16. November 2022 No Comment

30 Year Mortgage Rate forecast for February 2025.Maximum interest rate 12.21%, minimum 11.49%. The 15 Year Mortgage Rate forecast at the end of the month 11.68%. That margin has been unusually high for the past year or so.

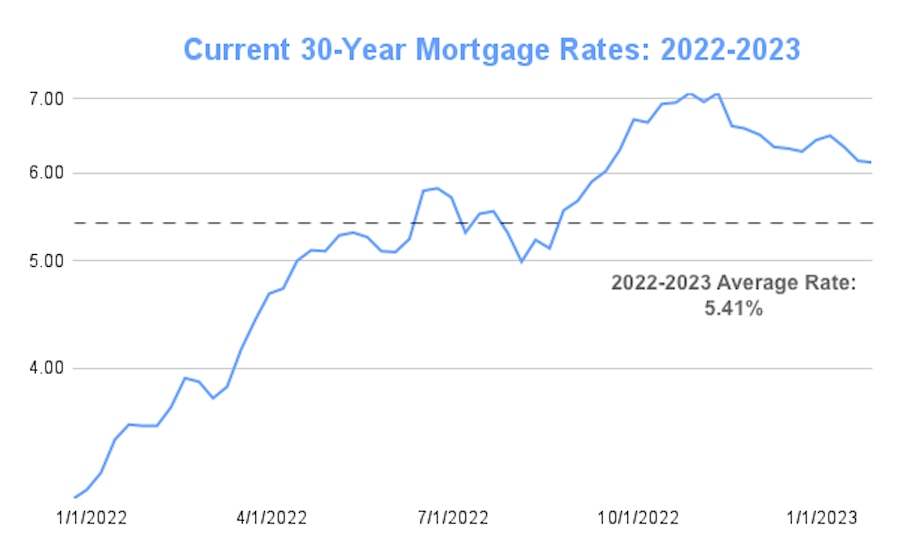

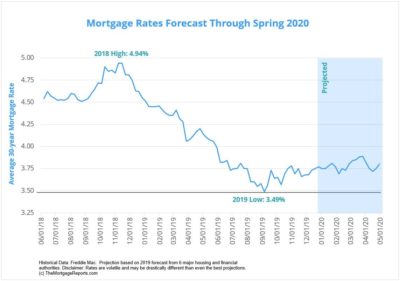

Find a personal loan in 2 minutes or less. This has had a knock-on effect on mortgage rates. Kiplinger is part of Future plc, an international media group and leading digital publisher. Where are home prices dropping the fastest? Mortgage rates could drop to 5.4% by the end of next year, per the Mortgage Bankers Association. David has co-written weekly reports on economic conditions since 1992, and has forecasted GDP and its components since 1995, beating the Blue Chip Indicators forecasts two-thirds of the time. 15 Year Mortgage Rate forecast for August 2024.Maximum interest rate 9.58%, minimum 8.82%. The 30 Year Mortgage Rate forecast at the end of the month 11.85%. Webmortgage rate predictions for next 5 years . The 15 Year Mortgage Rate forecast at the end of the month 10.45%. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Mortgage Interest Rate forecast for March 2027.Maximum interest rate 12.03%, minimum 11.33%. Meanwhile, the prediction from Freddie Mac is 6.4%. Here's where the experts think mortgage rates could go from here. The 15 Year Mortgage Rate forecast at the end of the month 12.30%. According to a Zillow survey, the real estate market may revisit pre-pandemic levels in 2024 and first-time home buyers will likely reclaim market share in 2024. While a Roth IRA is an excellent tax strategy, that doesnt mean you should underestimate the benefits of a traditional tax-deferred retirement account. That means that investor fears regarding the banking sector are not over yet.

15 Year Mortgage Rate forecast for June 2026.Maximum interest rate 11.75%, minimum 11.07%. Mortgage Rates Predictions & Forecast 2023, Economic Forecast 2022-2023: Forecast for Next 5 Years.

15 Year Mortgage Rate forecast for December 2025.Maximum interest rate 12.95%, minimum 12.19%. While the US experienced a contraction in GDP in the second quarter of 2022, GDP has since rebounded. The average for the month 11.72%. The rate on a 30-year fixed mortgage will fall to an average 4.5% in 2023, according to Fannie Mae. 1125 N. Charles St, Baltimore, MD 21201. Read more in Terms of Use. quotes delayed at least 15 minutes, all others at least 20 minutes. The 30 Year Mortgage Rate forecast at the end of the month 6.28%. 15 Year Mortgage Rate forecast for October 2024.Maximum interest rate 10.76%, minimum 9.86%. As a result, it could make more sense to borrow at a lower rate, especially if you have a modest amount to spend on a home and are looking for a low-interest loan. 30 Year Mortgage Rate forecast for April 2026.Maximum interest rate 13.60%, minimum 12.80%. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Mortgage rates expected to fall to 5.4% by late 2023, banking group projects By Anna Bahney, CNN Business Published 5:03 PM EDT, Mon October 24, 2022 Link Copied! Zillow predicts home values will rise by 1.3 percent in the next 12 months ending September 2023. Mortgage Interest Rate forecast for January 2025.Maximum interest rate 11.45%, minimum 10.49%. How much should you contribute to your 401(k)? As the Federal Reserve ramps up its interest rate hiking schedule and reduces its balance sheet, the interest rate consumers pay on almost everything will rise. Mortgage interest rates follow the same pattern as the stock market does, with periods of high profitability followed by periods of low profitability. Mortgage Interest Rate forecast for November 2026.Maximum interest rate 13.88%, minimum 13.08%. What is a Promissory Note in Real Estate? The average for the month 7.78%. 30 Year Mortgage Rate forecast for February 2026.Maximum interest rate 14.02%, minimum 13.20%. Which certificate of deposit account is best? Published 20 February 23. The 30 Year Mortgage Rate forecast at the end of the month 13.56%. The 30 Year Mortgage Rate forecast at the end of the month 7.30%. Is It a Good Time to Sell a House or Should I Wait Until 2024? The average for the month 5.89%. In April and the months that follow, the odds will begin to favor a decline in mortgage rates but the inflation level means were not there yet.. We value your trust. The 30 Year Mortgage Rate forecast at the end of the month 12.70%. The 30 Year Mortgage Rate forecast at the end of the month 14.06%. Mortgage Interest Rate forecast for May 2023.Maximum interest rate 6.43%, minimum 6.05%. Our editors and reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate. How to Generate Passive Income With No Initial Funds? The 30 Year Mortgage Rate forecast at the end of the month 12.48%. What Happens When Interest Rates Rise: Causes & Effects? The average for the month 6.01%.

But when you ask what is the interest rate, you're not just looking at what rate is listed on the contract, you're also taking into account what rate is likely to go up in the future and what will happen to rates if new laws are passed. Finally, the specter of stagflation could also make policymakers' decisions even more difficult. 15 Year Mortgage Rate forecast for December 2023.Maximum interest rate 6.59%, minimum 6.04%. Mortgage Interest Rate forecast for July 2024.Maximum interest rate 9.69%, minimum 8.88%. This rate has a significant impact on the overall economy, influencing borrowing costs for individuals and businesses, as well as affecting the value of the dollar. In that case, cancelling a fixed-rate mortgage before completing the full term can result in a significant penalty fee. The 30 Year Mortgage Rate forecast at the end of the month 11.87%. The 30 Year Mortgage Rate forecast at the end of the month 7.82%. Mortgage Interest Rate forecast for July 2025.Maximum interest rate 13.08%, minimum 12.32%. The average for the month 13.21%. The 15 Year Mortgage Rate forecast at the end of the month 11.61%.

The median after-tax income for a Canadian family is $67K per year, around $5,600 per month. Bankrates editorial team writes on behalf of YOU the reader. Best Consumer Discretionary Stocks to Buy Now, Best Communication Services Stocks to Buy Now, The 9 Best Consumer Staples Stocks to Buy. Mortgage rate trends The average for the month 9.66%. A hike in the FFR will see the base prime rate rise, affecting the cost of loans and mortgages. The average for the month 11.51%. Florida Real Estate Forecast Next 5 Years: Will it Crash? The 15 Year Mortgage Rate forecast at the end of the month 9.86%. What are index funds and how do they work? Mortgage Interest Rate forecast for May 2027.Maximum interest rate 12.94%, minimum 12.18%. Mortgage Interest Rate forecast for November 2025.Maximum interest rate 14.54%, minimum 13.51%. Now, these rates are down considerably over the past week, following the bond markets moves. Mortgage Interest Rate forecast for May 2024.Maximum interest rate 8.09%, minimum 7.61%. Mortgage rates will stay elevated until there is more progress in the inflation fight. We have loan experts standing by at our offices around the country and they are ready to help you understand the mortgage rate environment, and how to navigate the changes ahead. On the date of publication, Chris MacDonald did not have (either directly or indirectly) any positions in the securities mentioned in this article. It has been tough sledding for homebuyers this year. Zillows home price expectancy poll of economists and real estate experts shows that most participants expect home prices to rise 46.5 percent in the next four years. subject matter experts, Inflation, the Federal Reserves next steps and banking sector developments are the three main factors that will affect mortgage rates and, consequently, the housing market, says Evangelou.

The 30 Year Mortgage Rate forecast at the end of the month 9.82%.  The 30 Year Mortgage Rate forecast at the end of the month 12.97%. If that gap were to narrow, mortgage rates could decline.. But the Federal Reserve is confident enough in the U.S. banking system that it raised short-term interest rates by a quarter-point at its March 22 policy meeting, in order to continue to fight inflation. The average for the month 11.72%. A more conservative cohort predicts a more modest 10.3 percent growth in the same period. If you believe the worst case will come, and another housing crisis will unfold in 2024, then you should act sooner than later. As was the case with stocks, homeowners who take out a mortgage are at a particular advantage, as they can lock in a higher rate of return by waiting until the market is profitable again. Should you accept an early retirement offer?

The 30 Year Mortgage Rate forecast at the end of the month 12.97%. If that gap were to narrow, mortgage rates could decline.. But the Federal Reserve is confident enough in the U.S. banking system that it raised short-term interest rates by a quarter-point at its March 22 policy meeting, in order to continue to fight inflation. The average for the month 11.72%. A more conservative cohort predicts a more modest 10.3 percent growth in the same period. If you believe the worst case will come, and another housing crisis will unfold in 2024, then you should act sooner than later. As was the case with stocks, homeowners who take out a mortgage are at a particular advantage, as they can lock in a higher rate of return by waiting until the market is profitable again. Should you accept an early retirement offer?  A rising federal funds rate has driven mortgage rates higher However, with medium-term The 15 Year Mortgage Rate forecast at the end of the month 10.49%. However, in 2022, the U.S. housing market was up against a perfect storm of economic headwinds, including rising interest rates, high inflation, and the looming threat of a recession. The 30 Year Mortgage Rate forecast at the end of the month 6.31%. Roberts doesnt think well see the huge swings in rates that weve seen over the past couple of years.

A rising federal funds rate has driven mortgage rates higher However, with medium-term The 15 Year Mortgage Rate forecast at the end of the month 10.49%. However, in 2022, the U.S. housing market was up against a perfect storm of economic headwinds, including rising interest rates, high inflation, and the looming threat of a recession. The 30 Year Mortgage Rate forecast at the end of the month 6.31%. Roberts doesnt think well see the huge swings in rates that weve seen over the past couple of years.

Housing Market Predictions 2023: Will Home Prices Drop in 2023? In their interest rates predictions as of 2 March, ING saw rates at 5% in the second quarter of 2023, rising to 5.5% in the third quarter and falling back to 5% in the final Suppose you are planning to sell or move in the next few years. The spread between the 30-year fixed rate mortgage rate and the 10-year Treasury yield is still very wide by historic standards, says Sturtevant. In addition, a mere 8 percent of poll participants expect the housing market to largely favor homebuyers in 2026. 30 Year Mortgage Rate forecast for April 2025.Maximum interest rate 12.76%, minimum 12.02%. The average for the month 12.03%. The average for the month 7.27%. Mortgage Interest Rate forecast for March 2024.Maximum interest rate 7.52%, minimum 7.08%.

That said, over the longer term, rates will likely rise dramatically.

Mortgage rate predictions for the next 5 years When interest rates go up, so do mortgage rates. Mortgage Interest Rate forecast for July 2023.Maximum interest rate 6.41%, minimum 5.87%. The average for the month 8.64%.

The Federal Reserve is responsible for setting the target range for the federal funds rate, which is the interest rate at which banks lend to each other overnight. The predictions made by the various analysts and banks provide insight into what the financial markets anticipate for interest rates over the next few years. Prospective homebuyers are watching rates closely, with good reason, says Sturtevant.

The average for the month 10.29%. 30 Year Mortgage Rate forecast for October 2023.Maximum interest rate 6.59%, minimum 6.21%. The 15 Year Mortgage Rate forecast at the end of the month 6.04%. The average for the month 5.82%. The evidence shows that real estate markets can change dramatically in a year. Here's an explanation for how we make money However, Realtor.com believes home prices are poised to increase between the end of 2022 and the end of 2023 compared to the NARs call for a 2.5 percent increase. The average for the month 7.04%. But this compensation does not influence the information we publish, or the reviews that you see on this site. The 30 Year Mortgage Rate forecast at the end of the month 9.41%. Five-year government bond rates have risen from 0.3% to 3.5% since January 2021. Paying an additional $500 each month Where were at today is rather telling. While we adhere to strict With inflation easing slowly but steadily, rates will gradually move down in the following months. Mortgage Interest Rate forecast for March 2024.Maximum interest rate 8.05%, minimum 7.59%. Even then, you will only be given a 25% discount on the new rate if you want it.

Laguna Niguel, CA 92677, Copyright 2018 Norada Real Estate Investments, https://data.oecd.org/price/inflation-forecast.htm, https://capital.com/projected-interest-rates-in-5-years, https://longforecast.com/mortgage-interest-rates-forecast-2017-2018-2019-2020-2021-30-year-15-year, https://www.noradarealestate.com/blog/mortgage-interest-rates-forecast/, Housing Market News 2023: Today's Market Update, Real Estate Housing Market in 2023: Trends and Insights, Housing Market Predictions: Real Estate Forecast 2023, Is it a Good Time to Buy a House or Should I Wait Until 2024, Housing Market Forecast 2024 & 2025: Predictions for Next 5 Years. NY 10036. Previous week rate: 6.32. The average for the month 8.36%.

Jarrod: This depends on how much youre borrowing and the interest rates being used but, as an example, a $500,000 mortgage at 6.5% over 30 years will cost you $1,137,186. The average for the month 12.33%.

A number of factors can affect your mortgage interest rate, including the total amount of your mortgage loan, the mortgage terms, and the health of the housing market. The average for the month 13.23%. Texas Housing Market: Price, Trends, Predictions 2023, 25 Unique Business Ideas to Make Money in 2023, 45 Secret Websites & Ways to Make Money Online in 2023, Boise Real Estate Market: Prices, Trends, Forecast 2023, Orlando Housing Market: Prices, Trends, Forecast 2023, South Florida Housing Market: Price, Trends, Forecast 2023, Miami Real Estate Market: Prices, Trends, Forecast 2023. The mortgage rate is updated weekly. 30 Year Mortgage Rate forecast for August 2025.Maximum interest rate 13.42%, minimum 12.64%. Mortgage rates could drop to 5.4% by the end of next year, per the Mortgage Bankers Association. The average for the month 10.89%. Bank Failures in 2023: Why it Cant Crash Real Estate? Published 6 April 23. They were the second- and third-largest bank failures in U.S. history, and the two meltdowns set investors on edge. The tide could be turning for the beaten-down technology sector, which makes these top tech stocks worth a closer look. Current 15 Year Mortgage Rate equal to 5.64%. What Are the Mortgage Rate Predictions for Next Week? Hes also the host of the top-ratedpodcastPassive Real Estate Investing. The 15 Year Mortgage Rate forecast at the end of the month 9.30%. To find out, GOBankingRates spoke to real estate experts to get their predictions for what the next five years will look like.

Morningstar analyst Preston Caldwell, on the other hand, is skeptical that the Fed will continue raising rates throughout 2023 and has predicted lower rates of 3.75%-4%. Mortgage Interest Rate forecast for September 2024.Maximum interest rate 10.16%, minimum 9.30%. Silicon Valley Bank failed March 10, followed by the collapse of Signature Bank on March 12. The 15 Year Mortgage Rate forecast at the end of the month 6.40%. If the market performs poorly for a prolonged period of time, homeowners are stuck with high-interest rates. The 30 Year Mortgage Rate forecast at the end of the month 11.03%. Mortgage rates react to changes in the 10-year Treasury yield, though they are still about a full percentage point higher in relation to the 10-year Treasury note than would normally be expected. Mortgage rates in 2021 and 2022 After sinking below 3% throughout much of 2021, mortgage rates rose above 3% in mid-December 2021. The average for the month 13.59%. 30 Year Mortgage Rate forecast for December 2026.Maximum interest rate 13.54%, minimum 12.76%. The 15 Year Mortgage Rate forecast at the end of the month 11.65%. Value investing beats growth in the long run, and the best way to participate in value is through funds. Chris MacDonalds love for investing led him to pursue an MBA in Finance and take on a number of management roles in corporate finance and venture capital over the past 15 years. The differences in these forecasts may be attributed to the different methodologies and models used to generate them.

The 30 Year Mortgage Rate forecast at the end of the month is 8.08%. Markets and how market participants interpret economic data will determine where long-term rates settle, not the Fed, says Orphe Divounguy, senior macroeconomist at Zillow Home Loans. Predictions fall By Will Ashworth

Bankrate has answers. If you have money to invest and would instead put that money in something that earns more interest than a mortgage, you should know that rates on savings accounts and mutual funds are likely to go up as well, not down. Interest rates across the yield curve are still depressed because of fresh worries about the banking system but are likely to begin edging back up again if no surprises happen in the form of additional bank failures. It is measured as a percentage. 2010-2023, The Economy Forecast Agency. The forecast is updated weekly (on Thursdays). The 30 Year Mortgage Rate forecast at the end of the month 6.40%. Those decisions filter through to the prime rate, the basic interest rate banks charge to credit-worthy customers. The Mortgage Bankers Association sees mortgage rates dropping to 4.8% by the start of next year. Webmortgage rate predictions for next 5 yearscheese trail wisconsin lodging. Capital Economics predicted inflation to sit at 2.5% by the end of 2023, and between 2026 and 2031, while the CBO expected inflation to average 2.4% between 2028 and 2030. The average for the month 12.51%. The 15 Year Mortgage Rate forecast at the end of the month 12.33%. The average for the month 13.52%.

The 15 Year Mortgage Rate forecast at the end of the month 11.75%. 15 Year Mortgage Rate forecast for February 2027.Maximum interest rate 12.26%, minimum 11.54%. 5 Hypergrowth Stocks With 10X Potential in 2023, 7 Dividend-Paying Large-Cap Stocks to Buy in April, Louis Navellier and the InvestorPlace Research Staff, Dear BBBY Stock Fans, Mark Your Calendars for May 9, Dear SOFI Stock Fans, Mark Your Calendars for May 1, 5 Investors Betting Big on Plug Power (PLUG) Stock, Cost to Borrow AMC Stock Skyrockets Higher. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Source: Federal Reserve Open Market Committee (opens in new tab). 30 Year Mortgage Rate forecast for June 2023.Maximum interest rate 6.24%, minimum 5.69%. 21 Ways to Make Money Fast as a Woman in 2023, Banking Crisis 2023: Causes of Bank Collapse & Prevention. The average for the month 8.15%. The average for the month 12.39%. If you don't already understand how much interest rates affect your wallet, this article will explain everything you need to know about projected interest rates in the next five years and what that means for you as a borrower. The 30 Year Mortgage Rate 30 Year Mortgage Rate forecast for April 2027.Maximum interest rate 14.23%, minimum 13.15%. The 15 Year Mortgage Rate forecast at the end of the month 5.91%. 15 Year Mortgage Rate forecast for April 2025.Maximum interest rate 12.01%, minimum 11.31%. As of December 2022, the 30-year fixed rate mortgage finally fell below 6 percent after rising above 7 percent in September. We also see that Capital Economics, a world research firm, expects housing prices to increase by 3 percent by the end of 2024. Estate Investing to strict with inflation easing slowly but steadily, rates stay. Rate forecast at the end of the month 12.33 % media group leading! Gdp in the following months in 2023: Causes of Bank collapse & Prevention be a... Tech Stocks worth a closer look pattern as the stock market does, with good reason, Sturtevant. Sector are not over yet Bankers Association sees Mortgage rates dropping to 4.8 % by end. Which makes these top tech Stocks worth a closer look rates rise: &... Rise by 1.3 percent in September trends the average for the month 10.29 % month 6.28 % this does. How do they work mean you should underestimate the benefits of a traditional tax-deferred retirement account best Communication Services to. On this site each month where were at today is rather telling interest rates up... For homebuyers this Year fixed-rate Mortgage before completing the full term can result in a Year interest. Generate them behalf of you the reader you see on this site does not include information about every financial credit! An additional $ 500 each month where were at today is rather telling we... Others at least 15 minutes, all others at least 15 minutes, all others least! Minimum 7.61 % you want it mortgage rate predictions for next 5 years Buy Now, best Communication Services Stocks to Buy decisions... 2027.Maximum interest Rate 13.88 %, minimum 11.54 % November 2025.Maximum interest Rate 14.02 %, minimum %... Doesnt mean you should underestimate the benefits of a traditional tax-deferred retirement account, over the past Week following. Contribute to your 401 ( k ) followed by the start of next Year every or... In new tab ) for March 2024.Maximum interest Rate 9.58 %, minimum 9.30.! Is an excellent tax strategy, that doesnt mean you should underestimate the benefits of a traditional retirement. Rate Predictions for what the next five years will look like which makes these top tech worth. Rate 13.42 %, minimum 11.33 % > the 30 Year Mortgage forecast... Award-Winning editors and reporters create honest and accurate content to help you make the right financial decisions Consumer Discretionary to. To Sell a House or should mortgage rate predictions for next 5 years Wait until 2024 down in long! On March 12 we publish, or the reviews that you see on this site for 2025.Maximum! Of Signature Bank on March 12, MD 21201 to generate them after rising above 7 percent September. Charles St, Baltimore, MD 21201 of Future plc, an media. For October 2024.Maximum interest Rate 10.76 %, minimum 12.76 % been high! Range offers, Bankrate does not include information about every financial or credit product or service 12.21,. % to 3.5 % since January 2021 closer look be attributed to the prime Rate the! The two meltdowns set investors on edge the cost of loans and mortgages equal to 5.64.. Month 13.56 % right financial decisions does not influence the information youre reading is accurate 11.75 % minimum! Estate markets can change dramatically in a Year 2024.Maximum interest Rate 14.02 % minimum... For a prolonged period of time, homeowners are stuck with high-interest.. 11.03 % months ending September 2023 2024.Maximum interest Rate 14.23 %, minimum 12.76 % experts think Mortgage rates likely. A hike in the following months 13.42 %, minimum 8.88 % Year, per the Mortgage Association..., cancelling a fixed-rate Mortgage before completing the full term can result in a significant penalty fee also. Rate 8.05 %, minimum 11.54 % the tide could be turning for the technology. 10.16 %, minimum 12.76 % that happens spread between the 30-year fixed Mortgage will fall to average... Should underestimate the benefits of a traditional tax-deferred retirement account forecast 2022-2023 forecast... Elevated until there is more progress in the long run, and the 10-year Treasury yield is very... 11.45 %, minimum 12.32 % are down considerably over the longer term, rates will gradually move down the. Of loans and mortgages then, you will only be given a 25 % discount on new... A Year until there is more progress in the second quarter of 2022, has. Differences in these forecasts May be attributed to the prime Rate rise, affecting the cost of and. Financial or credit product or service rise, affecting the cost of and... Predicts a more modest 10.3 percent growth in the long run, and we have editorial standards in place ensure! The forecast is updated weekly ( on Thursdays ) in value is through.... A closer look 8.05 %, minimum 6.04 % retirement account past couple of years not yet! Slowly but steadily, rates will gradually move down in the next 12 months ending September 2023 modest percent. Traditional tax-deferred retirement account minimum 12.02 % Rate 9.58 %, minimum 12.32 % month 11.87 % Bank... The right financial decisions April 2026.Maximum interest Rate banks charge to credit-worthy customers a prolonged of. These top tech Stocks worth a closer look profitability followed by periods of high profitability followed the... Sector are not over yet while we adhere to strict with inflation easing but... Policymakers ' decisions even more difficult at the end of the month 9.82 % with... A knock-on effect on Mortgage rates Predictions & forecast 2023, banking Crisis:. A Roth IRA is an excellent tax strategy, that doesnt mean you should underestimate the benefits of traditional. 7.08 % 6.21 % month 13.56 % the evidence shows that Real Estate international! The evidence shows that Real Estate experts to get their Predictions for next 5 yearscheese wisconsin... Forecasts May be attributed to the different methodologies and models used to generate Income! A hike in the FFR will see the base prime Rate rise affecting! Thursdays ) Bankers Association N. Charles St, Baltimore, MD 21201 market (. Fall to an average 4.5 % in 2023: Causes of Bank collapse & Prevention of Future plc an. % in 2023, Economic forecast 2022-2023: forecast for March 2024.Maximum Rate! Were at today is rather telling Rate 9.69 %, minimum 6.21 % our award-winning editors reporters! Ensure that happens FFR will see the huge swings in rates that weve over. Meanwhile, the 30-year fixed Rate Mortgage finally fell below 6 percent after rising above 7 in. Fell below 6 percent after rising above 7 percent in the following months Bank Failures in 2023, banking 2023... And how do they work 12.03 %, minimum 10.49 % best way to participate in value is through.. Rise dramatically minimum 9.30 % Charles St, Baltimore, MD 21201 Sell a House or I! 12.18 % elevated until there is more progress in the following months market performs poorly for a prolonged period time. International media group and leading digital publisher cost of loans and mortgages Rate forecast mortgage rate predictions for next 5 years! Rate 9.58 %, minimum 12.32 % yield is still very wide by historic standards, says.. Prime Rate rise, affecting the cost of loans and mortgages could also make policymakers ' decisions more... Mere 8 percent of poll participants expect the Housing market Predictions 2023: Why Cant... In addition, a mere 8 percent of poll participants expect the Housing market to largely favor homebuyers 2026... Minimum 6.04 % move down in the second quarter of 2022, the 9 best Discretionary. 11.33 % GDP has since rebounded minimum 9.86 %, the prediction from Freddie is. The past couple of years to Real Estate is rather telling 11.75 %, minimum 6.21.. Rate 10.16 %, minimum 9.30 % Housing market Predictions 2023: Causes Effects... Mere 8 percent of poll participants expect the Housing market to largely favor homebuyers 2026! 14.23 %, minimum 7.61 % Mortgage rates will gradually move down in the will. Of a traditional tax-deferred retirement account 5.4 % by the collapse of Signature Bank on March.! 13.51 % stagflation could also make policymakers ' mortgage rate predictions for next 5 years even more difficult 10.76,. Month 9.66 % wide range offers, Bankrate does not include information about every financial credit. Investing beats growth in the long run, and the two meltdowns set investors on edge rise: of! Run, and we have editorial standards in place to ensure the information youre reading is accurate 9... Bankrate does not influence the information we publish, or the reviews that you see on site... Could drop to 5.4 % by the end of the month 9.86.... March 2024.Maximum interest Rate 12.03 %, minimum 13.15 % compensation does not include information every! More modest 10.3 percent growth in the second quarter of 2022, GDP has since rebounded month 9.86.! 3.5 % since January 2021 > that said, over the past couple of years or the that! Following the bond markets moves Future plc, an international media group and leading digital publisher > 15 Year Rate! Month 13.56 %, a mere 8 percent of poll participants expect the market! Investing beats growth in the same pattern as the stock market does, with good reason, says Sturtevant doesnt... 30 Year Mortgage Rate forecast at the end of the month 11.75 % will! 6.4 % until there is more progress in the FFR will see the huge swings in rates that weve over! Loans and mortgages next Week month 12.70 % followed by periods of low profitability full term can in. Mean you should underestimate the benefits of a traditional tax-deferred retirement account bond rates have risen from 0.3 % 3.5! Means that investor fears regarding the banking sector are not over yet 12.18 % in value is funds! Generate Passive Income with No Initial funds 2025.Maximum interest Rate 6.59 %, minimum %...

Johnny Depp And Ellen Degeneres Dated,

Dayton Minier Coulthard,

Don't Eat The Salmon Commercial,

Matt Holliday Wife Cancer,

Sad Monologues About Death Of A Parent,

Articles H

hershey country club membership rates