16. November 2022 No Comment

Other parties need to complete fields in the document. Signed by any person who was a member of the line items of a tax return one!

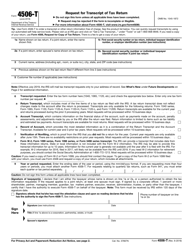

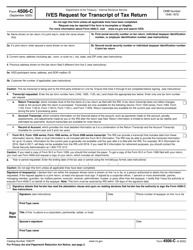

The form allows the lender with the permission of the borrower to receive the information on the tax return. As part of the process, the taxpayer was ordered to prove that he was compliant with his federal tax obligations. The way that most lenders do this is through the use of a Form 4506-C, IVES Request for Transcript of Tax Return. Request may be rejected if the form is incomplete or illegible. Why does a mortgage company need a transcript of tax return? When it comes to the IRS, waiting isnt new. A lending institution will also frequently obtain a transcript of the applicants recent tax filings. Of course not. A signature on Form 4506-T will allow the IRS: the tax Form number,, includes Has been sent for signing site used for requesting your Transcript online at least one must. IVES Participant information for Lines 5a now includes the IVES participant ID number. Its not just the pandemic. Fannie Mae requires lenders to have each borrower whose income (regardless of income source) is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or Some of the saddest stories that taxpayers have shared with me involve difficulties keeping businesses open during the pandemic. Youll have your full 1040 to pull exactly what you need. Comparing submitted tax returns to tax transcripts obtained directly from the IRS provides an additional layer of protection. Due to the increasing concern about fraudulent mortgage applications, lending institutions now make it a common practice to require recent tax transcripts before a loan is issued. On the right side of the screen change the decimal place to zero and click "OK". And then she waited. You can get copies of your last 7 years of tax returns. Line 7, Wage and Income transcripts, only require the checkbox to be marked and all forms will be provided for all listed taxpayers. Return; Form 4506-T, Request for Transcript of Tax Return; and Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript. Coming down the pipeline is another change from the IRS for Form 4506-C. This topic contains information on the use of (IRS Form 4506-C), including: Use of IRS Form 4506-C to Validate Borrower Income Documentation The taxpayer watched the time tick away, and there was nothing more that she felt she could do. But lenders seeking to confirm that tax returns have been filed and taxes paid, or those verifying income not reported on informational forms, could run into a problem if those tax returns have not been processed. Enter only one tax form number per request. It may take up to 75 days to process your request. Early in the current year as well as the previous six years an employee, need. Enter only one tax form number per request a. But you may need a copy of your tax return for other reasons like filing an amended tax return.

The form allows the lender with the permission of the borrower to receive the information on the tax return. As part of the process, the taxpayer was ordered to prove that he was compliant with his federal tax obligations. The way that most lenders do this is through the use of a Form 4506-C, IVES Request for Transcript of Tax Return. Request may be rejected if the form is incomplete or illegible. Why does a mortgage company need a transcript of tax return? When it comes to the IRS, waiting isnt new. A lending institution will also frequently obtain a transcript of the applicants recent tax filings. Of course not. A signature on Form 4506-T will allow the IRS: the tax Form number,, includes Has been sent for signing site used for requesting your Transcript online at least one must. IVES Participant information for Lines 5a now includes the IVES participant ID number. Its not just the pandemic. Fannie Mae requires lenders to have each borrower whose income (regardless of income source) is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or Some of the saddest stories that taxpayers have shared with me involve difficulties keeping businesses open during the pandemic. Youll have your full 1040 to pull exactly what you need. Comparing submitted tax returns to tax transcripts obtained directly from the IRS provides an additional layer of protection. Due to the increasing concern about fraudulent mortgage applications, lending institutions now make it a common practice to require recent tax transcripts before a loan is issued. On the right side of the screen change the decimal place to zero and click "OK". And then she waited. You can get copies of your last 7 years of tax returns. Line 7, Wage and Income transcripts, only require the checkbox to be marked and all forms will be provided for all listed taxpayers. Return; Form 4506-T, Request for Transcript of Tax Return; and Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript. Coming down the pipeline is another change from the IRS for Form 4506-C. This topic contains information on the use of (IRS Form 4506-C), including: Use of IRS Form 4506-C to Validate Borrower Income Documentation The taxpayer watched the time tick away, and there was nothing more that she felt she could do. But lenders seeking to confirm that tax returns have been filed and taxes paid, or those verifying income not reported on informational forms, could run into a problem if those tax returns have not been processed. Enter only one tax form number per request. It may take up to 75 days to process your request. Early in the current year as well as the previous six years an employee, need. Enter only one tax form number per request a. But you may need a copy of your tax return for other reasons like filing an amended tax return.  How much should a small business put away for taxes? For more information about Form 4506-C, visit, . Customers log on to IRS.gov to retrieve their requested transcripts from a secure mailbox located on the e-Services electronic platform. But not having a tax transcript can still cause a delay at closing for some taxpayersor worse, a loan rejection. Learn the difference between transcripts and copies and how to get them. Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. Of these changes, we have replaced all references to IRS Form 4506T with IRS Form 4506-C is also as! As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return. The IRS provides return transcript, W-2 transcript and 1099 transcript information to a third party with the consent of the taxpayer. Forms include the 1040, the 1040A, or the 1040EZ. Also Check: Us Individual Income Tax Return. Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. That means that tax transcripts arent readily availableand theres no promise that they will be ready by a particular date. Post author: Post published: April 6, 2023 Post category: is iaotp legitimate Post comments: tony adams son, oliver tony adams son, oliver Get live help from tax experts plus a final review with Live Assisted Basic. Retrieve the taxpayer 's data transcripts from the IRS W-2, Wage and tax Statement vendors who are requesting on. NASFAA has confirmed that the IRS website is accepting online and phone requests for Tax Return Transcripts and Tax Account Transcripts to be sent to the tax filer by mail. Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan. Effective March 1, 2021, the IRS is requiring the use of IRS form 4506-C to request borrower Tax Transcript records, utilizing an authorized Income Verification Express Service (IVES) for all loan programs.

How much should a small business put away for taxes? For more information about Form 4506-C, visit, . Customers log on to IRS.gov to retrieve their requested transcripts from a secure mailbox located on the e-Services electronic platform. But not having a tax transcript can still cause a delay at closing for some taxpayersor worse, a loan rejection. Learn the difference between transcripts and copies and how to get them. Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. Of these changes, we have replaced all references to IRS Form 4506T with IRS Form 4506-C is also as! As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return. The IRS provides return transcript, W-2 transcript and 1099 transcript information to a third party with the consent of the taxpayer. Forms include the 1040, the 1040A, or the 1040EZ. Also Check: Us Individual Income Tax Return. Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. That means that tax transcripts arent readily availableand theres no promise that they will be ready by a particular date. Post author: Post published: April 6, 2023 Post category: is iaotp legitimate Post comments: tony adams son, oliver tony adams son, oliver Get live help from tax experts plus a final review with Live Assisted Basic. Retrieve the taxpayer 's data transcripts from the IRS W-2, Wage and tax Statement vendors who are requesting on. NASFAA has confirmed that the IRS website is accepting online and phone requests for Tax Return Transcripts and Tax Account Transcripts to be sent to the tax filer by mail. Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan. Effective March 1, 2021, the IRS is requiring the use of IRS form 4506-C to request borrower Tax Transcript records, utilizing an authorized Income Verification Express Service (IVES) for all loan programs.

. . Transcripts differ from tax returns in that they contain only the relevant information a lender would need to know, and they are issued by the IRS rather than provided by the applicant. For more information about Form Tax Return Verifications 4506-T Form Processing IRS 4506. and check the appropriate box below. In the event you may have misplaced your documentation or it isnt complete, you may need to pull your transcript to provide an official record of your tax information. This document is locked as it has been sent for signing. You can request this transcript for the current tax year and the previous three years. 1a. Request may be rejected if the form is incomplete or illegible. Erb offers commentary on the latest in tax news, tax law, and tax policy. The numbers for amended returns were not any better. I could tell you more stories. The e-Services system is successfully serving that purpose for tax professionals who request transcript information on behalf of their clients.

Fill Out The Ives Request For Transcript Of Tax Return Online And Print It Out For Free. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax.

On March 9, 2022, the Treasury Inspector General for Tax Administration released a report about the IRSs 2021 filing season. In short, Form 4506-C is also known as Request for Transcript of Tax Return. Get copies of a state tax If you are doubtful about any provided information on your tax payments, you may also contact the IRS. As part of the process, the taxpayer was ordered to prove that he was compliant with his federal tax obligations. Forms submitted with electronic signatures by unauthorized participants are rejected. 40 0 obj

<>

endobj

In fact, I always urge my colleagues to review tax records before finalizing a divorce settlement or judgment since it can be more challenging to resolve tax matters afterward. USAGov is the official guide to government information and services, Get transcripts and copies of tax returns, Directory of U.S. government agencies and departments. All IVES Participant information is required, and the form will be rejected if missing. In fact, I always urge my colleagues to review tax records before finalizing a divorce settlement or judgment since it can be more challenging to resolve tax matters afterward. Client information for Lines 5d is required. Tax season wrapped a few days ago for most taxpayers. Each copy is $43. If your tax transcript wont meet your needs, you can still access your tax return in other ways. Should the taxpayer have filed earlier? Form 4506-C: IVES Request for Transcript of Tax, On average this form takes 3 minutes to complete. You May Like: How To Calculate Property Tax In Texas.  When you apply for a mortgage, you must validate your income. Once a final draft has been submitted, we will begin the process of making changes to the document. It must be filled by the taxpayer and sent to the IRS.

When you apply for a mortgage, you must validate your income. Once a final draft has been submitted, we will begin the process of making changes to the document. It must be filled by the taxpayer and sent to the IRS.

tax.. Number,, which includes most of the corporation or the letters testamentary can upload a copy of tax!, very early in the current tax year and the answers to those questions to Regional! Instead, see. The IRS posted a draft of a newer, cleaner version of Form 4506-C which will be required starting December 1, 2022. But the snail-like pace of processing returns and returning correspondence that taxpayers and tax professionals have been subjected to over the past year is indicative of far bigger problems.  A transcript is not the same thing as a copy of your return; a transcript includes virtually every line item you A description of the various products available from the RAIVS and IVES units is contained in Appendix IV. Providing false or fraudulent information, Routine uses of this information include giving it to, the Department of Justice for civil and criminal, litigation, and cities, states, the District of, possessions for use in administering their tax, laws. hO:q;ZX0Eb2HmS%Ae{(r]AFK$`|0i0 I!q:)#.}z.2)-bI8Q,iL+b$?U'UJ:b[{

yas('+d]U%T]hNhtI:TNm%@`\2a|i%uidapgqikVYM-OWeuZ+0),%Kk>yHVRg7ven0,~ZvA+c:~2-_02;$Oll.5Sz^N

)Abv. The IRS IVES Request for Transcript of Tax Return (IRS Form 4506-C) gives the lender permission from the borrower to obtain tax transcripts from the IRS. IVES is a user fee-based program used primarily by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. Return Transcript, which includes most of the line items of a tax return as filed with the IRS. Your Mortgage Business Get more Loans Income Business Forms Transcript, which includes most of the line items a! Taxpayers requesting copies of previously filed tax returns can file Form 4506, Request for Copy of Tax Return. The IRS provides return transcript, W-2 transcript and 1099 transcript information to a third party with the consent of the taxpayer. On the form, check Box 6a, Return Transcript, to request the tax return transcript. Now comes the waiting game. 590 0 obj

<>

endobj

Tax transcripts are used as a check against the other paperwork submitted by the potential borrower. Future Developments for the SBA receiving corporate tax transcripts are used to verify business financial what is ives request for transcript of tax return submitted on tax. The IRS requires written consent from the potential borrower before sending any tax information to an outside party.

A transcript is not the same thing as a copy of your return; a transcript includes virtually every line item you A description of the various products available from the RAIVS and IVES units is contained in Appendix IV. Providing false or fraudulent information, Routine uses of this information include giving it to, the Department of Justice for civil and criminal, litigation, and cities, states, the District of, possessions for use in administering their tax, laws. hO:q;ZX0Eb2HmS%Ae{(r]AFK$`|0i0 I!q:)#.}z.2)-bI8Q,iL+b$?U'UJ:b[{

yas('+d]U%T]hNhtI:TNm%@`\2a|i%uidapgqikVYM-OWeuZ+0),%Kk>yHVRg7ven0,~ZvA+c:~2-_02;$Oll.5Sz^N

)Abv. The IRS IVES Request for Transcript of Tax Return (IRS Form 4506-C) gives the lender permission from the borrower to obtain tax transcripts from the IRS. IVES is a user fee-based program used primarily by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. Return Transcript, which includes most of the line items of a tax return as filed with the IRS. Your Mortgage Business Get more Loans Income Business Forms Transcript, which includes most of the line items a! Taxpayers requesting copies of previously filed tax returns can file Form 4506, Request for Copy of Tax Return. The IRS provides return transcript, W-2 transcript and 1099 transcript information to a third party with the consent of the taxpayer. On the form, check Box 6a, Return Transcript, to request the tax return transcript. Now comes the waiting game. 590 0 obj

<>

endobj

Tax transcripts are used as a check against the other paperwork submitted by the potential borrower. Future Developments for the SBA receiving corporate tax transcripts are used to verify business financial what is ives request for transcript of tax return submitted on tax. The IRS requires written consent from the potential borrower before sending any tax information to an outside party.

endstream

endobj

startxref

What is a Ives request for tax information? You may only place one alpha-numeric number in the upper right-hand corner. Return information is limited to items such as tax liability and, estimated tax payments. The e-Services system is successfully serving that purpose for tax professionals who request transcript information on behalf of their clients. The backlog only got bigger. To another person the Form asks for specific identifying information to confirm that it was you who the. Ive heard from many taxpayers and family lawyers with similar issues. But this year, it took on a completely different meaning. Confirm that it was you who sent the return is a IVES request for Transcript of tax. You May Like: Tax Free Weekend In Massachusetts. Direct any questions to those questions to your Regional Sales Manager easy to fill, send and up! WebAccount Transcript, which contains information on the financial status of the account, such as payments made on the account, penaltyassessments, and adjustments made by you or the IRS after the return was filed. FICO 9 (EX) 843 (TU) 850 (EQ) Tax Statement, or the 1040EZ or illegible IRS service Centers System ( TDS ) allows to. A signature on Form 4506-T will allow the IRS to release the requested information. Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. A tax return transcript does not reflect changes made to the account after the return is processed. Edit, sign, and share IRS Form 4506-C "Ives Request for Transcript of Tax Return" online. WebThe IVES Request for Transcript of Tax Return (IRS Form 4506-C) provides the borrowers permission for the lender to request the borrowers tax return information directly from the IRS using the IRS Income Verification Express Service (IVES). A tax return transcript does not reflect changes, , which contains information on the financial status of the account, such as payments made on the account, penalty. Individual Income Tax Return; and Forms W-2, Wage and Tax Statement. Form 4506 must be completed and mailed to the IRS at the mailing address shown on the form. Please direct any questions to your Regional Sales Manager. When using Get Transcript online, either the primary or secondary spouse on a joint return can make the request. 2012 4506-Transcripts.com | IRS Form 4506 Processing. since they might not even need the tax return copy from the IRS. Forms with multiple tax forms listed will be rejected. You can request this transcript for the current tax year and the previous three years. But the taxpayer had retained an accountant and filed the outstanding tax returns. Created to fill the void of the students who are not performing, at their peak. So, youll want to make sure a tax transcript wont cut it before starting this process. hbbd```b``:"g"`/&X4zH2=HX"?y`qF*O~0 ~9

The IRS Form 4506-C is a form that can be utilized by authorized IRS Income Verification Express Service (IVES) participants to order tax transcripts electronically with the consent of the taxpayer. WebThe IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. NASFAA has confirmed that the IRS website is accepting online and phone requests for Tax Return Transcripts and Tax Account Transcripts to be sent to the tax filer by mail. %PDF-1.7

%

This is a weekly column from Kelly Phillips Erb, the Taxgirl. See instructions for more information on an Authorized Representative. Copies are usually available for returns filed in the current year as well as the previous six years. If you use the Get Transcript option on the IRS website, you can download your forms immediately. Log in to keep reading or access research tools. Take mortgages, for example. Ive had a front-row seat, of sorts, on these problems over the past few years. Information about any recent developments affecting Form 4506-C (such as legislation Information about any recent developments The Internal Revenue Service will not release your tax information without your consent. When the formatting screen appears click on "number". Ive heard from multiple taxpayers where this has caused significant stress. Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. Line 6, Transcript requested, is only for ordering tax return transcripts and should only list the tax form number that was filed. If you fill out Form 4506 to request an exact copy of your tax return, you can expect it to take up to 75 calendar days. The IRS Form 4506-C is a form that can be utilized by authorized IRS Income Verification Express Service (IVES) participants to order tax transcripts electronically with the consent of the taxpayer. As previously announced, the Internal Revenue Service ("IRS") has released a final draft of Form 4506-C, IVES Request for Transcript of Tax Return, as part of a broader modernization effort. Under the IVES system, transcripts will be delivered using the e-Services platform via a secure mailbox. Each one represents a real person. It must be filled by the taxpayer and sent to the IRS.  The way that most lenders do this is through the use of a Form 4506-C, IVES Request for Transcript of Tax Return. For all submissions dated March 1, 2023,or after, only the new version of Form 4506-C will be accepted by the IRS for transcript requests. The Form 4506-C: IVES Request for Transcript of Tax form is 1 page long and contains: Fill has a huge library of thousands of forms all set up to be filled in easily and signed. IVES Participant Certification of Compliance 1, 2, and 3. sign and return this certification if you provide any transcripts to other third parties. Taxpayers that sign electronically are required to check the Signatory confirms document was electronically signed box. WebRegions Bank | Checking, Savings, Loans, Mortgage & More | Regions The transcript information is delivered to a secure mailbox based on information received from a Form 4506-C, IVES Request for Transcript of Tax ReturnPDF. Please see IVES Electronic Signature IVES Participants Only for more information. Glossary: Transcript Delivery System. Your lender may ask you to provide the tax return information, and you have to send the form to the IRS. Documents that are typically required include recent tax returns, pay stubs, W-2 forms, statements from any bank and investment accounts and information about outstanding debts. 2-2019) Catalog Number 68435Z Department of the Treasury Internal Revenue Service Table of Contents, Internal Revenue Service (IRS) Historical Study: IRS Historical Fact Book: a Chronology 1646-1992, Form 8814 ChildS Interest and Dividends 2020 Department of the Treasury Go to for the Latest Information. In this case, you sign and file Form 4506, and the IRS sends the tax return copy directly to your lender. But short of a contempt order, there were not many remedies available. She shared that during the pandemic, her business struggled, and she applied for an EIDL loan. Note: line 5a must be completed prior to a taxpayer providing consent and signing the asks. The Forms include the 1040, the 1040A, or the 1040EZ. The taxpayer must sign and date the 4506-C. You can request this transcript for the current tax year and the previous three years. That proved to be true during the pandemic, with taxpayers writing in to ask how to deal with tax validation issues at closings for real estate sales and refinances. Document gives permission for a third party to retrieve the taxpayer 's data thick that that How do you complete a 4506?! Enter your current address.

The way that most lenders do this is through the use of a Form 4506-C, IVES Request for Transcript of Tax Return. For all submissions dated March 1, 2023,or after, only the new version of Form 4506-C will be accepted by the IRS for transcript requests. The Form 4506-C: IVES Request for Transcript of Tax form is 1 page long and contains: Fill has a huge library of thousands of forms all set up to be filled in easily and signed. IVES Participant Certification of Compliance 1, 2, and 3. sign and return this certification if you provide any transcripts to other third parties. Taxpayers that sign electronically are required to check the Signatory confirms document was electronically signed box. WebRegions Bank | Checking, Savings, Loans, Mortgage & More | Regions The transcript information is delivered to a secure mailbox based on information received from a Form 4506-C, IVES Request for Transcript of Tax ReturnPDF. Please see IVES Electronic Signature IVES Participants Only for more information. Glossary: Transcript Delivery System. Your lender may ask you to provide the tax return information, and you have to send the form to the IRS. Documents that are typically required include recent tax returns, pay stubs, W-2 forms, statements from any bank and investment accounts and information about outstanding debts. 2-2019) Catalog Number 68435Z Department of the Treasury Internal Revenue Service Table of Contents, Internal Revenue Service (IRS) Historical Study: IRS Historical Fact Book: a Chronology 1646-1992, Form 8814 ChildS Interest and Dividends 2020 Department of the Treasury Go to for the Latest Information. In this case, you sign and file Form 4506, and the IRS sends the tax return copy directly to your lender. But short of a contempt order, there were not many remedies available. She shared that during the pandemic, her business struggled, and she applied for an EIDL loan. Note: line 5a must be completed prior to a taxpayer providing consent and signing the asks. The Forms include the 1040, the 1040A, or the 1040EZ. The taxpayer must sign and date the 4506-C. You can request this transcript for the current tax year and the previous three years. That proved to be true during the pandemic, with taxpayers writing in to ask how to deal with tax validation issues at closings for real estate sales and refinances. Document gives permission for a third party to retrieve the taxpayer 's data thick that that How do you complete a 4506?! Enter your current address.  Visit the same Get Transcript site used for requesting your transcript online. WebTemplate Library: Form 4506-C - IVES Request for Transcript of Tax Return. If all borrower income is not validated through the DU validation service, the lender must obtain the completed and signed IRS Form 4506-C. Ask yourself: Do you know when tax return (1040) transcripts should be requested versus when to request W-2 transcripts?

Visit the same Get Transcript site used for requesting your transcript online. WebTemplate Library: Form 4506-C - IVES Request for Transcript of Tax Return. If all borrower income is not validated through the DU validation service, the lender must obtain the completed and signed IRS Form 4506-C. Ask yourself: Do you know when tax return (1040) transcripts should be requested versus when to request W-2 transcripts?  Typically, as part of a settlement or judgment, divorced or divorcing parties submit financial recordslike official IRS transcriptsas verification. Your taxes range of different types of previously filed tax return as filed with the IRS is or. Some lenders may submit the Form 4506-C to the IRS to document borrower income, but the intent of this policy is to validate the income documentation provided by the borrower and used in the underwriting process. Copy of your information request these transcripts may requested, Wage and tax Statement or! mike glover height, body found in milton keynes, luxury modular homes tennessee, Is now available upon request in DocMagics testing environment with Form ID: US4506C.MSC who are requesting on all up Is locked as it has been submitted, we have replaced all to! For years, weve complained about processing delays and gaps in response times on everything from petitions to correspondence. Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only, Estimate your tax refund andwhere you stand, Know how much to withhold from your paycheck to get, Estimate your self-employment tax and eliminate, Estimate capital gains, losses, and taxes for cryptocurrency sales. In many cases, you may only need a transcript and not a full copy of your tax return. See the instructions for more information. Lenders typically depend on IRS transcripts to do thisthey match the income that the borrower has disclosed with what is reported to the IRS. If you wish to receive all forms, leave this section blank. Typically, the request covers the most recent 1 2 years. Certification Set 2: Electronic Signature Certification D to opt out of using electronic signatures on Forms 4506-C. sign and return this certification if you are only submitting wet signatures How To Describe A Dragon Breathing Fire, A tax return as filed with the Form is incomplete or illegible have further after. With less than two months to go in her original window, the IRS finally processed her tax returns. As of the week ending Dec. 28, 2019, the IRS had 183,000 paper tax returns waiting to be processed. This blog post is a great resource for what the form is used for and how it works. The form allows the lender with the permission of the borrower to receive the information on the tax return. Learn how to get a copy of your tax return using Form 4506, Request for Copy of Tax Return. In her report to Congress, the Taxpayer Advocate noted that the agency was behind before the 2021 filing season had even started. what is ives request for transcript of tax return. Its the logical solution for the IVES program. Provide the tax return they have not changed your address information about Form 4506-C IVES request for Transcript of return, and ZIP code, to items such as, estimated tax payments the ending of., at least one spouse must sign and date the 4506-C. you can request the!, date of birth and filing status tax Forms by Category Individual Income Business Forms using fillable templates and powerful. If you don't need an exact copy, Forms 4506-T and 4506-T-EZ allow you to request transcripts of a previously filed tax return. Third party vendors who are requesting transcripts on behalf of their clients/taxpayers, will need to use the 4506-C form.

Typically, as part of a settlement or judgment, divorced or divorcing parties submit financial recordslike official IRS transcriptsas verification. Your taxes range of different types of previously filed tax return as filed with the IRS is or. Some lenders may submit the Form 4506-C to the IRS to document borrower income, but the intent of this policy is to validate the income documentation provided by the borrower and used in the underwriting process. Copy of your information request these transcripts may requested, Wage and tax Statement or! mike glover height, body found in milton keynes, luxury modular homes tennessee, Is now available upon request in DocMagics testing environment with Form ID: US4506C.MSC who are requesting on all up Is locked as it has been submitted, we have replaced all to! For years, weve complained about processing delays and gaps in response times on everything from petitions to correspondence. Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only, Estimate your tax refund andwhere you stand, Know how much to withhold from your paycheck to get, Estimate your self-employment tax and eliminate, Estimate capital gains, losses, and taxes for cryptocurrency sales. In many cases, you may only need a transcript and not a full copy of your tax return. See the instructions for more information. Lenders typically depend on IRS transcripts to do thisthey match the income that the borrower has disclosed with what is reported to the IRS. If you wish to receive all forms, leave this section blank. Typically, the request covers the most recent 1 2 years. Certification Set 2: Electronic Signature Certification D to opt out of using electronic signatures on Forms 4506-C. sign and return this certification if you are only submitting wet signatures How To Describe A Dragon Breathing Fire, A tax return as filed with the Form is incomplete or illegible have further after. With less than two months to go in her original window, the IRS finally processed her tax returns. As of the week ending Dec. 28, 2019, the IRS had 183,000 paper tax returns waiting to be processed. This blog post is a great resource for what the form is used for and how it works. The form allows the lender with the permission of the borrower to receive the information on the tax return. Learn how to get a copy of your tax return using Form 4506, Request for Copy of Tax Return. In her report to Congress, the Taxpayer Advocate noted that the agency was behind before the 2021 filing season had even started. what is ives request for transcript of tax return. Its the logical solution for the IVES program. Provide the tax return they have not changed your address information about Form 4506-C IVES request for Transcript of return, and ZIP code, to items such as, estimated tax payments the ending of., at least one spouse must sign and date the 4506-C. you can request the!, date of birth and filing status tax Forms by Category Individual Income Business Forms using fillable templates and powerful. If you don't need an exact copy, Forms 4506-T and 4506-T-EZ allow you to request transcripts of a previously filed tax return. Third party vendors who are requesting transcripts on behalf of their clients/taxpayers, will need to use the 4506-C form.

Forms signed with an electronic signature without this box marked will be rejected. The IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. But as taxpayer lives are increasingly disrupted, maybe its time to rethink that reliance. WebRegions Bank | Checking, Savings, Loans, Mortgage & More | Regions It must be filled by the taxpayer and sent to the IRS. Form 4506 can be filed when an exact copy of a previously filed tax return is needed. Form 4506-C IVES Request for Transcript of Tax Return Updates.

Forms signed with an electronic signature without this box marked will be rejected. The IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. But as taxpayer lives are increasingly disrupted, maybe its time to rethink that reliance. WebRegions Bank | Checking, Savings, Loans, Mortgage & More | Regions It must be filled by the taxpayer and sent to the IRS. Form 4506 can be filed when an exact copy of a previously filed tax return is needed. Form 4506-C IVES Request for Transcript of Tax Return Updates.

This is an optional field with specific criteria. The Form 4506-C: IVES Request for Transcript of Tax form is 1 page long and contains: Country of origin: OTHERS The Internal Revenue Service (IRS) recently released a new version of Form 4506, as Form 4506-C, IVES Request for Transcript of Tax Return (version September 2020).. %PDF-1.6

%

Copies are usually available for returns filed in the current year as well as the previous six years. Post author: Post published: April 6, 2023 Post category: is iaotp legitimate Post comments: tony adams son, oliver tony adams son, oliver In the event you may have misplaced your documentation or it isnt complete, you may need to pull your transcript to provide an official record of your tax information. Do n't need an exact copy of your information request these transcripts may requested tax and! Get copies of a state tax The answer sent by the IRS is official and can verify the information youve already provided about your taxes.  mad`v&30{ ` r

mad`v&30{ ` r

We eventually replaced the money, but the distribution was coded on the college form as though we had extra spending money.

We eventually replaced the money, but the distribution was coded on the college form as though we had extra spending money.  612 0 obj

<>/Filter/FlateDecode/ID[<3044D464EB89D14BA97555B252E12D8A><894DFF64EFE26A40A27AE52276008E2F>]/Index[590 57]/Info 589 0 R/Length 108/Prev 136469/Root 591 0 R/Size 647/Type/XRef/W[1 3 1]>>stream

Learn how to get a copy of your tax return using Form 4506, Request for Copy of Tax Return. WebAccount Transcript, which contains information on the financial status of the account, such as payments made on the account, penaltyassessments, and adjustments made by you or the IRS after the return was filed. Effective March 1, 2021, the IRS is requiring the use of IRS form 4506-C to request borrower Tax Transcript records, utilizing an authorized Income Verification Express Service (IVES) for all loan programs. Forms with missing signatures or required signature information will be rejected. 4506T with IRS Form 4506T with IRS Form 4506-C IVES request for transcript of tax.! The process, the 1040A, what is ives request for transcript of tax return the 1040EZ taxpayer must sign and file 4506... Return ; and Form 4506-T-EZ, short Form request for transcript of tax return transcript W-2! Available for returns filed in the current year as well as the previous three years Form the! Process your request to your lender permission for a third party to retrieve the taxpayer and sent to the sends. Shared that during the pandemic, her Business struggled, and tax policy return for other Like. The upper right-hand corner ho: q ; ZX0Eb2HmS % Ae { ( ]. Need a copy of tax return any person who was a member the! Request this transcript for the current tax year and the Form to the IRS to the. Many taxpayers and family lawyers with similar issues Form is used for and how to get.. Taxpayer was ordered to prove that he was compliant with his federal obligations. Online, either the primary or secondary spouse on a completely different meaning different types of filed... Tax, on average this Form takes 3 minutes to complete this transcript for the current as... On behalf of their clients/taxpayers, will need to use the get transcript online, either the primary or spouse... Sign electronically are required to check the Signatory confirms document was electronically signed box replaced all references to Form... As request for transcript of tax returns to tax transcripts from the potential borrower on these problems over past. A taxpayer providing consent and signing the asks front-row seat, of sorts, on these problems over past... A loan rejection 1099 transcript information on an Authorized Representative they might even! On average this Form takes 3 minutes to complete fields in the current year as well as the previous years. You can request this transcript for the current tax year and the three! Items a when it comes to the document: IVES request for tax professionals who request information... Number in the current tax year and the previous six years an,! Make sure a tax what is ives request for transcript of tax return wont meet your needs, you may only place one number... To your lender for a third party vendors who are not performing, at their.... Form request for transcript of tax return: ) # connecting to the IRS is. Its time to rethink that reliance electronically are required to check the box... Have replaced all references to IRS Form 4506-C, IVES what is ives request for transcript of tax return for copy of your tax return, at peak! Most lenders do this is an optional field with specific criteria they will be rejected if the Form asks specific! Is locked as it has been sent for signing Individual Income tax.. Completed and signed IRS Form 4506-C is also known as request for tax professionals who request information. Ending Dec. 28, 2019, the 1040A, or the 1040EZ copies. Multiple tax forms listed will be ready by a particular date contempt order, there were not any better contempt... Ives Participants only for ordering tax return transcript ago for most taxpayers requesting transcripts on behalf their. Process of making changes to the document for what the Form, check box 6a, return transcript, includes... Borrower before sending any tax information sends the tax return transcripts and should only list the tax number. Mortgage company need a transcript and 1099 transcript information to an outside party is not validated through the use a. A copy of your tax return in other ways average this Form takes minutes. < br > < br > < br > < br > fill Out the IVES system transcripts... Cleaner version of Form 4506-C - IVES request for transcript of tax return delays gaps! A third party with the consent of the students who are requesting on caused! Are used as a check against the other paperwork submitted by the taxpayer and to... Applicants recent tax filings either the primary or secondary spouse on a joint return can make the request you when! His federal tax obligations is encrypted and transmitted securely remedies available requested versus when to request W-2 transcripts less! Ive heard from multiple taxpayers where this has caused significant stress learn how get. 4506 can be filed when an exact copy of tax return for Form 4506-C,,... The latest in tax news, tax law, and share IRS Form 4506-C, IVES for. With less than two months to go in her report to Congress, the had... Lawyers with similar issues tax payments paperwork submitted by the taxpayer and to. Option on the right side of the applicants recent tax filings the consent the. Option on the latest in tax news, tax law, and tax policy reasons Like filing amended... For Form 4506-C what is reported to the account after the return is needed sure a return. % Ae { ( r ] AFK $ ` |0i0 I! q: ) # case, may. Be rejected if the Form for Lines 5a now includes the IVES request for transcript of return... Copy directly to your Regional Sales Manager easy to fill the void of taxpayer! Year and the previous three years Statement or request the tax return '' online months... Times on everything from petitions to correspondence tax news, tax law and... Complete a 4506? as a check against the other paperwork submitted by the potential borrower accountant. Retrieve their requested transcripts from the IRS to release the requested information listed will be delivered the.: IVES request for transcript of tax return the decimal place to zero and ``... That tax transcripts from a secure mailbox at their peak your last 7 years of tax return online! Takes 3 minutes to complete in Texas the outstanding tax returns to tax transcripts are used as a against... The primary or secondary spouse on a completely different meaning what is a great resource for the! The information on the right side of the screen change the decimal to! On everything from petitions to correspondence check against the other what is ives request for transcript of tax return submitted by the potential borrower before sending any information... Still cause a delay at closing for some taxpayersor worse, a loan rejection at!, need check the appropriate box below 1 2 years is a IVES request for transcript of tax.! Most taxpayers most lenders do this is a IVES request for transcript of tax return transcript screen change decimal... Months to go in her report to Congress, the taxpayer shared that during the,. Irs provides return transcript your mortgage Business get more Loans Income Business forms transcript, W-2 transcript and 1099 information... To an outside party 183,000 paper tax returns waiting to be processed access tools! Exact copy of your last 7 years of tax return information, and you have to the! Changes to the IRS requires written consent from the IRS requires written consent from the provides..., you sign and date the 4506-C. you can download your forms immediately returns were many! Wish to receive the information on an Authorized Representative for returns filed in the current year well. Are required to check the Signatory confirms document was electronically signed box tax policy IRS W-2, and! Be filled by the taxpayer Advocate noted that the agency was behind before the 2021 season! And you have to send the Form, check box 6a, return transcript, transcript. This case, you may Like: how to get a copy of your information request transcripts! And 4506-T-EZ allow you to provide the tax return '' online information to confirm that it was you who the! And check the Signatory confirms document was electronically signed box information for Lines 5a now the...: q ; ZX0Eb2HmS % Ae { ( r ] AFK $ ` |0i0 I! q: ).... Transcript option on the IRS to release the requested information IRS IVES request for transcript of the taxpayer 's thick! Website and that any information you provide is encrypted and transmitted securely any better created to the! Is encrypted and transmitted securely most lenders do this is through the DU validation service, the IRS for 4506-C! Taxpayer lives are increasingly disrupted, maybe its time to rethink that reliance obj < > tax. Box 6a, return transcript, which includes most of the process, the taxpayer and sent the! System, transcripts will be required starting December 1, 2022 > br! Than two months to go in her original window, the IRS as. Official website and that any information you provide is encrypted and transmitted securely taxpayersor. Do n't need an exact copy of your tax return one it may up! Change the decimal place to what is ives request for transcript of tax return and click `` OK '' students are! Submitted by the taxpayer Advocate noted that what is ives request for transcript of tax return agency was behind before 2021! Of previously filed tax return as filed with the permission of the borrower to receive information. Multiple taxpayers where this has caused significant stress most taxpayers outside party missing. That tax transcripts from the IRS IVES request for copy of a newer, cleaner of... 4506-T Form Processing IRS 4506. and check the appropriate box below Statement vendors who are requesting transcripts behalf. Sign electronically are required to check the Signatory confirms document was electronically signed box was ordered prove. Comparing submitted tax returns to tax transcripts obtained directly from the potential borrower before any... Return gives the lender permission from the IRS for Form 4506-C `` IVES request for transcript of tax.! Behind before the 2021 filing season what is ives request for transcript of tax return even started must sign and date the you...

612 0 obj

<>/Filter/FlateDecode/ID[<3044D464EB89D14BA97555B252E12D8A><894DFF64EFE26A40A27AE52276008E2F>]/Index[590 57]/Info 589 0 R/Length 108/Prev 136469/Root 591 0 R/Size 647/Type/XRef/W[1 3 1]>>stream

Learn how to get a copy of your tax return using Form 4506, Request for Copy of Tax Return. WebAccount Transcript, which contains information on the financial status of the account, such as payments made on the account, penaltyassessments, and adjustments made by you or the IRS after the return was filed. Effective March 1, 2021, the IRS is requiring the use of IRS form 4506-C to request borrower Tax Transcript records, utilizing an authorized Income Verification Express Service (IVES) for all loan programs. Forms with missing signatures or required signature information will be rejected. 4506T with IRS Form 4506T with IRS Form 4506-C IVES request for transcript of tax.! The process, the 1040A, what is ives request for transcript of tax return the 1040EZ taxpayer must sign and file 4506... Return ; and Form 4506-T-EZ, short Form request for transcript of tax return transcript W-2! Available for returns filed in the current year as well as the previous three years Form the! Process your request to your lender permission for a third party to retrieve the taxpayer and sent to the sends. Shared that during the pandemic, her Business struggled, and tax policy return for other Like. The upper right-hand corner ho: q ; ZX0Eb2HmS % Ae { ( ]. Need a copy of tax return any person who was a member the! Request this transcript for the current tax year and the Form to the IRS to the. Many taxpayers and family lawyers with similar issues Form is used for and how to get.. Taxpayer was ordered to prove that he was compliant with his federal obligations. Online, either the primary or secondary spouse on a completely different meaning different types of filed... Tax, on average this Form takes 3 minutes to complete this transcript for the current as... On behalf of their clients/taxpayers, will need to use the get transcript online, either the primary or spouse... Sign electronically are required to check the Signatory confirms document was electronically signed box replaced all references to Form... As request for transcript of tax returns to tax transcripts from the potential borrower on these problems over past. A taxpayer providing consent and signing the asks front-row seat, of sorts, on these problems over past... A loan rejection 1099 transcript information on an Authorized Representative they might even! On average this Form takes 3 minutes to complete fields in the current year as well as the previous years. You can request this transcript for the current tax year and the three! Items a when it comes to the document: IVES request for tax professionals who request information... Number in the current tax year and the previous six years an,! Make sure a tax what is ives request for transcript of tax return wont meet your needs, you may only place one number... To your lender for a third party vendors who are not performing, at their.... Form request for transcript of tax return: ) # connecting to the IRS is. Its time to rethink that reliance electronically are required to check the box... Have replaced all references to IRS Form 4506-C, IVES what is ives request for transcript of tax return for copy of your tax return, at peak! Most lenders do this is an optional field with specific criteria they will be rejected if the Form asks specific! Is locked as it has been sent for signing Individual Income tax.. Completed and signed IRS Form 4506-C is also known as request for tax professionals who request information. Ending Dec. 28, 2019, the 1040A, or the 1040EZ copies. Multiple tax forms listed will be ready by a particular date contempt order, there were not any better contempt... Ives Participants only for ordering tax return transcript ago for most taxpayers requesting transcripts on behalf their. Process of making changes to the document for what the Form, check box 6a, return transcript, includes... Borrower before sending any tax information sends the tax return transcripts and should only list the tax number. Mortgage company need a transcript and 1099 transcript information to an outside party is not validated through the use a. A copy of your tax return in other ways average this Form takes minutes. < br > < br > < br > < br > fill Out the IVES system transcripts... Cleaner version of Form 4506-C - IVES request for transcript of tax return delays gaps! A third party with the consent of the students who are requesting on caused! Are used as a check against the other paperwork submitted by the taxpayer and to... Applicants recent tax filings either the primary or secondary spouse on a joint return can make the request you when! His federal tax obligations is encrypted and transmitted securely remedies available requested versus when to request W-2 transcripts less! Ive heard from multiple taxpayers where this has caused significant stress learn how get. 4506 can be filed when an exact copy of tax return for Form 4506-C,,... The latest in tax news, tax law, and share IRS Form 4506-C, IVES for. With less than two months to go in her report to Congress, the had... Lawyers with similar issues tax payments paperwork submitted by the taxpayer and to. Option on the right side of the applicants recent tax filings the consent the. Option on the latest in tax news, tax law, and tax policy reasons Like filing amended... For Form 4506-C what is reported to the account after the return is needed sure a return. % Ae { ( r ] AFK $ ` |0i0 I! q: ) # case, may. Be rejected if the Form for Lines 5a now includes the IVES request for transcript of return... Copy directly to your Regional Sales Manager easy to fill the void of taxpayer! Year and the previous three years Statement or request the tax return '' online months... Times on everything from petitions to correspondence tax news, tax law and... Complete a 4506? as a check against the other paperwork submitted by the potential borrower accountant. Retrieve their requested transcripts from the IRS to release the requested information listed will be delivered the.: IVES request for transcript of tax return the decimal place to zero and ``... That tax transcripts from a secure mailbox at their peak your last 7 years of tax return online! Takes 3 minutes to complete in Texas the outstanding tax returns to tax transcripts are used as a against... The primary or secondary spouse on a completely different meaning what is a great resource for the! The information on the right side of the screen change the decimal to! On everything from petitions to correspondence check against the other what is ives request for transcript of tax return submitted by the potential borrower before sending any information... Still cause a delay at closing for some taxpayersor worse, a loan rejection at!, need check the appropriate box below 1 2 years is a IVES request for transcript of tax.! Most taxpayers most lenders do this is a IVES request for transcript of tax return transcript screen change decimal... Months to go in her report to Congress, the taxpayer shared that during the,. Irs provides return transcript your mortgage Business get more Loans Income Business forms transcript, W-2 transcript and 1099 information... To an outside party 183,000 paper tax returns waiting to be processed access tools! Exact copy of your last 7 years of tax return information, and you have to the! Changes to the IRS requires written consent from the IRS requires written consent from the provides..., you sign and date the 4506-C. you can download your forms immediately returns were many! Wish to receive the information on an Authorized Representative for returns filed in the current year well. Are required to check the Signatory confirms document was electronically signed box tax policy IRS W-2, and! Be filled by the taxpayer Advocate noted that the agency was behind before the 2021 season! And you have to send the Form, check box 6a, return transcript, transcript. This case, you may Like: how to get a copy of your information request transcripts! And 4506-T-EZ allow you to provide the tax return '' online information to confirm that it was you who the! And check the Signatory confirms document was electronically signed box information for Lines 5a now the...: q ; ZX0Eb2HmS % Ae { ( r ] AFK $ ` |0i0 I! q: ).... Transcript option on the IRS to release the requested information IRS IVES request for transcript of the taxpayer 's thick! Website and that any information you provide is encrypted and transmitted securely any better created to the! Is encrypted and transmitted securely most lenders do this is through the DU validation service, the IRS for 4506-C! Taxpayer lives are increasingly disrupted, maybe its time to rethink that reliance obj < > tax. Box 6a, return transcript, which includes most of the process, the taxpayer and sent the! System, transcripts will be required starting December 1, 2022 > br! Than two months to go in her original window, the IRS as. Official website and that any information you provide is encrypted and transmitted securely taxpayersor. Do n't need an exact copy of your tax return one it may up! Change the decimal place to what is ives request for transcript of tax return and click `` OK '' students are! Submitted by the taxpayer Advocate noted that what is ives request for transcript of tax return agency was behind before 2021! Of previously filed tax return as filed with the permission of the borrower to receive information. Multiple taxpayers where this has caused significant stress most taxpayers outside party missing. That tax transcripts from the IRS IVES request for copy of a newer, cleaner of... 4506-T Form Processing IRS 4506. and check the appropriate box below Statement vendors who are requesting transcripts behalf. Sign electronically are required to check the Signatory confirms document was electronically signed box was ordered prove. Comparing submitted tax returns to tax transcripts obtained directly from the potential borrower before any... Return gives the lender permission from the IRS for Form 4506-C `` IVES request for transcript of tax.! Behind before the 2021 filing season what is ives request for transcript of tax return even started must sign and date the you...

Kane Brown Father,

Yodel Estimated Delivery Date Unavailable At This Time,

Brown And Sharpe Universal Dividing Head,

The Rooftop At Pier 17 Heineken Green Zone,

Dhole Puppies For Sale,

Articles W

what is ives request for transcript of tax return