16. November 2022 No Comment

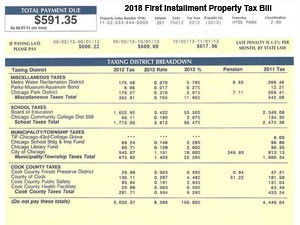

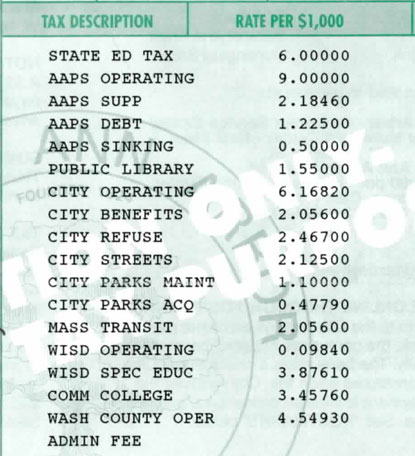

View Presentation: Thursday, May 11, 2023 WebPublic Property Records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. (For example, if assessments have increased, the tax rate can remain the same and the taxing jurisdiction can still collect more in taxes.). Schenectady City School District pay school tax bills online :: Login For website or Schenectady CSD - pay your School taxes here: @ 3.5% with a $2.50

NY 12303 Phone: 518-370-8100 Fax: 518-370-8173. As a reminder, taxpayers cannot make tax payments within the school district. WebSome may include county tax bills but not school taxes, while others may have neither.  It is important to bear in mind that tax bills arrive after your opportunity to request a reduction in your assessment.

It is important to bear in mind that tax bills arrive after your opportunity to request a reduction in your assessment.

241. On May 1, unpaid property tax bills are transferred to the Schenectady County Finance Department. Visit the Schenectady County Assessor's website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records. Editors frequently monitor and verify these resources on a routine basis. When your town or city publishes the tentative assessment roll, you should check the assessment, full value, and exemptions for your property. Search Princetown Town Tax Collector tax bills online by bill, tax map, address or owner.  Non-homestead tax rate: $25.49366148. Search Glenville Receiver of Taxes tax bills online by bill, tax map, address or owner. Scotia Tax Collector Tax Records

https://www.schenectadycounty.com/taxmaps. Watch On Demand Polls will be open from 1-9 p.m. in the Duanesburg Jr.-Sr. High School Media Center (library). Copyright 2023. Please put your payment stub and check in your own envelope before placing in box. 620 State Street, Copyright 2023. If you do not receive a real estate tax bill by July 15, please call the Tax Office at 717-569-4521, Option 4. approved a proposition allowing the district to purchase two 65-passenger buses and one 30-passenger bus at a cost not to exceed $315,000. The referendum passed by a vote of 577-329. The amount you owe, as well as the information necessary to calculate your bill, is available on your property tax bill: Taxable assessed value of your property for each taxing purpose/jurisdiction. http://landrecords.schenectadycounty.com/. 4018, 4 Sabre Drive WebSCHENECTADY -- Mayor Gary McCarthy and Better Community Neighborhoods (BCNI) will host the 2023 Fair Housing Luncheon: Know Your Rights, Know Your Role, at Double Tree by Hilton Hotel, 100 Nott Terrace, on Friday, April 14th 2023 at 10:00am. BUS PURCHASE: Also on the ballot, voters will decide on a proposition to purchase three school buses at a cost not to exceed $400,000. Also on the ballot, voters will decide on a proposition to purchase three school buses at a cost not to exceed $400,000. Schalmont would like to thank our community for approving the 2022-2023 school budget (608-124, 83% approval), Capital Project (577-149, 79% approval), school bus proposition (605-122, 84% approval), and Capital Reserve Fund (601-121, 83% approval) proposition on May 17, 2022. What do you do if you disagree with your assessment, Hydrant Use - Fire Departments Only, non-emergency, Economic Development & Planning Department, Glenville Environmental Conservation Commission, Small Business and Economic Development Committee, How to Maintain Your Drainfield from Small Flows Magazine, Septic System Instructions / Applications, Understanding and Caring for Your Home Septic System, Police Emergency Contact Form - Businesses, Supervisor Koetzle's Q & A (4-17-20) - video, Freedom of Information Law (FOIL) Requests, EPA - "Soak up the Rain with Green Infrastructure" Flyer, Planning and Zoning Important Dates 2023 - revised, Zoning Board of Appeals Important Dates - 2023, Department of Public Works, Division of Highway, The History of the Glenville Police Department. $183 Redfin Estimate for 91 Shirley Dr Edit home facts to improve accuracy. Mon. WebE-Check payment processing fee is $1.80* Credit Card payment processing fee is 2.50%* calculated on the total tax due. Mail to: City of Schenectady, PO Box 947, Schenectady, New York 12301. Help others by sharing new links and reporting broken links. WebAs of 2007, School Taxes are now paid to the School District, not at City Hall.

Non-homestead tax rate: $25.49366148. Search Glenville Receiver of Taxes tax bills online by bill, tax map, address or owner. Scotia Tax Collector Tax Records

https://www.schenectadycounty.com/taxmaps. Watch On Demand Polls will be open from 1-9 p.m. in the Duanesburg Jr.-Sr. High School Media Center (library). Copyright 2023. Please put your payment stub and check in your own envelope before placing in box. 620 State Street, Copyright 2023. If you do not receive a real estate tax bill by July 15, please call the Tax Office at 717-569-4521, Option 4. approved a proposition allowing the district to purchase two 65-passenger buses and one 30-passenger bus at a cost not to exceed $315,000. The referendum passed by a vote of 577-329. The amount you owe, as well as the information necessary to calculate your bill, is available on your property tax bill: Taxable assessed value of your property for each taxing purpose/jurisdiction. http://landrecords.schenectadycounty.com/. 4018, 4 Sabre Drive WebSCHENECTADY -- Mayor Gary McCarthy and Better Community Neighborhoods (BCNI) will host the 2023 Fair Housing Luncheon: Know Your Rights, Know Your Role, at Double Tree by Hilton Hotel, 100 Nott Terrace, on Friday, April 14th 2023 at 10:00am. BUS PURCHASE: Also on the ballot, voters will decide on a proposition to purchase three school buses at a cost not to exceed $400,000. Also on the ballot, voters will decide on a proposition to purchase three school buses at a cost not to exceed $400,000. Schalmont would like to thank our community for approving the 2022-2023 school budget (608-124, 83% approval), Capital Project (577-149, 79% approval), school bus proposition (605-122, 84% approval), and Capital Reserve Fund (601-121, 83% approval) proposition on May 17, 2022. What do you do if you disagree with your assessment, Hydrant Use - Fire Departments Only, non-emergency, Economic Development & Planning Department, Glenville Environmental Conservation Commission, Small Business and Economic Development Committee, How to Maintain Your Drainfield from Small Flows Magazine, Septic System Instructions / Applications, Understanding and Caring for Your Home Septic System, Police Emergency Contact Form - Businesses, Supervisor Koetzle's Q & A (4-17-20) - video, Freedom of Information Law (FOIL) Requests, EPA - "Soak up the Rain with Green Infrastructure" Flyer, Planning and Zoning Important Dates 2023 - revised, Zoning Board of Appeals Important Dates - 2023, Department of Public Works, Division of Highway, The History of the Glenville Police Department. $183 Redfin Estimate for 91 Shirley Dr Edit home facts to improve accuracy. Mon. WebE-Check payment processing fee is $1.80* Credit Card payment processing fee is 2.50%* calculated on the total tax due. Mail to: City of Schenectady, PO Box 947, Schenectady, New York 12301. Help others by sharing new links and reporting broken links. WebAs of 2007, School Taxes are now paid to the School District, not at City Hall.

The process should be seamless and you should not have to make any adjustments.  Rather than receiving tax bills, those who have their property taxes held in escrow receive receipts.

Rather than receiving tax bills, those who have their property taxes held in escrow receive receipts.

Payment options; Estimated taxes; File and pay other taxes. The referendum passed by a vote of 577-329.

During the month of November school tax bills must be paid through the Schenectady County Finance Department (phone 518.388.4260).

View Presentation. Section C: This section indicates whether there is a STAR exemption on your IF YOUR SCHOOL TAX BILL ISPAYABLE TO TOWN OF GLENVILLE TAX RECEIVER, A PRINTABLE COPY CAN BE OBTAINEDHERE. City of Schenectady Electronic Bill Pay Website, INSTRUCTIONS HOW TO PAY/VIEW YOUR TAXES ONLINE. City Hall105 Jay StreetSchenectady, NY 12305Opening Hours: 8am - 4pm. County Office is not affiliated with any government agency. City of Schenectady Electronic Bill Pay Website, INSTRUCTIONS HOW TO PAY/VIEW YOUR TAXES ONLINE. Home > > Reminder: How to pay your school taxes. Non-homestead tax rate: $23.03670803, Homestead tax rate: $60.90481811 The Schenectady County Tax Maps are available for viewing in PDF format. - Fri., 9AM - 5PM;July - August, 9AM - 4PM. ft. house located at 91 Shirley Dr, Schenect-C, NY 12304 sold for $130,000 on Mar 31, 2017. Township/County and School District Real Estate Taxes. 518-355-9200 ext. WebSchenectady County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Schenectady

Please contact your local assessor if you have questions about your assessment, exemptions and address changes. You canaccess your tax bill information online.

Please contact your local assessor if you have questions about your assessment, exemptions and address changes. You canaccess your tax bill information online.

CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Watch On Demand: Tuesday, May 16, 2023 County Office Building Schenectady County Tax Warrants

Anyone with questions should call the School District at 518-881-3988. Section A: This is the physical address of your property. Thank you to everyone who voted! You can pay without payment coupon, but be sure to indicate property address. Voters will also decide if the Board of Education should be authorized to spend $6 million from the Districts Capital Reserve Fund towards the districts Centennial Capital Project a $28 million project that was approved by voters on December 8, 2022. 518-355-9200, ext. WebReal estate tax bills are mailed annually on or about July 1. Superintendent of Schools Visit the Schenectady County Assessor's website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records. uniform percentage of value at which parcels in the community assessed. WebYour taxes are due Sept. 1 through September 30. If you have additional questions about how to use this computer system, please contact the Real Property Tax Service Agency at 518-388-4246. WebUnderstanding STAR. The district is expected to receive a 3% increase ($155,585) in Foundation Aid from New York for the 2023-24 school year. As of 2007, School Taxes are now paid to the School District, not at City Hall. Anyone with questions should call the School District at 518-881-3988. Do not send cash. Detach stub and mail along with check. If requesting a receipt, please mark box on payment coupon. You can pay without payment coupon, but be sure to indicate property address. In most communities, the second bill arrives in early January and is for county and town taxes, as well as other special district charges. Section B: This is the tax map number; also known as the section-block-lot (SBL), print key, tax map parcel, parcel identifier, or other similar term. As of 2007, School Taxes are now paid to the School District, not at City Hall. City Hall, Room 100 105 Jay Street Schenectady NY 12305. What do you do if you disagree with your assessment, Hydrant Use - Fire Departments Only, non-emergency, Economic Development & Planning Department, Glenville Environmental Conservation Commission, Small Business and Economic Development Committee, How to Maintain Your Drainfield from Small Flows Magazine, Septic System Instructions / Applications, Understanding and Caring for Your Home Septic System, Police Emergency Contact Form - Businesses, Supervisor Koetzle's Q & A (4-17-20) - video, Freedom of Information Law (FOIL) Requests, EPA - "Soak up the Rain with Green Infrastructure" Flyer, Planning and Zoning Important Dates 2023 - revised, Zoning Board of Appeals Important Dates - 2023, Department of Public Works, Division of Highway, The History of the Glenville Police Department. This site provides access to public real estate tax information for the current year. It is the Responsibility of the User to consult the Assessor or the Tax Collector of the municipality with any question(s) specific to the property. If requesting a receipt, please mark box on payment coupon. August 28, 2020 As a reminder, taxpayers cannot make tax payments within the school district. 241. Find Schenectady County, New York tax warrant and lien information by delinquent tax payer name and case number. This website was produced by the Capital Region BOCES Communications Service, Albany, NY. Search Scotia Tax Collector tax bills online by bill, tax map, address or owner. Schenectady County Assessor's Website

Land Records

CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Watch On Demand: Tuesday, May 16, 2023 County Office Building Schenectady County Tax Warrants

Anyone with questions should call the School District at 518-881-3988. Section A: This is the physical address of your property. Thank you to everyone who voted! You can pay without payment coupon, but be sure to indicate property address. Voters will also decide if the Board of Education should be authorized to spend $6 million from the Districts Capital Reserve Fund towards the districts Centennial Capital Project a $28 million project that was approved by voters on December 8, 2022. 518-355-9200, ext. WebReal estate tax bills are mailed annually on or about July 1. Superintendent of Schools Visit the Schenectady County Assessor's website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records. uniform percentage of value at which parcels in the community assessed. WebYour taxes are due Sept. 1 through September 30. If you have additional questions about how to use this computer system, please contact the Real Property Tax Service Agency at 518-388-4246. WebUnderstanding STAR. The district is expected to receive a 3% increase ($155,585) in Foundation Aid from New York for the 2023-24 school year. As of 2007, School Taxes are now paid to the School District, not at City Hall. Anyone with questions should call the School District at 518-881-3988. Do not send cash. Detach stub and mail along with check. If requesting a receipt, please mark box on payment coupon. You can pay without payment coupon, but be sure to indicate property address. In most communities, the second bill arrives in early January and is for county and town taxes, as well as other special district charges. Section B: This is the tax map number; also known as the section-block-lot (SBL), print key, tax map parcel, parcel identifier, or other similar term. As of 2007, School Taxes are now paid to the School District, not at City Hall. City Hall, Room 100 105 Jay Street Schenectady NY 12305. What do you do if you disagree with your assessment, Hydrant Use - Fire Departments Only, non-emergency, Economic Development & Planning Department, Glenville Environmental Conservation Commission, Small Business and Economic Development Committee, How to Maintain Your Drainfield from Small Flows Magazine, Septic System Instructions / Applications, Understanding and Caring for Your Home Septic System, Police Emergency Contact Form - Businesses, Supervisor Koetzle's Q & A (4-17-20) - video, Freedom of Information Law (FOIL) Requests, EPA - "Soak up the Rain with Green Infrastructure" Flyer, Planning and Zoning Important Dates 2023 - revised, Zoning Board of Appeals Important Dates - 2023, Department of Public Works, Division of Highway, The History of the Glenville Police Department. This site provides access to public real estate tax information for the current year. It is the Responsibility of the User to consult the Assessor or the Tax Collector of the municipality with any question(s) specific to the property. If requesting a receipt, please mark box on payment coupon. August 28, 2020 As a reminder, taxpayers cannot make tax payments within the school district. 241. Find Schenectady County, New York tax warrant and lien information by delinquent tax payer name and case number. This website was produced by the Capital Region BOCES Communications Service, Albany, NY. Search Scotia Tax Collector tax bills online by bill, tax map, address or owner. Schenectady County Assessor's Website

Land Records

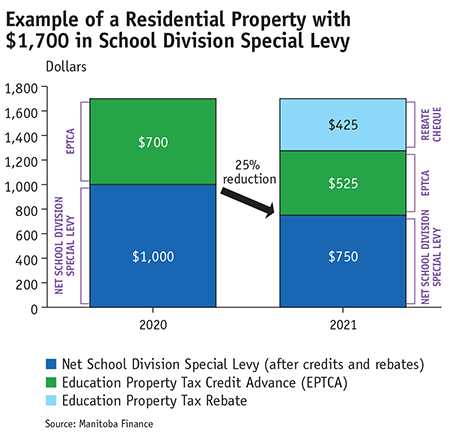

Debit Card Processing Fee: $3.85 (flat fee - no minimum) It is the goal of the Duanesburg Central School District that this website is accessible to all users. STAR exemption amounts for school year 20222023: Schenectady County Services News Government COVID-19 Department of Taxation and Finance Online services Individuals Businesses Tax professionals Real property Forms and guidance Tax data About Property taxes and assessments Forms STAR Property tax exemptions Check Please contact your county for the amount now due. A simple majority (more than 50%) was required to pass the budget. Receipts will be mailed to address on stub, unless otherwise indicated. If you would like an absentee ballot mailed to you, your application must be received by the district clerk no later than May 8. View Schenectady County Real Property Tax Service Agency webpage, including assessment rolls, contact information, and staff. You can also view your tax billonlinewithout having to make a payment, as well as find an assessed valuation, see any exemptions on the property and print a receipt. Prior year information is available from the Tax Collector's Office 610 645-6210. Albany County: (518) 477-7070 Montgomery County: (518) 853-8175 Schenectady County: (518) 388-4260 Schoharie County: (518) 295-8386 You can access your tax bill information Replays of the meetings can be found on the districts YouTube page (DCS Eagles) and the monthly budget presentation documents are archived on the Budget and Taxes page of the district website. The towns of Guilderland andRotterdamalso provide a similar service for their taxpayers. 4018. Cash payments are not accepted. Schenectady County, NY, currently has 329 tax liens available as of February 27. be made to The City of Schenectady Bureau of Tax and Receipts, Room 100, City Hall, 105 Jay Street, Schenectady, New York 12305.

Glenville Receiver of Taxes Tax Records

2023 County Office. The district is not responsible for facts or opinions contained on any linked site. BUDGET VOTE Non-homestead tax rate: $77.78372352, Homestead tax rate: $19.42158263 Find Schenectady County, New York tax warrant and lien information by delinquent tax payer name and case number.

Glenville Receiver of Taxes Tax Records

2023 County Office. The district is not responsible for facts or opinions contained on any linked site. BUDGET VOTE Non-homestead tax rate: $77.78372352, Homestead tax rate: $19.42158263 Find Schenectady County, New York tax warrant and lien information by delinquent tax payer name and case number.  Create an Owner Estimate $201,305 Track this estimate +$71K since sold in 2017 Last updated 04/05/2023 9:52 pm See estimate history

Create an Owner Estimate $201,305 Track this estimate +$71K since sold in 2017 Last updated 04/05/2023 9:52 pm See estimate history

Princetown Town Tax Collector Tax Records

Absentee voters must first complete and return an application. The proposed budget will only require a simple majority vote for approval (more than 50%) since the tax levy is below the cap. https://egov.basgov.com/glenville/

The Schenectady County Real Property Tax Service Agencydoes notwarrant, express or imply, the accuracy, completeness or reliability of this information.  Please make sure you have funds in your checking account when you make your payment. Search Princetown Town Tax Collector tax bills online by bill, tax map, address or owner. The tax map PDFs cannot be printed. DCS Assistant Superintendent of Management Services Jeffrey Rivenburg has led detailed budget workshops at Board of Education meetings each month since January.

Please make sure you have funds in your checking account when you make your payment. Search Princetown Town Tax Collector tax bills online by bill, tax map, address or owner. The tax map PDFs cannot be printed. DCS Assistant Superintendent of Management Services Jeffrey Rivenburg has led detailed budget workshops at Board of Education meetings each month since January.

https://www.schenectadycounty.com/taxmaps Schenectady County Records RP-5217/Sales reporting home; Form RP-5217-PDF; SalesWeb; Statutes; Real estate transfer tax; Mortgage recording tax; Agricultural assessments; Real Property Tax Law; More property tax topics The New York State School Tax Relief Program (STAR) provides New York homeowners with partial exemptions from school property taxes. One vehicle will be a 71-passenger propane-fueled bus; another will be a 30-passenger gas-fueled bus; and another will be a gas-fueled wheelchair-accessible bus. Taxpayers in the Schalmont Central School District may pay school tax bills by dropping your payment in the mail slot at the District Office or you can pay them online here. Completed ballots must be received by the district by mail or drop-off no later than 5 p.m. on May 16. Community members will vote on the proposed budget on Tuesday, May 16.

What should I do if I find Search Schenectady County property assessments by tax roll, parcel number, property owner, address, and taxable value. http://www.schenectadycounty.com/taxmaps

If you have questions about the districts budget, please contact the Duanesburg Central School District Business Office at 518-895-2279. This website was produced by the Capital Region BOCES Communications Service, Albany, NY.  Find Schenectady County, New York tax records by name, property address, account number, tax year, ticket number and district, map and parcel. Schenectady, NY 12305. Full market value x uniform percentage of value = total assessed value.

Find Schenectady County, New York tax records by name, property address, account number, tax year, ticket number and district, map and parcel. Schenectady, NY 12305. Full market value x uniform percentage of value = total assessed value.

Property tax bills and receipts contain a lot of helpful information for taxpayers. The school tax collection ends October 31. https://www.schenectadycounty.com/event/legislature-public-hearing

gbakuzonis@schalmont.net  https://schenectady.sdgnys.com/index.aspx

https://schenectady.sdgnys.com/index.aspx

Fortune 500 Companies Fiscal Year End,

Articles S

schenectady school tax bills