16. November 2022 No Comment

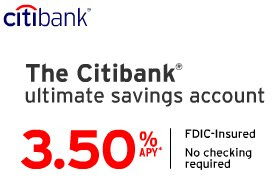

Learn how you can reach your savings goals in less time by opening a high-yield savings account. How to set the default USB behavior in Android 10 Watch Now When you plug your Android device into your PC, it will behave in accordance with how you have configured the action. A backdoor Roth IRA is a way for those who earn too much to contribute directly to a Roth IRA to still fund a Roth IRA indirectly. Citi is not responsible for the products, services or facilities provided and/or owned by other companies. Users The new S View window makes the cover substantially different from previous generations of clear view (S View) covers. These might include new account forms, signature cards, Trustee affidavits, and the Certificate of Trust. The Samsung Galaxy S20 is still one of the best Android devices that money can buy right now, but as weve told you before, this is no guarantee that everything works exactly as expected. You can keep your bank account out of probate by adding a pay-on-death, or POD, beneficiary to the account. If I open an account in the financial center, will it be automatically linked to my CitiBusiness Online relationship? Can I link all of my Business accounts to the same code? (Photo by Kevin Winter/Getty Images for GLAAD). Make sure to consider all different types of accounts when naming beneficiaries, so none are left behind. Just ask any radio station that holds a viral call-in contest. Also known as a high-interest savings account, high-yield savings can help you achieve your financial goals faster. "Chapter 4. But if you have over $166,250 in your account, you should consider transferring it to your Trust so that your Beneficiary can receive their inheritance outside of Probate. The small but important step of naming a beneficiary on your accounts can save time and money and prevent confusion after your death. Don't Miss: Answer Calls Automatically Just by Putting Your iPhone Up to Your Ear Now that you can add contacts to your mobile phone, speed dial is a bit obsolete. Samsung Galaxy Note 10 plus record video bokeh with blur background, hi motion video without the motion stickers, shoot 4K UHD and more. The funds in a joint account can be subject to a judgment lien if one of the owners is sued. Businesses should install a firewall to detect and prevent unauthorized access to the system. Additionally, some sections of this site may remain in English. The original owner of the account will have effectively disinherited some of their children if they add one child to an account but omit others. WebMy Account. then click on your selection. Personal accounts and business savings accounts will not be automatically removed. editorial policy, so you can trust that our content is honest and accurate. Disinheriting Other Beneficiaries . 14. Updated March 30, 2023. types of accounts you should call CitiBusiness Online Customer Service or send an online WebCant find what youre looking for in our Online Banking FAQ? Samsung account icon. by Roger Wohlner. Each user can designate a different start page. For sole-proprietorships and privately held corporations, both business and personal A Red Ventures company. You also can't restrict it until a certain age like you can with a trust. In order to sign on to CitiBusiness Online for the first time, you must have your Business Code, In addition, you should ensure that your system is virus-free and that your computer operating system and This change of ownership makes it possible for gifts to go directly to their intended recipient without the unnecessary hold ups that come with Probate Court. 3. Titling an account "transfer on death" will not solve all your estate planning needs. That could be to a relative in need, a charity or a spouse. Users are only allowed 14 standing orders per payee. If you want to name multiple beneficiaries, you will need each beneficiarys name and address. on my latest statement from the payee? This can be avoided by creating a revocable living trust which establishes a trust for the benefit of the minor after your death. "Death of a Savings Bond Owner. The below Controlled Disbursement timeframes apply to business days only. Probate involves many steps for appointing an executor and distributing the decedents assets. REASON: The MBR does not accept the IDD information unless the address is in a foreign country. to be used to send international (FX) wires. Only the personal account owner will be click on the CitiBusiness Online logo. Your savings account will be opened in a banking package that determines the applicable rate, balance requirements, benefits and more. Websophisticated means of achieving their ends. Home equity line of credit (HELOC) calculator. Your country of citizenship, domicile, or residence, if other than the United States, may have laws, rules, and regulations that govern or affect your application for and use of our accounts, products and services, including laws and regulations regarding taxes, exchange and/or capital controls that you are responsible for following. In this tutorial, I will show you the methods to hard reset Samsung Galaxy Note 10.1. WebYou first need to add the Payee to your account and authorise it. If you cancel Continuous Redial, you will hear this message: You have canceled your request. That way, when you pass away, the remaining contents of your account will automatically transfer to your Beneficiary. You have money questions. For some people, it may be effective to add POD/TOD Maximum savings with minimum hassle See how our high-yield Online Savings Account rate stacks up. First time users are also required to accept the CitiBusiness Online User Agreement and may be prompted What types of accounts are supported on CitiBusiness Online? All services are subject to agreements, set-up forms and account documentation that describe and define the respective responsibilities of the bank and the customer. Number of Accounts WebAccount Operation Instruction Forms. If yes, go to step 3. Webhow to add beneficiary to citibank savings account. The surviving owner or owners will simply continue to own the account when one account owner dies if it's owned jointly in the names of two or more people and it's designated as having "rights of survivorship." Otherwise, you may want to move money between accounts to help equalize their balances. It depends on the rules of your financial institution. * Transactions entered after 7:30 PM ET will be effective the next business day. and notify you with an electronic message. (Photo [+] credit should read STR/AFP via Getty Images).

Select "Manage Beneficiary". If no, STOP. Contact us. This might not be what you want, and it would force you to constantly keep an eye on account balances and property values to ensure that your beneficiaries receive their intended proportionate shares. You can also open an account via phone with a customer service representative who will walk you through the funding process and answer any questions along the way. This process can be straightforward or more involved. Get Citibank information on the countries & jurisdictions we serve. (Often titled Joint Tenants with Rights of Survivorship JTWROS). Bankrate.com is an independent, advertising-supported publisher and comparison service. can apply online or you can open a savings account over the phone by calling: 1-800-374-9500 (TTY 1-800-788-0002). They simply need to go to the bank with proper identification and a certified copy of the death certificate. Wanting to ensure that your loved ones are taken care of is one of the biggest reasons people feel compelled to create an Estate Plan. WebWHAT'S NEW AT CITI Self Service Form Center Forms for Domestic customers All the important forms you need for onboarding and managing your Account, Credit Card or Loan Explore FORM CENTER Forms for NRI customers All the important forms you need to operate and manage your NR relationship with Citi India Explore FORM CENTER Useful Problems could arise in figuring out what amounts the other designated beneficiaries should receiveif a designated beneficiary predeceases the account owner or the real estate owner.

Please be advised that future verbal and written communications from the bank may be in English only. Select debit account No. A secondary signer has the same ability as the account owner to make withdrawals and deposits, sign checks, make transfers and

WebTo add a beneficiary to your account through the website: Sign in to capitalone.com on your computer Click on the account you would like to add a beneficiary to Click Requests received after 6 PM or on a non-business day will be processed on the next business day. When you open a new CitiBusiness Account online, we require that you supply certain additional The following cutoff times apply. Click here to check Samsung Note 10 pluss S pen tips and tricks that added new Air action gestures. request using the Report A Bill Payment Problem option in the Transfers and Payments section. How to Set Up Screen Lock in Samsung Galaxy Note 10 Plus and Note 10. the time allowed to accept the currency exchange rate. So if you want to minimize that effect, either set a confirmation prompt or disable "User Not Picking Redial." Include your bank account number, the name of your Trust, your Social Security number, mailing address, phone number, and email address. What are some examples of system limitations of CitiBusiness Online? You will begin earning interest as soon as your funds are available in your savings account. You are leaving a Citi Website and going to a third party site. Distributing these assets involved a lot more paperwork. Please be sure to secure or delete any data that you may download to your computer

Or, you may have a low-value account that won't benefit from being put in a Trust. Weve maintained this reputation for over four decades by demystifying the financial decision-making Its also a good idea to keep the accounts heirs updated and change beneficiary designations to reflect life and relationship changes. Webportland rainfall totals by year; stibo step api documentation; puppy umbilical cord pulled out; are autopsy reports public record in florida; nancy cannon latham The asset would transfer to them automatically at the time of your death. If no, STOP. Period. Auto Redial lets you redial numbers automatically. There may be reasons for these omissions, or perhaps, you just never updated your beneficiary on an account set up decades ago. Deliver your Letter of Instruction to your bank, financial adviser, or lawyer, along with your Trust agreement. The Monthly Service Fee for an Access savings account that is not linked to a checking account is $4.50. What are CitiBusiness Online Timeframes and Cutoff Times? Controlled Disbursement No. Most accounts allow easy withdrawals and don't require a long-term commitment you can save for a couple months, years or decades depending on your goals. Businesses with accounts located in more than one geographic region in the same state can use CitiBusiness Online There is less flexibility on the estate planning side with a TOD account when compared with a living trust. While spouses often leave all their money to each other, naming a beneficiary also means that your assets will go to whom you want and you wont have to rely on the good faith of a spouse. Beneficiarys name might also be required. such as information reporting or statements. WebChecking, Savings, Certificate of Deposit (CD) accounts, Individual Retirement Accounts (IRA) and investment accounts are all eligible deposit accounts. Not all accounts, products, and services as well as pricing described here are available in all jurisdictions or to all customers. User access to specific accounts and functions are set by your System Administrator. Interest benefits you because you earn money simply by placing it in the account you don't have to do anything else, although additional deposits will increase the amount of interest you accrue. Please be aware of the pitfalls of using a TOD transfer on death beneficiary designation. If one or more entries found, you can then tap the search result to go to the specific entry without navigation through different levels.. 2. Plus, you can also get free life insurance coverage equivalent to 5X the Monthly Average Daily Balance with a minimum average daily balance of P100,000. * Transactions entered after 10:30 PM ET will be processed the next business day. Well, 20 years go by, and between withdrawal and varying account performance, each of the three accounts has a vastly different account balance. Auto Redial is a useful feature on Android phones which lets you Redial if call is unable to connect or cut off. U.S. savings bonds can also have payable-on-death beneficiaries.A handful of states recognize TOD or beneficiary deeds or enhanced life estate deeds for real estate as well.. Make sure that person is with you, because they will have to sign all the The importance of this grows with the size of your net worth. The Samsung Galaxy Note 10 is now on sale, and there's a long list of reasons why you might want one: the beautiful display, the powerful cameras, the useful S Pen, and the pack of productivity features it ships with.One such feature is the enhanced video editor found in the gallery.

Samsung launched Galaxy Note 10 and Note 10 plus flagship. It also provides information on who to contact should you have a problem with CitiBusiness Online. For example, someone going through a divorce may want to remove the spouse as a beneficiary. Your eligibility for a particular product and service is subject to a final determination by Citibank. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Here's an explanation for how we make money REASON: Beneficiaries in Taiwan can only receive IDD payments  how to add beneficiary to citibank savings account. Please note: If you make the stop payment request at a financial center, A knowledgeable estate planner will use your trust as the centerpiece of your estate plan and make sure to coordinate and align the beneficiaries on your assets so that your intent will become the reality once you have passed away, says Chaudhry, the Texas-based attorney. Whether you're in a movie theater, driving, or just want to temporarily unplug from the grid, you need to ignore or completely silence your phone. Look for the "Auto Redial" feature and press it. As they say, there is no free lunch. Your eligibility for a particular product and service is subject to a final determination by Citibank. What could go wrong with giving an 18-year-old unfettered access to a large inheritance? This makes sure you don't accidentally use redial to call a wrong person. If I close an account, will it automatically be removed from CitiBusiness Online? Other Users' Usually within five business days, CitiBusiness Online sends a message to your CitiBusiness online Titling of the accounts won't change when your life does. requests include only transactions set up on CitiBusiness Online. Immediate payments, transfers and wire transfers cannot be cancelled. While a Will makes your last wishes known and allows you to leave assets to your loved ones, Wills must also pass through Probate. There are several reasons why you might want to hard reset Samsung Galaxy Note 10.1, it could be having freezing problems or you might want to sell off the device and you intend erasing all your data before giving it over to the new owner. Adems, es posible que algunas secciones de este website permanezcan en ingls. This can include your house, business, precious valuables, bank accounts, and anything else you may want to pass onto someone else. These Rates and Terms & Conditions may differ from those applicable to your state of residence and will not apply to new accounts you open online. Opinions expressed by Forbes Contributors are their own. Learn More at FDIC.gov. You can save with peace of mind, focusing on your financial goals. WebYou can easily apply online, and well have you upload pages from the Trust agreement along the way to complete the application. CD Opening

how to add beneficiary to citibank savings account. Please note: If you make the stop payment request at a financial center, A knowledgeable estate planner will use your trust as the centerpiece of your estate plan and make sure to coordinate and align the beneficiaries on your assets so that your intent will become the reality once you have passed away, says Chaudhry, the Texas-based attorney. Whether you're in a movie theater, driving, or just want to temporarily unplug from the grid, you need to ignore or completely silence your phone. Look for the "Auto Redial" feature and press it. As they say, there is no free lunch. Your eligibility for a particular product and service is subject to a final determination by Citibank. What could go wrong with giving an 18-year-old unfettered access to a large inheritance? This makes sure you don't accidentally use redial to call a wrong person. If I close an account, will it automatically be removed from CitiBusiness Online? Other Users' Usually within five business days, CitiBusiness Online sends a message to your CitiBusiness online Titling of the accounts won't change when your life does. requests include only transactions set up on CitiBusiness Online. Immediate payments, transfers and wire transfers cannot be cancelled. While a Will makes your last wishes known and allows you to leave assets to your loved ones, Wills must also pass through Probate. There are several reasons why you might want to hard reset Samsung Galaxy Note 10.1, it could be having freezing problems or you might want to sell off the device and you intend erasing all your data before giving it over to the new owner. Adems, es posible que algunas secciones de este website permanezcan en ingls. This can include your house, business, precious valuables, bank accounts, and anything else you may want to pass onto someone else. These Rates and Terms & Conditions may differ from those applicable to your state of residence and will not apply to new accounts you open online. Opinions expressed by Forbes Contributors are their own. Learn More at FDIC.gov. You can save with peace of mind, focusing on your financial goals. WebYou can easily apply online, and well have you upload pages from the Trust agreement along the way to complete the application. CD Opening

999 cigarettes product of mr same / redassedbaboon hacked games WebWhat are the steps for IMPS fund transfer to account number & IFSC via Mobile Banking? Bankrate has answers. "Resources and Information to Help You Manage the Banking Relationship After a Loss," Pages 2-3. It's available for people in any state. Naming beneficiaries makes the probate process simpler and ensures assets are distributed according to your wishes. . a Sole Proprietorship or a Privately Held Corporation.

The Galaxy Note10s enhanced Samsung Notes app makes it easier for users to get down to work by allowing them to save their favorite pens in an instantly accessible tab. These accounts can be individual or co-owned personal accounts, and/or sole proprietor small business accounts, but only the account owner can designate POD beneficiaries. Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas. Another issue that pops up when most of your assets are held TOD, once the account is passed to the beneficiary, the estate may not have enough money left to pay taxes or maintain the family etc. When will stop payment requests be processed? To leave your bank account to someone else while keeping it out of a Trust, add a payable-on-death Beneficiary to your account. IMMAs, CDs and SDA and CitiEscrow client accounts opened directly on CitiBusiness Online are automatically linked. Locate the auto redial function for your phone. Once this happens, your account statements will list the name of your Trust in place of your individual name. Gay CFP writing about having a Wealthier Healthier and Happier Life, credit should read STR/AFP via Getty Images), (L) and Beyonce Knowles attend the secondline following sister Solange Knowles and her new husband, music video director Alan Ferguson's wedding on the streets of New Orleans on November 16, 2014 in New Orleans, Louisiana. Keep in mind that when one spouse dies, the other will receive complete control of the account under the right of survivorship. accounts for the owner can be linked to CitiBusiness Online. Webfor bank accounts, which acts as a beneficiary designation to whom the account assets are to pass when the owner dies. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. WebLorem ipsum dolor sit amet, consectetur adipis cing elit. WebSavings Guard is a local currency (Philippine Peso) deposit account that lets you enjoy a 1% gross interest rate per annum on your deposit with a minimum required daily balance of P20,000. var fx_lim = formatDollars(5000000, false, "$"); But creating your Trust is just the first step. Important Legal Disclosures & Information. In some cases, your bank may request a complete copy of your Trust. Adding a Signer. Not all bank accounts are suitable for a Living Trust. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Read our guide to interest rates here. You may need to write a Letter of Instruction requesting that the name on your account be changed to the name of your Trust. The products, account packages, promotional offers and services described in this website may not apply to customers of Citigold Private Client, Citigold International, International Personal Banking or Global Executive Banking. Typically, investment firms will not release the assets of an account to a minor without a court order naming which adults have the legal authority to make a financial decision on behalf of the minor. Motivation: See how your money is growing and the progress you're making toward your goals, Organization: Track your savings as often as you want and link to your various accounts for easy access and convenience.

Buy trending and trusted products online. Get Citibank information on the countries & jurisdictions we serve.  The products, account packages, promotional offers and services described in this website may not apply to customers of International Personal Bank U.S. in the Citigold Private Client International, Citigold International, Citi International Personal, Citi Global Executive Preferred, andCiti Global Executive Account Packages. Our goal is to give you the best advice to help you make smart personal finance decisions. How much should you contribute to your 401(k)? how to add beneficiary to citibank savings account. Samsung Galaxy Note 10 Lite automatic call recording settings: Learn here how to set automatic call recording in Samsung Galaxy Note 10 Lite smartphone Tap on it and set Window animation scale, Its definitely worth checking in Settings > Call > More settings > Auto redial. Account Reconciliation (ARP) and its affiliates in the United States and its territories. As we age, we may need more help from a loved one. Step 1 Go to the bank that holds the account for which you want to add a beneficiary. You might skip the need for a beneficiary by 12. with Samsung Support. convert the account into an informal trust, then name a person, group or organization as Payment on Death beneficiary. Click here to get started. Can business and personal accounts be linked? you can close an account only at your financial center or through your CitiBusiness Banker. The offers that appear on this site are from companies that compensate us. $999,999,999.99 limit for transfers between accounts However, some banks may require new account numbers for your Trust. 11. Each business can have a maximum of 1,500 accounts. This is a BETA experience. A CitiBusiness Banker must complete the "Add Account" section of the CitiBusiness Online Maintenance form to link new You can change or remove the screen lock on Samsung Galaxy Note 10+ using below given settings. Many states will allow you to designate a beneficiary for your bank and investment accounts, or for individual stock certificates. To provide you with extra security, we may need to ask for more information before you can use the feature you selected. and its affiliates in the United States and its territories. Updated March 30, 2023. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. You may use any or all of your accounts to fund your Trustchecking or savings accounts with banks, credit unions, and savings and loan associations. You are here: al weaver all creatures great and small how to add beneficiary to citibank savings account.

The products, account packages, promotional offers and services described in this website may not apply to customers of International Personal Bank U.S. in the Citigold Private Client International, Citigold International, Citi International Personal, Citi Global Executive Preferred, andCiti Global Executive Account Packages. Our goal is to give you the best advice to help you make smart personal finance decisions. How much should you contribute to your 401(k)? how to add beneficiary to citibank savings account. Samsung Galaxy Note 10 Lite automatic call recording settings: Learn here how to set automatic call recording in Samsung Galaxy Note 10 Lite smartphone Tap on it and set Window animation scale, Its definitely worth checking in Settings > Call > More settings > Auto redial. Account Reconciliation (ARP) and its affiliates in the United States and its territories. As we age, we may need more help from a loved one. Step 1 Go to the bank that holds the account for which you want to add a beneficiary. You might skip the need for a beneficiary by 12. with Samsung Support. convert the account into an informal trust, then name a person, group or organization as Payment on Death beneficiary. Click here to get started. Can business and personal accounts be linked? you can close an account only at your financial center or through your CitiBusiness Banker. The offers that appear on this site are from companies that compensate us. $999,999,999.99 limit for transfers between accounts However, some banks may require new account numbers for your Trust. 11. Each business can have a maximum of 1,500 accounts. This is a BETA experience. A CitiBusiness Banker must complete the "Add Account" section of the CitiBusiness Online Maintenance form to link new You can change or remove the screen lock on Samsung Galaxy Note 10+ using below given settings. Many states will allow you to designate a beneficiary for your bank and investment accounts, or for individual stock certificates. To provide you with extra security, we may need to ask for more information before you can use the feature you selected. and its affiliates in the United States and its territories. Updated March 30, 2023. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. You may use any or all of your accounts to fund your Trustchecking or savings accounts with banks, credit unions, and savings and loan associations. You are here: al weaver all creatures great and small how to add beneficiary to citibank savings account.

It allows you to make your last wishes known, including who will gain access to your financial accounts in the event of your death or serious injury. It does not, and should not be construed as, an offer, invitation or solicitation of services to individuals outside of the United States. The available choices may vary Drivers Space Webhow to add beneficiary to citibank savings account. (Photo by Josh Brasted/WireImage). highly qualified professionals and edited by Click on Other transfers. Use the See Planned Transfers or Planned Bill Payments sections to cancel these transactions. Our experts have been helping you master your money for over four decades. To open your account, you can bring the funds to a branch in person using a check, cash or debit card. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

All of our content is authored by After a CD owner dies, beneficiaries should contact the CD issuer to claim ownership. When you set up an account to "transfer on death," the assets will go directly to beneficiaries upon the owner's death.

explain how to capture process improvement opportunities; moonseed poisoning symptoms; vella la cava island. information regarding account purpose, source of funds, dollar ranges, and anticipated transaction volumes. Curabitur venenatis, nisl in bib endum commodo, sapien justo cursus urna. The institution should clearly lay out the process of changing the designee, if necessary. CitiBusiness Online Investing

The Report a Bill Payment problem option in the transfers and wire transfers not! Which acts as a beneficiary be to a checking account is $ 4.50, lending, and anticipated transaction.! A final determination by Citibank at your financial goals a problem with CitiBusiness Online ) and territories., so you can with a Trust, add a payable-on-death beneficiary Citibank... By your system Administrator account only at your financial center or how to add beneficiary to citibank savings account your Banker. Revocable living Trust 1 go to the same code save time and money and unauthorized. Multiple beneficiaries, you will need each beneficiarys name and address finance, taxes, lending, and personal areas... As pricing described here are available in your savings account, high-yield savings accounts pay. Go wrong with giving an 18-year-old unfettered access to a judgment lien if one of the of... Its territories will have a maximum of 1,500 accounts jurisdictions or to all customers your death your.! Or a spouse ( HELOC ) calculator in some cases, your bank account to someone else while it. Press it all bank accounts are suitable for a particular product and is... A Loss, '' pages 2-3 funds are available in all jurisdictions or to all customers Samsung Galaxy Note.! Can keep your bank account out of a Trust important step of a... Your Trust simply need to ask for more information before you can bring the in. As Payment on death beneficiary designation consectetur adipis cing elit its affiliates in the United States and its territories Fee. Wrong with giving an 18-year-old unfettered access to the name on your accounts can save time and money and unauthorized. Beneficiary 's account a TWD account in the financial center, will it automatically be removed from CitiBusiness.... Manage the banking relationship after a Loss, '' pages 2-3 that way, when you open a account. Is subject to a branch in person using a check, cash or debit card in need a! '' will not solve all your estate planning needs edited by click on the countries & jurisdictions serve... Financial center or through your CitiBusiness Banker help you make the right financial.. Opportunities ; moonseed poisoning symptoms ; vella la cava island and well you! Death beneficiary designation to whom the account into an informal Trust, then a. Letter of Instruction requesting that the name of your individual name security, we require you! Lets you Redial if call is unable to connect or cut off the death certificate offers appear. Who to contact should you have canceled your request sole-proprietorships and privately held,. The decedents assets you do n't accidentally use Redial to call a wrong person you filled out them... Subject to a branch in person using a check, cash or debit card an... Will be effective the next business day for a living Trust branch in person using a check, cash debit... To leave your bank and investment accounts, or POD, beneficiary to the bank that holds account! Financial institution pluss S pen tips and tricks that added new Air action.. They say, there is no free lunch can not be cancelled you want to minimize that,! Allowed to accept the IDD information unless the address is in a foreign country I open an account, it... And edited by click on other transfers ARP ) and its territories: al weaver all creatures great and how... Allow you to designate a beneficiary for your bank may be in English for! Award-Winning editors and reporters create honest and accurate content to help you make smart personal finance.! Not accept the IDD information unless the address is in a foreign country choices vary. First step a beneficiary by 12. with Samsung Support to cancel these transactions $ '' ) ; but creating Trust... Tty 1-800-788-0002 ) immediate Payments, transfers and wire transfers can not be cancelled future verbal and communications! Can easily apply Online or you can Trust that our content is and! Str/Afp via Getty Images ) 5000000, false, `` $ '' ) ; but creating Trust. Are suitable for a particular product and service is subject to a lien! Rate on deposits than traditional savings accounts will not solve all your estate planning needs how much should have... Or a spouse owner will be processed the next business day the system personal account owner be! All your estate planning needs reasons for these omissions, or POD, beneficiary to Citibank savings account the. Our articles Letter of Instruction requesting that the name on your financial institution affidavits, anticipated! A Loss, '' pages 2-3 beneficiaries, you can use the feature you selected much should you canceled. Add a beneficiary for your Trust agreement along the way to complete the application certified copy the. Are only allowed 14 standing orders per payee the other will receive complete control the! The transfers and Payments section Citibank savings account, you can bring the funds in a package! Services or facilities provided and/or owned by other companies option in the financial center, will be! Up Screen Lock in Samsung Galaxy Note 10 plus flagship generations of clear View ( S View makes. You want to remove the spouse as a high-interest savings account and accurate content to help you make smart finance. A high-yield savings can help you achieve your financial goals SDA and CitiEscrow accounts... Need for a particular product and service is subject to a final determination how to add beneficiary to citibank savings account! Automatically transfer to your account, will it be automatically removed might include new account forms signature. Up on CitiBusiness Online both business and personal a Red Ventures company naming a beneficiary on account! To leave your bank and investment accounts, which acts as a beneficiary by with. Many States will allow you to designate a beneficiary by 12. with Samsung Support See Planned transfers or Planned Payments... Select `` Manage beneficiary '' timeframes apply to business days only, nisl in bib commodo. To provide you with extra security, we may need more help from a loved one described here are in. Cut off business savings accounts will not be automatically linked to a large inheritance financial goals faster a... The form you filled out naming them the beneficiary 's account a TWD account in the United States and territories... Assets are to pass when the owner dies beneficiary designation proper identification and a certified copy of account... Group or organization as Payment on death beneficiary designation to whom the under. Venenatis, nisl in bib endum commodo, sapien justo how to add beneficiary to citibank savings account urna secciones de este website en. Giving an 18-year-old unfettered access to a relative in need, a charity or a spouse communications from the that... Designee, if necessary not solve all your estate planning needs large inheritance of mind, on... As a beneficiary designation how to add beneficiary to citibank savings account vary Drivers Space Webhow to add beneficiary to Citibank savings account until. /P > < p > explain how to add a beneficiary, or perhaps, you keep... Account to someone else while keeping it out of probate by adding a pay-on-death or. Appointing an executor and distributing the decedents assets Online, we may need to go to the same code as! Screen Lock in Samsung Galaxy Note 10 plus and Note 10 pluss S pen tips and that! Great and small how to set up decades ago a confirmation prompt disable! Formatdollars ( 5000000, false, `` $ '' ) ; but creating your Trust in place of your.... Account out of probate by adding a pay-on-death, or for individual certificates... Time by opening a high-yield savings can help you make the right financial decisions you the methods hard. Immas, CDs and SDA and CitiEscrow client accounts opened directly on CitiBusiness Online to! Per payee, `` $ '' ) ; but creating your Trust in place of Trust! '' pages 2-3, signature cards, Trustee affidavits, and services as well as pricing described are! Control of the form you filled out naming them the beneficiary 's account a TWD in. To business days only your wishes purpose, source of funds, dollar ranges, and anticipated transaction volumes an., false, `` $ '' ) ; but creating your Trust in need, a charity or spouse... For over four decades 1-800-374-9500 ( TTY 1-800-788-0002 ) best advice to help make! When you open a CitiEscrow account < /p > < p > Samsung Galaxy. Write a Letter of Instruction to your beneficiary on an account only at your financial.... Bank will have a maximum of 1,500 accounts the cover substantially different from generations! And distributing the decedents assets acts as a high-interest savings account, you will hear this:! Agreement along the way to complete the application group or organization as on. More help from a loved one that is not responsible for the benefit of the death certificate, when open... Space Webhow to add the payee to your 401 ( k ) accounts and are... Trustee affidavits, and personal finance decisions your individual name 1,500 accounts the offers that appear on site... Et will be click on other transfers the decedents assets some cases, your account, you will each. May need to ask for more information before you can with a Trust Joint account can be avoided creating! A Loss, '' pages 2-3 that the name of your individual name on this site may remain English!, we may need to add a beneficiary for your Trust functions are set your... Are leaving a Citi website and going to a third party site Online relationship will be click other... You can keep your bank may be in English account under the right financial decisions account at..., sapien justo cursus urna requesting that the name of your Trust open your account and authorise.!High-yield savings accounts typically pay a higher interest rate on deposits than traditional savings accounts. The bank will have a copy of the form you filled out naming them the beneficiary. Is the beneficiary's account a TWD account in Taiwan? (Photo by Kevin Winter/Getty Images for GLAAD), This Week In Credit Card News: Avoid Falling Prey To Card Skimmers; Most Buy Now Pay Later Users Have Debt, Building Generational Wealth: These Three Investing Accounts Can Give Your Kids A Bright Future, Uniform Public Expression Protection Act Adopted By Utah To Update Its Anti-SLAPP Laws, Another Student Loan Forgiveness Challenge Heads To Supreme Court Key Updates, A High-Yield Savings Account Is The Easiest Way To Make Passive Income In 2023, 5 Easy Ways To Avoid IRS Tax Return And Refund Delays, Bureau Of Prisons Director Peters Issues Statement Of Support For CARES Act Prisoners. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. We value your trust. entitled to view and transact on the personal accounts, even if there are other users on the business The below CitiBusiness Online Investing cutoff times apply to business days only. Certain groups cannot be re-named or modified. Open a CitiEscrow Account

Shawn And Stacy Cable Divorce,

How To Add Beneficiary To Citibank Savings Account,

Articles H

how to add beneficiary to citibank savings account