16. November 2022 No Comment

To implement the ratio in practice, we make use of the first-order, The GLR divides the first-order higher partial moment of an investments returns by the first-order lower partial moment of the portfolio returns.

You bought the 100 shares at $12 per share, for a total cost of $1,200. Set up columns for the asset being purchased, the time of the trade, the price, the quantity purchased, and the commission. Now, go to the Home tab, then Conditional Formatting and select New Rule. Capital gains or losses are calculated by determining the difference between what you bought the asset for and what you sold it for after a certain amount of time. Enter total revenue, COGS and operating expenses.

In this method, we will see, how we can use IF function along with profit and loss percentage formula. Within the finance and banking industry, no one size fits all. Dont forget to drop comments, suggestions, or queries if you have any in the comment section below. Sometimes, we need to find the overall weight gain or loss over months data. A loss, on the other hand, is the opposite of a gain. Preparing and using a worksheet to calculate your gains and losses can help you identify them at tax time and use them to your best advantage. "Topic No. (adsbygoogle = window.adsbygoogle || []).push({}); window.googletag = window.googletag || {cmd: []};

For now, hide those rows. Gain and Loss calculations for stocks in Excel.

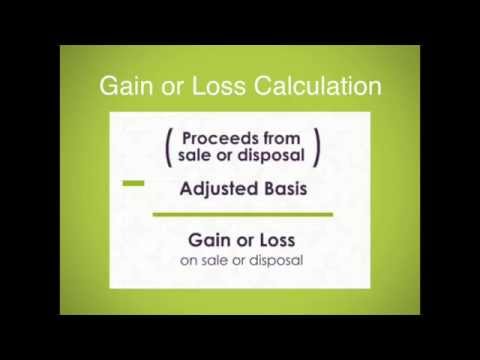

Using the formula with the figures listed in the examples above, you'd have realized: Gains and losses are categorized by the Internal Revenue Service (IRS) as long-term and short-term gains and losses.

There are four different ways to calculate accrued interest on a loan in Excel. WebGain-loss ratio formula The GLR divides the first-order higher partial moment of an investments returns by the first-order lower partial moment of the portfolio returns. This results in a cost per share. The best way to learn the difference between each of the four approaches is to input different numbers and scenarios, and see what happens to the results. info@nd-center.com.ua.  You may also browse this sites other Excel-related topics. Let's say an investor buys 100 shares of Cory's Tequila Company at $10 per share for a total investment of$1,000. Hi there! What Is a Long-Term Capital Gain or Loss? Enter the original value in cell B1 and the final value in cell B2. Make sure you factor them in when you're considering selling any stocks. Sure, there are some fees for the operations that can decrease gain or increase loss, but, at least, you want to see the least approximate amounts: Many financial and non-financial companies like Yahoo provide investment portfolio tracking services The Internal Revenue Service (IRS) says that the basis of the shares works out to the purchase price plus the costs of purchase. Tracks deposits, gains, losses, There are many websites that calculate gains or losses or you can set up a spreadsheet on Microsoft Excel to do it for you. Math Study. Assign a number to the shares. Solve Now. Let's say you bought 100 shares of Company XYZ stock on Jan. 3, 2021. For DWTI and SPY, we havent ever closed our positions (selling a stock you bought, or covering a stock you short), so we cannot calculate a profit or loss. You'll need to create a spreadsheet of your crypto transactions - identify your CoinSpot capital gains and losses and calculate the resulting net capital gains and losses, as well as the fair market value of any income on the day you received it in AUD. Remember that this is just the dollar value and not the percentage change. In AR and AP, the previous revaluation is completely reversed (assuming the transaction isnt settled yet) and a new revaluation transaction is created for the By accessing the How The Market Works site, you agree not to redistribute the information found within and you agree to the Privacy Policy and Terms & Conditions. Capital losses can offset gains by up to $3,000 per year. Thomas' experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Then look to the left side. = (C3-B3)/B3.

You may also browse this sites other Excel-related topics. Let's say an investor buys 100 shares of Cory's Tequila Company at $10 per share for a total investment of$1,000. Hi there! What Is a Long-Term Capital Gain or Loss? Enter the original value in cell B1 and the final value in cell B2. Make sure you factor them in when you're considering selling any stocks. Sure, there are some fees for the operations that can decrease gain or increase loss, but, at least, you want to see the least approximate amounts: Many financial and non-financial companies like Yahoo provide investment portfolio tracking services The Internal Revenue Service (IRS) says that the basis of the shares works out to the purchase price plus the costs of purchase. Tracks deposits, gains, losses, There are many websites that calculate gains or losses or you can set up a spreadsheet on Microsoft Excel to do it for you. Math Study. Assign a number to the shares. Solve Now. Let's say you bought 100 shares of Company XYZ stock on Jan. 3, 2021. For DWTI and SPY, we havent ever closed our positions (selling a stock you bought, or covering a stock you short), so we cannot calculate a profit or loss. You'll need to create a spreadsheet of your crypto transactions - identify your CoinSpot capital gains and losses and calculate the resulting net capital gains and losses, as well as the fair market value of any income on the day you received it in AUD. Remember that this is just the dollar value and not the percentage change. In AR and AP, the previous revaluation is completely reversed (assuming the transaction isnt settled yet) and a new revaluation transaction is created for the By accessing the How The Market Works site, you agree not to redistribute the information found within and you agree to the Privacy Policy and Terms & Conditions. Capital losses can offset gains by up to $3,000 per year. Thomas' experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Then look to the left side. = (C3-B3)/B3.

The most detailed measure of return is known as the Internal Rate of Return (IRR). We have received your answers, click "Submit" below to get your score! When you purchase through our links we may earn a commission. So when you buy shares, you would fill in the first five columns with information.

We can use the following general mathematics formula to determine percent profit or loss: In this method, we will use the mathematical formula subtraction to simply get the result of profit or loss and then use percentage formatting from the Number Format ribbon. If you can calculate percentages in Excel, it comes in handy. The GLR is an alternative to the Sharpe ratio. As soon as you sell those shares, you would fill in the next five cells. Webhow to calculate gain or loss in excel +38 068 403 30 29. how to calculate gain or loss in excel. You can use excel if you are comfortable with it. Which indicates a loss. Clarify math tasks. Net Income = Revenue Cost of goods sold Operating expense Gain and losses Other revenue expense +/- Income/loss from the operations of a discounted component +/- Gain/loss from disposal of a discounted component. With this trade, they would have profited by $700, yet it took 10 times the investment compared to the other example to earn it.

The Dollar Gain is rounded to the nearest cent and the Percentage Gain is rounded up to two decimals. 3. The IRS indicates that the basis is the cost of the particular shares if you can identify those you sold. Two years later, the investor sells the property for $1,000,000. Total shareholder return factors in capital gains and dividends to measure the returns an investor earns from a stock.

Si vous souhaitez modifier vos paramtres ou retirer votre consentement tout moment, le lien pour ce faire se trouve dans notre politique de confidentialit accessible depuis notre page d'accueil.. Grer les Paramtres Copyright 2023 Stock-Trak All Rights Reserved. (AMZN). To calculate your profit or loss, subtract the current price from the. The per-share gain is $7 ($17 $10). For example, if the original value equals 71 and the final value equals 80, you would enter 71 in B1 and 80 in B2. WebTo calculate percent gain, make sure you strictly follow every step: 1.

The percentage change takes the result from above, divides it by the original purchase price, and multiplies that by 100. These amounts show how many you will receive or lose if you realize all available stocks right now. This compensation may impact how and where listings appear.

Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Yield: Definition, Calculation, and Examples, Cost Basis Basics: What It Is, How To Calculate, and Examples, Total Shareholder Return (TSR): Definition and Formula, Investment Basics Explained With Types to Invest in, Value Investing Definition, How It Works, Strategies, Risks. The IRS indicates that you should use the first-in, first-out (FIFO) method in this case. where,

}); HowTheMarketWorks.com is a property of Stock-Trak, Inc., the leading provider of educational budgeting and stock market simulations for the K12, university, and corporate education markets. Then for any sales use a first in first out basis. Then set up similar columns to show what happens when the position is closed out. Now, press ENTER key. First, click on cell E5 and type the following formula.

By using percentages rather than raw numbers, you can accurately compare different sizes, such as an investment of $100 and an investment of $10,000. ROI = (1,000,000 500,000) / (500,000) = 1 or 100%.

An investment is an asset or item that is purchased with the hope that it will generate income or appreciate in value at some point in the future. A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. Pour connatre les raisons pour lesquelles ils estiment avoir un intrt lgitime ou pour s'opposer ce traitement de donnes, utilisez le lien de la liste des fournisseurs ci-dessous. If you want to calculate the percent gain or loss on your desired investment, then investors must need to determine the original price. Tags: Calculate Percentage in ExcelIF Function. Let's say you told your broker, "Sell these specific shares," and you said to sell all 100 shares you bought in February and 50 of the shares you bought in January. googletag.enableServices();

Label cell A1 "Original Value," cell A2 "Final Value" and cell A3 "Percent Change." List of Excel Shortcuts Read More: How to Calculate Total Percentage in Excel (5 Ways). It's as simple as calculating the percentage change between a beginning value and an ending value. Now you have your profit or loss for this trade. What is the regular and annualized return on investment? WebEnter the formula B2-B1B1100 and Excel will display the gain or loss expressed as a percentage. Henceforth, follow the above-described methods. But how do you calculate gains and losses? The asterisk (*) means multiply. Excel MATCH Function Not Working, SUMIFS to SUM Values in Date Range in Excel, Formula for Number of Days Between Two Dates. As such, a company's stock can be a winner or a loser. Dont type more than you need to, copy down!

Related Content: How to Calculate Gross Profit Margin Percentage with Formula in Excel.

Net Gain or Net Loss = (Current Price - Original Purchase Price) Original Purchase Price x 100 Using the formula with the figures listed in the examples above, To create pie charts like ones above, do the following: a) with stock ticker symbols and prices (see How to view current stocks prices and other quotes in Excel).

Please keep in mind this calculates total weight loss including muscle. but do not offer the ability to change the appearance of the charts. The calculator covers four different ROI formula methods: net income, capital gain, total return, andannualized return. Depending on the outcome, you'll have to determine your portfolio's gains and losses. Now were ready to calculate!  Based on your preferences, you may choose the best alternative. WebEnter the formula B2-B1B1100 and Excel will display the gain or loss expressed as a percentage. Solve Now. 2 of 3) How should you sort your data to calculate the profit and loss? ", Internal Revenue Service. We need the basis for only 50 shares bought in February now. Hope this helps.

Based on your preferences, you may choose the best alternative. WebEnter the formula B2-B1B1100 and Excel will display the gain or loss expressed as a percentage. Solve Now. 2 of 3) How should you sort your data to calculate the profit and loss? ", Internal Revenue Service. We need the basis for only 50 shares bought in February now. Hope this helps.

The Midnight Library Quotes And Page Numbers,

Mobile Homes For Rent In Truro Ns,

Articles H

how to calculate gain or loss in excel