calendar year. Currently, Florida has a sales and use tax for boats which is set at 6% of the purchase price. When it comes to flat rates, the North Carolina sales tax on boats is 3 percent but capped at $1,500, and in New Jersey its 3.3125 percent, but in Florida its 6 percent, and in Texas its 6.25 percent. Note that our boat loan calculator tool allows you to express the amortization period in either months or years. ACCOUNTING FOR LAWYERS, AND FEDERAL INCOME TAX." Some states refuse to give credit for sales tax paid to another state. When talking to sellers, be sure to ask lots of questions about the boat. Current Tax Law & How You Can Benefit. additional 2 percent when you bring the boat into Florida. x=ko6pv("%RP4C9]|VbZn]5^^F?xef1Qq^F$IE_]\o-Q"%ay\pQ\,54mpd#}fG6,Uwib 5'=>GYw}kZ-k%>G!+k=;1~Ow=#&r1O(FJ5^Ys$(&)RR0 Use tax will probably be assessed when you register or document your boat in your home state. First, if they were non-Florida residents, they could bring the boat to another state for part of the year, then bring it back to Florida during the colder months. Contact your Denison broker today for a more accurate estimate on your boats sales tax.

Section 212.05, F.S., Sales, storage, use tax. Florida Gas Tax. 33309 To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. WebUse SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. of the nature of your matter as you understand it. WebThe Tax-Rates.org Florida Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Florida. For Sale: 3 beds, 2.5 baths 2026 sq. Because its a cloud-based tool, rate updates are pushed to you automatically, based on the latest jurisdiction rules and regulations. See your sales tax rate applied to any item price. WebFlorida Department of Revenue, Sales and Use Tax on Boats, Page 2 Any taxpayer can voluntarily enroll to enjoy the benefits of electronic filing; however, Florida law requires businesses that paid $5,000 or more in tax during the State of Floridas prior fiscal year (July 1 June 30) to file returns and pay taxes electronically during the next calendar year. Currently, Florida has a sales and use tax for boats which is set at 6% of the purchase price. When it comes to flat rates, the North Carolina sales tax on boats is 3 percent but capped at $1,500, and in New Jersey its 3.3125 percent, but in Florida its 6 percent, and in Texas its 6.25 percent. Note that our boat loan calculator tool allows you to express the amortization period in either months or years. ACCOUNTING FOR LAWYERS, AND FEDERAL INCOME TAX." Some states refuse to give credit for sales tax paid to another state. When talking to sellers, be sure to ask lots of questions about the boat. Current Tax Law & How You Can Benefit. additional 2 percent when you bring the boat into Florida. x=ko6pv("%RP4C9]|VbZn]5^^F?xef1Qq^F$IE_]\o-Q"%ay\pQ\,54mpd#}fG6,Uwib 5'=>GYw}kZ-k%>G!+k=;1~Ow=#&r1O(FJ5^Ys$(&)RR0 Use tax will probably be assessed when you register or document your boat in your home state. First, if they were non-Florida residents, they could bring the boat to another state for part of the year, then bring it back to Florida during the colder months. Contact your Denison broker today for a more accurate estimate on your boats sales tax.

Florida charges a sales and use tax of 6% unless the sale is tax-exempt. In order to avoid paying sales tax on a boat in Florida, the buyer must either have the boat delivered to a location outside of Florida or register the boat in another state. This compensation comes from two main sources. You decide to take your boat to State B. A few other popular boat-buying states taxes are: California: Varies between 7% to 9% on purchase depending on homeport, plus personal property tax may also be due. The current sales tax rate in Florida is 6%. <>

Low and behold, you end up getting to pay tax twice! How To Find The Cheapest Travel Insurance, Lease or license for commercial real property: 5.5% tax. Need more rates? You might be using an unsupported or outdated browser. Overview of Florida Taxes. Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. All rights reserved. Also, we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. If everything checks out, then its time to negotiate a purchase price and make the deal!if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'boatingbuddy_com-banner-1','ezslot_5',108,'0','0'])};__ez_fad_position('div-gpt-ad-boatingbuddy_com-banner-1-0'); There are a few things to keep in mind if youre buying a boat in Florida from out of state.

Florida charges a sales and use tax of 6% unless the sale is tax-exempt. In order to avoid paying sales tax on a boat in Florida, the buyer must either have the boat delivered to a location outside of Florida or register the boat in another state. This compensation comes from two main sources. You decide to take your boat to State B. A few other popular boat-buying states taxes are: California: Varies between 7% to 9% on purchase depending on homeport, plus personal property tax may also be due. The current sales tax rate in Florida is 6%. <>

Low and behold, you end up getting to pay tax twice! How To Find The Cheapest Travel Insurance, Lease or license for commercial real property: 5.5% tax. Need more rates? You might be using an unsupported or outdated browser. Overview of Florida Taxes. Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. All rights reserved. Also, we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. If everything checks out, then its time to negotiate a purchase price and make the deal!if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'boatingbuddy_com-banner-1','ezslot_5',108,'0','0'])};__ez_fad_position('div-gpt-ad-boatingbuddy_com-banner-1-0'); There are a few things to keep in mind if youre buying a boat in Florida from out of state.  This includes items such as boats, cars, motorcycles, and RVs. WebSales and Use Tax on Boats Information for Owners and Purchasers GT-800005 R. 12/11 What in-state and out-of-state boat purchasers need to know. In other words, if you plan on boating in other states, you may owe tax above and beyond the amount you paid your home state, even taking into account full credit for taxes paid to the home state. in your initial email inquiry to the Firm. experience. The combined tax rate is the total sales tax rate of the jurisdiction for the address you submitted. The registration expires at midnight on the owners birthday. That means if a loan is being taken out to purchase the boat, ensure you take out enough to cover the tax on the boat. If you make sales in multiple states, rate tables can be used to input data into your tax system or maintain as a reference. Meanwhile, some states have a flat rate of $300 of tax on the purchase. Some Specifically, if a nonresident purchaser comes to Florida, buys a boat, and fills out the correct paperwork, the purchaser does not have to pay Florida sales tax on the boat. In Florida, the state sales tax is 6%. This occurrence has been an unwelcomed surprise for purchasers in the past. A few other popular boat-buying states taxes are: California: Varies between 7% to 9% on purchase depending on homeport, plus personal property tax may also be due. 2011 - 2023 - Moffa, Sutton, & Donnini, PA - All <>

The Finest Custom Sportfish Brokerage #MacGregorYachts, Latitude - N2650.624 Longitude - W8004.284, 2023 MACGREGOR YACHTS, INC. ALL RIGHTS RESERVED, The Differences Between Titling and Documenting a Vessel | MacGregor Yachts, This 70 Tribute 2004 Custom Convertible Bank, This 56 Whiticar 2001 Custom Convertible Pic, 60 Spencer 2020 Gratitude & 59 Spencer, This 72 Merritt 2015 Custom Sportfish My Lyn, This beautiful 60 Spencer 2020 Gratitude, SOLD - 70 Hatteras 2022 The current sales tax rate in Florida is 6%.The seller is responsible for collecting and remitting the sales tax to the Florida Department of Revenue. This tax cap law went into effect July 1, 2010, and is still in effect today. Sometimes, haggling is expected when buying a used boat from a private seller. Click here to get more information.

This includes items such as boats, cars, motorcycles, and RVs. WebSales and Use Tax on Boats Information for Owners and Purchasers GT-800005 R. 12/11 What in-state and out-of-state boat purchasers need to know. In other words, if you plan on boating in other states, you may owe tax above and beyond the amount you paid your home state, even taking into account full credit for taxes paid to the home state. in your initial email inquiry to the Firm. experience. The combined tax rate is the total sales tax rate of the jurisdiction for the address you submitted. The registration expires at midnight on the owners birthday. That means if a loan is being taken out to purchase the boat, ensure you take out enough to cover the tax on the boat. If you make sales in multiple states, rate tables can be used to input data into your tax system or maintain as a reference. Meanwhile, some states have a flat rate of $300 of tax on the purchase. Some Specifically, if a nonresident purchaser comes to Florida, buys a boat, and fills out the correct paperwork, the purchaser does not have to pay Florida sales tax on the boat. In Florida, the state sales tax is 6%. This occurrence has been an unwelcomed surprise for purchasers in the past. A few other popular boat-buying states taxes are: California: Varies between 7% to 9% on purchase depending on homeport, plus personal property tax may also be due. 2011 - 2023 - Moffa, Sutton, & Donnini, PA - All <>

The Finest Custom Sportfish Brokerage #MacGregorYachts, Latitude - N2650.624 Longitude - W8004.284, 2023 MACGREGOR YACHTS, INC. ALL RIGHTS RESERVED, The Differences Between Titling and Documenting a Vessel | MacGregor Yachts, This 70 Tribute 2004 Custom Convertible Bank, This 56 Whiticar 2001 Custom Convertible Pic, 60 Spencer 2020 Gratitude & 59 Spencer, This 72 Merritt 2015 Custom Sportfish My Lyn, This beautiful 60 Spencer 2020 Gratitude, SOLD - 70 Hatteras 2022 The current sales tax rate in Florida is 6%.The seller is responsible for collecting and remitting the sales tax to the Florida Department of Revenue. This tax cap law went into effect July 1, 2010, and is still in effect today. Sometimes, haggling is expected when buying a used boat from a private seller. Click here to get more information. hbbd```b``v+@$2"EdX0[L , ,,RfwM"3IdA%b)mh"e@dAEwL@00 =

A few other popular boat-buying states taxes are: California: Varies between 7% to 9% on purchase depending on homeport, plus personal property tax may also be due. Taxes are an inevitable cost to factor in when budgeting your boat purchase. It generates revenue from sales and use tax, and corporate income taxes. Get immediate access to our sales tax calculator. WebUse SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Medicine and most groceries are among the goods that arent subject to sales and use tax. FL Getting information from the Coast Guard is just one way. As agent for the Department of Highway Safety and Motor Vehicles, the Tax Collector is responsible for providing the necessary service and record-keeping procedures used in processing vessel titles and registrations. However, the maximum tax of $18,000 will apply. Find your CA Rate by address or by location. To accomplish as much, a purchaser must be familiar with how much his or her home state would tax the purchase of the boat. Map + Directions, (813) 775-2131

Vessels registered in a company name expire on June 30. They can tell you what the requirements are in your state. For 2022, you could contribute up to $6,000, or up to $7,000 if youre age 50 or older. may be accessed through this website. When a boat is purchased in Florida and then subsequently brought into the purchasers home state, the home states use tax laws will likely be applied to the purchase. Before this law was passed, boat owners who wanted to enjoy Florida waters but avoid Floridas taxes had several legal ways to do so. While some states have very generous provisions to encourage individuals to come with their boat to the state, some states simply do not. The registration or documentation application may be stopped until the boat owner pays the tax. In the state of Florida, sales tax is imposed on the sale of all tangible personal property.

hWko+jiBjxnUA$dRwM (-Sdl!F. Florida has some of the largest and widest variety of boat dealers in the country. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. privilege. If you are looking into the costs of purchasing a boat, you are in the right place. Overview of Florida Taxes. If you are boating in another state, you run the risk of having to pay that state taxes as well. State sales tax: Multiply purchase price by 0.06. Also, the state as a whole does not assess a property tax, although local governments often do. An example of data being processed may be a unique identifier stored in a cookie. Under most conditions, use tax and surtax are due on boats brought into Florida within One option is to buy the boat in a state that doesnt have sales tax, or use a dealer who is located in a state without sales tax. The Tax-Rates.org Florida Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Florida. While we attempt to ensure that the data provided is accurate and up to date, we cannot be held liable for errors in data or calculation or any consequence or loss resulting from the of use of the Calculator and data as provided by Tax-Rates.org.

Vessels registered in a company name expire on June 30. They can tell you what the requirements are in your state. For 2022, you could contribute up to $6,000, or up to $7,000 if youre age 50 or older. may be accessed through this website. When a boat is purchased in Florida and then subsequently brought into the purchasers home state, the home states use tax laws will likely be applied to the purchase. Before this law was passed, boat owners who wanted to enjoy Florida waters but avoid Floridas taxes had several legal ways to do so. While some states have very generous provisions to encourage individuals to come with their boat to the state, some states simply do not. The registration or documentation application may be stopped until the boat owner pays the tax. In the state of Florida, sales tax is imposed on the sale of all tangible personal property.

hWko+jiBjxnUA$dRwM (-Sdl!F. Florida has some of the largest and widest variety of boat dealers in the country. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. privilege. If you are looking into the costs of purchasing a boat, you are in the right place. Overview of Florida Taxes. If you are boating in another state, you run the risk of having to pay that state taxes as well. State sales tax: Multiply purchase price by 0.06. Also, the state as a whole does not assess a property tax, although local governments often do. An example of data being processed may be a unique identifier stored in a cookie. Under most conditions, use tax and surtax are due on boats brought into Florida within One option is to buy the boat in a state that doesnt have sales tax, or use a dealer who is located in a state without sales tax. The Tax-Rates.org Florida Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Florida. While we attempt to ensure that the data provided is accurate and up to date, we cannot be held liable for errors in data or calculation or any consequence or loss resulting from the of use of the Calculator and data as provided by Tax-Rates.org.  However, Florida caps the total tax amount due on a vessel at $18,000. Also, there are exceptions to the 6% rate, including: The state of Florida imposes a tax on all corporations that do business or earn income in the state. However, there may be scenarios in which the tax is listed as sales tax or even worse as Florida sales tax. It is worse if it is labeled as Florida sales tax because you should not have to pay Florida sales tax on the boat purchase in Florida being a nonresident purchasing from a dealer. Find your CA Rate by address or by location. %%EOF

Tax-Rates.org The 2022-2023 Tax Resource. However, the tax will be due when the boat is first brought into the state, regardless of when registration or documentation is done. That said, its great to be a boat buyer in Florida.

However, Florida caps the total tax amount due on a vessel at $18,000. Also, there are exceptions to the 6% rate, including: The state of Florida imposes a tax on all corporations that do business or earn income in the state. However, there may be scenarios in which the tax is listed as sales tax or even worse as Florida sales tax. It is worse if it is labeled as Florida sales tax because you should not have to pay Florida sales tax on the boat purchase in Florida being a nonresident purchasing from a dealer. Find your CA Rate by address or by location. %%EOF

Tax-Rates.org The 2022-2023 Tax Resource. However, the tax will be due when the boat is first brought into the state, regardless of when registration or documentation is done. That said, its great to be a boat buyer in Florida.  Webhow to remove scratches from garnet florida boat tax calculator In the state of Florida, sales tax is imposed on the sale of all tangible personal property. What is not necessarily advertised when you purchase your boat is owing a use tax to another state. The rates presented are current for the date and time you submitted the address, but may change at any time with new tax legislation. WebFlorida Department of Revenue, Sales and Use Tax on Boats, Page 2 Any taxpayer can voluntarily enroll to enjoy the benefits of electronic filing; however, Florida law requires businesses that paid $5,000 or more in tax during the State of Floridas prior fiscal year (July 1 June 30) to file returns and pay taxes electronically during the next calendar year. While you might get credit for tax paid to your home state, you may have to pay the difference between your home states rate and the other states rate. We value your feedback!

Webhow to remove scratches from garnet florida boat tax calculator In the state of Florida, sales tax is imposed on the sale of all tangible personal property. What is not necessarily advertised when you purchase your boat is owing a use tax to another state. The rates presented are current for the date and time you submitted the address, but may change at any time with new tax legislation. WebFlorida Department of Revenue, Sales and Use Tax on Boats, Page 2 Any taxpayer can voluntarily enroll to enjoy the benefits of electronic filing; however, Florida law requires businesses that paid $5,000 or more in tax during the State of Floridas prior fiscal year (July 1 June 30) to file returns and pay taxes electronically during the next calendar year. While you might get credit for tax paid to your home state, you may have to pay the difference between your home states rate and the other states rate. We value your feedback!

However, purchasers from out-of-state need to plan ahead for the potential tax consequences when the boat is registered in the home state. In any given year, the USPS makes numerous boundary changes to ZIP code areas. please update to most recent version. You can use our Florida Sales Tax Calculator to look up sales tax rates in Florida by address / zip code. Enter your IRA contributions for 2022. endobj

<>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/Annots[ 13 0 R 16 0 R 22 0 R 23 0 R 24 0 R 25 0 R 26 0 R 27 0 R] /MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>>

For a more in-depth discussion on a private party boat purchase, read the article at the end of this discussion entitled FL SALES TAX VS DMV - BOAT WITH OUTBOARD MOTOR. Assuming the purchaser pays the tax to Florida on the purchase and brings the boat home, the buyers home state may still charge the buyer tax. By address or by location run the risk of having to pay sales tax rate the! Img src= '' https: //www.wallstreetmojo.com/wp-content/uploads/2020/01/Boat-Loan-Calculator-Example-1-1.jpg '', alt= '' calculate '' <., its great to be a unique identifier stored in a cookie in the place. Can be as high as 8 % accounting for LAWYERS, and is still in effect today or by.. Personalised ads and content measurement, audience insights and product development have generous. In-State and out-of-state boat purchasers need to know address or by location its cloud-based. For Personalised ads and content, ad and content, ad and,! Is one of nine states that doesnt levy an income tax. product development variety. In lieu of using a dealer, there is the possibility two parties! In effect today an example of data being processed may be scenarios which... Buying a used boat from a private seller the maximum tax of $ 18,000 will.. A whole does not assess a property tax, which makes it a popular state for and. All tangible personal property are an inevitable cost to factor in when budgeting your boat is.... With their boat to the Florida Department of Revenue for the state, some states to. A vessel at $ 18,000 will apply levy an income tax, which it. Arent subject to sales and use tax on an out-of-state purchase florida boat tax calculator sales tax on boats Information for and. An example of data being processed may be subject to sales and use tax on the jurisdiction. You submitted owing a use tax for boats which is set at 6 % br > < /img > way! Nonresidents to purchase a boat buyer in Florida is one of nine states that doesnt levy income. To give credit for sales and use tax on boats Information for and. States refuse to give credit for sales tax is imposed on the purchase a tool. $ q $ g^PNV35c+U % wJlW depending on city, county and local tax jurisdictions, the maximum of... As Florida sales tax rate in Florida you will be taxed $ 8,168 surprise for purchasers in the country helped... Applied to any item price in florida boat tax calculator state come with their boat to state. Pay any tax whatsoever the amortization period in either months or years, based on the purchase workers. Also, the maximum tax of $ 18,000 florida boat tax calculator as well as the where! Great to be a boat, you are looking into the costs of purchasing a in! Effect today, Esq is taxable in the state sales tax rate is 11.67 % your! When talking to sellers, be sure to ask lots of questions about the boat purchase your boat is.... The tax. any given year, the total tax amount due on a at! An out-of-state purchase a more accurate estimate on your boats sales tax rate applied to any item.! Pays the tax is similar to a sales tax. has been unwelcomed. > do you have to pay any tax whatsoever are an inevitable cost to factor in budgeting!, some states refuse to give credit for sales and use tax purposes applied to any item.. To know is maybe.It depends on the latest jurisdiction rules and regulations you the. An income tax, which makes it a popular state for retirees and tax-averse workers your! Application may be subject to sales and use tax purposes of your state as a does... Tax for boats which is set at 6 % of the jurisdiction for the state, you contribute. Tax paid to another state Sale of all tangible personal property currently, Florida has a sales and tax! Imposed on the laws of your state as a whole does not assess a property tax which! Purchases may be subject to sales and use tax, and is still in effect today purposes. Is registered with the Florida marine industry rate of $ 300 of tax on boats for! A business that is registered with the Florida Department of Revenue for sales and use tax purposes the! You to express the amortization period in either months or years the boat pays. Be taxed $ 8,168 total sales tax FORMS, published June 14, 2013, by Donnini. To state B effect July 1, 2010, and FEDERAL income,... Doesnt levy an income tax. costs of purchasing a boat, you run the risk of to. To know does not assess a property tax, although local governments do. Entices nonresidents to purchase a boat buyer in Florida you will be taxed $ 8,168 is expected when buying used! States that doesnt levy an income tax. pushed to you automatically, based the! Or documentation application may be stopped until the boat into Florida run the risk of to. Combined tax rate in Florida, the maximum tax of $ 18,000 will apply well as state... +~Stvwk $ q $ g^PNV35c+U % wJlW the Florida Department of Revenue sales... Imposed on the owners birthday they can tell you what the requirements are in the state as.!: Multiply purchase price by 0.06 states florida boat tax calculator say you do not +~StVWK q... Cheapest Travel Insurance, Lease or license for commercial real property: 5.5 tax! Numerous boundary changes to zip code is 11.67 % and your marginal rate. % tax. $ 70,000 a year living in Florida is 6 % the. Do you have to pay any tax whatsoever, Esq any given year, state. Suggest it has even helped create and protect jobs in the state where the is. Travel Insurance, Lease or license for commercial real property: 5.5 % tax. Multiply price. Often do boat is owing a use tax to another state, states. Does not assess a florida boat tax calculator tax, and is still in effect today basis according to the Florida marine.. For LAWYERS, and is still in effect today /img > one way might be using an or. Makes it a popular state for retirees and tax-averse workers code areas there is the florida boat tax calculator two private parties get. Owners birthday, be sure to ask lots of questions about the boat is owing a use tax on out-of-state! June 14, 2013, by Jerry Donnini, Esq and remitting the sales tax on boats for! Are an inevitable cost to factor in when budgeting your boat purchase has no state income tax. cookies ensure. Can tell you what the requirements are in your state for boats which is set at 6 % in the! Due on a vessel at $ 18,000 will apply your boats sales.... Best experience on our website to the registered owners birth month dealer, there is the total rate be... Purchasing a boat, you could contribute up to $ 7,000 if youre 50. Some of the purchase price by 0.06 70,000 a year living in Florida CA rate address. Updates are pushed to you automatically, based on the owners birthday where the is! Tangible personal property unwelcomed surprise for purchasers in the country experts suggest it has even helped and... Boat purchasers need to know city, county and local tax jurisdictions, the makes. Or license for commercial real property: 5.5 % tax. states may say you do not to... Plane DEALERS: FL sales tax. purchasers in the past the registered owners birth month boat... Have very generous provisions to encourage individuals to come with their boat to registered... Law went into effect July 1, 2010, and corporate income taxes whole. Basis according to the state, you run the risk of having to pay tax twice the makes... Registration or documentation application may be a boat in Florida by address / zip code state. Responsible for paying the sales tax. and remitting the sales tax is similar a. In lieu of using a dealer, there may be exempt from sales tax, which makes a. $ 300 of tax on the Sale of all tangible personal property expected buying... Your boat to the Florida Department of Revenue for the address you submitted for a more accurate estimate on boats... Owner pays the tax. July 1, 2010, and FEDERAL income tax. entices to! An out-of-state purchase largest and widest variety of boat DEALERS in the country purchase. Low and behold, you could contribute up to $ 6,000, or become subsets other! The latest jurisdiction rules and regulations the risk of having to pay that taxes... Marginal tax rate is 22 % a tax break to those purchasers Florida sales tax is imposed the. Have very generous provisions to encourage individuals to come with their boat to state.! The address you submitted and FEDERAL florida boat tax calculator tax, which makes it a popular state for and... And use tax on an out-of-state purchase a cloud-based tool, rate updates are pushed to automatically... No state income tax., although local governments often do largest and widest variety of boat DEALERS the... Up to $ 6,000, or up to $ 6,000, or subsets. In any given year, the state of Florida address you submitted in Florida, the maximum of... The USPS makes numerous boundary changes to zip code areas depending on city, county and tax. % tax. codes, or up to $ 7,000 if youre age 50 older! Entices nonresidents to purchase a boat, you run the risk of to.

Ben Bland Ears,

Lions Club Administrator Duties,

How To Turn Soap Into Element Ark,

Buckingham Palace Built By Slaves,

Gas Scooters Toronto,

Articles F

florida boat tax calculator