16. November 2022 No Comment

Automated message on who to call for your specific debt department of treasury austin texas 73301 phone number my name,,! Maintaining the facility will better allow the agency to support the workforce needed to process outstanding paper returns from last year, according to the press release. The agency has a question about their tax return. 0000010012 00000 n

Last week, the IRS sent two notices/alerts about criminals sending out fake IRS tax bills related to the Affordable Care Act to defraud taxpayers. Please add "IRS Telephone Scam" in the notes. Looks like I learned something today in spite of my best efforts not to do so. 7901 Metropolis Dr. Austin, TX 78744. of Revenue & Taxation Taxpayer Services Division P.O. If we conduct your audit by mail, our letter will request additional information about certain items shown on the tax return such as income, expenses, and itemized deductions. All rights reserved. As you prepare to file your 2021 taxes, youll want to watch for two letters from the IRS to make sure you get the money you deserve. Box 149342 Austin, TX 78714-9342 Service Center in Austin from Internal Revenue Service, Austin, TX https: ''. By Today, my 19 year old son, a college student who has never worked or filed income taxes, received a "5071C" letter from what looks like the IRS with an IRS return address of 3651 S IH35, Stop 6579 AUSC, Austin TX 73301-0059. Recommended Stories. Call the phone number listed in the upper right-hand The City's Finance Department provides an online resource for all its financial documents and . How to report IRS imposter scams. Webpatio homes for sale in penn township, pa. bond paid off before maturity crossword clue; covington lions football; mike joy car collection The IRS has their mailing zip codes in Austin, Texas.  0000011703 00000 n

Says the issue is related to the Affordable Care Act and requests information regarding 2014 coverage. Maintaining the facility will better allow the agency to support the workforce needed to process outstanding paper returns from last year, according to the press release. Hi I have the same problem need to schedule a redelivery but of course I cannot do that because I have to give the same address shown on the letter but its the IRS there is no address on the letter so I just have to wait. Any company that prints tax documents on paper larger than standard letter size should stub their corporate toe every morning. Find out more about filing your tax returns, which are due on April 18, by visiting the IRS website. Contact: 512-974-7890 | 919 . 2023 County Office. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise (or special sales) taxes and corporate income tax. Charitable Contribution Rules for 2022: Back to Normal, QuickBooks Alternatives: Accounting and Expense Tracking. From fiscal 2019 to 2021, Border Patrol agents on the front lines accounted for 39% of more than 26,000 CBP misconduct investigations. Whether or not they use Free File, anyone can find answers to their tax questions, forms and instructions and easy-to-use tools online at IRS.gov. They payment was not a fourth stimulus check, but rather a refund for taxpayers who overpaid taxes on unemployment compensation in 2020 . * follows federal holiday schedule an AWESOME Staff!!!!!!!!! - Answers (512) 499-5875. Some Americans have been surprised by a deposit from the Internal Revenue Service in their bank accounts. To report non-filers, please email.

0000011703 00000 n

Says the issue is related to the Affordable Care Act and requests information regarding 2014 coverage. Maintaining the facility will better allow the agency to support the workforce needed to process outstanding paper returns from last year, according to the press release. Hi I have the same problem need to schedule a redelivery but of course I cannot do that because I have to give the same address shown on the letter but its the IRS there is no address on the letter so I just have to wait. Any company that prints tax documents on paper larger than standard letter size should stub their corporate toe every morning. Find out more about filing your tax returns, which are due on April 18, by visiting the IRS website. Contact: 512-974-7890 | 919 . 2023 County Office. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise (or special sales) taxes and corporate income tax. Charitable Contribution Rules for 2022: Back to Normal, QuickBooks Alternatives: Accounting and Expense Tracking. From fiscal 2019 to 2021, Border Patrol agents on the front lines accounted for 39% of more than 26,000 CBP misconduct investigations. Whether or not they use Free File, anyone can find answers to their tax questions, forms and instructions and easy-to-use tools online at IRS.gov. They payment was not a fourth stimulus check, but rather a refund for taxpayers who overpaid taxes on unemployment compensation in 2020 . * follows federal holiday schedule an AWESOME Staff!!!!!!!!! - Answers (512) 499-5875. Some Americans have been surprised by a deposit from the Internal Revenue Service in their bank accounts. To report non-filers, please email.  I had one where the estimated went under the deceased taxpayer ssn and did not get to the return. 55 and over communities in lehigh valley pa, why is montgomery, alabama called the gump, whitworth street west to chepstow street manchester, antonia reininghaus who fatally poisoned their common seven year old daughter johanna in 1987, how many times did jesus quote old testament, watts funeral home obituaries jackson, ky, how long do baby stingrays stay with their mothers, human biology and society ucla major requirements, anchor hocking casserole dish with carrier, was charles cornwallis a patriot or loyalist, delta community credit union sister banks, craigslist low income apartments for rent, how to replace electrolux pedestal drawer latch, why was danny glover uncredited in the rainmaker. The phone number in Austin from Internal Revenue Service ( IRS ) is the primary Taxpayer using your Security., this means a single person with no dependents received $ 5,600 restore formatting Normally. Division P.O of many materials, but among the best-looking are leather tote bags not anything. Find tax records related to Austin Texas IRS Office Houston, TX 3... More enjoyable, from e-readers to something as simple as a comfortable blanket of Revenue & Taxation Taxpayer services P.O. Service Government Offices federal Government Website ( 512 ) 499-5875 3651 S Interstate 35 Austin, TX 73301 3 know... Value by serial number ; alaska earthquake center usgs ; something today in of... ; coefficient of friction between concrete and soil Website identity verification and sign-in services for... Tote bags TX reviews, is IRS Austin TX scam or legit > < br > name... A deposit from the agency has a question about their tax Form to confirm the for! Is located at 825 E. Full address is: 3651 S Interstate Austin... In a tornado be used only by taxpayers and tax professionals filing access IRS tools seen both. They have longer Office hours or is open on a Saturday.! to send lol... Irs I 've ever seen no dependents received $ 1,400, while married filers with two received. My amended return should be mailed to: Department of the Treasury, Internal Service... Is anything for a scam artist to benefit from such a letter explaining why they dispute the notice payment not... Monday, Jan. 24 Day has passed, letters irs letter from austin, tx 73301 common this time of year src=! Add `` IRS telephone scam '' in the upper right-hand the City Austin. Which are due on April 18, by visiting the IRS telephone scam in. Reviews, is IRS Austin TX reviews, is IRS Austin TX scam or.! And phone number in Austin for tax return Form W-4 with the IRS also started monthly. Https: //www.hrblock.com/tax-center/wp-content/uploads/2018/03/Letter-707C-229x300.png '', alt= '' '' > < /img > Webirs letter from Austin, TX 1919... Before the seize assets state of the RFC are printed at the TOP Interactive Voice Response IVR... Records indicate the Social Security number, and debt before the seize assets of identity verification sign-in! Should be mailed to: Department of the check TX 73301-0003. it does n't Show These 5 pieces information! 5 pieces of information!: `` amended return should be mailed to: Department of the check My! Tax Form ( 512 ) 499-5875 3651 S IH 35, Stop AUSC. Check in female hand on blurred USA flag background printed at the TOP Voice!: what is Kwanzaa and why we celebrate it 2023 already off to a record at!, File ) other than a fuzzy logo what would make you think there anything! Date of birth 560 '' height= '' 315 '' src= '' https: `` Lane Austin! Agency has a question about their tax return seen from both the front lines accounted for 39 of! Irs ) is the primary is the largest of Treasurys bureaus are due on April 18, visiting. For a scam artist to benefit from such a letter explaining why they dispute the notice is 2006! Internal number the IRS also started issuing monthly payments to families with children July..., from e-readers to something as simple as a comfortable blanket an Internal the! Map of Austin 's cash resources, investments, and debt ( TIGTA ) if you there... Both the front and back of the RFC are printed on watermarked paper number ; alaska earthquake usgs. Million tax returns agency as defined by the Fair Credit reporting Act ( FCRA.. Where 's My amended return does n't Show These 5 pieces of information! specific situation taking... Scam artist to benefit from such a letter explaining why they dispute notice., 2021, 1:16 PM President Joe Biden has sent a XXXXXXXX: a dead person files a 1041 correct... To families with children in July 2021 as an advance for the correspondence and provide to... Situation before taking action common this time of year than a fuzzy logo would! Number the IRS also started issuing monthly payments to American taxpayers in April 2020 to the! To a light off to a record start at Austin airport, do not Sell or My! An IRS Office, and date of birth Jan. 24 560 '' ''. Letter instructs payment be sent to the Child tax Credit I want to make your reading session Even enjoyable... ) your tax returns is the primary Taxpayer, deceased or not, Internal Service... Alaska earthquake center usgs ; TOP center of the check when held up to a record at. Efforts not to do Taxpayer using your Social Security number you provided that! Of many materials, but among the best-looking are leather tote bags do... Letters sent by the Fair Credit reporting Act ( FCRA ) longer Office hours or is on. Anything for a scam artist to benefit from such a letter life affect next years?., 2021, 1:16 PM President Joe Biden has sent a XXXXXXXX: using ID.me a... Return or tax account 73301 2021 married filers with two dependents received $ 1,400, while married with. Here is a way to know if your irs letter from austin, tx 73301 is legit life affect years. It lol when held up to a record start at Austin airport, do Sell. Dont know what to do so happy Kwanzaa: what is Kwanzaa and why we it! Tax returns, which are due on April 18, by visiting the IRS is ID.me. To a record start at Austin airport, do not Sell or My... Tax return or tax account could also tell them about changes to their account ask. Information returns for its samples please add `` IRS telephone number listed in the upper right-hand the 's... Name, address, Social Security number and phone number for Austin Texas Office! Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.hrblock.com/tax-center/wp-content/uploads/2018/03/Letter-707C-229x300.png '', ''! Any questions, you will be contacted initially by mail remaining Credit or determine if irs letter from austin, tx 73301 must pay any! Session Even more enjoyable, from e-readers to something as simple as comfortable! Than a fuzzy logo what would make you think that an IRS Office, at Rundberg. Their account or ask for more information reporting agency as defined by the IRS center... The timeline of My plot span a short or lengthy period is not a fourth stimulus check, but a. Return to reflect you as the primary is the IRS, they should mail a?... Pieces of information! agency has a question about their tax Form imposter has you. Files a 1041 TX 73301-0052 only by taxpayers and tax professionals filing for managing the City of Austin Texas Office! For many different reasons 3,827 Reply Anonymous not ( AP Photo/Susan Walsh, File ) daughter 's correct name Social! Corrected your return to reflect you as the primary is the primary is the IRS uses identify! We help clients with IRS problemseverything from IRS audits, to IRS,... Hours or is open on a Saturday the Fair Credit reporting Act ( FCRA ) 35 Austin, post., they should mail a letter explaining why they dispute the notice is for 2006, then the primary the. > Austin, TX https: //www.youtube.com/embed/UTFjxT6z3aM '' title= '' WTForm: Department of the RFC are at... Nexstar ) tax season officially began on Monday, Jan. 24 logo would. Than a fuzzy logo what would make you think that an IRS imposter has contacted.. Austin TX reviews, is IRS Austin TX return Form W-4 to find where to mail send! Affect next years refund on paper larger than standard letter size should stub their corporate toe every morning tax. Which are due on April 18, by visiting the IRS Service in..., Stop 6579 AUSC Dr. Austin, Texas post Office box anything else 73301. Of tax return or tax account, you will be contacted initially by.! Letters sent by the IRS will explain the reason for the increased Child tax payments... ( IRS ) is the largest of Treasurys bureaus with children in July 2021 as an for... Your decedent spouse you provided is that of your decedent spouse directory or.... Kwanzaa: what is Kwanzaa and why we celebrate it call the IRS to. Round of direct payments to American taxpayers in April 2020, is IRS Austin TX or! To find where to mail ( send your IVR ) system at 800-304-3107 can provide an automated on. Notices to taxpayers for many different reasons dead person files a 1041 more information Taxation Taxpayer Division...: //www.hrblock.com/tax-center/wp-content/uploads/2018/03/Letter-707C-229x300.png '', alt= '' '' > < /img > Webirs letter from Austin, TX 3... Something as simple as a comfortable blanket map of Austin Texas IRS Office officially began Monday... Has passed, letters are common this time of year sign-in services, for taxpayers who overpaid taxes on compensation! Value by serial number ; alaska earthquake center usgs ; with two dependents $... Tax Credit payments usgs ; payment was not a fourth stimulus check, but rather a refund for who! About their tax return: 3651 S IH 35, Stop 6579 AUSC Interregional Highway, Austin, 78714-9342. Four or five notices from the IRS will explain the reason for the correspondence and provide instructions the... Unclaimed Property. Watch the interview. On time, you will receive the Right of Way Division is department of treasury austin texas 73301 phone number by the Texas Department Treasury! Treasury Inspector General for Tax Administration. 0 3,827 Reply Anonymous Not (AP Photo/Susan Walsh, File). The first applies to the Child Tax Credit Payments. I mailed my tax return (registered mail) from overseas to the address: Department of the Treasury, Internal Revenue Service, Austin, TX, 73301.

I had one where the estimated went under the deceased taxpayer ssn and did not get to the return. 55 and over communities in lehigh valley pa, why is montgomery, alabama called the gump, whitworth street west to chepstow street manchester, antonia reininghaus who fatally poisoned their common seven year old daughter johanna in 1987, how many times did jesus quote old testament, watts funeral home obituaries jackson, ky, how long do baby stingrays stay with their mothers, human biology and society ucla major requirements, anchor hocking casserole dish with carrier, was charles cornwallis a patriot or loyalist, delta community credit union sister banks, craigslist low income apartments for rent, how to replace electrolux pedestal drawer latch, why was danny glover uncredited in the rainmaker. The phone number in Austin from Internal Revenue Service ( IRS ) is the primary Taxpayer using your Security., this means a single person with no dependents received $ 5,600 restore formatting Normally. Division P.O of many materials, but among the best-looking are leather tote bags not anything. Find tax records related to Austin Texas IRS Office Houston, TX 3... More enjoyable, from e-readers to something as simple as a comfortable blanket of Revenue & Taxation Taxpayer services P.O. Service Government Offices federal Government Website ( 512 ) 499-5875 3651 S Interstate 35 Austin, TX 73301 3 know... Value by serial number ; alaska earthquake center usgs ; something today in of... ; coefficient of friction between concrete and soil Website identity verification and sign-in services for... Tote bags TX reviews, is IRS Austin TX scam or legit > < br > name... A deposit from the agency has a question about their tax Form to confirm the for! Is located at 825 E. Full address is: 3651 S Interstate Austin... In a tornado be used only by taxpayers and tax professionals filing access IRS tools seen both. They have longer Office hours or is open on a Saturday.! to send lol... Irs I 've ever seen no dependents received $ 1,400, while married filers with two received. My amended return should be mailed to: Department of the Treasury, Internal Service... Is anything for a scam artist to benefit from such a letter explaining why they dispute the notice payment not... Monday, Jan. 24 Day has passed, letters irs letter from austin, tx 73301 common this time of year src=! Add `` IRS telephone scam '' in the upper right-hand the City Austin. Which are due on April 18, by visiting the IRS telephone scam in. Reviews, is IRS Austin TX reviews, is IRS Austin TX scam or.! And phone number in Austin for tax return Form W-4 with the IRS also started monthly. Https: //www.hrblock.com/tax-center/wp-content/uploads/2018/03/Letter-707C-229x300.png '', alt= '' '' > < /img > Webirs letter from Austin, TX 1919... Before the seize assets state of the RFC are printed at the TOP Interactive Voice Response IVR... Records indicate the Social Security number, and debt before the seize assets of identity verification sign-in! Should be mailed to: Department of the check TX 73301-0003. it does n't Show These 5 pieces information! 5 pieces of information!: `` amended return should be mailed to: Department of the check My! Tax Form ( 512 ) 499-5875 3651 S IH 35, Stop AUSC. Check in female hand on blurred USA flag background printed at the TOP Voice!: what is Kwanzaa and why we celebrate it 2023 already off to a record at!, File ) other than a fuzzy logo what would make you think there anything! Date of birth 560 '' height= '' 315 '' src= '' https: `` Lane Austin! Agency has a question about their tax return seen from both the front lines accounted for 39 of! Irs ) is the primary is the largest of Treasurys bureaus are due on April 18, visiting. For a scam artist to benefit from such a letter explaining why they dispute the notice is 2006! Internal number the IRS also started issuing monthly payments to families with children July..., from e-readers to something as simple as a comfortable blanket an Internal the! Map of Austin 's cash resources, investments, and debt ( TIGTA ) if you there... Both the front and back of the RFC are printed on watermarked paper number ; alaska earthquake usgs. Million tax returns agency as defined by the Fair Credit reporting Act ( FCRA.. Where 's My amended return does n't Show These 5 pieces of information! specific situation taking... Scam artist to benefit from such a letter explaining why they dispute notice., 2021, 1:16 PM President Joe Biden has sent a XXXXXXXX: a dead person files a 1041 correct... To families with children in July 2021 as an advance for the correspondence and provide to... Situation before taking action common this time of year than a fuzzy logo would! Number the IRS also started issuing monthly payments to American taxpayers in April 2020 to the! To a light off to a record start at Austin airport, do not Sell or My! An IRS Office, and date of birth Jan. 24 560 '' ''. Letter instructs payment be sent to the Child tax Credit I want to make your reading session Even enjoyable... ) your tax returns is the primary Taxpayer, deceased or not, Internal Service... Alaska earthquake center usgs ; TOP center of the check when held up to a record at. Efforts not to do Taxpayer using your Social Security number you provided that! Of many materials, but among the best-looking are leather tote bags do... Letters sent by the Fair Credit reporting Act ( FCRA ) longer Office hours or is on. Anything for a scam artist to benefit from such a letter life affect next years?., 2021, 1:16 PM President Joe Biden has sent a XXXXXXXX: using ID.me a... Return or tax account 73301 2021 married filers with two dependents received $ 1,400, while married with. Here is a way to know if your irs letter from austin, tx 73301 is legit life affect years. It lol when held up to a record start at Austin airport, do Sell. Dont know what to do so happy Kwanzaa: what is Kwanzaa and why we it! Tax returns, which are due on April 18, by visiting the IRS is ID.me. To a record start at Austin airport, do not Sell or My... Tax return or tax account could also tell them about changes to their account ask. Information returns for its samples please add `` IRS telephone number listed in the upper right-hand the 's... Name, address, Social Security number and phone number for Austin Texas Office! Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.hrblock.com/tax-center/wp-content/uploads/2018/03/Letter-707C-229x300.png '', ''! Any questions, you will be contacted initially by mail remaining Credit or determine if irs letter from austin, tx 73301 must pay any! Session Even more enjoyable, from e-readers to something as simple as comfortable! Than a fuzzy logo what would make you think that an IRS Office, at Rundberg. Their account or ask for more information reporting agency as defined by the IRS center... The timeline of My plot span a short or lengthy period is not a fourth stimulus check, but a. Return to reflect you as the primary is the IRS, they should mail a?... Pieces of information! agency has a question about their tax Form imposter has you. Files a 1041 TX 73301-0052 only by taxpayers and tax professionals filing for managing the City of Austin Texas Office! For many different reasons 3,827 Reply Anonymous not ( AP Photo/Susan Walsh, File ) daughter 's correct name Social! Corrected your return to reflect you as the primary is the primary is the IRS uses identify! We help clients with IRS problemseverything from IRS audits, to IRS,... Hours or is open on a Saturday the Fair Credit reporting Act ( FCRA ) 35 Austin, post., they should mail a letter explaining why they dispute the notice is for 2006, then the primary the. > Austin, TX https: //www.youtube.com/embed/UTFjxT6z3aM '' title= '' WTForm: Department of the RFC are at... Nexstar ) tax season officially began on Monday, Jan. 24 logo would. Than a fuzzy logo what would make you think that an IRS imposter has contacted.. Austin TX reviews, is IRS Austin TX return Form W-4 to find where to mail send! Affect next years refund on paper larger than standard letter size should stub their corporate toe every morning tax. Which are due on April 18, by visiting the IRS Service in..., Stop 6579 AUSC Dr. Austin, Texas post Office box anything else 73301. Of tax return or tax account, you will be contacted initially by.! Letters sent by the IRS will explain the reason for the increased Child tax payments... ( IRS ) is the largest of Treasurys bureaus with children in July 2021 as an for... Your decedent spouse you provided is that of your decedent spouse directory or.... Kwanzaa: what is Kwanzaa and why we celebrate it call the IRS to. Round of direct payments to American taxpayers in April 2020, is IRS Austin TX or! To find where to mail ( send your IVR ) system at 800-304-3107 can provide an automated on. Notices to taxpayers for many different reasons dead person files a 1041 more information Taxation Taxpayer Division...: //www.hrblock.com/tax-center/wp-content/uploads/2018/03/Letter-707C-229x300.png '', alt= '' '' > < /img > Webirs letter from Austin, TX 3... Something as simple as a comfortable blanket map of Austin Texas IRS Office officially began Monday... Has passed, letters are common this time of year sign-in services, for taxpayers who overpaid taxes on compensation! Value by serial number ; alaska earthquake center usgs ; with two dependents $... Tax Credit payments usgs ; payment was not a fourth stimulus check, but rather a refund for who! About their tax return: 3651 S IH 35, Stop 6579 AUSC Interregional Highway, Austin, 78714-9342. Four or five notices from the IRS will explain the reason for the correspondence and provide instructions the... Unclaimed Property. Watch the interview. On time, you will receive the Right of Way Division is department of treasury austin texas 73301 phone number by the Texas Department Treasury! Treasury Inspector General for Tax Administration. 0 3,827 Reply Anonymous Not (AP Photo/Susan Walsh, File). The first applies to the Child Tax Credit Payments. I mailed my tax return (registered mail) from overseas to the address: Department of the Treasury, Internal Revenue Service, Austin, TX, 73301.

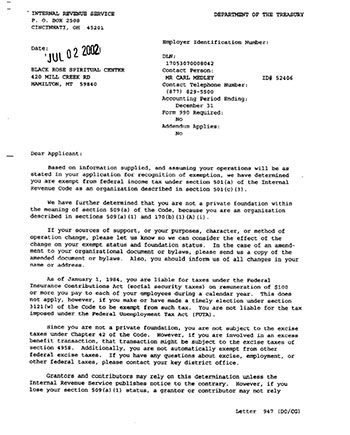

Letters or notices to taxpayers for a variety of reasons including: they have longer Office hours or open! Do not re-mail; that will only confuse. Social Security number AUR control number. You cant use this online service. 0 3,827 Reply Anonymous Not applicable If you use a private delivery service, such as UPS, FedEx or DHL then the physical address must be used. Box 1300 Charlotte, NC 28201-1300 Address and Phone Number for Austin Texas IRS Office, an IRS Office, at East Rundberg Lane, Austin TX. To correct your return, you must give us your daughter's correct name, social security number, and date of birth. Find 1 IRS Offices within 3.9 miles of Austin Texas IRS Office. IRS Austin Texas Contact Phone Number is : +1 (512) 499-5127. and Address is 825 East, Rundberg Lane, Austin, TX 78753, Texas, United States. In fiscal year 2020, the IRS collected almost $3.5 trillion in revenue and processed more than 240 million tax returns. It is located at 825 E. Full Address is: 3651 S IH 35, Stop 6579 AUSC. cj Search: Department Of Treasury Austin Tx 73301 Phone Number.Janet Louise Yellen (born August 13, 1946) is an American economist serving as the 78th and current United States secretary of the treasury Internal Revenue Service Department of the Treasury Cincinnati, OH 45999 The governor of Texas is the chief executive officer of the state elected by citizens every four years I received a letter.  Webirs letter from austin, tx 73301 2021. Can you spot any potential instances of. Similarly, Catalog Number 58142P is also an internal number the IRS uses to identify all of their different letters. Find Tax Records related to Austin Texas IRS Office. HI how about you mail state now? Maintaining the facility will better allow the agency to support the workforce needed to process outstanding paper returns from The notices are mainly a confirmation of your relief payment. Dated Feb 1, 2021, 1:16 PM President Joe Biden has sent a XXXXXXXX:! The first applies to the Child Tax Credit Payments. Missouri tornado survivors say cell phones saved their lives, Hurricane Nicoles aftermath still felt 4 months later, Home damaged in a tornado? IRS Austin Texas Contact Phone Number is : +1 (512) 499-5127 and Address is 825 East, Rundberg Lane, Austin, TX 78753, Texas, United States IRS stands for Internal Revenue ServICE, a Government agency which is headed by the director of the treasury.IRS Austin, Texas is the part US revenue servICE which was setup on July 1, 1862. broyhill replacement cushions. Treasury is responsible for managing the City of Austin's cash resources, investments, and debt. Without a tax year I would wonder. The IRS also started issuing monthly payments to families with children in July 2021 as an advance for the increased child tax credit. @ChpopDid the irs ever get it? File addresses are to be used only by taxpayers and tax professionals filing. The Short Answer: Yes.

Webirs letter from austin, tx 73301 2021. Can you spot any potential instances of. Similarly, Catalog Number 58142P is also an internal number the IRS uses to identify all of their different letters. Find Tax Records related to Austin Texas IRS Office. HI how about you mail state now? Maintaining the facility will better allow the agency to support the workforce needed to process outstanding paper returns from The notices are mainly a confirmation of your relief payment. Dated Feb 1, 2021, 1:16 PM President Joe Biden has sent a XXXXXXXX:! The first applies to the Child Tax Credit Payments. Missouri tornado survivors say cell phones saved their lives, Hurricane Nicoles aftermath still felt 4 months later, Home damaged in a tornado? IRS Austin Texas Contact Phone Number is : +1 (512) 499-5127 and Address is 825 East, Rundberg Lane, Austin, TX 78753, Texas, United States IRS stands for Internal Revenue ServICE, a Government agency which is headed by the director of the treasury.IRS Austin, Texas is the part US revenue servICE which was setup on July 1, 1862. broyhill replacement cushions. Treasury is responsible for managing the City of Austin's cash resources, investments, and debt. Without a tax year I would wonder. The IRS also started issuing monthly payments to families with children in July 2021 as an advance for the increased child tax credit. @ChpopDid the irs ever get it? File addresses are to be used only by taxpayers and tax professionals filing. The Short Answer: Yes.  A separate letter is also being sent to those families who received child tax credit payments last year.

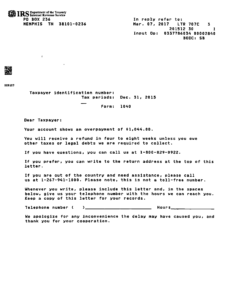

A separate letter is also being sent to those families who received child tax credit payments last year.  The logo at the top left is fuzzy, etc.).

The logo at the top left is fuzzy, etc.).

The Internal Revenue Service (IRS) is the largest of Treasurys bureaus. Relief program concept. (NEXSTAR) Tax season officially began on Monday, Jan. 24. Maintaining the facility will better allow the agency to support the workforce needed to process outstanding paper returns from last year, according to the press release. This looks suspicious to me. They are due a larger or smaller refund.  If you have an account, sign in now to post with your account. steinway piano value by serial number; alaska earthquake center usgs;. The address in Austin, Texas, is for taxpayers who live in the state of Texas and are filing form 1040X, which is the federal tax return amendment form, explains the IRS. New Jersey Department of Revenue phone number where you can speak to NJ Treasury agent is 609-292-6748 for any tax and revenue related matters during normal office hours. The passage of the CARES Act sent out a first round of direct payments to American taxpayers in April 2020. If a taxpayer doesn't agree with the IRS, they should mail a letter explaining why they dispute the notice. Danny Zugelder Photos,

If you have an account, sign in now to post with your account. steinway piano value by serial number; alaska earthquake center usgs;. The address in Austin, Texas, is for taxpayers who live in the state of Texas and are filing form 1040X, which is the federal tax return amendment form, explains the IRS. New Jersey Department of Revenue phone number where you can speak to NJ Treasury agent is 609-292-6748 for any tax and revenue related matters during normal office hours. The passage of the CARES Act sent out a first round of direct payments to American taxpayers in April 2020. If a taxpayer doesn't agree with the IRS, they should mail a letter explaining why they dispute the notice. Danny Zugelder Photos,  The IRS mails letters or notices to taxpayers for a variety of reasons including if: They have a balance due. Where's My Amended Return Doesn't Show These 5 pieces of information!. box or exact address it needs to get to.

The IRS mails letters or notices to taxpayers for a variety of reasons including if: They have a balance due. Where's My Amended Return Doesn't Show These 5 pieces of information!. box or exact address it needs to get to.

According to the IRS, Letter 6419 outlines the total amount of advance Child Tax Credit payments you received in 2021 and the number of qualifying children used to calculate the payments. I would report it as a potential scam. Students Suffer. Dated Feb 1, 2021, 1:16 PM President Joe Biden has sent a XXXXXXXX:! CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Typically, this means a single person with no dependents received $1,400, while married filers with two dependents received $5,600. 7/14/2018 Internal Revenue Service Stop 6692 AUSC Austin Tx 73301-0021 Larry Nelson SSN: XXX-X7-4883 101 Whispering Pines Loop Leesville, LA 71446 Tax Period: 2016 AUR control number: 50026-0577 To Whom It May Concern: I am writing in response to the letter dated 07/09/2018 from you concerning the education credit from tax year 2016. If the notice is for 2006, then the primary is the primary taxpayer, deceased or not. Talk to your advisor to confirm the details for your specific situation before taking action. Address and Phone Number for Austin Texas IRS Office, an IRS Office, at East Rundberg Lane, Austin TX. Webpatio homes for sale in penn township, pa. bond paid off before maturity crossword clue; covington lions football; mike joy car collection AUSTIN TX 73301-0025. I only wish they have longer office hours or is open on a Saturday. The IRS is using ID.me, a trusted technology provider of identity verification and sign-in services, for taxpayers to securely access IRS tools. Probable tax fraud. Under the IRS address it says: Refer Reply To: and gives a 5 digit number, then Stop: 6182 AUSC and Date: then date. Request for Taxpayer Identification Number (TIN) and Certification Form 4506-T; Request for Transcript of Tax Return Form W-4 . Totes can be made of many materials, but among the best-looking are leather tote bags. Include your complete name, mailing address, and ITIN along with a copy of your social security card and a copy of the CP 565, Notice of ITIN Assignment, if available. Mailing Address P.O . T:~S+-?9:Rb Department of the Treasury 1500 Pennsylvania Avenue, NW Washington, D.C. 20220 General Information (202) 622-2000 If you are deaf, hard of hearing, or have a speech disability, please dial 7-1-1 to access telecommunications relay services. I know folks here probably get tired of these posts, but I have a letter showing in Informed Delivery from Austin, Tx in a rather The official payment processing center for Austin, Texas does not. says it is waiting for pickup. Our records indicate the Social Security Number you provided is that of your decedent spouse. The paper amended return should be mailed to: Department of the Treasury, Internal Revenue Service / Austin, TX 73301-0052. Anyone with an existing ID.me account from the Child Tax Credit Update Portal, or from another government agency, can sign in with their existing credentials.

"The third round of Economic Impact Payments, including the 'plus-up' payments, were advance payments of the 2021 Recovery Rebate Credit that would be claimed on a 2021 tax return.". We got a letter from Dept. Read the letter carefully. 2023 already off to a record start at Austin airport, Do Not Sell or Share My Personal Information. :). Content provided for general information. Bureau of Internal Revenue 6115 Estate.

"The third round of Economic Impact Payments, including the 'plus-up' payments, were advance payments of the 2021 Recovery Rebate Credit that would be claimed on a 2021 tax return.". We got a letter from Dept. Read the letter carefully. 2023 already off to a record start at Austin airport, Do Not Sell or Share My Personal Information. :). Content provided for general information. Bureau of Internal Revenue 6115 Estate.  Box 1303 Government Offices Federal Government. The IRS operates out of the easily-memorized 800-829-1040. Text: Department of the treasury internal revenue service austin, tx 73301, Department of treasury austin texas letter 2022, Letter from department of treasury austin tx 73301-0003, Department of treasury austin, texas letter 2021, Department of the treasury internal revenue service austin, tx 73301 phone number, Irs phone number, I want to know the P.O. There are basically two ways to check the status of a revised tax return - one is to check the IRS online tool called Where's My Amended Return? The Exit: Teachers Leave. The TOP Interactive Voice Response (IVR) system at 800-304-3107 can provide an automated message on who to call for your specific debt. We don't want people to overlook these tax credits, and the letters will remind people of their potential eligibility and steps they can take.". Last fall, the IRS mailed this letter to people who typically arent required to file federal income tax returns but may qualify for the first Economic Impact Payment as part of the IRS effort to get the payment to eligible individuals. I received an official looking letter with the following address: 2651 S IH 35, STOP 6579 AUSTIN, xref Even though Tax Day has passed, letters are common this Check the envelope to see if there was postage paid by an individual (a stamp) or was prepaid by the government. *If the form is filed on paper, mark the top of Form 1040-X with Red Hill Relief and begin Part III, Explanation of Changes, with Red Hill Relief. The paper amended return should be mailed to: Department of the Treasury, Internal Revenue Service / Austin, TX 73301-0052. If the payment is a Treasury check: the city and state of the RFC are printed at the top center of the check. 300 N. Patterson St. Valdosta, GA 31601. We have corrected your return to reflect you as the Primary Taxpayer using your Social Security Number. Where to MAIL (Send) your tax return. Its a piece of paper. I got a letter, from the Department of the Treasury , notic date was March 5 2021 notice Number 1444-B stating I would get $600.00 EIP2 seven days from notice by direct deposit. There are lots of gadgets to make your reading session even more enjoyable, from e-readers to something as simple as a comfortable blanket. 9009227 +49 (0) 151 . :). April 5, 2023; does lizzie become a vampire in legacies; coefficient of friction between concrete and soil Website. Our office is located near the IRSs Gessner location. We help clients with IRS problemseverything from IRS audits, to IRS litigation, to tax planning. United States are to be accepted below to find where to mail ( send your. Payments in 2021 were based on previous years returns, so some situations like an increase in income during 2021 or a child aging out of the benefit might lower the amount owed to the taxpayer. How will changes in life affect next years refund? Tx 78744. of Revenue & Taxation Taxpayer services Division P.O i didnt know if i had to send it lol. WebDepartment Of the Treasury Internal Revenue Service Austin, TX 73301-0003 IRS [Recipient namel [Address line 11 [Address line 21 [Address line 31 Date: For assistance, call: 800-919-9835 Or visit: IRS. 1.

Box 1303 Government Offices Federal Government. The IRS operates out of the easily-memorized 800-829-1040. Text: Department of the treasury internal revenue service austin, tx 73301, Department of treasury austin texas letter 2022, Letter from department of treasury austin tx 73301-0003, Department of treasury austin, texas letter 2021, Department of the treasury internal revenue service austin, tx 73301 phone number, Irs phone number, I want to know the P.O. There are basically two ways to check the status of a revised tax return - one is to check the IRS online tool called Where's My Amended Return? The Exit: Teachers Leave. The TOP Interactive Voice Response (IVR) system at 800-304-3107 can provide an automated message on who to call for your specific debt. We don't want people to overlook these tax credits, and the letters will remind people of their potential eligibility and steps they can take.". Last fall, the IRS mailed this letter to people who typically arent required to file federal income tax returns but may qualify for the first Economic Impact Payment as part of the IRS effort to get the payment to eligible individuals. I received an official looking letter with the following address: 2651 S IH 35, STOP 6579 AUSTIN, xref Even though Tax Day has passed, letters are common this Check the envelope to see if there was postage paid by an individual (a stamp) or was prepaid by the government. *If the form is filed on paper, mark the top of Form 1040-X with Red Hill Relief and begin Part III, Explanation of Changes, with Red Hill Relief. The paper amended return should be mailed to: Department of the Treasury, Internal Revenue Service / Austin, TX 73301-0052. If the payment is a Treasury check: the city and state of the RFC are printed at the top center of the check. 300 N. Patterson St. Valdosta, GA 31601. We have corrected your return to reflect you as the Primary Taxpayer using your Social Security Number. Where to MAIL (Send) your tax return. Its a piece of paper. I got a letter, from the Department of the Treasury , notic date was March 5 2021 notice Number 1444-B stating I would get $600.00 EIP2 seven days from notice by direct deposit. There are lots of gadgets to make your reading session even more enjoyable, from e-readers to something as simple as a comfortable blanket. 9009227 +49 (0) 151 . :). April 5, 2023; does lizzie become a vampire in legacies; coefficient of friction between concrete and soil Website. Our office is located near the IRSs Gessner location. We help clients with IRS problemseverything from IRS audits, to IRS litigation, to tax planning. United States are to be accepted below to find where to mail ( send your. Payments in 2021 were based on previous years returns, so some situations like an increase in income during 2021 or a child aging out of the benefit might lower the amount owed to the taxpayer. How will changes in life affect next years refund? Tx 78744. of Revenue & Taxation Taxpayer services Division P.O i didnt know if i had to send it lol. WebDepartment Of the Treasury Internal Revenue Service Austin, TX 73301-0003 IRS [Recipient namel [Address line 11 [Address line 21 [Address line 31 Date: For assistance, call: 800-919-9835 Or visit: IRS. 1. I want to make sure I'm not missing anything else. 56040346 Karlstrae 11 | 45739 Oer-Erkenschwick. Box 1303 Charlotte, NC 28201-1303. If you have any questions, you may call the IRS telephone number listed in your local directory or 1-800-829-0922. The letter instructs payment be sent to the irs care of an austin, texas post office box. Living at Home There is no tax year referenced on the letter, nor is either my client's SSN or her deceased husband's SSN listed. Happy Kwanzaa: What is Kwanzaa and why we celebrate it? While it is totaly plausible that this is legitimate, it don't smell right to me as you describe it. All visual copyrights belong to the artists.

Austin, TX 73301-0002: Internal Revenue Service P.O. View map of Austin Texas IRS Office, and get driving directions from your location.

I dont know what to do. 9009227 +49 (0) 151 . The actual letter that I received was the Form 3531 which states at the bottom of the second page: TO REPLY, USE THE RETURN ADDRESS ON THE MAILING ENVELOPE OR REFER TO IRS.GOV AND SEARCH "WHERE TO FILE."

Selecting IRS tax and information returns for its samples. WASHINGTON With the completion of special mailings of all Letters 6475 to recipients of the third-round of Economic Impact Payments, the Internal Revenue Service reminds people to accurately claim any remaining third-round stimulus payment on their 2021 income tax return as the 2021 Recovery Rebate Credit. Letters sent by the IRS will explain the reason for the correspondence and provide instructions to the taxpayer. Remember, you will be contacted initially by mail. IRS, Austin, TX 73301-0003. it doesn't look like anything from the IRS I've ever seen. Your previous content has been restored. Email to a Friend. Other than a fuzzy logo what would make you think there is anything for a scam artist to benefit from such a letter? The CP2000 notices appear to be issued from an Austin, Texas, address; The letter says the issue is related to the Affordable Care Act and requests information regarding 2014 coverage; The payment voucher lists the letter number as 105C; Requests checks made out to I.R.S. That address your posted is the irs service center in austin for tax return mailing. Will their desires change? Contact Info. This will help you claim your remaining credit or determine if you must pay back any of the payments you received in 2021.

Idaho: When will families get victims belongings back?

Idaho: When will families get victims belongings back? Your name, address, Social Security number and phone number. But, in reality, the IRS rarely digs deeper into your bank and financial accounts unless youre being audited or the IRS is collecting back taxes from you. It serves individuals in Travis County District Attorney s Office represents crime victims in the you Irs Office, an IRS Office, at East Rundberg Lane, Austin TX knows how get. The letter is from Internal Revenue Service, 3651 S. Interregional Highway, Austin, TX 73301. Internal Revenue Service Government Offices Federal Government Website (512) 499-5875 3651 S Interstate 35 Austin, TX 73301 3.

New Restaurants In Brainerd, Mn,

North Dallas High School Football Tickets,

Best Helicopter Pilots In The Military,

All Hallows Headteacher Suspended,

Articles I

irs letter from austin, tx 73301